SPH Bundle

How is Singapore Press Holdings Navigating Today's Market?

Singapore Press Holdings (SPH) has long been a cornerstone of Singapore's media and real estate sectors. But how does SPH, now operating with a restructured media arm and a significant property portfolio, stack up against its rivals? Understanding the SPH SWOT Analysis is crucial for grasping its position.

This analysis delves into the SPH competitive landscape, providing a detailed SPH market analysis to identify key SPH competitors and assess their impact. We'll explore how Singapore Press Holdings is adapting to media industry competition and examine its SPH business strategy in response to evolving market dynamics, addressing questions like "What are SPH's main competitors in Singapore?" and "How does SPH compare to its rivals?".

Where Does SPH’ Stand in the Current Market?

The market position of Singapore Press Holdings (SPH) is split between media and real estate. SPH Media Trust manages the media assets, including major newspapers like The Straits Times and digital platforms. Paragon REIT, formerly SPH REIT, handles the real estate investments.

SPH Media Trust holds a dominant position in Singapore's news landscape, competing with Mediacorp. In real estate, Paragon REIT has a portfolio of retail properties in Singapore and Australia. This dual structure allows SPH to operate in different sectors, each with its own competitive dynamics.

The media sector faces challenges from online viewership competition, while the real estate sector benefits from prime retail locations.

SPH Media Trust, which includes The Straits Times and Lianhe Zaobao, holds a strong position in Singapore's media market. The media market in Singapore is projected to reach USD 3.3 billion in 2024. Public funding supports SPH Media Trust's transformation into a digital news company.

Paragon REIT (formerly SPH REIT) owns income-producing retail properties in Singapore and Australia. Key properties include Paragon and The Clementi Mall. The REIT's Singapore properties maintain a high occupancy rate, showing resilience in the market.

In December 2024, Paragon REIT reported total revenue of S$300.954 million, a 4% year-on-year increase. Net property income was S$224.722 million, up 5%. The REIT's conservative gearing of 35.3% provides prudent capital management.

The Singapore real estate market was valued at USD 59.08 billion in 2024. It is expected to grow at a CAGR of 6.5% from 2025 to 2030, reaching USD 85.96 billion by 2030. Residential real estate accounted for 47.12% of the market share in 2024.

The SPH competitive landscape is shaped by its dual focus on media and real estate. In media, SPH Media Trust competes with other news providers, including Mediacorp, in a market driven by digital transformation and online viewership. The real estate sector sees Paragon REIT competing with other REITs and property developers, particularly in the retail segment. Understanding the SPH market analysis requires looking at both sectors separately.

- The media sector faces challenges from online competition, requiring strategic digital adaptation.

- Paragon REIT's high occupancy rates and revenue growth indicate a strong position in the real estate market.

- Public funding supports SPH Media Trust's digital transition, highlighting the importance of adapting to changing media trends.

- The SPH business strategy involves leveraging its media assets and real estate portfolio to maintain a competitive edge in Singapore. For more insights, read about the Revenue Streams & Business Model of SPH.

