Sally Beauty Holdings Bundle

How Does Sally Beauty Holdings Navigate the Beauty Industry's Competitive Waters?

The beauty industry is a dynamic arena, constantly reshaped by digital innovation and shifting consumer demands. Sally Beauty Holdings SWOT Analysis reveals a company striving to maintain its position. Understanding the Competitive Landscape of Sally Beauty Holdings is crucial for investors, analysts, and anyone seeking to understand the beauty market's complexities. This analysis delves into the company's strategies and its rivals.

This exploration of Sally Beauty competitors will examine its market share, business model, and strategic initiatives. We'll dissect its competitive advantages and threats, examining how it fares against rivals like Ulta Beauty. Furthermore, we will analyze Sally Beauty Holdings' financial performance compared to competitors and its recent moves. This beauty industry analysis provides insights into the company's ability to adapt and thrive in the face of evolving retail industry trends and e-commerce challenges.

Where Does Sally Beauty Holdings’ Stand in the Current Market?

Sally Beauty Holdings, Inc. maintains a significant market position within the beauty supply sector, targeting both professional stylists and retail consumers. Operating a vast global network of stores, with a strong presence in North America, Europe, and Latin America, the company offers a wide array of beauty products through its Sally Beauty Supply segment, catering to a broad retail customer base. Its Beauty Systems Group (CosmoProf) segment focuses on distributing professional beauty products to salons and salon professionals, highlighting its dual-market approach.

The company's core offerings include hair color, hair care, skincare, and nail products, alongside salon equipment and educational resources. Sally Beauty has been actively enhancing its e-commerce capabilities and loyalty programs, reflecting a broader industry trend towards omnichannel retail. This strategy aims to provide a seamless shopping experience across physical and digital platforms. For the second quarter of fiscal year 2024, Sally Beauty Holdings reported net sales of $920.6 million, showing a slight decrease compared to the prior year, indicating a dynamic market environment.

The company's established distribution network and physical store presence in accessible areas continue to underpin its market position. Its professional segment leverages direct relationships with salons. For further insights into the company's ownership structure, you can explore Owners & Shareholders of Sally Beauty Holdings.

Sally Beauty Holdings is one of the largest specialty retailers and distributors in the beauty supply industry. While specific market share data for 2024-2025 is subject to ongoing market analysis, the company's scale and established distribution network are key to its competitive advantage. The company's strongholds are typically in suburban and accessible urban areas.

The primary product lines include hair color, hair care, skincare, and nail products. Sally Beauty also offers salon equipment and educational resources. The company's focus on both retail consumers and professional stylists through its two main segments allows it to capture a wider market segment.

Sally Beauty is actively engaged in digital transformation, enhancing its e-commerce capabilities and loyalty programs. This strategy aligns with the industry's shift towards omnichannel retail, aiming for a seamless shopping experience across physical and digital touchpoints. The company's digital presence is a key factor in maintaining its competitive edge.

For the second quarter of fiscal year 2024, Sally Beauty Holdings reported net sales of $920.6 million. Despite slight fluctuations, the company's scale and established distribution network continue to underpin its market position. The financial performance reflects the dynamic market environment and the company's ongoing strategic adjustments.

Sally Beauty Holdings' market position is characterized by its extensive retail network, dual-market approach, and focus on digital transformation. The company's ability to serve both retail consumers and professional stylists sets it apart.

- Extensive retail presence with stores globally.

- Dual-market approach serving both retail and professional segments.

- Focus on e-commerce and digital enhancements.

- Strong distribution network.

