Skanska Bundle

How Does Skanska Dominate the Global Construction Arena?

Skanska, a titan in the construction industry, has been shaping skylines and infrastructure worldwide since 1887. From its humble beginnings in Sweden, Skanska has evolved into a multinational force, consistently undertaking ambitious projects. Understanding the Skanska SWOT Analysis is key to grasping its strategic positioning.

The Skanska competitive landscape is complex, and this analysis will dissect the dynamics of its global presence. We'll explore Skanska competitors, evaluating their strengths and weaknesses to understand the company's strategic advantages. This deep dive into Skanska market analysis will reveal how it navigates the challenges and opportunities within the ever-evolving construction industry analysis, offering insights into its future trajectory and Skanska business strategy while assessing its Skanska financial performance.

Where Does Skanska’ Stand in the Current Market?

Skanska holds a strong market position within the construction and development industry, operating across select markets in the Nordics, Europe, and the United States. The company's core operations encompass construction projects, commercial property development, residential building, and infrastructure development. Its value proposition lies in delivering comprehensive services to a diverse range of sectors, including transportation, healthcare, and data centers, ensuring high-quality project execution and sustainable practices.

In 2024, Skanska's global revenue reached SEK 177.2 billion (approximately $17.3 billion USD), reflecting a 13% increase year-over-year. The U.S. market is a significant contributor, accounting for over one-third of Skanska's global revenue in 2024, totaling $8.2 billion. The company's operating income for the full year 2024 was SEK 7.1 billion, a 121% increase compared to the previous year. Skanska's construction division posted an operating margin of 3.5% for the full year 2024, aligning with its target. As a leader in the construction sector, Skanska's growth strategy is crucial for its sustained success.

Skanska serves a broad range of customer segments, and its financial position remains robust. As of December 31, 2024, Skanska had an adjusted interest-bearing net receivables of SEK 12.0 billion. In Q1 2025, revenue increased by 15% year-on-year to SEK 42.3 billion ($4.3 billion USD), with operating income reaching SEK 1.1 billion ($113 million USD). The company's construction division revenue rose 14% to SEK 41.8 billion ($4.3 billion USD) in Q1 2025, with the U.S. contributing 60% of this revenue. The order backlog remained strong, with a rolling 12-month book-to-build ratio of 115% in Q1 2025, representing 19 months of production.

Skanska's competitive landscape includes major players in the construction industry. Its market position is influenced by factors such as project portfolio, geographical presence, and financial health. The company faces competition from both domestic and international firms.

Skanska focuses on several key market segments, including infrastructure, commercial buildings, and residential projects. The company's success depends on its ability to secure and execute projects in these areas. Understanding these segments is critical for a Skanska market analysis.

Skanska's operations are concentrated in the Nordics, Europe, and the United States. The company's performance varies across these regions, with the U.S. market being a significant driver of revenue. The Skanska competitive landscape is shaped by its regional focus.

Key financial metrics for Skanska include revenue, operating income, and order backlog. These indicators reflect the company's financial health and competitive standing. Analyzing these metrics provides insights into Skanska's business strategy.

Skanska faces challenges such as economic uncertainties and shifts in market conditions. In Q1 2025, the company adopted a more cautious view of the U.S. building market due to delays in investment decisions. Skanska's response to market challenges involves strategic diversification and innovation.

- Diversifying its project development portfolio with a focus on life sciences and multi-family rental housing.

- Maintaining a strong presence in civil construction and infrastructure.

- Focusing on the U.S. market, particularly in infrastructure and data centers, as a primary growth engine.

- Adapting to economic uncertainties by adjusting investment strategies.