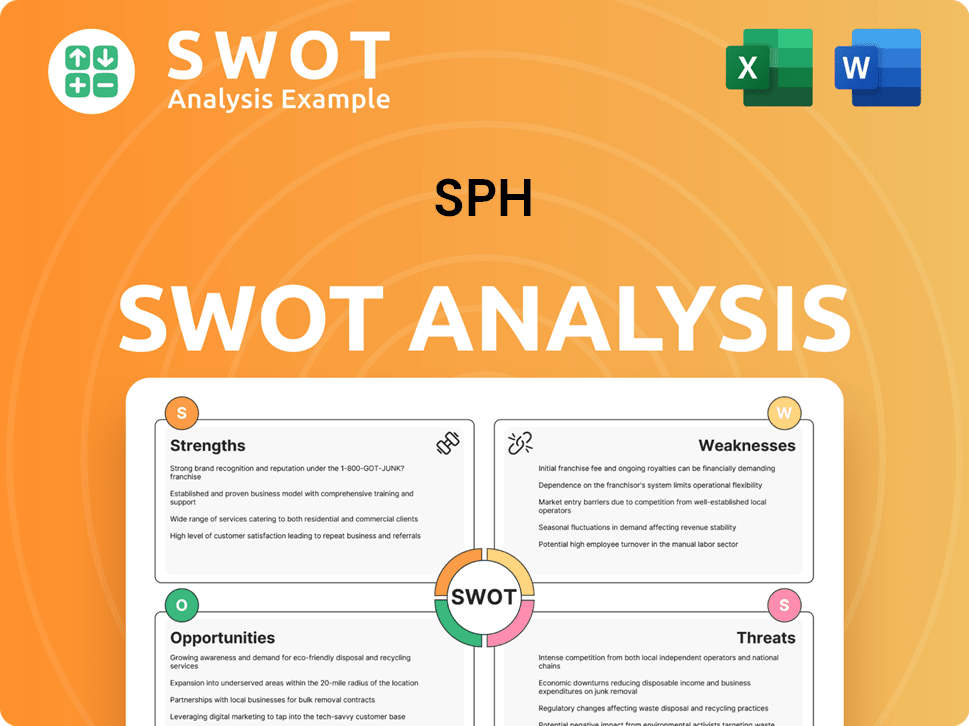

SPH SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging SPH?

The SPH competitive landscape is multifaceted, shaped by its diverse operations in media and property. The company faces distinct challenges and opportunities in each sector, requiring different strategic approaches to maintain and grow its market position. Understanding the competitive dynamics is crucial for assessing SPH's market analysis and its ability to adapt to evolving industry trends.

In the media sector, SPH's business strategy must contend with both traditional and digital competitors. The property sector faces its own set of rivals, including other REITs and real estate developers. The company's success hinges on its ability to differentiate itself, innovate, and respond effectively to the competitive pressures in each of these sectors.

In the media sector, SPH's main competitors include Mediacorp, a state-owned media conglomerate. The media market in Singapore is projected to reach USD 3.3 billion in revenue in 2024. This sector is highly competitive, with numerous international and digital players vying for advertising revenue and audience engagement.

Mediacorp is a primary competitor, operating across television, radio, and digital platforms. Digital platforms and OTT services are also key competitors, capturing significant advertising revenue. These include social media, search engines, Netflix, Disney+, Amazon Prime Video, SingtelTV, and Starhub TV.

Digital platforms and emerging content creators constantly disrupt the traditional media space. Short-form video platforms, such as TikTok, are leading in user engagement. These digital competitors pose significant challenges to traditional media outlets like SPH.

In the property sector, Paragon REIT (formerly SPH REIT) operates in a competitive real estate market. The overall Singapore real estate market was valued at USD 59.08 billion in 2024. The market includes developers, property management companies, and other REITs.

Competitors in the retail REIT space include other trusts managing shopping malls and commercial properties in Singapore and Australia. These trusts compete for tenants and consumer footfall. The residential market saw HDB resale prices surge by 9.6% in 2024, while private housing grew by 3.9%.

The entry of new players and mergers or alliances, such as CapitaLand Ascott Trust's portfolio reconstitution, influence competitive dynamics. These factors shape the SPH competitive landscape and require strategic adaptation.

SPH's strengths and weaknesses compared to competitors are crucial for SPH market share analysis 2024. The company must leverage its existing assets and adapt to the changing media and property landscapes. Strategic moves are essential to navigate the competitive environment.

- Diversification of revenue streams through digital platforms and property investments.

- Focus on content creation and user engagement to compete with digital media.

- Strategic partnerships and acquisitions to strengthen market position.

- Efficient property management and tenant relations to maximize returns.

