State Farm Bundle

How Well Does State Farm Know Its Customers?

The insurance landscape is constantly shifting, driven by demographic changes and technological leaps, making it essential for industry leaders to deeply understand their customer base. For State Farm, a century-old institution, adapting to these shifts is critical to maintaining its market position. This exploration dives into the core of State Farm's customer strategy, revealing how it identifies and caters to its diverse audience.

Understanding the State Farm SWOT Analysis reveals the importance of knowing the company's customer base. This analysis will uncover the State Farm target market, exploring the State Farm customer profile and how it has evolved. We'll investigate customer demographics, examining the State Farm audience, including factors like age, income, location, and buying behavior, to see how State Farm strategically adapts to meet the needs of its diverse clientele and maintain its leadership in the insurance sector through effective target audience analysis.

Who Are State Farm’s Main Customers?

Understanding the State Farm target market involves analyzing its customer demographics and identifying its primary customer segments. The company's approach targets a broad audience, primarily focusing on individual consumers seeking personal lines of insurance. This strategy reflects the company's comprehensive suite of insurance and financial products.

State Farm's customer profile historically aligns with a stable, middle-class demographic, including homeowners and families. This segment values reliability and the strong agent relationships that State Farm emphasizes. The company's reputation for financial stability and local agent presence has resonated well with individuals who prefer in-person interactions and personalized advice for their insurance needs.

While specific details on age, income, and other demographics are proprietary, industry analysis suggests a strong presence across various life stages and income brackets. The company has been adapting to serve younger demographics, recognizing the need to engage with millennials and Gen Z who may prefer digital channels and different product structures. This shift is prompted by broader demographic trends and the increasing digital fluency of newer generations, leading State Farm to invest in online tools and mobile applications to complement its traditional agent model.

State Farm primarily serves individual consumers (B2C) seeking personal lines of insurance. This includes a broad range of customers across different age groups and income levels. The company's focus is on providing comprehensive insurance and financial products to meet the diverse needs of its customer base.

The State Farm audience often includes homeowners and families who value stability and personal relationships. The company's strong agent network and reputation for financial stability appeal to customers seeking personalized service. State Farm also caters to small businesses (B2B) with insurance offerings.

State Farm is adapting to attract younger demographics, including millennials and Gen Z, who prefer digital channels. The company is investing in online tools and mobile applications to complement its traditional agent model. The life insurance segment has shown significant potential, with over 16 million life insurance policies in force as of early 2024.

State Farm segments its market to target various customer needs, including auto and homeowners insurance. The company's approach aims to provide tailored insurance solutions. Understanding the customer needs and wants is crucial for effective market segmentation and product development.

State Farm's customer base is diverse, with a significant portion of its clientele being homeowners and families. The company's focus on providing personalized service through its agent network is a key differentiator. The company is also expanding its digital presence to cater to younger demographics.

- Customer Age Range: While specific data is proprietary, State Farm serves customers across various age groups, with a notable presence among middle-aged adults and families.

- Income Levels: The company caters to a broad spectrum of income levels, with a strong presence in the middle-class demographic.

- Digital Adoption: The company is actively investing in digital tools to engage with younger customers who prefer online interactions.

- Product Focus: State Farm emphasizes both property and casualty insurance and life insurance, with over 16 million life insurance policies.

For more insights into the competitive landscape, including how State Farm compares to its rivals, explore the Competitors Landscape of State Farm.

