Sally Beauty Holdings Bundle

Can Sally Beauty Holdings Maintain Its Beauty Industry Reign?

Sally Beauty Holdings, a titan in the beauty retail market, is undergoing a significant transformation to solidify its position as a dynamic beauty powerhouse. From its humble beginnings in 1964, the company has grown into the largest distributor of professional beauty products in the U.S., boasting a global presence with over 4,000 stores. This Sally Beauty Holdings SWOT Analysis reveals the strategic shifts driving its evolution.

This exploration delves into Sally Beauty's growth strategy, examining its customer-centric approach, expansion of owned brands, and commitment to innovation. Understanding Sally Beauty's future outlook requires a deep dive into its strategic initiatives, including its e-commerce strategy and international expansion plans. Analyzing the company's financial performance and market share within the competitive cosmetics industry trends will provide valuable insights for investors and stakeholders alike, offering a comprehensive view of Sally Beauty's potential.

How Is Sally Beauty Holdings Expanding Its Reach?

The expansion initiatives of Sally Beauty Holdings are focused on accessing new customers, diversifying revenue streams, and staying competitive in the beauty retail market. The company is actively implementing strategies to enhance customer engagement, expand its product offerings, and optimize its store network. These efforts are crucial for driving future growth and maintaining a strong position within the cosmetics industry.

A key aspect of Sally Beauty's growth strategy involves leveraging digital platforms and enhancing its online presence. This includes strategic partnerships and the expansion of e-commerce capabilities. By focusing on these areas, Sally Beauty aims to capture a larger share of the market and meet the evolving needs of its customer base. The company's focus on innovation and strategic partnerships is a key element of its future outlook.

Sally Beauty is enhancing customer centricity through services like Sally's Licensed Colorist on Demand (LCOD). This service provides professional consultation online, attracting new customers. In fiscal year 2024, 45% of customers using LCOD were new to the brand.

The company is expanding its marketplace initiative by partnering with platforms like Amazon, DoorDash, Instacart, and Walmart. This strategy is fueling digital sales growth and attracting new customers. Global e-commerce sales reached $364 million in fiscal 2024, representing 10% of total net sales.

Sally Beauty is accelerating innovation across both owned and third-party brands in 2025. New offerings include products in color, bonding, nails, and appliances. This includes an expanded partnership with Sauce Beauty and a new Ion 8-in-1 Airstyler.

Beauty Systems Group (BSG) is increasing its presence with major brands like Amika, expanding to all full-service stores. BSG also announced a distribution partnership with K18, which launched in all U.S. and Canada BSG stores and e-commerce channels on April 1, 2025.

While the company operated 22 fewer stores at the end of Q1 fiscal 2025 compared to the prior year, it is piloting a store refresh that includes modernized branding and an expanded assortment. The company plans to open a small number of additional pilot stores within the same markets during fiscal year 2025.

- In Q4 fiscal 2024, Beauty Systems Group acquired Exclusive Beauty Supplies of Florida.

- This acquisition expanded distribution rights for key brands like Moroccanoil, Olaplex, Rusk, and Verb throughout Florida.

- E-commerce sales in Q1 fiscal 2025 increased to $99 million, representing 10.6% of net sales.

- These initiatives are part of a broader Brief History of Sally Beauty Holdings and its strategic goals.

