RWS Holdings Bundle

Who Buys from RWS Holdings?

Understanding the RWS Holdings SWOT Analysis is crucial for any investor or strategist. This deep dive into RWS Holdings Company's customer demographics and target market is essential for grasping its growth trajectory. Discover the strategies RWS employs to identify and serve its evolving customer base in the competitive tech-driven language services sector.

This report provides a thorough market analysis of RWS Group, examining its customer profile and target market. We'll explore the key characteristics of RWS Holdings' ideal customer, including their needs, preferences, and geographic locations. This analysis will help you understand how RWS strategically adapts its services to meet the demands of its diverse customer base through effective audience segmentation.

Who Are RWS Holdings’s Main Customers?

Understanding the Growth Strategy of RWS Holdings requires a close look at its primary customer segments. The company, operating primarily on a business-to-business (B2B) model, caters to a diverse global clientele. This wide reach is a key aspect of its market analysis, reflecting its ability to serve various industries effectively.

The target market of RWS Holdings is extensive, including over 80% of the world's top 100 brands. Furthermore, the company serves more than three-quarters of Fortune's 20 'Most Admired Companies' and nearly all top pharmaceutical companies, investment banks, law firms, and patent filers. This broad customer base highlights its significant presence across different sectors.

RWS Holdings' customer demographics are diverse, spanning several key industries. These include automotive, chemical, financial, legal, medical, pharmaceutical, technology, and telecommunications. This wide-ranging customer base is supported by the company's segmented operations, which allow for specialized services tailored to each industry's needs.

The Language Services segment, which generated £327.1 million in revenue in FY24, focuses on localization services. This includes translation and content adaptation, representing 46% of the Group's total revenues. This segment is a cornerstone of RWS Holdings' offerings.

The Regulated Industries segment, accounting for 20% of Group revenues in FY24 with £146.5 million, specializes in translation and linguistic validation for highly regulated sectors. This division experienced some performance fluctuations, particularly in the life sciences sector during the first half of FY25.

IP Services provides patent translation, filing, and search services. This segment is crucial for businesses needing to protect and manage their intellectual property globally. The segment's services are essential for clients in various technology-driven industries.

The Language and Content Technology segment offers translation technologies and content platforms, including AI-driven solutions. This segment is increasingly important, especially with the growing demand for AI-led solutions and data services, which accounted for approximately 25% of Group revenues in FY24.

A significant shift in RWS Holdings' target market is the increasing focus on AI-led solutions and data services. AI-centered products and services saw an organic constant currency (OCC) growth rate of approximately 7% in FY24. This growth is driven by the increasing demand for data used to train AI models, with an emphasis on enterprise-grade security and ethical data practices.

- The company's data training business, TrainAI, has shown strong momentum.

- TrainAI has secured new clients outside of major technology accounts.

- This expansion indicates an evolving customer profile.

- The focus on AI-driven solutions reflects the company's adaptability.

