Stryker Bundle

Who Does Stryker Serve? Unveiling Its Customer Demographics

Understanding the customer demographics and target market is critical for Stryker Corporation's sustained success in the competitive medical device market. The global healthcare industry is constantly evolving, and Stryker must adapt to meet the needs of its diverse customer base. From its origins with Dr. Homer Stryker, Stryker has expanded its reach, making it essential to understand its target audience thoroughly.

This exploration delves into Stryker's customer segmentation strategies, examining who their key customers are, and how they address customer needs and pain points. The Stryker SWOT Analysis provides a deeper understanding of the company's position within the healthcare industry. We will investigate Stryker's target market geographic location, including the US and emerging markets, and analyze how Stryker's marketing strategies cater to these demographics, ultimately impacting its market share in orthopedics and overall revenue.

Who Are Stryker’s Main Customers?

Understanding the customer demographics of the company requires a look at its business model. The company operates primarily in a Business-to-Business (B2B) model. This means that the primary customer segments are hospitals, surgical centers, and other healthcare providers globally. These institutions, in turn, serve diverse patient populations.

The company's target market is the medical professionals and administrators who make purchasing decisions. However, the ultimate beneficiaries of its products are the patients. The medical device market is a significant sector, and the company's success is tied to understanding and meeting the needs of both its direct and indirect customers.

The company's customer demographics for product utilization often skew towards an aging population. This is due to the prevalence of orthopedic conditions like joint degeneration and trauma in older individuals. For example, joint replacement surgeries are more common among older adults. The company's strategic focus and product portfolio are designed to address these specific needs, reflecting a deep understanding of its customer base.

The company's Orthopaedics segment represented 40.2% of its global sales in 2024. This highlights the importance of understanding the customer demographics related to orthopedic conditions. The company's product range extends beyond orthopedics.

The MedSurg and Neurotechnology segments accounted for 59.8% of sales in 2024. These segments serve a wide range of patient demographics. This diversification shows the company's broader market reach.

The company's acquisition of Inari Medical, Inc. in February 2025, demonstrates a strategic expansion. This move into the high-growth peripheral vascular segment is expected to contribute approximately $590 million in sales for the 2025 stub period. This shows how the company adapts to market opportunities.

The company is also divesting its U.S. spinal implants business. This segment's revenue contribution decreased to 8% by 2024. This strategic decision allows the company to focus on higher-growth areas.

Analyzing the company's customer demographics reveals a focus on both direct and indirect customers. The company's target market includes hospitals and medical professionals. The company's strategic decisions, such as acquisitions and divestitures, demonstrate its commitment to adapting to market changes and focusing on high-growth segments.

- The company's primary customers are healthcare providers.

- The company's products often serve an aging population.

- The company's strategic moves reflect a focus on high-growth areas.

- For more details, you can explore Owners & Shareholders of Stryker.

