Sydbank Bundle

How Does Sydbank Thrive in a Competitive Financial Market?

Sydbank, a cornerstone of the Danish financial landscape, has consistently adapted its Sydbank SWOT Analysis to navigate market complexities. Their success hinges on a dynamic Sydbank sales strategy and Sydbank marketing strategy that resonates with both individual and corporate clients. Understanding their approach is crucial for anyone seeking insights into modern banking practices.

From its roots as a regional bank, Sydbank's strategy has evolved, embracing digital transformation while maintaining a strong customer focus. This article will dissect the bank's current Sydbank financial services approach, exploring how they leverage innovative marketing tactics and sales channels to achieve sustained growth. We'll also examine their Sydbank market analysis and Sydbank business model to understand their competitive edge.

How Does Sydbank Reach Its Customers?

The Growth Strategy of Sydbank incorporates a hybrid sales approach, blending traditional and digital channels to reach its customers. This strategy is designed to cater to a diverse customer base, ensuring accessibility and personalized service. The bank's sales channels are pivotal in delivering its financial services and maintaining a strong market presence.

Sydbank's sales strategy focuses on a mix of physical branches and digital platforms. This approach allows the bank to provide both direct customer interaction and convenient online services. The integration of these channels is a key element of Sydbank's business model, supporting its growth and customer service objectives.

The company's sales channels are crucial for its marketing strategy. By using a combination of physical branches and digital platforms, Sydbank can provide both personalized advisory services and convenient online banking. This integrated approach helps the bank to meet the changing needs of its customers and maintain a strong presence in the financial market.

Physical branches remain a cornerstone of Sydbank's sales strategy, especially in its core regions of Denmark and Northern Germany. These branches offer personalized advisory services, fostering strong customer relationships. In 2024, Sydbank operates a significant number of branches, emphasizing local presence and direct customer interaction.

Sydbank has significantly expanded its digital channels to meet the growing demand for convenient online banking. The company website and mobile banking applications are crucial for everyday transactions and access to financial tools. Investments in IT infrastructure and digital solutions enhance customer experience and operational efficiency.

Sydbank aims for seamless omnichannel integration, allowing customers to move effortlessly between online and offline touchpoints. This includes initiating processes online and completing them in-branch, or vice-versa. This approach enhances customer convenience and supports a unified brand experience.

While direct product sales through e-commerce platforms are less common in banking, Sydbank's digital platforms offer self-service options. These platforms enable direct engagement for a wide range of financial products. This shift towards digital adoption is driven by changing customer preferences and the need for efficiency.

Sydbank's sales strategy is multifaceted, involving both traditional and digital methods. The bank focuses on maintaining a strong physical presence while enhancing its digital capabilities. This approach allows Sydbank to cater to a broad customer base and adapt to the evolving financial landscape.

- Physical Branches: Provide personalized advisory services and build strong customer relationships, especially for complex financial products.

- Digital Platforms: Offer convenient online banking, self-service options, and access to financial tools, enhancing customer experience.

- Omnichannel Integration: Enable seamless transitions between online and offline channels, improving customer convenience.

- Digital Transformation: Continuous investment in IT infrastructure and digital solutions to enhance operational efficiency and customer satisfaction.