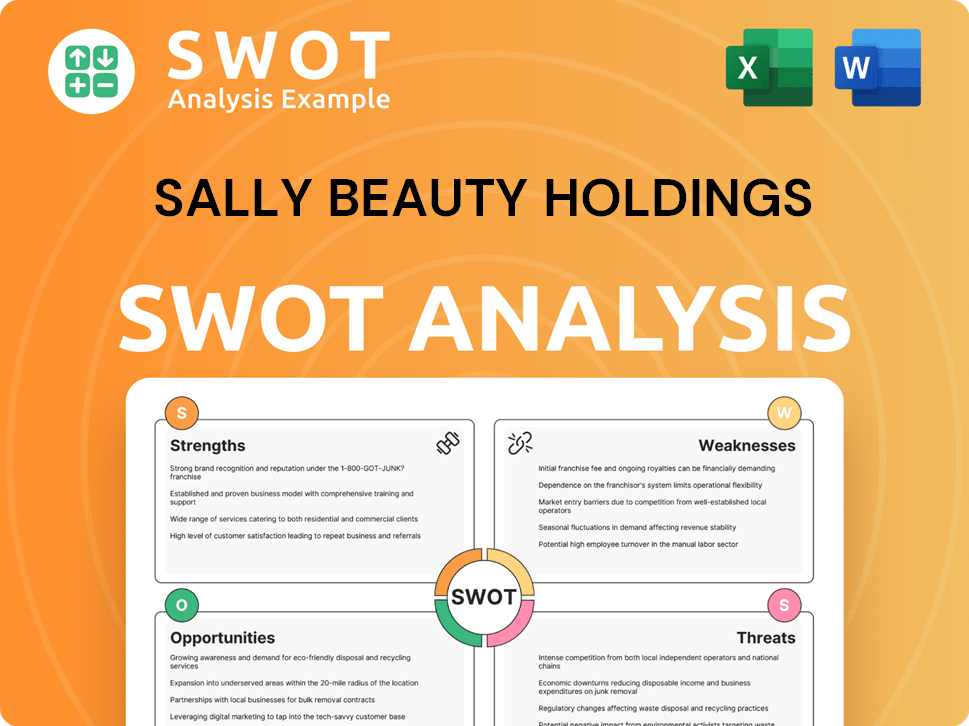

Sally Beauty Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Sally Beauty Holdings?

The competitive landscape for Sally Beauty Holdings is multifaceted, encompassing both retail and professional beauty segments. Understanding the Sally Beauty competitors is crucial for assessing its market position and strategic challenges. This analysis considers both direct and indirect rivals, including large beauty retailers, mass merchandisers, drugstores, e-commerce giants, and professional beauty distributors.

In the retail space, Sally Beauty faces intense competition from established players like Ulta Beauty and Sephora, which offer broader product selections and enhanced shopping experiences. Additionally, mass merchandisers and drugstores provide convenient access to beauty products at competitive prices. The rise of e-commerce, particularly from Amazon, further complicates the competitive environment by offering vast product choices and rapid delivery.

In the professional segment, Sally Beauty's Beauty Systems Group (CosmoProf) competes with professional beauty distributors like SalonCentric. These competitors focus on providing exclusive brands, education, and direct-to-salon sales. Emerging direct-to-consumer brands and subscription services also disrupt the market. Mergers and acquisitions within the beauty industry further intensify competition.

Ulta Beauty and Sephora are key direct competitors, offering a wide range of prestige and mass-market beauty products. They often include in-store services and loyalty programs. These competitors challenge Sally Beauty through their expansive product assortments and brand partnerships.

Walmart, Target, CVS, and Walgreens compete by offering convenient access to beauty and personal care items. They often compete on price and convenience, impacting Sally Beauty's retail sales.

Amazon presents a significant challenge due to its unparalleled product selection, competitive pricing, and rapid delivery options. This impacts both retail and professional sales, requiring Sally Beauty to enhance its online presence.

SalonCentric (L'Oréal) and regional independent distributors compete with Sally Beauty's Beauty Systems Group (CosmoProf). They offer exclusive professional brands and direct-to-salon sales forces. These competitors vie for market share by providing superior customer service and educational support to stylists.

Emerging direct-to-consumer (DTC) beauty brands and subscription box services are disrupting the traditional competitive landscape. They leverage social media and personalized marketing to reach consumers directly, bypassing traditional retail and distribution channels.

Mergers and acquisitions, such as brand acquisitions by larger beauty conglomerates, further intensify competition. These consolidations expand product portfolios and market power, influencing the Sally Beauty Holdings competitive landscape.