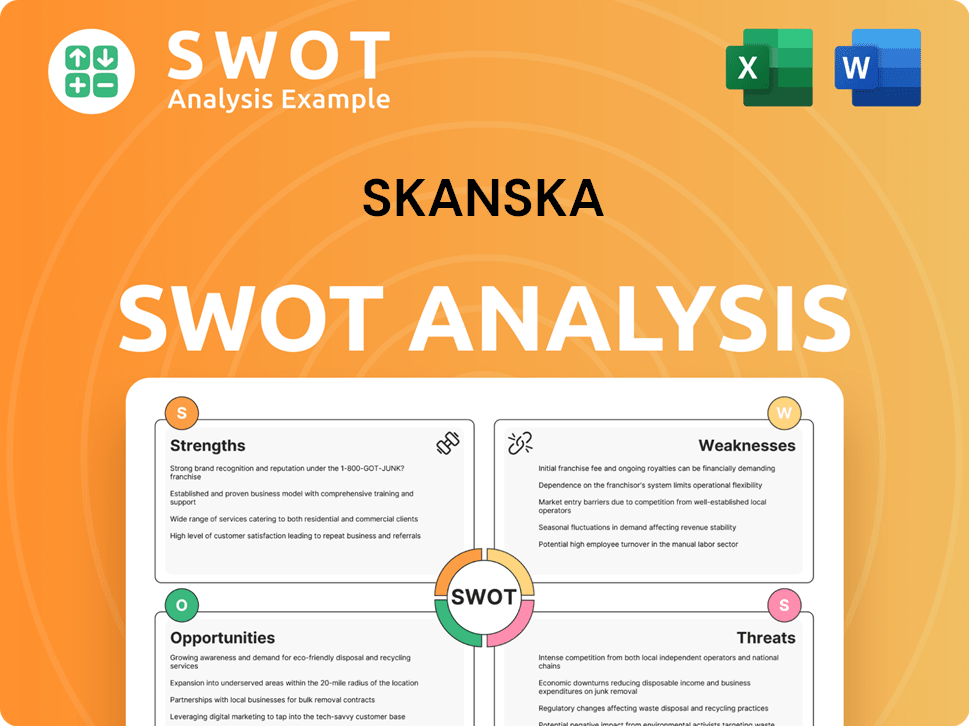

Skanska SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Skanska?

The Owners & Shareholders of Skanska operates within a highly competitive global construction and development market. Understanding the Skanska competitive landscape is crucial for stakeholders assessing its performance and future prospects. This analysis considers both direct and indirect rivals that challenge Skanska across its key segments.

Several major global players compete with Skanska. These competitors challenge Skanska through various means, including project bidding, geographic expansion, and technological innovation. The competitive dynamics vary across different regions and sectors, influencing Skanska's strategic decisions and financial outcomes.

The construction industry is dynamic, with competition intensifying due to factors like technological advancements and market consolidation. Staying informed about the Skanska competitors and their strategies is essential for evaluating Skanska's position in the global construction market and its ability to maintain or enhance its market share.

Skanska's market analysis reveals that the company faces significant competition from global construction giants. These rivals compete across various project types and geographic regions, influencing Skanska's strategic decisions.

CSCEC is the largest construction company globally, posing a major challenge to Skanska. CSCEC's extensive portfolio includes infrastructure and real estate development projects worldwide. This broad scope allows CSCEC to compete with Skanska on numerous fronts.

VINCI is a major player in construction and concessions, operating across transport infrastructure, energy, and construction services. VINCI's diverse operations, particularly in Europe, place it in direct competition with Skanska in several key markets.

Bechtel is a significant competitor, known for its large-scale projects in various sectors. Bechtel's global presence and project expertise make it a key rival, particularly in infrastructure and energy projects.

Fluor Corporation competes with Skanska in several markets, particularly in the engineering, procurement, and construction (EPC) sector. Fluor's project portfolio and global reach make it a significant competitor.

Balfour Beatty is a major player in the construction industry, with a strong presence in the UK and other markets. Balfour Beatty's projects and market focus place it in direct competition with Skanska.

The competitive landscape varies across different regions and sectors. In the U.S., Skanska benefits from strong infrastructure spending, while in Europe, competition is more fragmented, with local and regional players. The Skanska business strategy must adapt to these regional differences.

- U.S. Civil Market: Skanska benefits from substantial federal funding programs, competing with other large infrastructure contractors.

- European Markets: Competition in residential and commercial building is more fragmented, with local and regional players.

- Technological Disruptors: The adoption of technologies like BIM, AI, and modular construction allows new entrants to compete.

- Mergers and Alliances: These can reshape competitive dynamics, creating larger rivals with expanded service offerings.