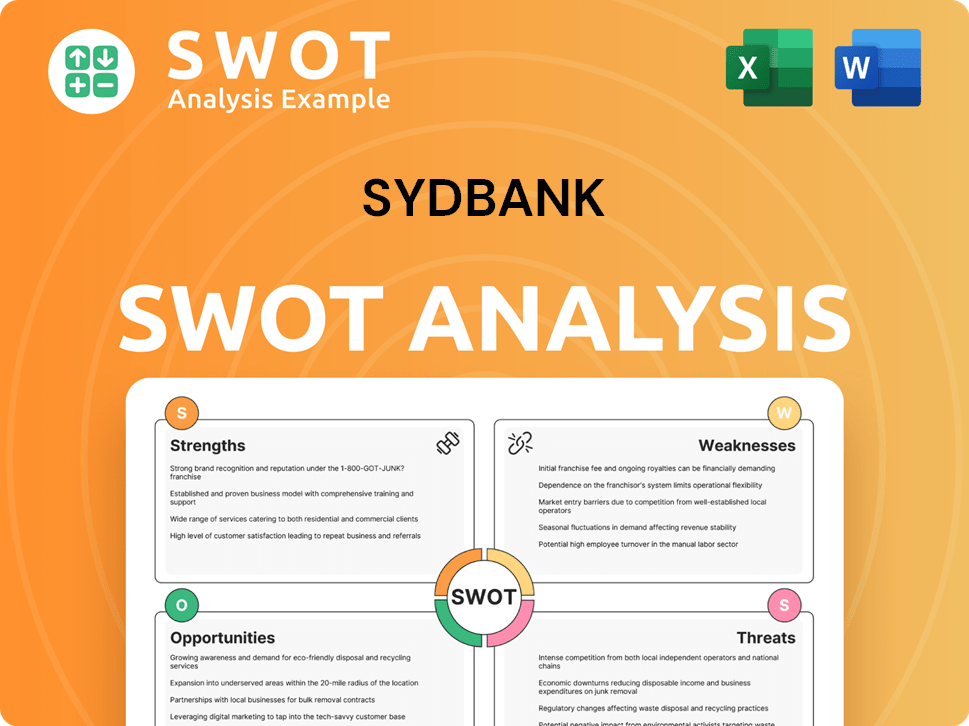

Sydbank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Sydbank Use?

The Sydbank marketing strategy employs a blend of digital and traditional tactics to boost brand awareness, generate leads, and drive sales. This multifaceted approach is designed to reach a broad audience and cater to diverse customer segments. The bank’s strategy focuses on establishing itself as a trusted financial expert while also directly connecting with potential and existing customers.

In the digital space, Sydbank emphasizes content marketing, SEO, and targeted advertising. Traditional methods, such as local media and event marketing, continue to play a role. Data-driven marketing, including customer segmentation and personalized communication, is also a key component of the strategy. This integrated approach allows for efficient resource allocation and campaign effectiveness measurement.

The bank continuously adapts its marketing efforts to stay competitive, reflecting shifts in consumer media consumption and embracing new technologies. This flexibility is crucial for maintaining a strong market presence and effectively reaching its target audience. The focus on digital channels reflects broader trends in consumer behavior.

Digital marketing is a cornerstone of Sydbank's approach. This includes content marketing, SEO, paid advertising, and email marketing. These initiatives aim to build brand awareness and generate leads.

Content marketing includes articles, analyses, and financial guides. The goal is to establish the bank as a trusted financial expert. This strategy supports the Sydbank financial services.

SEO ensures visibility in online searches. Paid advertising targets specific customer segments with tailored offerings. These tactics are essential for customer acquisition.

Email marketing is used for direct communication and lead nurturing. It informs customers about new services and financial news. This helps maintain customer relationships.

Social media platforms are used for brand building, customer service, and promoting financial literacy. Social media initiatives support the overall Sydbank strategy.

While less common, the bank may engage with financial experts for thought leadership. This can enhance brand credibility and reach.

Sydbank also utilizes traditional media and data-driven approaches to complement its digital efforts. This integrated approach aims to maximize reach and effectiveness. The Sydbank sales strategy benefits from this blend.

- Traditional Media: Local newspapers, radio, and regional television are used for broader brand awareness.

- Event Marketing: Sponsoring local events and hosting financial seminars to connect with customers.

- Data-Driven Marketing: Customer segmentation based on demographics and financial needs for personalized communication.

- CRM and Analytics: Utilizing robust CRM systems and data analytics to optimize marketing spend and measure campaign effectiveness. According to recent reports, banks that effectively use data analytics see a 15-20% increase in customer lifetime value.

