Sydbank Bundle

How Does Sydbank Navigate the Cutthroat Danish Banking Scene?

The Nordic financial arena is a battlefield of innovation and competition. Sydbank, a key player in the Danish banking sector, faces relentless pressure from all sides. To understand its position, we must dissect the Sydbank SWOT Analysis and explore its competitive landscape.

This analysis delves into the core of the Sydbank competitive landscape, examining its key competitors and the strategic moves shaping its future. A thorough Sydbank market analysis is essential to grasp its strengths and weaknesses within the financial services Denmark market. Understanding who Sydbank's main rivals are and its competitive advantages is crucial for investors and strategists alike, offering insights into its financial performance compared to peers and its future growth prospects.

Where Does Sydbank’ Stand in the Current Market?

Sydbank holds a significant position within the Danish financial sector, focusing on private and corporate customers primarily in Denmark and Northern Germany. A thorough Sydbank market analysis reveals its strong presence in these key areas. The bank's core operations revolve around traditional banking services, including deposits, loans, and payments, complemented by specialized offerings in asset management, insurance, and real estate.

The bank's value proposition centers on providing comprehensive financial solutions tailored to its customer base. Sydbank's competitive landscape is shaped by its commitment to a well-established branch network and a robust customer base. This strategic focus has allowed it to maintain a strong market position and consistently rank among the top Danish banks.

As of the end of 2023, Sydbank reported a net profit of DKK 2,829 million, demonstrating robust financial health. The bank's total assets reached DKK 394.9 billion by the end of 2023. Its loan portfolio was DKK 166.7 billion at the end of 2023, and deposits amounted to DKK 264.4 billion. The bank's financial performance is a key factor in understanding its market position.

Sydbank's financial performance in 2023 was marked by positive developments. Net interest income increased by DKK 1,215 million, reaching DKK 6,432 million. Net fee income also saw an increase, totaling DKK 2,333 million.

In February 2024, Sydbank initiated a share buyback program of DKK 1,500 million, reflecting its strong capital position and commitment to shareholder value. This program is a key part of its strategy.

Sydbank's primary focus remains on the domestic market, where it has a well-established branch network and a strong customer base. Sydbank's business strategy overview indicates a focus on organic growth and customer retention.

Sydbank offers a range of services, including deposits, loans, and payments. It also provides specialized services in asset management, insurance, and real estate, catering to diverse financial needs.

Competitive advantages of Sydbank include its strong domestic presence and diverse product offerings. Analyzing Sydbank competitors is crucial for understanding its market dynamics and potential challenges. The Danish banking sector is highly competitive, with several major players vying for market share.

- Strong domestic market presence and well-established branch network.

- Diverse product offerings, including traditional and specialized financial services.

- Commitment to returning value to shareholders through share buyback programs.

- Focus on customer relationships and tailored financial solutions.