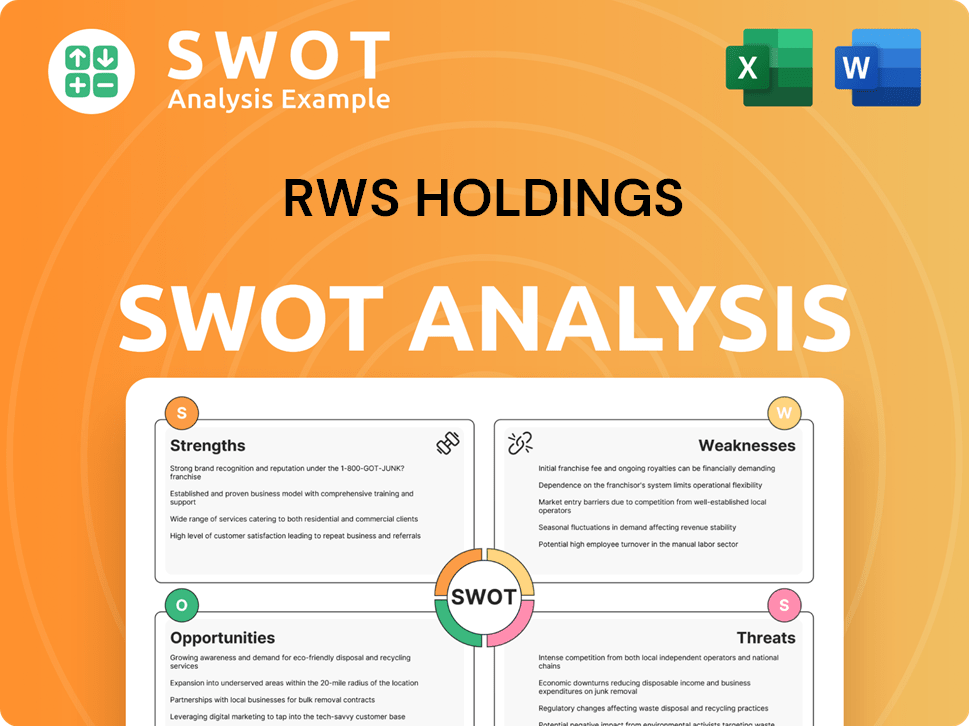

RWS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do RWS Holdings’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for RWS Holdings Company, this involves a deep dive into the demands of its global clientele. The company's customers are primarily driven by the need for seamless global communication, efficient content management, and robust intellectual property protection.

Their purchasing behaviors are heavily influenced by the necessity to localize content for diverse markets, manage complex global intellectual property portfolios, and navigate stringent international regulatory landscapes. These factors shape the company's approach to market analysis and customer acquisition.

The ideal customer for RWS Holdings seeks solutions that ensure brand consistency across various media, linguistic validation for regulated industries, and comprehensive patent translation and filing services. The assurance of compliance, the ability to acquire and retain customers globally, and gaining actionable insights from their data and content are key psychological drivers.

Customers prioritize solutions that offer both efficiency and accuracy in their global operations. This includes fast turnaround times, precise translations, and reliable content management systems.

Clients are increasingly looking for technologically advanced solutions that integrate seamlessly with their existing workflows. This includes AI-driven tools and platforms.

Compliance with international regulations and data security are paramount. Customers require solutions that ensure the confidentiality and integrity of their data.

The ability to reach and engage with global audiences is a key driver. This necessitates content localization and multilingual communication capabilities.

Customers seek cost-effective solutions that provide a strong return on investment. This includes efficient workflows and competitive pricing models.

Access to expert linguistic and technical support is crucial. Clients value providers who offer comprehensive assistance and guidance.

Common pain points addressed by RWS include the complexities of multilingual content analysis and the need for secure, ethical data sourcing for AI model training. RWS tailors its offerings by leveraging its combination of AI-enabled technology and human expertise. For instance, their AI-focused solutions, such as TrainAI, Language Weaver, and Evolve, are gaining traction, providing clients with secure 'human in the loop' self-service platforms and advanced linguistic AI solutions. The company's investment in its Language eXperience Delivery (LXD) production platform also drives efficiency in managing large volumes of content, with approximately 55% of content now machine-translated first by Language Weaver. Customer feedback and market trends, particularly the increasing demand for AI transparency and explainability, influence RWS's product development, as evidenced by their 45+ AI-related patents and over 100 peer-reviewed papers. For a deeper understanding of how RWS competes within the market, consider exploring the Competitors Landscape of RWS Holdings.

The primary needs of RWS Holdings' customers revolve around global communication, content management, and intellectual property protection. These needs are addressed through a combination of human expertise and AI-powered technology.

- Content Localization: Ensuring accurate and culturally relevant content for diverse markets.

- Intellectual Property Management: Protecting and managing global patent portfolios.

- Regulatory Compliance: Navigating complex international regulations.

