Simpson Thacher & Bartlett Bundle

How Will Simpson Thacher & Bartlett Shape the Future of Legal Services?

In the ever-evolving world of legal services, understanding a firm's Simpson Thacher & Bartlett SWOT Analysis and growth strategy is crucial for investors and industry professionals alike. Simpson Thacher & Bartlett, a leading global law firm, has a rich history of adapting and expanding, making it a compelling case study for anyone interested in business development. From its inception, the firm has demonstrated a commitment to strategic planning and navigating complex market dynamics.

This exploration into Simpson Thacher & Bartlett's future prospects will examine its strategic initiatives and financial outlook, considering the dynamic nature of the legal market. We'll delve into the firm's expansion plans, its approach to innovation, and its strategies for maintaining a strong market position. Analyzing the firm's Simpson Thacher & Bartlett revenue and Simpson Thacher & Bartlett market share provides valuable insights into its growth trajectory and competitive standing within the legal services industry. Moreover, understanding Simpson Thacher & Bartlett strategic planning is key to anticipating its future success.

How Is Simpson Thacher & Bartlett Expanding Its Reach?

The Growth strategy of Simpson Thacher & Bartlett heavily relies on strategic expansion initiatives. These initiatives are designed to broaden the firm's geographical reach and deepen its expertise in key practice areas. This dual approach is crucial for maintaining its competitive edge and serving its global client base effectively.

The firm continually strengthens its global footprint, especially in major financial centers and emerging markets. This includes bolstering its presence in cities like London, Hong Kong, and São Paulo. Simultaneously, Simpson Thacher & Bartlett explores opportunities in new jurisdictions where there's growing demand for sophisticated legal services. This strategic approach ensures the firm can capitalize on evolving market dynamics and client needs.

Beyond geographical expansion, Simpson Thacher & Bartlett actively enhances its capabilities in high-demand practice areas. This involves investing in talent acquisition and developing specialized teams to address evolving client needs. The firm's commitment to private equity, capital markets, and M&A remains a cornerstone of its strategy, with continued efforts to advise on some of the largest and most intricate deals globally.

Simpson Thacher & Bartlett focuses on expanding its global presence, particularly in key financial hubs. This includes strengthening its offices in London, Hong Kong, and São Paulo. The firm is also exploring opportunities in new jurisdictions to meet growing client demands.

The firm is enhancing its expertise in high-demand areas like cybersecurity, ESG, and regulatory compliance. This involves investing in talent and developing specialized teams. These efforts aim to provide comprehensive legal services.

Simpson Thacher & Bartlett fosters deeper relationships with existing clients by offering a comprehensive suite of legal services. This approach aims to capture a larger share of their legal spending. The firm focuses on being a trusted advisor.

The firm prioritizes private equity, capital markets, and M&A, advising on significant global deals. Simpson Thacher & Bartlett's strategic focus ensures it remains a leader in these sectors. The firm adapts to market trends.

The firm's strategy also includes fostering deeper relationships with existing clients by offering a comprehensive suite of legal services, thereby aiming to capture a larger share of their legal spend. This holistic approach ensures that Simpson Thacher & Bartlett remains a trusted advisor across various legal disciplines, anticipating and responding to the complex challenges faced by its clients. For more insights, you can explore the Marketing Strategy of Simpson Thacher & Bartlett.

Simpson Thacher & Bartlett's expansion is driven by geographical growth and practice area specialization. This strategy is supported by significant investments in talent and resources. The firm's commitment to client service and market leadership is evident in its strategic initiatives.

- Geographical Expansion: Strengthening presence in key financial centers and exploring new jurisdictions.

- Practice Area Enhancement: Investing in high-demand areas like cybersecurity and ESG.

- Client Relationship Management: Offering comprehensive legal services to capture a larger share of client spending.

- Strategic Focus: Prioritizing private equity, capital markets, and M&A.

