Vietnam Technological & Commercial Joint Stock Bank Bundle

How Does Techcombank Dominate Vietnam's Banking Scene?

Techcombank, a titan in the Vietnamese banking sector since 1993, has consistently redefined financial services through innovation and customer-centricity. From its humble beginnings, it has rapidly ascended to become one of the largest private sector banks, a testament to its strategic vision. This journey showcases its commitment to digital transformation and its deep understanding of the Vietnamese market.

As of early 2025, Techcombank's prominence in the Vietnam Technological & Commercial Joint Stock Bank SWOT Analysis is undeniable, consistently ranking among the top banks. This analysis delves into the Techcombank competitive landscape, exploring key players and strategic advantages within the Vietnamese banking sector. Understanding Techcombank's market share analysis and financial performance is crucial for any investor or strategist looking to navigate the Banking industry analysis in Vietnam.

Where Does Vietnam Technological & Commercial Joint Stock Bank’ Stand in the Current Market?

Techcombank holds a prominent position within the Vietnamese banking sector, consistently ranking among the leading private banks. Its strong performance and strategic initiatives have solidified its standing in the market. The bank's focus on innovation and customer experience further enhances its competitive edge, making it a key player in the Vietnamese banking sector.

The bank's financial health and operational efficiency are key indicators of its market position. Techcombank offers a comprehensive suite of financial products and services, including deposit accounts, loans, credit cards, and investment products. This diverse offering caters to a wide range of customers, from individual consumers to large corporations, supporting its robust market standing and ability to compete effectively.

Techcombank reported a profit before tax of VND 22,866 billion (approximately USD 940 million) in 2023, demonstrating its financial strength and scale. This financial performance underscores its ability to compete effectively within the Vietnamese market. The bank's strategic focus on digital transformation and premium customer experience has allowed it to attract and retain high-value customers while expanding its reach through accessible digital channels.

Techcombank consistently ranks among the top private banks in Vietnam. While precise market share data for 2024-2025 fluctuates, the bank maintains a significant presence. Its robust financial performance and strategic initiatives contribute to its strong market position within the Vietnamese banking sector.

In 2023, the bank achieved a profit before tax of VND 22,866 billion (approximately USD 940 million). This demonstrates Techcombank's strong financial health and operational efficiency. This financial performance supports its competitive standing in the market.

Techcombank offers a comprehensive suite of financial products, including deposit accounts, loans, credit cards, and investment products. These diverse offerings cater to a wide range of customers, supporting its robust market standing. The bank's focus on digital banking solutions enhances its competitiveness.

Techcombank has a widespread presence across Vietnam with a network of branches and transaction offices in key economic centers. Its customer base includes individual consumers, SMEs, and large corporations. This broad reach supports its strong market position.

Techcombank's competitive advantages include its strong financial performance, extensive branch network, and focus on digital transformation. The bank's strategic initiatives and customer-centric approach further enhance its position. These factors collectively contribute to its success in the Techcombank competitive landscape.

- Strong Capital Adequacy: Techcombank maintains a robust capital base, ensuring financial stability.

- Digital Banking Innovation: The bank's advanced digital platforms enhance customer experience and operational efficiency.

- Premium Customer Experience: Techcombank focuses on delivering high-quality service to attract and retain customers.

- Strategic Partnerships: Collaborations with technology providers and other businesses expand its reach and service offerings.

