Stryker Bundle

How Does Stryker Thrive in the Medical Technology Arena?

Stryker, a powerhouse in medical technology, consistently delivers impressive financial results, as evidenced by its strong performance in 2024 and the first quarter of 2025. With net sales soaring and earnings per share climbing, the Stryker SWOT Analysis reveals the strategic prowess behind its success. Its diverse product portfolio and strategic acquisitions further solidify its position in the dynamic healthcare landscape.

This deep dive into How Stryker Works will explore the company's operational strategies, revenue generation models, and future prospects. Understanding the intricacies of the Stryker company is essential for anyone seeking to navigate the complexities of the medical devices industry. From its innovative orthopedic solutions to its cutting-edge neurotechnology, Stryker's impact on healthcare is undeniable, making it a crucial subject for investors and industry professionals alike.

What Are the Key Operations Driving Stryker’s Success?

The Stryker company creates value through a wide array of innovative medical technologies, serving a global network of healthcare providers and their patients. Its core operations are structured around three main segments: Orthopaedics, MedSurg, and Neurotechnology and Spine. This structure allows the Stryker company to focus on specific market needs and emerging technologies, ensuring a competitive edge in the healthcare technology sector.

How Stryker works involves advanced manufacturing, strategic sourcing, and continuous technology development. The company operates in 75 countries, utilizing robust distribution networks to deliver its products to hospitals and surgery centers. Supply chain management and partnerships are critical for maintaining the availability of its diverse product portfolio, which includes surgical instruments and implantable devices.

A key differentiator for Stryker is its commitment to innovation, particularly in robotic-assisted surgery. The company's MAKO robotic system is a notable example, with Stryker planning a limited launch for its spine application in 2025. This focus on cutting-edge technology translates into significant customer benefits, offering enhanced surgical precision and improved patient outcomes. For more insights, explore the Growth Strategy of Stryker.

This segment provides implants for joint replacement, trauma, and sports medicine. This includes a wide range of medical devices designed to improve patient mobility and quality of life. Stryker consistently invests in research and development to enhance its orthopedic offerings.

The MedSurg segment includes surgical equipment, navigation systems, and instruments. These products are essential for various surgical procedures, enhancing precision and efficiency. Stryker continually updates its MedSurg portfolio to incorporate the latest technological advancements.

This segment focuses on neurosurgical, neurovascular, and spinal devices. These devices address critical needs in neurological and spinal care, contributing to improved patient outcomes. Stryker is dedicated to advancing technologies within this segment.

Stryker is a leader in robotic-assisted surgery, particularly with its MAKO system. This technology enhances surgical precision and patient outcomes. The company is expanding its robotic applications, with plans for new launches in 2025.

Stryker's operational processes are multifaceted, including advanced manufacturing and strategic sourcing. The company's decentralized approach allows each division to focus on specific market needs. Stryker maintains a strong global presence and robust distribution networks.

- Advanced Manufacturing: Ensures high-quality products.

- Strategic Sourcing: Manages supply chain efficiently.

- Global Presence: Operates in 75 countries.

- Distribution Networks: Delivers products to hospitals and surgery centers.