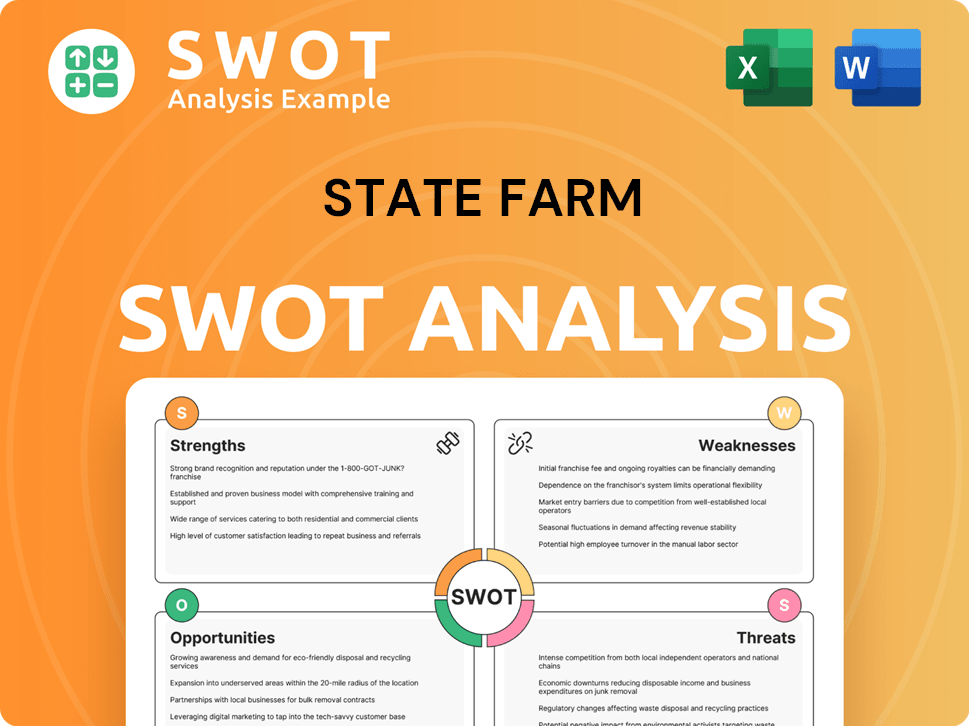

State Farm SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do State Farm’s Customers Want?

Understanding the customer needs and preferences is crucial for any insurance provider. For State Farm, this involves a deep dive into the State Farm customer profile, focusing on what drives their decisions and how the company can best meet those needs. This analysis helps in refining the State Farm target market and ensuring customer satisfaction.

The primary need driving State Farm's audience is financial security and protection. Customers seek reliable insurance coverage to safeguard against unexpected events, valuing trust, and responsive service. This focus on customer needs shapes State Farm's strategies, from product development to customer service.

For auto insurance, customers prioritize competitive pricing, comprehensive coverage options, and efficient claims processing. Homeowners emphasize robust dwelling and personal property coverage along with liability protection. Across all product lines, peace of mind and preparedness are vital psychological drivers. Practical drivers include ease of obtaining quotes, managing policies, and filing claims. Loyalty often stems from positive experiences with local agents.

State Farm addresses the complexity of insurance policies through accessible agent support and clear communication. This approach helps simplify the insurance process for customers.

The company adapts to market trends and customer feedback, influencing product development. For example, telematics-based auto insurance programs respond to customer preferences for usage-based models and potential cost savings.

State Farm tailors its marketing and customer experiences to specific segments. Younger demographics are increasingly targeted through digital advertising, while traditional channels reach older customer bases.

Emphasis on community involvement and local agent presence builds trust and tailors services to regional needs. This customer-centric approach reinforces State Farm's commitment to its customers.

State Farm continues to invest in digital platforms and mobile-friendly applications to meet the evolving needs of its customers. This includes online policy management and claims filing.

The role of local agents remains crucial, providing personalized advice and building long-term relationships. These agents help customers navigate their insurance needs effectively.

Understanding the State Farm customer age range and other demographics is key. The company's approach is to provide tailored solutions.

- Reliability and Trust: Customers value a sense of security and dependability in their insurance provider.

- Competitive Pricing: Customers seek affordable insurance options that provide comprehensive coverage.

- Comprehensive Coverage: The need for policies that cover a wide range of potential risks.

- Efficient Claims Processing: A streamlined and hassle-free claims experience is essential.

- Personalized Service: The preference for tailored advice and support from local agents.

- Digital Accessibility: The convenience of managing policies and filing claims online.

For deeper insights into the company's structure, including ownership and financial performance, you can explore Owners & Shareholders of State Farm.