The beauty industry analysis reveals a dynamic market where companies must adapt to changing consumer preferences and technological advancements. For example, the rise of e-commerce has forced traditional retailers to invest heavily in their online platforms and fulfillment capabilities. Understanding the Sally Beauty business model and its ability to compete in this environment is crucial. For more details on strategies, consider reading about the Marketing Strategy of Sally Beauty Holdings.

Several factors influence the competitive dynamics within the beauty industry. These include:

- Product Assortment: The breadth and depth of product offerings, including both mass-market and prestige brands.

- Pricing Strategies: Competitive pricing models, including discounts, promotions, and value-added services.

- Brand Partnerships: Exclusive distribution rights and collaborations with popular beauty brands.

- Customer Experience: In-store services, loyalty programs, and personalized shopping experiences.

- E-commerce Capabilities: User-friendly online platforms, mobile apps, and efficient fulfillment processes.

- Marketing and Branding: Effective marketing campaigns, social media presence, and brand recognition.

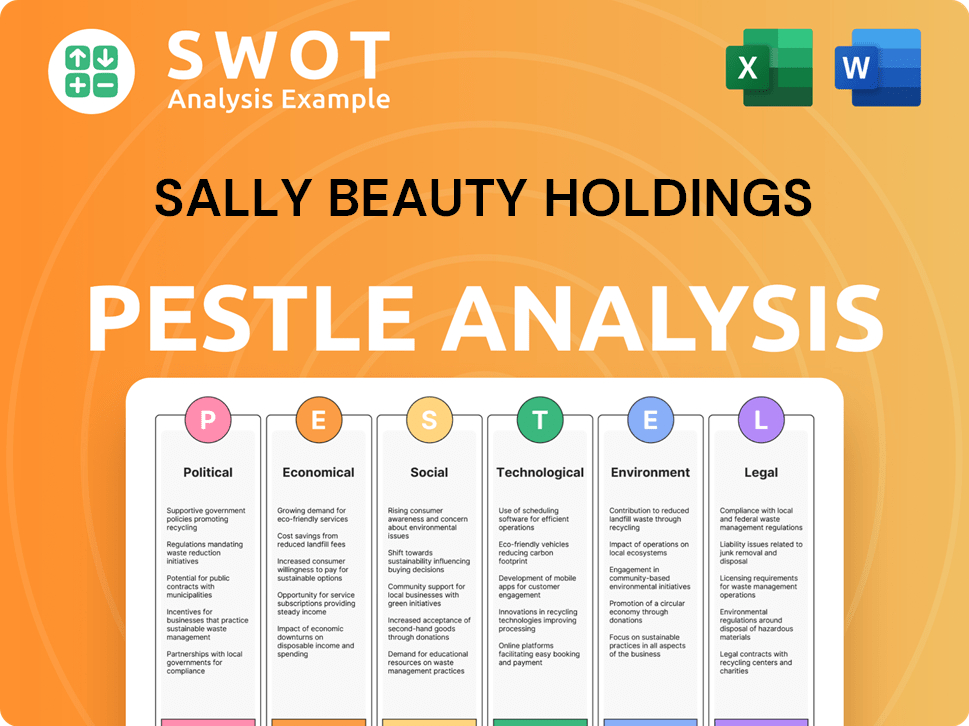

Sally Beauty Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Sally Beauty Holdings a Competitive Edge Over Its Rivals?

Understanding the Growth Strategy of Sally Beauty Holdings involves recognizing its key competitive advantages. The company has built a strong position in the beauty supply industry by leveraging its unique strengths. These advantages allow it to compete effectively against both online and offline rivals.

A significant advantage is the dual-channel distribution model. This model includes Sally Beauty Supply stores and Beauty Systems Group (CosmoProf). This extensive physical footprint provides convenient access and immediate product availability. The company also benefits from strong brand recognition and established customer loyalty. These factors are crucial in a competitive market.

Another key advantage is the broad product assortment. The company offers a wide range of national and exclusive brands. This comprehensive offering caters to varied customer needs. The emphasis on education and training for salon professionals also fosters loyalty.

