Stolt-Nielsen Bundle

Who Really Controls Stolt-Nielsen?

Unraveling the ownership of a global giant like Stolt-Nielsen is key to understanding its strategy and future. From its humble beginnings in 1959, Stolt-Nielsen has become a leader in transporting bulk liquids, but who holds the reins today? The evolution of its ownership tells a compelling story of growth, adaptation, and influence.

Understanding the Stolt-Nielsen SWOT Analysis is crucial for investors and analysts. This exploration will examine the shifts in Stolt-Nielsen ownership, from its founders to its current shareholders, and how these changes impact its operations. Knowing who owns Stolt-Nielsen provides insights into its strategic direction, governance, and long-term prospects, especially considering its significant presence in the shipping industry with Stolt Tankers.

Who Founded Stolt-Nielsen?

Stolt-Nielsen Limited was established in 1959 by Jacob Stolt-Nielsen. The company's early years saw Jacob Stolt-Nielsen as the primary owner, driving the vision to specialize in shipping liquid chemicals. This focus filled a gap in the market at the time, setting the stage for the company's growth.

Initial ownership details, such as the exact equity split at the start, are not widely available in public records. However, it's understood that Jacob Stolt-Nielsen held the majority stake. Early investors, potentially including family or close associates, likely played a role, typical for a startup.

The company's consistent success under the Stolt-Nielsen name suggests a stable foundation of ownership from the beginning. Information on early disputes or buyouts is not extensively documented. The founder's vision was key, with centralized control enabling the focused development of its specialized shipping services.

Jacob Stolt-Nielsen founded the company in 1959.

The company's initial focus was on specialized shipping for liquid chemicals, a niche market.

Jacob Stolt-Nielsen was the primary owner and driving force in the early years.

Early investment might have included family members or close associates.

The company's long-term stability suggests a consistent ownership structure.

Centralized control under Jacob Stolt-Nielsen allowed for focused development.

The early history of Stolt-Nielsen ownership is rooted in the vision of Jacob Stolt-Nielsen. The company's structure allowed for focused growth in the shipping industry. It's worth exploring the Target Market of Stolt-Nielsen to understand how this early focus shaped its future. While specific details of early Stolt-Nielsen shareholders are limited in public records, the company's success highlights the impact of its founder's vision. Understanding the Stolt-Nielsen history provides context for its current structure.

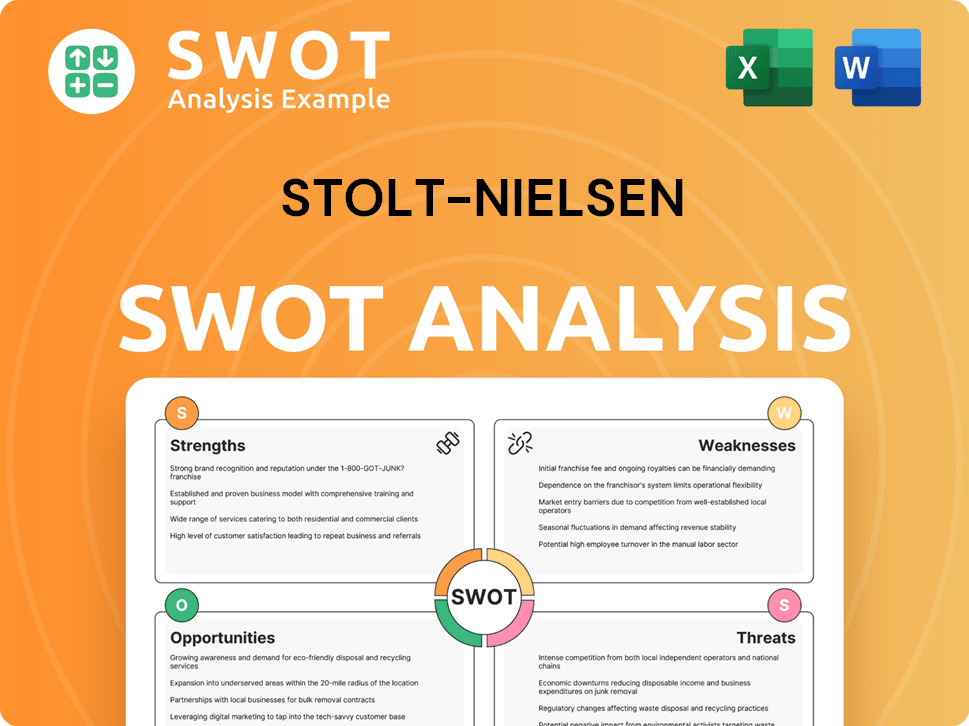

Stolt-Nielsen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Stolt-Nielsen’s Ownership Changed Over Time?