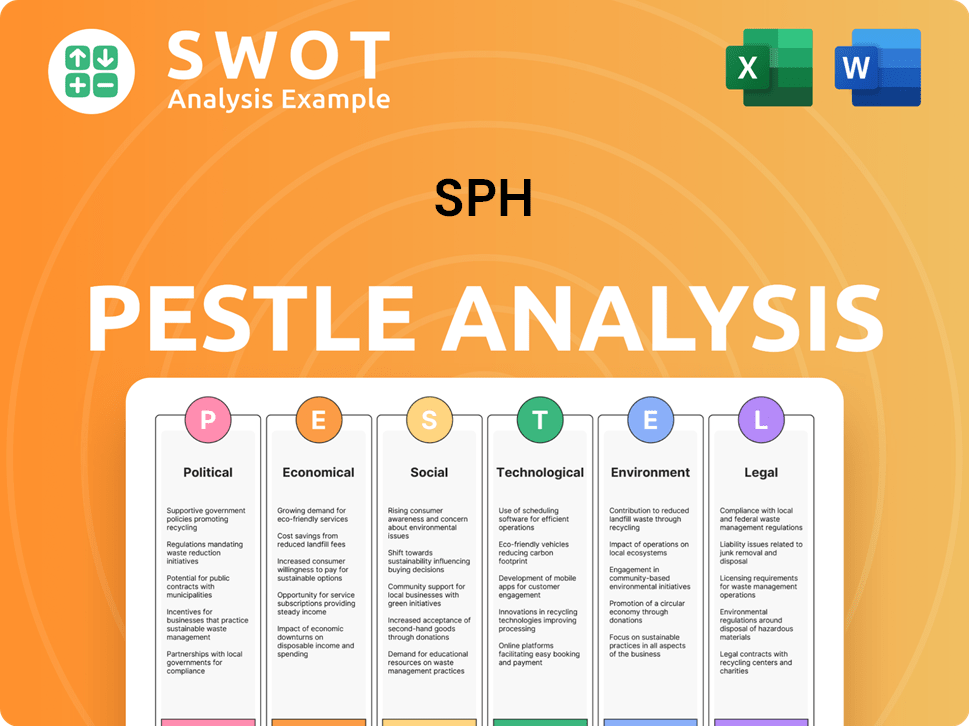

SPH PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives SPH a Competitive Edge Over Its Rivals?

The competitive advantages of the company, formerly known as Singapore Press Holdings (SPH), are multifaceted, stemming from its established legacy, strategic restructuring, and diverse asset base. The company's evolution has been marked by significant shifts, including the separation of its media business into a not-for-profit entity, SPH Media Trust, and the focus on maximizing shareholder value from its property and other assets. This strategic realignment has allowed the company to navigate the evolving media landscape and capitalize on opportunities in the real estate sector.

Key milestones include the transition of the media business to a not-for-profit model, supported by government funding, aimed at ensuring its long-term viability and ability to invest in digital transformation. Simultaneously, the company's property arm, Paragon REIT, has focused on strategic acquisitions and maintaining strong operational performance. These moves reflect the company's commitment to adapting to market changes and strengthening its position in the competitive landscape. For a deeper dive into its origins and development, consider reading the Brief History of SPH.

The company's competitive edge is evident in its media and property sectors. SPH Media Trust benefits from a strong brand reputation and high reader loyalty, while Paragon REIT boasts a portfolio of prime retail assets with high occupancy rates. These advantages are crucial in a fragmented media landscape and a dynamic real estate market.

SPH Media Trust benefits from its reputation for quality journalism. The Straits Times, for example, recorded a 77% trust rating among respondents in 2021. This strong brand equity is a significant advantage in the media industry competition.

Paragon REIT's portfolio includes prime retail assets in high-demand areas. Singapore properties have near-full average occupancy of 99.6% as of FY2024. This demonstrates resilience and strong tenant demand.

SPH Media has embraced digitalization, positioning itself as 'digital to the core'. It has over 30 digital products. This includes leveraging technologies like AI and data streaming to drive efficiencies.

Paragon REIT's conservative gearing of 35.3% provides financial flexibility. This allows for prudent capital management and potential acquisitions. This aids in SPH market analysis.