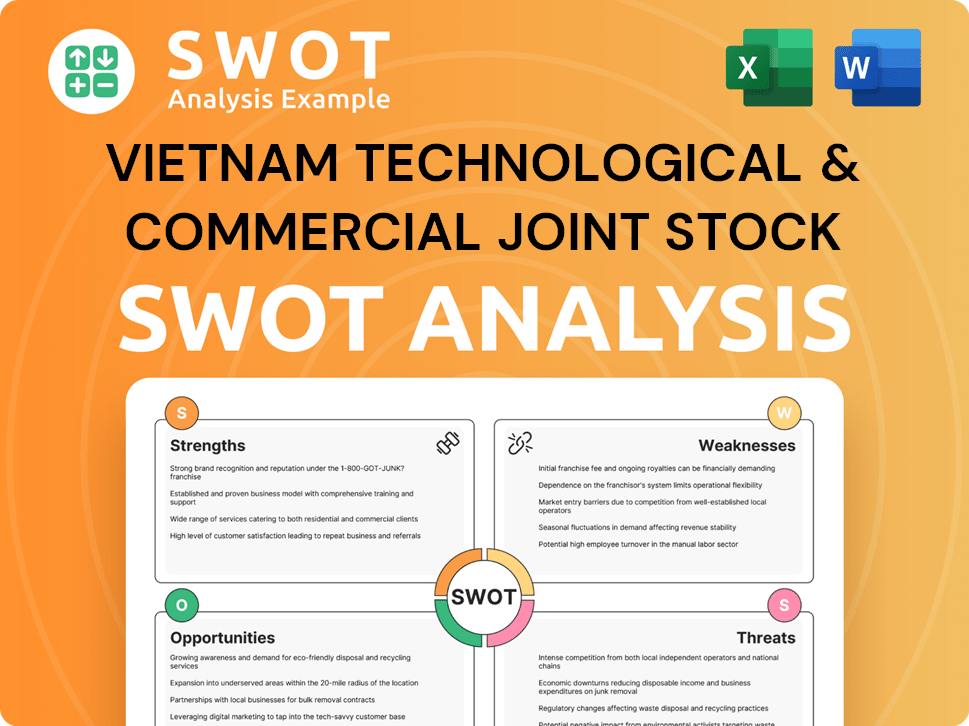

Vietnam Technological & Commercial Joint Stock Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Vietnam Technological & Commercial Joint Stock Bank?

The competitive landscape of Vietnam Technological & Commercial Joint Stock Bank (Techcombank) is complex, shaped by a diverse array of financial institutions vying for market share in the Vietnamese banking sector. Understanding the competitive dynamics is crucial for assessing Techcombank's strategic positioning and future prospects. This analysis considers both direct and indirect competitors, including state-owned banks, private joint-stock commercial banks, foreign banks, and emerging fintech companies.

Techcombank's ability to navigate this competitive environment depends on its strategic initiatives, customer base, and digital banking services. A thorough examination of its competitors, market share analysis, and financial performance provides insights into its strengths, weaknesses, opportunities, and threats. For a deeper dive into the bank's overall strategy, consider reading about the Growth Strategy of Vietnam Technological & Commercial Joint Stock Bank.

Techcombank operates within a highly competitive Vietnamese banking landscape, facing significant challenges from various financial institutions. Its main direct competitors include major state-owned banks like Vietcombank, BIDV, VietinBank, and Agribank. These state-owned entities often have larger branch networks and customer bases, providing an advantage in serving large corporations and government-linked entities. For example, Vietcombank competes directly with Techcombank in both retail and corporate banking, leveraging its extensive network and established brand.

Vietcombank, BIDV, VietinBank, and Agribank are key direct competitors. These banks have extensive networks and historical advantages.

VPBank, MBBank, ACB, and Sacombank are strong competitors. They often use product innovation and competitive pricing.

HSBC, Standard Chartered, and Citibank target multinational corporations and high-net-worth individuals. They offer global expertise.

Fintech firms disrupt traditional banking in digital payments and mobile banking. They push for continuous innovation.

Mergers and alliances within the sector impact market share and capabilities. Banks seek to consolidate their positions.

Competitive dynamics are influenced by mergers and alliances. Banks aim to enhance their capabilities and market share.

Beyond the state-owned giants, Techcombank faces competition from private joint-stock commercial banks such as VPBank, MBBank, ACB, and Sacombank. VPBank has established a strong presence in consumer finance, directly competing with Techcombank in retail lending. MBBank, with its military ties, has expanded rapidly, particularly in digital banking and services for its customer segments. These private banks often challenge Techcombank through product innovation, competitive pricing, and targeted marketing.

Techcombank's competitors employ various strategies to gain market share, including aggressive product innovation, competitive pricing, and targeted marketing campaigns.

