State Farm Bundle

How Does State Farm Dominate the Insurance Game?

State Farm, a titan in the U.S. insurance industry, has maintained its leading position for decades. Founded in 1922, the company's journey from a niche auto insurer to a financial services giant is a compelling story of strategic adaptation. Understanding the State Farm SWOT Analysis is crucial to grasping its competitive edge.

This exploration delves into the State Farm competitive landscape, analyzing its position within the insurance industry and identifying key State Farm competitors. We'll examine State Farm's market share in the US, its strategies, and how it differentiates itself from other insurance companies. Furthermore, we'll assess State Farm's strengths and weaknesses, providing a comprehensive market analysis to understand its enduring success and future prospects in a dynamic market.

Where Does State Farm’ Stand in the Current Market?

State Farm holds a dominant position in the U.S. insurance industry, especially in personal lines. As of December 2023, it led the private passenger auto insurance market with approximately 16.7% of the market share. This makes it a key player in the insurance industry. Similarly, it maintains a strong presence in the homeowners insurance sector, reinforcing its top-tier ranking.

The company offers a wide range of insurance products, including auto, home, life, and health insurance. They also provide financial services like banking products and investment services. State Farm operates across all 50 U.S. states and the District of Columbia, using a vast network of independent agents to serve its customers. This extensive agent network is a core part of their distribution strategy, offering a localized and personalized customer experience.

Over time, State Farm has focused on its core personal lines business while strategically diversifying into financial services. The company's financial health is strong, with solid ratings from major agencies. This reflects its large scale and stability compared to industry averages. State Farm's strong brand recognition and agent network contribute to its enduring market leadership, especially in the Midwest and Southern regions. If you want to know more, you can read a Brief History of State Farm.

State Farm's significant market share in both auto and homeowners insurance highlights its competitive advantage. This leadership position is a key element of its overall market analysis. The company's consistent performance and strong brand recognition contribute to its enduring success.

State Farm offers a broad range of products, including insurance and financial services. This diversification strategy helps it meet various customer needs. By providing a comprehensive suite of services, the company strengthens its customer relationships.

The extensive network of independent agents is crucial to State Farm's success. This network allows for personalized service and local market expertise. The agent-based model helps the company maintain strong customer relationships.

State Farm's strong financial ratings reflect its stability and reliability. This financial health supports its long-term competitiveness. The company's robust financial performance is a key factor in its market position.

State Farm's competitive advantages include its strong market share, broad product offerings, and extensive agent network. These factors contribute to its enduring success in the insurance industry. The company's focus on customer service and financial stability further strengthens its position.

- Leading market share in auto and homeowners insurance.

- Comprehensive product offerings, including insurance and financial services.

- Vast network of independent agents providing personalized service.

- Strong financial ratings and stability.

