Stolt-Nielsen Bundle

How Does Stolt-Nielsen Company Thrive in a Complex Market?

Stolt-Nielsen, a global powerhouse in specialty liquids transportation and aquaculture, recently posted a Q1 2025 net profit of $151.4 million, demonstrating its resilience. Despite facing market fluctuations, the company's diverse portfolio, including Stolt Tankers and tank containers, continues to generate substantial revenue. But how does Stolt-Nielsen SWOT Analysis contribute to its strategic direction?

This deep dive into Stolt-Nielsen operations will explore its strategic acquisitions and financial performance, offering insights for investors and industry watchers. Understanding Stolt-Nielsen's services and its role within the chemical industry is key to grasping its long-term growth potential. We'll examine the company's structure, its global footprint, and how it manages its supply chain, providing a comprehensive analysis of this logistics leader.

What Are the Key Operations Driving Stolt-Nielsen’s Success?

The Stolt-Nielsen Company creates value through its integrated logistics services, primarily focusing on bulk liquid chemicals and other specialty liquids. Its core operations serve a wide array of global customer segments. The company's structure is designed to provide comprehensive solutions, from transportation to storage and distribution.

Stolt-Nielsen's operational framework is divided into key segments, each contributing to its overall service offerings. These segments include Stolt Tankers, Stolthaven Terminals, Stolt Tank Containers, Stolt Sea Farm, and Stolt-Nielsen Gas. This diversified approach allows the company to address various aspects of the logistics chain, ensuring efficiency and customer satisfaction.

The company's value proposition is centered on providing reliable, safe, and efficient logistics solutions. It emphasizes customer-centric services, technological innovation, and sustainability. Stolt-Nielsen aims to meet the evolving needs of its customers while minimizing environmental impact.

Stolt Tankers operates a fleet of over 160 tankers, including deep-sea, coastal, and inland vessels. These tankers transport chemicals, edible oils, acids, and clean petroleum products globally. This extensive fleet supports the company's ability to provide comprehensive transportation services.

Stolthaven Terminals manages a global network of 20 owned and joint-venture bulk-liquid terminals. The total storage capacity across these terminals is 4.1 million cubic meters. These terminals offer essential storage and distribution services.

Stolt Tank Containers provides door-to-door logistics and transportation for bulk-liquid chemicals and food-grade products. This segment focuses on ensuring safe and efficient transport solutions. It handles a wide range of products.

Stolt-Nielsen's operational processes emphasize safety, efficiency, and sustainability. Significant investments are made in technology and digital solutions. These investments aim to optimize routes and enhance customer interactions.

A key differentiator for Stolt-Nielsen is its tank cleaning expertise, which ensures the safe transport of various cargoes. The company also leverages AI and machine learning to enhance operational efficiency and improve pricing strategies. This technological integration, combined with a strong customer focus, allows for tailored service solutions.

- Tank Cleaning Expertise: Ensures safe and effective transport of diverse cargoes, a significant competitive advantage.

- Technological Integration: Uses AI and machine learning to forecast supply and demand, optimize pricing, and improve operational efficiency.

- Customer-Centric Approach: Offers tailored service solutions, with a customer retention rate of 92% in 2023.

- Global Supply Chain: Extensive supply chain and distribution networks cater to regional nuances and regulatory demands across key markets.

The company's supply chain, partnerships, and distribution networks are globally extensive, enabling it to cater to regional nuances and regulatory demands across Asia, Europe, the Americas, and the Middle East. To understand more about their target market, you can read about the Target Market of Stolt-Nielsen.