- Vietcombank: Focuses on extensive network and customer base.

- VPBank: Specializes in consumer finance and retail lending.

- MBBank: Leverages military ties for digital banking and customer services.

- Foreign Banks: Target multinational corporations and high-net-worth individuals with sophisticated financial products.

- Fintech Companies: Disrupt traditional banking through digital payments and mobile banking solutions.

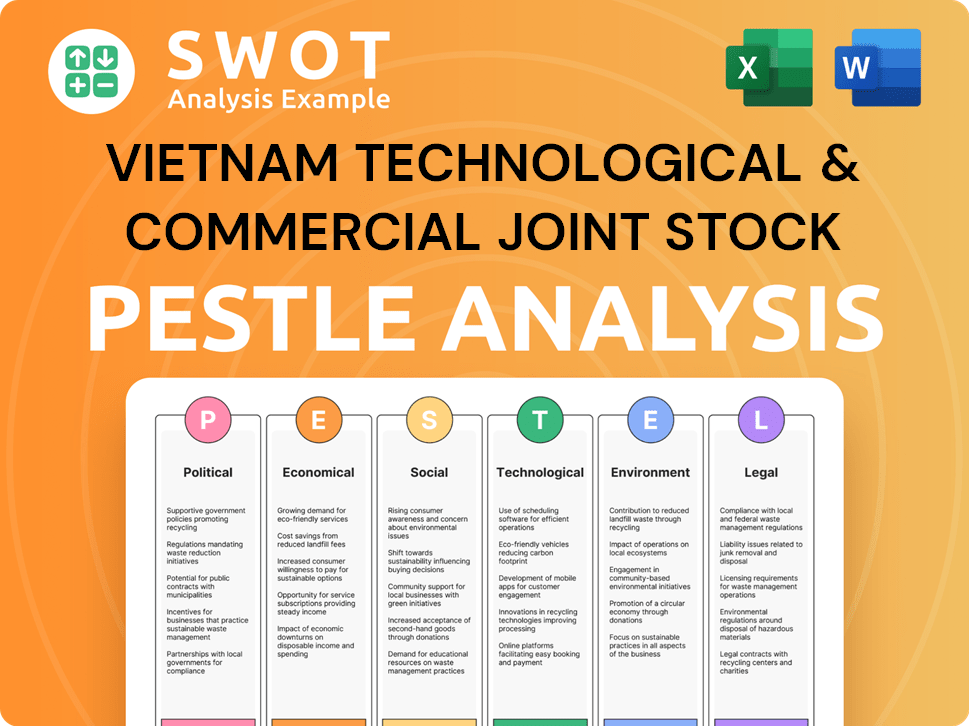

Vietnam Technological & Commercial Joint Stock Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Vietnam Technological & Commercial Joint Stock Bank a Competitive Edge Over Its Rivals?

The Vietnam Technological & Commercial Joint Stock Bank (Techcombank) distinguishes itself in the Vietnamese banking sector through a combination of strategic initiatives and operational strengths. Its competitive advantages are rooted in a strong focus on digital transformation, robust financial health, and a customer-centric approach. These elements collectively enhance its market position and contribute to sustained growth, making it a key player in the Vietnamese banking industry analysis.

Techcombank's strategic moves have consistently aimed at enhancing customer experience and operational efficiency. Investments in digital infrastructure and customer relationship management have been pivotal. The bank's focus on affluent and mass-affluent segments has allowed for the development of tailored products and services, fostering strong customer loyalty. These strategic initiatives are critical for understanding the Techcombank competitive landscape.

The bank's competitive edge is further bolstered by its strong brand reputation and a commitment to innovation. This has been evident in its financial performance and the continuous development of new services. Its sophisticated data analytics capabilities support deeper customer insights, personalization of offerings, and optimized risk management. For a deeper dive into the bank's financial model, consider reading Revenue Streams & Business Model of Vietnam Technological & Commercial Joint Stock Bank.

