Stolt-Nielsen Bundle

Can Stolt-Nielsen Maintain Its Dominance in a Volatile Market?

From its inception in 1959, Stolt-Nielsen has revolutionized the bulk liquid transportation sector, evolving into a global powerhouse. This company's journey, marked by strategic expansion and innovation, showcases its resilience in the face of evolving market demands. Understanding the Stolt-Nielsen SWOT Analysis is key to grasping its competitive edge.

To truly understand Stolt-Nielsen's position, we must dissect its competitive landscape. This detailed market analysis will identify its key rivals within the tank container industry and the broader shipping industry analysis, revealing how Stolt-Nielsen competes. We'll explore its competitive advantages, growth strategy, and financial performance compared to competitors, offering insights into its future outlook and sustainability initiatives within the bulk liquid transportation market.

Where Does Stolt-Nielsen’ Stand in the Current Market?

Stolt-Nielsen maintains a strong market position in the global specialty and bulk liquid transportation sector. The company is a key player in chemical tanker and tank container segments. The company's operations are global, with a significant presence across all major continents, which allows it to serve key industrial hubs and emerging markets.

The company provides parcel tanker shipping, tank container logistics, and terminal operations. Its customer base includes the chemical, petrochemical, edible oil, and pharmaceutical industries. Stolt-Nielsen focuses on integrated solutions and higher-value services, moving beyond transportation to offer comprehensive logistics management.

The company's financial health is robust, as seen in its Q1 2024 results. Revenue Streams & Business Model of Stolt-Nielsen shows that Stolt-Nielsen Limited reported a net profit of $100.8 million. Stolt Tankers contributed significantly with an operating profit of $70.7 million, and Stolt Tank Containers reported an operating profit of $28.3 million. This financial performance solidifies its strong position in specialized liquid transportation.

Stolt-Nielsen typically ranks among the top-tier providers in its core areas. Precise market share figures for 2024-2025 are subject to ongoing market dynamics and proprietary data. Stolt Tankers operates one of the world's largest and most sophisticated fleets of chemical tankers.

The company's primary services include parcel tanker shipping, tank container logistics, and terminal operations. These services cater to a diverse customer base within the chemical, petrochemical, edible oil, and pharmaceutical industries. Stolt-Nielsen focuses on providing integrated solutions.

Stolt-Nielsen has a strong global presence with operations and offices across all major continents. This extensive reach allows it to serve key industrial hubs and emerging markets. The global network of tank containers, managed by Stolt Tank Containers (STC), offers door-to-door transportation solutions.

Stolt-Nielsen has shifted its positioning to emphasize integrated solutions and higher-value services. This includes digital transformation initiatives aimed at enhancing efficiency and customer experience. The company focuses on comprehensive logistics management.

Stolt-Nielsen's financial health is strong, as demonstrated by its Q1 2024 results. Stolt-Nielsen Limited reported a net profit of $100.8 million. Stolt Tankers contributed significantly with an operating profit of $70.7 million, and Stolt Tank Containers reported an operating profit of $28.3 million.

- These figures reflect the company's scale and stability.

- The strong performance in both Stolt Tankers and Stolt Tank Containers underscores its solid position.

- The company's financial results are a key indicator of its competitive advantage.

- Stolt-Nielsen's financial strength supports its growth strategy.

