Skanska Bundle

How Does Skanska Thrive in the Global Construction Arena?

Skanska, a titan in the construction and project development landscape, consistently shapes the built environment. With a remarkable SEK 177.2 billion (approximately US$17.3 billion) in global revenue for 2024, the Skanska company showcases its financial prowess and extensive market reach. From infrastructure to commercial properties, Skanska projects span diverse sectors, primarily in Europe and the United States.

This deep dive into Skanska SWOT Analysis will explore the company's core operations, value proposition, and revenue streams, providing a comprehensive understanding of how Skanska works. We'll examine its key strategic moves, competitive advantages, and industry position, including risks and future outlook. Understanding the Skanska company is key for anyone looking to understand the future of construction and sustainable building practices, from Skanska construction projects to its commitment to net-zero emissions by 2045.

What Are the Key Operations Driving Skanska’s Success?

The Skanska company operates on an integrated business model, focusing on construction and the development of commercial and residential properties, along with infrastructure projects. Its primary markets are in the Nordics, Europe, and the United States. Skanska provides services to a diverse client base, including public entities and private clients.

How Skanska works involves comprehensive project management, from initial design to construction and eventual divestment. A core aspect of the company's strategy is its emphasis on sustainable building practices. This includes using energy-efficient methods and low-carbon materials to differentiate itself within the industry. For instance, Skanska is collaborating with Cemvision to scale up a new generation of cement with up to 95 percent lower climate impact than traditional Portland cement, with pilot projects slated for spring 2025.

Skanska projects involve a complex supply chain and distribution network. According to Skanska's Spring 2025 Construction Market Trends Report, over 40% of surveyed suppliers anticipate moderate to severe disruptions in material availability and lead times over the next 12 months, highlighting the challenges. Furthermore, the construction industry faces a persistent labor gap, estimated between 250,000 and 500,000 skilled workers in the US. Skanska's approach to 'building for a better society' balances commercial goals with sustainability, integrating it into its core capabilities. The construction division's operating margin was 2.8% in Q1 2025, with a rolling 12-month operating margin of 3.7%.

Skanska's core operations center on construction projects and property development. The company manages projects from inception to completion. Skanska focuses on sustainability and efficient resource management.

Skanska offers sustainable and efficient construction solutions. The company aims to deliver value through its commitment to quality and innovation. Skanska provides diverse services, from infrastructure to commercial and residential projects.

Skanska primarily operates in the Nordics, Europe, and the United States. These regions offer significant opportunities for construction and development projects. The company strategically focuses on these key geographic areas.

Skanska integrates sustainability into its core operations. The company uses sustainable materials and energy-efficient construction methods. Skanska's initiatives aim to reduce carbon emissions and enhance building performance.

Skanska faces challenges related to supply chain disruptions and labor shortages. The company mitigates these risks through proactive management and strategic partnerships. Skanska continues to adapt to market dynamics and industry trends.

- Supply Chain Management: Addressing material availability and lead times.

- Labor Force: Managing the persistent labor gap in the construction industry.

- Sustainability: Integrating sustainable practices to reduce environmental impact.

- Financial Performance: Maintaining a strong operating margin through efficient project execution.

For more insights into Skanska company history and its evolution, you can read a Brief History of Skanska.