- AI-Driven Solutions: Leveraging AI for efficient and accurate translation and content analysis.

- Data Security: Protecting sensitive data and ensuring ethical AI practices.

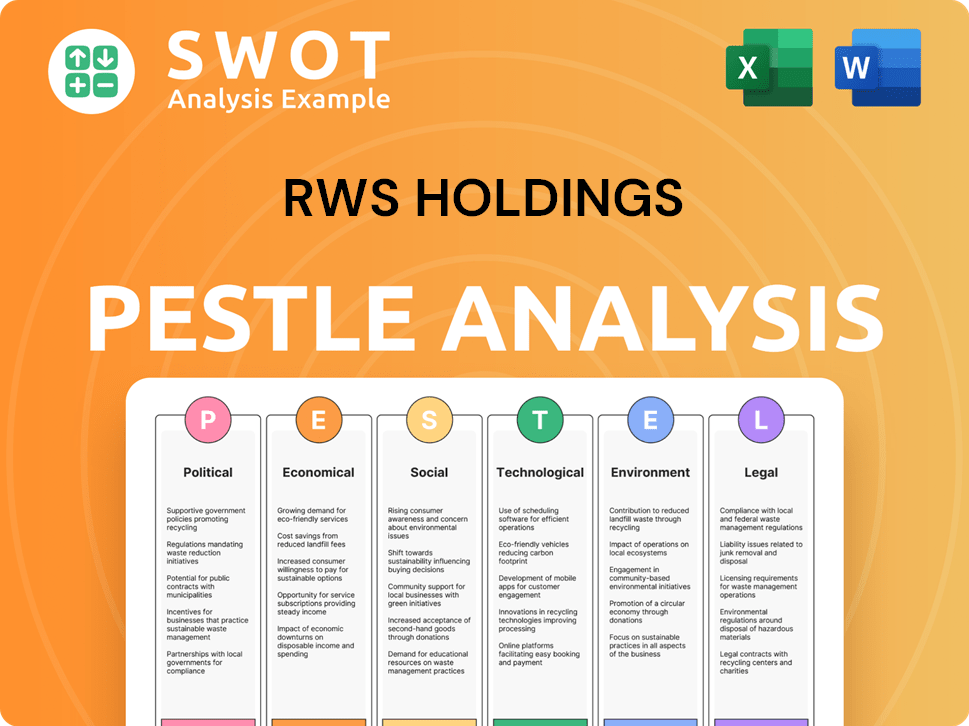

RWS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does RWS Holdings operate?

The geographical market presence of RWS Holdings Company is extensive, with operations spread across over 60 locations in 34 countries. This global footprint spans five continents, including Europe, Asia Pacific, Africa, North America, and South America. This wide reach is crucial for serving a diverse customer base and addressing varying regional demands.

The company strategically positions itself in key markets where global businesses require sophisticated language, content, and intellectual property services. This strategic focus allows RWS Holdings to maintain a strong market share and brand recognition. The company's ability to adapt to regional differences is a key factor in its success.

The United States represents the largest revenue source for RWS Holdings. In FY24, the U.S. contributed £315.3 million to the Group's revenue. The United Kingdom and Continental Europe are also significant markets, generating £184.8 million and £146.7 million, respectively, in the same period. These figures highlight the importance of these regions to the company's overall financial performance. For more insights into the company's origins and evolution, see Brief History of RWS Holdings.

RWS Holdings has a strong market share and brand recognition in key markets. This is particularly evident where global businesses require advanced language, content, and intellectual property services. The company's reputation helps attract and retain a large customer base.

RWS Holdings serves a substantial client base, including over 80% of the world's top 100 brands. This reflects the company's strong international presence and its ability to meet the needs of large, global organizations. This demonstrates the company's reach and influence in the global market.

The company addresses differences in customer demographics, preferences, and buying power through localization. Tailoring offerings and marketing strategies to suit specific regional requirements is a key part of RWS Holdings' approach. This strategy enhances customer satisfaction and market penetration.

