SPH Bundle

How Does the SPH Company Thrive in Today's Market?

Singapore Press Holdings (SPH), once a media titan, has undergone a significant transformation. From its roots as a dominant media company in Singapore, publishing across multiple languages, to its current structure, understanding SPH's evolution is key. This exploration unveils the SPH SWOT Analysis, its operations, and its strategic shifts.

This deep dive into the SPH business model and SPH operations will examine its core activities, including its real estate portfolio and its past media ventures. We'll explore how SPH generates revenue, its response to industry challenges, and its strategies for future growth. Whether you're interested in SPH company history and evolution or its role in Singapore's media landscape, this analysis offers valuable insights.

What Are the Key Operations Driving SPH’s Success?

The core operations of the SPH company historically revolved around two main areas: media and property. The media segment, now operating as SPH Media Trust (SMT), focuses on content creation and distribution across various platforms. The property segment, now under Cuscaden Peak Investments, is primarily managed through Paragon REIT, which focuses on real estate investments.

The value proposition for SPH lies in providing quality journalism and credible information, as well as generating recurring income through diversified real estate assets. Operational processes involve content creation, digital platform development, property management, and strategic acquisitions. The company aims to engage a broad audience through both print and digital channels, while also providing quality spaces for retail, medical services, and accommodation.

The SPH business model has evolved to adapt to changing market dynamics. The media segment focuses on delivering news and lifestyle content through various channels, including newspapers, magazines, radio stations, and digital platforms. The property segment concentrates on managing and growing its real estate portfolio, which includes retail malls, medical suites, and student accommodation.

SPH Media Trust (SMT) publishes 18 newspaper titles in four languages and over 100 magazine titles. It also operates radio stations and digital platforms like AsiaOne, The Straits Times, and The Business Times. SMT employs approximately 1,000 journalists for content creation.

Paragon REIT's portfolio, as of December 31, 2024, is valued at S$4.0 billion. The portfolio has an occupancy rate of 97.5%. The REIT owns assets in Singapore and Australia, including Paragon, The Clementi Mall, and Westfield Marion Shopping Centre.

The media segment provides quality journalism and credible information to a diverse readership. It aims to engage younger audiences and build next-generation digital media creation capabilities. The digital transformation efforts focus on enhancing accessibility, interactivity, and content discovery.

The property segment generates recurring income through diversified real estate assets. It provides quality spaces for retail, medical services, and accommodation. Paragon REIT's net property income increased by 4.5% in FY2024, driven by positive rental reversions.

The SPH operations are characterized by a focus on both content creation and real estate management. SPH's digital transformation strategy is crucial for adapting to changing media consumption habits. The company's financial performance analysis reveals the impact of these strategies.

- Content creation and distribution through print and digital channels.

- Property management, asset enhancement, and strategic acquisitions.

- Focus on defensive and cash-yielding sectors.

- Investment in media technology and digital platforms.

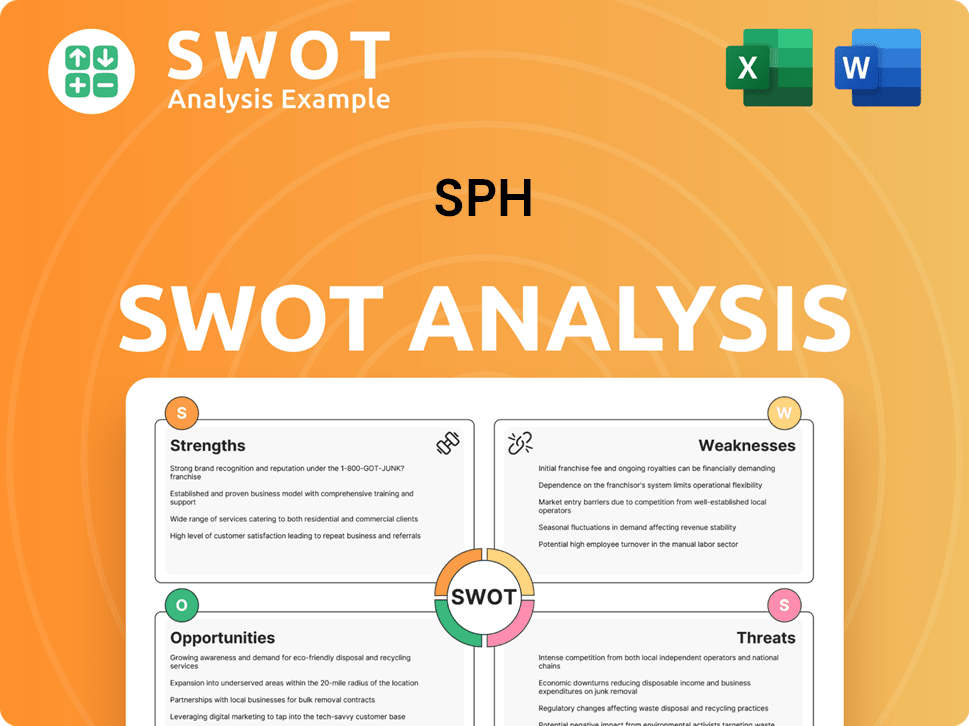

SPH SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does SPH Make Money?

