Stem Bundle

Can Stem Company Tune Up Its Future?

In the dynamic music industry, where artists are increasingly seeking control, Stem has emerged as a crucial player. Founded in 2015, Stem simplifies the financial complexities for musicians, offering tools for managing finances and streamlining revenue splits. This allows artists to focus on their craft, making Stem a pivotal force in the music tech ecosystem.

This article dives into the Stem SWOT Analysis, exploring the growth strategy and future prospects of the Stem company. We'll examine its strategic initiatives, approach to innovation, and financial outlook, providing a comprehensive market analysis of its potential. Understanding the company development and navigating the challenges will be key to assessing Stem's long-term success in this evolving landscape.

How Is Stem Expanding Its Reach?

The growth strategy for a music technology company like Stem focuses on strengthening its position within the independent music market. This involves a multi-faceted approach that includes enhancing its platform, exploring geographical expansion, and forming strategic partnerships. The goal is to offer a comprehensive suite of services that empower artists and foster their success in a competitive industry. Market analysis indicates a growing demand for artist-centric solutions, which aligns with Stem's core mission.

Stem's future prospects are closely tied to its ability to adapt to the evolving needs of independent artists. This includes staying ahead of technological advancements and regulatory changes. The company's success will depend on its capacity to provide innovative tools and services that streamline the music creation, distribution, and monetization processes. The independent music market is projected to continue its upward trajectory, creating significant opportunities for companies like Stem.

The company's expansion initiatives are designed to capitalize on these trends. These initiatives are centered around enhancing the existing platform, exploring new markets, and forming strategic partnerships. Stem's commitment to innovation and artist empowerment positions it well for sustained growth in the dynamic music industry. For more information, you can read about the Target Market of Stem.

Stem's primary focus is on improving its existing platform to meet the evolving needs of independent artists. This includes integrating new features and tools that streamline music distribution, royalty tracking, and financial management. By offering a more comprehensive suite of services, Stem aims to increase user engagement and retention.

While not explicitly detailed in recent public statements, geographical expansion remains a potential long-term goal for Stem. This could involve entering new markets, particularly those with thriving independent music scenes. Partnerships with international artist communities or local music organizations could facilitate market entry and accelerate growth.

Stem may pursue strategic partnerships with other music technology companies or artist services providers. These collaborations could create a more integrated ecosystem for artists, offering resources such as financial literacy programs and marketing tools. These partnerships aim to provide a more holistic support system for independent artists.

Specific financial projections for Stem are not publicly available. However, the independent music market is experiencing significant growth, with some estimates suggesting a continued increase in revenue. The company's future success will depend on its ability to capture a share of this growing market and maintain a competitive edge through innovation and strategic partnerships.

Stem's expansion plans are centered on enhancing its platform, exploring new markets, and forming strategic partnerships to support independent artists. The company aims to provide a comprehensive suite of services, including distribution, royalty tracking, and financial management tools. The independent music market is growing, with projections indicating continued revenue increases.

- Platform enhancements to increase user engagement.

- Geographical expansion to tap into new markets.

- Strategic partnerships for a more integrated ecosystem.

- Focus on artist empowerment and financial literacy.

Stem SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Stem Invest in Innovation?

The Growth strategy of a company like the one specializing in financial solutions for the music industry hinges on its ability to innovate and adapt. This involves a deep understanding of the ever-changing needs of independent artists and the technological landscape that supports their financial well-being. The focus is on creating a seamless and efficient platform that simplifies complex financial processes.

The Future prospects for the company are closely tied to its capacity to enhance its technology and expand its services. By continuously improving its platform and exploring new features, it can attract and retain artists. This approach allows for growth and solidifies its position in the market.

The company's innovation strategy is centered on in-house development to refine its core platform. This includes improving algorithms for royalty tracking and payout automation, ensuring accuracy and efficiency for artists and their collaborators. The platform is designed to provide a seamless, intuitive, and transparent financial dashboard for musicians.

While specific R&D investment details are not publicly available, the continuous introduction of new features and improvements suggests ongoing technological development. This commitment is crucial for staying competitive and meeting evolving market demands.