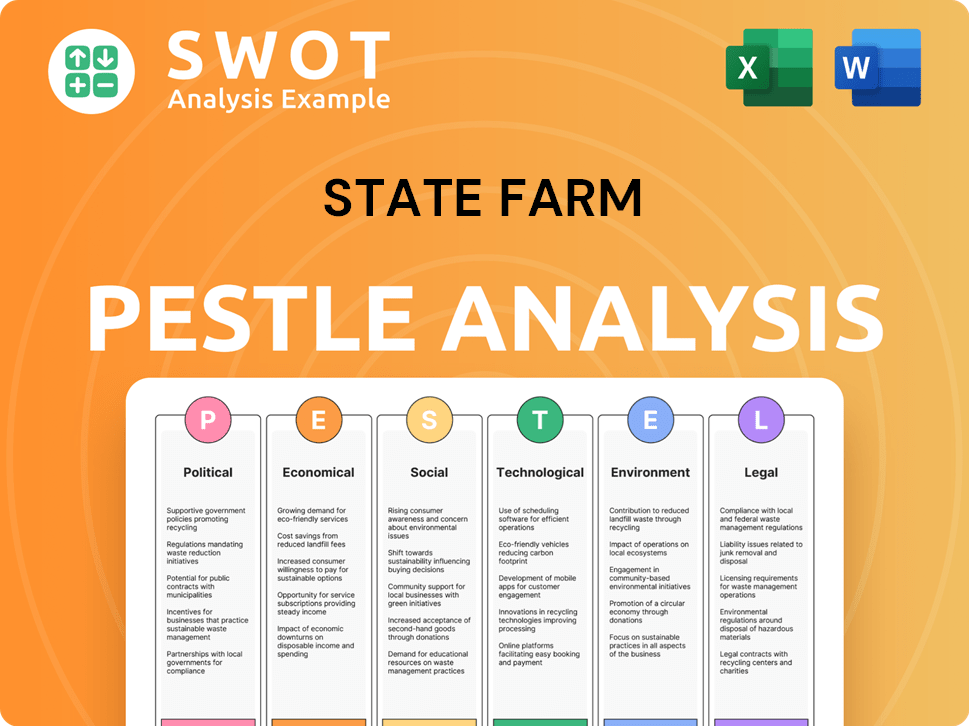

State Farm PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does State Farm operate?

The geographical market presence of the company is primarily within the United States. The company holds a significant market share and strong brand recognition across numerous states. Its roots and long-standing presence are most notable in the Midwest and Southern states.

For example, the company has consistently been a leading auto insurer in states like Illinois, California, and Texas. The company's approach to the market involves tailoring its services to meet the specific needs of different regions. Customer demographics and preferences vary across these regions.

The company localizes its offerings and marketing through its extensive network of independent agents, who are deeply embedded in their local communities. These agents understand regional nuances, local regulations, and specific customer needs, allowing the company to tailor its service and product recommendations effectively.

The company operates across all U.S. states, ensuring broad accessibility for potential insurance customers. Its extensive reach allows it to serve a wide range of demographics and needs. The company's widespread presence is a key factor in its market leadership.

Historically, the company has demonstrated strong market share in the Midwest and Southern regions. This reflects its long-standing presence and deep-rooted customer relationships in these areas. These regions often represent a significant portion of the company's overall revenue.

The company's network of independent agents is a crucial element of its geographical strategy. These agents provide localized service and support, which helps the company understand and meet the unique needs of its customers. This network is particularly effective in both urban and rural areas.

Instead of focusing on broad geographical expansion, the company prioritizes deepening its presence within existing states. This approach allows for more targeted marketing and customer service improvements. The company is focused on enhancing its market share in areas where it already operates.

The geographical distribution of sales and growth generally aligns with population density and economic activity, with major metropolitan areas contributing significantly to its overall revenue. However, its strong agent network also ensures robust performance in less densely populated areas, distinguishing it from some direct-to-consumer competitors. The company's success is also rooted in its ability to adapt to changing market dynamics, as highlighted in Brief History of State Farm.