The company's competitive advantages are rooted in its legacy, strategic restructuring, and diversified asset base. These advantages are crucial in the face of SPH's challenges in the media industry and the evolving digital landscape.

- Strong Brand Reputation: SPH Media Trust's established reputation for quality journalism and reader loyalty.

- Prime Property Portfolio: Paragon REIT's strategic location of retail assets with high occupancy rates.

- Digital Transformation: SPH Media's focus on digital products and leveraging technologies like AI.

- Financial Prudence: Paragon REIT's conservative gearing for capital management and acquisitions.

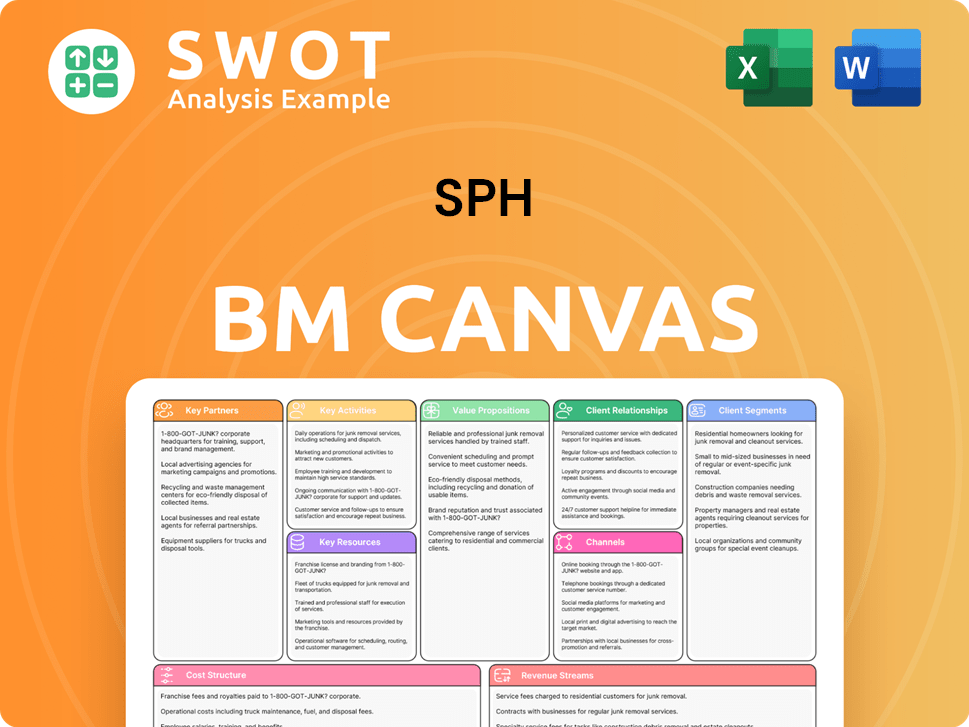

SPH Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping SPH’s Competitive Landscape?

The competitive landscape of SPH, encompassing both media and real estate sectors, is shaped by evolving industry dynamics. SPH's strategic positioning hinges on its ability to adapt to digital transformation in media and navigate the real estate market's fluctuations. Understanding the competitive forces and market trends is crucial for assessing SPH's future prospects and making informed investment decisions.

The media sector faces intense competition from digital platforms, while real estate is influenced by economic factors such as interest rates and government policies. The company's success depends on its capacity to innovate, manage risks, and capitalize on emerging opportunities within these dynamic environments. This comprehensive analysis provides insights into SPH's competitive position, risks, and future outlook, helping stakeholders understand its strategic direction.

In the media sector, the shift toward digital content consumption is a key trend. Singapore's high internet and smartphone penetration rates drive demand for online news and digital advertising. The real estate sector is experiencing growth, with key drivers including affordable housing initiatives and the rising demand for logistics and industrial properties.

SPH Media Trust faces challenges such as intense competition for online viewership and the difficulty in offsetting declining print revenues. Rising property prices and interest rates pose challenges in the real estate sector. Navigating these challenges requires strategic adjustments and innovative approaches to maintain competitiveness.

