RWS Holdings Bundle

How is RWS Holdings Redefining Global Communication?

The 2020 acquisition of SDL catapulted RWS Holdings to the forefront of the language and content management industry, fundamentally reshaping its trajectory. Founded in 1958, RWS has evolved from a patent translation service to a publicly traded global powerhouse, boasting a market capitalization of approximately £985.96 million as of April 2025. This transformation highlights the critical role of strategic planning in today's dynamic global market.

RWS Holdings, a leader in RWS Holdings SWOT Analysis, provides essential Localization Services and Language Technology solutions, supporting clients worldwide. Its services are vital for international communication and innovation, spanning diverse industries. This article delves into RWS's Growth Strategy, examining its expansion plans, technological advancements, and financial performance to understand its future outlook and competitive landscape in the Global Market.

How Is RWS Holdings Expanding Its Reach?

The growth strategy of RWS Holdings centers on aggressive expansion initiatives, both geographically and through service diversification. These efforts are designed to bolster its market position and capitalize on emerging opportunities within the language technology and localization services sectors. The company's strategic moves are geared towards sustained growth and maintaining a competitive edge in a dynamic industry.

RWS Holdings is actively expanding its global footprint, particularly in high-growth regions, to access new customer bases and strengthen its international presence. This includes strategic investments in sales and operational infrastructure in key territories. The company is also focused on launching new products and services that address evolving client needs in content management, localization, and intellectual property.

Mergers and acquisitions are a vital component of RWS's expansion strategy. Future M&A activities are expected to target companies that complement RWS's core offerings or provide entry into new, synergistic market segments. These initiatives are designed to diversify revenue streams and mitigate risks.

RWS Holdings focuses on expanding its presence in high-growth regions and emerging markets. This includes strategic investments in sales and operational infrastructure in key territories. The aim is to access new customer bases and strengthen its international presence.

The company is launching new products and services to meet evolving client needs. This includes content management, localization, and intellectual property services. The focus is on leveraging artificial intelligence and automation to improve efficiency.

M&A activities remain a vital part of RWS's expansion strategy. The company seeks to acquire companies that complement its core offerings. The goal is to gain access to new technologies, talent, and market share.

RWS aims to broaden its reach within regulated industries like life sciences and legal. Demand for specialized language and IP services remains strong in these sectors. This strategy helps diversify revenue streams.

RWS Holdings is committed to sustained growth through strategic initiatives. These include geographical expansion, service diversification, and strategic acquisitions. These efforts are designed to maintain a competitive edge.

- Geographical Expansion: Targeting high-growth regions and emerging markets.

- Service Diversification: Launching new products and services, especially those leveraging AI.

- Strategic Acquisitions: Focusing on companies that complement core offerings.

- Industry Focus: Broadening reach in regulated industries like life sciences and legal.

RWS Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does RWS Holdings Invest in Innovation?

The company, RWS Holdings, heavily emphasizes technology and innovation to drive sustained growth. This strategy involves significant investment in research and development to enhance its core offerings. The focus is on digital transformation, automation, and integrating cutting-edge technologies.

A key area of focus for RWS Holdings is the application of artificial intelligence (AI), machine learning (ML), and natural language processing (NLP). These technologies are used to improve the speed, accuracy, and cost-effectiveness of language and content services. This approach is crucial for meeting the increasing demand for high-quality, rapid, and cost-efficient global communication solutions, directly contributing to RWS's growth objectives.

RWS Holdings is actively developing and deploying AI-powered translation tools, content creation platforms, and intellectual property management solutions. These advancements streamline workflows and provide greater value to clients. The company's commitment to innovation is further demonstrated through its in-house development efforts and strategic collaborations with external innovators and technology partners.

RWS Holdings leverages AI and automation to enhance its Localization Services and other offerings. This includes AI-powered translation tools and content creation platforms. These tools improve efficiency and reduce costs.

The company develops robust cloud-based platforms for scalability and seamless integration. These platforms offer a comprehensive suite of services. This includes global content localization and patent searching.

RWS Holdings collaborates with external innovators and technology partners. These partnerships enhance its capabilities and drive innovation. The company continuously invests in these areas.

Digital transformation is a core part of RWS Holdings' strategy. This involves automation and the integration of cutting-edge technologies. The goal is to improve efficiency and client value.

Technological advancements help meet the increasing demand for efficient global communication. This directly supports RWS Holdings' Growth Strategy. The company focuses on high-quality, rapid, and cost-efficient solutions.

RWS Holdings invests in in-house development efforts to drive innovation. This includes creating new tools and platforms. The company aims to maintain a leadership position in the industry.