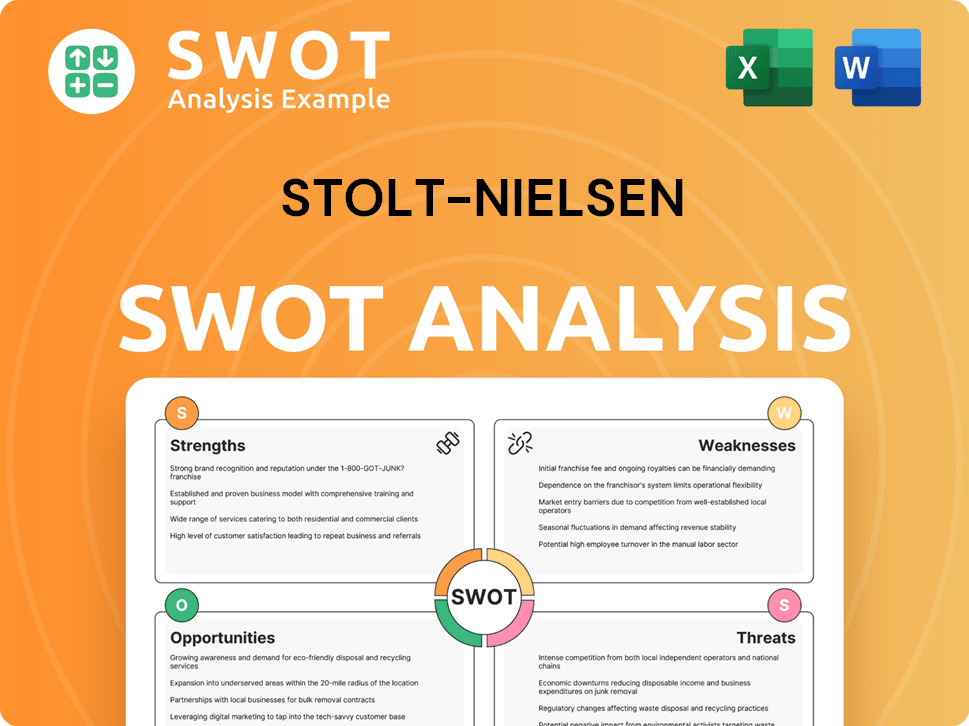

Stolt-Nielsen SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Stolt-Nielsen Make Money?

The Stolt-Nielsen Company generates revenue through a diversified portfolio of businesses, with the tanker segment being the primary driver of its financial performance. The company's revenue streams are segmented across various services, including chemical and liquid bulk transportation, terminal operations, tank container leasing, and aquaculture. In the fiscal year ending November 30, 2024, total revenue reached $2.89 billion, showcasing the scale of Stolt-Nielsen operations.

In the first quarter of 2025, the company reported a revenue of $675.6 million, demonstrating its ongoing financial activity. This revenue is derived from a mix of freight, storage, and other services. The company's revenue streams are strategically managed to maximize profitability and adapt to market conditions, which is crucial for Stolt-Nielsen logistics.

The company's financial health is closely tied to its ability to optimize margins and respond to market dynamics, including trade policies. Stolt-Nielsen services are essential for the global transportation of chemicals and other liquid bulk products, making it a key player in the industry.

The largest revenue contributor is freight from Stolt Tankers, generating $1.53 billion in 2024. This segment's operating profit in Q1 2025 was $66.6 million.

Stolthaven Terminals brought in $308.0 million in revenue in 2024, up from $299.8 million in 2023. The operating profit in Q1 2025 was $28.5 million.

The operating profit for Stolt Tank Containers in Q1 2025 was $15.2 million. The revenue decreased by $47.4 million in 2024.

Stolt Sea Farm generated $126.8 million in operating revenue in 2024. The operating profit before fair value adjustment of biomass was $7.4 million in Q1 2025.

These segments also contribute to the company's revenue. Stolt-Nielsen Gas reported an operating loss of $3.5 million in Q1 2025.

The company employs various strategies to generate revenue, including contracts of affreightment and spot market contracts. Margin optimization, especially within Stolthaven Terminals, is a key focus. The company actively monitors US trade policy implications, which can affect trade flows and freight rates.

