Stolt-Nielsen Bundle

Can Stolt-Nielsen Continue Its Dominance in a Changing World?

Stolt-Nielsen, a titan in the global logistics and shipping arena, recently made headlines with a strategic investment signaling its ambition for sustained expansion. This move underscores the critical importance of a robust growth strategy in today's volatile market. Founded on a pioneering vision, the company has evolved from a specialized shipping venture into a diversified powerhouse.

This deep dive into Stolt-Nielsen's operations will explore its Stolt-Nielsen SWOT Analysis, future prospects, and the key drivers behind its sustained market leadership. We'll dissect the company's business model, assess its financial performance, and analyze its strategic initiatives, including recent acquisitions and investments, to understand its potential for long-term growth. Furthermore, we'll examine how Stolt-Nielsen navigates the challenges and opportunities within the shipping industry, considering its competitive advantages and its response to global economic trends and environmental regulations.

How Is Stolt-Nielsen Expanding Its Reach?

The company is actively pursuing several expansion initiatives to strengthen its market position and diversify revenue streams. These initiatives are strategically designed to capitalize on growing global demand for specialized logistics and sustainable seafood. The focus is on accessing new customer segments and maintaining a competitive edge within their respective industries, which is crucial for long-term growth.

A key area of focus is the expansion of its Stolthaven Terminals network. Significant investments are aimed at increasing storage capacity and improving operational efficiency. This expansion is driven by the increasing demand for specialized storage solutions, particularly in key petrochemical hubs. This strategy is vital for solidifying the company's presence and enhancing its capabilities in handling a wider range of specialty liquids.

In its Stolt Tankers division, the company is optimizing its fleet through strategic newbuilds and vessel upgrades. These efforts are designed to enhance fuel efficiency and reduce emissions, aligning with evolving environmental regulations. While aggressive geographical expansions haven't been widely publicized, the focus remains on deepening penetration in existing, high-value trade lanes, securing long-term contracts, and improving overall operational sustainability. The company’s Stolt Tank Containers division also sees continuous investment to meet growing global demand.

The company is expanding its Stolthaven Terminals network, with a focus on increasing storage capacity. This includes projects like the expansion of the Houston terminal. These expansions are driven by growing demand for specialized storage solutions, particularly in key petrochemical hubs.

Stolt Tankers is optimizing its fleet through newbuilds and vessel upgrades. These enhancements aim to improve fuel efficiency and reduce emissions. The strategy focuses on deepening penetration in existing trade lanes and securing long-term contracts.

Continuous investment in the Stolt Tank Containers fleet is ongoing. This investment supports the growing global demand for door-to-door bulk liquid transportation. Focus is on emerging markets where industrialization is driving increased chemical consumption.

Stolt Sea Farm is actively expanding its production capacity for turbot and sole. Recent investments include new farms and technologies to increase output and improve efficiency. This diversification provides a stable, growing revenue stream.

Furthermore, Stolt-Nielsen's land-based aquaculture business, Stolt Sea Farm, is a significant growth engine. The company is actively expanding its production capacity for turbot and sole, with recent investments in new farms and technologies to increase output and improve efficiency. This diversification into aquaculture provides a stable, growing revenue stream that is less correlated with the cyclical nature of the shipping industry, thereby enhancing overall business resilience. These actions are part of the company's broader Marketing Strategy of Stolt-Nielsen to enhance its market position and financial performance.

The company's expansion initiatives are strategically chosen to access new customer segments and capitalize on growing global demand. These strategies aim to maintain a competitive edge in their respective industries. The focus is on optimizing existing operations and diversifying revenue streams.

- Expanding terminal storage capacity to meet demand.

- Optimizing the tanker fleet for fuel efficiency and emissions reduction.

- Investing in the Stolt Tank Containers fleet for global demand.

- Growing aquaculture production to diversify revenue.

