Stryker Bundle

Navigating the Medical Device Arena: How Does Stryker Stack Up?

Stryker Corporation, a titan in the medical technology sector, is constantly navigating a complex and dynamic competitive landscape. From its humble beginnings in 1941, Stryker has become a global force, revolutionizing healthcare through innovation in orthopedics, surgical equipment, and neurotechnology. But who are its main rivals, and how does Stryker maintain its leading edge in this fiercely contested market?

This exploration of the Stryker SWOT Analysis will dissect the company's competitive environment, providing a detailed Stryker market analysis. We'll identify key Stryker competitors and evaluate their strategies, assessing Stryker's position within the medical device industry. Understanding the competitive advantages of Stryker's products and its strategies for market dominance is crucial for any investor or industry professional seeking to understand the company's future prospects, including its response to competitor product launches and its overall financial performance compared to competitors.

Where Does Stryker’ Stand in the Current Market?

Stryker holds a significant market position in the medical technology industry, consistently ranking among the top global players. The company is a leader in several key segments, particularly in orthopaedics, where it maintains a substantial market share. This strong position allows Stryker to influence market trends and maintain a competitive edge. The company’s diverse product portfolio and global presence contribute to its robust market standing.

The company's financial health remains robust, with strong cash flow generation and a commitment to innovation, as evidenced by its continued investment in research and development. Stryker's consistent financial performance and strategic market moves reinforce its leading position in the global medical technology landscape. This stability is a key factor in its ability to withstand competitive pressures and pursue growth opportunities. Stryker's strategic acquisitions have also played a crucial role in expanding its market presence and product offerings.

Stryker's core operations revolve around the design, development, manufacturing, and marketing of medical devices, with a focus on orthopaedics, MedSurg, neurotechnology, and spine. The company's value proposition centers on providing innovative, high-quality products and services that improve patient outcomes and enhance healthcare efficiency. This commitment to innovation and quality has helped Stryker maintain a strong reputation and customer loyalty within the medical device industry.

Stryker holds a leading position in the orthopedic market, including joint replacement, trauma, and sports medicine. In Q1 2024, the company reported net sales of $5.2 billion. The MedSurg segment saw a 10.5% organic net sales increase in Q1 2024.

Stryker has a strong global presence with substantial operations and sales in North America, Europe, and emerging markets. North America continues to be a primary revenue driver. The company is expanding its footprint in high-growth regions.

Stryker has strategically shifted its positioning through targeted acquisitions. The acquisition of Mako Surgical in 2013 propelled Stryker to the forefront of robotic-assisted joint replacement. These moves reflect a broader trend of digital transformation and diversification.

Stryker's financial health remains robust, with strong cash flow generation and a commitment to innovation. Organic net sales increased by 9.7% in Q1 2024, demonstrating robust performance. The Neurotechnology and Spine segments saw an 8.7% organic net sales increase in Q1 2024.

Stryker's competitive advantages include a diversified product portfolio, a strong global presence, and a focus on innovation. The company's investment in research and development, along with strategic acquisitions, supports its market leadership. Understanding the Stryker competitive landscape is crucial for investors and industry analysts.

- Leading market share in key segments, particularly orthopaedics.

- Strong financial performance, with consistent revenue growth and profitability.

- Strategic acquisitions that expand product offerings and market reach.

- Commitment to innovation, including investments in robotic-assisted surgery and digital health.

