Simpson Thacher & Bartlett Bundle

How Does Simpson Thacher & Bartlett Dominate the Legal Arena?

In the high-stakes world of global legal services, where every deal and dispute can redefine fortunes, understanding the Simpson Thacher & Bartlett SWOT Analysis is crucial. This law firm analysis dives into the competitive landscape, revealing how Simpson Thacher & Bartlett, a titan in the legal industry, maintains its edge. With a history rooted in advising industry giants, this firm's strategic moves and market position are key to its success.

From its inception in 1884, Simpson Thacher & Bartlett has evolved into a global powerhouse, consistently ranking among the top law firms. This deep dive explores its competitive advantages, examining its market share and recent deals to understand its financial performance and client base. We'll analyze its geographic presence and industry focus, comparing it to key competitors to uncover its winning competitive strategy within the legal industry.

Where Does Simpson Thacher & Bartlett’ Stand in the Current Market?

Simpson Thacher & Bartlett (STB) maintains a premier position within the global legal industry, particularly in high-value segments like mergers and acquisitions (M&A), private equity, and capital markets. The firm's consistent top-tier rankings by various legal directories and financial data providers highlight its market dominance. This Law firm analysis reveals STB's strategic focus and competitive advantages.

The firm's core operations revolve around providing sophisticated legal services to large corporations, financial institutions, and private equity firms. STB's value proposition lies in its ability to handle complex, cross-border transactions, offering expertise in corporate law, litigation, banking and credit, real estate, and restructuring. Its global presence, with offices in major financial centers, enables it to serve a diverse international client base effectively.

In 2023, STB advised on numerous significant deals, reflecting its continued leadership in these areas. While specific market share figures are not publicly disclosed, the firm's consistent involvement in high-profile transactions and its top rankings in key areas like M&A deal value indicate strong financial performance and a robust market position. STB's strong performance is a testament to its strategic focus and client-centric approach.

STB frequently ranks among the top law firms globally for M&A deal value and private equity transactions. The firm's consistent presence in the top rankings underscores its market leadership and competitive advantages within the legal industry. These rankings are key indicators of its market share and financial success.

STB has a robust global presence with offices in major financial centers such as New York, London, Hong Kong, Tokyo, and São Paulo. This extensive network enables the firm to serve a diverse international client base effectively. Its global footprint is a key factor in its competitive strategy.

STB's client segments primarily comprise large corporations, leading financial institutions, and prominent private equity firms. This focus on sophisticated, institutional clients allows the firm to concentrate on high-value, complex transactions. STB's client base is a key driver of its market position.

While specific financial metrics for law firms are not always public, STB's consistent high rankings and involvement in major deals suggest strong financial performance. The firm's success in the private equity sector further highlights its financial health. STB's financial performance is a key aspect of its competitive landscape.

STB's competitive advantages include its strong reputation, global presence, and expertise in high-value transactions. The firm's focus on complex, cross-border deals and its ability to attract top legal talent are also significant strengths. These factors contribute to STB's market position.

- Strong reputation in M&A and private equity.

- Extensive global network of offices.

- Expertise in complex, cross-border transactions.

- Focus on sophisticated, institutional clients.

