Sally Beauty Holdings Bundle

Who Really Controls Sally Beauty Holdings?

Ever wondered who steers the ship at Sally Beauty Holdings, a global powerhouse in professional beauty products? From its humble beginnings in 1964 to its current status as a publicly traded company, understanding the Sally Beauty Holdings SWOT Analysis is key. Knowing the company's ownership structure unveils its strategic direction and financial performance.

This exploration of Sally Beauty ownership will cover its journey from its inception to its current status as a publicly traded entity. We'll examine the major shareholders, the evolution of its board, and the impact of these changes on Sally Beauty's market position. Discover the key players influencing this beauty industry leader, including its investors and the dynamics shaping its future. Learn about Sally Beauty's parent company and its stock performance.

Who Founded Sally Beauty Holdings?

The story of Sally Beauty Holdings, a major player in the beauty supply industry, began in 1964. The company's roots trace back to a single store in New Orleans, marking the beginning of what would become a widespread retail chain.

The founder, C. Ray Farber, named the store after his daughter, Sally. This personal touch highlights the family-oriented origins of the business. The initial store, located on Magazine Street, served as the foundation for the company's early operations.

In 1969, a significant shift occurred when Alberto-Culver, a consumer products company, acquired the then 11-store operation. This acquisition marked a transition in Sally Beauty's ownership structure.

C. Ray Farber founded Sally Beauty in 1964, naming it after his daughter.

The first store was located in New Orleans on Magazine Street.

Alberto-Culver acquired the company in 1969.

The acquisition by Alberto-Culver changed the company's ownership from a founder-owned business to part of a larger corporate entity.

Specific details about the equity split or shareholding percentages of the founder and early backers are not publicly available.

By the time of the acquisition, Sally Beauty had expanded to 11 stores.

Information about the initial equity distribution among C. Ray Farber and other early investors is not available in public records. For more detailed information on the company's current status, including its financial performance and ownership structure, you can refer to this article about Sally Beauty Holdings. The acquisition by Alberto-Culver marked a pivotal moment, transforming Sally Beauty from a small, independent venture into a part of a larger corporate structure.

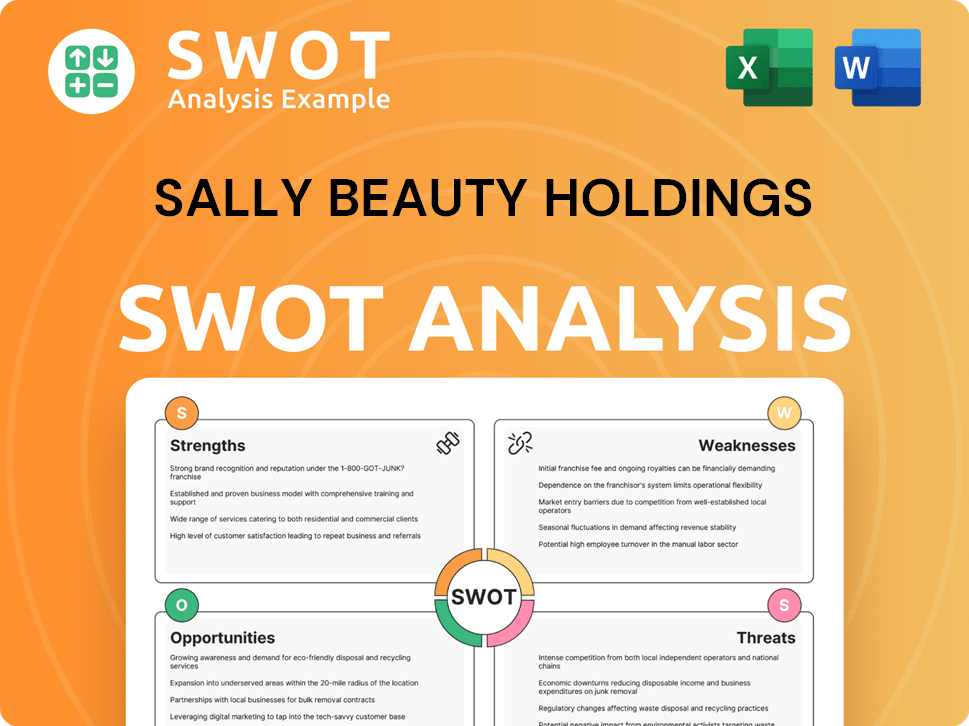

Sally Beauty Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Sally Beauty Holdings’s Ownership Changed Over Time?

