Sally Beauty Holdings Bundle

Who Are Sally Beauty Holdings' Customers?

Navigating the ever-changing beauty landscape requires a deep understanding of your audience. For Sally Beauty Holdings, pinpointing its customer demographics and target market is essential for sustained success. This involves adapting to shifts like the demand for personalized beauty solutions and the rise of DIY enthusiasts. Understanding the nuances of its diverse customer base is key to strategic growth.

The beauty industry's dynamism necessitates continuous market analysis to refine strategies. Sally Beauty Holdings must understand its customer profile, including age range, income levels, and preferred product categories, to tailor its offerings. Analyzing customer buying behavior, location, and lifestyle helps the company refine its approach to customer centricity, a key strategic initiative for fiscal year 2025, ensuring it meets the evolving needs of its target market.

Who Are Sally Beauty Holdings’s Main Customers?

Understanding the customer base is crucial for any business, and for Sally Beauty Holdings, the customer demographics and target market are quite diverse. The company caters to both individual consumers (B2C) and salon professionals (B2B), creating a dual customer segment strategy. This approach allows Sally Beauty Holdings to capture a broad market within the beauty industry.

The Sally Beauty Supply segment focuses on retail consumers and salon professionals, offering professional-quality beauty supplies. The Beauty Systems Group (CosmoProf) segment, on the other hand, concentrates on selling professionally branded products for use in salons and for resale. This dual approach allows the company to serve a wide range of customers, from DIY enthusiasts to professional stylists.

In fiscal year 2024, the company's U.S. and Canada operations generated 78% of its sales from its 16 million known customers. This highlights the importance of its loyal customer base and provides insights into the customer profile. The company is actively working to attract 'next-generation beauty enthusiasts' and DIY customers through initiatives like its brand refresh and expanded digital marketplaces, indicating a focus on younger, trend-driven segments.

Sally Beauty Holdings' target market segmentation includes both individual consumers and salon professionals. The retail segment attracts value-conscious customers, while the professional segment focuses on salon owners and stylists. This dual approach allows the company to cater to a wide range of needs within the beauty industry.

Middle- and high-income consumers are returning to normalized service cadences, leading to strength in color and care product sales. Lower-income consumers are more likely to seek deals and discounts. This difference in spending behavior influences the company's marketing strategies and product offerings.

In 2024, hair color accounted for 40% of sales, hair care 24%, and styling tools and supplies 17%. These figures indicate strong demand in these areas from both professional and retail customers. The company's strategic focus on these product categories reflects customer preferences and market trends.

Sally Beauty has shifted to enhance its customer centricity, aiming to move from a 'supply house' to a 'beauty experience'. This involves personalization and catering to a wide range of consumers, from DIY enthusiasts to professional stylists. The company is focusing on a more customer-centric approach.

The primary customer segments include retail consumers and salon professionals. Key customer demographics include age, gender, and income levels, although specific breakdowns are not fully disclosed. The company's focus on attracting 'next-generation beauty enthusiasts' and DIY customers indicates a focus on younger demographics. The company's target market segmentation is designed to meet the diverse needs of its customer base.

- Retail consumers seeking value and convenience.

- Salon professionals purchasing professional-grade products.

- Younger, trend-driven customers interested in DIY beauty.

- Customers with varying income levels and spending habits.