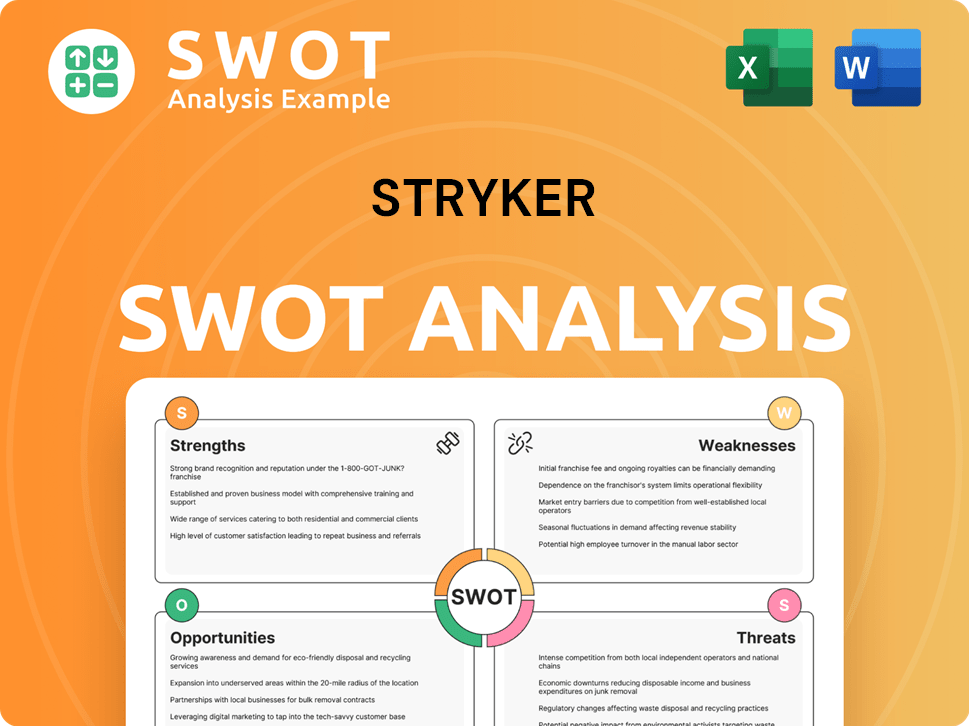

Stryker SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Stryker’s Customers Want?

Understanding the needs and preferences of its customers is crucial for the success of any company, and for Stryker, this is especially true. Their primary customers, which include healthcare institutions and medical professionals, have specific demands that drive their purchasing decisions. These demands are centered around clinical efficacy, patient safety, operational efficiency, and cost-effectiveness, all of which influence the medical device market.

The purchasing behaviors within the healthcare industry are significantly impacted by the proven outcomes of medical technologies. Regulatory approvals and the seamless integration of products into existing healthcare workflows also play a vital role. For instance, the demand for robotic-assisted surgery, particularly with Stryker's Mako system, exemplifies this trend. The Mako system's ability to enhance surgical precision and potentially improve patient recovery is a strong motivator for adoption, influencing the company's customer demographics.

The decision-making process also considers the long-term value and reliability of the equipment, along with the level of training and support provided by Stryker. Product usage patterns are characterized by high volume in established procedures like joint replacements, along with an increasing adoption of advanced technologies for minimally invasive surgeries. Customer loyalty is often built on the strong performance and reputation of Stryker's products, along with consistent customer service and ongoing innovation. Stryker's target market focuses on these aspects to maintain and grow its customer base.

Customers prioritize medical devices that offer proven clinical benefits. This includes technologies that improve patient outcomes and reduce complications.

Products that enhance patient safety are highly valued. This includes features that minimize risks during procedures and improve overall patient care.

Healthcare providers seek devices that streamline workflows and reduce operational costs. This includes ease of use, quick setup, and efficient maintenance.

The healthcare industry is always looking for cost-effective solutions. This includes devices that offer a good return on investment and reduce long-term expenses.

Comprehensive training and ongoing support are essential. Customers need to ensure that they can effectively use and maintain the devices.

Customers are interested in the latest technological advancements. This includes devices that offer new features and capabilities.

Stryker addresses common pain points such as the need for improved surgical outcomes, reduced recovery times, and increased efficiency in operating rooms. The company's focus on organic innovation, as demonstrated by the recent FDA clearance for the OptaBlate BVN system for chronic low back pain, shows its commitment to addressing unmet needs and influencing product development based on market demands. Stryker tailors its offerings, marketing, and customer experiences by emphasizing the clinical benefits and technological advancements of its products. For instance, the ongoing development and anticipated full U.S. commercial launch of Mako Spine in the second half of 2025, and Mako Shoulder remaining in limited market release through 2025, illustrate how the company is expanding its robotic platform to new specialties based on identified surgical needs.

- Mako System: In 2024, Mako procedures exceeded 1.5 million globally across 45 countries.

- Innovation: The OptaBlate BVN system received FDA clearance, reflecting a focus on addressing unmet needs.

- Robotic Platform Expansion: Anticipated launches of Mako Spine and Mako Shoulder in 2025 demonstrate expansion into new surgical specialties.

- Customer Service: Consistent customer service and ongoing innovation contribute to customer loyalty.