The company likely utilizes data analytics to provide artists with deeper insights into their earnings and audience engagement. This helps artists make more informed business decisions, contributing to their financial success and loyalty to the platform.

Although specific patents or industry awards are not publicly highlighted, the company's reputation for simplifying financial processes for independent artists underscores its leadership in this niche of music technology. This focus gives it a competitive edge.

Technological advancements in areas like automated royalty tracking and payment processing are critical. These improvements enhance user experience and operational efficiency, which are key to attracting and retaining users in the competitive music industry.

Prioritizing user experience through a seamless and intuitive platform is essential. This approach ensures that artists can easily manage their finances, which can lead to increased user satisfaction and platform adoption.

Adapting to market changes is crucial. This includes staying current with industry trends and incorporating new technologies to meet the evolving needs of independent artists. This adaptability ensures long-term viability.

The company's ability to provide a user-friendly platform is a key factor in its success. This is evident when considering the financial challenges faced by independent musicians, as highlighted in Brief History of Stem. By offering a streamlined solution, the company addresses a critical need in the market.

The company's technological strategies are focused on providing a seamless financial management experience for artists. This involves continuous improvements in several key areas:

- Enhancing royalty tracking accuracy.

- Automating payout processes for efficiency.

- Developing data analytics tools for informed decision-making.

- Ensuring a user-friendly and transparent platform.

Stem PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Stem’s Growth Forecast?

As a privately held entity, the company, does not publicly release detailed financial reports. However, assessing its financial health and future prospects requires analyzing its operational model and market position. The company's revenue is primarily derived from a percentage of the earnings it processes for artists, which directly links its financial performance to the success and expansion of its user base.

The company's financial outlook is positively influenced by the increasing professionalization within the independent music sector. The company's ability to secure funding rounds and sustain operations highlights a favorable financial trajectory. This is supported by the growing demand for transparent and efficient financial management tools within the independent music industry.

The overall financial narrative for the company revolves around consistent growth, driven by market demand and its value proposition to independent creators. The company's continued success is dependent on its ability to attract and retain independent artists, which directly impacts its revenue and profit margins. The company’s financial strategy is closely tied to its ability to innovate and adapt to the evolving needs of its user base.

The company's revenue model is based on a percentage of the earnings it processes for artists. This means that as more independent artists use the platform, the company's revenue increases. The company's financial success is directly tied to the success of the artists using its platform.

The independent music market is growing, creating a strong demand for the company's services. The increasing professionalization of independent music suggests a robust market for the company's services. This market demand supports the company's growth strategy.

The company's ability to secure funding rounds and maintain operations indicates a positive financial outlook. This financial stability is crucial for the company's long-term growth. The company's financial health is supported by its ability to attract and retain independent artists.

The company offers transparent and efficient financial management tools to independent creators. This value proposition attracts and retains artists, supporting the company's growth. The company's business model is designed to meet the needs of independent artists.

While specific financial projections are not available, the company's growth is expected to mirror the expansion of the independent music market. The company's financial performance is influenced by its ability to attract and retain independent artists. The company's Owners & Shareholders of Stem are key to its financial success.

- Revenue growth is tied to the number of artists using the platform.

- Profit margins are influenced by the efficiency of the platform.

- Investment in technology and services will drive future growth.

- Market trends suggest continued expansion of the independent music sector.

Stem Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Stem’s Growth?

The path to growth for a company like Stem is not without its hurdles. Navigating the competitive landscape, staying ahead of technological advancements, and adapting to evolving regulatory environments are critical for sustained success. Understanding and proactively addressing these potential risks is essential for a company's long-term viability and ability to capitalize on its future prospects.

One of the primary challenges is the intense competition within the music tech sector. As the market evolves, new platforms and services emerge, offering artists financial management tools. To thrive, Stem must continuously innovate and differentiate its offerings. Moreover, the company's reliance on third-party providers for essential services like data and payments introduces potential vulnerabilities.

Regulatory shifts, especially those concerning royalty collection and distribution, could demand significant platform adjustments. Resource limitations, such as attracting and retaining top talent, also pose a threat to the pace of innovation. The ability to mitigate these risks through continuous market monitoring and agile development practices is crucial for Stem's continued success and its Marketing Strategy of Stem.