- Contracts of affreightment provide a stable revenue stream.

- Spot market contracts allow for flexibility and capturing market opportunities.

- Margin optimization efforts have led to observable gains.

- Monitoring trade policies helps in adapting to market changes.

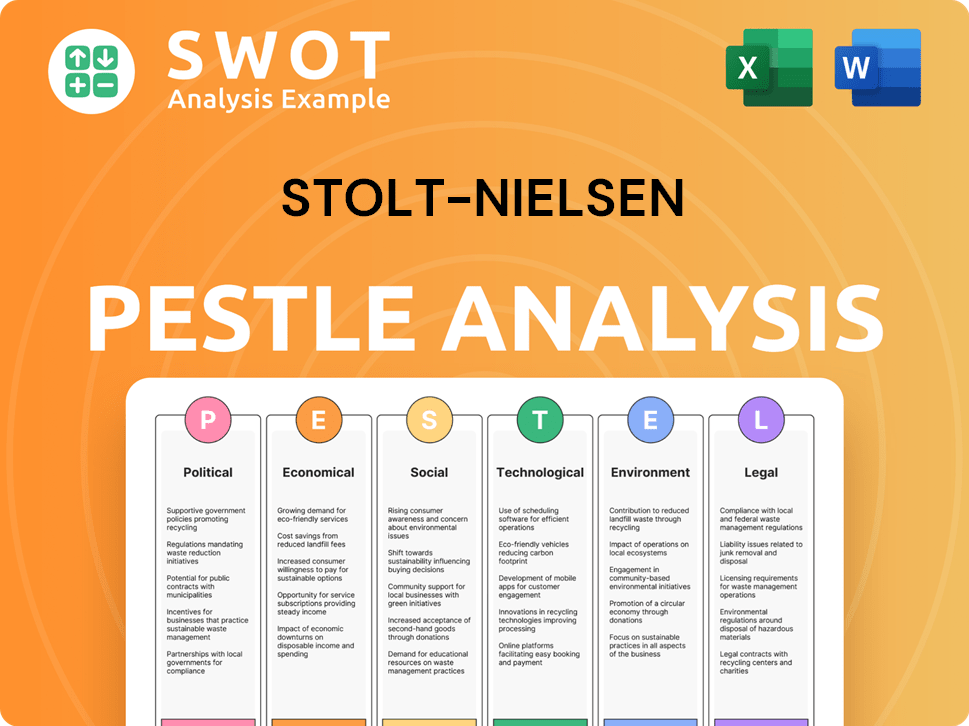

Stolt-Nielsen PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Stolt-Nielsen’s Business Model?

Founded in 1959, the Stolt-Nielsen Company has established itself as a significant player in the logistics and transportation sector. The company's journey has been marked by strategic expansions and a commitment to operational excellence, solidifying its position in the global market. Its evolution showcases a dedication to adapting to industry changes and maintaining a competitive edge.

Key milestones for Stolt-Nielsen operations include the continuous expansion of its fleet and terminal network. This expansion has been crucial in establishing its global leadership in bulk liquid transportation. The company's strategic moves, especially in late 2024 and early 2025, highlight its proactive approach to market opportunities and its commitment to enhancing its service offerings. A recent article, Marketing Strategy of Stolt-Nielsen, provides additional insights into the company's approach.

The company's ability to navigate market volatility and geopolitical events is a testament to its resilience. Despite facing challenges, such as the impact on tanker markets, Stolt-Nielsen services continue to adapt and innovate, ensuring sustained value for its stakeholders. The company’s diversified portfolio and strategic investments underscore its long-term growth strategy.

The company has consistently expanded its fleet and terminal network. In 2023, it reported over 95% compliance with international maritime regulations. This expansion has been crucial in establishing its global leadership in bulk liquid transportation.

In late 2024 and early 2025, the company acquired the remaining 50% of the Hasselt four joint venture. It also took full control of Avenir LNG. These moves are expected to contribute an annual EBITDA of $50 million.