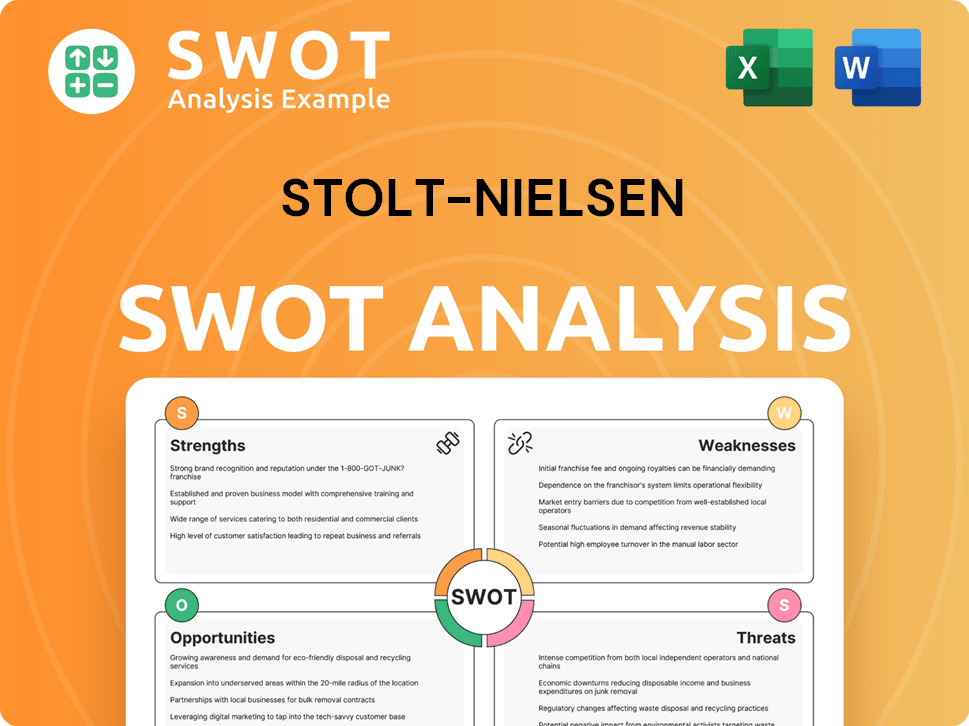

Stolt-Nielsen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Stolt-Nielsen Invest in Innovation?

The company's innovation and technology strategy is a key component of its overall Stolt-Nielsen growth strategy, driving improvements across its diverse operations. This focus is particularly evident in its shipping, terminals, and aquaculture businesses. By embracing digital transformation, automation, and sustainable practices, the company aims to enhance efficiency, reduce environmental impact, and maintain a competitive edge in the market.

Technological advancements are central to the company's approach to operational excellence. This includes the implementation of advanced fleet management systems, real-time cargo tracking, and predictive maintenance technologies. These initiatives are designed to optimize vessel performance, improve safety, and provide superior customer service. Furthermore, the company's commitment to sustainability is reflected in its investments in alternative fuels and propulsion systems, aligning with global efforts to decarbonize the shipping industry.

In the aquaculture sector, innovation is focused on improving aquaculture practices and increasing yield. This involves significant R&D investments in areas such as fish genetics, feed optimization, and advanced recirculation aquaculture systems (RAS) technology. These technological advancements not only contribute to higher production volumes but also ensure the sustainable and responsible farming of turbot and sole.

The company is actively implementing digital solutions to enhance operational efficiency. This includes the use of data analytics and AI to optimize vessel routing and fuel consumption, aiming to reduce operational costs and environmental impact.

The company is investing in alternative fuels and propulsion systems to meet stringent environmental regulations. Research and development are focused on methanol and ammonia-fueled vessels, as well as shore power connections at terminals.

Significant R&D investments are made in fish genetics, feed optimization, and advanced recirculation aquaculture systems (RAS) technology. These advancements contribute to higher production volumes and sustainable farming practices.

The company is implementing advanced fleet management systems to improve operational efficiency. These systems provide real-time cargo tracking and predictive maintenance capabilities.

Data analytics and artificial intelligence are being utilized to optimize vessel routing and fuel consumption. This helps in reducing operational costs and environmental impact.

The company is exploring and investing in alternative fuels such as methanol and ammonia. This aligns with the goal of reducing the carbon footprint of its operations.

The company's technological advancements are focused on creating competitive advantages and improving operational performance. These advancements include:

- Implementation of advanced fleet management systems for real-time tracking and predictive maintenance.

- Use of data analytics and AI to optimize vessel routing and fuel consumption.