The Asia-Pacific region has shown strong organic performance, particularly in Language Services. This growth is a testament to the company's ability to succeed in diverse markets. This expansion highlights the company's adaptability and forward-thinking strategies.

RWS Holdings' strategic expansions are often driven by the increasing demand for AI-led solutions and data services. This focus on innovation and emerging technologies positions the company for future growth. This strategic direction reflects the company's commitment to staying at the forefront of industry trends.

Continued investment in its global presence and diverse market portfolio strengthens RWS Holdings' long-term potential. This strategic approach ensures the company is well-positioned to capitalize on future opportunities. This investment strategy supports sustainable growth and market leadership.

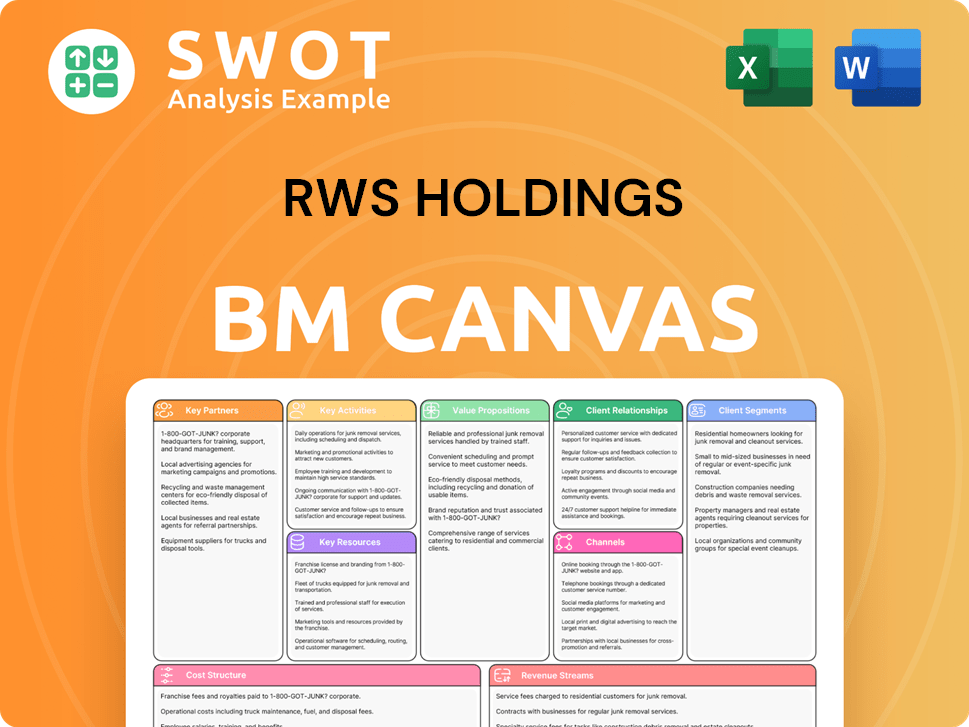

RWS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does RWS Holdings Win & Keep Customers?

The approach of RWS Holdings Company to customer acquisition and retention is multifaceted, leveraging its strong market position and technological advancements. A key indicator of its success is the consistently high client retention rates across all divisions. The company’s focus is on maintaining and improving customer relationships through continuous innovation and service excellence. This strategy is crucial in a competitive market where customer loyalty is paramount.

RWS Holdings Company, a leader in its sector, employs a dual strategy for customer acquisition and retention. They focus on securing new clients in key sectors such as technology, e-commerce, and financial services. Simultaneously, they invest heavily in retaining existing customers through high-quality service, technological enhancements, and AI-driven solutions. Their strategic emphasis on enterprise-grade security and ethical data practices for AI training further solidifies their appeal to global technology clients.