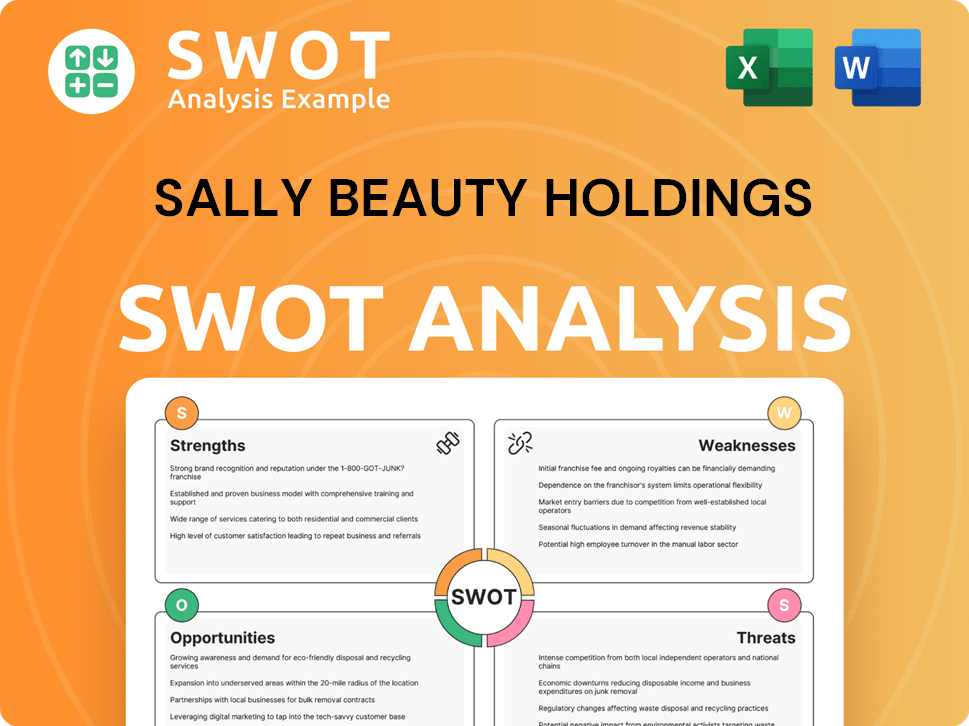

Sally Beauty Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Sally Beauty Holdings’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, and for Sally Beauty Holdings, this means catering to a diverse customer base within the beauty industry. The company's strategy focuses on providing professional-quality products at competitive prices, along with educational resources and personalized services. This approach is designed to meet the evolving demands of both retail customers and salon professionals.

For retail customers, the desire for accessible, trend-driven products and the ability to achieve salon-quality results at home are key drivers. Salon professionals, on the other hand, prioritize access to a wide selection of professional-grade products, the latest technologies, and educational resources. The company's focus on innovation and customer engagement, as well as its efforts to address unmet needs, reflects a deep understanding of its target market's preferences.

The company's commitment to understanding its customers is evident in its product development, marketing strategies, and customer service initiatives. By tailoring its offerings to specific segments and continuously adapting to market trends, Sally Beauty Holdings aims to maintain customer loyalty and drive growth. This customer-centric approach is a cornerstone of its business model, ensuring that it remains relevant and competitive in the dynamic beauty industry.

Retail customers, particularly DIY beauty enthusiasts, seek professional-quality products at value prices. They are drawn to accessible, trend-driven innovations. The expansion of nail product assortments in June 2025 reflects this focus.

Customers are increasingly looking for resources and education to achieve salon-quality results at home. The 'Licensed Colorist on Demand' (LCOD) initiative, which provides at-home hair color consultations, saw a 20% increase in demand in Q4 2024.

Salon professionals require access to a wide selection of professionally branded products, the latest technology, and educational resources. Loyalty is driven by product effectiveness, value, and brand diversity.

Product innovation is a significant driver of growth and customer engagement. In fiscal year 2024, the company focused on delivering a consistent pipeline of innovation across its owned and third-party brands, with plans to accelerate this in fiscal year 2025.

The company addresses unmet needs through new services like LCOD and marketplace initiatives. Customer feedback and market trends directly influence product development, tailoring marketing and customer experiences to specific segments.

Marketplace initiatives make products more accessible. The company focuses on delivering a consistent pipeline of innovation across its owned and third-party brands, with plans to accelerate this in fiscal year 2025.

The primary needs of Sally Beauty Holdings' customers revolve around product quality, value, and access to information and services. Understanding these needs is essential for the company's success in the beauty industry.