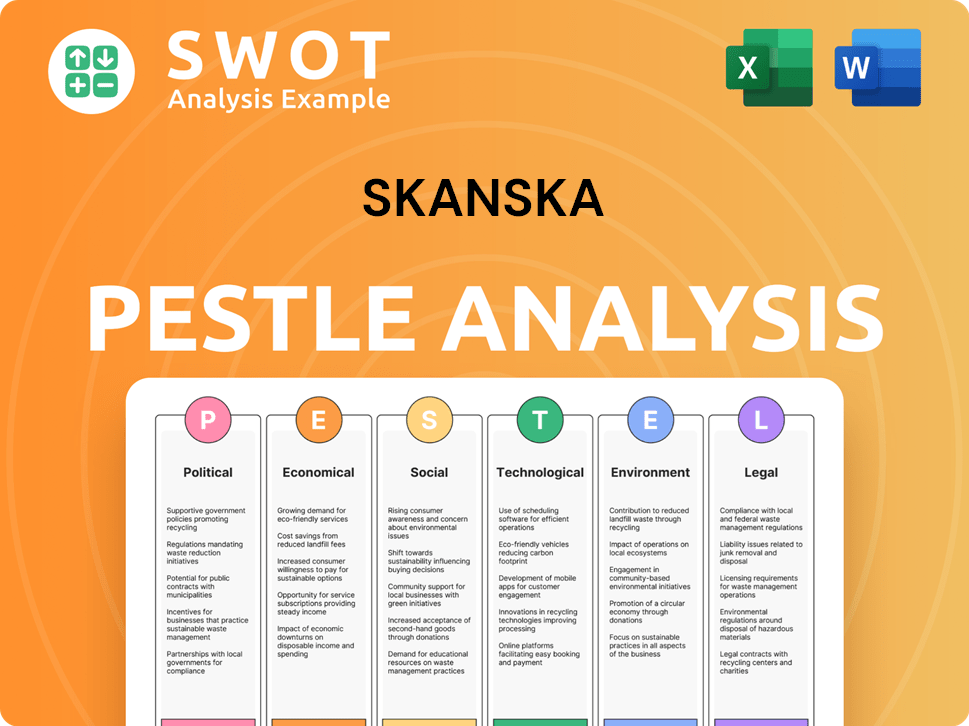

Skanska PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Skanska a Competitive Edge Over Its Rivals?

Understanding the Skanska competitive landscape requires a deep dive into its core strengths, strategic initiatives, and financial performance. The company's longevity and global presence provide a solid foundation, allowing it to compete effectively in the complex construction industry. This analysis will explore the key elements that define its competitive advantages, including its financial stability, sustainability efforts, and operational efficiencies.

Skanska's business strategy is built on a foundation of experience and financial prudence. It has consistently demonstrated the ability to secure and execute large-scale projects. This has allowed it to maintain a strong market position, especially in an industry often subject to economic fluctuations and project-specific risks. The company's commitment to sustainability and its focus on strategic project selection further enhance its competitive edge.

Skanska market analysis reveals a company that is well-positioned due to its capacity to adapt to market changes and its commitment to innovation. This includes embracing sustainable practices and leveraging technological advancements. The following sections will delve into these aspects, providing a comprehensive view of Skanska's competitive advantages.

With over 135 years in the construction industry, Skanska has built a wealth of experience. This vast experience allows it to handle complex projects worldwide. Skanska's global presence provides a significant advantage in securing and executing projects across diverse markets.

Skanska's robust financial health is a key competitive advantage. In 2024, the company reported record-high order backlogs and double-digit revenue growth. Its strong net cash position of $1.19 billion as of Q1 2025 allows for strategic investments and selective bidding.

Sustainability is a key differentiator for Skanska. The company is known for its sustainable building practices and a strong focus on green construction. Skanska's commitment to reducing carbon emissions positions it favorably in markets prioritizing sustainable development.

Skanska focuses on strategic project selection and operational efficiency. It targets high-growth sectors like infrastructure and data centers. This approach helps maintain stable performance even amidst challenges like labor shortages and supply chain disruptions.

