RWS Holdings Bundle

How Does RWS Holdings Thrive in a Globalized World?

RWS Holdings, a pivotal player in the realm of RWS Holdings SWOT Analysis, empowers multinational corporations through its comprehensive suite of language, content management, and intellectual property services. With a client roster boasting over 80% of the world's top brands, understanding RWS's operational framework is paramount. This deep dive explores the core mechanics behind RWS's success, offering insights for investors, clients, and industry watchers alike.

From its origins in 1958 to its current status as a publicly traded entity on the London Stock Exchange, RWS has consistently adapted to the evolving needs of the global market. Its services, which span language services, translation services, and localization, are critical for businesses aiming to expand their reach and navigate international regulations. This analysis will uncover the intricacies of the RWS business model, its RWS company structure, and its strategic response to the challenges and opportunities presented by advancements in AI and automation within the RWS sector. Furthermore, we will explore How does RWS Holdings provide translation services and what is the RWS Holdings services overview.

What Are the Key Operations Driving RWS Holdings’s Success?

RWS Holdings, a global leader in language and content services, operates by providing technology-enabled solutions to a diverse clientele. The company's core business revolves around offering language services, content management, and intellectual property support. These services are crucial for businesses looking to expand globally and ensure effective communication across different markets.

The value proposition of RWS lies in its ability to combine advanced technology with human expertise. By integrating AI-powered tools with a vast network of expert linguists, RWS delivers high-quality, secure, and compliant solutions. This approach is particularly vital in regulated industries like life sciences and pharmaceuticals, where accuracy and precision are paramount. RWS's services enable clients to navigate the complexities of global markets, ensuring their content resonates with diverse audiences.

RWS's operational model is built on a foundation of technological innovation and a global network of language experts. The company leverages proprietary technology, such as Language Weaver, for machine translation and TrainAI for data services. These tools are complemented by a team of skilled linguists who possess deep industry knowledge. This combination allows RWS to offer comprehensive solutions tailored to meet the specific needs of its clients. The company's global presence, with over 65 locations across five continents, further supports its ability to serve a worldwide customer base.

RWS provides a wide range of services, including translation, localization, and linguistic validation. They also offer patent translation and filing services, as well as intellectual property search services. Furthermore, the company provides language technologies and content platforms through its Language & Content Technology (L&CT) division, catering to diverse client needs.

RWS focuses on operational efficiency to reduce costs and ensure timely delivery. They have achieved a 10% reduction in logistics costs through optimized supplier relationships and technology investments, according to its 2022 annual report. This efficiency is crucial for maintaining competitiveness and delivering value to clients.

RWS has a significant global presence, with over 65 locations across five continents. This extensive network allows them to serve clients worldwide, ensuring they can meet the language and content needs of businesses across various regions. Their global distribution network supports clients in Europe, Asia Pacific, Africa, and North and South America.

RWS maintains strong relationships with global brands, including 92% of the top 100 technology companies. These long-term partnerships highlight the trust and value clients place in RWS's services. Their ability to retain and expand their client base is a testament to their quality and reliability.

RWS provides significant benefits to its clients, enabling them to effectively communicate across borders and comply with regulations. Their services facilitate market access and support innovation programs, helping clients achieve their global objectives. The company's focus on quality and compliance makes them a trusted partner for businesses in various industries.

- Effective Cross-Border Communication: Ensuring clear and accurate messaging.

- Regulatory Compliance: Assisting clients in meeting industry standards.

- Market Access: Facilitating entry into new global markets.

- Innovation Support: Helping clients with their innovation programs.