- Product Quality and Value: Customers seek professional-quality products at competitive prices.

- Trend-Driven Innovation: Retail customers, especially DIY enthusiasts, want the latest beauty trends.

- Educational Resources: Customers desire resources and guidance to achieve salon-quality results at home.

- Personalized Services: The demand for personalized services, such as at-home hair color consultations, is increasing.

- Wide Product Selection: Salon professionals require access to a broad range of professional-grade products.

- Education and Technology: Salon professionals need the latest technologies and educational resources to stay competitive.

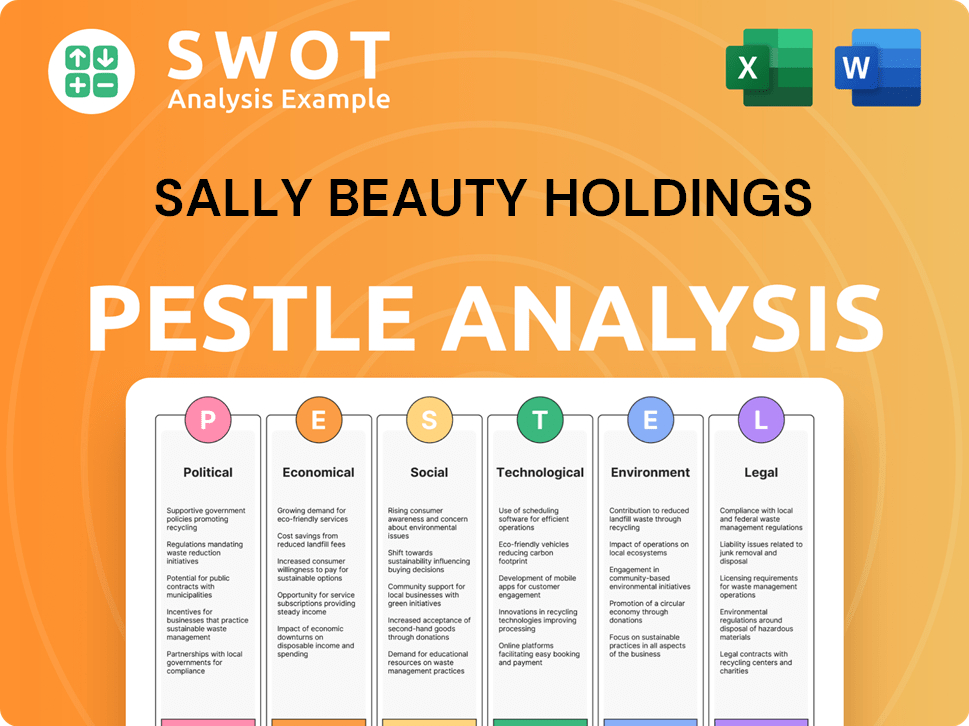

Sally Beauty Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Sally Beauty Holdings operate?

The geographical market presence of Sally Beauty Holdings is extensive, with operations spanning across 11 countries. The company's reach includes North America, South America, and Europe, making it a significant player in the global beauty industry. This broad footprint allows Sally Beauty to cater to a diverse customer base and adapt to varying market demands.

In the United States, Sally Beauty is recognized as the largest distributor of professional beauty products, highlighting its strong market position. Recent strategic moves, such as acquisitions and expansions, further solidify its presence in key regions. These initiatives are crucial for maintaining and growing market share, particularly in a competitive sector like beauty.

Sally Beauty's approach to its target market involves tailoring offerings and marketing strategies to suit different regions. For instance, store designs and product selections may vary based on the specific customer demographics of each country. The company's focus on both physical stores and e-commerce, with online sales reaching $364 million in fiscal year 2024, demonstrates its commitment to a multi-channel retail strategy and meeting the evolving needs of its customers.

Sally Beauty operates in 11 countries, including the U.S., Canada, and several European and South American nations. The company's geographical diversification is a key factor in its overall strategy.