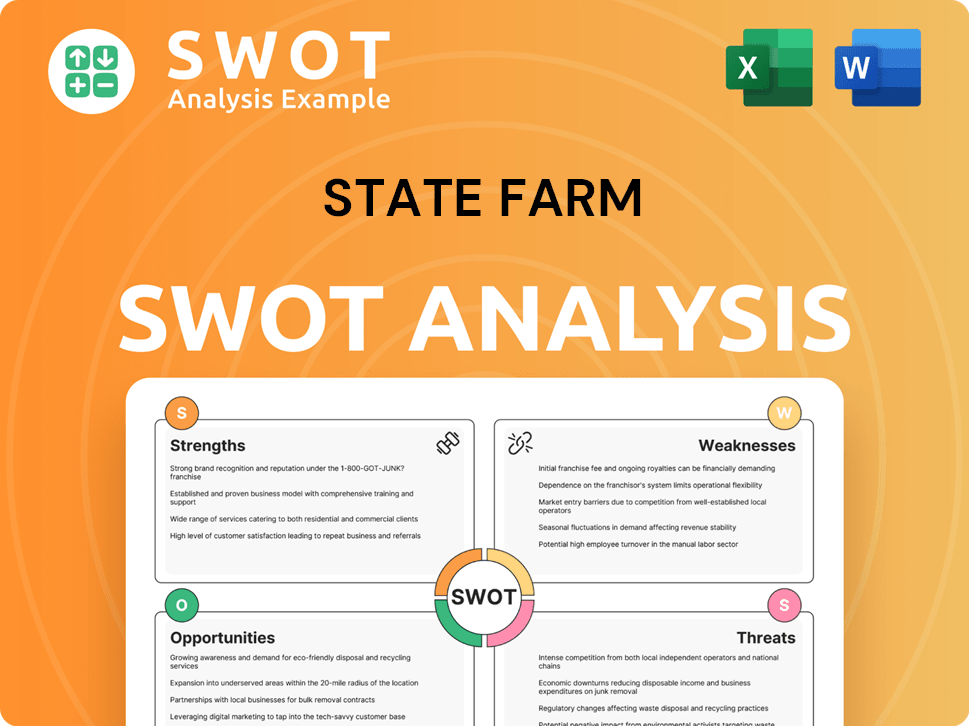

State Farm SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging State Farm?

The State Farm competitive landscape is characterized by intense competition across various insurance segments. The company faces challenges from both established insurance giants and emerging InsurTech firms. Understanding the strategies of State Farm's competitors is crucial for assessing its market position and future growth prospects.

State Farm's market analysis reveals a dynamic environment where companies constantly vie for market share. This competition impacts pricing, product innovation, and customer service. The strategies of State Farm's competitors often involve aggressive marketing campaigns and technological advancements.

State Farm's position in the insurance market is influenced by its ability to adapt to these competitive pressures. The company's financial performance is closely watched, especially when compared to its rivals. The competitive environment for State Farm is constantly evolving, requiring continuous strategic adjustments.

Geico, known for its direct-to-consumer model, consistently challenges State Farm on price. Progressive uses telematics and personalized pricing. Allstate mirrors State Farm's broad agent network and product portfolio.

Geico focuses on direct sales, leveraging digital platforms and aggressive advertising. They offer competitive pricing, especially for younger demographics. Geico's efficiency in operations allows for lower premiums.

Progressive uses telematics to personalize pricing based on driving behavior. They offer usage-based insurance (UBI) and other innovative products. Progressive's data-driven approach attracts customers seeking customized rates.

Allstate competes through a wide agent network and a comprehensive product portfolio. They focus on bundling policies to attract and retain customers. Allstate targets similar customer segments as State Farm.

Liberty Mutual has a strong presence in both commercial and personal lines. They utilize diverse distribution channels to reach customers. Liberty Mutual competes with State Farm across multiple insurance categories.

InsurTech startups like Lemonade are gaining traction with AI-driven platforms. They offer simplified user experiences and new pricing models. These companies target specific insurance niches.

State Farm competes with banks, investment firms, and other life insurance providers. Northwestern Mutual and Prudential are key rivals in this segment. Intense advertising campaigns and product innovation are common.

- Northwestern Mutual: A mutual company, emphasizing financial planning and long-term relationships.

- Prudential: Offers a wide range of financial products, including life insurance and retirement solutions.

- Banks and Investment Firms: Compete by offering investment and financial planning services.

- Market Share: In 2024, the top five life insurance companies held a significant portion of the market.