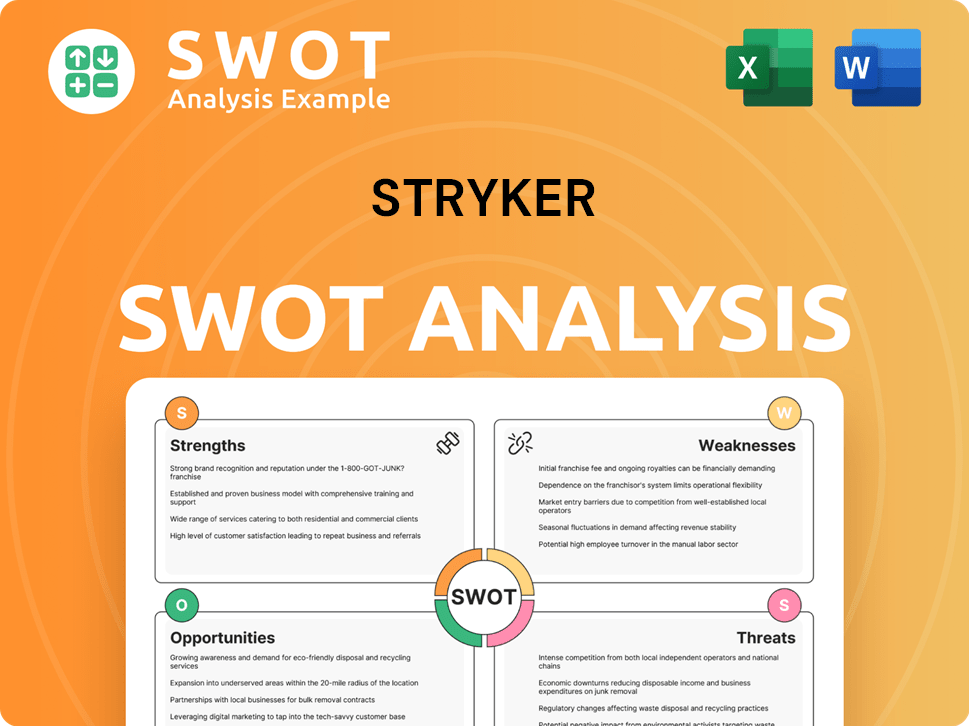

Stryker SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Stryker?

The Stryker competitive landscape is characterized by intense rivalry across its various segments. The medical device industry is highly competitive, with companies constantly vying for market share through innovation, pricing, and distribution strategies. This environment necessitates continuous adaptation and strategic initiatives to maintain a strong market position.

Stryker's market analysis reveals a complex interplay of established players and emerging innovators. The company faces both direct and indirect competition, requiring it to continually enhance its product offerings and operational efficiency. Understanding the competitive dynamics is crucial for assessing Stryker's growth potential and strategic positioning.

The orthopedic market, a significant segment for Stryker, is particularly competitive. Key players in this space include Johnson & Johnson (DePuy Synthes) and Zimmer Biomet. These competitors offer comprehensive product portfolios, challenging Stryker's dominance in joint reconstruction and other orthopedic procedures. Stryker's ability to innovate and maintain a competitive edge in this market is vital for its overall success.

Johnson & Johnson (DePuy Synthes) is a major competitor, offering a wide range of orthopedic products. Zimmer Biomet is another significant rival, particularly in knee and hip implants. These companies compete directly with Stryker in the orthopedic market.

Companies like Karl Storz and Olympus provide advanced surgical equipment, competing with Stryker's offerings. These competitors focus on innovation in visualization and surgical instruments. Their specialized focus allows them to challenge Stryker in specific niches.

Penumbra and Terumo are key competitors in the neurotechnology space, offering neurovascular devices. These companies compete with Stryker in the market for neurosurgical and neurovascular solutions. The neurotechnology market is experiencing rapid technological advancements.

New entrants are leveraging technologies like AI and 3D printing to disrupt traditional markets. These emerging innovators pose a challenge to established players like Stryker. The adoption of advanced technologies is reshaping the competitive landscape.

Consolidation in the medical device industry creates larger, more diversified competitors. These larger entities have enhanced market power and can compete more effectively. Mergers and acquisitions significantly impact the competitive dynamics.

Competitors use aggressive pricing, rapid innovation, and extensive distribution networks. Strong brand recognition also plays a crucial role in the competitive landscape. These strategies are essential for gaining and maintaining market share.

Stryker's competitive advantages include its diversified product portfolio and strong presence in the orthopedic market. The company's Mako robotic-assisted surgery system provides a technological edge. However, Stryker faces challenges from competitors with aggressive pricing and rapid innovation.

- Market Share: Stryker holds a significant market share in orthopedics, but faces intense competition from Johnson & Johnson and Zimmer Biomet.

- Innovation: Stryker's innovation in surgical robotics, such as the Mako system, is a key differentiator.