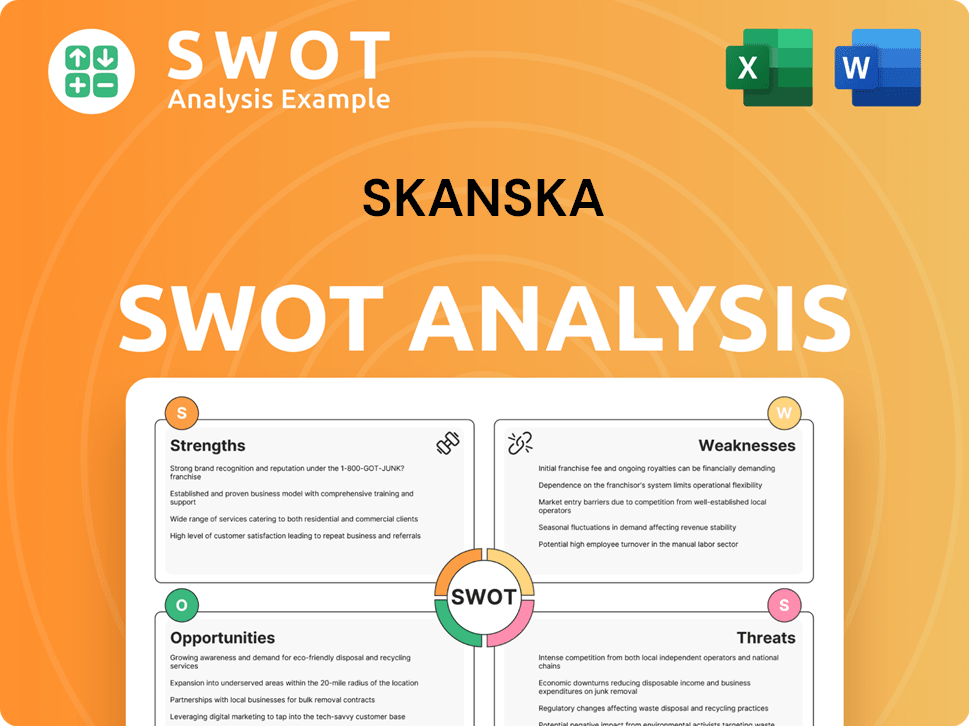

Skanska SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Skanska Make Money?

The Skanska company generates revenue through diverse business streams, including construction, residential development, commercial property development, and investment properties. The Skanska company's construction division is the primary driver of its financial performance. This diversified approach allows Skanska to capitalize on various market opportunities and mitigate risks across different sectors.

Skanska's monetization strategies are tailored to each segment. The construction segment relies on direct project contracts. Residential units are sold, commercial properties are leased or divested, and investment properties generate income. This multi-faceted approach helps Skanska maintain a stable financial foundation.

In 2024, Skanska reported a full-year revenue of SEK 177.2 billion (approximately US$17.3 billion), a 13% increase from 2023. The construction division's revenue rose 14% to SEK 41.8 billion (US$4.3 billion) in Q1 2025, with the US market contributing 60% of this figure. The company's adjusted interest-bearing net receivables totaled SEK 11.6 billion as of Q1 2025. The company aims to churn its project development portfolio to capitalize on market opportunities.

Skanska employs a range of strategies to generate revenue and maximize profitability across its various business segments. This includes a focus on strong project execution in construction, strategic property development, and a growing investment portfolio. Understanding the Target Market of Skanska is crucial for these strategies.

- Construction: Revenue generated through direct project contracts, including building and infrastructure projects. The US market is a significant contributor, accounting for 60% of the construction division's Q1 2025 revenue.

- Residential Development: Monetization through the sale of developed residential units. In Q1 2025, this segment faced challenges, with a 27% decrease in revenue and a drop in units sold.

- Commercial Property Development: Revenue from leasing and divestment of commercial properties. This segment, along with Investment Properties, showed stable results in Q1 2025.

- Investment Properties: Income generated from a portfolio of investment properties. The portfolio grew in 2024 with the acquisition of Citygate and Oas, bringing the total to seven buildings worth SEK 8.2 billion.