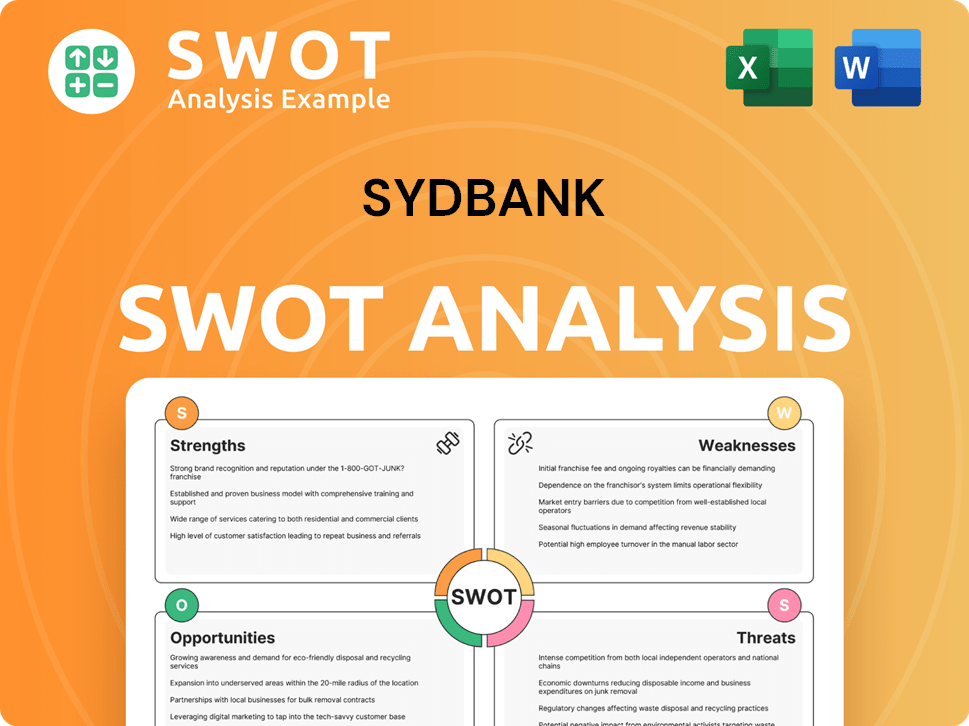

Sydbank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Sydbank?

The Growth Strategy of Sydbank involves navigating a complex competitive landscape within the Danish and Northern German financial services markets. This landscape is shaped by a diverse array of competitors, from established universal banks to specialized financial institutions and emerging fintech players. Understanding these competitors is crucial for Sydbank to maintain and enhance its market position.

Sydbank's competitive environment requires continuous adaptation to evolving market dynamics, including technological advancements, regulatory changes, and shifting customer preferences. Analyzing the strengths and weaknesses of key rivals helps Sydbank refine its strategies and identify opportunities for differentiation. This analysis is essential for sustainable growth and success within the Danish banking sector.

The competitive landscape for Sydbank is influenced by several factors, including market share, service offerings, and technological capabilities. The bank must continuously evaluate its position relative to its competitors to maintain a strong market presence. This involves strategic decision-making to address challenges and capitalize on opportunities within the financial services sector.

In Denmark, Sydbank's primary competitors include Danske Bank, Nordea, Nykredit, and Jyske Bank. These institutions compete across various segments, from retail banking to corporate finance.

Danske Bank, as the largest financial institution in Denmark, poses a significant challenge. It has a large market share and extensive digital capabilities. In 2024, Danske Bank reported a net profit of DKK 18.5 billion.

Nordea, a pan-Nordic banking group, competes strongly, especially in corporate banking and wealth management. Nordea's total operating income for 2024 was EUR 7.8 billion.

Nykredit, a mortgage credit institution and bank, is a major competitor in the mortgage and real estate financing sectors. Nykredit's pre-tax profit for 2024 was DKK 5.1 billion.

Jyske Bank offers a similar range of services and competes directly for both private and corporate clients. Jyske Bank reported a profit before tax of DKK 3.5 billion in 2024.

Sydbank also faces indirect competition from pension funds, insurance companies, and fintech firms. These competitors challenge traditional banking models.

The Danish banking sector is subject to ongoing changes, including consolidation and technological advancements. These factors influence the competitive landscape.

- Digitalization: The increasing adoption of digital banking services is a key trend, with banks investing heavily in online and mobile platforms.

- Mergers and Acquisitions: Consolidation among smaller banks creates larger, more competitive regional players.

- Fintech Disruption: Fintech companies are offering innovative solutions, particularly in payments and lending, posing a growing challenge to traditional banks.

- Customer Preferences: Customers are increasingly seeking personalized services and convenient banking experiences.