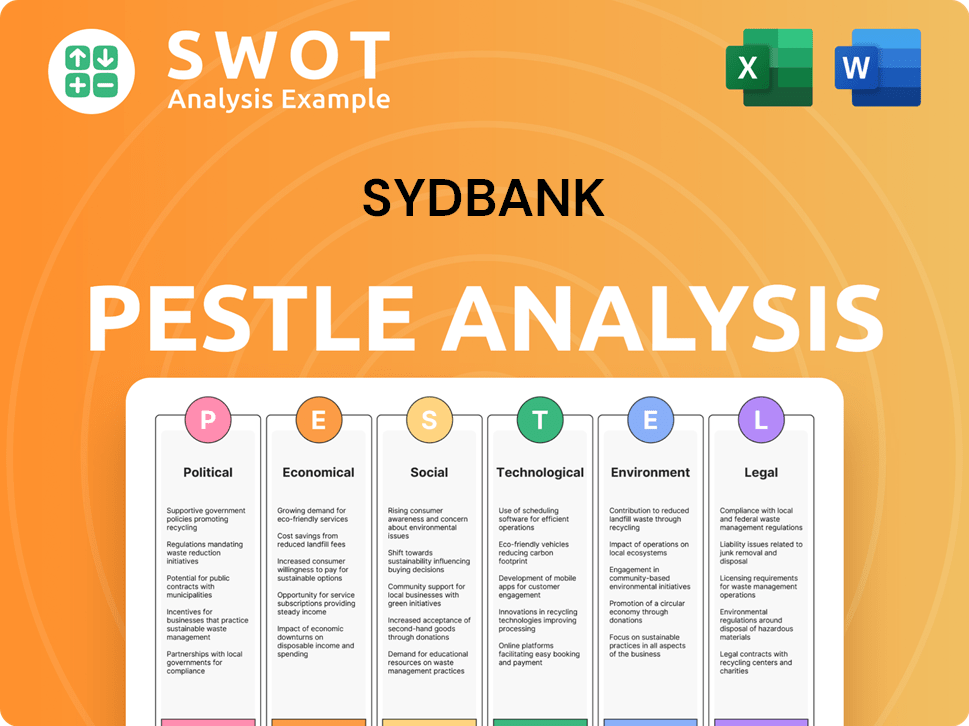

Sydbank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Sydbank Positioned in the Market?

The brand positioning of Sydbank centers on being a local and accessible financial partner, emphasizing proximity and personalized service. This strategy aims to build trust and long-term relationships with customers, differentiating it from competitors through a human-centric approach. The focus is on delivering comprehensive financial solutions and expert guidance to a diverse target audience, including private individuals and businesses.

Sydbank’s core message revolves around trust and reliability, reflecting its role as a trusted advisor. This is supported by a visual identity that conveys stability and approachability, and a clear, direct, and reassuring tone of voice in communications. The customer experience is designed to be attentive, tailored, and easily accessible through various channels.

Sydbank's approach to Owners & Shareholders of Sydbank is to provide value through high-quality service and advisory capabilities rather than solely competing on price. This strategy is reinforced by a strong regional presence and community involvement, which further strengthens its unique selling proposition. This approach is crucial in a dynamic market.

The Sydbank sales strategy emphasizes relationship-building and personalized service, focusing on understanding customer needs. This approach is particularly relevant for private banking and SME clients. The sales team structure likely supports this strategy through local presence and specialized expertise.

The Sydbank marketing strategy focuses on building brand trust and highlighting the value of expert advice. This includes digital marketing initiatives and consistent branding across all touchpoints. Marketing campaigns likely emphasize customer testimonials and community involvement.

Sydbank targets a diverse demographic, including private individuals, SMEs, and larger corporations in Denmark and Northern Germany. The focus is on providing tailored financial solutions to meet the specific needs of each segment. Understanding these demographics is key to effective marketing.

Customer acquisition strategies likely involve a mix of digital marketing, branch presence, and community engagement. The emphasis is on building long-term relationships and providing exceptional customer service. This includes leveraging digital platforms for ease of access.

Sydbank maintains a consistent brand across all channels, from physical branches to digital platforms. This ensures a cohesive customer experience and reinforces brand recognition. This consistency is crucial for building trust.

Sydbank's competitive analysis likely focuses on local and regional banks, emphasizing its unique selling proposition. This involves monitoring market trends and adapting to competitive threats. This helps in refining the Sydbank strategy.