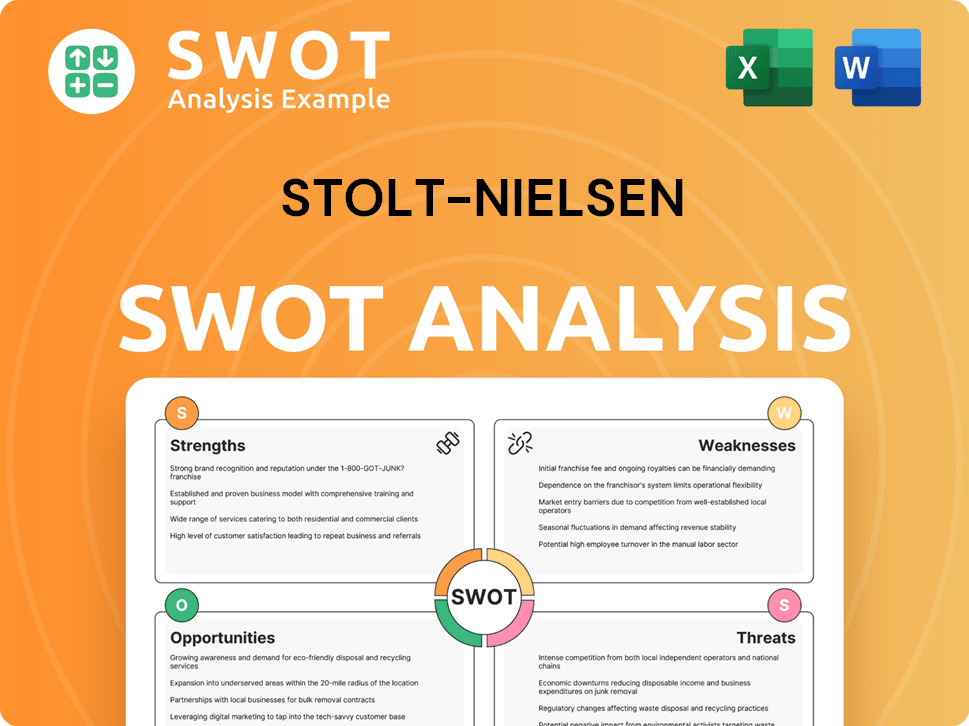

Stolt-Nielsen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Stolt-Nielsen?

The Stolt-Nielsen competitive landscape is shaped by its diverse business segments, each facing unique challenges and opportunities within the shipping and logistics sectors. Understanding its key Stolt-Nielsen competitors is crucial for assessing its market position and strategic direction. A comprehensive Stolt-Nielsen market analysis reveals the competitive pressures and the strategies employed to maintain and enhance its market share.

The company operates in a global market, where competition is driven by factors such as fleet size, operational efficiency, pricing, and service offerings. The competitive environment is dynamic, influenced by market trends, technological advancements, and regulatory changes. Analyzing the competitive dynamics helps in evaluating Stolt-Nielsen's ability to adapt and thrive in a complex and evolving industry.

Stolt-Nielsen faces competition across its core business segments: chemical tankers, tank containers, terminal operations, and aquaculture. Each segment has its own set of rivals that compete for market share. The strategies employed by these competitors, along with market conditions, influence Stolt-Nielsen's performance and strategic decisions.

In the chemical tanker market, Stolt-Nielsen's primary rivals include Odfjell SE and Jo Tankers. These competitors challenge Stolt-Nielsen through fleet size, operational efficiency, and pricing strategies. They compete for contracts and shipping routes globally, impacting Stolt-Nielsen's market share and profitability.

Stolt Tank Containers faces competition from companies such as Suttons International and Hoyer Group in the tank container logistics segment. These competitors focus on network density, specialized equipment, and integrated logistics services. They compete for customers by offering competitive pricing or niche solutions.

In terminal operations, Stolt-Nielsen competes with independent tank storage providers like Vopak and other port-based logistics companies. These competitors focus on storage capacity, transshipment services, and value-added services. Competition is centered around key logistical hubs and service offerings.

Stolt Sea Farm competes with other aquaculture producers in its emerging land-based aquaculture business. Competition here is based on product quality, sustainable practices, and market access for premium seafood products. The aquaculture segment is growing, attracting new entrants.

The competitive landscape is also influenced by new entrants in specialized logistics and increasing consolidation within the shipping and logistics sectors. These factors can lead to larger, more integrated competitors. Market trends and regulatory changes also play a significant role.

For a detailed look at the company's performance, you can refer to an article that further examines the company's financial health and strategic positioning within the industry, providing a deeper understanding of how it navigates the competitive environment. Read more about the company's performance here.

The tank container industry is characterized by a mix of global and regional players, each with varying strengths. Stolt-Nielsen's competitive advantages of Stolt-Nielsen include its extensive global network and specialized fleet. However, competitors often offer competitive pricing or niche solutions. The bulk liquid transportation market is subject to fluctuations in demand and supply, impacting profitability and market share. Understanding the shipping industry analysis and the strategies of Stolt-Nielsen's main rivals is essential for assessing its future outlook. The company's geographical presence and customer base analysis are also critical factors in its competitive strategy. The company's growth strategy and recent acquisitions are significant indicators of its future direction. Stolt-Nielsen's sustainability initiatives are increasingly important in attracting customers and navigating regulatory changes. The company's ability to adapt to changes and maintain its market position depends on its strategic responses to Stolt-Nielsen's challenges and opportunities.