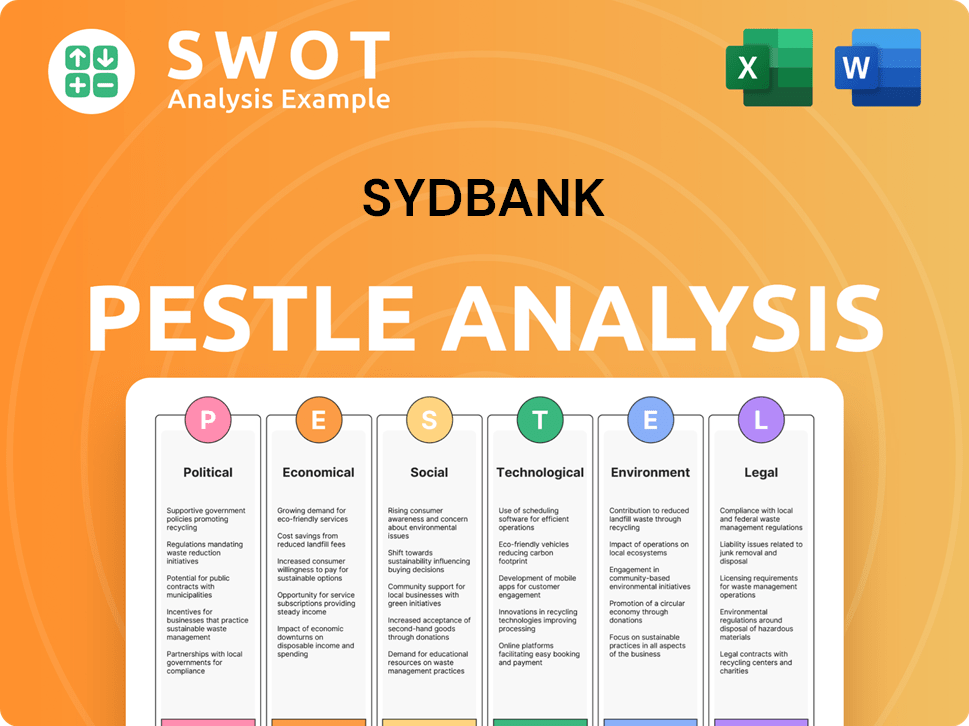

Sydbank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Sydbank a Competitive Edge Over Its Rivals?

The Brief History of Sydbank reveals a journey marked by strategic focus and adaptation within the Danish banking sector. Key milestones include its establishment and subsequent growth, primarily within Denmark and Northern Germany. These regions have been central to its operations, allowing it to cultivate deep local market knowledge. This localized approach has been a cornerstone of its competitive strategy, enabling tailored financial solutions.

Strategic moves by the bank have consistently prioritized customer relationships, particularly with small and medium-sized enterprises (SMEs) and private clients. This customer-centric approach, combined with a focus on financial stability, has shaped its competitive edge. The bank's commitment to maintaining strong capital positions and profitability has been crucial for weathering economic fluctuations and supporting strategic investments.

The competitive landscape for Sydbank involves navigating a dynamic market. The bank's ability to offer competitive pricing while maintaining healthy margins is a key factor. Furthermore, its investment in digital transformation ensures it remains competitive in a digitalizing industry. The bank's comprehensive suite of services, including banking, asset management, insurance, and real estate, allows for cross-selling opportunities and deeper client engagement.

Sydbank's deep understanding of the local markets in Denmark and Northern Germany provides a significant competitive advantage. This regional focus allows the bank to tailor financial solutions to meet specific local needs. The bank's strong client relationships, especially with SMEs and private customers, are a direct result of this localized approach.

The bank's customer-centric approach is a key differentiator in a market often seen as commoditized. High customer satisfaction, as reflected in client retention rates, underscores the success of this strategy. This focus on customer needs fosters loyalty and increases the lifetime value of its customer base.

Sydbank's robust financial performance, including a 2023 net profit of DKK 2,829 million and a return on equity of 14.5%, provides a strong base for strategic investments. Its solid capital position enables the bank to weather economic fluctuations effectively. This financial strength supports its competitive edge in the Danish banking sector.

Efficient operations and cost management contribute to Sydbank's ability to offer competitive pricing while maintaining healthy margins. The bank's steady investment in digital transformation enhances customer experience and operational efficiency. This ensures Sydbank remains competitive in an increasingly digital industry.