Understanding the revenue streams and monetization strategies of the SPH company is crucial for assessing its financial health and future prospects. The SPH business model has historically encompassed both media and property sectors, each with distinct approaches to generating income. This analysis delves into how SPH operations translate into financial results, highlighting key strategies and recent developments.

The SPH company has evolved its approach to revenue generation. The media arm has been actively transforming its strategies to adapt to digital trends, while the property sector focuses on optimizing its real estate portfolio. These shifts reflect the company's efforts to remain competitive and sustainable in a changing market. For more insights, check out the Marketing Strategy of SPH.

The media operations, now under SPH Media Trust, primarily rely on advertising, subscriptions, and content distribution. While print advertising faces decline, digital subscriptions have surged, with digital revenue now exceeding print subscriptions by 35%, a significant increase from 20% two years ago. The government's financial support, including approximately S$320 million disbursed across 2022 and 2023, and an additional S$260 million earmarked for FY2024/2025, further supports its digital initiatives.

The property sector, managed by Paragon REIT (formerly SPH REIT), generates revenue mainly from rental income from its retail malls and other real estate assets. Monetization strategies include active portfolio management and strategic investments.

- Digital Transformation: SPH Media focuses on digital subscriptions and advertising to drive revenue. The Straits Times app generates an estimated $75,000 in monthly revenue through a soft paywall strategy.

- Property Portfolio Optimization: Paragon REIT actively manages its portfolio through acquisitions, asset enhancements, and divestments. For example, it recently divested an 85% stake in an Australian mall for $168.3 million and The Rail Mall for $78.5 million.

- Strategic Acquisitions and Investments: The company explores joint ventures, such as developing data center facilities at its former Media Centre premises, to grow its recurring income base.

- Financial Performance: In H1 2024, Paragon REIT's revenue soared 30% to $147.4 million, despite a 3% year-on-year dip in tenant sales in Singapore.

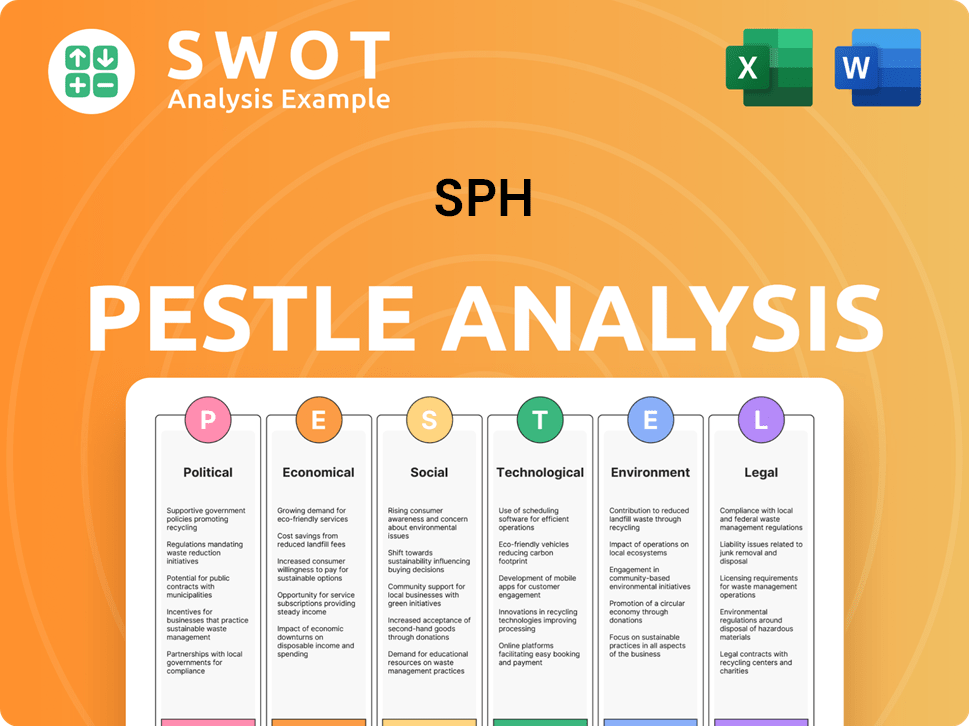

SPH PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped SPH’s Business Model?