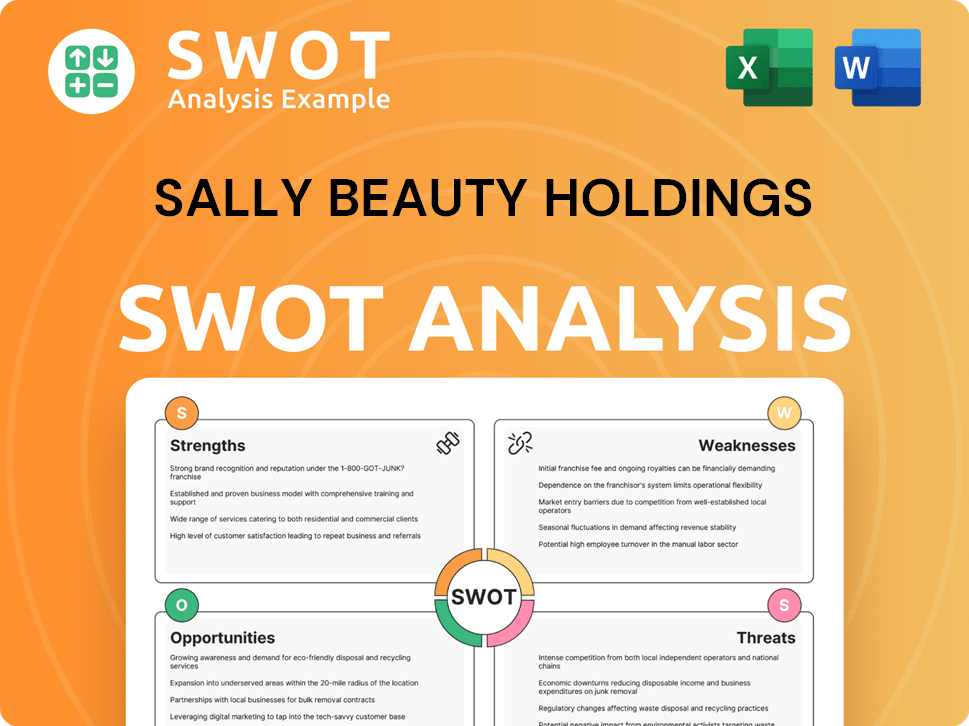

Sally Beauty Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sally Beauty Holdings Invest in Innovation?

The growth strategy of Sally Beauty Holdings is heavily influenced by its ability to adapt to evolving customer needs and preferences in the beauty retail market. Consumers are increasingly seeking convenience, personalized experiences, and a wide selection of products, which drives the company's focus on digital transformation and product innovation. Understanding these trends allows Sally Beauty to tailor its strategies to meet customer demands effectively and maintain a competitive edge within the cosmetics industry.

Sally Beauty's approach also considers the growing importance of online shopping and the demand for professional-grade products. By expanding its e-commerce capabilities and offering services like the Licensed Colorist on Demand (LCOD), the company caters to customers who value both accessibility and expert advice. This dual focus on digital and professional services reflects a deeper understanding of how customers engage with beauty products and seek guidance.

Furthermore, the company recognizes the significance of operational efficiency and cost management. By implementing programs like 'Fuel for Growth', Sally Beauty aims to optimize its processes and improve profitability, which ultimately benefits customers through better pricing and service. This operational focus ensures the company can sustain its growth while meeting customer expectations.

Sally Beauty is significantly investing in digital transformation to enhance its market position. This includes expanding its online digital marketplaces and partnering with key platforms to drive sales growth.

E-commerce sales are a crucial part of Sally Beauty's growth strategy. In fiscal Q2 2025, e-commerce sales in Sally U.S. and Canada increased by 29% year-over-year.

The company is actively partnering with platforms like Amazon, DoorDash, Instacart, and Walmart to boost digital sales. The addition of Uber Eats in March 2025 further expands its store-fulfilled marketplace portfolio.

Sally Beauty is accelerating its product innovation pipeline across owned and third-party brands. The focus is on categories like color, bonding, nails, and appliances.

The Licensed Colorist on Demand (LCOD) initiative provides online professional consultation services. This service continues to gain traction and attract new customers.

The 'Fuel for Growth Program' aims to improve profitability. This program is expected to generate $70 million by the end of fiscal 2025, building on $28 million in fiscal 2024.

Sally Beauty's growth strategy is built on digital innovation, product development, and operational efficiency. These initiatives are designed to enhance the customer experience and drive profitability. For more insights into the company's financial performance and strategic direction, consider exploring the information on Owners & Shareholders of Sally Beauty Holdings.

- E-commerce Growth: Expanding online sales through partnerships and direct channels.

- Product Innovation: Introducing new products and services to meet evolving customer needs.

- Operational Efficiency: Implementing programs to reduce costs and improve margins.

- Customer Engagement: Utilizing digital platforms to provide expert consultations and enhance customer service.

