Stem Bundle

How Does Stem Navigate the Music Tech Battlefield?

The independent music scene is booming, but managing its financial intricacies remains a challenge. Stem emerged as a solution, promising transparency and efficiency for artists. This Stem SWOT Analysis will delve into the competitive landscape, exploring how Stem contends with rivals in the dynamic music technology sector.

Understanding the Stem company competitive landscape is crucial for anyone invested in the future of music. This Stem industry analysis will uncover the key players, their strategies, and the factors shaping Stem's market overview. We'll examine Stem's business strategy, analyze the company, and assess the market competition to provide a comprehensive view of its position.

Where Does Stem’ Stand in the Current Market?

Stem carves out a unique space in the music technology arena, specifically catering to independent musicians, producers, and their teams. The company's core operations revolve around providing tools for royalty tracking, automating revenue splits, and offering financial insights. This focus aims to bring transparency and simplicity to the financial aspects of music for independent artists.

The value proposition of Stem lies in empowering independent artists by giving them control over their finances and simplifying complex financial management tasks. By offering a comprehensive platform, Stem enables creators to manage their business operations more efficiently, allowing them to focus on their music. This approach has positioned Stem as a key player in the independent artist ecosystem.

Stem holds a significant market position within the music technology sector, particularly among independent artists. Its primary focus is on providing financial management tools and royalty distribution solutions. This strategic positioning has allowed Stem to become a leading platform for independent creators.

Stem's geographic presence is strongest in North America, with a significant presence in major cities known for their vibrant independent music scenes. The company's customer base includes self-releasing artists, independent labels, music producers, and songwriters. These creators benefit from streamlined financial operations.

Stem has strategically evolved by continually refining its platform to meet the changing needs of artists. This evolution includes moving beyond basic distribution to offer more robust financial management features. The company's goal is to become a comprehensive business partner for creators, deeply integrated into their financial workflow.

While specific financial health comparisons are challenging due to Stem's private status, the company's ability to attract funding rounds indicates a strong financial footing. For example, in 2022, Stem secured a $20 million Series C funding round, demonstrating investor confidence. This funding supports platform enhancements and potential expansion.

Stem's market position is further solidified by its support for artists who prioritize direct control over their careers and require efficient financial tools. This focus on independent creators and their financial needs has allowed Stem to establish a strong presence in the music technology sector. To learn more about the company's origins, check out Brief History of Stem.

Stem's key strengths include its focus on independent artists, its comprehensive financial management tools, and its strong presence in North America. The company's strategic evolution and ability to attract funding further enhance its market position.