Skanska's competitive advantages are multifaceted, encompassing financial strength, sustainability leadership, and operational excellence. The company's financial performance in 2024, with a 13% increase in full-year revenue to SEK 177.2 billion ($17.3 billion) and an operating income of $687 million, a 121% increase year-over-year, underscores its robust position. Its ability to navigate market challenges, such as labor shortages and supply chain issues, further solidifies its competitive edge. For a deeper understanding of the company's origins and evolution, consider reading a Brief History of Skanska.

Skanska's competitive advantages are rooted in its extensive industry experience, strong financial performance, and commitment to sustainability. These elements enable it to secure and execute large-scale projects efficiently. The company's strategic focus on high-growth sectors further strengthens its market position.

- Financial Strength: Demonstrated by a record order backlog and double-digit revenue growth in 2024.

- Sustainability: Significant reductions in carbon emissions, aligning with growing market demands for eco-friendly solutions.

- Operational Efficiency: Strategic project selection and disciplined investment in high-growth sectors.

- Global Presence: Extensive experience across diverse construction and development projects worldwide.

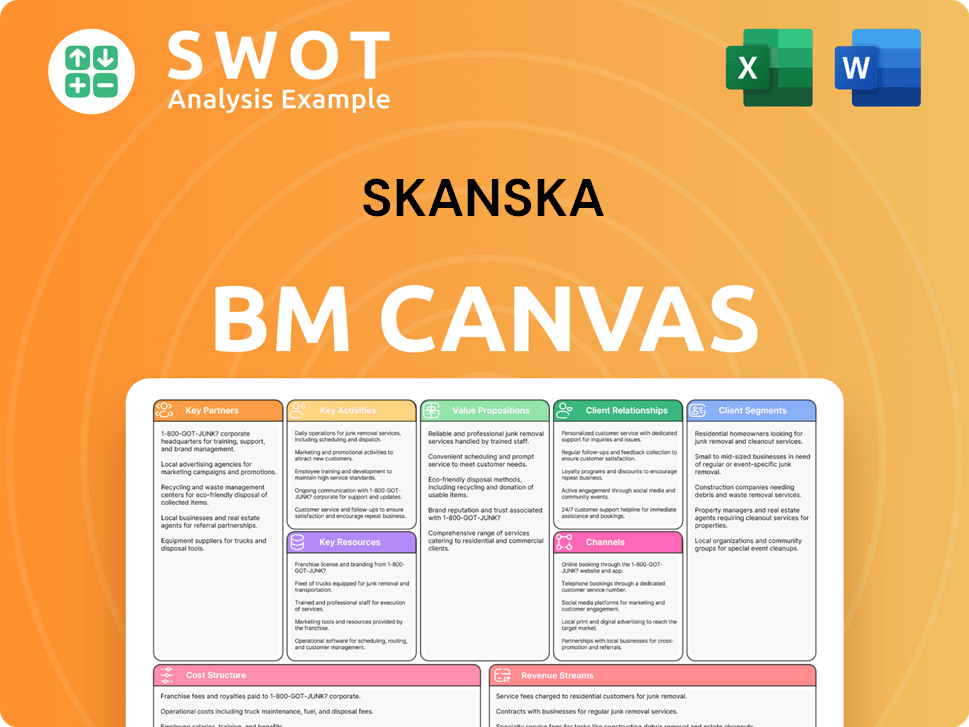

Skanska Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Skanska’s Competitive Landscape?

The construction industry is experiencing a period of transformation, with significant trends shaping the Skanska competitive landscape. Digitalization, sustainability regulations, and economic factors are key drivers influencing the sector's evolution. Understanding these elements is crucial for assessing Skanska's business strategy and its future prospects.

Skanska's market analysis reveals both challenges and opportunities. The company's ability to adapt to technological advancements, manage cost pressures, and capitalize on infrastructure investments will be critical for maintaining a competitive edge. This chapter will explore the industry trends, future challenges, and opportunities, offering insights into Skanska's financial performance and strategic positioning.

Technological advancements such as BIM, AI, and automation are streamlining project management and improving decision-making. Sustainability is a major focus, with demand for eco-friendly materials and low-carbon construction rising. Inflation, volatile material costs, and labor shortages are persistent challenges within the construction industry analysis.