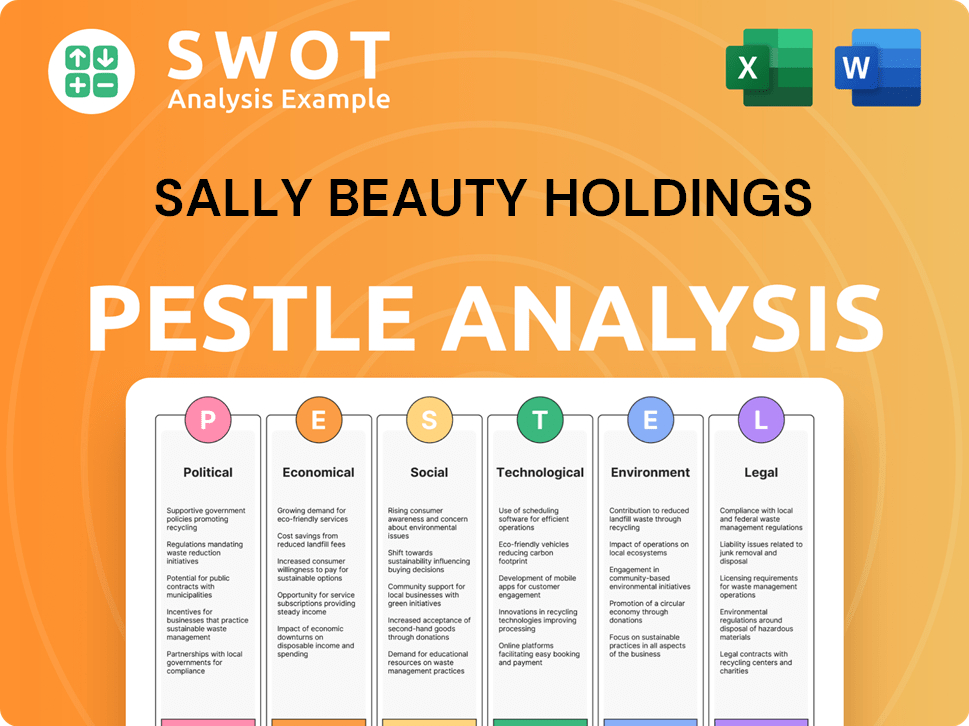

Sally Beauty Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Sally Beauty Holdings’s Growth Forecast?

The financial outlook for Sally Beauty Holdings reflects a strategic focus on sustained, profitable growth, aiming to enhance shareholder value in fiscal year 2025. In fiscal year 2024, the company's consolidated net sales reached $3.7 billion, with global e-commerce sales contributing $364 million, which is approximately 10% of total net sales. The company demonstrated strong financial health with a gross margin of 51% and GAAP operating earnings of $283 million, leading to a GAAP diluted net earnings per share of $1.43. Cash flow from operations was robust, totaling $247 million for the full year.

Looking at the initial performance of fiscal year 2025, Sally Beauty Holdings reported positive results in the first quarter. Consolidated net sales for Q1 fiscal 2025 increased by 0.7% to $938 million, with consolidated comparable sales increasing by 1.6%. Global e-commerce sales were $99 million, representing 10.6% of net sales. The GAAP gross margin improved to 50.8%, and GAAP operating earnings reached $100 million, resulting in an operating margin of 10.7%. The company generated $33 million in cash flow from operations during Q1 fiscal 2025.

Despite a strong start to fiscal 2025, Sally Beauty Holdings has adjusted its full-year financial outlook due to macroeconomic challenges. The revised projections for fiscal 2025 include comparable sales ranging from flat to a 1% decline, a shift from the previous expectation of flat to a 2% increase. Consolidated net sales are anticipated to be approximately 75 basis points lower than comparable sales, impacted by unfavorable foreign exchange rates. The adjusted operating margin for fiscal 2025 is now expected to be between 8% and 8.5%, slightly down from the prior forecast of 8.5% to 9%. The company forecasts a full-year free cash flow of between $180 million and $200 million.

In fiscal year 2024, Sally Beauty Holdings achieved consolidated net sales of $3.7 billion. Global e-commerce sales reached $364 million, representing 10% of total net sales, demonstrating a strong online presence. The company maintained a healthy gross margin of 51% and delivered GAAP operating earnings of $283 million.

The first quarter of fiscal 2025 showed positive results with a 0.7% increase in consolidated net sales to $938 million. Consolidated comparable sales increased by 1.6%, indicating growth in existing stores. Global e-commerce sales were $99 million, representing 10.6% of net sales.

For fiscal year 2025, the company anticipates comparable sales to range from flat to a 1% decline. Consolidated net sales are expected to be approximately 75 basis points lower due to unfavorable foreign exchange rates. The adjusted operating margin is projected to be between 8% and 8.5%, and free cash flow is estimated at $180-$200 million.

The company's e-commerce strategy continues to be a significant component of its overall growth, with online sales contributing substantially to total revenue. The focus remains on enhancing the online shopping experience and expanding digital marketing efforts to drive sales.