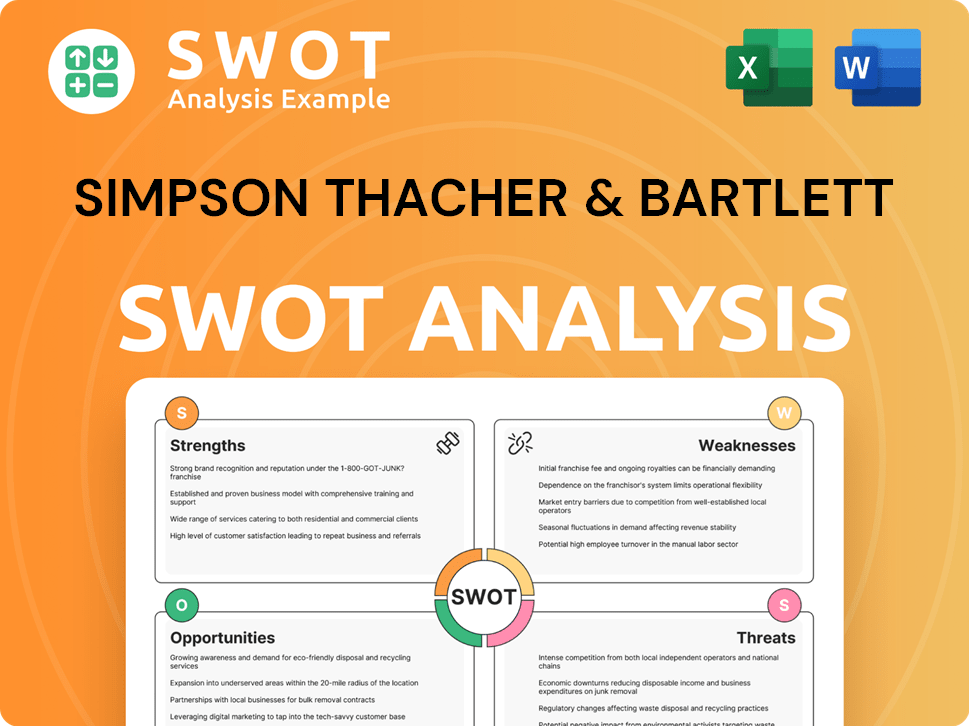

Simpson Thacher & Bartlett SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Simpson Thacher & Bartlett?

The competitive landscape for Simpson Thacher & Bartlett is primarily shaped by other leading global law firms. These firms compete across various fronts, including pricing, innovation, brand reputation, and the ability to attract top legal talent. Understanding this competitive environment is crucial for assessing the firm's market position and strategic direction.

The legal industry is dynamic, with firms constantly vying for market share and adapting to changing client needs and economic conditions. The competitive analysis must consider both direct and indirect competitors, as well as emerging trends that could impact the firm's operations and strategic planning. For a deeper dive into the firm's background, one can refer to the Brief History of Simpson Thacher & Bartlett.

Direct competitors are typically 'white shoe' firms with strong corporate and transactional practices. These firms compete directly with Simpson Thacher for clients and deals. The competition is fierce, especially in high-value transactions.

Key competitors include Kirkland & Ellis, Latham & Watkins, Davis Polk & Wardwell, Sullivan & Cromwell, Skadden, Arps, Slate, Meagher & Flom, and Weil, Gotshal & Manges. These firms have a significant presence in the legal industry.

Competition occurs on multiple fronts, including price, innovation, brand reputation, and talent acquisition. Firms continually strive to differentiate themselves to attract and retain clients and top legal professionals.

Kirkland & Ellis has made significant inroads in the private equity space. This intensifies competition for mandates in that lucrative sector. The firm's growth has been substantial.

Latham & Watkins often competes directly on large-cap M&A and capital markets deals. They leverage their broad global platform. The firm's global reach is a key competitive advantage.

Indirect competitors include boutique law firms specializing in niche areas. Alternative Legal Service Providers (ALSPs) and in-house legal departments are also indirect competitors.

The legal industry is subject to constant change, including mergers, acquisitions, and the rise of new players. These factors can shift the competitive dynamics, creating both challenges and opportunities for firms like Simpson Thacher & Bartlett. Understanding these shifts is crucial for strategic planning and maintaining a strong market position.

- Market Share: The top law firms continually compete for market share in various practice areas.

- Mergers and Acquisitions: Consolidation among law firms creates larger, more diversified competitors.

- Technology: Emerging players leveraging technology could disrupt the traditional landscape.

- Geographic Presence: Global firms compete based on their geographic reach and local expertise.

