SPH Bundle

Who Really Owns SPH Today?

Unraveling the complex ownership structure of Singapore Press Holdings (SPH) is key to understanding its evolution and future. From its origins as a media giant to its transformation into a real estate powerhouse, SPH's ownership has undergone significant shifts. This exploration will provide a clear picture of who controls SPH and the implications of these changes.

The story of SPH SWOT Analysis, a company originally rooted in media, is now largely defined by its substantial real estate portfolio, making understanding its ownership more critical than ever. The recent restructuring, including the separation of its media assets into SPH Media Trust, has fundamentally altered the SPH company ownership landscape. This analysis will delve into the SPH shareholders, tracing the evolution of its ownership from its early days as a media conglomerate to its current status as a real estate investment holding company, examining the impact of pivotal events like the SPH merger and the influence of major shareholders.

Who Founded SPH?

The formation of the SPH company, now known as SPH Media, in 1984 was a significant event orchestrated by the Singapore government. This involved merging three major publishing houses: The Straits Times Press, Singapore News and Publications Limited, and Times Publishing Berhad. This consolidation aimed to create a stronger media entity, reflecting the government's strategic interest in the media landscape.

Unlike typical startups, SPH didn't have individual 'founders' with specific equity splits at its inception. Instead, the merger brought together existing shareholders from the three merged companies. These shareholders included institutional and individual investors who held stakes in the predecessor companies. The government, through various investment vehicles, also held substantial influence over the media sector, which continued with SPH's formation.

The early ownership structure of SPH was characterized by a broad base of public shareholders, as its constituent companies were already publicly listed. However, a crucial aspect influencing early ownership and control was the Newspaper and Printing Presses Act (NPPA) in Singapore. This act introduced 'management shares,' which, while representing a small fraction of the total share capital, carried significant voting power, often 200 times that of ordinary shares.

The early ownership and control of SPH were significantly shaped by the NPPA and other regulations. The presence of management shares meant that even with a large public shareholding, the ultimate decision-making power rested with holders of these special shares. This structure was designed to prevent any single foreign or undesirable influence from gaining control over Singapore's mainstream media. Learn more about SPH company ownership structure explained in this article.

- The NPPA ensured government influence through management shares.

- Public shareholders held ordinary shares.

- Strategic control was maintained by government-approved entities.

- The merger consolidated existing shareholders.

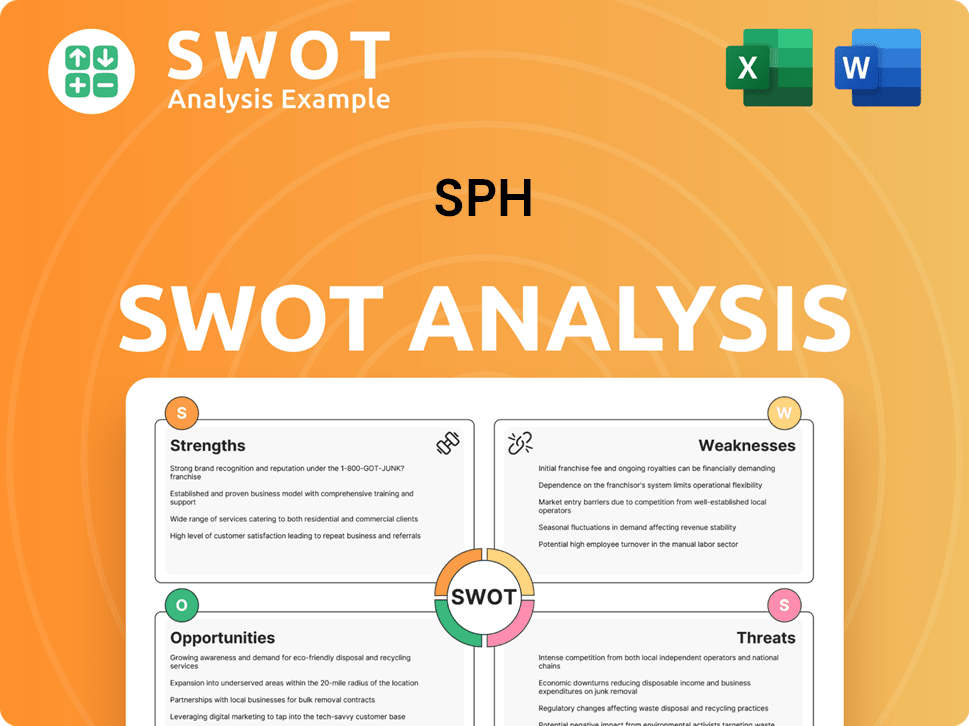

SPH SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has SPH’s Ownership Changed Over Time?

