Synaptics Bundle

How Does Synaptics Stack Up in Today's Tech Arena?

In a world driven by seamless human-device interaction, Synaptics Inc. is a pivotal player, constantly reshaping our digital experiences. From its inception in 1986, Synaptics has evolved from touchpads to a leader in human interface solutions. This evolution highlights its crucial role in the tech sector and its ability to adapt to changing market demands.

Understanding the Synaptics SWOT Analysis is crucial for grasping its position within the Synaptics competitive landscape. This analysis will delve into Synaptics competitors, assessing their strengths and weaknesses relative to Synaptics, alongside an examination of Synaptics market share. Furthermore, we'll explore the Synaptics industry analysis and how Synaptics technology contributes to its Synaptics financial performance, providing a comprehensive overview of this dynamic market.

Where Does Synaptics’ Stand in the Current Market?

Synaptics holds a significant position in the human interface solutions market. The company is a leading provider in areas such as display drivers, touch controllers, and biometric sensors. Assessing the Synaptics competitive landscape reveals its strong presence, particularly in the PC touchpad market, with expansion into mobile and IoT sectors.

The company's core offerings include touchpads and keyboards for PCs, touch and display integration (TDDI) solutions for smartphones and tablets, and biometric fingerprint sensors. Synaptics serves a broad customer base, including leading global manufacturers of laptops, smartphones, automotive systems, and IoT devices. Its geographical reach is global, with substantial revenue from North America, Asia, and Europe.

Synaptics has strategically shifted towards higher-value, integrated solutions, moving beyond discrete components. This approach allows the company to offer comprehensive system-level expertise. In fiscal year 2023, Synaptics reported total revenue of $1.166 billion, demonstrating its financial performance and market presence.

Synaptics is recognized as a leading provider in several of its segments. While specific market share figures fluctuate, the company maintains a strong position in the PC touchpad market. Its expansion into the mobile and IoT sectors further solidifies its market presence. Assessing the Synaptics market share is crucial for understanding its competitive standing.

Synaptics' primary product lines include touchpads and keyboards for PCs, touch and display integration (TDDI) solutions for smartphones and tablets, and biometric fingerprint sensors. These products cater to a wide range of applications across various industries. The company's technology portfolio is diverse, supporting numerous consumer electronics.

Synaptics serves a broad customer base, including leading global manufacturers of laptops, smartphones, automotive systems, and various IoT devices. The company's global presence is reflected in its revenue streams from North America, Asia, and Europe. This widespread adoption of its technologies in consumer electronics highlights its market reach.

The company has strategically shifted its focus towards higher-value, more integrated solutions. This move allows Synaptics to offer comprehensive system-level expertise. In fiscal year 2023, Synaptics reported total revenue of $1.166 billion. This demonstrates its financial performance and market presence in the industry.

Synaptics' competitive advantages include its strong market position, diverse product portfolio, and strategic focus on integrated solutions. Its ability to serve a broad customer base and maintain a global presence is also crucial. For more insights, consider reading about the Marketing Strategy of Synaptics.

- Strong presence in key markets like PC touchpads.

- Diverse product offerings including TDDI solutions and biometric sensors.

- Strategic shift towards higher-value, integrated solutions.

- Global customer base and revenue streams.

Synaptics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Synaptics?

Understanding the Synaptics competitive landscape is crucial for assessing its market position and future prospects. The company faces a diverse set of rivals across its various product lines, from established semiconductor giants to specialized component providers. This competitive environment shapes Synaptics' market share and influences its strategic decisions.

Synaptics' industry analysis reveals a dynamic market where innovation and technological advancements are key drivers. The company's ability to navigate this landscape depends on its competitive advantages and its responses to Synaptics' competitors. Analyzing these factors provides a comprehensive view of Synaptics' financial performance and potential for growth.

The competitive dynamics also impact Synaptics' technology roadmap. The company must continuously innovate to maintain its edge. For more details, you can explore the Target Market of Synaptics.

In the touch and display integration (TDDI) solutions market, Synaptics' key competitors include Novatek and Himax Technologies. These companies offer integrated solutions for smartphones and tablets. Their market presence directly challenges Synaptics' offerings.