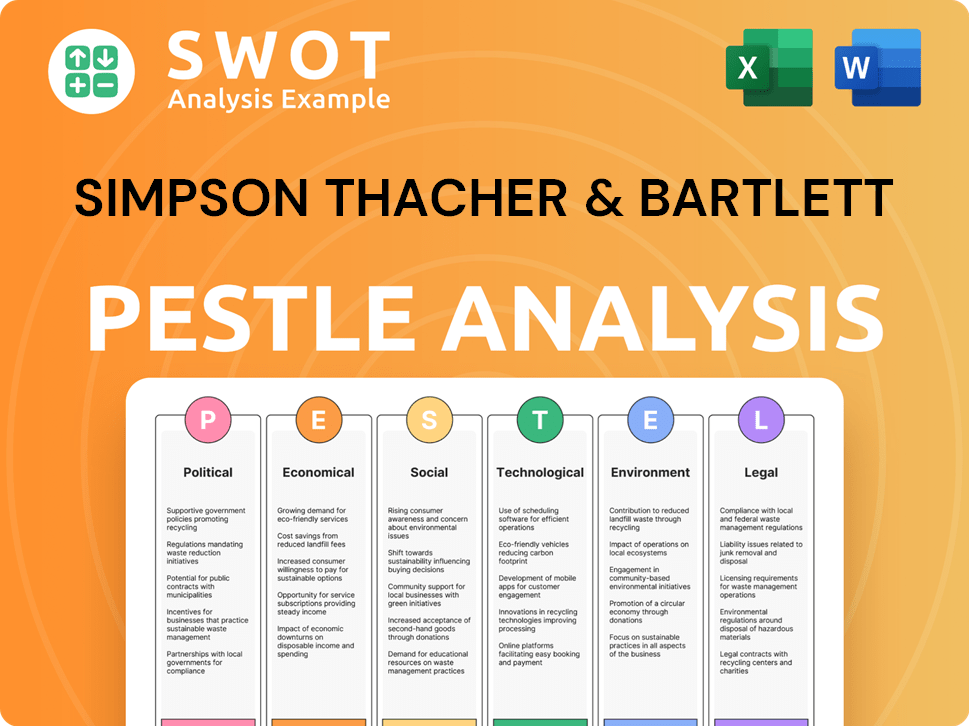

Simpson Thacher & Bartlett PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Simpson Thacher & Bartlett a Competitive Edge Over Its Rivals?

The competitive landscape for Simpson Thacher & Bartlett is shaped by its distinctive strengths and strategic positioning within the legal industry. The firm has cultivated a robust market share by focusing on high-value transactions and cultivating deep expertise in key sectors, particularly private equity. This approach has allowed it to consistently rank among the top law firms globally, attracting both premier clients and top-tier legal talent.

Simpson Thacher & Bartlett's success is not just about size but also about the quality of its services and its ability to navigate complex, cross-border deals. The firm's global presence and reputation for excellence have solidified its position as a leading legal advisor. This reputation is supported by its involvement in landmark deals and its strong financial performance, which allows for continued investment in talent and technology.

Understanding the competitive advantages of Simpson Thacher & Bartlett is crucial for anyone analyzing the legal industry. Its focus on private equity, strong brand, and global reach create a formidable competitive edge. This strategic focus allows the firm to maintain its position and adapt to the changing dynamics of the legal market.

Simpson Thacher & Bartlett's specialization in private equity is a significant competitive advantage. The firm consistently advises leading private equity sponsors on major transactions. This focus allows for the development of specialized knowledge and a strong network within this lucrative sector.

The firm's strong brand equity is another key advantage. Simpson Thacher's involvement in high-profile deals and consistent high rankings in legal publications reinforce its image as a top-tier legal advisor. This reputation attracts premium clients and top legal talent, further strengthening its market position.

Simpson Thacher's global platform provides a seamless service offering for cross-border transactions. With strategically located offices in major financial hubs, the firm can advise on complex international matters. This global reach is a critical advantage in today's interconnected global economy.

The firm's robust talent pool is a significant asset. Simpson Thacher is known for its rigorous hiring process and commitment to professional development. This ensures that its lawyers are at the forefront of legal innovation and client service, translating into superior legal advice and execution.