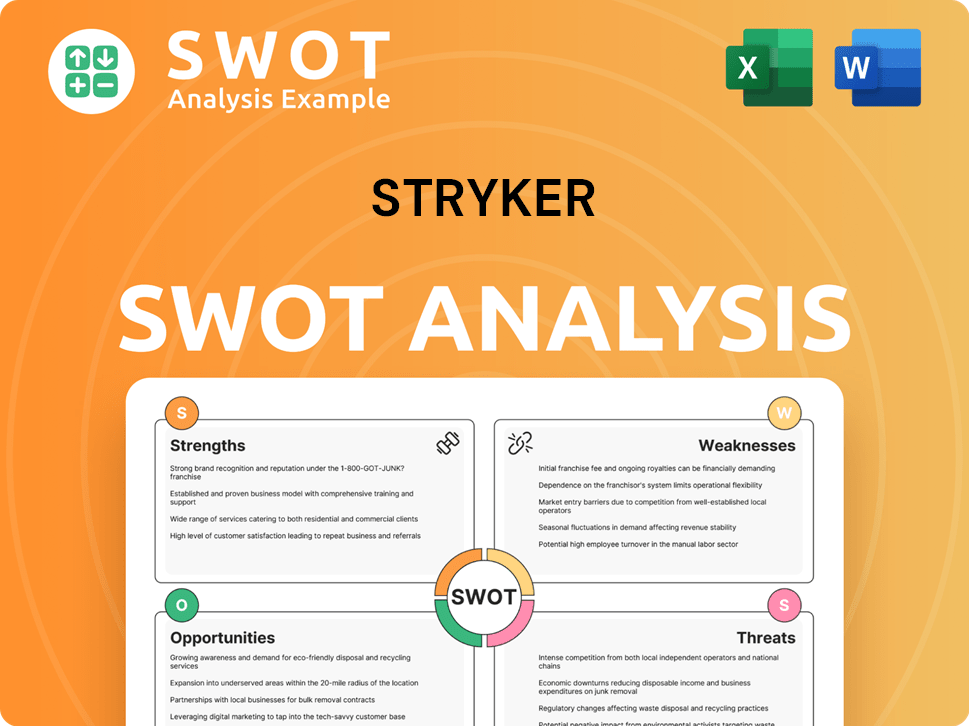

Stryker SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Stryker Make Money?

The Stryker company generates revenue primarily through the sale of its medical technology products. These products span across segments like Orthopaedics, MedSurg, and Neurotechnology and Spine. Understanding the Stryker company's revenue streams and how it monetizes its products is crucial for anyone interested in the medical devices industry.

In 2024, Stryker reported total net sales of $22.6 billion, marking a 10.2% increase from the previous year. The MedSurg and Neurotechnology segments were the largest contributors, accounting for 59.8% of global sales, while Orthopaedics contributed 40.2%. This demonstrates the company's diverse product portfolio and its strong market presence across various healthcare sectors.

For the first quarter of 2025, consolidated net sales increased by 11.9% to $5.9 billion. Organic net sales, which exclude the impact of foreign currency and acquisitions/divestitures, increased by 10.1% in Q1 2025. This growth was driven by a 9.4% increase from unit volume and a 0.7% increase from higher prices, indicating strong demand and effective pricing strategies. Approximately 85% of Stryker's 2024 revenue came from single-use, recurring revenue streams, showcasing the stability of their business model.

The company employs various monetization strategies, including direct product sales, bundled services, and strategic acquisitions. These approaches help Stryker maximize revenue and ensure long-term growth within the healthcare technology market.

- Direct Product Sales: This involves selling high-value capital equipment and associated consumables.

- Bundled Services and Tiered Pricing: Particularly with robotic systems like MAKO, which generate recurring revenue through service and consumable sales.

- Strategic Acquisitions: Such as the pending acquisition of Inari Medical in early 2025, which is expected to contribute approximately $590 million in sales in the 2025 stub period. This acquisition aims to enhance Stryker's product portfolio in the vascular space.

- Focus on Recurring Revenue: Approximately 85% of Stryker's 2024 revenue came from single-use, recurring revenue streams.

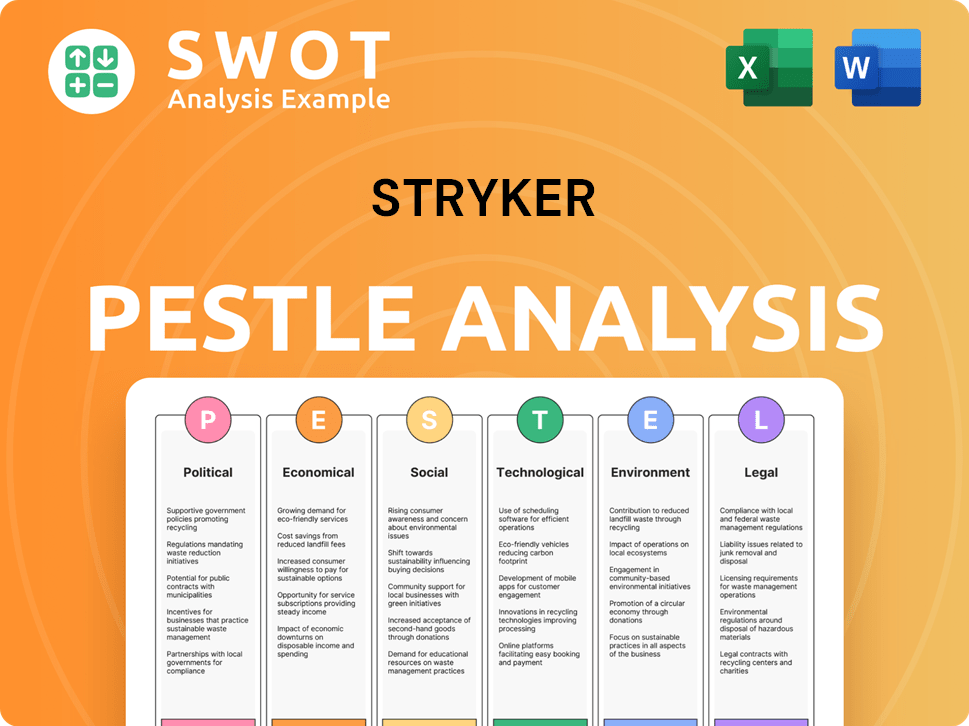

Stryker PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Stryker’s Business Model?