The evolution of SPH company ownership has been shaped by significant events, starting with its formation in 1984 through a merger. Initially, the company was listed on the Singapore Exchange, with its shares held by a mix of institutional and individual investors. Market trends and the company's performance in its media and property sectors influenced major shareholding shifts over time. The SPH merger was a pivotal event in the company's history.

A crucial change occurred in late 2021 when the media business was restructured. This involved transferring the media assets to a new entity, SPH Media Trust (SMT), a company limited by guarantee. This strategic move separated the media operations from the publicly listed SPH Limited. The Singapore government supported this restructuring with a commitment of S$900 million over five years to SMT. As a result, the publicly listed SPH Limited shifted its focus to its real estate assets.

| Aspect | Details | Impact |

|---|---|---|

| Initial Public Listing | Listed on Singapore Exchange in 1984. | Established a mix of institutional and individual shareholders. |

| Media Restructuring (2021) | Media assets transferred to SPH Media Trust (SMT). | Shifted SPH Limited's focus to real estate; SMT operates under a different financial model. |

| Current Ownership | Predominantly institutional investors and fund managers for SPH Limited. SMT has members and a board of directors. | Reflects SPH Limited's status as a real estate investment company. SMT's governance is structured differently. |

As of early 2025, the major stakeholders of the publicly listed SPH Limited are primarily institutional investors. These include large asset management firms and sovereign wealth funds. For example, Temasek Holdings has historically held stakes in prominent Singaporean companies. The ownership structure of SPH Media Trust differs, with governance managed by members and a board of directors. This change in ownership structure has allowed the listed entity to concentrate on its property portfolio. For more insights, consider reading about the Marketing Strategy of SPH.

The ownership of SPH has evolved significantly over time, particularly with the restructuring of its media business.

- SPH Limited now focuses on real estate, with major shareholders being institutional investors.

- SPH Media Trust operates under a different governance model, supported by government funding.

- Understanding the SPH shareholders and their roles is crucial for investors.

- The shift reflects changes in the media landscape and strategic business decisions.

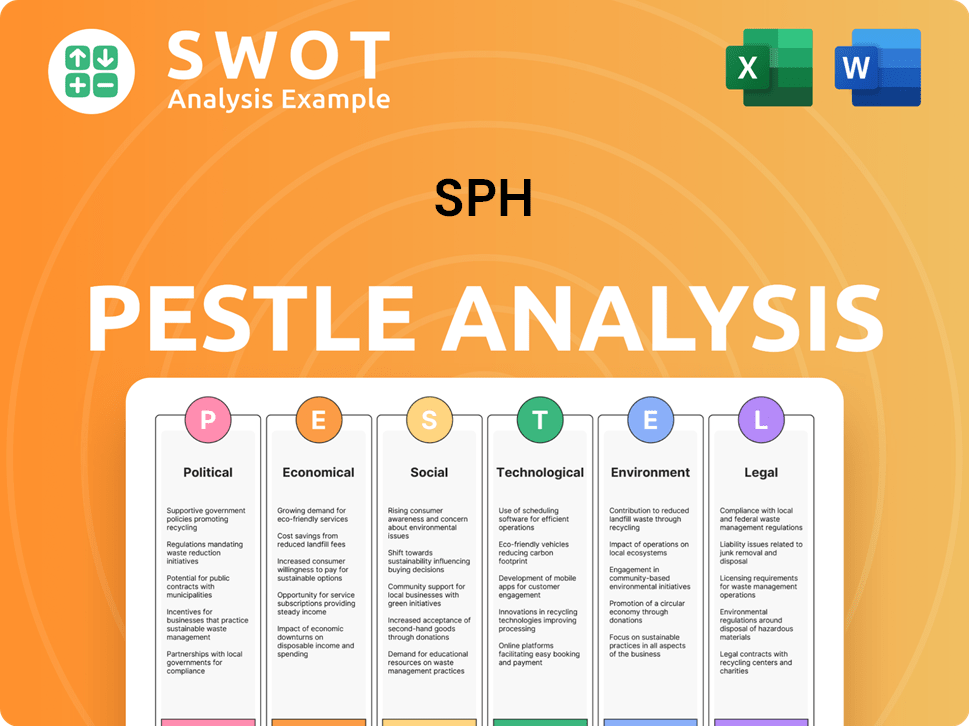

SPH PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on SPH’s Board?