The competitive landscape for Simpson Thacher & Bartlett is dynamic, with the firm continually adapting its strategies to maintain its leading position. For example, in 2024, the firm advised on several high-profile mergers and acquisitions, demonstrating its continued strength in this area. According to recent reports, the firm's revenue has shown consistent growth, reflecting its strong market position and client demand. To learn more about how the firm strategizes for growth, consider reading about the Growth Strategy of Simpson Thacher & Bartlett.

Simpson Thacher & Bartlett's competitive advantages include its expertise in private equity, strong brand reputation, global platform, and robust talent pool. These factors contribute to its leading position in the legal industry.

- Specialization in Private Equity: Deep expertise and strong client relationships.

- Strong Brand and Reputation: High rankings and involvement in landmark deals.

- Global Platform: Seamless service for cross-border transactions.

- Robust Talent Pool: Highly skilled and experienced attorneys.

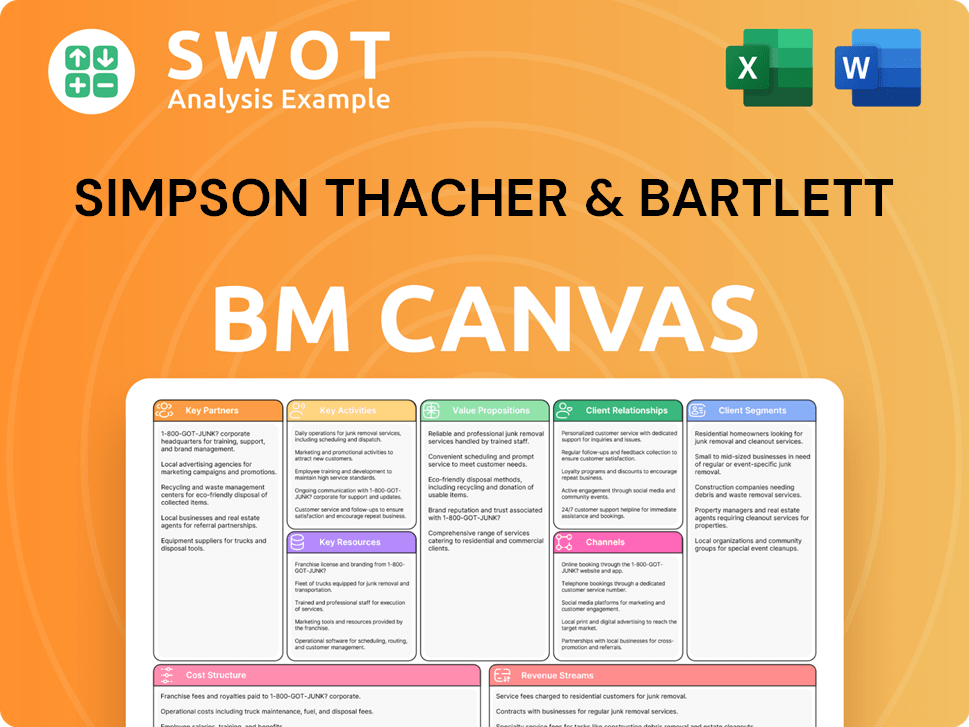

Simpson Thacher & Bartlett Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Simpson Thacher & Bartlett’s Competitive Landscape?

The competitive landscape for Simpson Thacher & Bartlett is shaped by evolving industry trends, presenting both challenges and opportunities. As a top law firm, understanding its position requires analyzing its strengths against the backdrop of technological advancements, regulatory changes, and global economic shifts. The firm's future hinges on its ability to adapt and innovate within a dynamic legal market.

Simpson Thacher & Bartlett faces risks such as increased competition and economic downturns, but also possesses significant growth opportunities in emerging markets and specialized legal areas. The firm's outlook is tied to its strategic responses to these factors, including talent management, technological integration, and proactive adaptation to emerging legal and business trends. The firm's success will likely depend on its ability to maintain its leadership in high-value legal matters while embracing technological advancements.

Technological advancements, particularly AI and automation, are transforming legal service delivery. Regulatory changes in areas like data privacy and ESG are creating new legal work. These shifts present opportunities for firms like Simpson Thacher & Bartlett to leverage their expertise.