Sydbank's competitive advantages are multifaceted, including its strong regional presence, customer-centric approach, and robust financial performance. These elements work together to create a resilient and adaptable business model within the Danish banking sector. Its focus on a comprehensive suite of services, including banking, asset management, insurance, and real estate, allows for cross-selling opportunities and deeper client engagement.

- Deep understanding of local markets in Denmark and Northern Germany.

- Strong client relationships, especially with SMEs and private customers.

- Consistent profitability and a solid capital position.

- Efficient operations and a focus on digital transformation.

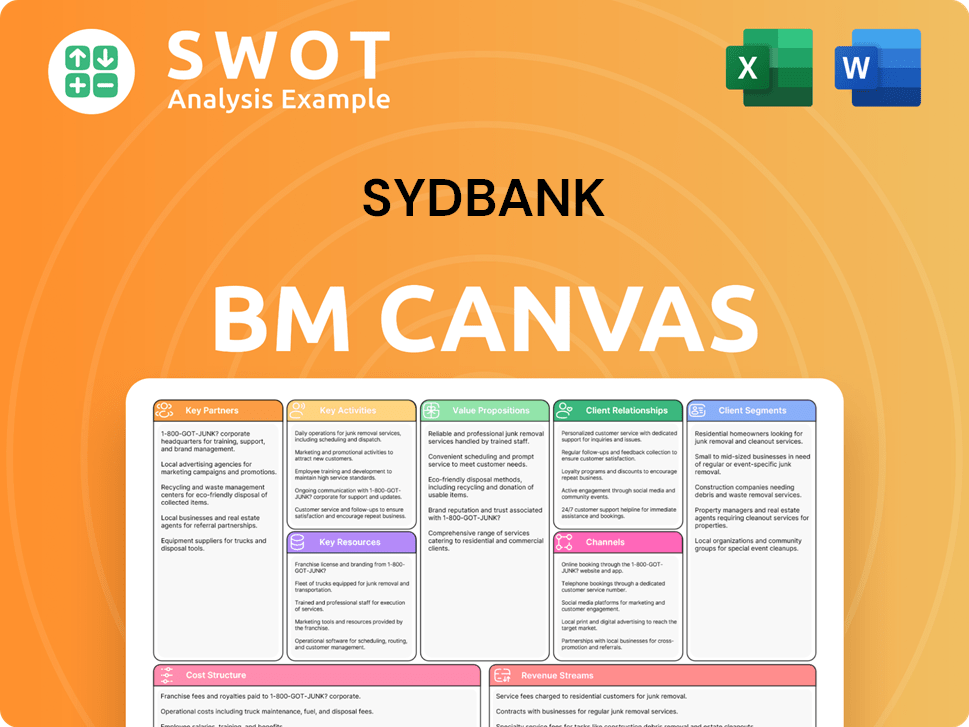

Sydbank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Sydbank’s Competitive Landscape?

The Revenue Streams & Business Model of Sydbank operates within the dynamic Danish banking sector, facing a competitive landscape shaped by technological advancements, regulatory pressures, and evolving customer expectations. Sydbank's market position is influenced by its focus on relationship-based banking, particularly serving small and medium-sized enterprises (SMEs) and private banking clients. The bank must navigate challenges such as digital transformation and competition from fintechs while capitalizing on opportunities like sustainable finance and strategic partnerships.

The risks for Sydbank include increased competition from digital-first financial institutions, stringent regulatory compliance costs, and the impact of macroeconomic factors on its financial performance. The future outlook for Sydbank hinges on its ability to adapt to these changes, leveraging its strengths in customer relationships and local expertise to maintain a competitive edge. The bank's strategic decisions regarding digital innovation, sustainable finance, and potential acquisitions will be crucial for its long-term success.

Digitalization continues to reshape the financial services landscape, with customers demanding seamless online and mobile banking experiences. Regulatory changes, including those related to anti-money laundering (AML) and data privacy (GDPR), are increasing compliance burdens. The macroeconomic environment, including interest rate fluctuations and inflation, influences lending volumes and investment returns.

