Stryker Bundle

Can Stryker Continue its Dominance in the Medical Technology Arena?

Stryker, a titan in the medical device industry, has consistently demonstrated a remarkable ability to adapt and thrive. Founded in 1941, the company has evolved from a small orthopedic innovator to a global powerhouse impacting millions of lives. With 2024 sales reaching $22.6 billion, understanding Stryker's growth strategy and future prospects is crucial for anyone invested in the healthcare sector.

Stryker's success is deeply rooted in its commitment to innovation, particularly in robotic-assisted surgery with systems like Mako, and a strategic approach to mergers and acquisitions. Stryker SWOT Analysis reveals the intricacies of its market position and highlights its strengths in the competitive landscape. This analysis will delve into Stryker's expansion plans, financial performance, and the key drivers that will shape its future in the medical device industry, offering crucial insights for investors and industry watchers alike.

How Is Stryker Expanding Its Reach?

The expansion initiatives of the company are designed to foster growth across various segments. A key focus is on penetrating new markets and broadening the product portfolio. This strategy is supported by strategic mergers and acquisitions, driving the company's long-term growth.

International expansion is a significant driver, with 8.8% organic sales growth internationally in 2024. The company continues to see under-penetration in many markets outside the U.S., indicating substantial growth potential. This global approach is essential for sustaining a competitive edge in the medical device industry.

A major recent initiative is the planned acquisition of Inari Medical, Inc., valued at $4.9 billion, expected to close by the end of February 2025. This acquisition will significantly expand the company's presence in the rapidly growing peripheral vascular market, which is projected to grow over 20% annually in the U.S. This strategic move diversifies revenue streams and offers potential cross-selling opportunities.

The company is actively targeting under-penetrated markets globally. International sales growth of 8.8% in 2024 highlights the success of this strategy. The company's growth strategy emphasizes expanding its reach in key international markets.

The company consistently launches new products to strengthen its multi-segment strength. Key launches in 2025 include advancements in its Mako robotic system. These launches are crucial for maintaining leadership in the orthopedic robotic surgery space.

The company's M&A strategy is a carefully orchestrated plan to strengthen its market position. Over 50 acquisitions in the past decade have focused on complementary and enhancing existing portfolios. This includes a focus on high-growth markets like neurotechnology.

The company invests heavily in research and development. The recent FDA clearance for the OptaBlate BVN system expands the company's footprint in pain management. Innovation is a key driver of the company's long-term success.

The company's expansion strategy includes market penetration, product portfolio expansion, and strategic acquisitions. These initiatives are designed to drive revenue growth and increase market share. The company's focus on innovation and strategic partnerships is also crucial.

- International growth, with a focus on under-penetrated markets.

- Product launches, especially in robotic surgery and spine applications.

- Strategic acquisitions to strengthen market position and diversify product offerings.

- Investment in research and development to drive innovation.

The company's expansion initiatives are comprehensive, focusing on both organic growth and strategic acquisitions. The pending acquisition of Inari Medical, Inc. is a prime example of the company's commitment to expanding its presence in high-growth markets. The company's focus on innovation, as seen with the OptaBlate BVN system, further strengthens its position in key markets. This approach aligns with the company's long-term vision, as highlighted in Mission, Vision & Core Values of Stryker, and supports its continued growth and leadership in the medical device industry.