- Focus on independent artists

- Comprehensive financial management tools

- Strong presence in North America

- Strategic evolution and funding success

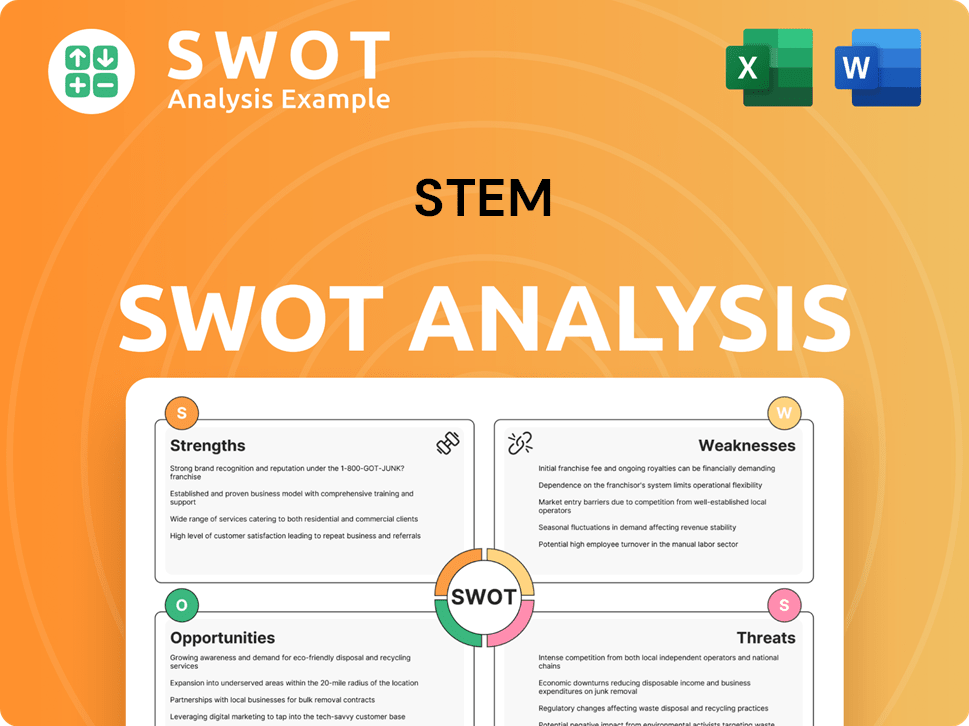

Stem SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Stem?

The Stem company competitive landscape is characterized by a mix of direct and indirect competitors vying for market share in the independent music sector. This analysis offers a Stem industry analysis, examining key players and their strategies. Understanding the Stem market overview is crucial for assessing the company's position and potential for growth.

Direct competitors offer similar services, such as digital distribution and financial management tools. Indirect competitors include traditional record labels and accounting software solutions. The competitive dynamics are influenced by pricing, features, ease of use, and customer support. The market is constantly evolving with mergers, acquisitions, and the introduction of new features.

The competitive landscape is dynamic, with platforms constantly innovating to attract artists. The focus on transparent royalty splits and efficient payment systems is a key area of competition. The Stem business strategy must adapt to these changes to remain competitive. This includes a Stem company analysis to understand the strengths and weaknesses of the company. The Stem market competition is intense, requiring continuous adaptation and innovation.

Direct competitors include platforms that offer digital distribution and artist services. These platforms often provide tools for financial management, royalty collection, and publishing administration. The competition focuses on features, pricing, and ease of use to attract independent artists.

TuneCore is a prominent direct competitor. It provides digital distribution to various platforms. TuneCore also offers publishing administration and royalty collection services. It caters to a wide range of independent artists.

DistroKid is known for its affordable and unlimited music distribution. It facilitates royalty payments to collaborators. DistroKid's pricing model is a key differentiator in the market.

CD Baby is a long-standing player in the independent music space. It offers distribution, sync licensing, and publishing administration. CD Baby provides a comprehensive suite of services for artists.

Indirect competitors include traditional record labels and accounting software. Record labels offer financial backing and administrative support. Accounting software can be adapted for financial tracking by artists.

The market sees the constant emergence of new players. These companies often specialize in micro-royalty payments or advanced analytics. Innovation in these areas drives competition.

The competitive landscape is shaped by several factors, including pricing, features, and customer support. Platforms compete for exclusive artist sign-ups and introduce innovative features to simplify financial workflows. The race to offer transparent and efficient royalty split mechanisms is a key competitive area. The market is also influenced by mergers and acquisitions.

- Pricing Structures: Competitive pricing models, including subscription fees and commission rates, are crucial.

- Financial Tools: The breadth and depth of financial tools, such as royalty tracking and payment processing, are essential.

- Ease of Use: User-friendly interfaces and intuitive platforms attract artists.

- Customer Support: Responsive and helpful customer support enhances artist satisfaction.

- Innovation: Continuous innovation in features, such as advanced analytics and micro-royalty payments, drives competition.