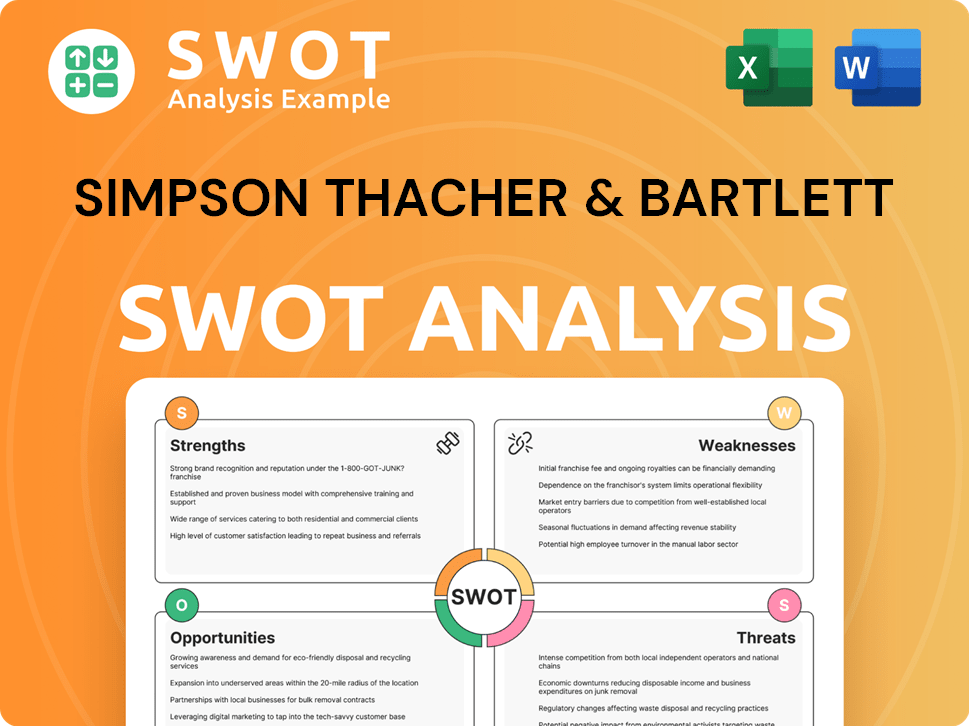

Simpson Thacher & Bartlett SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Simpson Thacher & Bartlett Invest in Innovation?

Simpson Thacher & Bartlett recognizes that innovation and technology are crucial for sustained growth within the legal sector. Their growth strategy emphasizes leveraging advanced technologies to boost efficiency, improve client service, and develop new legal solutions. This approach is essential in today's competitive landscape, ensuring the firm remains agile and responsive to the evolving needs of its clients.

The firm's commitment to technological advancement includes significant investments in digital transformation initiatives. These initiatives are designed to streamline internal processes, optimize document management, and enhance data analytics capabilities. By integrating cutting-edge tools, Simpson Thacher aims to maintain a competitive edge and deliver superior value to its clients. This forward-thinking approach is key to the firm's future prospects.

Simpson Thacher & Bartlett's strategic focus on innovation ensures they remain adaptable to the rapidly changing demands of the legal profession. The firm's approach to technology includes both in-house development and strategic collaborations with external innovators and legal technology providers. This dual strategy allows them to stay at the forefront of technological advancements and integrate best-in-class solutions.

Simpson Thacher invests in digital transformation to streamline internal processes. This includes optimizing document management and enhancing data analytics. These efforts aim to improve efficiency and client service.

The firm explores and implements advanced tools for legal research and contract analysis. They often incorporate artificial intelligence (AI) and machine learning (ML). This helps expedite tasks and gain deeper insights.

Simpson Thacher collaborates with external innovators and legal technology providers. This approach allows the firm to integrate best-in-class solutions. These partnerships help to stay at the forefront of technological advancements.

The firm is likely exploring how generative AI can be applied to legal drafting and due diligence. This is done while maintaining strict confidentiality and ethical guidelines. This exploration is a key part of their innovation strategy.

Simpson Thacher enhances cybersecurity measures to protect sensitive client information. This is a critical aspect in today's digital landscape. Protecting client data is a top priority.

The firm's continuous investment in technology underscores its dedication to maintaining a competitive edge. This ensures they can deliver superior value to their clients. Technological prowess is key to their success.

Simpson Thacher & Bartlett's innovation strategy focuses on several key areas to enhance its legal services and maintain its competitive edge. These initiatives are crucial for the firm's growth strategy and future prospects in the legal market.