Several factors influence the competitive dynamics within the Stolt-Nielsen competitive landscape. These include fleet size, operational efficiency, pricing strategies, service offerings, and geographical reach. Understanding these factors helps assess the company's market position and strategic direction.

- Fleet Size and Capacity: The size and capacity of the fleet are critical in the chemical tanker and tank container segments. Larger fleets often allow for greater economies of scale and broader service coverage.

- Operational Efficiency: Efficient operations, including fuel consumption, port turnaround times, and cargo handling, impact profitability.

- Pricing Strategies: Competitive pricing is essential for securing contracts and maintaining market share. Pricing strategies vary based on market conditions and customer needs.

- Service Offerings: Value-added services, such as specialized equipment, integrated logistics, and tank cleaning, differentiate companies and attract customers.

- Geographical Presence: A strong global network and presence in key markets provide a competitive advantage. This includes access to major shipping routes and logistical hubs.

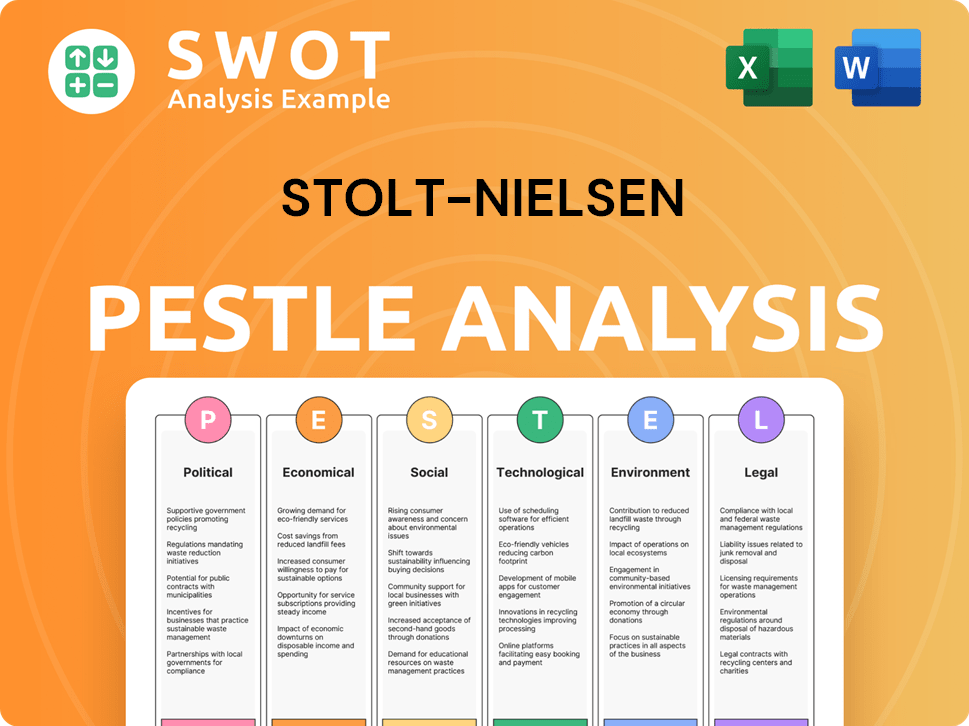

Stolt-Nielsen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Stolt-Nielsen a Competitive Edge Over Its Rivals?

The competitive advantages of Stolt-Nielsen stem from its specialized infrastructure and expertise in the bulk liquid transportation sector. The company has cultivated a strong reputation, supported by a global network and operational efficiencies. Understanding the Brief History of Stolt-Nielsen provides context for its strategic evolution and market positioning.

Stolt-Nielsen's core strengths include its specialized fleet, global reach, and operational expertise. These elements combine to provide an integrated logistics solution that few competitors can match, improving supply chain reliability for its customers. The company's financial health, as demonstrated by its Q1 2024 net profit of $100.8 million, enables continuous investment in fleet modernization and strategic acquisitions.

The company's long-standing experience in managing complex and sensitive shipments has cultivated an unparalleled level of expertise and a strong safety record, which is highly valued by its chemical and pharmaceutical clients. Its brand equity, built over decades, signifies reliability, quality, and adherence to stringent environmental and safety standards. This fosters strong customer loyalty, evidenced by long-term contracts and repeat business.