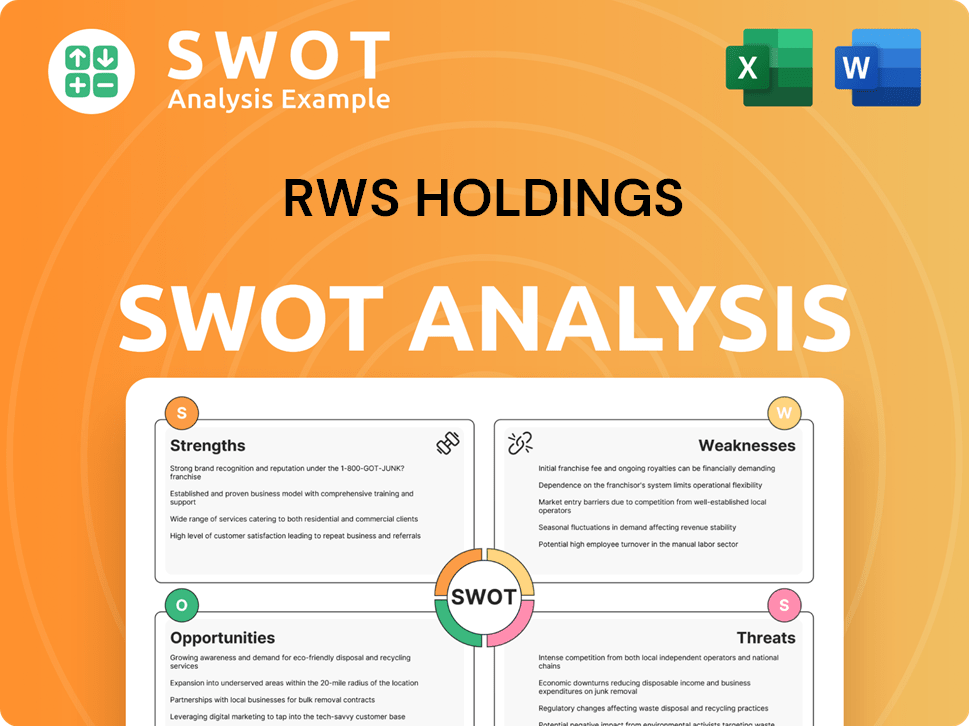

RWS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does RWS Holdings Make Money?

RWS Holdings, a prominent player in the language and content services industry, generates revenue through a multifaceted approach. The company's financial performance is segmented into various service areas, each contributing to its overall revenue streams. Understanding these revenue streams and monetization strategies is crucial for assessing the company's financial health and future prospects.

The company's primary revenue streams are categorized into four main segments: Language Services, Regulated Industries, IP Services, and Language & Content Technology (L&CT). These segments offer a range of services, from translation and localization to content management and intellectual property support. The company's ability to adapt and innovate within these segments is key to its financial success.

In the fiscal year ending September 30, 2024, RWS Holdings reported total revenue of £718.2 million. For the six months ending March 31, 2025, the company expects reported revenue to be approximately £344 million.

RWS Holdings' revenue is primarily derived from its diverse service offerings. The Language Services segment is the largest, followed by Regulated Industries, L&CT, and IP Services. The company's monetization strategies include product sales and service fees.

- Language Services: This segment is the largest contributor, accounting for £327.1 million in FY24. It provides translation services, localization, and adaptation of content.

- Regulated Industries: This division accounted for £146.5 million in FY24, focusing on translation and linguistic validation for sectors like life sciences.

- L&CT: This segment, which provides translation technologies and content platforms, generated £142.3 million in FY24.

- IP Services: This division represented £102.3 million in FY24, driven by growth in its renewals segment.

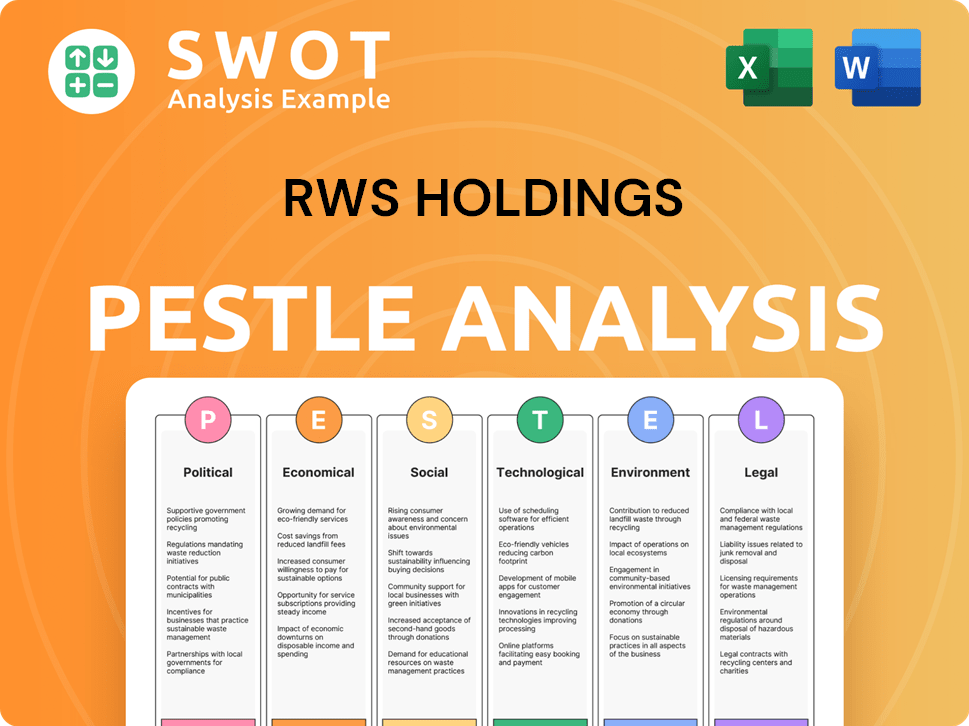

RWS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped RWS Holdings’s Business Model?