The ownership structure of Sally Beauty Holdings underwent a significant transformation in November 2006. This occurred when it separated from Alberto-Culver and became an independent public company. The initial public offering (IPO) took place on November 17, 2006, with the company listing on the New York Stock Exchange under the ticker symbol SBH. At the time of the separation, Alberto-Culver shareholders received one share of the new Sally Beauty Holdings for each share of Alberto-Culver common stock held, along with a special cash dividend of $25.00 per share.

As of March 7, 2025, the market capitalization of Sally Beauty Holdings was approximately $1.097 billion. However, by June 12, 2025, its market cap had decreased to $903 million. This shift highlights the dynamic nature of the Sally Beauty ownership and its valuation in the market.

| Date | Event | Impact |

|---|---|---|

| November 2006 | Separation from Alberto-Culver; IPO | Established Sally Beauty Holdings as an independent public company. |

| March 7, 2025 | Market Capitalization | Market cap of approximately $1.097 billion |

| June 12, 2025 | Market Capitalization | Market cap of $903 million |

Currently, institutional investors hold a significant portion of Sally Beauty ownership. As of May 2025, they owned approximately 97.69% of the company's stock. Insiders hold about 0.84%, while public companies and individual investors account for approximately 1.47%. Major institutional shareholders include BlackRock, Inc., and Vanguard Group Inc. In May 2025, institutional investors' holdings remained unchanged at 115.14%, and mutual funds increased their holdings from 86.58% to 86.61%. Insider holdings remained unchanged at 1.26% in May 2025. This high level of institutional ownership suggests that the company's strategic decisions are heavily influenced by these large investment firms.

Institutional investors dominate Sally Beauty stock ownership, holding nearly 98% as of May 2025.

- The IPO occurred in November 2006.

- Market capitalization was $903 million as of June 12, 2025.

- Insiders hold a small percentage of the shares.

- Major shareholders include BlackRock and Vanguard.

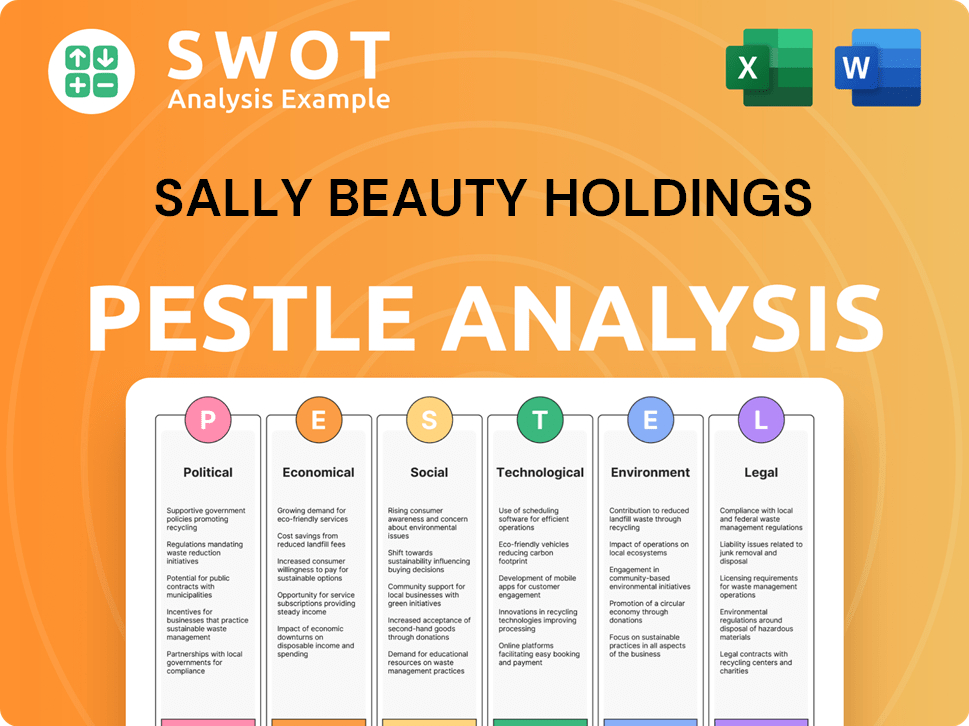

Sally Beauty Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Sally Beauty Holdings’s Board?