Stolt-Nielsen operates a highly specialized fleet of parcel tankers designed for a diverse range of liquid cargoes. This is a key differentiator in the Stolt-Nielsen competitive landscape. The global network of tank containers and strategically located terminals provides a comprehensive 'door-to-door' service.

Proprietary technologies and operational efficiencies in cargo handling and tank cleaning set Stolt-Nielsen apart. The company's focus on safety and environmental standards is crucial. This expertise has cultivated an unparalleled level of expertise and a strong safety record, which is highly valued by its chemical and pharmaceutical clients.

The company's brand equity, built over decades, signifies reliability and quality. This fosters strong customer loyalty, evidenced by long-term contracts and repeat business. This contributes to Stolt-Nielsen's position in the bulk liquid market.

Economies of scale, particularly in its tanker and tank container operations, allow Stolt-Nielsen to optimize routes and achieve cost efficiencies. The company's strong financial health enables continuous investment in fleet modernization and acquisitions. Stolt-Nielsen's market share 2024 is supported by its financial performance.

Stolt-Nielsen's competitive advantages include its specialized fleet, global network, and operational expertise. These advantages help the company compete in a global market. The company’s strong financial performance, such as the Q1 2024 net profit of $100.8 million, supports its market position.

- Specialized Fleet: Parcel tankers designed for diverse and often hazardous liquid cargoes.

- Integrated Logistics: Comprehensive 'door-to-door' service with a global network of tank containers and terminals.

- Operational Efficiency: Proprietary technologies and expertise in cargo handling, tank cleaning, and safety protocols.

- Brand Reputation: Long-standing reputation for reliability, quality, and adherence to stringent standards.

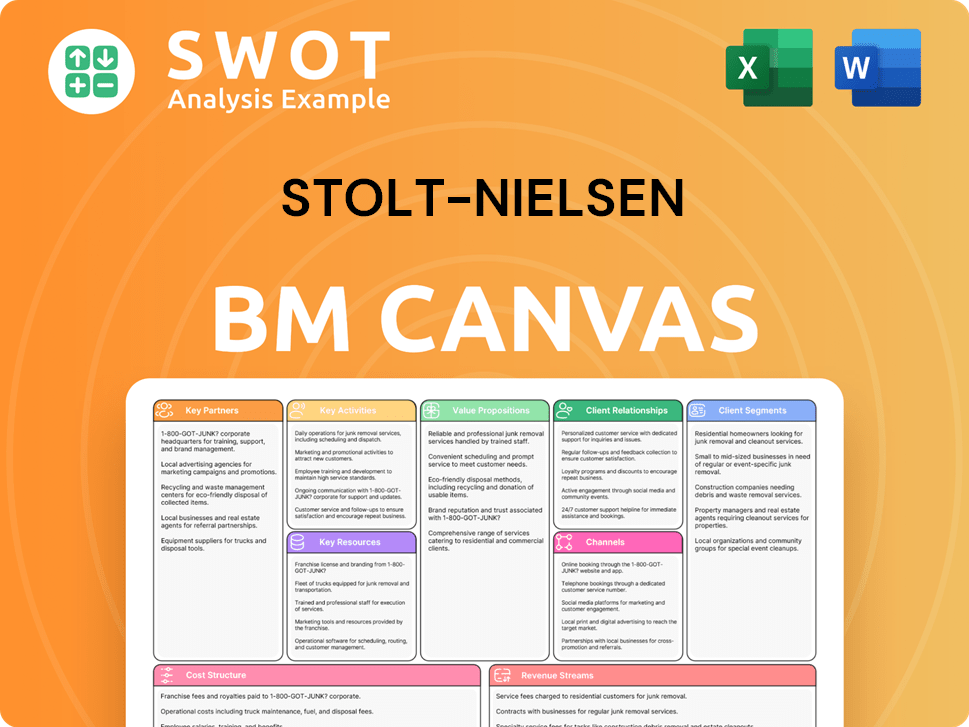

Stolt-Nielsen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Stolt-Nielsen’s Competitive Landscape?

The competitive landscape for the company is shaped by industry trends, presenting both challenges and opportunities. Technological advancements, regulatory changes, and global economic shifts are key factors influencing the company's strategic direction. Understanding these elements is crucial for assessing the company's long-term prospects and its ability to maintain a strong position in the market.

The company faces a dynamic environment marked by both risks and prospects. These include the need to adapt to environmental regulations, manage economic uncertainties, and capitalize on emerging market opportunities. The company's approach to these factors will determine its success in the bulk liquid transportation and tank container industry. For more detail, you can review Target Market of Stolt-Nielsen.