The journey of Stolt-Nielsen from a private entity to a publicly listed company on the Oslo Stock Exchange marks a significant evolution in its ownership structure. This transition opened the door for a broader investor base, yet the founding family has maintained a substantial stake, ensuring their continued influence. The company's history is marked by strategic decisions that have shaped its ownership, reflecting changes in market dynamics and growth strategies.

As of early 2025, the Stolt-Nielsen family, through various holdings, remains a key player in the company's ownership. This ongoing presence is a testament to their commitment and strategic vision. The company's annual reports and filings with regulatory bodies, such as those available through the Oslo Stock Exchange, offer the most current insights into the ownership distribution, including the holdings of institutional investors and any shifts in major shareholders.

| Event | Impact on Ownership | Year |

|---|---|---|

| Initial Public Offering (IPO) | Transition from private to public ownership; introduction of external shareholders. | Early 1990s |

| Secondary Offerings | Potential dilution of existing shareholders; increased public float. | Ongoing |

| Family Holdings | Continued significant ownership by the Stolt-Nielsen family, maintaining influence. | Ongoing |

Major stakeholders in Stolt-Nielsen include the Stolt-Nielsen family, institutional investors, and mutual funds. While the specific percentages held by institutional investors fluctuate, the family's stake remains a consistent feature. Understanding the ownership structure is crucial for investors and stakeholders, as it impacts company strategy and governance. Changes in shareholder composition can lead to shifts in strategic direction and operational decisions. The company's annual and quarterly reports provide the most up-to-date information on the major shareholders and any significant changes in equity allocation.

The Stolt-Nielsen family retains a strong influence over the company's direction.

- The company is publicly listed on the Oslo Stock Exchange.

- Institutional investors and mutual funds are also major shareholders.

- Annual reports provide the most current ownership information.

- Understanding the ownership structure is crucial for investors.

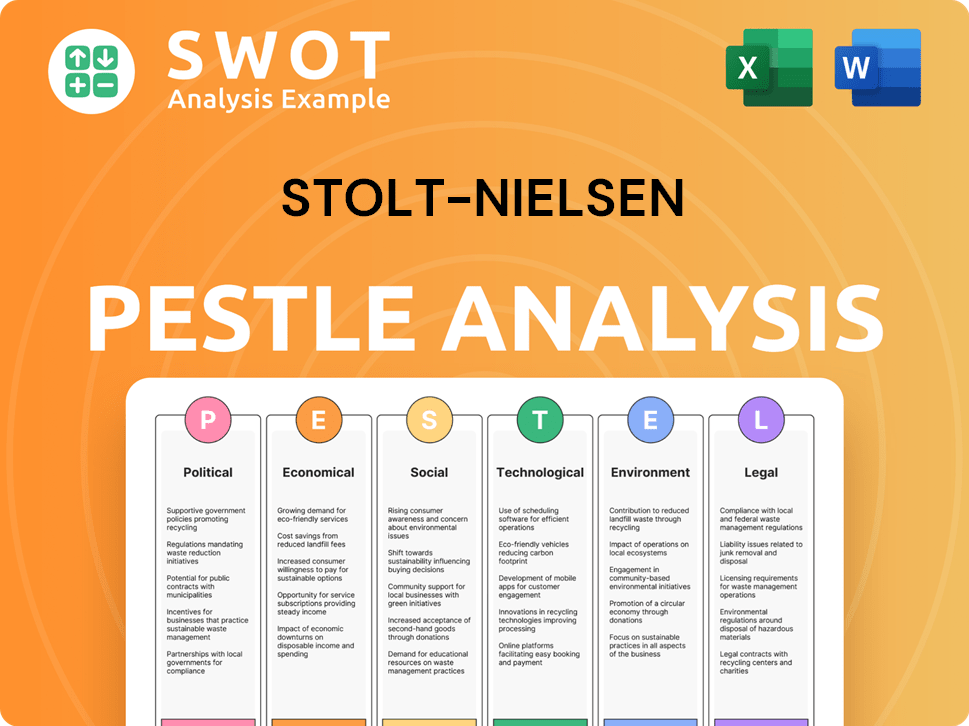

Stolt-Nielsen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Stolt-Nielsen’s Board?