- AI and Machine Learning: Implementing AI and ML tools for legal research, e-discovery, and contract analysis to expedite tasks and gain deeper insights.

- Digital Transformation: Streamlining internal processes, optimizing document management, and improving data analytics capabilities through significant investments in digital transformation initiatives.

- Cybersecurity: Enhancing cybersecurity measures to protect sensitive client information, a critical aspect in today's digital landscape, ensuring data security and client trust.

- Strategic Collaborations: Engaging in both in-house development and strategic collaborations with external innovators and legal technology providers to stay at the forefront of technological advancements and integrate best-in-class solutions.

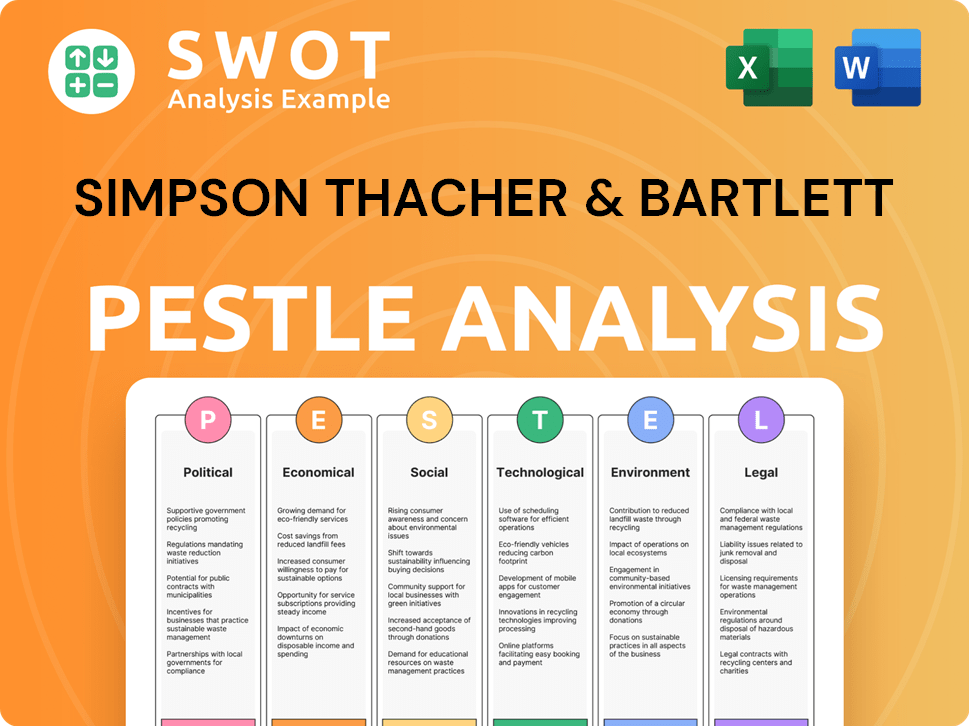

Simpson Thacher & Bartlett PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Simpson Thacher & Bartlett’s Growth Forecast?

The financial outlook for Simpson Thacher & Bartlett reflects a robust and strategically managed approach to sustain its growth trajectory. As a leading law firm, it is well-positioned to capitalize on the continued expansion of the legal services market. The firm's strategic focus on high-margin work and efficient operations is expected to drive strong profitability.

The global legal services market was valued at approximately USD $849.0 billion in 2023. Projections indicate a compound annual growth rate (CAGR) of 4.5% from 2024 to 2030. Simpson Thacher's expertise in high-value practice areas, such as M&A and private equity, positions it favorably to benefit from this growth. The firm's commitment to investing in technology, talent, and global expansion supports its long-term financial health.

The firm's financial strategy emphasizes strong profitability through efficient operations and a focus on high-margin work. Investment levels are directed towards strategic areas such as technology infrastructure, talent acquisition, and global expansion, all aimed at supporting long-term growth. The firm's ability to attract and retain top legal talent, command premium billing rates, and secure mandates on complex, high-stakes matters contributes significantly to its financial strength.

While specific revenue figures for Simpson Thacher & Bartlett are not publicly available, the firm's performance is likely aligned with the overall growth of the legal services market. The firm's focus on high-value transactions and complex litigation supports its revenue generation.