The current board of directors for Sally Beauty Holdings, Inc. oversees the company's operations. As of January 24, 2025, the board consisted of nine members elected for one-year terms at the Annual Meeting of Stockholders. The election of these directors hinges on receiving more 'for' votes than 'against' votes. The board includes key figures like Denise Paulonis, who serves as President & CEO, alongside independent directors such as Diana Ferguson (Independent Chairman), and others like Jeffrey Boyer and Debra Perelman, who joined the board in January 2025.

The voting structure for the company is straightforward, with each share of common stock entitled to one vote, as confirmed at the 2025 Annual Meeting. Denise Paulonis, the President and CEO, holds a direct ownership stake of 0.36% of the company's shares, which is valued at $3.32 million. The board's composition reflects a blend of executive and independent directors, ensuring a balanced approach to governance. Stockholders re-elected the nine directors, approved executive compensation, and ratified KPMG LLP as auditors at the January 24, 2025 Annual Meeting.

| Board Member | Title | Ownership (as of Jan 24, 2025) |

|---|---|---|

| Denise Paulonis | President & CEO | 0.36% |

| Diana Ferguson | Independent Chairman | N/A |

| Jeffrey Boyer | Independent Director | N/A |

| Debra Perelman | Director | N/A |

Understanding the board of directors is crucial for anyone looking into Sally Beauty Holdings company history. The board's decisions and the voting power of major shareholders significantly influence the company's strategic direction and financial performance, making it a key area for investors and stakeholders to monitor. The structure and composition of the board, including the presence of independent directors, are vital for ensuring effective corporate governance.

The board of directors at Sally Beauty Holdings plays a pivotal role in the company's governance and strategic decisions.

- The board consists of nine members, including the CEO and independent directors.

- Each share of common stock has one vote, influencing board elections and key decisions.

- The CEO's direct ownership is a notable aspect of the company's structure.

- The board's decisions impact the company's financial performance and strategic direction.

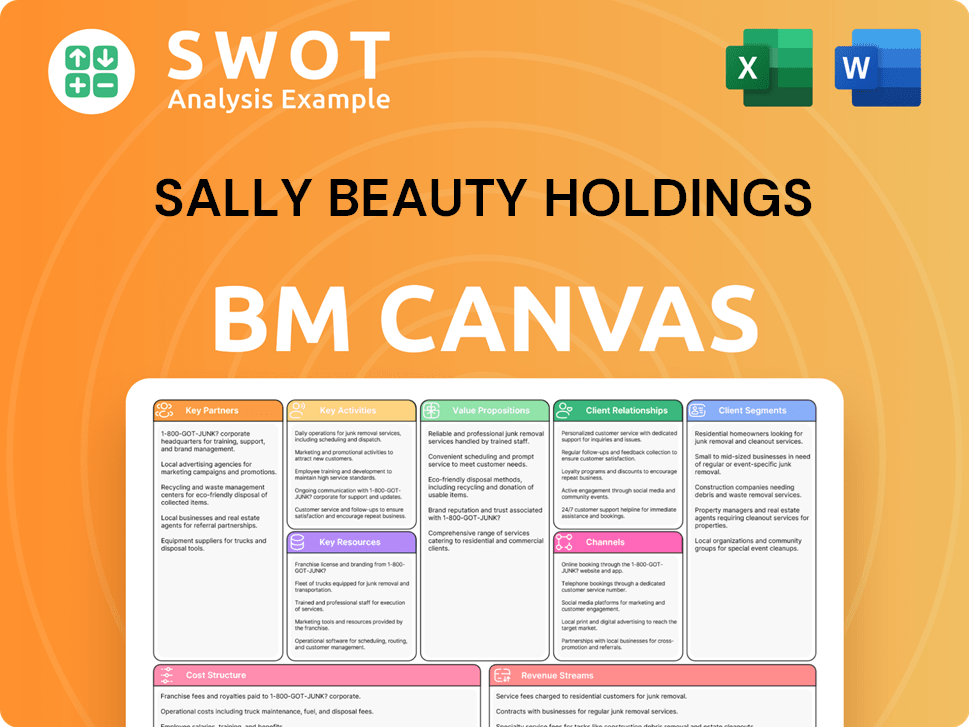

Sally Beauty Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Sally Beauty Holdings’s Ownership Landscape?