The beauty retail market and the cosmetics industry trends influence Sally Beauty's performance. The company adapts to changing consumer preferences and economic conditions to maintain its market position. For more insights, check out the Marketing Strategy of Sally Beauty Holdings.

Sally Beauty Holdings is focused on achieving its strategic goals through various initiatives, including product innovation, customer acquisition strategies, and potential international expansion. These efforts are designed to drive long-term growth and enhance shareholder value.

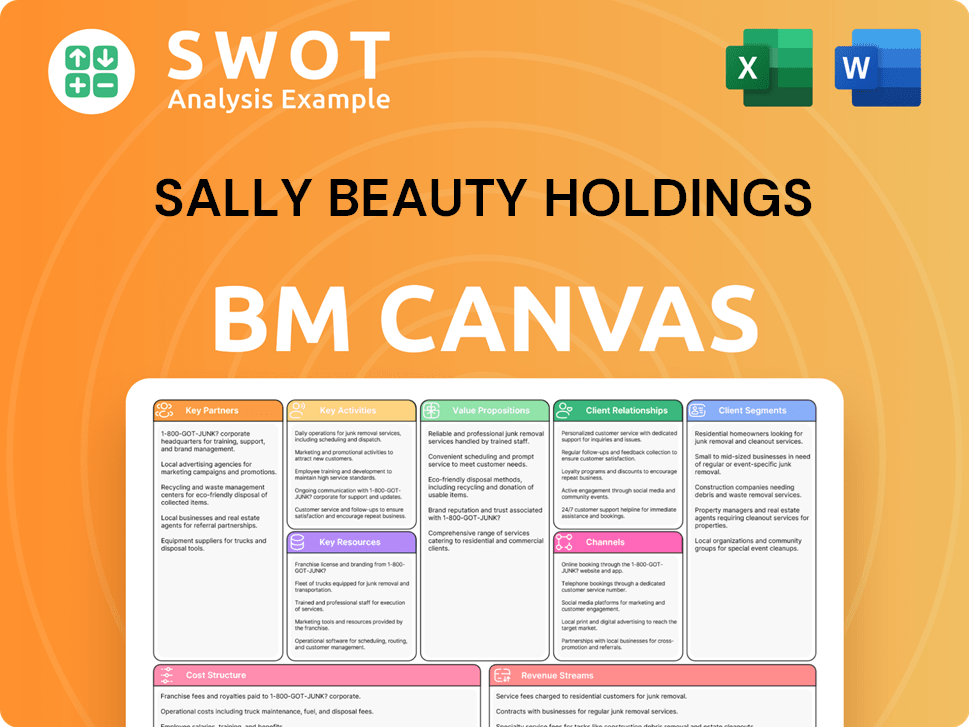

Sally Beauty Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Sally Beauty Holdings’s Growth?

The beauty products distribution industry is highly competitive, posing a significant risk for Sally Beauty Holdings. Competition comes from various sources, including other beauty stores, mass merchandisers, online retailers, and more. Factors like price, brand recognition, and customer service are crucial in this landscape, creating constant strategic challenges.

Macroeconomic conditions and shifts in consumer behavior also present considerable obstacles. External factors such as weather and broader economic uncertainty have impacted consumer spending. This has directly affected the company's financial performance, as seen in the recent revenue declines.

Supply chain vulnerabilities and the need to adapt to changing consumer preferences add further complexities. The company must proactively manage these risks through strategic initiatives and operational efficiencies to maintain its market position and achieve future growth.

The Beauty Retail Market is intensely competitive, with numerous players vying for market share. Competition is fierce across various aspects, including pricing, product variety, and customer service. Maintaining a competitive edge requires continuous adaptation and strategic investments.

Economic downturns and shifts in consumer behavior can significantly impact Sally Beauty Performance. Factors like inflation, interest rates, and consumer confidence directly influence spending patterns. The company must navigate these challenges effectively to maintain profitability.

Disruptions in the supply chain can lead to inventory shortages and increased costs. Dependence on third-party manufacturers and distributors introduces vulnerabilities. Managing these risks requires robust supply chain strategies and diversification efforts.

The Cosmetics Industry Trends evolve rapidly, requiring companies to stay agile and responsive. Consumer preferences for products, brands, and shopping experiences change frequently. Adapting to these shifts is crucial for long-term success.