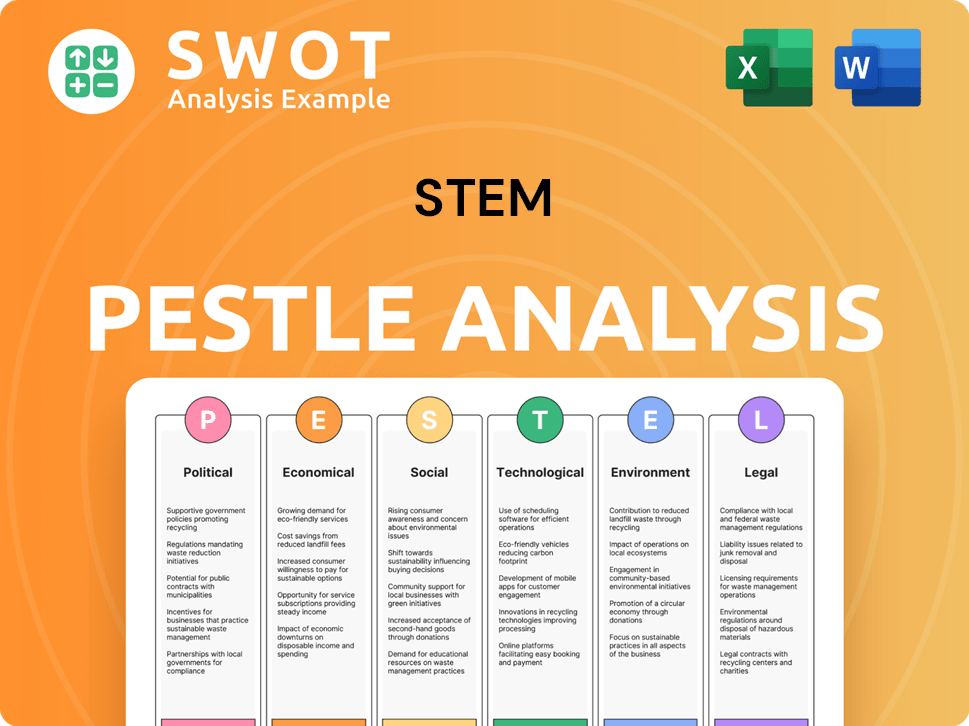

Stem PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Stem a Competitive Edge Over Its Rivals?

The competitive advantages of the company are rooted in its commitment to financial transparency, automated royalty management, and a user-friendly platform tailored for the independent music business. Its proprietary technology streamlines revenue splitting among collaborators, a historically complex task. This automated payout system, combined with detailed financial insights, distinguishes it from general distribution platforms. This focus on intellectual property management, particularly in tracking and attributing earnings across digital platforms, provides crucial security and clarity for creators.

The company's brand equity is built on trust and empowering artists, fostering a sense of community. This has cultivated customer loyalty among independent musicians who value direct control and transparency in their financial dealings. While economies of scale might be more pronounced for larger distribution platforms, the company leverages its specialized technology to achieve operational efficiencies in managing complex royalty streams for a high volume of independent artists. The company's talent pool, comprising individuals with expertise in both music industry finance and technology, contributes to its ability to innovate and adapt its offerings.

These advantages have evolved as the company has continually refined its platform to meet the growing demands of the creator economy. For instance, the introduction of more sophisticated analytics tools allows artists to gain deeper insights into their revenue sources and audience engagement, directly leveraging their technological advantage. The company often integrates these advantages into its marketing by highlighting success stories of artists who have successfully managed their careers using the platform. While imitation is a constant threat in the technology sector, the company's deep understanding of the music industry's financial intricacies and its continuous investment in R&D help sustain its competitive edge. For a deeper dive into the company's strategic direction, consider exploring the Growth Strategy of Stem.

The company has achieved significant milestones by focusing on technology that simplifies royalty splits and provides financial transparency. It has consistently updated its platform to meet the evolving needs of independent artists. The company's commitment to innovation has allowed it to maintain a competitive edge in the market.

