Simpson Thacher & Bartlett Bundle

Who Does Simpson Thacher & Bartlett Really Serve?

In the high-stakes world of global law, understanding the Simpson Thacher & Bartlett SWOT Analysis is crucial, but equally important is knowing their customer demographics and target market. This knowledge directly shapes the firm's strategic direction and ability to thrive in a competitive landscape. The legal industry's evolution, driven by shifts in global regulations and economic forces, demands a keen understanding of client needs.

Delving into the client profile of an elite law firm like Simpson Thacher & Bartlett reveals a sophisticated clientele. This analysis will explore Simpson Thacher & Bartlett's key client sectors and their specific legal requirements, providing insights into the firm's strategic adaptation to meet these evolving demands. Understanding the target market is vital for any law firm clients to ensure continued prominence in the global legal market.

Who Are Simpson Thacher & Bartlett’s Main Customers?

Understanding the Owners & Shareholders of Simpson Thacher & Bartlett requires a deep dive into its primary customer segments. The firm primarily operates in the B2B sector, focusing on a sophisticated clientele. This strategic focus allows the firm to provide specialized legal services in complex areas.

The target market of Simpson Thacher & Bartlett is primarily composed of corporations, financial institutions, and governments worldwide. These entities often navigate intricate regulatory landscapes, necessitating expert legal counsel. The firm's expertise is crucial in high-value transactions and disputes, making them a go-to legal advisor for major players.

The firm's success is closely tied to its ability to serve the needs of its diverse client base. This includes providing top-tier legal services in areas like mergers and acquisitions (M&A), capital markets, private equity, and litigation. The firm's client profile reflects a commitment to excellence and a deep understanding of the industries it serves.

Corporate clients range from Fortune 500 companies to emerging enterprises. These clients are often involved in high-value transactions and disputes. The firm's ability to handle complex legal matters makes it a valuable partner for these businesses.

Financial institutions include major banks, investment funds, and asset managers. These clients seek counsel on regulatory compliance, financing, and investment activities. The firm's expertise helps these institutions navigate complex financial regulations.

Governments and sovereign entities engage the firm for advice on international law, public finance, and dispute resolution. The firm's global reach and expertise make it a trusted advisor for these clients. These clients often require specialized legal services.

The private equity practice has seen substantial activity, driving demand for legal services. This segment includes private equity sponsors, institutional investors, and their portfolio companies. The firm's expertise in this area is a significant revenue driver.

The firm's strategic focus on private equity and complex financial transactions is a response to market trends. The increasing sophistication of global finance and the growth of alternative investment strategies have fueled this shift. In 2024, the global private equity market remained robust, with significant deal volumes, highlighting the importance of this sector. This has led to increased demand for legal services in fund formation, leveraged buyouts, and portfolio company management. The customer demographics of Simpson Thacher & Bartlett reflect a commitment to serving high-value clients in complex and evolving financial landscapes.

The firm's key client sectors include corporate, financial institutions, and private equity. These sectors drive a significant portion of the firm's revenue and growth. Understanding these sectors is crucial for analyzing the firm's performance.

- Corporate clients are involved in high-value transactions.

- Financial institutions require expertise in regulatory compliance.

- Private equity clients drive demand for specialized legal services.

- Government and sovereign entities seek advice on international law.

Simpson Thacher & Bartlett SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Simpson Thacher & Bartlett’s Customers Want?

Understanding the customer needs and preferences of Simpson Thacher & Bartlett is crucial for tailoring services and maintaining a competitive edge. The firm's clients, primarily high-profile corporations and financial institutions, seek sophisticated legal counsel to navigate complex business challenges. Their motivations are driven by a need for strategic guidance, risk mitigation, and favorable outcomes in high-stakes transactions and disputes.

The firm's target market, as defined by its customer demographics, includes entities involved in significant financial transactions, regulatory compliance, and litigation. These clients value expertise, a proven track record, and a global presence. The firm's success hinges on its ability to meet these needs through specialized practice areas and a client-centric approach.

The purchasing behavior of Simpson Thacher & Bartlett's clients is heavily influenced by the firm's reputation and the perceived value of its services. Clients often prioritize responsiveness, efficiency, and a deep understanding of their business operations. Key decision-making criteria include the firm's industry knowledge, global reach, and the ability to handle complex, high-value matters.

Clients aim to achieve their strategic goals, such as mergers and acquisitions, global expansion, and securing favorable outcomes in disputes.

Clients seek to minimize legal and regulatory risks, ensuring compliance and protecting their interests in complex transactions.

Clients require assistance in navigating intricate legal and regulatory landscapes, including cross-border transactions and compliance issues.