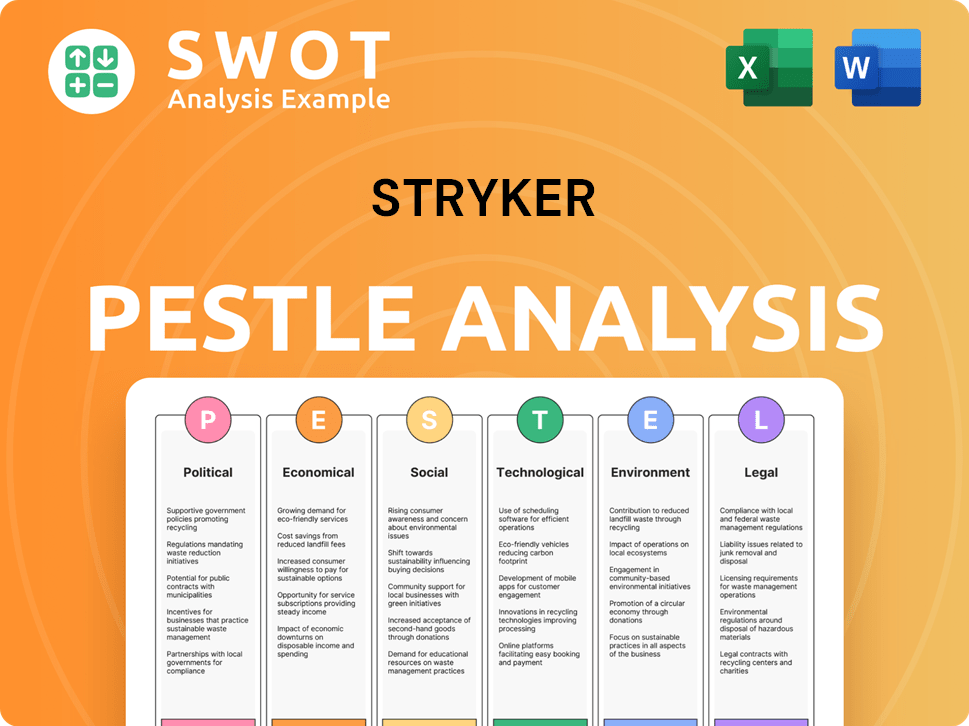

Stryker PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Stryker operate?

The geographical market presence of the company is substantial, with its products utilized in healthcare settings worldwide. The United States is its largest market, generating the majority of its revenue. The company strategically adapts its offerings and marketing to succeed in diverse markets, reflecting its understanding of varying customer demographics and preferences.

The company's global footprint is significant, with a focus on developed markets like North America and parts of Europe, where healthcare infrastructure is more advanced. International organic sales growth indicates continued expansion outside the U.S. The company acknowledges that it remains under-penetrated in many markets internationally, signaling further growth opportunities.

The company's approach includes both expansion and strategic adjustments to optimize its portfolio. The company's geographic distribution of sales in 2024 saw the United States as the highest growth region compared to 2023.

In fiscal year 2024, the United States accounted for approximately 74.99% of total revenue, totaling $16.94 billion. This highlights the U.S. as a primary market for the company. This is a key aspect of the company's customer demographics.

Europe, the Middle East, and Africa (EMEA) collectively generated $2.90 billion, representing 12.82% of total revenue in 2024. Asia Pacific contributed $2.02 billion, or 8.94%. These regions are crucial for the company's global presence and target market geographic location.

The company's international organic sales growth was 8.8% in 2024, showing continued expansion outside the U.S. This growth indicates the company's strategic focus on global market penetration and its ability to adapt to different customer demographics.

The company engages in strategic acquisitions and divestitures to optimize its portfolio. Recent acquisitions, like Inari Medical, aim to strengthen its presence in specific market segments. The company's customer segmentation strategies involve adapting to the needs of different markets.

For more insight into the company's strategic direction, consider reading about the Growth Strategy of Stryker. The company's ability to navigate diverse markets is a key factor in its success within the medical device market.