- Research and development in alternative fuels like methanol and ammonia to reduce emissions.

- Investments in RAS technology for sustainable aquaculture practices.

- Focus on fish genetics and feed optimization to increase yields in aquaculture.

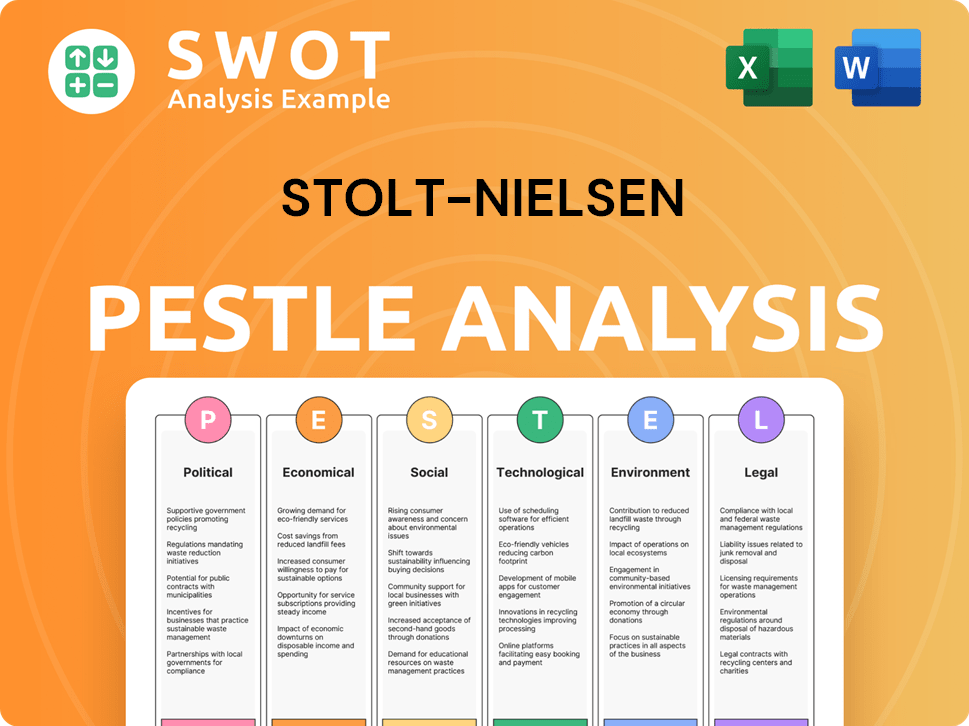

Stolt-Nielsen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Stolt-Nielsen’s Growth Forecast?

The financial outlook for Stolt-Nielsen appears promising, supported by strong recent performance and ambitious growth plans. The company's ability to generate robust cash flow and deliver shareholder value is underpinned by favorable market conditions across its key segments, reflecting a solid foundation for future expansion. A detailed Target Market of Stolt-Nielsen analysis provides additional insights into the company's strategic positioning.

In the first quarter of 2024, Stolt-Nielsen reported a net profit of $83.6 million, an increase from $71.1 million in the previous quarter, indicating a positive financial trajectory. Revenue for the same period reached $710.2 million, up from $695.1 million in the fourth quarter of 2023, demonstrating consistent revenue growth. These figures highlight the company's strong financial health and its ability to navigate market dynamics effectively, contributing to a positive outlook for Stolt-Nielsen's future prospects.

Stolt-Nielsen's financial strategy focuses on disciplined capital allocation, emphasizing investments that support organic growth, strategic acquisitions, and debt reduction. The company's long-term goals include maintaining a healthy balance sheet, optimizing its capital structure, and consistently generating returns above its cost of capital. This approach is designed to ensure sustainable growth and enhance shareholder value.

Stolt Tankers continues to be a significant contributor to profitability, benefiting from stable freight rates and high fleet utilization. This division's performance is crucial to the overall Stolt-Nielsen business model. The chemical tanker market is a key area for Stolt-Nielsen's growth strategy.

Stolthaven Terminals is expected to contribute positively, driven by increased storage demand and ongoing expansion projects. These projects are part of Stolt-Nielsen's expansion plans and strategies. This segment's growth is crucial to the company's market position.