- Financial Performance: Stryker's financial performance is closely watched against competitors to assess its market position. In 2024, Stryker's revenue was approximately $20 billion, reflecting its strong market presence.

- Acquisitions: Recent acquisitions have aimed to strengthen Stryker's product offerings and market position.

- Challenges: Stryker must navigate challenges such as pricing pressures, regulatory hurdles, and the need for continuous innovation.

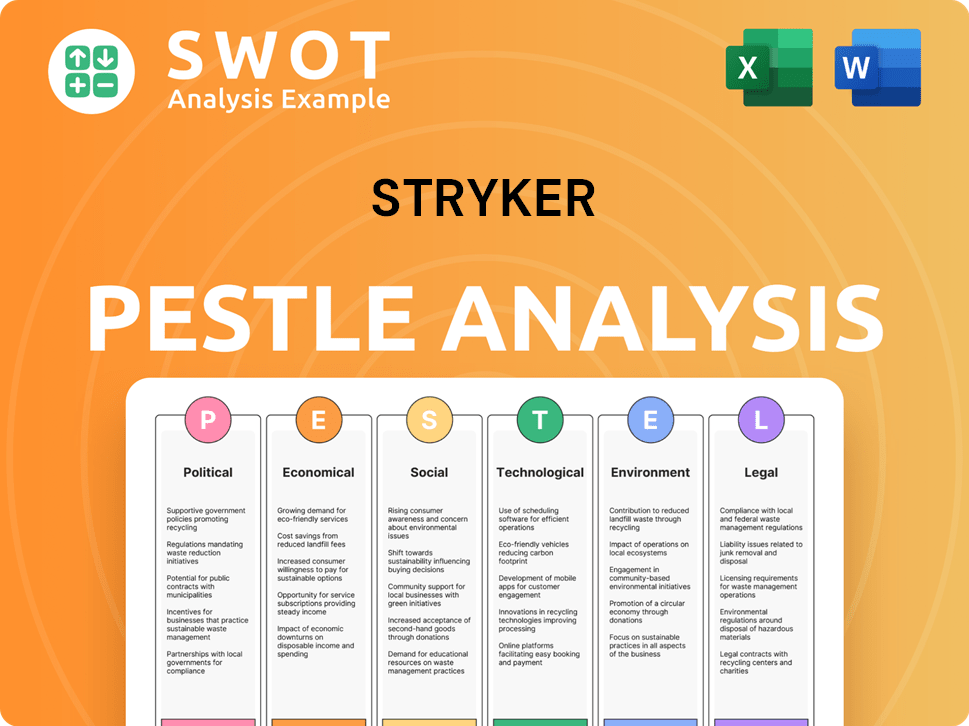

Stryker PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Stryker a Competitive Edge Over Its Rivals?

The Growth Strategy of Stryker is significantly shaped by its robust competitive advantages, allowing it to maintain a leading position in the medical technology industry. These advantages include a strong focus on innovation, brand equity, and operational efficiency. This has enabled the company to consistently introduce advanced products and solutions, build strong relationships with healthcare providers, and achieve broad market penetration.

A key aspect of Stryker's success lies in its strategic investments in research and development (R&D). This commitment fuels the creation of cutting-edge technologies and proprietary products, such as the Mako SmartRobotics system, which enhances precision in joint replacement surgeries. This innovation not only attracts surgeons and healthcare institutions but also sets Stryker apart in the competitive landscape of the orthopedic market.

Furthermore, Stryker benefits from a vast patent portfolio and a global distribution network, ensuring its products reach a wide customer base efficiently. The company's strong brand reputation and customer loyalty, built over decades, further solidify its market position. These factors, combined with a skilled workforce, contribute to Stryker's ability to maintain a premium market position and defend against competitive pressures.

Stryker's consistent investment in R&D is a cornerstone of its competitive advantage. This focus has led to the development of innovative products like the Mako SmartRobotics system, which has revolutionized joint replacement surgeries. The company's commitment to innovation is evident in its financial reports, with R&D expenses consistently representing a significant portion of its revenue.