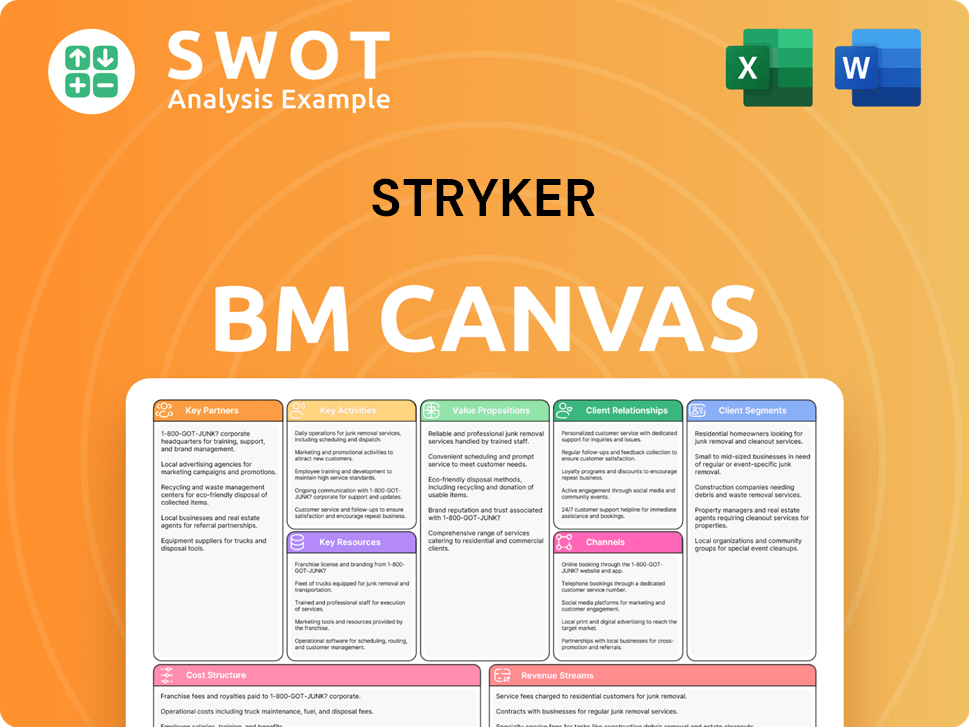

Stryker Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Stryker Win & Keep Customers?

The company, a prominent player in the medical device market, employs a comprehensive strategy for both customer acquisition and retention. Its approach is deeply rooted in its strong brand reputation, innovative product offerings, and an extensive global distribution network. This multifaceted strategy is essential for navigating the complexities of the healthcare industry and maintaining a competitive edge.

Customer acquisition is primarily driven by a direct sales force that engages with hospitals, surgeons, and healthcare administrators. This business-to-business (B2B) strategy relies heavily on product demonstrations, clinical evidence, and detailed cost-benefit analyses. Marketing efforts include participation in medical conferences and trade shows, digital marketing campaigns, and educational programs tailored for healthcare professionals. These strategies are designed to reach and influence key decision-makers within the healthcare ecosystem.

Retention strategies focus on delivering exceptional after-sales service, including technical support, maintenance, and ongoing training for its complex medical equipment. The company also emphasizes personalized experiences by tailoring product features and clinical support to the specific needs of different medical specialties and institutions. This approach aims to build strong, long-lasting relationships with its customers, fostering loyalty and repeat business.

The company's direct sales teams actively engage with hospitals, surgeons, and healthcare administrators. This B2B approach is central to acquiring new customers. It involves detailed product demonstrations and clinical evidence to showcase the value of their medical devices.

The company consistently launches new products and upgrades existing ones, such as advancements in its Mako robotic system and the LIFEPAK 35 defibrillator. These innovations are key drivers for attracting new customers and expanding market share. These product launches are carefully timed and strategically marketed.

The company provides excellent after-sales service, including technical support, maintenance, and training for its medical equipment. This ensures customer satisfaction and builds long-term relationships. This commitment to service is crucial for retaining customers.

Customization of product features and clinical support is done to meet the specific needs of different medical specialties and institutions. This personalized approach enhances customer satisfaction. This ensures that the company's offerings are highly relevant to each customer's needs.