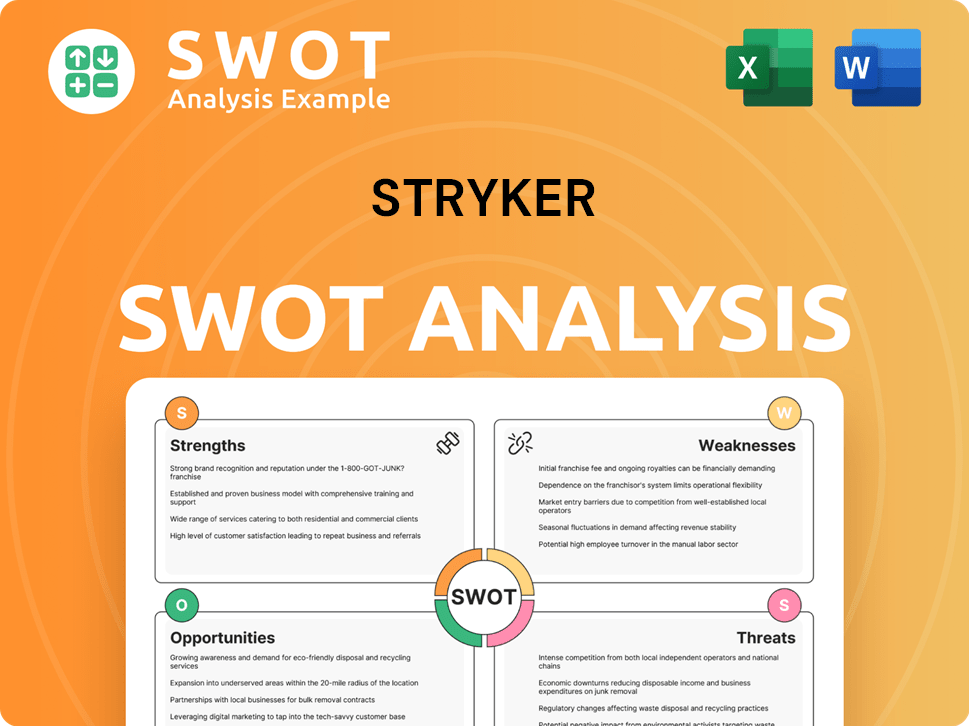

Stryker SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Stryker Invest in Innovation?

The sustained success of the company, a key player in the medical device industry, is fundamentally linked to its robust innovation and technology strategy. This approach is critical for maintaining its competitive edge and driving future prospects within the evolving healthcare landscape. The company's commitment to research and development is a core element, ensuring it remains at the forefront of technological advancements.

The company's strategic focus on innovation is evident in its significant investments in R&D, which directly support its growth strategy. This includes the development of advanced medical devices and the integration of cutting-edge technologies like AI and robotics. These initiatives are designed to enhance patient outcomes and improve the efficiency of healthcare providers.

The company's growth strategy is significantly influenced by its technological advancements and strategic acquisitions. These moves are aimed at expanding its product portfolio, enhancing its market position, and driving its future prospects in the medical device industry.

In 2024, the company allocated $1.466 billion to research and development (R&D). This represents a 5.62% increase compared to 2023, highlighting a continuous dedication to innovation and technological advancement. This investment is crucial for maintaining its competitive edge and driving future growth within the medical device industry.

The Mako system, a key component of the company's technological portfolio, leads in robotic-assisted surgery. This platform is expanding into spine and shoulder applications. This expansion is part of a broader strategy to integrate advanced technologies into medical devices, supported by a $6 billion investment from 2010 to 2024.

The company is actively exploring the potential of AI and machine learning (ML) in healthcare. This includes evaluating their use across its development portfolio and internal operations. An AI Governance Committee was established in 2024 to manage risks and address ethical considerations related to AI.

A significant strategic move in 2024 was the acquisition of care.ai, an AI pioneer in healthcare. This acquisition is designed to bolster the company's digital vision and accelerate its healthcare IT and digital ambitions by integrating AI-driven virtual care workflows and smart room technology. This move aims to optimize clinical and operational workflows for customers and address challenges like nursing shortages.

The company continues to invest in additive manufacturing capabilities for orthopedic devices. A $150 million investment underscores its commitment to customization and efficiency in this area. This investment supports the company's focus on innovation and its ability to provide advanced medical solutions.

Patents filed in Q1 2024 include computer-implemented techniques for selecting machine-trained models for implant parameters, recommending surgery based on patient data, and aiding surgical object positioning using machine vision. These patents demonstrate the company's commitment to innovation in medical technology and its focus on improving patient outcomes.