The evolution of RWS Holdings has been marked by strategic acquisitions and a shift towards technology-driven solutions. A pivotal moment was the acquisition of SDL in November 2020, which significantly broadened the company's capabilities in language services and technology. This move transformed RWS from a translation-focused company to a technology-centric enterprise within the language industry.

RWS has consistently invested in growth and efficiency, particularly focusing on AI-led and specialist solutions. These include innovative offerings such as TrainAI and Language Weaver, which have gained traction with clients. However, the company has also faced operational challenges, including shifts in service mix and initial costs associated with transitioning clients to new automated delivery models.

Despite operational hurdles, RWS maintains a strong market position, supported by its brand value and intellectual property. The company's ability to adapt to technological advancements, particularly in AI, is central to its strategy for future growth. RWS is focused on accelerating growth in the second half of FY25 by investing in its technology platform and AI-centered solutions.

The acquisition of SDL in November 2020 was a transformative event, establishing RWS as a leading language services and technology group. This acquisition marked a significant shift in the company's focus. The company has continued to invest in growth and efficiency, leading to a pivot towards AI-led and more specialist solutions.

RWS has strategically invested in AI-led solutions like TrainAI and Language Weaver. The company is adapting to new trends and technology shifts by investing in its technology platform and focusing on AI-centered solutions. These moves aim to accelerate growth through the second half of FY25.

RWS benefits from a strong brand value, estimated at approximately £500 million as of 2023. The company's intellectual property, including over 40,000 registered trademarks and patents as of 2023, provides a competitive advantage. RWS leverages an efficient supply chain and a robust global distribution network.

Adjusted profit before tax for the six months ended March 31, 2025, is expected to be approximately £17 million, down from £46 million in the prior year. Despite these challenges, RWS has seen high client retention levels and secured new client wins across various end markets. For more details on the company's strategy, see this article about the Marketing Strategy of RWS Holdings.

RWS's competitive advantages include a strong brand, valuable intellectual property, and an efficient operational structure. The company's brand value, estimated at £500 million in 2023, supports premium pricing and customer retention. RWS invests in technology and a skilled workforce, including 1,800 language specialists and a pool of tens of thousands of freelancers.

- Strong Brand Value: Attracts and retains customers.

- Intellectual Property: Over 40,000 registered trademarks and patents as of 2023.

- Efficient Supply Chain: Supports global distribution.

- Technology and Workforce: Investment in AI and language specialists.

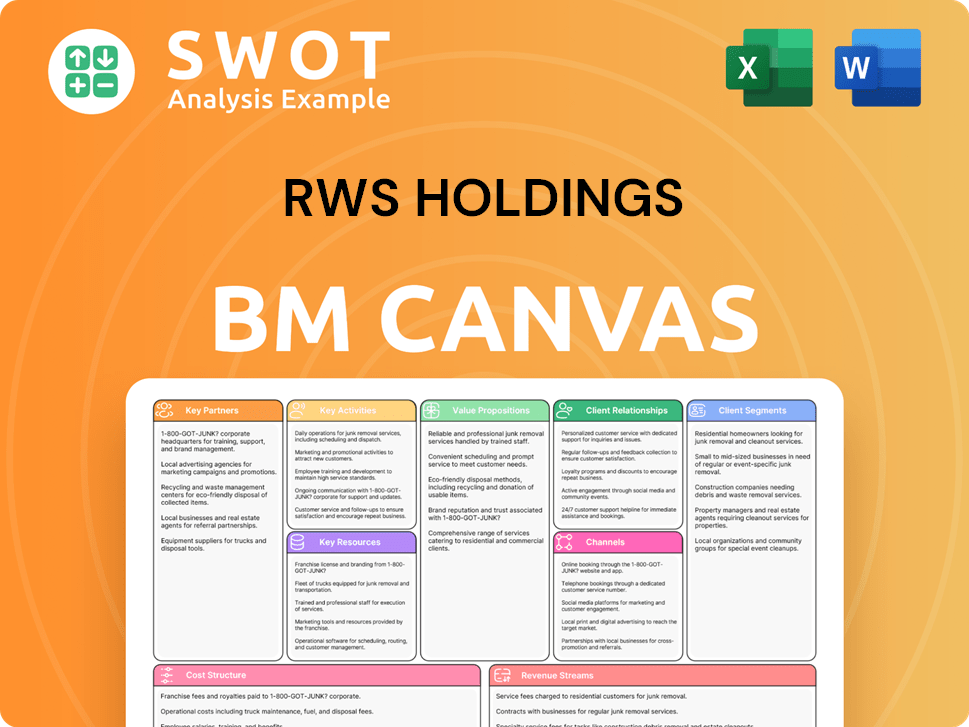

RWS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is RWS Holdings Positioning Itself for Continued Success?