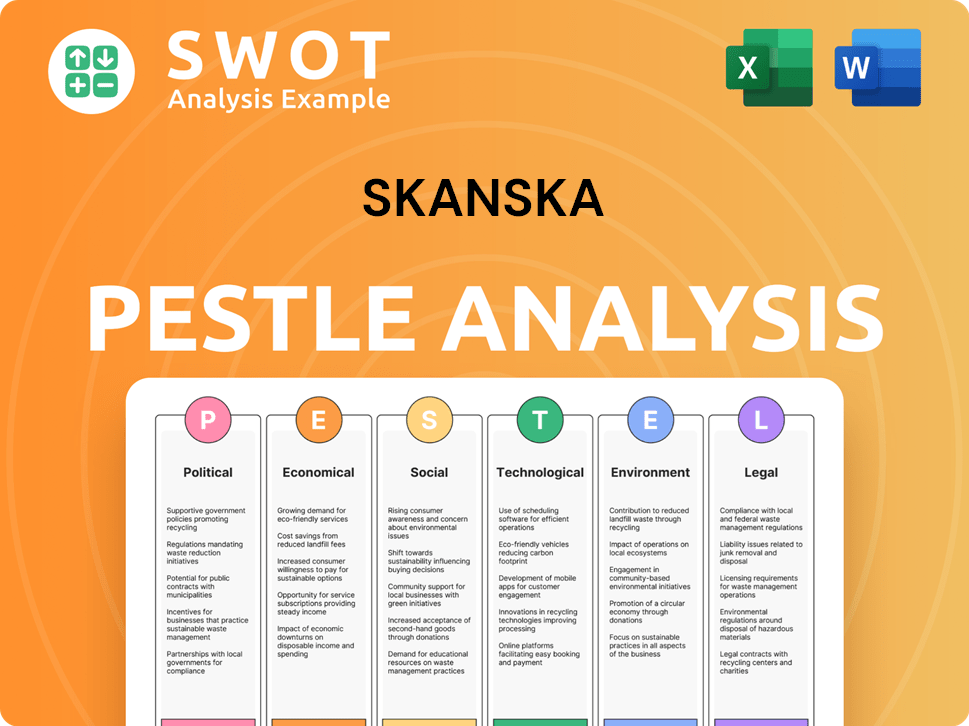

Skanska PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Skanska’s Business Model?

The operations and financial performance of the Skanska company have been significantly shaped by key milestones and strategic moves, particularly its focus on the US market and its commitment to sustainability. In 2024, the company demonstrated robust performance, marked by a record-high order backlog and double-digit revenue growth, largely fueled by strong demand in the US, especially in infrastructure projects and the burgeoning data center sector. This strategic focus and market positioning are central to understanding how Skanska works.

The US market's book-to-build ratio of 152% in 2024 provided Skanska with 24 months of production, indicating a longer duration of projects than previously observed. Despite facing challenges, such as a more 'normalized' US building market in Q1 2025 due to investment decision delays across various sectors, Skanska's leadership remains optimistic. The company is strategically positioned to remain selective in projects where it holds a competitive advantage, showcasing its ability to adapt and thrive in dynamic market conditions.

Skanska's competitive advantages include its strong market position, diverse geographic presence, and robust client base, which help reduce business risks and provide stability to revenues. The company's emphasis on sustainability is a core competitive edge, with a goal of achieving net-zero carbon emissions by 2045 and significant progress already made, including a 61% reduction in carbon emissions in its own operations (scope 1 and 2) compared to 2015 levels by 2024. Skanska's strategic moves also include leveraging innovative technologies like its Intellekt IoT solution, which helps building managers control energy usage and has resulted in 34% customer savings, and exploring AI-powered tools for job site safety.

Achieved a record-high order backlog in 2024, demonstrating strong project acquisition and market demand. The company's focus on the US market has been a key driver of this success, particularly in infrastructure and data center projects. Skanska's strategic moves have allowed it to capitalize on these opportunities, showcasing its ability to adapt and thrive in dynamic market conditions.

Leveraging innovative technologies like the Intellekt IoT solution, which has resulted in 34% customer savings. Exploring AI-powered tools for job site safety, demonstrating a commitment to innovation and efficiency. The company's strategic investments in technology are designed to improve operational performance and enhance customer value, highlighting how Skanska works to stay ahead.

Strong market position, diverse geographic presence, and robust client base reduce business risks. Significant progress in sustainability, with a 61% reduction in carbon emissions by 2024. These factors contribute to Skanska's ability to maintain a competitive edge and deliver consistent value to stakeholders.

Double-digit revenue growth in 2024, driven by strong demand in the US market. The US market's book-to-build ratio of 152% in 2024 provided Skanska with 24 months of production. These figures reflect the company's strong financial health and effective strategic execution.

Skanska is committed to achieving net-zero carbon emissions by 2045, reflecting its dedication to environmental responsibility. The company has already achieved a 61% reduction in carbon emissions in its own operations (scope 1 and 2) compared to 2015 levels by 2024, demonstrating significant progress. These initiatives are central to Skanska's long-term strategy and its commitment to sustainable construction practices.

- Focus on reducing carbon emissions across all operations.

- Implementation of sustainable construction practices in all projects.

- Investment in renewable energy and energy-efficient technologies.

- Collaboration with clients and partners to promote sustainability.