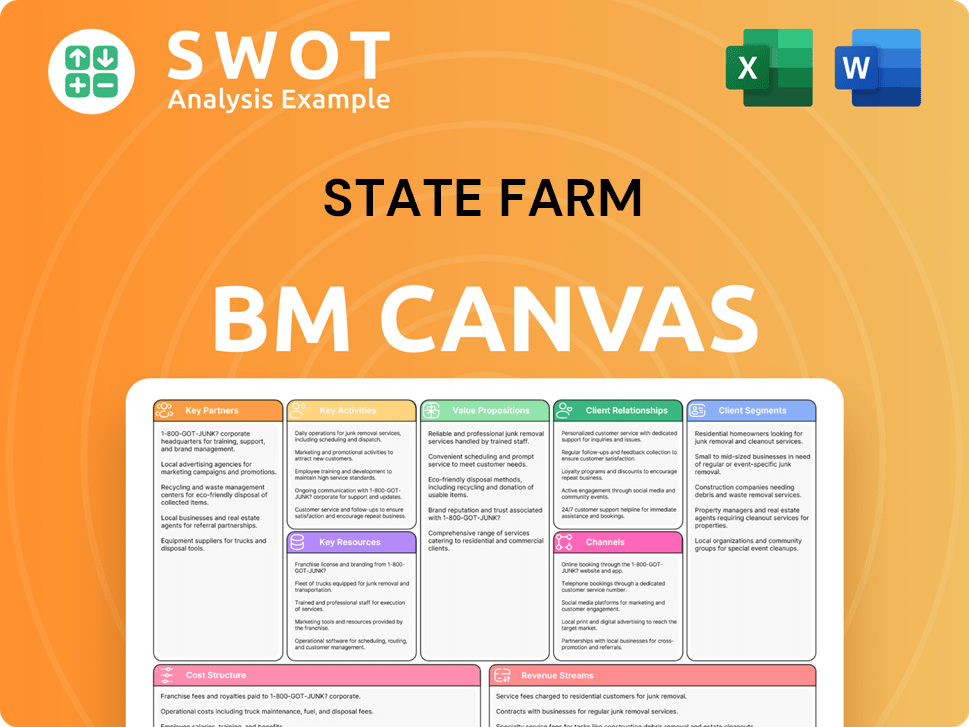

State Farm Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does State Farm Win & Keep Customers?

The company's customer acquisition and retention strategies are built upon a blend of traditional and digital marketing, alongside its extensive agent network. A key component of its acquisition strategy involves a network of nearly 19,000 independent agents across the United States. These agents are the primary points of contact for sales and customer service, engaging in local marketing efforts and community involvement.

The company invests significantly in online advertising, SEO, and social media marketing to reach a wider audience, particularly younger demographics. Their website and mobile applications play a vital role in obtaining quotes, managing policies, and filing claims, catering to customers who prefer digital interactions. They also use personalized marketing campaigns, leveraging customer data and CRM systems to target specific segments with relevant product offerings and communications.

For retention, the company focuses on the personalized service provided by agents, who proactively reach out to policyholders for policy reviews and to address changing needs. Excellent after-sales service, efficient claims processing, and the ability to bundle multiple insurance products are critical retention drivers, increasing customer lifetime value and reducing churn. Recent strategic shifts include an increased emphasis on digital engagement and self-service options.

The company's expansive agent network is a cornerstone of its customer acquisition efforts. These agents build relationships within their communities, offering personalized service and support. This localized approach helps to build trust and brand loyalty, attracting new customers through referrals and word-of-mouth.

Digital marketing campaigns are crucial for reaching a broader audience. The company utilizes online advertising, SEO, and social media to connect with potential customers. Their website and mobile apps provide convenient ways to manage policies and file claims, enhancing customer experience.

The company employs personalized marketing strategies to target specific customer segments. By leveraging customer data and CRM systems, they tailor communications and product offerings to meet individual needs. This approach improves customer engagement and satisfaction.