The music tech industry is highly competitive, with numerous platforms vying for artists' attention. Companies need to differentiate their services to stand out. This requires continuous innovation and a deep understanding of artist needs.

Changes in music industry regulations, especially concerning royalties, can significantly impact operations. Companies must adapt their platforms to remain compliant. Staying informed about upcoming regulatory shifts is essential.

Reliance on third-party providers for data and payment processing introduces risks. Disruptions with these partners can affect service delivery. Diversifying partnerships and ensuring robust contracts is crucial.

Rapid technological advancements can render existing solutions obsolete. Companies must stay ahead of the curve. Investing in research and development is key to staying competitive.

Attracting and retaining top talent is a challenge. Competition for skilled engineers and product developers is fierce. Companies need to offer competitive compensation and a strong company culture.

Protecting artist data from breaches is crucial for maintaining trust. Data breaches can lead to financial and reputational damage. Implementing robust security measures is essential.

The music industry is constantly evolving, with new trends and technologies emerging. Companies must be agile and responsive. This includes monitoring market trends and adapting strategies.

Understanding the competitive landscape is key to success. Companies need to analyze their competitors. This includes identifying their strengths and weaknesses and differentiating their offerings.

Creating accurate financial projections is essential for long-term planning. Companies need to forecast revenue, expenses, and profitability. This helps in making informed decisions.

Identifying and capitalizing on investment opportunities is crucial for growth. Companies should explore potential partnerships. This includes evaluating the risks and rewards of each opportunity.

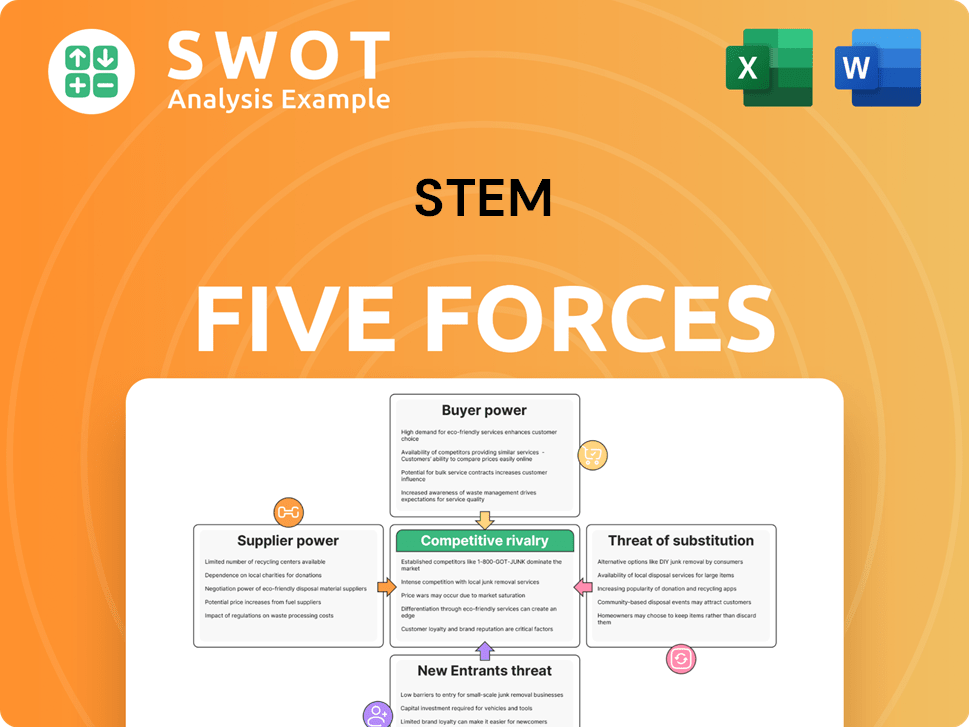

Stem Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stem Company?

- What is Competitive Landscape of Stem Company?

- How Does Stem Company Work?

- What is Sales and Marketing Strategy of Stem Company?

- What is Brief History of Stem Company?

- Who Owns Stem Company?

- What is Customer Demographics and Target Market of Stem Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.