Stryker has cultivated a strong brand reputation for quality and reliability, fostering deep relationships with healthcare professionals. This has resulted in high customer loyalty and repeat business. The company's strong brand equity allows it to command premium pricing in the market, which is a testament to its trusted position in the medical device industry.

Stryker's extensive distribution network ensures broad market penetration and timely product delivery. This global reach is crucial in the medical device industry, allowing the company to serve a diverse customer base. The efficiency of its distribution network contributes significantly to its competitive advantage, enabling it to reach customers efficiently worldwide.

Stryker benefits from significant economies of scale, which allow for efficient manufacturing, procurement, and distribution. This leads to reduced costs and improved profitability. The company's operational efficiency is a key factor in its ability to maintain a competitive edge in the medical device market, allowing it to optimize its resources and improve its financial performance.

Stryker's competitive advantages are multifaceted, encompassing innovation, brand strength, and operational efficiency. The company's focus on R&D, particularly in areas like surgical robotics, allows it to introduce groundbreaking products that differentiate it from competitors. This is evident in its market share analysis, where Stryker consistently holds a significant position in the orthopedic market.

- Innovation Pipeline: Continuous investment in R&D, with R&D spending reaching approximately $1.2 billion in 2023.

- Brand Equity: A strong reputation built over decades, leading to high customer loyalty and repeat business.

- Global Reach: Extensive distribution network ensuring broad market penetration and timely delivery of products.

- Operational Efficiency: Economies of scale leading to efficient manufacturing and procurement, enhancing profitability.

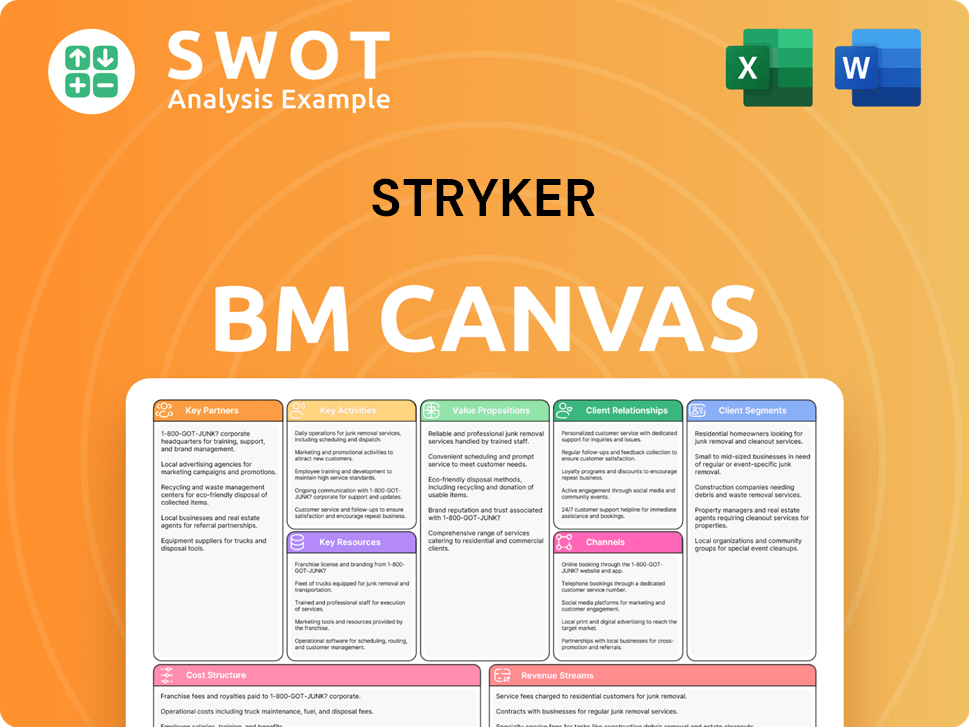

Stryker Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Stryker’s Competitive Landscape?

The medical technology industry is experiencing rapid transformation, influencing the Stryker competitive landscape. Technological advancements, particularly in areas like robotics and AI, are crucial for future growth. Regulatory changes and shifting consumer preferences also present challenges and opportunities for Stryker market analysis.

Stryker's ability to adapt to global economic shifts, including inflation and supply chain disruptions, will be critical. New market entrants and increased consolidation within the healthcare provider landscape could intensify competition. However, emerging markets offer significant growth potential for Stryker.