Clients are drawn to the firm's strong reputation, expertise in specific practice areas, and a proven track record of success.

Clients value the firm's global presence, industry-specific knowledge, and ability to handle high-stakes matters across various jurisdictions.

Clients prioritize responsiveness, efficiency, and clear communication from the firm to ensure timely and effective legal support.

In 2024, the firm's target market analysis reveals a continued focus on industries such as private equity, financial services, and technology, where clients face significant legal and regulatory challenges. For instance, in the first quarter of 2024, the firm advised on several high-profile M&A deals, demonstrating its expertise in this area. The firm's marketing efforts highlight its specialized practice groups and successful case studies to attract and retain clients. The firm's client base characteristics include large corporations and financial institutions with significant legal needs. A recent article provides additional insights into the firm's operations and client relationships, offering a deeper understanding of its market position.

The firm addresses client needs through a combination of specialized legal services and a client-centric approach.

- Regulatory Compliance: Assisting clients in navigating complex regulatory environments, including antitrust, data privacy, and financial regulations.

- Cross-Border Transactions: Providing legal support for international mergers, acquisitions, and other cross-border deals.

- Dispute Resolution: Offering effective and swift dispute resolution services to protect client interests.

- Strategic Counsel: Providing strategic advice aligned with client business goals, including market leadership and expansion.

- Industry-Specific Expertise: Delivering legal services tailored to specific industries, such as private equity, financial services, and technology.

Simpson Thacher & Bartlett PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Simpson Thacher & Bartlett operate?

The firm, Simpson Thacher & Bartlett, maintains a significant global geographical market presence, strategically positioning major offices in key financial and legal hubs worldwide. Its primary markets include the United States, Europe, and Asia. This strategic distribution allows the firm to effectively serve its diverse client base and capitalize on global economic opportunities.

The firm's primary markets include the United States (New York, Washington D.C., Los Angeles, Palo Alto, Houston), Europe (London), and Asia (Hong Kong, Beijing, Tokyo, Seoul). These locations are critical centers for international finance, mergers and acquisitions, and other high-value legal services. The firm's strong presence in these regions underscores its commitment to serving a global target market.

The firm's geographic distribution of sales and growth is heavily weighted toward its major financial center offices, reflecting the concentration of its target clientele. The firm has a robust presence in London and New York, which are epicenters for global finance and M&A activity. Its continued investment in its Asian offices reflects the growing economic influence and deal activity in the region. The firm's strategic office locations allow it to cater to the needs of a diverse client profile.

The firm localizes its offerings by staffing offices with lawyers who possess deep knowledge of local laws, regulations, and cultural nuances. This approach ensures that clients receive tailored legal advice that is relevant to their specific needs and the jurisdictions in which they operate.

Marketing efforts are also localized, with the firm participating in regional industry events and publishing insights relevant to specific markets. This strategy helps the firm build brand recognition and establish itself as a thought leader in its key geographic areas, attracting a diverse range of law firm clients.

Recent expansions or strategic adjustments are often driven by global economic shifts and emerging markets. For example, the continued investment in its Asian offices reflects the growing economic influence and deal activity in the region. This adaptability is crucial for maintaining a competitive edge in the legal market.

Differences in customer demographics, preferences, and buying power across these regions are substantial. For instance, while New York clients may prioritize complex capital markets and corporate finance, Asian clients might focus more on cross-border investments and regulatory compliance within their respective jurisdictions. This requires a nuanced approach to client service.

The firm's global presence is a key factor in its success. This allows the firm to serve a diverse target market. For more insights, consider exploring the Competitors Landscape of Simpson Thacher & Bartlett.

- United States: Strong presence in New York and other major cities.

- Europe: Significant operations in London, a major financial hub.

- Asia: Expanding presence in Hong Kong, Beijing, Tokyo, and Seoul.

- Global Reach: The firm's strategic locations enable it to serve clients worldwide.

Simpson Thacher & Bartlett Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Simpson Thacher & Bartlett Win & Keep Customers?

The customer acquisition and retention strategies of Simpson Thacher & Bartlett are central to its success as an elite law firm. The firm's approach focuses on attracting and retaining high-value clients through a combination of reputation, expertise, and relationship management. Understanding the firm's methods provides insight into how it maintains its position in a competitive legal market.

Simpson Thacher & Bartlett's strategy involves a multifaceted approach, including direct client pitches, referrals, and thought leadership. The firm leverages both traditional and digital channels to showcase its expertise and attract potential clients. The focus on delivering exceptional service and building long-term relationships underscores its commitment to client retention.