The company's innovation strategy is a key driver of its market position and future prospects. For more in-depth insights, you can explore a comprehensive analysis of the company's performance and strategic direction in an article about Stryker's financial performance.

The company's technological initiatives are focused on several key areas, including robotic surgery, AI integration, and additive manufacturing, which are critical for its growth strategy and market leadership.

- Robotic-Assisted Surgery: Expanding the Mako system into new applications.

- AI and Machine Learning: Integrating AI to improve patient care and operational efficiency.

- Additive Manufacturing: Investing in customization and efficiency for orthopedic devices.

- Digital Health: Leveraging digital technologies to enhance patient outcomes and streamline healthcare processes.

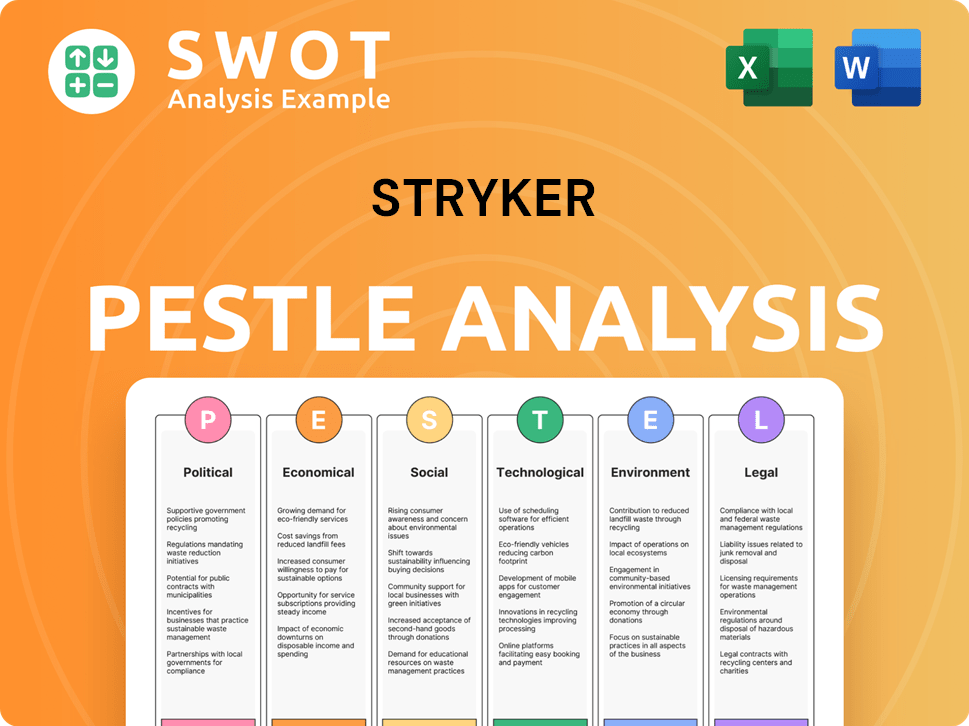

Stryker PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Stryker’s Growth Forecast?

The financial outlook for the company, a key player in the medical device industry, remains positive, building on a robust 2024 performance. The company's growth strategy is clearly reflected in its financial results and future projections. This positive trajectory is crucial for understanding the company's future prospects.

In 2024, the company reported solid financial results. Net sales reached $22.6 billion, marking a 10.2% increase, with organic net sales also growing by 10.2%. Adjusted net earnings per diluted share increased by 15.0%, reaching $12.19. These figures underscore the company's strong financial performance and its ability to generate consistent revenue growth.

Looking ahead to 2025, the company anticipates continued growth. The company expects organic net sales growth to be between 8.0% and 9.0%. Furthermore, the adjusted net earnings per diluted share are projected to be between $13.45 and $13.70. These projections highlight the company's confidence in its ability to sustain growth and profitability.

The primary drivers of revenue growth for the company include innovation in medical technology and strategic partnerships. These elements support the company's growth in emerging markets and its overall market position. The company's focus on these areas is central to its strategy.