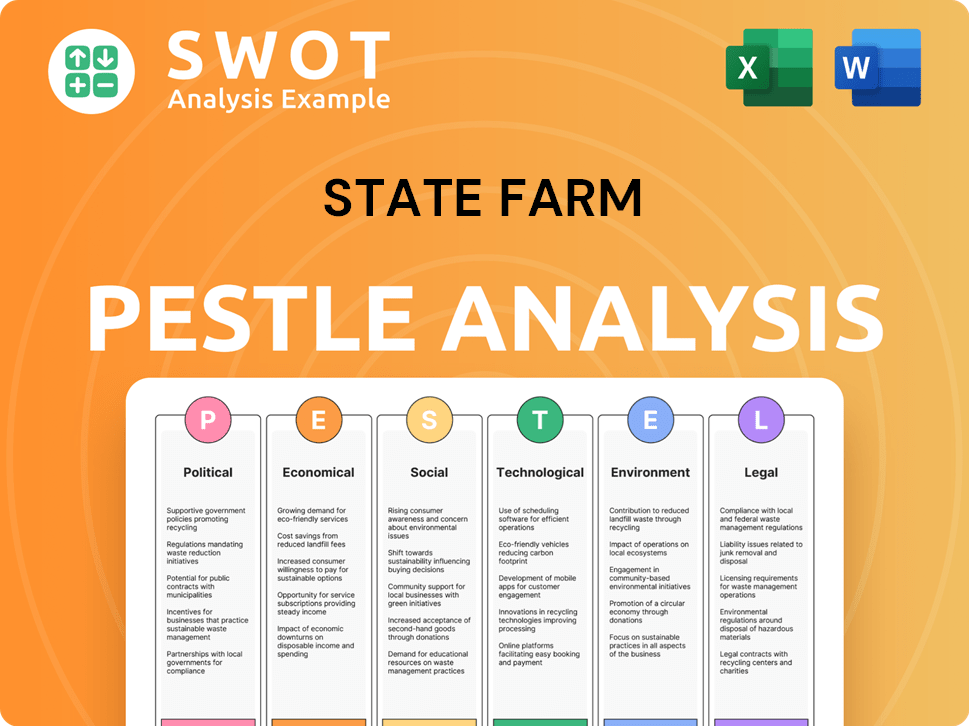

State Farm PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives State Farm a Competitive Edge Over Its Rivals?

The competitive landscape for State Farm is shaped by its enduring brand recognition and extensive agent network. The company's 'Good Neighbor' image has cultivated strong customer loyalty, contributing to high retention rates. This, combined with a vast network of independent agents, allows for personalized service, a key differentiator in the insurance industry. The Growth Strategy of State Farm emphasizes these strengths.

State Farm's market position is further solidified by its economies of scale, being the largest property and casualty insurer in the U.S. This scale enables efficient risk diversification and lower operational costs. The company leverages its financial strength to invest in technology and data analytics, enhancing its underwriting and claims processing capabilities, while adapting to evolving consumer preferences.

Understanding the State Farm competitive landscape involves recognizing its core strengths and how they stack up against rivals. The company's ability to maintain a strong market share in the face of digital disruption is a testament to its strategic approach. The insurance industry is dynamic, and State Farm's ability to adapt is crucial.

State Farm's 'Good Neighbor' brand is deeply ingrained in American culture, fostering trust and high customer retention. This strong brand recognition is a significant advantage in the competitive insurance market. The company's focus on community and personal service has built lasting relationships with customers.

With tens of thousands of independent agents, State Farm offers a personalized, local touch that many direct-to-consumer insurers cannot replicate. This agent-led model supports strong customer relationships and tailored advice. This network is a crucial differentiator in the competitive environment.

As the largest property and casualty insurer in the U.S., State Farm benefits from significant economies of scale. This allows for efficient risk diversification and lower administrative costs. This scale also enables substantial investment in technology and data analytics.

State Farm's financial strength and conservative investment strategy provide a stable foundation. This allows the company to withstand market fluctuations and meet its obligations to policyholders. This stability further bolsters customer trust.

State Farm's competitive advantages are rooted in its brand, agent network, and financial strength, allowing it to maintain a strong position in the insurance industry. These factors help differentiate it from competitors and contribute to its enduring success.

- Brand Recognition: The 'Good Neighbor' image fosters trust and loyalty.

- Agent Network: Provides personalized service and local support.

- Economies of Scale: Enables efficient operations and investment in technology.

- Financial Stability: Ensures the ability to meet policyholder obligations.