Digital marketing initiatives likely include content marketing, social media engagement, and search engine optimization. These efforts aim to increase brand visibility and attract new customers. Digital platforms are key for Sydbank marketing strategy.

Sydbank sales performance indicators probably include customer acquisition rates, customer retention, and revenue growth. These metrics help assess the effectiveness of sales strategies. These are important for Sydbank sales strategy.

The Sydbank marketing budget allocation likely prioritizes digital marketing, branch marketing, and community engagement. This reflects the bank's focus on local presence and digital reach. This is a part of the Sydbank marketing strategy.

Sydbank's customer relationship management likely involves personalized service and tailored financial advice. This approach aims to build long-term relationships and increase customer loyalty. This is a key part of the Sydbank business model.

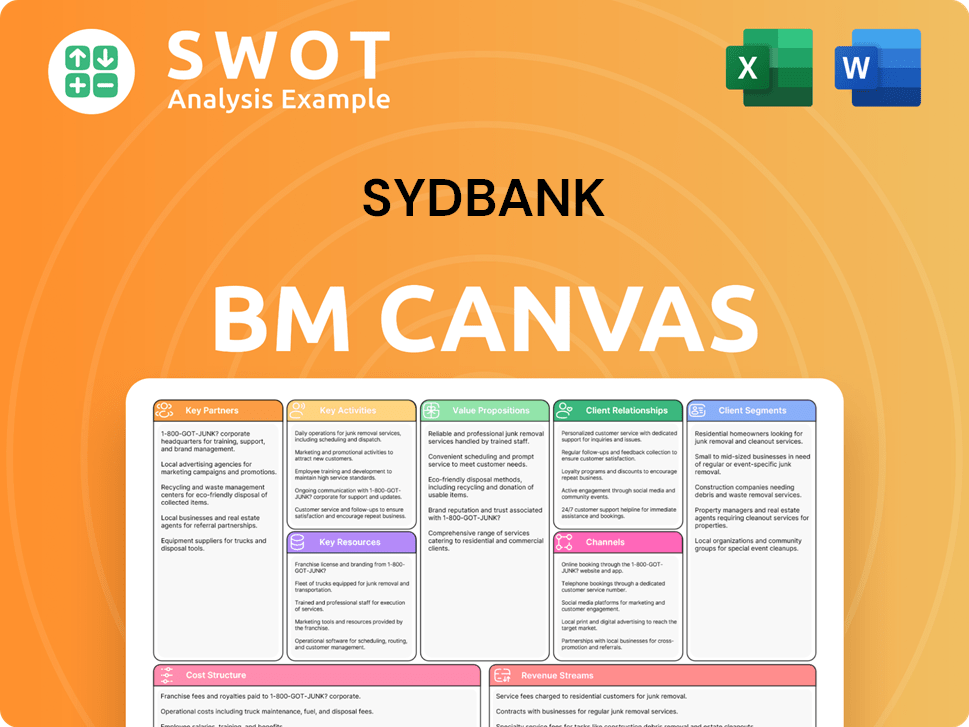

Sydbank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Sydbank’s Most Notable Campaigns?

The Sydbank sales strategy and Sydbank marketing strategy consistently focus on reinforcing its brand as a reliable and accessible financial partner, particularly within its core markets of Denmark and Northern Germany. Campaigns often highlight their comprehensive range of services, from everyday banking to more specialized areas like asset management and real estate, and to emphasize their local expertise. A key element of their Sydbank strategy involves promoting advisory services for mortgage financing and showcasing solutions for corporate clients.

Creative concepts for Sydbank's campaigns typically revolve around real-life scenarios, demonstrating how the bank's services simplify financial decisions or help customers achieve their financial goals. Main channels include digital advertising (social media, search engine marketing), the corporate website, email marketing, and traditional media such as local newspapers and radio. The success of these campaigns is likely measured by metrics such as increased inquiries for specific products, growth in customer deposits or loan portfolios, website traffic, and improved brand perception scores.