The company operates both Sally Beauty Supply stores and Beauty Systems Group (CosmoProf). This strategy provides broad market coverage. This approach allows it to reach a diverse customer base.

Sally Beauty has strong brand recognition, especially within the professional salon community. CosmoProf has long-standing relationships with stylists and salon owners. This builds customer loyalty and trust.

The company offers a wide range of products, including hair care, skincare, and nail products. It carries both national and exclusive brands. This variety caters to different customer preferences and needs.

Beauty Systems Group provides education and training for salon professionals. This adds value beyond product sales. It helps build stronger relationships with its professional customers.

These advantages help Sally Beauty maintain its market position. The company focuses on omnichannel strategies and exclusive product offerings. However, it faces threats from competitors and shifts in consumer behavior.

- Extensive Store Network: Thousands of stores globally offer convenient access.

- Strong Customer Relationships: Especially with salon professionals through CosmoProf.

- Comprehensive Product Range: Catering to both retail and professional customers.

- Digital Investments: Enhancing e-commerce and loyalty programs.

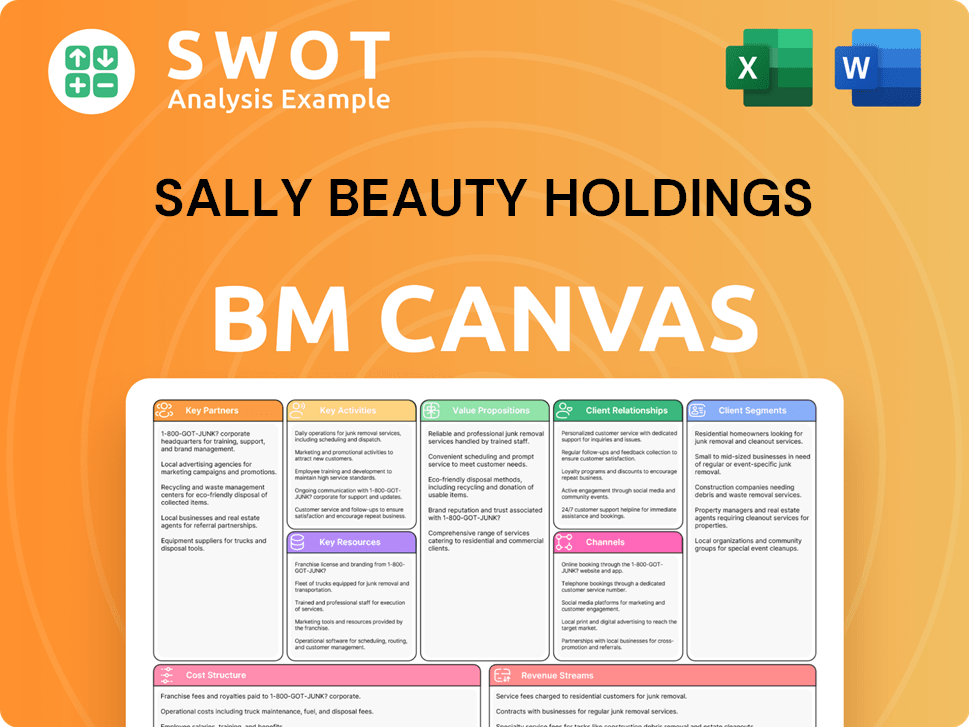

Sally Beauty Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Sally Beauty Holdings’s Competitive Landscape?

The beauty industry is experiencing significant shifts driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. These trends create both challenges and opportunities for companies like Sally Beauty Holdings. Understanding the competitive landscape is crucial for analyzing the revenue streams and business model of Sally Beauty Holdings and its ability to adapt and thrive.

For Sally Beauty, staying competitive means navigating increasing competition from various retail channels and online platforms. Adapting to rapid product innovation and evolving beauty trends is also essential. The company must continuously innovate, optimize its operations, and leverage its strengths to maintain its market position.

E-commerce and digital engagement are reshaping consumer purchasing habits. There's a growing preference for online shopping and direct-to-consumer brands. Regulatory changes, especially concerning product safety and ingredient transparency, are also influencing product development.