The firm's client base is primarily composed of large corporations, financial institutions, and private equity firms, reflecting its focus on high-stakes, complex legal matters. This focus is a key element of their target market strategy, differentiating them from firms serving a broader range of clients. The firm's ability to attract and retain these clients is crucial for its financial performance.

Simpson Thacher & Bartlett's strong reputation is a primary driver for attracting new clients. This reputation is built on a history of successful outcomes and high-profile deals. The firm's prestige often precedes its outreach efforts, making it a sought-after legal partner.

Referrals from existing clients and other professional service firms are significant sources of new business. These referrals leverage existing relationships and trust. The firm actively cultivates these networks to generate a consistent flow of new clients.

Simpson Thacher & Bartlett's lawyers often publish articles and speak at industry events, establishing them as thought leaders. This strategy enhances the firm's visibility and attracts potential clients seeking expert legal advice. Thought leadership helps to define the firm's expertise.

The firm uses digital channels, including its website and professional networking platforms, to showcase its expertise. Digital marketing plays an increasingly important role in attracting potential clients. This approach is crucial in the modern legal landscape.

Simpson Thacher & Bartlett focuses on delivering exceptional client service and building long-term relationships to retain clients. This involves providing high-quality, results-oriented legal advice and fostering personalized experiences. The firm's commitment to client satisfaction is a key factor in its retention rates.

- Exceptional Client Service: Providing consistent, high-quality legal advice.

- Relationship Building: Cultivating long-term relationships through dedicated client teams.

- Proactive Communication: Keeping clients informed about legal developments and matters.

- Personalized Experiences: Tailoring services to meet individual client needs.

The firm's strategic approach to customer acquisition and retention, as highlighted in this analysis of the Growth Strategy of Simpson Thacher & Bartlett, is crucial for maintaining its position in the legal market. This strategy, encompassing reputation, expertise, and relationship management, is a key factor in its sustained success.

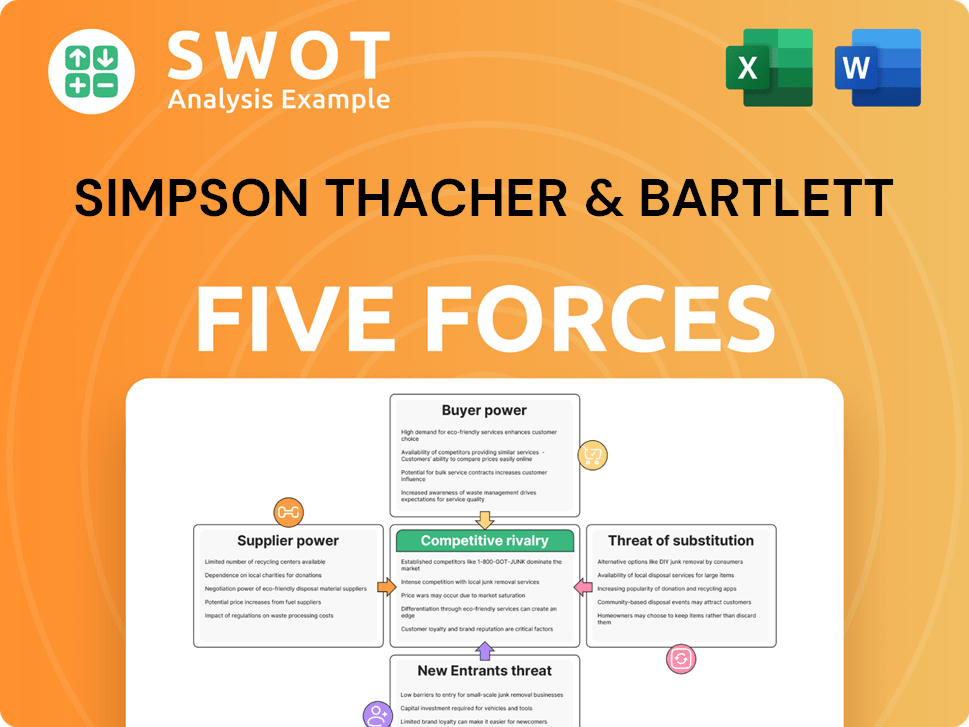

Simpson Thacher & Bartlett Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Simpson Thacher & Bartlett Company?

- What is Competitive Landscape of Simpson Thacher & Bartlett Company?

- What is Growth Strategy and Future Prospects of Simpson Thacher & Bartlett Company?

- How Does Simpson Thacher & Bartlett Company Work?

- What is Sales and Marketing Strategy of Simpson Thacher & Bartlett Company?

- What is Brief History of Simpson Thacher & Bartlett Company?

- Who Owns Simpson Thacher & Bartlett Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.