Strategic moves include continuous investment in R&D to enhance its platform and expand its offerings. The company focuses on building a strong brand reputation based on trust and empowering artists. It also emphasizes its ability to manage complex royalty streams efficiently, which attracts a large volume of independent artists.

The company's competitive edge stems from its specialized technology for royalty management and its focus on transparency. Its deep understanding of the music industry's financial intricacies and continuous innovation sets it apart. The company's ability to provide detailed financial insights and build a strong community further strengthens its position in the market.

The company faces competition from larger distribution platforms, but it differentiates itself through its specialized services. Key competitors include platforms that offer similar distribution and royalty management solutions. The company's focus on the independent music sector allows it to cater to a specific market segment.

The company's competitive advantages include its proprietary technology for automated royalty management, detailed financial insights, and a user-friendly platform. This focus on transparency and control has fostered strong customer loyalty among independent artists. The company's specialized services allow it to efficiently manage complex royalty streams, setting it apart from competitors.

- Proprietary technology for automated royalty management.

- Focus on transparency and detailed financial insights.

- User-friendly platform tailored for independent artists.

- Strong brand equity built on trust and community.

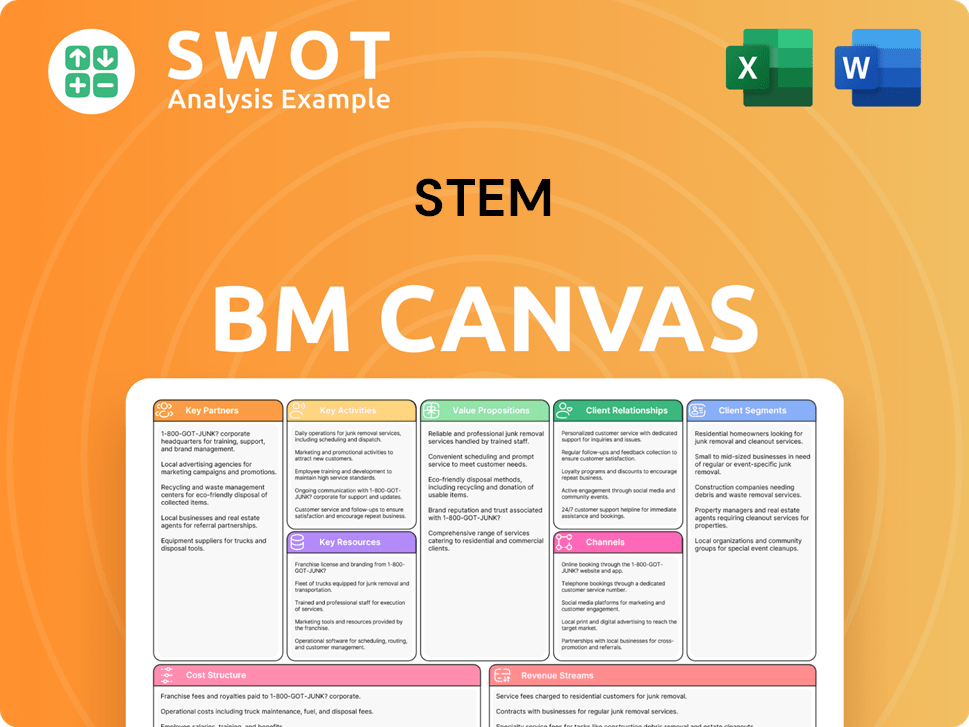

Stem Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Stem’s Competitive Landscape?

The competitive landscape for companies like Stem is heavily influenced by shifts in the music industry, especially within the growing creator economy. The increasing professionalization of independent artists and the need for sophisticated financial tools are key drivers. The Marketing Strategy of Stem must adapt to technological advancements and evolving consumer preferences to maintain its position.

Stem's competitive position is also affected by regulatory changes concerning artist rights and digital royalties, as well as global economic conditions. Anticipated disruptions include new market entrants and tech companies integrating artist services. Conversely, opportunities lie in emerging markets and product innovations.