The journey of the Stryker company has been marked by significant milestones and strategic initiatives. The company consistently introduces innovative products, such as the next-generation LIFEPAK CR2 AED and an evacuation chair in 2024, and the OptaBlate BVN system in 2025, which offers a minimally invasive treatment for chronic low back pain. These launches reflect a commitment to advancing healthcare technology and expanding its product portfolio.

A crucial element of How Stryker works is its aggressive approach to mergers and acquisitions (M&A). The company has completed over 50 acquisitions in the last decade, with eight major acquisitions occurring in the last 18 months alone. These strategic moves are designed to strengthen market positions and enter high-growth segments. The acquisition of Inari Medical, finalized in February 2025, exemplifies this strategy, positioning Stryker in the peripheral vascular market.

Navigating operational challenges, such as inflationary pressures and supply chain disruptions, is another key aspect of Stryker's operations. The company is addressing these issues through operational efficiencies and proactive tariff mitigation, aiming to offset an estimated $200 million tariff impact for 2025. This proactive stance demonstrates its ability to adapt and maintain financial stability.

The company has consistently launched new products, including the next-generation LIFEPAK CR2 AED and an evacuation chair in 2024. The OptaBlate BVN system, launched in 2025, offers minimally invasive treatment for chronic low back pain. These innovations highlight Stryker's commitment to advancing healthcare technology.

A key strategic move is the company's focus on mergers and acquisitions. Stryker has completed over 50 acquisitions in the last decade. The acquisition of Inari Medical in February 2025 strategically positions Stryker in the peripheral vascular market.

The company's competitive edge is bolstered by a strong brand reputation and a global distribution network. Consistent innovation, particularly in robotic surgery, is a key differentiator. Stryker's leadership in robotic-assisted knee procedures, driven by its MAKO system, is a prime example of its technological superiority.

In 2024, Stryker invested $1.47 billion in research and development, representing 6.47% of its revenue. The company also adapts to new trends by expanding into cutting-edge technologies like AI and digital health. This commitment to innovation and strategic investments ensures its position at the forefront of the medtech industry.

The company's competitive advantages include a strong brand reputation, an extensive global distribution network, and a consistent pipeline of innovation, particularly in robotic surgery. Stryker is also expanding into cutting-edge technologies like AI and digital health.

- Strong brand reputation and global reach.

- Consistent innovation, especially in robotic surgery.

- Strategic focus on mergers and acquisitions.

- Commitment to research and development, with $1.47 billion spent in 2024.

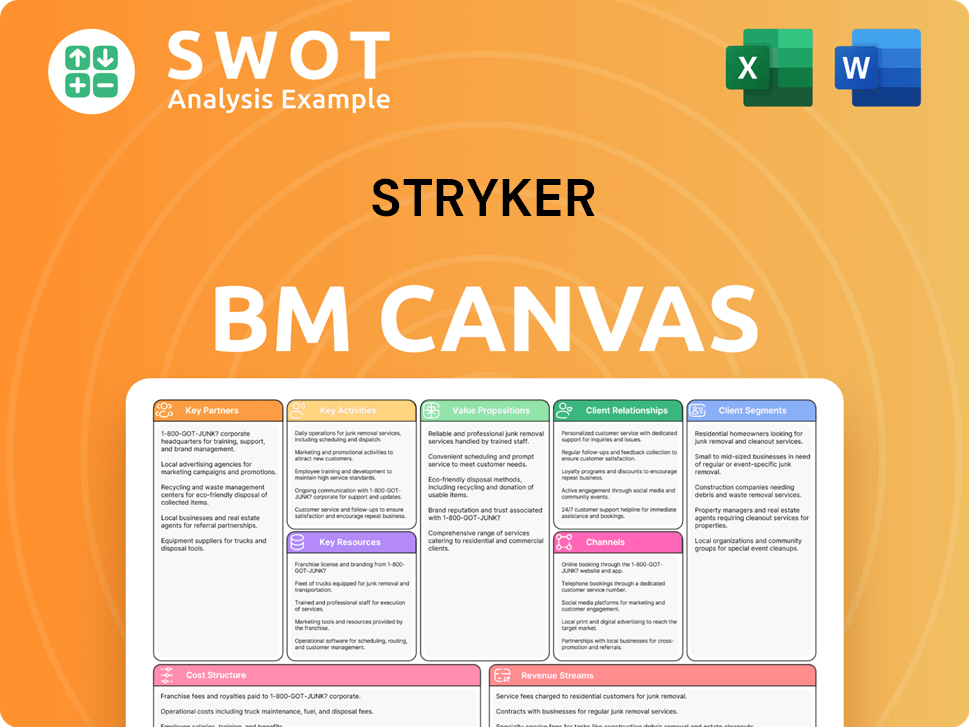

Stryker Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Stryker Positioning Itself for Continued Success?