Construction costs are projected to increase by 5-7% in 2025 due to supply chain disruptions and material costs. Labor shortages, with an estimated gap of 250,000 to 500,000 skilled workers in the U.S., will impact project timelines and wages. Geopolitical factors and trade policies also contribute to cost volatility, presenting significant hurdles.

Government infrastructure spending, particularly in the U.S. through initiatives like the IIJA, provides substantial growth opportunities. Many countries are increasing their infrastructure budgets, which could reach over $9 trillion globally by 2025. Skanska's projects and their impact on competition are also influenced by exploring new market segments like life sciences and multi-family housing.

Maintaining a robust financial position allows for strategic project selection and cost management. The company continues to invest in workforce development and technology integration to address labor shortages and optimize efficiency. Skanska's response to market challenges involves adapting to global economic uncertainties and capitalizing on infrastructure investments.

Skanska's strengths and weaknesses analysis reveals a strong focus on sustainable construction and digitalization. The company's ability to navigate global economic uncertainties will be critical. Skanska's key performance indicators compared to rivals will be influenced by its leadership in sustainable construction practices.

- Leveraging Digital Technologies: Utilizing BIM, AI, and digital twins to enhance project efficiency and decision-making.

- Focus on Sustainability: Adhering to EU climate targets and promoting low-carbon construction to attract funding.

- Strategic Financial Management: Maintaining a robust financial position to manage costs and selectively bid on projects.

- Workforce Development: Investing in training and technology integration to address labor shortages and improve operational efficiency.

To delve deeper into Skanska's financial health and competitive standing, consider exploring Revenue Streams & Business Model of Skanska to gain a comprehensive understanding of the company's operations and financial strategies.

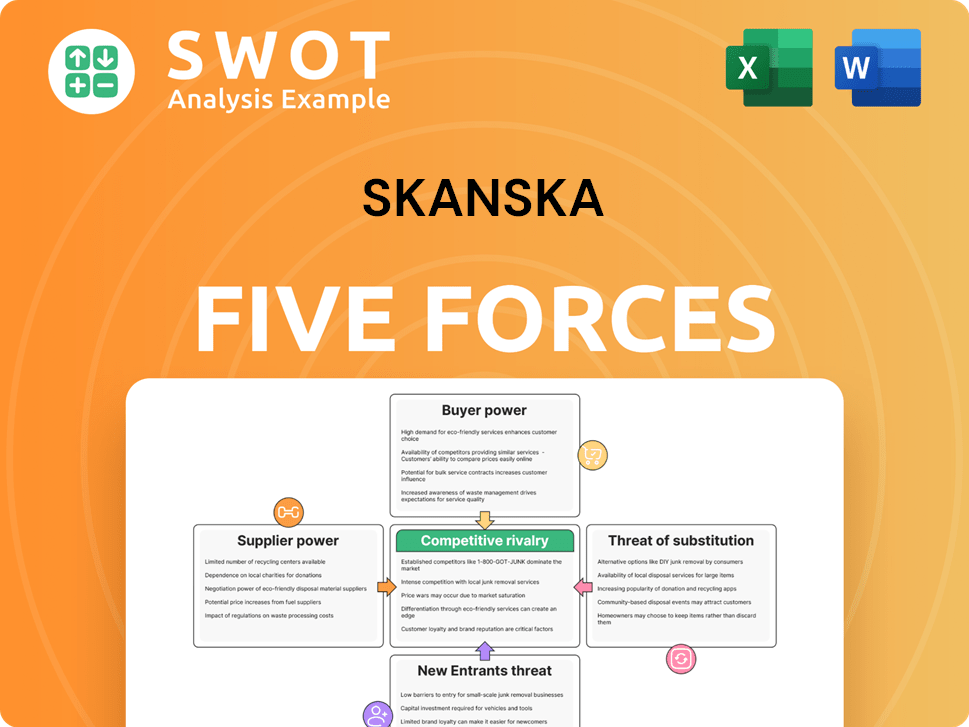

Skanska Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Skanska Company?

- What is Growth Strategy and Future Prospects of Skanska Company?

- How Does Skanska Company Work?

- What is Sales and Marketing Strategy of Skanska Company?

- What is Brief History of Skanska Company?

- Who Owns Skanska Company?

- What is Customer Demographics and Target Market of Skanska Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.