Inefficient operations can lead to higher costs and reduced profitability. Streamlining processes, optimizing inventory management, and improving store layouts are essential. Initiatives like 'Fuel for Growth' are designed to address these issues.

The growth of e-commerce presents both opportunities and challenges. Competing with online retailers requires a strong digital presence, efficient logistics, and a seamless customer experience. A well-executed e-commerce strategy is vital.

To mitigate these risks, Sally Beauty Holdings is focusing on several strategic initiatives. These include diversifying revenue streams through digital marketplaces and owned brands. Additionally, the company is implementing operational efficiencies through programs like 'Fuel for Growth' to improve overall performance. In Q2 fiscal 2025, the company reported a 2.8% year-over-year decline in revenue, and its adjusted fiscal 2025 outlook for comparable sales is now expected to be flat to down 1%, reflecting the ongoing pressures from these challenges. More details can be found in this Sally Beauty Holdings company overview.

The Beauty Retail Market is subject to fluctuations due to economic cycles and consumer sentiment. Changes in discretionary spending directly impact sales. Strategic financial planning and adaptable business models are essential to navigate these uncertainties.

Maintaining a positive brand image is crucial for customer loyalty and market share. Negative publicity, product recalls, or controversies can damage brand reputation. Proactive communication and quality control are critical in managing this risk.

Changes in regulations regarding product safety, labeling, and environmental sustainability can impact operations. Compliance with new regulations may require significant investment and adjustments. Staying informed and adaptable is essential.

Increasing labor costs, including wages and benefits, can affect profitability. Managing labor expenses while maintaining a skilled workforce is a key challenge. Automation and efficient staffing models may help mitigate these costs.

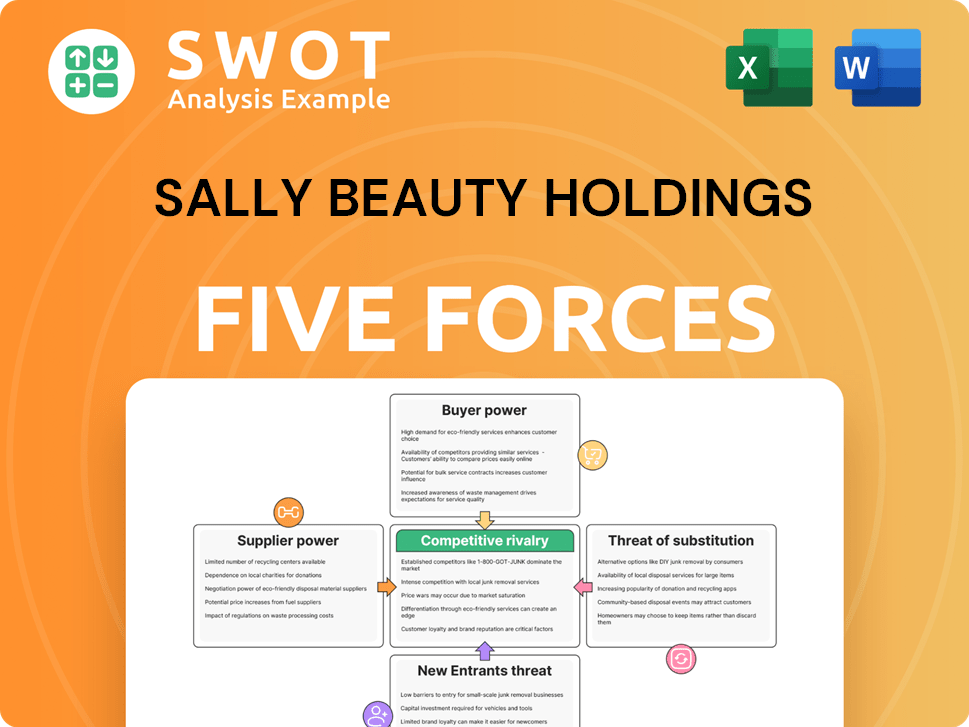

Sally Beauty Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sally Beauty Holdings Company?

- What is Competitive Landscape of Sally Beauty Holdings Company?

- How Does Sally Beauty Holdings Company Work?

- What is Sales and Marketing Strategy of Sally Beauty Holdings Company?

- What is Brief History of Sally Beauty Holdings Company?

- Who Owns Sally Beauty Holdings Company?

- What is Customer Demographics and Target Market of Sally Beauty Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.