The Stryker company holds a leading position in the medical device market, competing with major players like Medtronic and Johnson & Johnson. The company's global presence is significant, operating in approximately 75 countries. Its strengths are evident in orthopedics and healthcare technology, particularly in knee and hip implants and related robotic systems.

However, Stryker faces several risks. Macroeconomic factors, including potential changes in tariffs and currency exchange rate volatility, could impact margins. Regulatory risks, such as potential delays in product approvals and product recalls, also pose challenges. Furthermore, integrating large acquisitions presents execution risks.

Stryker is a leader in the medical devices sector, with a strong global footprint. The company's net sales for the full year 2024 reached $22.6 billion. Its market leadership is particularly strong in orthopedics, including implants and robotic surgery systems.

Macroeconomic headwinds, such as changes in tariffs and currency fluctuations, could affect profitability. Regulatory risks, including potential delays in product approvals, also pose challenges. Furthermore, the integration of acquisitions presents execution risks.

Stryker anticipates continued growth driven by strategic initiatives and innovation. The company is raising its 2025 organic net sales growth guidance to a range of 8.5% to 9.5%. Adjusted net earnings per diluted share for 2025 are expected to be in the range of $13.20 to $13.45.

Stryker plans to sustain and expand revenue through investments in research and development, strategic acquisitions, and a focus on procedural volumes. The company's commitment to innovation, especially in robotics and digital health, supports long-term growth. The company anticipates a $200 million tariff impact for 2025.

Stryker's financial performance is strong, with significant net sales in 2024. The company's outlook for 2025 is positive, driven by strategic investments and market demand.

- Full-year 2024 net sales: $22.6 billion.

- 2025 organic net sales growth guidance: 8.5% to 9.5%.

- 2025 adjusted net earnings per diluted share: $13.20 to $13.45.

- Anticipated tariff impact for 2025: $200 million.

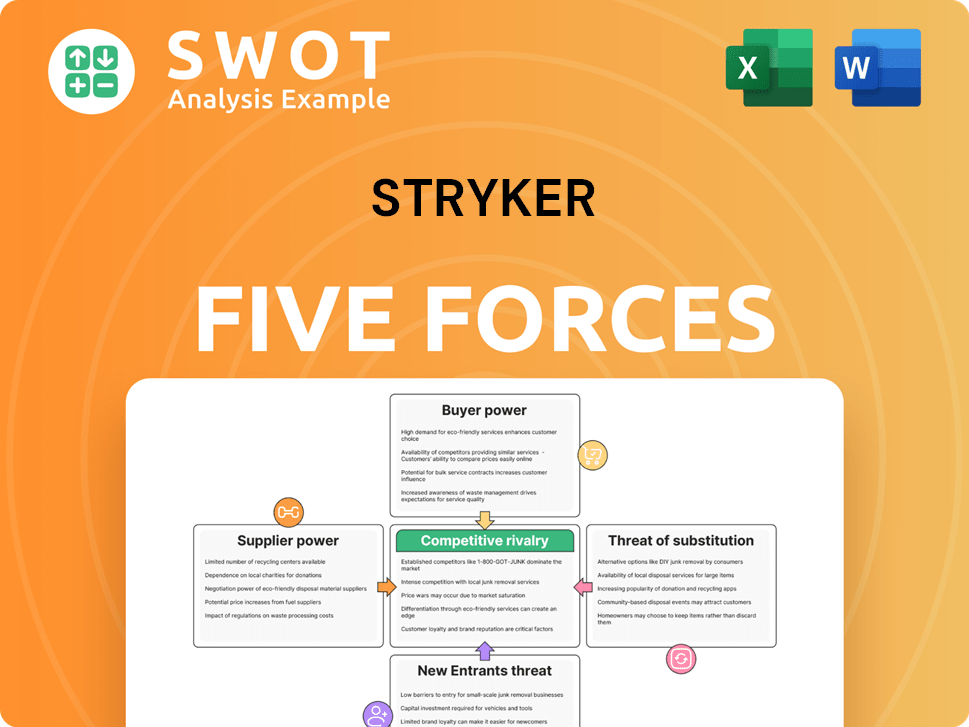

Stryker Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stryker Company?

- What is Competitive Landscape of Stryker Company?

- What is Growth Strategy and Future Prospects of Stryker Company?

- What is Sales and Marketing Strategy of Stryker Company?

- What is Brief History of Stryker Company?

- Who Owns Stryker Company?

- What is Customer Demographics and Target Market of Stryker Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.