Maintaining relevance amid aggressive competition from diversified retailers and online giants. Declining foot traffic in physical stores and increased price competition online pose significant threats. Keeping pace with rapid product innovation and changing beauty trends is another hurdle.

The growing demand for professional-grade products, driven by the rise of home styling and DIY beauty. Expansion into emerging markets with growing middle classes offers growth potential. Product innovation, especially in sustainable and personalized beauty solutions, can attract new segments.

Enhancing e-commerce platforms and optimizing store footprints are key. A focus on exclusive and high-margin product offerings is essential. Strategic partnerships with emerging brands or technology providers could also enhance market reach.

Sally Beauty's competitive position is evolving, with a greater emphasis on digital integration and personalized customer experiences. The company must curate a selection of professional and retail products to meet diverse consumer needs. To remain resilient, Sally Beauty is enhancing its e-commerce platforms and optimizing its store footprint.

- Market Share and Competition: The company faces competition from Ulta Beauty, mass retailers like Walmart and Target, and online platforms such as Amazon.

- E-commerce and Digital Strategy: Investing in e-commerce and digital marketing is crucial to compete effectively.

- Product Innovation: Adapting to changing beauty trends and offering innovative products is essential for attracting customers.

- Geographic Expansion: Exploring opportunities in emerging markets can drive growth.

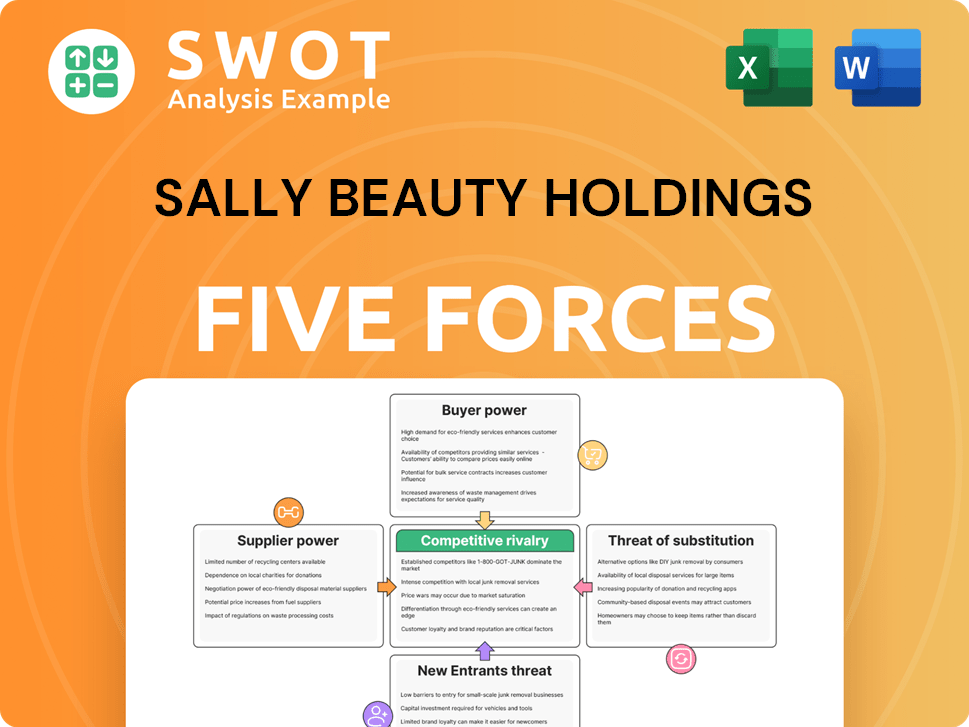

Sally Beauty Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sally Beauty Holdings Company?

- What is Growth Strategy and Future Prospects of Sally Beauty Holdings Company?

- How Does Sally Beauty Holdings Company Work?

- What is Sales and Marketing Strategy of Sally Beauty Holdings Company?

- What is Brief History of Sally Beauty Holdings Company?

- Who Owns Sally Beauty Holdings Company?

- What is Customer Demographics and Target Market of Sally Beauty Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.