The acquisition of Inari Medical is expected to contribute approximately $590 million in sales for the 2025 stub period. However, this acquisition is also expected to have a dilutive impact on adjusted operating income margin and adjusted net earnings per diluted share. This highlights the complexities of integrating new businesses.

The adjusted operating income margin for the full year 2024 increased by 110 basis points to 25.3%. The company is on track to achieve its goal of returning to the 2019 level of adjusted operating margin by the end of 2025. This improvement reflects the company's focus on operational efficiency.

Cash flow generation remains robust, with net cash provided by operating activities increasing by 14.31% to $4.24 billion in 2024. Strong cash flow is crucial for funding research and development investments and supporting future expansion plans. The company's financial health is evident in its cash flow.

The company's refined guidance for Q1 2025 indicates further optimism, with organic net sales growth guidance raised to 8.5% to 9.5% and adjusted EPS expected to be between $13.20 and $13.45. The company anticipates a modestly favorable impact of price on sales in 2025. For more insights into the company's target market, consider reading this article: Target Market of Stryker.

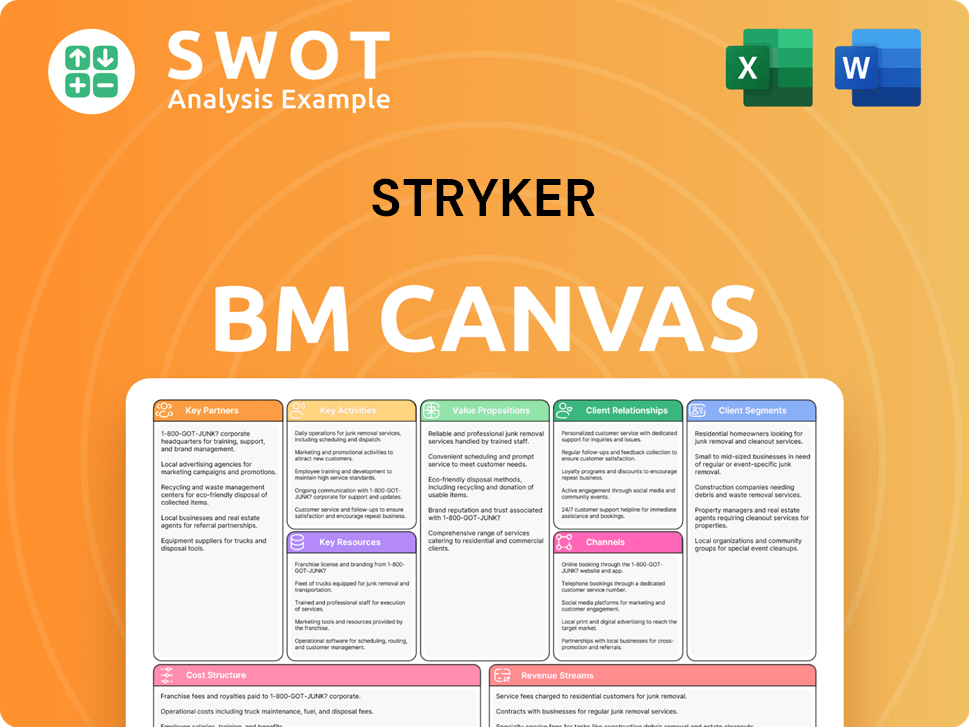

Stryker Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Stryker’s Growth?

The path of Stryker's growth strategy is not without its hurdles. Several strategic and operational risks could potentially impact its future prospects. Understanding these potential challenges is crucial for anyone assessing the company's long-term viability and investment potential in the medical device industry.

One significant area of concern revolves around competition within the medical device industry. Stryker faces stiff competition from major players and smaller, specialized firms. Another potential risk stems from regulatory changes and product liability claims, which could lead to financial losses and reputational damage.

Macroeconomic factors, such as changes in tariffs and currency exchange rate volatility, can also pose challenges to Stryker's financial performance. Moreover, supply chain disruptions and technological advancements present ongoing challenges. To gain more insights into Stryker's marketing approach, you can explore the Marketing Strategy of Stryker.