For PC-centric human interface devices, Elan Microelectronics is a significant competitor, particularly in touchpads and keyboard controllers. Synaptics' product offerings compared to Elan's influence the company's market share in the PC segment. Synaptics' market position analysis must consider Elan's strengths.

In the biometric fingerprint sensor market, Goodix Technology, Fingerprint Cards AB, and other specialized sensor manufacturers are key rivals. These competitors vie for design wins in smartphones, PCs, and other secure access devices. Synaptics vs. competitor comparison is essential to understanding its competitive edge.

Larger semiconductor companies like Qualcomm and MediaTek indirectly impact Synaptics. These companies offer integrated platforms that include touch and display functionalities. Their market presence affects Synaptics' opportunities.

Major OEMs developing their own proprietary human interface solutions also influence the competitive landscape. This in-house development presents a challenge to Synaptics' market share. Synaptics' growth strategies must consider this factor.

Synaptics' market challenges include intense competition and rapid technological advancements. The company must continuously innovate to stay competitive. Synaptics' future outlook depends on its ability to address these challenges.

The competitive landscape for Synaptics is complex, involving both direct and indirect competitors. Synaptics' technology portfolio overview shows its diverse offerings. Analyzing Synaptics' latest financial results and Synaptics stock performance analysis provides insights into its competitive position. Synaptics acquisitions and partnerships also shape its competitive standing.

- Synaptics competitive advantage lies in its ability to offer integrated solutions.

- Synaptics' key competitors 2024 include both established and emerging players.

- Synaptics competitive intelligence report reveals the strategies of its rivals.

- Understanding who are Synaptics' main rivals is crucial for strategic planning.

Synaptics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Synaptics a Competitive Edge Over Its Rivals?

Understanding the Synaptics competitive landscape involves recognizing its core strengths. The company's success is built upon a foundation of intellectual property, engineering expertise, and strong relationships with key original equipment manufacturers (OEMs). This strategic positioning allows for the development of innovative, differentiated products in the human interface solutions market.

Synaptics' competitive advantage is further solidified by its long-standing collaborations with major global brands across the PC, mobile, and IoT sectors. These partnerships enable the company to anticipate market trends and tailor solutions to specific customer needs. The ability to offer integrated solutions, such as its TDDI technology, enhances cost-efficiency and design simplicity for its clients.

The company's ability to maintain a strong market position is also supported by economies of scale in manufacturing and a robust global supply chain. These factors contribute to consistent product delivery and operational efficiency. For a deeper dive into the company's strategic direction, consider reading about the Growth Strategy of Synaptics.

Synaptics' technology portfolio includes a significant number of patents related to touch, display, and biometric technologies. These patents create a barrier to entry for competitors. The company's proprietary algorithms and specialized silicon designs enable superior performance in its human interface solutions.

Strong relationships with leading OEMs in the PC, mobile, and IoT industries are a key advantage. These relationships facilitate deep integration into product development cycles. This allows Synaptics to co-develop solutions tailored to specific customer requirements, enhancing customer loyalty.

The company offers highly integrated solutions, such as TDDI technology, which combines touch and display functionalities. This integration provides cost efficiencies and simplifies the design process for customers. This approach helps Synaptics maintain a competitive edge.

Synaptics benefits from economies of scale in manufacturing and a robust global supply chain. These factors ensure consistent product delivery and operational efficiency. This allows the company to meet the demands of its global customer base effectively.

Synaptics' competitive advantages are multifaceted, encompassing technological innovation, strategic partnerships, and operational efficiency. The company's focus on human interface solutions allows it to maintain relevance in a dynamic technological landscape, with a strong emphasis on innovation and customer-centric solutions. In 2024, the company continues to evolve its product offerings to meet the changing demands of the market.

- Extensive patent portfolio in touch, display, and biometric technologies.

- Strong relationships with major OEMs in PC, mobile, and IoT industries.

- Highly integrated solutions like TDDI, offering cost efficiencies.

- Economies of scale in manufacturing and a robust global supply chain.

Synaptics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Synaptics’s Competitive Landscape?

The human interface technology industry is experiencing significant shifts, influencing the Synaptics competitive landscape. These changes present both challenges and opportunities. The industry is driven by technological advancements, particularly in AI and ML, which are reshaping user interfaces. This will require companies like Synaptics to adapt and innovate to remain competitive.