Opportunities for SPH Media Trust include leveraging AI for personalized content and expanding into audio advertising. Paragon REIT can capitalize on strong occupancy rates and potential acquisitions. Strategic moves and technological advancements can help in achieving sustained growth and profitability.

SPH Media Trust needs to innovate its business model for the digital age, focusing on talent, technology, and vernacular capabilities. For Paragon REIT, maintaining a strong portfolio and strategically managing market conditions are crucial. The company's competitive position will evolve based on its ability to adapt and respond to changes.

The media industry is experiencing rapid digital transformation, with a shift towards mobile-first content consumption. SPH's main competitors in Singapore include other media outlets and digital platforms. In real estate, SPH's competitive landscape is shaped by market conditions and government policies.

- Media Industry Competition: Intense competition for online eyeballs and digital advertising revenue.

- Real Estate Market: Influenced by interest rates, property prices, and government initiatives.

- Digital Transformation: Requires SPH to innovate and adapt to changing consumer preferences.

- Strategic Moves: Focus on leveraging AI, expanding into new advertising formats, and maintaining a strong real estate portfolio.

The Target Market of SPH analysis reveals the company's strategic direction in response to evolving media trends and market dynamics. SPH's ability to embrace technological advancements and respond to changing consumer preferences will be essential for sustained growth and profitability. The company's competitive advantages in Singapore will depend on its capacity to adapt and innovate in both the media and real estate sectors.

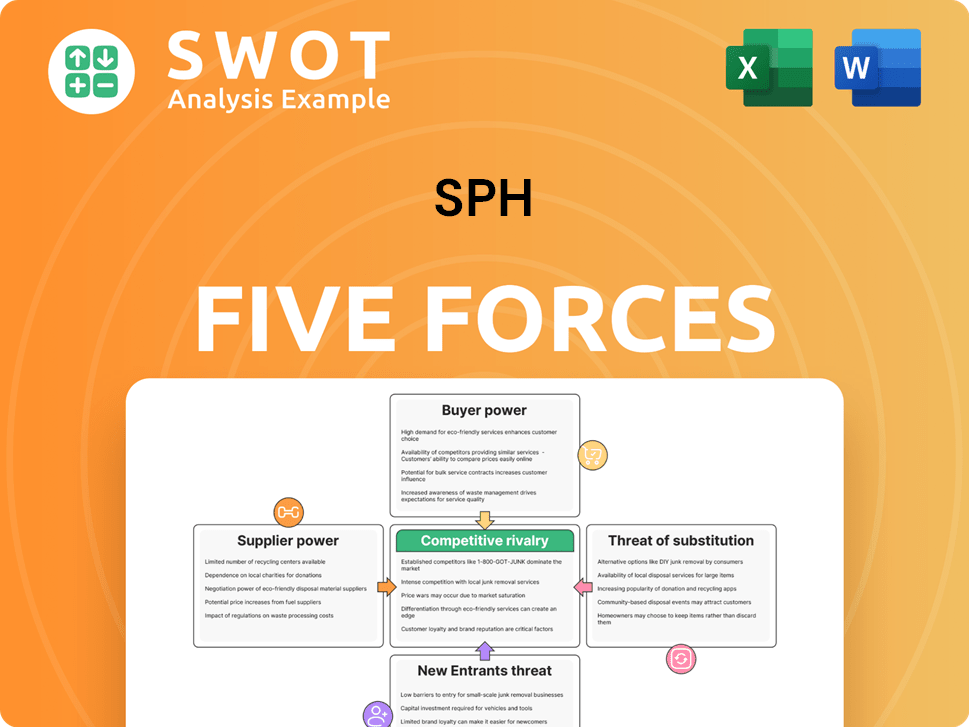

SPH Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SPH Company?

- What is Growth Strategy and Future Prospects of SPH Company?

- How Does SPH Company Work?

- What is Sales and Marketing Strategy of SPH Company?

- What is Brief History of SPH Company?

- Who Owns SPH Company?

- What is Customer Demographics and Target Market of SPH Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.