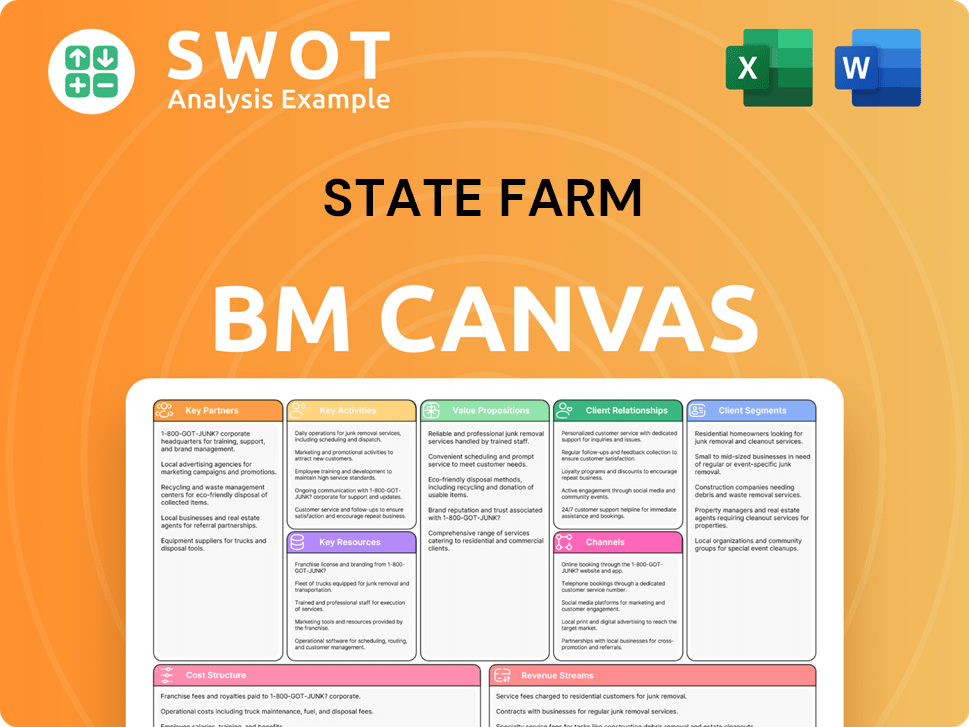

State Farm Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping State Farm’s Competitive Landscape?

The State Farm competitive landscape within the U.S. insurance industry is shaped by evolving trends and challenges. The company must navigate technological advancements, regulatory changes, and shifting consumer preferences. Understanding these dynamics is crucial for maintaining its market position and identifying future growth opportunities. A thorough State Farm market analysis is essential to assess its strengths and weaknesses against its rivals.

The insurance industry faces constant change, impacting companies like State Farm. Factors such as economic shifts, including inflation and interest rate fluctuations, influence investment returns and claims costs, thereby affecting profitability. The ability to adapt to these changes is critical for success. To understand the competitive dynamics, it's important to analyze State Farm's competitors and the strategies they employ.

Technological advancements, including AI and machine learning, are transforming underwriting, claims processing, and customer engagement. InsurTech startups are disrupting traditional models with personalized products and data-driven pricing. Regulatory changes related to data privacy also pose ongoing challenges. These trends affect all insurance companies, including State Farm.

Balancing the agent-centric model with growing digital self-service demands is a key challenge. Adapting to the increasing frequency and severity of natural disasters requires sophisticated risk assessment. Competition from direct insurers and InsurTech companies continues to intensify. Addressing these challenges is vital for maintaining and growing State Farm's market share in the US.

Leveraging vast data reserves and financial strength to invest in advanced analytics and AI. Expanding digital offerings to cater to digitally-native consumers. Forming strategic partnerships to drive innovation and growth. Developing new insurance products to address emerging risks, such as cyber threats. For more insights, read the Marketing Strategy of State Farm.

The competitive environment is dynamic, with companies constantly adapting. State Farm's hybrid model, integrating agents with digital capabilities, positions it well. The ability to innovate and respond to market changes is crucial. Understanding State Farm's competitive advantages is vital for long-term success.

The future of State Farm's competitive landscape depends on its ability to adapt and innovate. Key factors include technological integration, customer experience, and risk management. The company's performance will be influenced by its strategic decisions and ability to anticipate market shifts.

- Technological Adoption: Implementing AI and data analytics for better risk assessment and customer service.

- Customer Experience: Enhancing digital platforms and personalized offerings to meet evolving consumer demands.

- Risk Management: Developing sophisticated models to address the increasing frequency of natural disasters and emerging risks.

- Strategic Partnerships: Collaborating with technology firms and other financial institutions to drive innovation.

State Farm Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of State Farm Company?

- What is Growth Strategy and Future Prospects of State Farm Company?

- How Does State Farm Company Work?

- What is Sales and Marketing Strategy of State Farm Company?

- What is Brief History of State Farm Company?

- Who Owns State Farm Company?

- What is Customer Demographics and Target Market of State Farm Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.