Intensified competition from other elite firms and the potential for in-house legal departments to handle more complex work pose challenges. Economic downturns impacting transactional volumes also present a risk. These factors require strategic responses to maintain market share.

Expanding presence in emerging markets and developing innovative legal tech solutions offer growth prospects. Forging strategic partnerships and specializing in emerging sectors like fintech and biotech also provide opportunities. These areas can drive future success.

Simpson Thacher & Bartlett is likely deploying strategies focused on talent retention and development and continued investment in technology. A proactive approach to identifying and advising on emerging legal and business trends is also crucial. These moves will shape the firm's future.

Simpson Thacher & Bartlett's competitive strategy involves focusing on high-value, complex legal matters, particularly in M&A and capital markets. The firm's strong reputation and deep client relationships, as well as its geographic presence, contribute to its market position. The firm likely invests heavily in its talent and in cutting-edge technology to maintain its competitive edge. For more details, consider reviewing the insights on Owners & Shareholders of Simpson Thacher & Bartlett.

- Specialization in high-value transactions.

- Strong client relationships and a global presence.

- Investment in technology and talent development.

- Proactive adaptation to evolving legal and business trends.

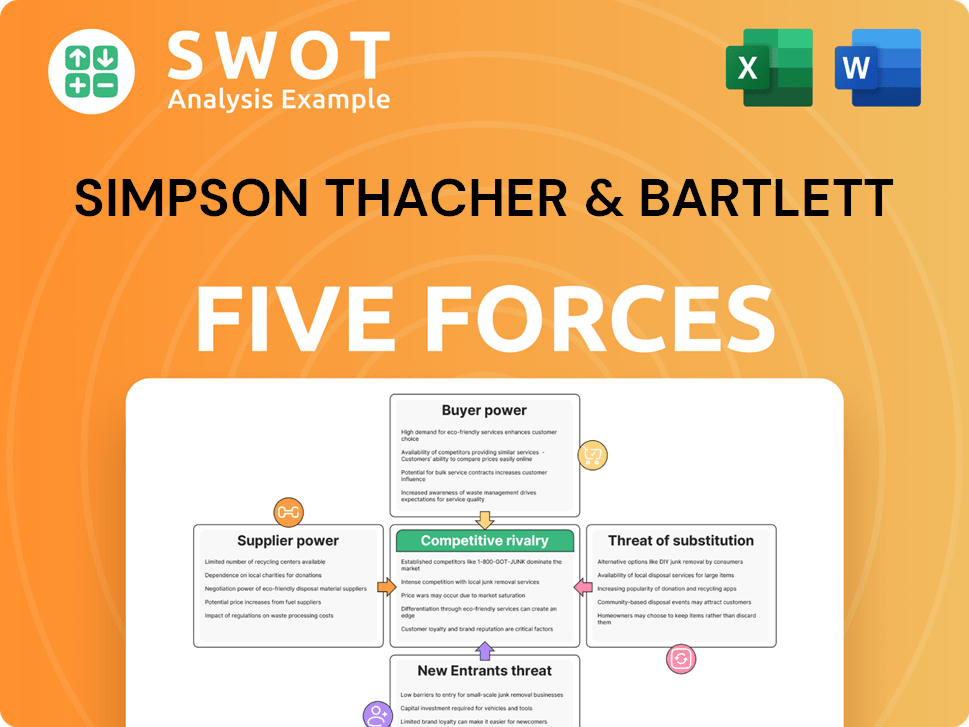

Simpson Thacher & Bartlett Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Simpson Thacher & Bartlett Company?

- What is Growth Strategy and Future Prospects of Simpson Thacher & Bartlett Company?

- How Does Simpson Thacher & Bartlett Company Work?

- What is Sales and Marketing Strategy of Simpson Thacher & Bartlett Company?

- What is Brief History of Simpson Thacher & Bartlett Company?

- Who Owns Simpson Thacher & Bartlett Company?

- What is Customer Demographics and Target Market of Simpson Thacher & Bartlett Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.