Sydbank faces challenges in balancing digital innovation with its traditional relationship-based banking model, especially for SME and private banking clients. Competition from fintechs and challenger banks, which often have lower overheads, poses a threat to traditional revenue streams. Talent acquisition and retention in a rapidly evolving tech landscape are critical for Sydbank's digital agenda.

The growing demand for sustainable finance and ESG-compliant products offers new avenues for growth and differentiation for Sydbank. Strategic partnerships with fintech companies could allow Sydbank to integrate innovative solutions without incurring full development costs. Consolidation within the banking sector could present acquisition opportunities, strengthening its market position.

The Danish banking sector is highly competitive, with players like Danske Bank and Jyske Bank vying for market share. Sydbank's competitive advantages include its strong customer relationships and regional presence. Key competitors include both traditional banks and emerging fintech companies. A detailed Sydbank market analysis reveals the need for strategic adaptation.

Sydbank's strategic priorities include enhancing its digital offerings, expanding its sustainable finance portfolio, and exploring strategic partnerships. The bank aims to maintain its strong customer relationships while embracing digital transformation. Recent data indicates a growing emphasis on ESG investments and a focus on SME lending.

- Digital Transformation: Investing in online platforms and mobile applications.

- Sustainable Finance: Expanding offerings in green financing and sustainable investments.

- Strategic Partnerships: Collaborating with fintech companies for innovative solutions.

- Customer Focus: Maintaining strong relationships with SME and private banking clients.

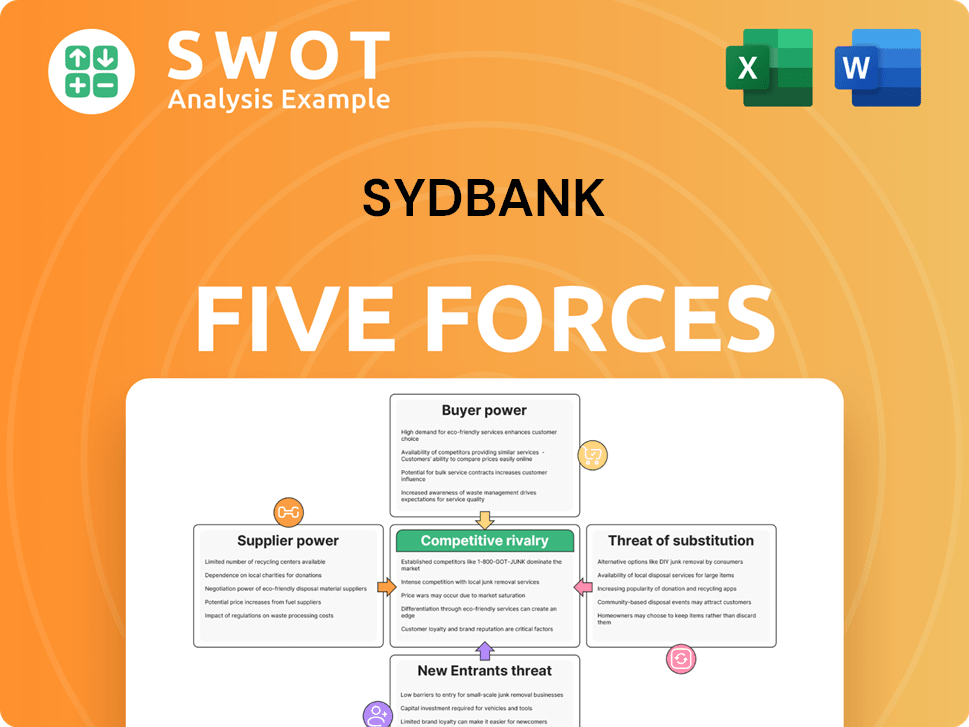

Sydbank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sydbank Company?

- What is Growth Strategy and Future Prospects of Sydbank Company?

- How Does Sydbank Company Work?

- What is Sales and Marketing Strategy of Sydbank Company?

- What is Brief History of Sydbank Company?

- Who Owns Sydbank Company?

- What is Customer Demographics and Target Market of Sydbank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.