The current Board of Directors of Stolt-Nielsen plays a vital role in the company's governance and its relationship to ownership. The board is typically composed of members representing major shareholders, including the Stolt-Nielsen family, and independent directors. As of the latest available information, Niels G. Stolt-Nielsen, a member of the founding family, serves as the Chief Executive Officer and is also a significant figure on the board, representing the family's continued involvement. Other board members include individuals with backgrounds in finance, shipping, and other relevant industries. The specific composition of the board, including which members represent major shareholders, is detailed in the company's annual reports and proxy statements.

Understanding the board's composition is key to grasping the dynamics of

| Board Member | Role | Notes |

|---|---|---|

| Niels G. Stolt-Nielsen | Chief Executive Officer | Represents the Stolt-Nielsen family. |

| Other Members | Directors | Include individuals with expertise in finance, shipping, and other industries. |

| Independent Directors | Directors | Provide a balanced approach to decision-making. |

The voting structure of Stolt-Nielsen generally follows a one-share-one-vote principle for its common shares. There are no widely reported details of dual-class shares or special voting rights that would grant outsized control to specific individuals or entities beyond their equity stake. Recent public disclosures do not prominently feature proxy battles or governance controversies, suggesting a relatively stable governance environment. The board's decisions aim to balance the interests of all

The board includes family representation and independent directors.

- Niels G. Stolt-Nielsen, CEO, represents the founding family.

- Voting follows a one-share-one-vote principle.

- The board aims to balance shareholder interests.

- Governance appears stable, with no major controversies.

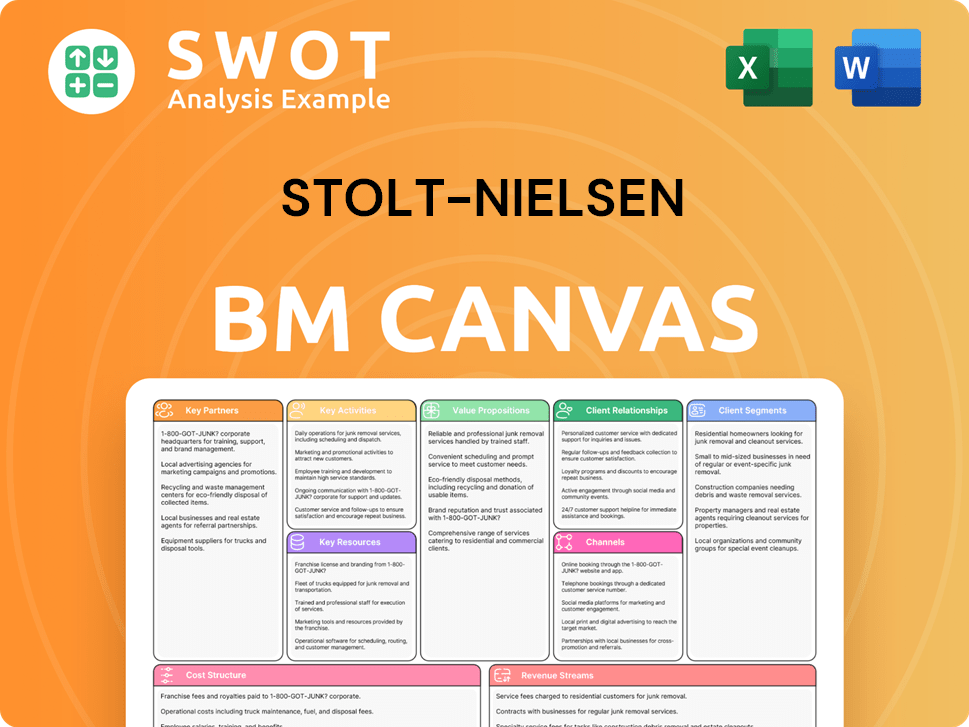

Stolt-Nielsen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Stolt-Nielsen’s Ownership Landscape?

Over the past few years (2022-2025), the ownership structure of Stolt-Nielsen has evolved within the context of the global shipping and logistics markets. While specific details on share buybacks and secondary offerings require referencing the most recent financial reports, the company consistently evaluates its capital structure. Acquisitions, such as the 2024 purchase of Fairfield Chemical Carriers' chemical tanker operations, may lead to shifts in ownership as new strategic partnerships form, potentially involving new significant investors or adjustments to existing stakes. Examining the Growth Strategy of Stolt-Nielsen provides additional context on the company's expansion and how it might influence ownership dynamics.