The brand strength and extensive global network of chemical tankers, tank containers, and terminals are key advantages. The company has specialized expertise in handling a vast array of liquid chemicals. The company's commitment to innovation is evident in its allocation of $10 million towards research and development in 2024.

While Stolt Tankers' EBITDA decreased by 17% in Q1 2025, the overall company EBITDA was only down 9%. Non-shipping businesses showed a 6% increase. The company continues to invest in digital solutions and new technologies to enhance its depot services.

The company invested $10 million in research and development in 2024, leading to an eco-friendly shipping solution. This innovation reduces carbon emissions by 25%. AI and machine learning improved operational efficiency by 20% in 2023.

- Eco-friendly shipping solutions.

- AI and machine learning for efficiency.

- Investment in digital solutions.

- Focus on sustainability initiatives.

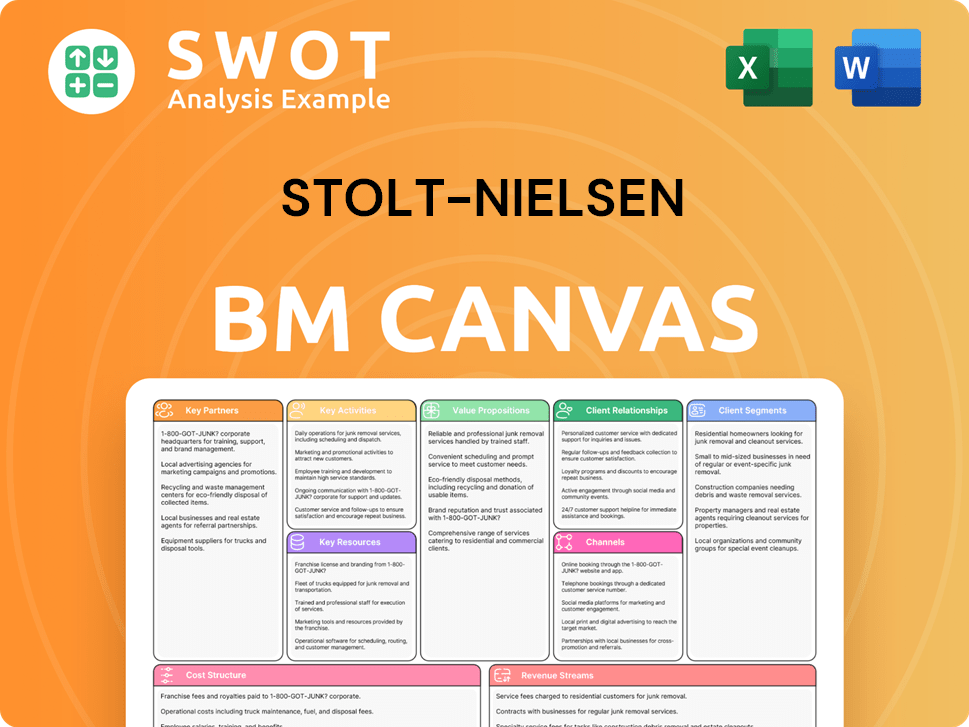

Stolt-Nielsen Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Stolt-Nielsen Positioning Itself for Continued Success?

The Stolt-Nielsen Company maintains a strong position in the global logistics market, particularly in the transportation of liquid chemicals and other bulk liquids. With a significant market share and a focus on customer retention, Stolt-Nielsen operations span across key regions, ensuring a robust presence in the industry. This strategic positioning supports its goal of increasing market share and maintaining operational excellence.

Understanding the risks and future outlook is crucial for assessing Stolt-Nielsen’s long-term prospects. While the company benefits from its diversified portfolio and strategic initiatives, it also faces challenges such as market volatility and the need to adapt to technological changes. The company's commitment to sustainability and strategic acquisitions highlights its proactive approach to future growth.