As a global leader in technology-enabled language, content, and intellectual property services, RWS Holdings (RWS company) holds a strong industry position. They serve a significant portion of the world's top brands and major companies across various sectors. With a global presence spanning Europe, Asia Pacific, Africa, and the Americas, and over 65 locations worldwide, RWS demonstrates substantial market penetration and customer loyalty.

However, the company faces challenges. The language services sector is transforming due to automation, machine translation, and AI. RWS has seen short-term costs and operational friction from this transition, affecting profitability. Additional risks include regulatory changes, such as those related to patent translation, and fluctuations in foreign exchange rates.

RWS is a world-leading provider of language services and translation services. They work with many of the world's top brands. Their global reach includes over 65 locations worldwide, highlighting their extensive market presence.

The company faces risks from the increasing integration of automation and AI. Transition costs for new delivery models have impacted profitability. Regulatory changes and foreign exchange fluctuations also pose challenges to RWS.

RWS is focused on investing in AI-led solutions to drive growth. They anticipate accelerating growth in the second half of FY25. The company expects modest single-digit organic constant currency (OCC) growth for the full year 2025.

RWS is driving efficiency and automation to support sustained profitability. A refreshed strategy with an improved go-to-market approach is expected. Further details will be released with the half-year results on June 17, 2025.

Looking ahead, RWS is strategically focused on sustaining growth by investing in AI-led solutions like TrainAI and Language Weaver. The company anticipates accelerating growth in the second half of FY25 and expects modest single-digit organic constant currency (OCC) growth for the full year 2025. RWS is also focused on driving efficiency and automation to support sustained profitability. For more insights into the company's strategies, you can read about the Growth Strategy of RWS Holdings.

RWS is prioritizing AI-led solutions and efficiency to drive growth. They aim to improve their go-to-market approach. The company is focused on delivering sustainable profitability and capturing higher volume growth.

- Investment in AI-led solutions (TrainAI, Language Weaver).

- Focus on efficiency, agility, and automation.

- Improved go-to-market approach.

- Anticipated modest single-digit OCC growth for FY25.

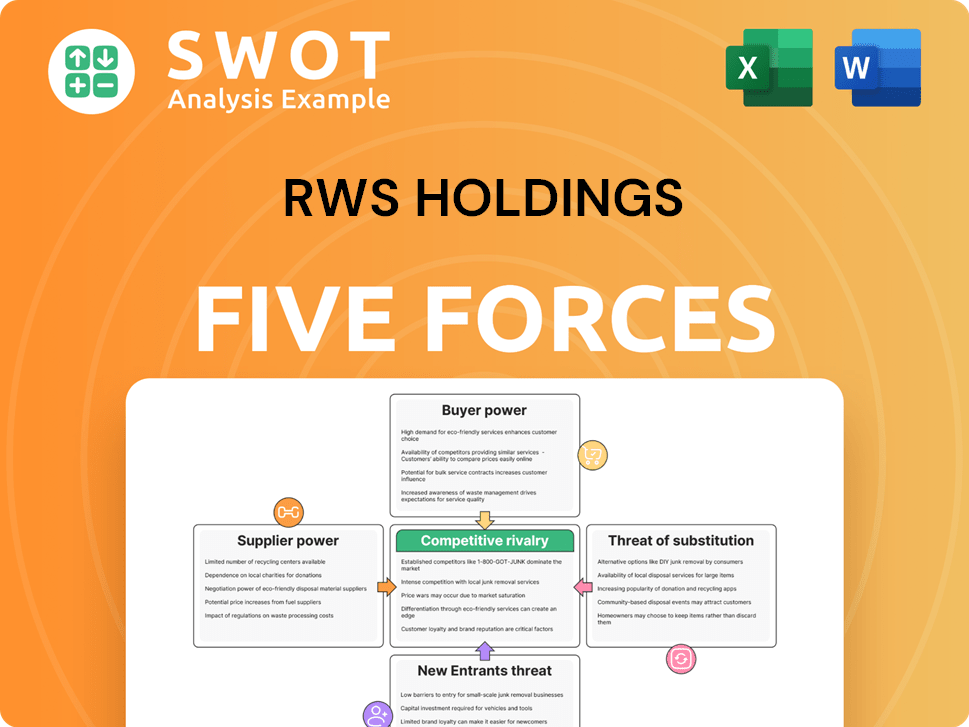

RWS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of RWS Holdings Company?

- What is Competitive Landscape of RWS Holdings Company?

- What is Growth Strategy and Future Prospects of RWS Holdings Company?

- What is Sales and Marketing Strategy of RWS Holdings Company?

- What is Brief History of RWS Holdings Company?

- Who Owns RWS Holdings Company?

- What is Customer Demographics and Target Market of RWS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.