Leadership changes and any departures of founders, while not directly impacting ownership shifts in recent years, are always important factors in long-term ownership trends. The ongoing presence of the Stolt-Nielsen family in executive and board positions indicates a stable and sustained influence. Industry trends, such as increasing institutional ownership across the shipping and logistics sectors, likely reflect within Stolt-Nielsen, with major investment funds and asset managers seeking exposure to established global operators. Founder dilution, a natural progression for publicly traded companies, seems to be managed to preserve the family's significant influence. There have been no major public announcements by the company or analysts regarding significant future ownership changes, such as privatization or a major new public listing, beyond the regular course of business.

Stolt-Nielsen is a publicly traded company. The ownership structure involves a mix of institutional investors, the Stolt-Nielsen family, and other shareholders. The family's influence remains significant, ensuring stability. Institutional investors often hold substantial stakes, reflecting the company's standing in the shipping industry.

Major shareholders include institutional investors and members of the Stolt-Nielsen family. The exact percentages of ownership change over time. It is recommended to consult the latest annual reports and filings for the most accurate and up-to-date information on Stolt-Nielsen shareholders.

Recent developments include acquisitions and strategic partnerships that can affect Stolt-Nielsen ownership. The company regularly evaluates its capital structure. Any significant transactions are usually announced through official channels, so it is essential to follow official announcements for the latest news about Stolt-Nielsen ownership.

The future outlook for Stolt-Nielsen involves monitoring the shipping and logistics sectors. Any changes in the ownership structure will depend on market conditions and strategic decisions. Investors should stay informed through the company's reports and announcements.

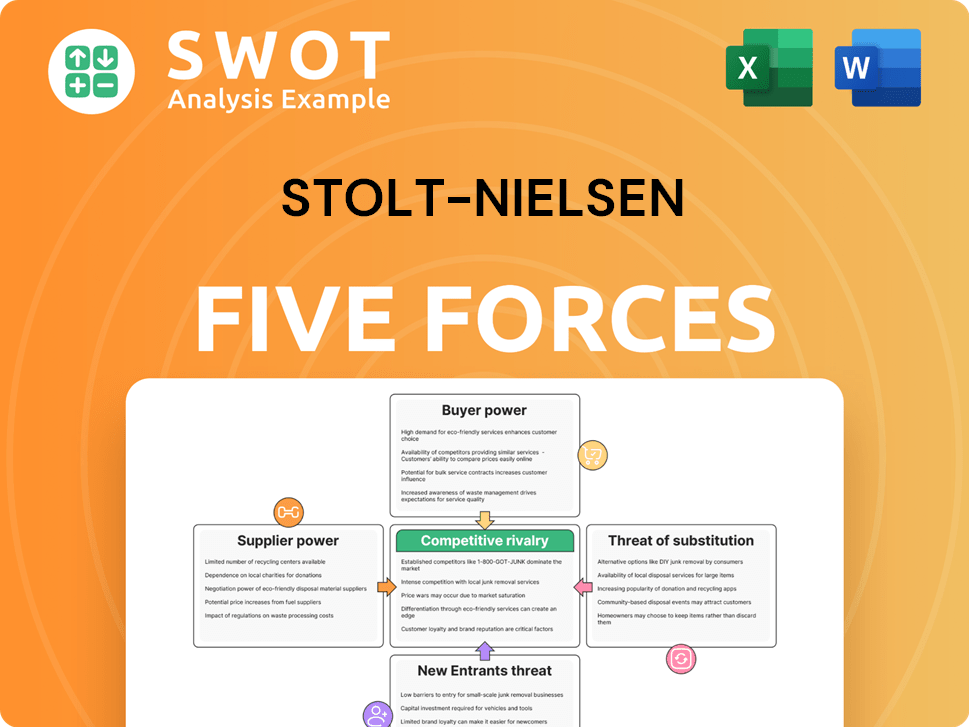

Stolt-Nielsen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stolt-Nielsen Company?

- What is Competitive Landscape of Stolt-Nielsen Company?

- What is Growth Strategy and Future Prospects of Stolt-Nielsen Company?

- How Does Stolt-Nielsen Company Work?

- What is Sales and Marketing Strategy of Stolt-Nielsen Company?

- What is Brief History of Stolt-Nielsen Company?

- What is Customer Demographics and Target Market of Stolt-Nielsen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.