In recent years, Sally Beauty Holdings has actively returned value to its shareholders through share repurchases. In fiscal year 2024, the company repurchased 5.1 million shares, spending $60 million, a significant increase from the $15 million spent in 2023. This trend continued into fiscal year 2025, with an additional $20 million spent on repurchases in the first two quarters. The Board of Directors has also approved an extension of its share repurchase program through September 30, 2029, with $501.1 million remaining under the authorization, showing a commitment to its investors.

Institutional investors maintain a strong presence in Sally Beauty's ownership structure. As of May 2025, institutional ownership stood at 115.14%, which can be influenced by factors like short selling. Mutual funds increased their holdings slightly to 86.61% during the same period. Insider ownership remains relatively stable at 1.26% as of May 2025, indicating confidence from within the company. These trends offer insights into the Sally Beauty ownership dynamics and investor sentiment regarding the company's stock.

Denise Paulonis has been the President and CEO since October 1, 2021. The company's 'Fuel for Growth' program delivered $24 million in benefits in 2024 and is expected to deliver $40 million or more in benefits in 2025, with annualized run rate savings of around $120 million by the end of 2026. Additionally, Sally Beauty has partnered with K18 for distribution in its Beauty Systems Group. The net debt leverage ratio was 1.8x at the end of the second quarter of fiscal 2025.

Sally Beauty has actively repurchased shares, spending $60 million in 2024 and $20 million in the first two quarters of 2025. This strategy aims to boost shareholder value. The Board has extended the repurchase program through September 2029, with $501.1 million remaining.

Institutional investors hold a significant portion of Sally Beauty's shares, with 115.14% ownership as of May 2025. Mutual funds increased their holdings to 86.61%. Insider ownership remains stable at 1.26%, showing confidence in the company.

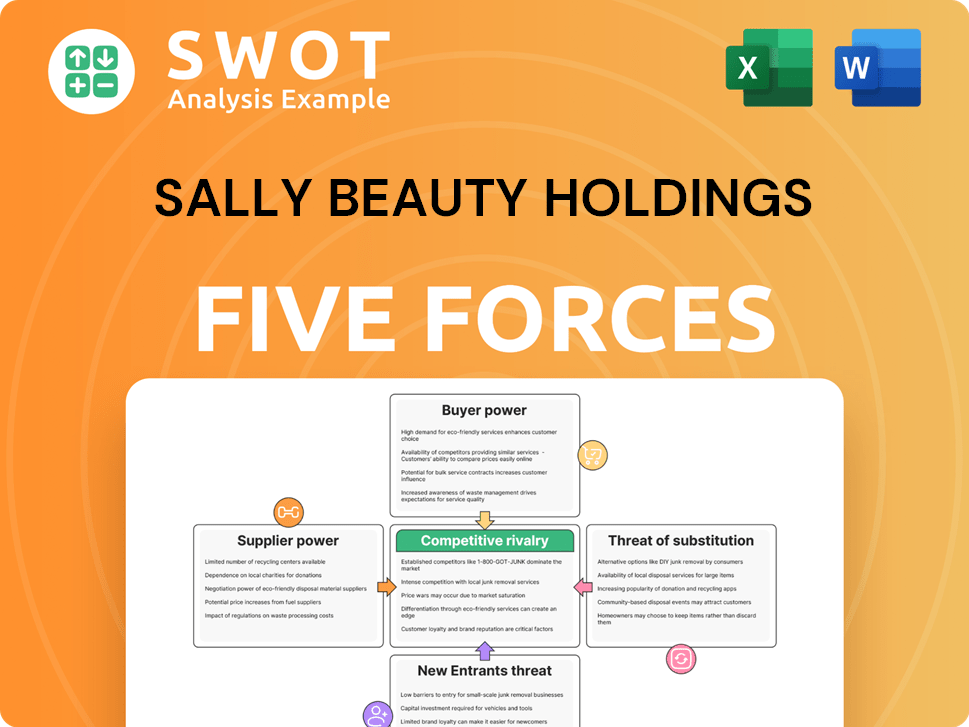

Sally Beauty Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sally Beauty Holdings Company?

- What is Competitive Landscape of Sally Beauty Holdings Company?

- What is Growth Strategy and Future Prospects of Sally Beauty Holdings Company?

- How Does Sally Beauty Holdings Company Work?

- What is Sales and Marketing Strategy of Sally Beauty Holdings Company?

- What is Brief History of Sally Beauty Holdings Company?

- What is Customer Demographics and Target Market of Sally Beauty Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.