The acquisition of Exclusive Beauty Supplies in Florida by Beauty Systems Group expanded distribution rights for key brands. This localized approach strengthens regional market share and enhances the customer experience.

Global e-commerce sales reached $364 million in fiscal year 2024, representing 10% of total net sales. This growth reflects the increasing importance of online channels for reaching customers.

In fiscal year 2024, Sally U.S. and Canada sales performance was a key focus, with 78% of its sales derived from its 16 million known customers. This highlights the importance of customer retention.

The company's financial performance is also influenced by its global presence. For example, in Q2 fiscal year 2025, foreign currency translation had an unfavorable impact on consolidated net sales. Understanding the geographical market presence is vital for analyzing the company's overall performance and strategic direction. For more information about the financial aspects of the company, you can read about Owners & Shareholders of Sally Beauty Holdings.

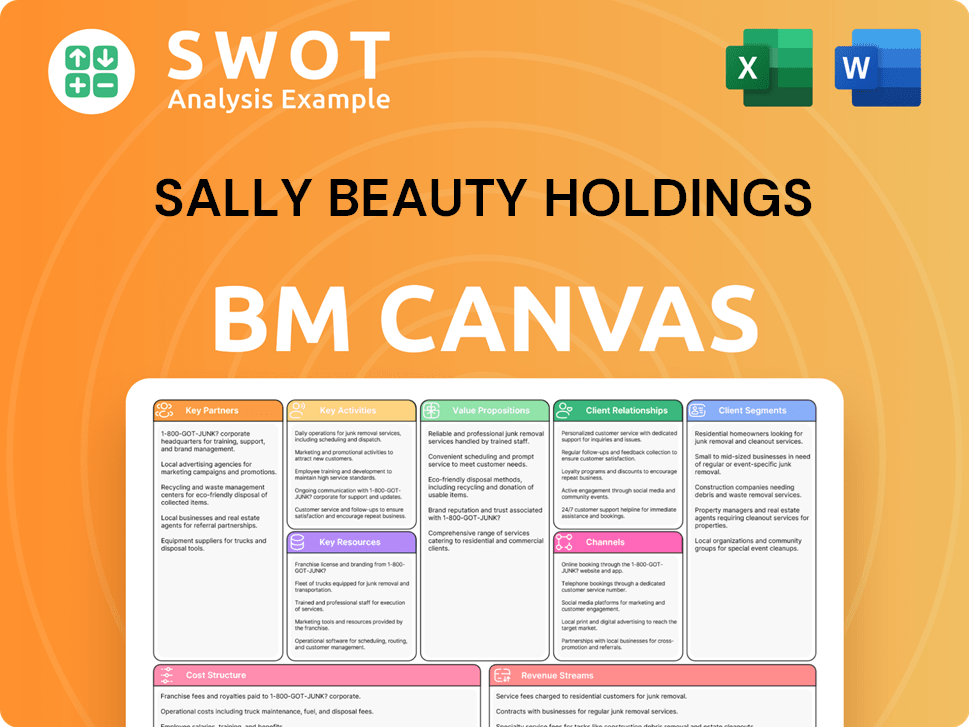

Sally Beauty Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Sally Beauty Holdings Win & Keep Customers?

To attract and keep customers, Sally Beauty Holdings uses different strategies. They focus on being customer-centric, building relationships through engagement, education, and marketing. A significant portion of their sales, about 78% in fiscal year 2024, came from their known customers, showing strong retention.

For acquiring new customers, Sally Beauty has expanded its digital presence. They collaborate with platforms like Amazon and Instacart to boost online sales. The 'Licensed Colorist On Demand' (LCOD) initiative has also proven successful, with 45% of its customers being new to the brand in fiscal year 2024.

Retention strategies include loyalty programs and personalized experiences. They use their 16 million loyalty members in the U.S. and Canada. They also use CRM tools to improve communication across SMS, email, and mobile platforms. Product innovation is also key, with new offerings driving growth and customer engagement. These efforts contributed over 225 basis points of comparable sales growth from fiscal Q3 2024 through Q1 2025.