Simpson Thacher & Bartlett is expected to maintain strong profitability through efficient operations and a focus on high-margin work. The firm's ability to attract top legal talent and command premium billing rates contributes to its financial success.

The firm's investment strategy focuses on areas that support long-term growth, including technology, talent acquisition, and global expansion. These investments are crucial for maintaining a competitive edge and capitalizing on market opportunities.

Simpson Thacher & Bartlett holds a strong position in the legal market, particularly in high-value practice areas such as M&A and private equity. This strategic focus allows the firm to capitalize on industry trends and maintain a competitive advantage.

The firm's financial health is supported by consistent revenue generation from its diverse client base and a proactive approach to market opportunities. Strategic planning ensures continued financial stability and growth. Learn more about the firm's core values and mission in this article: Mission, Vision & Core Values of Simpson Thacher & Bartlett.

- Focus on high-margin work and efficient operations.

- Investments in technology and talent.

- Strategic global expansion initiatives.

- Strong market position in key practice areas.

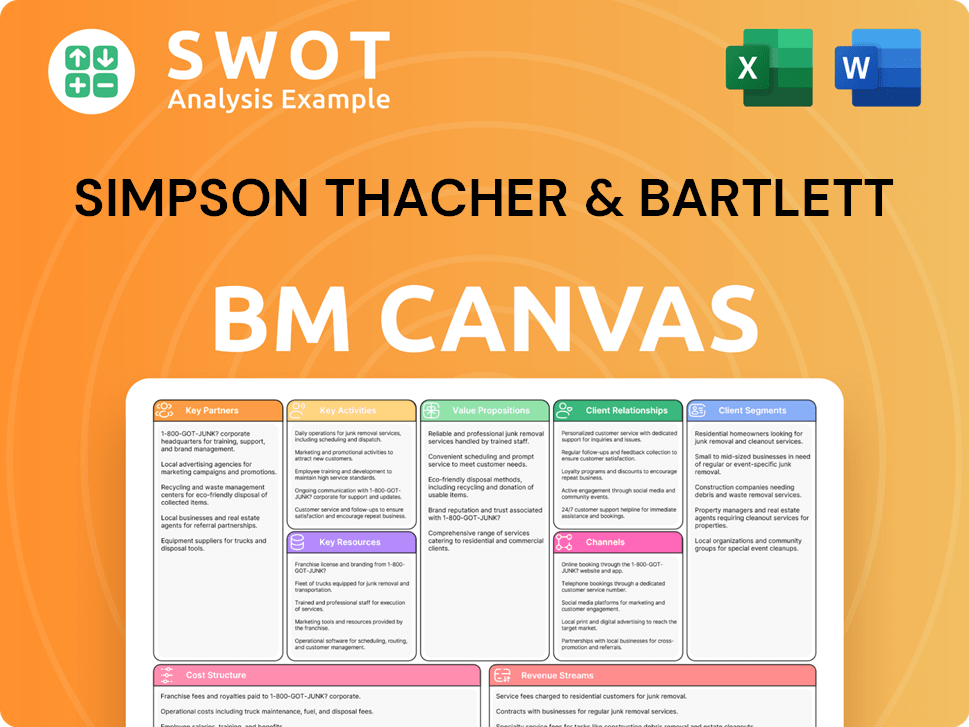

Simpson Thacher & Bartlett Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Simpson Thacher & Bartlett’s Growth?

The Simpson Thacher & Bartlett faces several potential risks and obstacles that could hinder its growth strategy. These challenges include intense competition from other top-tier global law firms and the need to adapt to evolving regulatory landscapes. Furthermore, technological disruptions and the ongoing 'war for talent' in the legal sector pose significant hurdles.

Simpson Thacher & Bartlett's ability to maintain its market share and achieve its business development goals is also affected by broader external factors, such as geopolitical instability and economic downturns. These factors can impact client demand for legal services, particularly in areas like M&A and capital markets. Addressing these risks requires a proactive and multi-faceted approach.

The firm's success depends on its ability to navigate these challenges effectively. Its strategic responses and adaptability will be crucial for maintaining its strong position in the legal market outlook and achieving its future prospects.

The legal market is highly competitive, with numerous firms vying for the same clients. This competition can lead to pressure on Simpson Thacher & Bartlett's billing rates. Constant differentiation in service offerings is necessary to stay ahead.