The increasing demand for intuitive interactions across connected devices, fueled by the Internet of Things (IoT), is another key trend. However, intense price competition, rapid consumer expectation changes, and geopolitical tensions pose challenges. For a detailed look at how Synaptics generates revenue, you can review the Revenue Streams & Business Model of Synaptics.

Key trends include AI/ML integration, driving smarter user interfaces. The IoT's expansion is increasing the need for seamless interactions. These trends are reshaping the Synaptics technology focus, pushing for more advanced products.

Challenges include intense price competition, especially in mature markets. Rapidly evolving consumer expectations and potential supply chain disruptions also pose risks. Vertical integration by OEMs could reduce reliance on external suppliers.

Opportunities exist in emerging markets and the automotive sector. Expansion into new applications needing secure biometric authentication is also promising. Strategic investments in R&D, partnerships, and agility are key.

Synaptics' success depends on R&D, partnerships, and adapting to new technologies. The company must balance its strategies to maintain its leadership. The ability to innovate and respond to market changes is essential for long-term growth.

Synaptics' market position analysis shows a focus on innovation and strategic partnerships. The company is investing in R&D to maintain its Synaptics competitive advantage. The Synaptics future outlook hinges on its ability to adapt to industry changes.

- Synaptics needs to navigate intense competition from established players and emerging rivals.

- The company must leverage its technology portfolio to capture growth opportunities in new markets.

- Synaptics' financial performance will be influenced by its ability to manage costs and secure key partnerships.

- The company must stay ahead of technological advancements to remain relevant.

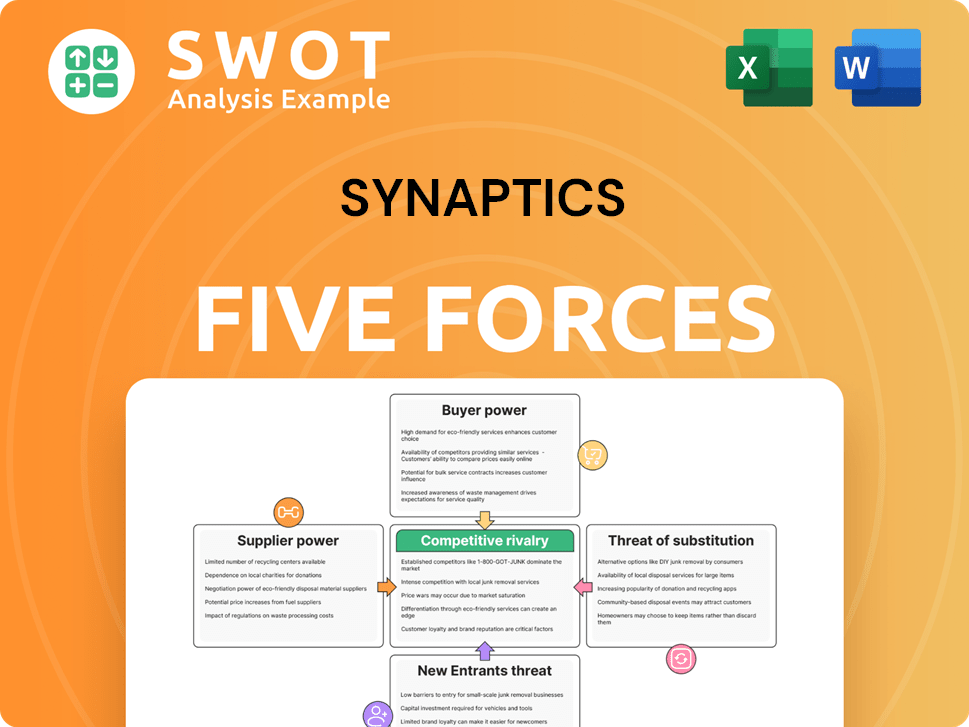

Synaptics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Synaptics Company?

- What is Growth Strategy and Future Prospects of Synaptics Company?

- How Does Synaptics Company Work?

- What is Sales and Marketing Strategy of Synaptics Company?

- What is Brief History of Synaptics Company?

- Who Owns Synaptics Company?

- What is Customer Demographics and Target Market of Synaptics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.