Over time, the company has adapted its strategies, including an increased focus on strategic acquisitions to expand its portfolio and leadership in high-growth markets. An example of this is the acquisition of Inari Medical in February 2025, which is expected to significantly contribute to sales and expand the company's presence in the peripheral vascular segment. These strategic moves, combined with organic innovation, are designed to enhance customer lifetime value by offering a broader range of solutions and maintaining a competitive edge in the rapidly evolving medical technology landscape. For more insights, consider reading a Brief History of Stryker.

The company's primary customer acquisition strategy involves a direct sales force, engaging with hospitals and surgeons. This B2B approach emphasizes product demonstrations and cost-benefit analyses. Marketing efforts include participation in medical conferences and digital campaigns.

Consistent product launches and upgrades, such as advancements in the Mako robotic system, are key drivers for attracting new customers. These innovations help the company expand its market share. The company invests heavily in research and development to stay ahead.

The company focuses on providing exceptional after-sales service, including technical support and training for its complex medical equipment. This commitment to service is crucial for customer retention. This builds trust and encourages customer loyalty.

The company utilizes customer data and segmentation to target its campaigns effectively, ensuring that relevant product information and support reach the appropriate healthcare providers. This ensures that marketing efforts are highly targeted. This increases the efficiency of marketing spending.

The company has increased its focus on strategic acquisitions to expand its portfolio and accelerate its leadership in high-growth medtech markets. The acquisition of Inari Medical is a prime example. These moves enhance customer lifetime value.

The company focuses on enhancing customer lifetime value by offering a broader range of solutions and maintaining a competitive edge. This approach ensures long-term relationships. This leads to sustainable growth and profitability.

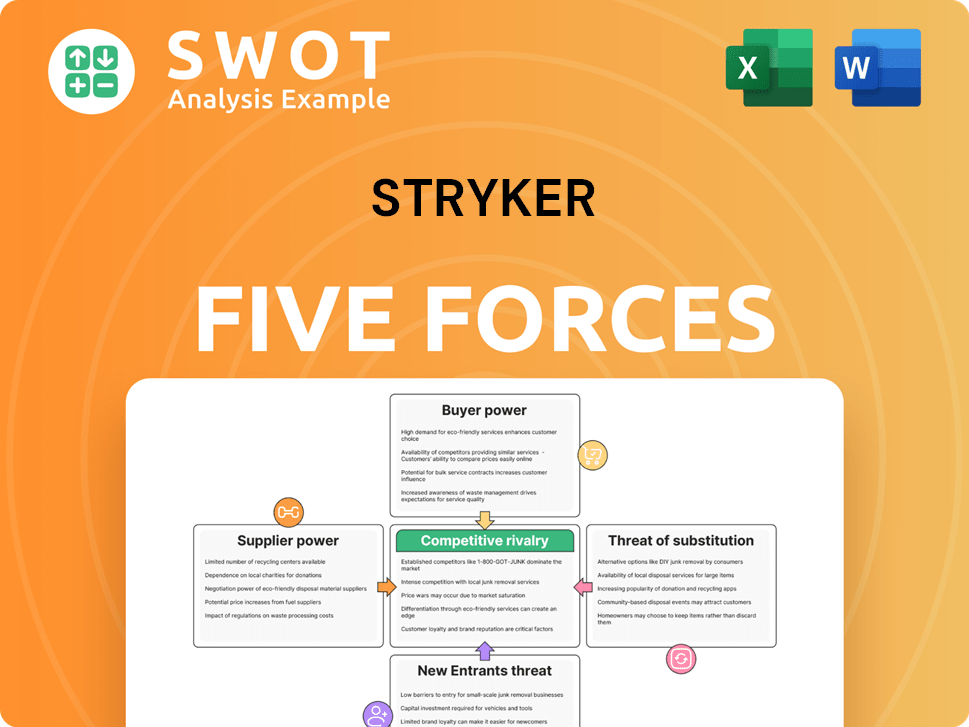

Stryker Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Stryker Company?

- What is Competitive Landscape of Stryker Company?

- What is Growth Strategy and Future Prospects of Stryker Company?

- How Does Stryker Company Work?

- What is Sales and Marketing Strategy of Stryker Company?

- What is Brief History of Stryker Company?

- Who Owns Stryker Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.