Evolving legal frameworks across various jurisdictions pose a continuous risk. New regulations, such as those related to data privacy or antitrust, can create complexities for the firm and its clients. Adapting to these changes is essential.

Failure to adapt to new legal tech solutions presents a risk. Competitors gaining an advantage through advanced automation or AI could impact Simpson Thacher & Bartlett's competitiveness. Staying updated with technology is crucial.

Attracting and retaining top legal talent is a constant challenge. The 'war for talent' requires continual investment in compensation, benefits, and professional development. Securing the best lawyers is a priority.

Geopolitical instability and economic downturns can affect client demand. These external risks can particularly impact transactional areas. Diversifying practice areas and client base can mitigate these risks.

Increasing focus on ESG compliance and advancements in generative AI are emerging risks. These will shape the firm's future trajectory. Ongoing vigilance and strategic responses are necessary.

Simpson Thacher & Bartlett addresses risks by diversifying its practice areas and client base. This reduces reliance on any single sector, providing stability. The firm employs robust risk management frameworks, including scenario planning, to anticipate and prepare for potential disruptions.

The firm's long history and consistent ranking among leading global firms demonstrate its capacity for resilience and adaptation. This ability to navigate challenges is key to its growth strategy and future prospects. Simpson Thacher & Bartlett continues to focus on strategic planning.

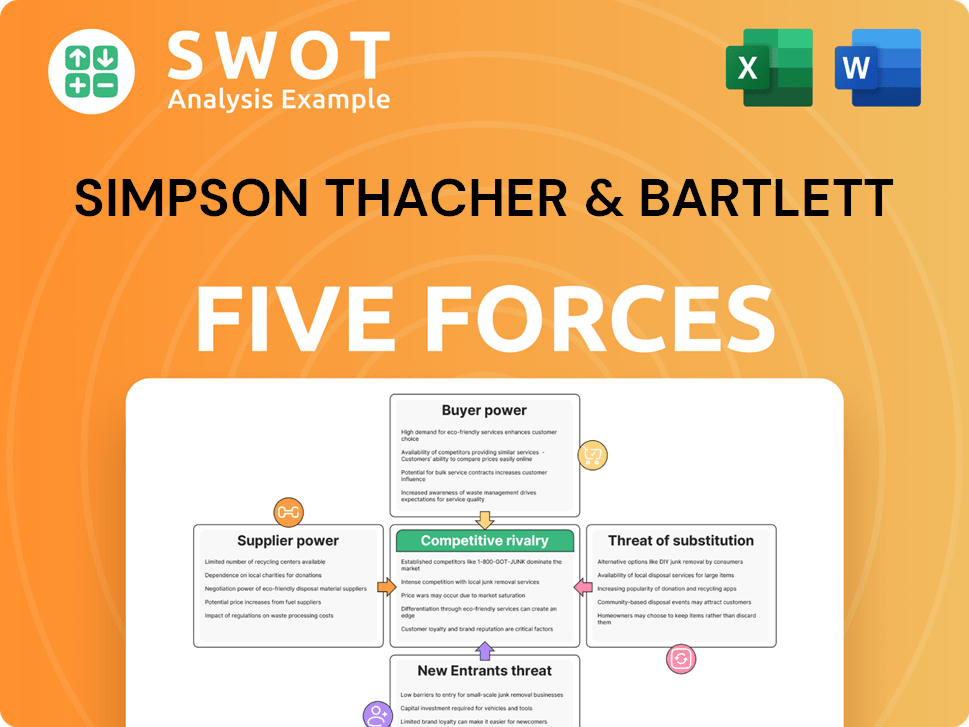

Simpson Thacher & Bartlett Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Simpson Thacher & Bartlett Company?

- What is Competitive Landscape of Simpson Thacher & Bartlett Company?

- How Does Simpson Thacher & Bartlett Company Work?

- What is Sales and Marketing Strategy of Simpson Thacher & Bartlett Company?

- What is Brief History of Simpson Thacher & Bartlett Company?

- Who Owns Simpson Thacher & Bartlett Company?

- What is Customer Demographics and Target Market of Simpson Thacher & Bartlett Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.