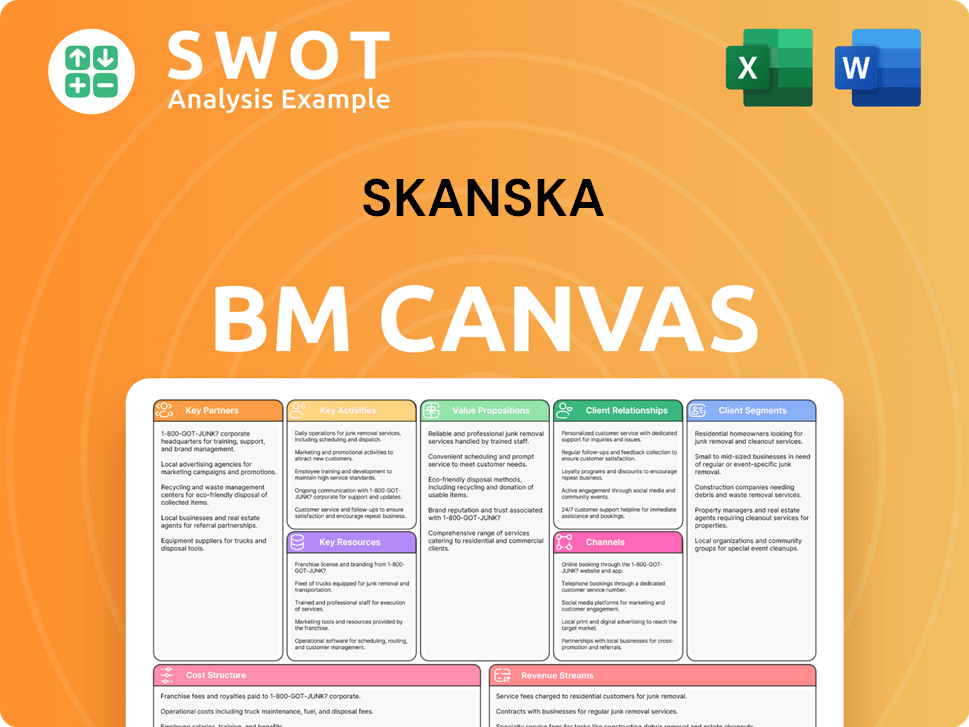

Skanska Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Skanska Positioning Itself for Continued Success?

The Skanska company maintains a strong position in the global construction and project development market. With significant operations in the Nordics, Europe, and the United States, the company leverages its focus on sustainable building practices and large-scale infrastructure projects to maintain its market share. The company's substantial construction backlog, representing 19 months of production as of Q1 2025, underscores its robust operational capacity.

Several risks and headwinds could impact Skanska's performance. These include volatile construction costs due to material tariffs, ongoing global supply chain disruptions, and a persistent labor gap within the construction industry. Political uncertainty and the US Federal Reserve's reluctance to lower interest rates have also led to delays in investment decisions, particularly in the US building market. The residential development market, especially in the Nordics, is anticipated to remain weak for the next 12 months, while Central Europe presents good opportunities for project development.

Skanska is a leading global construction and project development company. It has a strong presence in the Nordics, Europe, and the United States. Its focus on sustainable building and infrastructure bolsters its market position.

Risks include volatile construction costs, supply chain disruptions, and labor gaps. Political and economic uncertainties, like interest rate decisions, can also cause delays. The residential market in the Nordics faces challenges.

Skanska anticipates a strong US civil market and stable European infrastructure. It expects a gradual recovery in residential development. The company is focused on strategic project selection and investment in high-growth sectors.

Skanska's robust financial position, with a net cash position of SEK 11.6 billion (US$1.19 billion) in Q1 2025, supports strategic project selection. This financial strength enables the company to bid selectively on projects with perceived value.

Skanska is prioritizing a strong financial position and optimizing its project development portfolio. The company is committed to achieving net-zero carbon emissions by 2045. They are investing in digitalization and technology to improve operations.

- Focus on sustainability targets, including net-zero carbon emissions by 2045.

- Exploring innovative solutions like low-carbon concrete.

- Investing in digitalization and technology, such as Intellekt IoT and AI tools.

- Prioritizing a robust financial position and strategic project selection.

Skanska Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Skanska Company?

- What is Competitive Landscape of Skanska Company?

- What is Growth Strategy and Future Prospects of Skanska Company?

- What is Sales and Marketing Strategy of Skanska Company?

- What is Brief History of Skanska Company?

- Who Owns Skanska Company?

- What is Customer Demographics and Target Market of Skanska Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.