Stolt Tank Containers has shown resilient performance, capitalizing on the demand for flexible and efficient bulk liquid logistics. This resilience is a key aspect of Stolt-Nielsen's competitive advantages in the chemical tanker market. The company's strategies for risk management are evident in this division.

Stolt Sea Farm is projected to continue its growth trajectory, with increasing production volumes and strong market demand for its premium seafood products. This segment contributes to the potential for diversification within Stolt-Nielsen. It reflects the company's long-term growth projections.

Stolt-Nielsen's financial ambitions are underpinned by its diversified business model, which provides resilience against market fluctuations in any single segment, and its commitment to operational efficiency and cost control. The company is focused on maintaining a healthy balance sheet and optimizing its capital structure. The company's financial performance is a key indicator for investors.

- $83.6 million Net Profit (Q1 2024)

- $710.2 million Revenue (Q1 2024)

- Disciplined Capital Allocation

- Focus on Organic Growth and Strategic Acquisitions

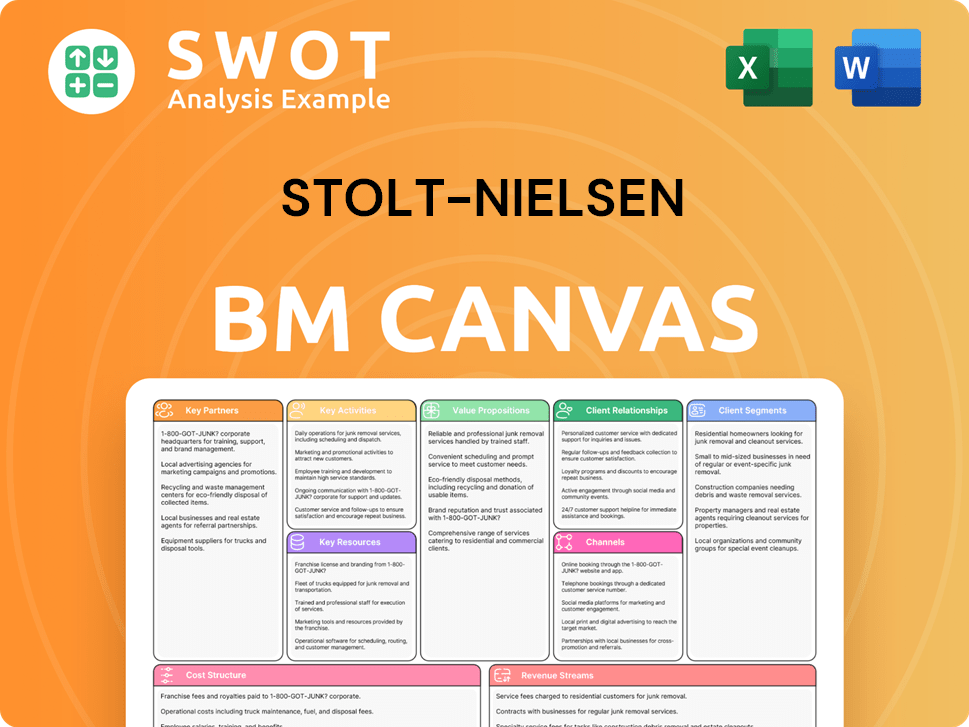

Stolt-Nielsen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Stolt-Nielsen’s Growth?

Despite a positive outlook, the future prospects of Stolt-Nielsen are subject to several potential risks and obstacles. These challenges could impact the company's strategic ambitions and overall financial performance. Understanding these risks is crucial for investors and stakeholders assessing the long-term viability of the company.

Market competition, regulatory changes, and supply chain vulnerabilities are key areas of concern. Additionally, technological disruption and internal resource constraints pose significant hurdles. Addressing these risks proactively is essential for Stolt-Nielsen to sustain its growth trajectory and maintain its market position.

The company's ability to navigate these challenges will determine its success. Strategic initiatives, risk management frameworks, and adaptability to changing market conditions are critical. For a deeper dive into the company's operations, consider exploring Revenue Streams & Business Model of Stolt-Nielsen.

The chemical tanker and tank container markets are highly fragmented, leading to intense competition. Oversupply or aggressive pricing strategies from competitors can erode profit margins. This competitive pressure requires Stolt-Nielsen to continuously innovate and optimize its operations to maintain its market position.