Digitalization and automation are transforming logistics, offering opportunities for cost reduction and improved service. Regulatory changes, particularly those related to environmental protection, require significant investments. Global economic shifts introduce volatility, impacting demand and freight rates. The company's strategic flexibility is key.

Increased competition from new entrants and consolidation poses a threat. Declining demand in specific chemical sectors may impact cargo volumes. Compliance costs related to environmental regulations are a concern. Adapting to changing trade patterns and geopolitical instability is crucial.

Growth in emerging markets, particularly in Asia and Latin America, drives demand. Product innovations in sustainable chemicals and biofuels will increase demand. Strategic partnerships and acquisitions can facilitate expansion. The company's focus on sustainability can create a competitive advantage.

Continued investment in technology and sustainability is critical. Adapting to evolving global trade patterns and regulatory environments is key. Strategic partnerships and acquisitions will support growth. Maintaining agility and resilience will ensure long-term success.

The company's ability to navigate industry trends, address challenges, and seize opportunities will determine its future success. Strategic investments in technology and sustainability are crucial. Adapting to global economic shifts and regulatory changes is essential for maintaining a competitive edge. The company's strategic focus on growth markets, such as Asia and Latin America, will be vital for expanding its market share and financial performance.

- Technological advancements, including AI and IoT, can enhance operational efficiency.

- Compliance with IMO regulations for reducing emissions is a major focus.

- Geopolitical instability and trade tensions can impact shipping and logistics.

- Strategic partnerships and acquisitions are key for expansion, especially in aquaculture.

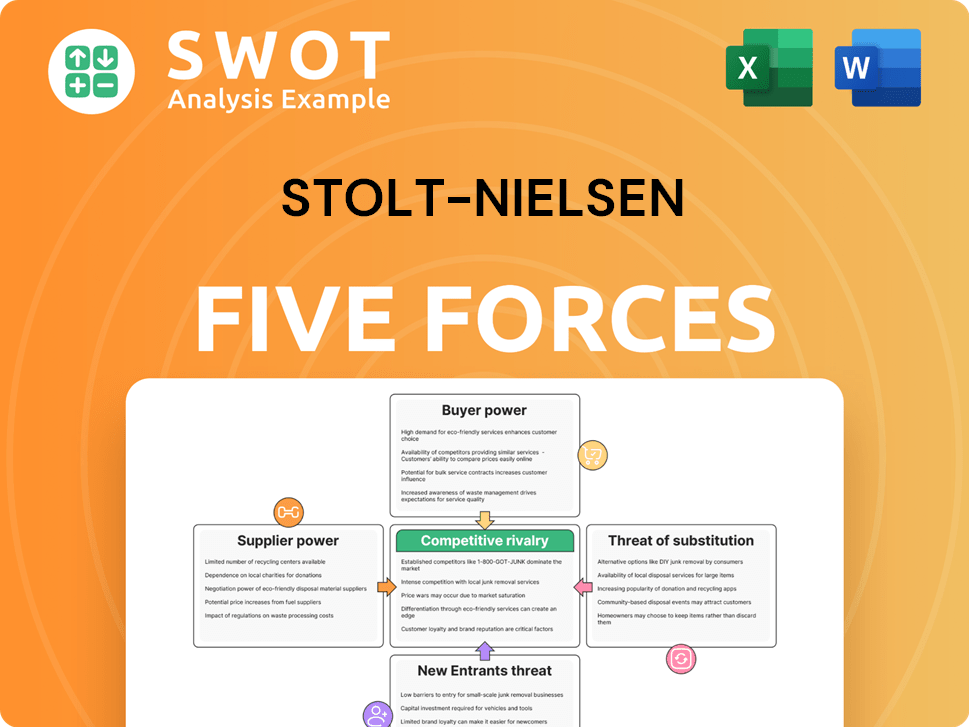

Stolt-Nielsen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stolt-Nielsen Company?

- What is Growth Strategy and Future Prospects of Stolt-Nielsen Company?

- How Does Stolt-Nielsen Company Work?

- What is Sales and Marketing Strategy of Stolt-Nielsen Company?

- What is Brief History of Stolt-Nielsen Company?

- Who Owns Stolt-Nielsen Company?

- What is Customer Demographics and Target Market of Stolt-Nielsen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.