The story of the SPH company is marked by significant shifts in strategy and structure. A pivotal moment was the 2021 restructuring, which saw the media business spun off into the SPH Media Trust (SMT). This move allowed the media arm to seek diverse funding sources, while giving SPH greater financial flexibility for its other ventures. Following this, SPH itself was delisted in May 2022 after being acquired by Cuscaden Peak and renamed Cuscaden Peak Investments.

The SPH business model has evolved, with a strong focus on digital transformation in its media operations and strategic real estate investments. SPH Media Trust has been actively refreshing digital platforms and mobile apps to improve user experience and content discovery. Simultaneously, Paragon REIT, formerly SPH REIT, has been expanding its real estate portfolio through acquisitions and strategic divestments. These moves reflect a dynamic approach to navigating the changing media and real estate landscapes.

Understanding the SPH operations involves looking at both its media and real estate sectors. The media arm is focused on digital growth and audience engagement, while the real estate division, Paragon REIT, concentrates on quality properties and strategic portfolio management. These dual focuses highlight the company's efforts to adapt and thrive in a competitive environment. For more insights into the ownership structure, consider exploring Owners & Shareholders of SPH.

The 2021 restructuring and the delisting in May 2022 were major turning points. The media business was spun off into SPH Media Trust to secure long-term viability. The delisting marked a significant change in the company's ownership and strategic direction.

SPH Media Trust is focused on digital transformation, refreshing digital platforms and mobile apps. Paragon REIT has expanded its real estate portfolio through acquisitions and divestments. These actions demonstrate a proactive response to market dynamics.

Paragon REIT's portfolio of quality properties in Singapore and Australia provides a competitive advantage. SPH Media's strong overall reach of 70% of Singapore's resident population is also a key strength. The government's financial support to SPH Media Trust further strengthens its position.

The government has committed up to S$900 million in funding to SPH Media Trust over five years. S$320 million was disbursed in 2022 and 2023, with S$260 million earmarked for FY2024/2025. Paragon REIT's occupancy rate was 97.5% as of December 31, 2024.

SPH Media faces challenges, including declining advertising revenue and cost optimization needs. However, the digital transformation efforts and government support offer opportunities for growth. Paragon REIT's focus on defensive sectors and effective capital management are key to its sustained business model.

- Digital transformation is a key focus for SPH Media.

- Geographical diversification is a strategic move for Paragon REIT.

- Cost optimization is crucial for SPH Media's sustainability.

- High occupancy rates support Paragon REIT's financial performance.

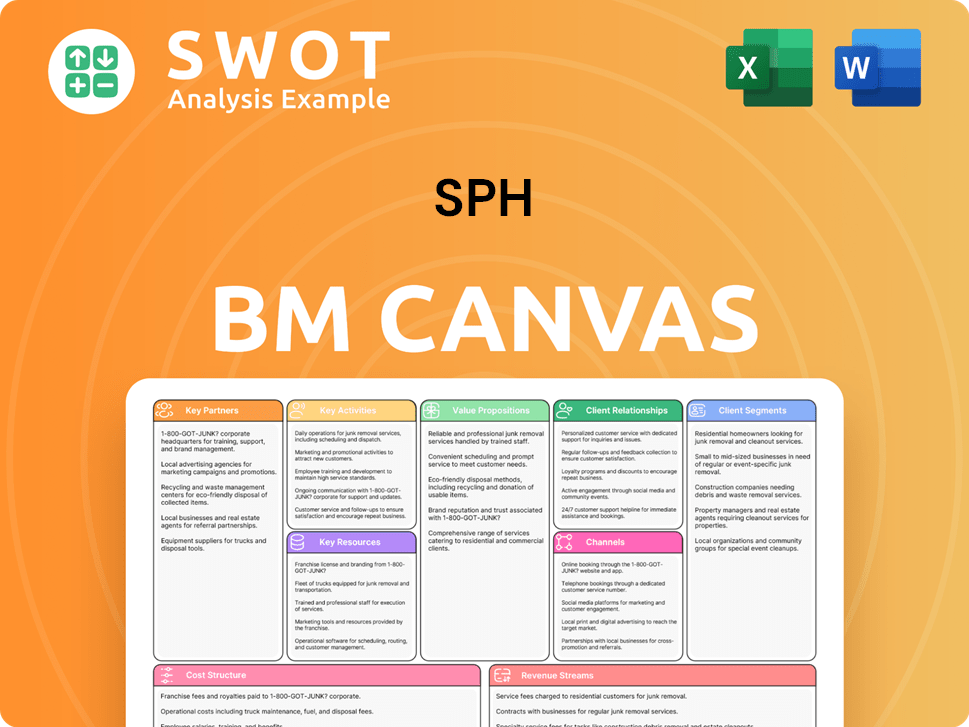

SPH Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is SPH Positioning Itself for Continued Success?