In 2023, Stolt-Nielsen held a 12% market share in the chemical logistics sector. The company aims to increase its market share by 5% in key segments by the end of 2024. Its global presence includes operations in the United States, Belgium, Malaysia, and China, with Europe and North America contributing 60% of total revenues in 2024.

Market volatility, particularly in tanker markets, poses a significant risk. US trade policy and tariffs could affect traded goods. New competitors and technological disruption also present ongoing challenges. The LNG bunkering market, projected to grow at a CAGR of 12.3% through 2030, presents risks related to LNG price volatility and competition.

Strategic initiatives focus on margin optimization across terminals, with expected improvements in utilization. Stolt-Nielsen is investing in depot services through digital solutions and new technologies. The company plans to expand profitability through a diversified portfolio and acquisitions like Avenir LNG.

The company aims to achieve carbon neutrality by 2050. It plans to reduce carbon intensity by 50% by 2030. Stolt-Nielsen plans to have at least one carbon-neutral ship by 2030. For more information on the company's ownership, you can read Owners & Shareholders of Stolt-Nielsen.

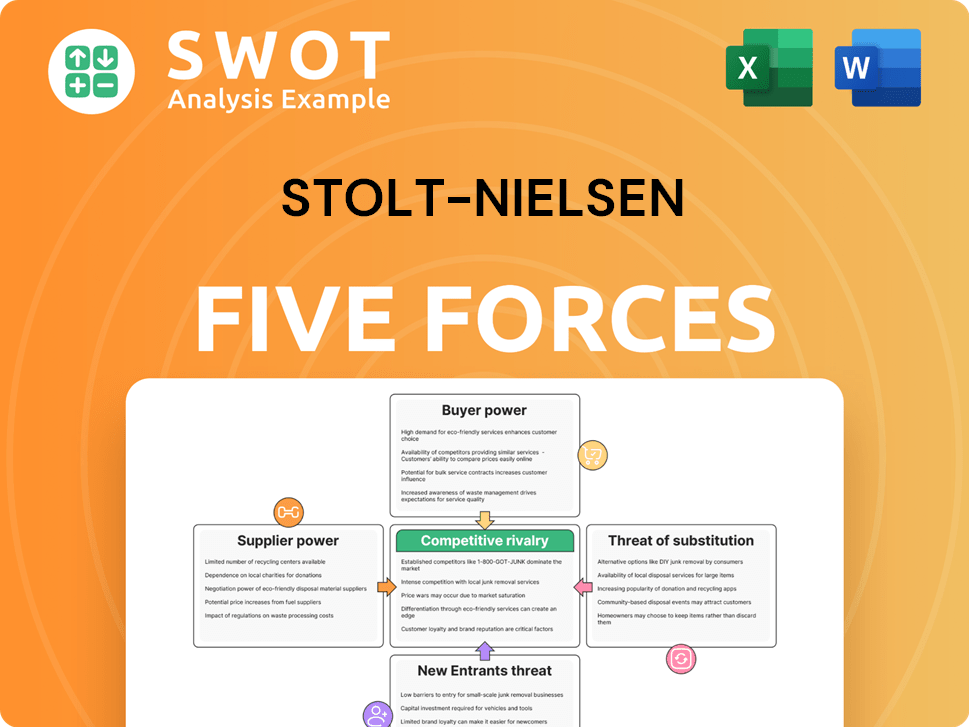

Stolt-Nielsen Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stolt-Nielsen Company?

- What is Competitive Landscape of Stolt-Nielsen Company?

- What is Growth Strategy and Future Prospects of Stolt-Nielsen Company?

- What is Sales and Marketing Strategy of Stolt-Nielsen Company?

- What is Brief History of Stolt-Nielsen Company?

- Who Owns Stolt-Nielsen Company?

- What is Customer Demographics and Target Market of Stolt-Nielsen Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.