The current Board of Directors of the publicly listed SPH Limited, now primarily focused on its real estate and investment portfolio, typically includes a mix of independent directors and executive directors. The board's composition is detailed in the company's annual reports and corporate governance statements. As of late 2024, the board of SPH REIT, a real estate investment trust managed by SPH, featured members with extensive experience in real estate and finance, reflecting the company's strategic direction. Information on the specific breakdown of board members representing major shareholders versus independent seats is available in the latest corporate filings. Understanding the SPH company ownership structure involves reviewing these official documents.

The shift in focus to real estate and investments followed the restructuring of its media business. This restructuring saw the media assets transferred to SPH Media Trust. This strategic move significantly realigned the company's operations. The board's role is crucial in overseeing the company's investment strategies and ensuring compliance with regulatory requirements. The board's decisions impact the financial performance and strategic direction of the company. For a deeper dive, check out the Target Market of SPH.

| Board Member Role | Description | Responsibilities |

|---|---|---|

| Independent Directors | Non-executive members without material relationships with the company. | Oversee management, ensure accountability, and protect shareholder interests. |

| Executive Directors | Members of the management team. | Responsible for the day-to-day operations and strategic execution. |

| Representatives from Institutional Shareholders | Individuals nominated by significant shareholders. | Represent the interests of major investors and contribute to strategic decisions. |

In terms of voting structure, SPH Limited generally operates on a one-share-one-vote principle for its ordinary shares, a standard practice for public companies in Singapore. The historical context of 'management shares' under the Newspaper and Printing Presses Act (NPPA) is important. While the media business has been transferred, the NPPA previously granted disproportionate voting rights to holders of special shares in media organizations. This ensured that key strategic decisions, particularly those related to editorial policy and national interests, remained under the purview of specific entities or individuals approved by the government. This structure, though not directly applicable to the current property-focused SPH Limited, highlights a legacy of structured control within entities that were once part of the broader SPH group. This relates to the question of who owns SPH and the historical context of SPH Singapore.

The board of directors at SPH Limited oversees the real estate and investment portfolio. The voting structure is primarily one-share-one-vote, but the historical context of the NPPA is important.

- Board composition includes independent and executive directors.

- The transfer of the media business to SPH Media Trust was a key restructuring.

- The board's role is crucial for strategic direction and financial performance.

- Understanding the SPH shareholders is vital for investors.

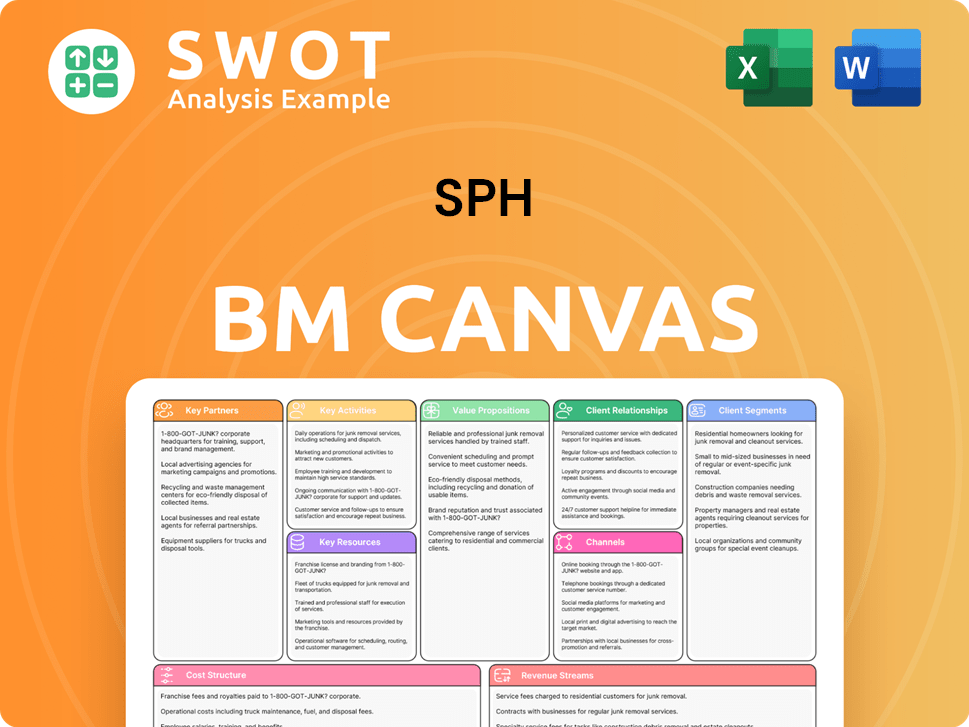

SPH Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped SPH’s Ownership Landscape?