The company's approach to digital transformation also includes the development of robust cloud-based platforms that offer scalability and seamless integration with client systems. These platforms enable RWS to deliver a more comprehensive and efficient suite of services, from global content localization to patent searching and filing. For more insights into the company's marketing approach, you can read about the Marketing Strategy of RWS Holdings.

RWS Holdings focuses on several key technological advancements to maintain its competitive edge and achieve its RWS Future goals. These advancements are crucial for meeting the evolving needs of its clients and expanding its market presence.

- AI-Powered Translation Tools: Developing and deploying AI-powered translation tools to improve accuracy and speed.

- Content Creation Platforms: Creating platforms that streamline content creation processes.

- Cloud-Based Platforms: Utilizing cloud-based platforms for scalability and integration.

- Intellectual Property Management Solutions: Offering solutions to manage intellectual property efficiently.

- Strategic Partnerships: Collaborating with technology partners to enhance its capabilities.

RWS Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is RWS Holdings’s Growth Forecast?

The financial outlook for RWS Holdings reflects a strategy focused on sustainable growth, supported by strategic expansion and technological innovation. For the fiscal year ending September 30, 2024, the company reported revenues of £727.1 million. This was a slight decrease from £749.1 million in the previous year, mainly due to currency headwinds and market challenges. Despite these factors, the company maintained a solid adjusted profit before tax of £115.1 million.

Looking ahead, RWS Holdings anticipates a return to organic growth in fiscal year 2025. This growth is expected to be driven by a rebound in client spending and the benefits of its strategic initiatives. Analysts project a potential revenue increase in the coming years, with some forecasting approximately £738.9 million for 2025. The company's financial strategy emphasizes maintaining healthy profit margins through operational efficiencies and the scalable nature of its technology-enabled services, which is discussed in Revenue Streams & Business Model of RWS Holdings.

RWS Holdings is committed to disciplined investment in R&D and strategic acquisitions. This ensures that capital deployment supports long-term growth without compromising financial stability. The company's robust cash flow generation allows for continued investment and shareholder returns, as demonstrated by its consistent dividend payments. The overall financial narrative suggests a focus on incremental, profitable growth, leveraging its strong market position and diversified service portfolio to navigate potential economic fluctuations.

RWS Holdings reported revenues of £727.1 million for the fiscal year ending September 30, 2024. This was a slight decrease compared to £749.1 million in the previous year. The company maintained a strong adjusted profit before tax of £115.1 million, despite facing currency headwinds and market challenges.

The company anticipates a return to organic growth in fiscal year 2025. This is driven by a rebound in client spending and strategic initiatives. Analysts project potential revenue increases in the coming years. RWS Holdings focuses on incremental, profitable growth, leveraging its strong market position and diversified service portfolio.

RWS Holdings is committed to disciplined investment in R&D and strategic acquisitions. This ensures that capital deployment supports long-term growth without compromising financial stability. The company's robust cash flow generation supports continued investment and shareholder returns. These investments are key to the RWS Future.

Analysts' forecasts suggest a potential revenue increase in the coming years. Projections indicate a revenue of approximately £738.9 million for 2025. This growth is supported by the company's strategic initiatives and a rebound in client spending. This is a key part of the RWS Holdings Growth Strategy.

The financial strategy emphasizes maintaining healthy profit margins through operational efficiencies. This is achieved through the scalable nature of its technology-enabled services. The focus on profitability and efficiency supports the RWS Holdings Growth Strategy.

RWS Holdings leverages its strong market position and diversified service portfolio. This helps the company navigate potential economic fluctuations. This diversification is a key element of the company's long-term financial health. The company's Localization Services and Language Technology are key drivers.

RWS Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow RWS Holdings’s Growth?

The path for RWS Holdings toward achieving its growth strategy and securing its RWS future is fraught with potential risks and obstacles. These challenges span from intense competition and regulatory hurdles to the rapid evolution of technology and the complexities of supply chain management. A proactive and adaptable approach to risk management is crucial for navigating these complexities successfully.

The company must contend with a highly competitive global market, where differentiation and pricing strategies are constantly under pressure. Moreover, staying compliant with evolving data privacy regulations and intellectual property laws across various jurisdictions presents an ongoing challenge. Technological disruptions, particularly from AI and machine learning, require continuous investment and adaptation to maintain a competitive edge.

Operational risks also include supply chain vulnerabilities, specifically concerning the global network of linguists and subject matter experts. Internal resource limitations, such as attracting and retaining top talent, could also hinder expansion. RWS Holdings addresses these risks through a diversified client base, robust cybersecurity, and proactive market monitoring.

The Localization Services and language technology sectors are highly competitive. Numerous companies, from small specialized firms to large multinational corporations, compete for market share. This intense competition puts pressure on pricing and necessitates constant innovation and differentiation to secure and retain clients. For a deeper understanding of the competitive environment, consider exploring the Competitors Landscape of RWS Holdings.