Technological advancements in robotics, AI, and personalized medicine are major trends. There is a growing demand for robotic-assisted surgeries, which Stryker is addressing with its Mako SmartRobotics. Regulatory changes and consumer preferences for less invasive procedures are also shaping the industry.

Continuous R&D investment is needed to stay at the forefront of technology. Stricter regulations and increased scrutiny on medical device efficacy pose challenges. Inflation and supply chain disruptions continue to impact manufacturing costs. New market entrants and consolidation within the healthcare provider landscape could intensify competition.

Emerging markets offer significant growth potential due to increased access to healthcare. Product innovations, such as next-generation implants and smart surgical instruments, provide avenues for expansion. Strategic partnerships with healthcare systems and technology companies can unlock new growth pathways.

Stryker needs to emphasize innovation, operational efficiency, and strategic market expansion. Focus on adapting to evolving technologies and consumer preferences. Navigating global economic shifts and building strategic partnerships are also key.

Stryker's ability to navigate industry trends will determine its future success. Innovation in surgical robotics and digital health initiatives are crucial. The company's response to competitor product launches and its overall strategies for market dominance are also important.

- Technological Advancements: Investment in R&D, particularly in robotics and AI.

- Regulatory Environment: Compliance with stricter approval processes and safety standards.

- Market Dynamics: Adapting to consumer preferences and global economic shifts.

- Strategic Partnerships: Collaborations to expand market reach and access new technologies.

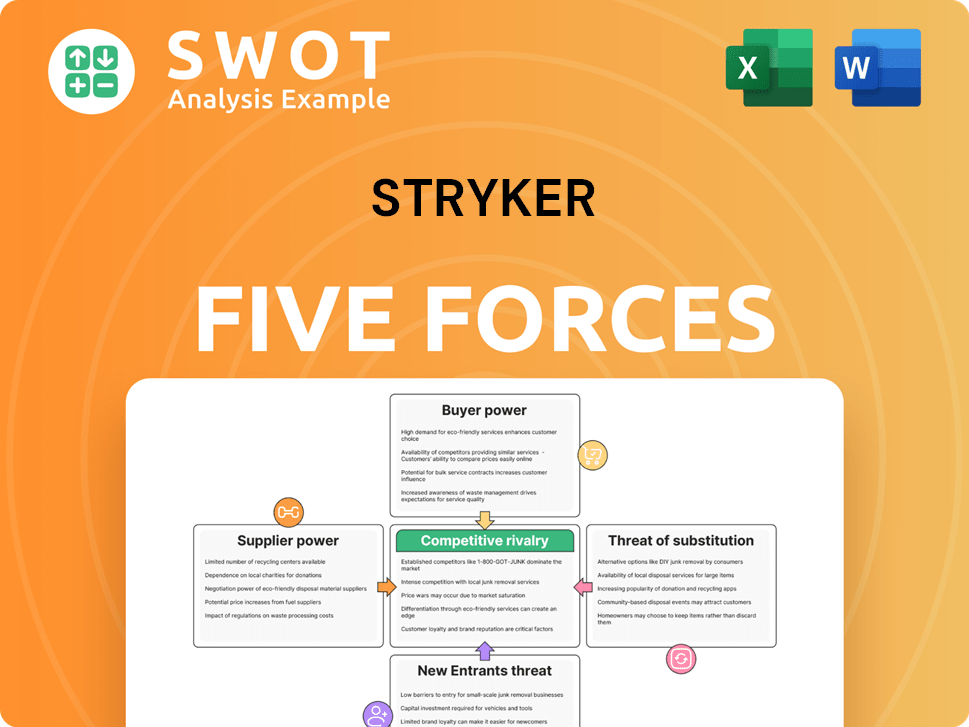

Stryker Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stryker Company?

- What is Growth Strategy and Future Prospects of Stryker Company?

- How Does Stryker Company Work?

- What is Sales and Marketing Strategy of Stryker Company?

- What is Brief History of Stryker Company?

- Who Owns Stryker Company?

- What is Customer Demographics and Target Market of Stryker Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.