The music industry is experiencing significant growth in the creator economy. Independent artists are demanding more professional financial management. Artificial intelligence (AI) and blockchain technologies are also playing a greater role in royalty tracking and distribution.

Regulatory changes regarding artist rights and digital royalties could impact revenue streams. New market entrants and tech companies integrating artist services pose a threat. Declining demand for specific services could also be a challenge.

Emerging markets offer growth potential for independent music scenes. Product innovations, such as AI-driven predictive analytics, could open new revenue streams. Strategic partnerships with streaming services and financial institutions are also beneficial.

Stem's strategy likely focuses on continuous platform innovation and global expansion. Fostering strong community engagement among its artist base is also crucial. The company aims to become an indispensable financial operating system for independent creators.

Several factors shape the competitive landscape for Stem, including technological advancements and evolving consumer preferences. The company must also navigate regulatory changes and global economic shifts. Stem's success depends on its ability to adapt and innovate.

- Technological Advancements: AI and blockchain are transforming royalty management.

- Regulatory Changes: Artist rights and digital royalties impact revenue.

- Market Competition: New entrants and tech integrations pose threats.

- Global Economic Shifts: Inflation and regional economic health affect artists.

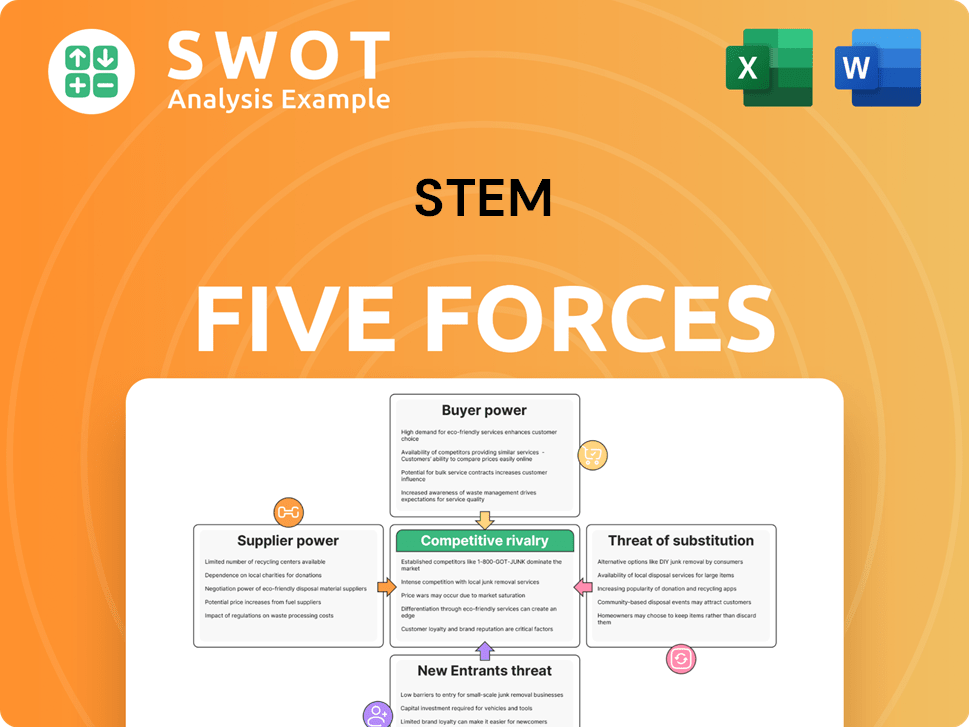

Stem Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stem Company?

- What is Growth Strategy and Future Prospects of Stem Company?

- How Does Stem Company Work?

- What is Sales and Marketing Strategy of Stem Company?

- What is Brief History of Stem Company?

- Who Owns Stem Company?

- What is Customer Demographics and Target Market of Stem Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.