Changes in data privacy regulations, such as GDPR, and intellectual property laws across different regions, pose a significant risk. Compliance requires continuous adaptation of operational procedures and significant investment in legal and technological infrastructure. Failure to comply can lead to hefty fines and damage to reputation.

Rapid advancements in AI and machine learning technologies could disrupt the market. New solutions could quickly alter market dynamics, requiring RWS Holdings to continually invest in and adapt its language technology offerings. This includes the development of automated translation tools and advanced content management systems to stay competitive. For instance, the global market for AI in translation is projected to reach billions of dollars by 2025.

The global network of linguists and subject matter experts is a critical part of RWS Holdings' service delivery. Disruptions to this supply chain, whether due to geopolitical events, economic downturns, or other unforeseen issues, could significantly impact the company's ability to fulfill client orders and maintain service quality. Effective supply chain management and diversification are essential.

Attracting and retaining top talent, particularly in specialized areas like AI, data science, and linguistic expertise, can be a challenge. Competition for skilled professionals is fierce, and the ability to secure and retain these individuals is crucial for driving innovation and expansion. Investment in employee development and competitive compensation packages is vital.

Economic downturns or unforeseen global events can impact demand for services. RWS Holdings should prepare for potential economic fluctuations through strategic planning and diversification. Scenario planning allows the company to build resilience into its operational model, ensuring it can withstand adverse economic conditions.

RWS Holdings diversifies its client base across various sectors to mitigate the impact of economic downturns or sector-specific challenges. Diversification includes expanding into new Global Market segments and offering a broader range of services. This strategy helps to reduce reliance on any single client or industry, providing stability and resilience.

Robust cybersecurity measures are implemented to protect sensitive client data. This includes regular security audits, advanced threat detection systems, and employee training programs. Protecting client data is essential for maintaining trust and complying with data privacy regulations. The cost of cybercrime is expected to reach trillions of dollars globally in the coming years.

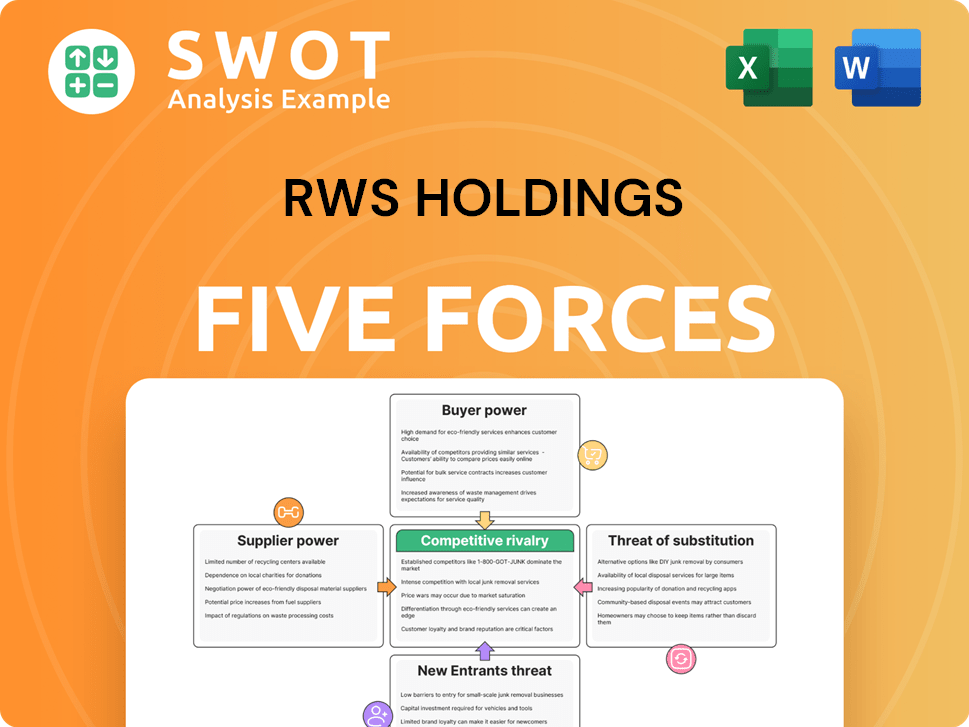

RWS Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of RWS Holdings Company?

- What is Competitive Landscape of RWS Holdings Company?

- How Does RWS Holdings Company Work?

- What is Sales and Marketing Strategy of RWS Holdings Company?

- What is Brief History of RWS Holdings Company?

- Who Owns RWS Holdings Company?

- What is Customer Demographics and Target Market of RWS Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.