The company's commitment to customer satisfaction is evident in its investment in automation and artificial intelligence. These investments aim to boost efficiency and agility, which in turn supports sustained profitability and addresses anticipated higher volume growth within its markets. The continuous adaptation to evolving client needs, particularly in an AI-enhanced workflow environment, is also a key component of their strategy. The Growth Strategy of RWS Holdings highlights the importance of these strategies.

RWS Holdings actively targets new clients in sectors like technology, e-commerce, and financial services. Their marketing emphasizes technology-enabled services and AI-led solutions, such as TrainAI, Language Weaver, and Evolve. Enterprise-grade security and ethical data practices are key in attracting global technology clients.

The company emphasizes high client satisfaction and repeat business through ongoing investments in automation and AI. They are transitioning clients to new, automated delivery models, even if initial costs are involved. Customer data and segmentation are crucial to aligning offerings with evolving client needs.

RWS Holdings maintains high client retention levels, with 95% repeat revenue in services. Their Net Promoter Score (NPS) reached +51 for the rolling 12 months to March 31, 2025, its highest ever. These metrics reflect the effectiveness of their customer-centric strategies and operational excellence.

The company leverages AI-led solutions like TrainAI, Language Weaver, and Evolve to enhance its services. These technologies support efficiency, agility, and sustained profitability. RWS Holdings focuses on enterprise-grade security and ethical practices, meeting the needs of clients in the global technology market.

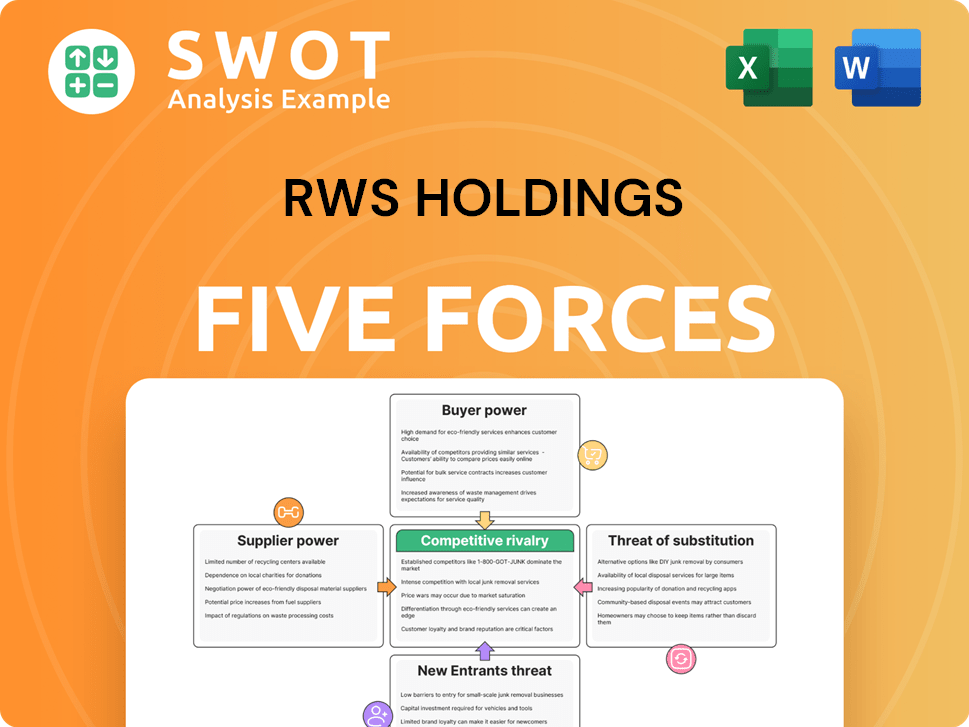

RWS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of RWS Holdings Company?

- What is Competitive Landscape of RWS Holdings Company?

- What is Growth Strategy and Future Prospects of RWS Holdings Company?

- How Does RWS Holdings Company Work?

- What is Sales and Marketing Strategy of RWS Holdings Company?

- What is Brief History of RWS Holdings Company?

- Who Owns RWS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.