While specific details of individual sales and marketing campaigns from 2024-2025 are often proprietary, the bank's consistent financial performance, including a strong net profit of DKK 2,873 million in 2023, indicates effective marketing and sales strategies supporting their business objectives. Any collaborations would likely involve local community initiatives or partnerships with regional businesses, further strengthening their image as a community-oriented bank.

Sydbank utilizes digital platforms such as social media and search engine marketing to reach a broad audience. This includes targeted advertising campaigns aimed at specific demographics and financial needs. The focus is on providing relevant information and driving traffic to their website for further engagement.

Their corporate website serves as a central hub for information, with email marketing used to nurture leads and communicate with existing customers. This strategy includes newsletters, product updates, and personalized offers. Website traffic and engagement metrics are key performance indicators.

Sydbank continues to use traditional media, such as local newspapers and radio, to reach a wider audience, particularly in their core markets. These campaigns often highlight local presence and community involvement. This helps build trust and brand recognition.

Collaborations with local community initiatives and regional businesses are a recurring feature of Sydbank's marketing efforts. These partnerships reinforce their image as a community-oriented bank. This approach enhances brand loyalty and positive public perception.

The effectiveness of Sydbank's campaigns is measured through several key performance indicators (KPIs). These metrics provide insights into the success of their marketing and sales strategies, allowing for data-driven decision-making and continuous improvement.

- Increased inquiries for specific products, such as mortgages or business loans.

- Growth in customer deposits and loan portfolios, reflecting increased customer engagement.

- Website traffic and engagement metrics, indicating the effectiveness of digital campaigns.

- Improved brand perception scores, as measured through customer surveys and market research.

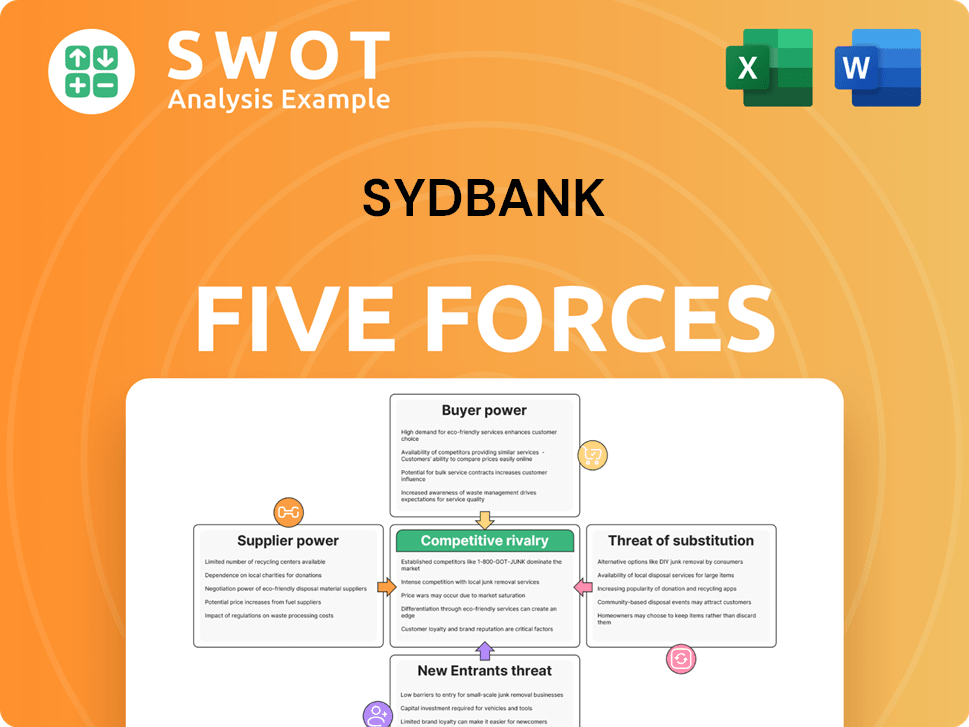

Sydbank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sydbank Company?

- What is Competitive Landscape of Sydbank Company?

- What is Growth Strategy and Future Prospects of Sydbank Company?

- How Does Sydbank Company Work?

- What is Brief History of Sydbank Company?

- Who Owns Sydbank Company?

- What is Customer Demographics and Target Market of Sydbank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.