Retention efforts focus on providing excellent after-sales service and efficient claims processing. Agents proactively reach out to policyholders for policy reviews and to address changing needs. Bundling multiple insurance products also increases customer lifetime value.

The company's strategies are designed to resonate with their target market. They aim to attract a wide range of customers, from young adults to families and small business owners, by offering a variety of insurance products and financial services. This approach is supported by a strong brand reputation and a focus on customer-centric service, which helps maintain customer loyalty and drive long-term growth.

The company segments its customer base to tailor marketing efforts and product offerings. This includes identifying key demographics such as age, income, and location. Understanding these segments allows for more effective targeting and personalized communication.

The company is increasing its focus on digital channels to enhance customer engagement. This includes improving online tools for policy management and claims filing. These improvements aim to provide customers with convenient and efficient service options.

The company is expanding self-service options to meet evolving customer preferences. This includes offering online resources and tools that allow customers to manage their policies independently. This enhances customer convenience and satisfaction.

Bundling multiple insurance products (auto, home, life) is a key retention strategy. This approach not only provides convenience for customers but also increases customer lifetime value. It encourages customers to consolidate their insurance needs.

Efficient claims processing is a critical factor in customer retention. The company focuses on providing a smooth and timely claims experience. This helps to build trust and maintain customer loyalty.

The strong relationships between agents and customers are essential for retention. Agents provide personalized service and support, which helps to build long-term customer loyalty. This personalized approach is a key differentiator.

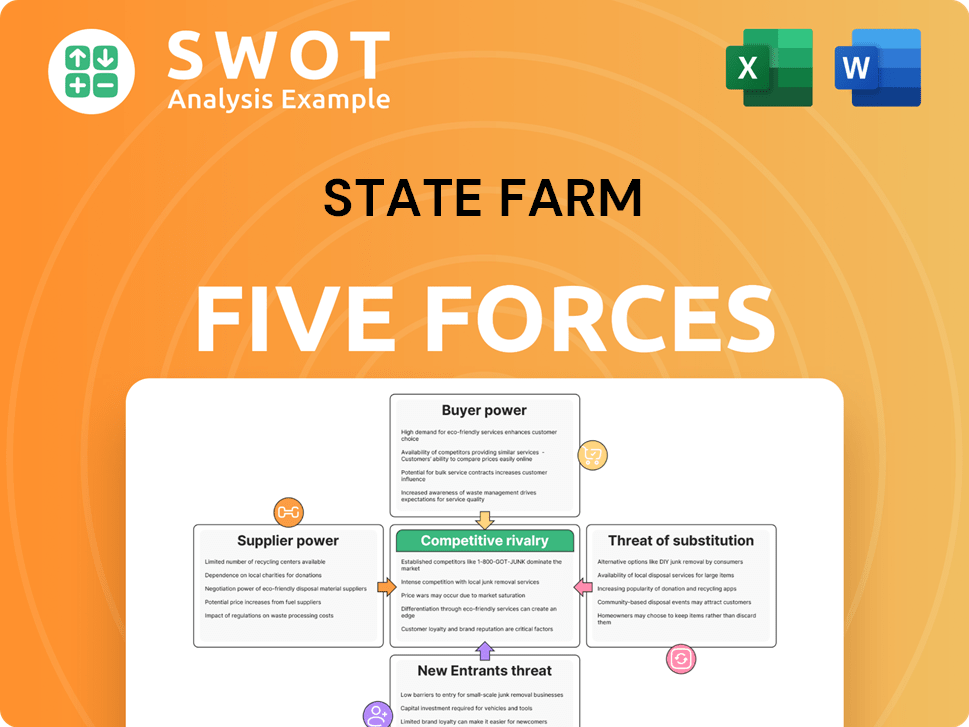

State Farm Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of State Farm Company?

- What is Competitive Landscape of State Farm Company?

- What is Growth Strategy and Future Prospects of State Farm Company?

- How Does State Farm Company Work?

- What is Sales and Marketing Strategy of State Farm Company?

- What is Brief History of State Farm Company?

- Who Owns State Farm Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.