Sally Beauty partners with platforms like Amazon, DoorDash, Instacart, and Walmart to expand its digital marketplace. This strategy aims to attract new customers and boost digital sales. In-store fulfillment options drive more profitable sales growth.

The LCOD initiative is a successful customer acquisition tool. In fiscal year 2024, 45% of LCOD customers were new to the brand. This program provides expert advice and services, attracting new customers.

Sally Beauty leverages its 16 million loyalty members in the U.S. and Canada. They enhance customer engagement through sophisticated CRM tools. This allows for improved communication via SMS, email, and mobile platforms, personalizing customer interactions.

Product innovation is a key driver for both acquisition and retention. New offerings across owned and third-party brands drive growth and customer engagement. The launch of Madison Reed Color and upcoming innovations like hair gloss and skincare from Sauce Beauty are designed to keep customers engaged.

These strategies, including digital marketplaces, LCOD, and product innovation, alongside personalization and enhanced performance marketing, contributed over 225 basis points of comparable sales growth from fiscal Q3 2024 through Q1 2025. To get a broader view of the competitive environment, consider the Competitors Landscape of Sally Beauty Holdings.

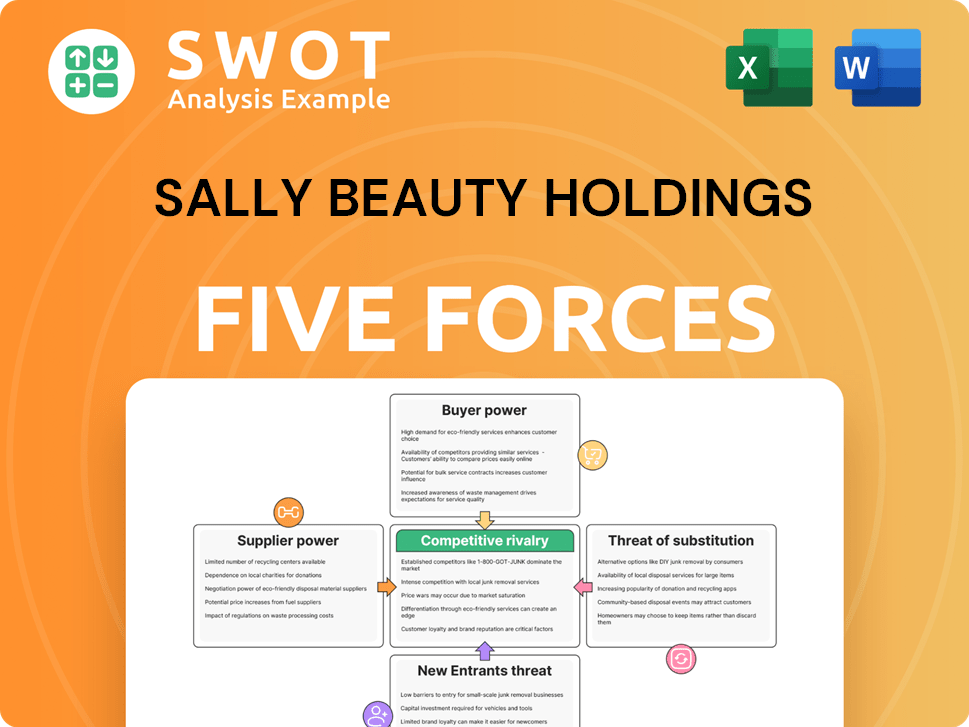

Sally Beauty Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sally Beauty Holdings Company?

- What is Competitive Landscape of Sally Beauty Holdings Company?

- What is Growth Strategy and Future Prospects of Sally Beauty Holdings Company?

- How Does Sally Beauty Holdings Company Work?

- What is Sales and Marketing Strategy of Sally Beauty Holdings Company?

- What is Brief History of Sally Beauty Holdings Company?

- Who Owns Sally Beauty Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.