Stricter environmental and shipping safety standards pose ongoing financial risks. Adapting to new emissions regulations requires significant capital expenditure. Compliance with these regulations is crucial, but it can also increase operational costs and impact profitability.

Geopolitical tensions and global events, such as pandemics, can disrupt operations and increase costs. These disruptions can impact delivery schedules. The company's global reach makes it susceptible to regional economic downturns or trade disputes.

Failure to keep pace with advancements in automation, digitalization, or alternative energy sources could be a risk. Technological advancements in shipping are occurring rapidly. Stolt-Nielsen must invest in these areas to remain competitive.

Cybersecurity threats are an increasing concern for globally connected enterprises. These threats can lead to operational disruptions or data breaches. Robust cybersecurity measures are essential to protect operations and data.

Shortages of skilled labor, particularly in specialized shipping or aquaculture, could hinder expansion plans. Attracting and retaining skilled workers is crucial for the company's growth. These internal constraints can limit Stolt-Nielsen's ability to execute its strategic initiatives.

Stolt-Nielsen employs a comprehensive risk management framework. This includes diversification across business segments to mitigate the impact of downturns in any single area. The company also utilizes robust insurance programs to protect against unforeseen events.

Continuous monitoring of market and regulatory landscapes is a key component of Stolt-Nielsen's strategy. This allows the company to anticipate and adapt to changes in the industry. Proactive monitoring helps in making informed decisions.

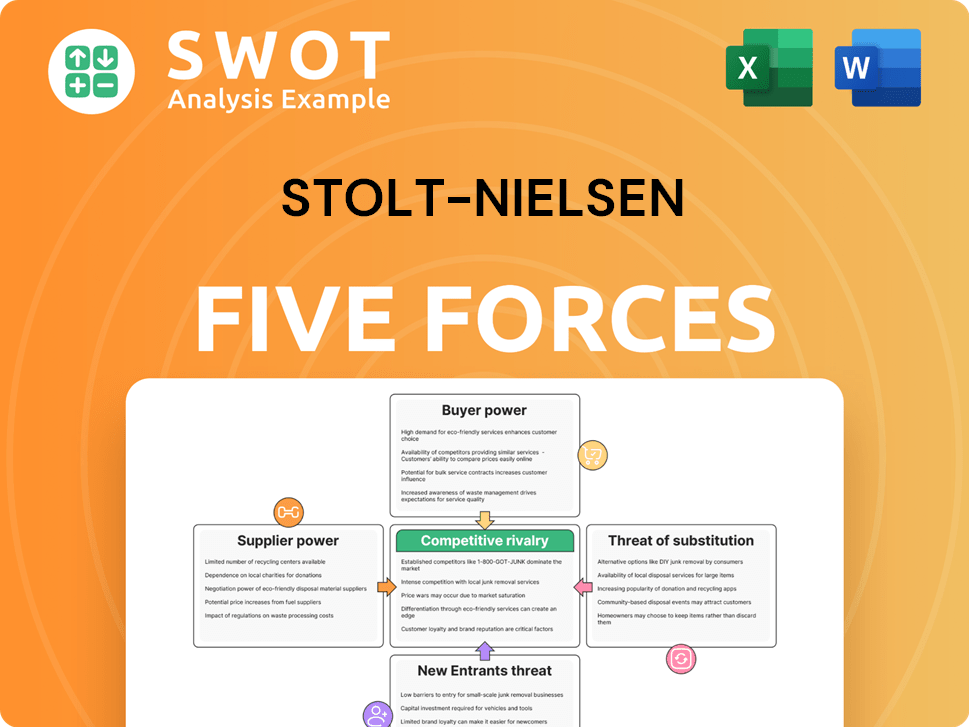

Stolt-Nielsen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stolt-Nielsen Company?

- What is Competitive Landscape of Stolt-Nielsen Company?

- How Does Stolt-Nielsen Company Work?

- What is Sales and Marketing Strategy of Stolt-Nielsen Company?

- What is Brief History of Stolt-Nielsen Company?

- Who Owns Stolt-Nielsen Company?

- What is Customer Demographics and Target Market of Stolt-Nielsen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.