The medical device industry is highly competitive. Stryker competes with large, diversified companies like Medtronic, Johnson & Johnson, and Zimmer Biomet, as well as numerous smaller, specialized companies. Innovation, brand reputation, and distribution networks are critical for maintaining Stryker's market share.

Regulatory changes and approvals from bodies like the FDA can significantly impact commercialization. Delays or stricter requirements can slow down product launches. Product liability claims are also a constant threat, potentially leading to substantial financial losses.

Stryker's financial performance can be affected by macroeconomic factors. Changes in tariffs, currency exchange rates, and economic slowdowns can pressure margins and profitability. For example, in 2025, tariffs were projected to cause a $200 million revenue headwind.

Supply chain vulnerabilities and technological advancements present ongoing challenges. Adapting to rapid technological changes and ensuring a resilient supply chain are crucial for sustained growth. These factors impact the company's ability to meet market demands effectively.

Integrating acquired companies can be complex. Challenges include operational inefficiencies, increased costs, and the potential loss of key talent. The Inari Medical acquisition, for instance, is expected to be dilutive to operating margins and earnings per share (EPS) in the short term.

Infringement of intellectual property can lead to a loss of market share. Stryker must protect its innovations to maintain its competitive edge. The company's enterprise-wide risk assessment process, updated in 2024, helps to address these risks.

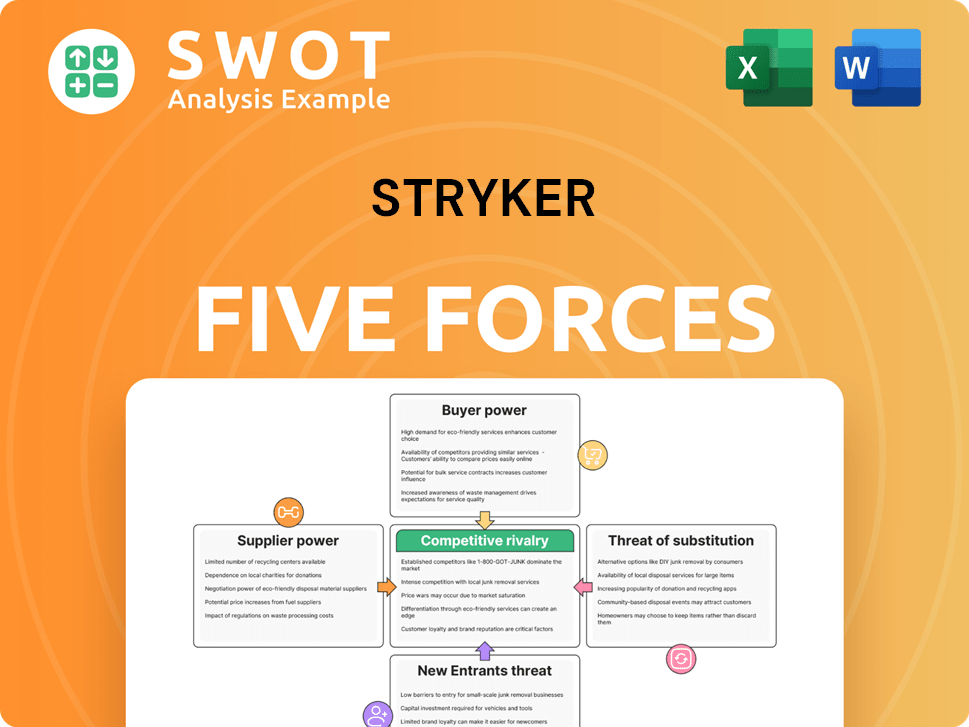

Stryker Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stryker Company?

- What is Competitive Landscape of Stryker Company?

- How Does Stryker Company Work?

- What is Sales and Marketing Strategy of Stryker Company?

- What is Brief History of Stryker Company?

- Who Owns Stryker Company?

- What is Customer Demographics and Target Market of Stryker Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.