The most significant change in the SPH company ownership structure over the past few years has been the strategic restructuring and subsequent privatization. In December 2021, the media assets were transferred to SPH Media Trust (SMT), a not-for-profit entity. This move separated the media operations from the publicly listed Singapore Press Holdings Limited (SPH Limited), which then focused on its real estate portfolio. This restructuring aimed to address the challenges faced by the print media industry.

Following the media restructuring, SPH shareholders approved a privatization bid. A consortium led by Cuscaden Peak Pte. Ltd. launched a S$3.4 billion offer to acquire SPH in late 2021. This acquisition, finalized in early 2022, led to the delisting of SPH from the Singapore Exchange in May 2022. The privatization reflects a broader trend of consolidation and strategic refocusing, allowing SPH to unlock value from its property assets. You can learn more about the company’s origins in this article: Brief History of SPH.

| Year | Event | Impact on Ownership |

|---|---|---|

| 2021 | Media Business Transfer | Media assets transferred to SPH Media Trust (SMT). |

| Late 2021 | Privatization Bid | Cuscaden Peak Pte. Ltd. launched a bid to acquire SPH. |

| Early 2022 | Shareholder Approval | Shareholders approved the privatization. |

| May 2022 | Delisting | SPH delisted from the Singapore Exchange. |

As of 2024, the former SPH property assets are managed under Cuscaden Peak, and SPH Media Trust continues its operations as a not-for-profit entity. The acquisition by Cuscaden Peak highlights the increasing role of large investment vehicles in shaping the SPH Singapore ownership landscape, indicating a move towards more concentrated ownership structures for mature companies.

December 2021: Media assets transferred to SPH Media Trust.

Cuscaden Peak Pte. Ltd. (primarily real estate), SPH Media Trust (media).

S$3.4 billion acquisition bid by Cuscaden Peak.

SPH is now a privately held entity.

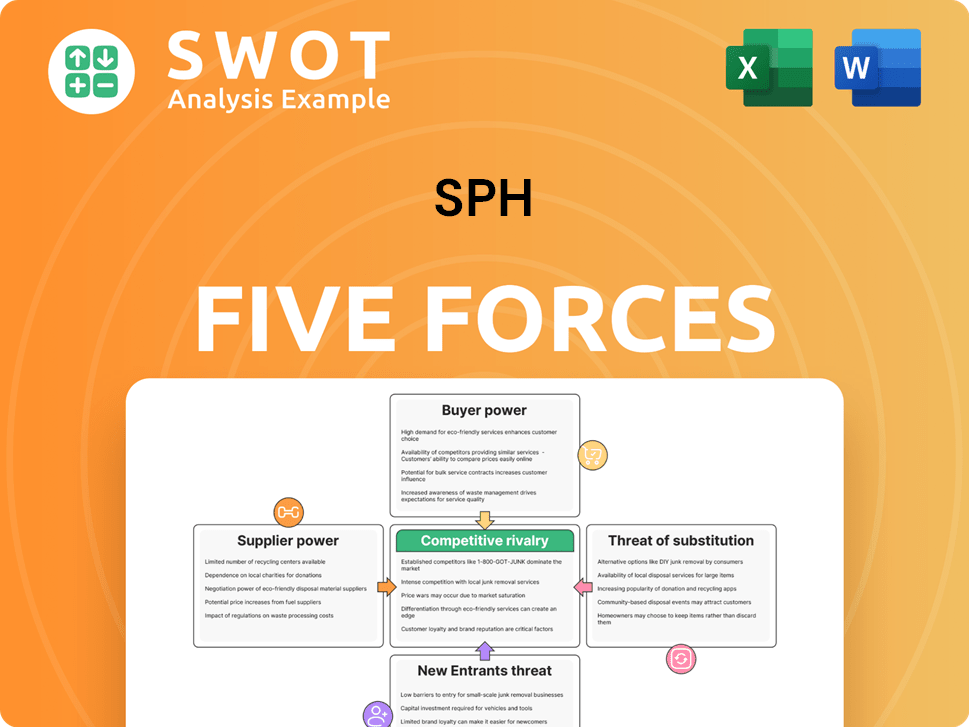

SPH Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SPH Company?

- What is Competitive Landscape of SPH Company?

- What is Growth Strategy and Future Prospects of SPH Company?

- How Does SPH Company Work?

- What is Sales and Marketing Strategy of SPH Company?

- What is Brief History of SPH Company?

- What is Customer Demographics and Target Market of SPH Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.