The SPH company, through its media arm SPH Media Trust (SMT) and its property interests under Cuscaden Peak Investments (formerly SPH and SPH REIT), occupies a significant position in Singapore's media and real estate sectors. SPH Media Trust remains a leading media organization in Singapore, with its publications like The Straits Times and CNA being among the most frequented online news platforms and highly trusted by Singaporeans, at 73% and 74% respectively, as of March 2025. The company's SPH business model has evolved to adapt to industry changes, while its property portfolio, managed by Paragon REIT (formerly SPH REIT), maintains a strong presence in retail assets.

However, the media industry faces challenges, including declining traditional advertising revenues and intense competition from social media. In the property sector, risks include potential competition from malls undergoing major upgrades and upcoming redevelopments, as well as uncertainties in the broader economic climate. This article provides an overview of the SPH operations, its position in the market, the risks it faces, and its future outlook.

SPH Media Trust maintains a strong position in Singapore's media landscape, reaching 70% of the resident population in 2024. Paragon REIT (formerly SPH REIT) holds a significant portfolio of retail assets. SPH's role in Singapore's media landscape is crucial, with its publications and platforms being major sources of news and information.

The media sector faces challenges from declining advertising revenues and social media competition. The struggle to attract and retain talent and the need to enhance user experience are also key concerns. In the property sector, potential competition and economic uncertainties pose risks.

SPH Media Trust is focused on digital transformation and exploring new revenue streams. Paragon REIT aims to capitalize on market recovery and growth opportunities. The delisting of Paragon REIT by June 6, 2025, will provide more flexibility in navigating market uncertainties.

SPH is investing in media technology to enhance its digital products and user experience. The company is also exploring new revenue streams through content distribution and video monetization. This strategy is crucial for the SPH services to remain competitive in the digital age.

To ensure long-term success, SPH is focusing on several key strategies and initiatives. These include digital transformation, exploring new revenue streams, and optimizing its real estate portfolio. Understanding the Target Market of SPH is crucial for its success.

- Continuing digital transformation to enhance digital products and user experience.

- Exploring new revenue streams through content distribution and video monetization.

- Enhancing its real estate portfolio to capitalize on market recovery and growth opportunities.

- Focusing on minimizing vacancies and providing sustainable rental income.

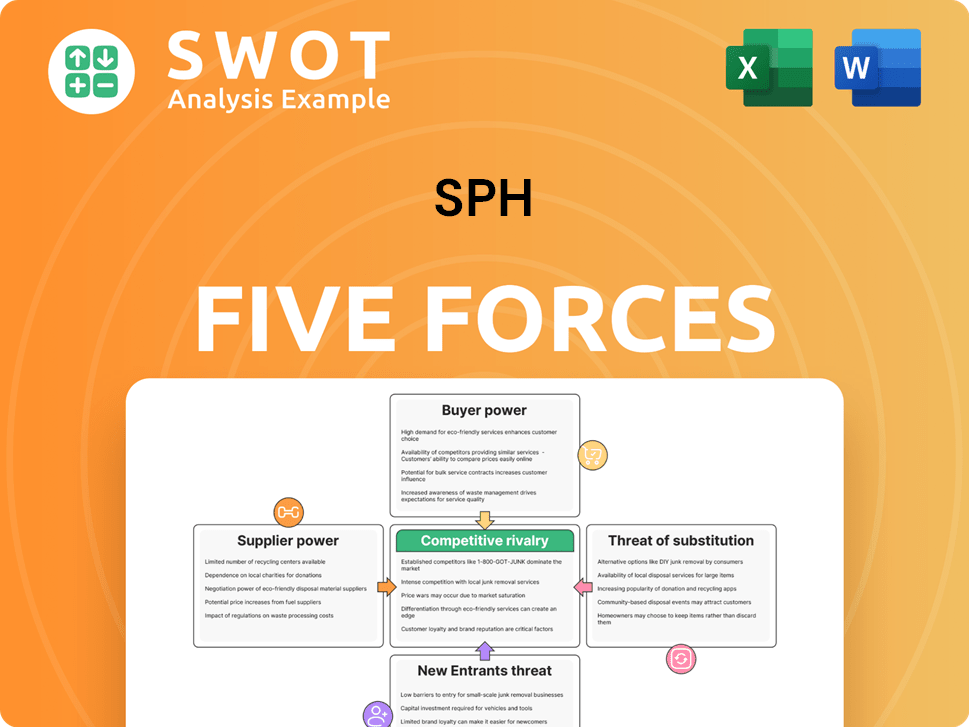

SPH Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SPH Company?

- What is Competitive Landscape of SPH Company?

- What is Growth Strategy and Future Prospects of SPH Company?

- What is Sales and Marketing Strategy of SPH Company?

- What is Brief History of SPH Company?

- Who Owns SPH Company?

- What is Customer Demographics and Target Market of SPH Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.