Techcombank's significant investment in digital infrastructure has resulted in robust online and mobile banking platforms. This focus enhances customer convenience and improves operational efficiency. The bank's digital prowess attracts a tech-savvy customer base. In 2024, Techcombank reported that approximately 90% of its transactions were conducted through digital channels.

Techcombank consistently maintains a healthy capital base, providing a strong foundation for expansion. This financial strength allows the bank to pursue strategic investments and withstand competitive pressures. The bank's strong asset quality ensures stability and resilience. In 2024, the bank's capital adequacy ratio (CAR) was reported at over 15%, significantly above the regulatory minimum.

The bank's focus on affluent and mass-affluent segments fosters strong customer loyalty. Techcombank tailors its products and services to meet the specific needs of these segments. Personalized banking experiences and value-added services are key offerings. Customer satisfaction scores consistently rank above the industry average.

Techcombank has built a strong brand equity through consistent marketing efforts and a focus on service quality. The bank has a track record of strong financial performance. Its reputation for innovation and reliability contributes significantly to its competitive edge. The bank's brand recognition is consistently high in the Vietnamese market.

Techcombank's competitive advantages are primarily driven by its digital transformation, robust financial health, and customer-centric strategies. These advantages are sustainable due to continuous investment in technology and prudent financial management. The bank's ability to leverage data analytics for customer insights further enhances its competitive standing.

- Digital Banking: High transaction volumes through digital channels.

- Financial Strength: Strong capital adequacy and asset quality.

- Customer Focus: Personalized services for affluent segments.

- Brand Reputation: Innovation and reliability.

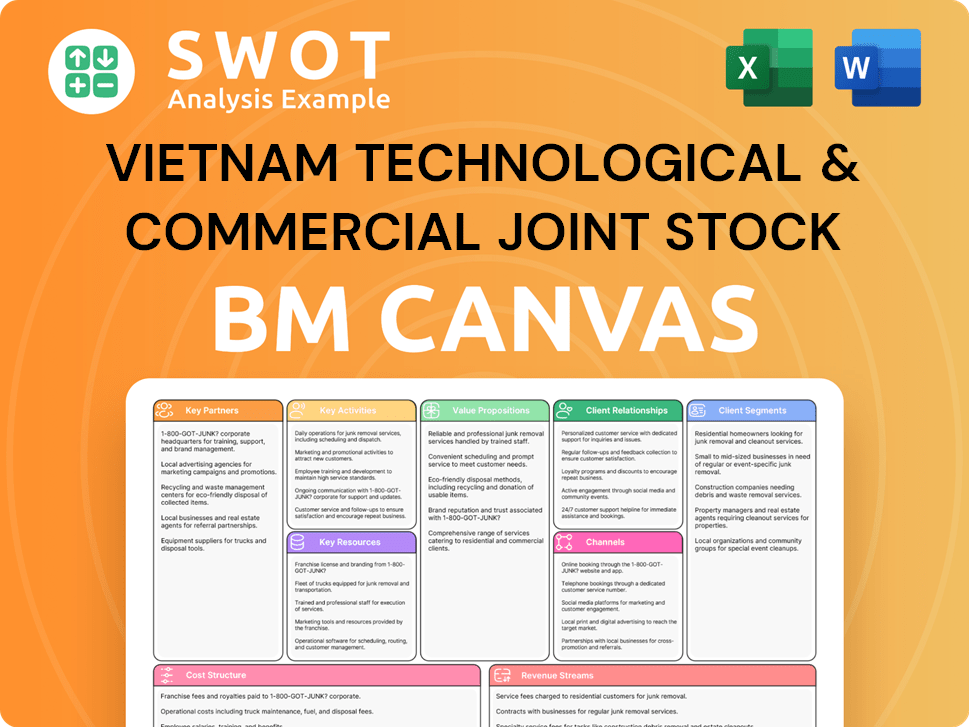

Vietnam Technological & Commercial Joint Stock Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Vietnam Technological & Commercial Joint Stock Bank’s Competitive Landscape?

The Vietnamese banking sector is undergoing rapid transformation, driven by technological advancements, evolving customer preferences, and stringent regulatory changes. These shifts significantly impact the competitive landscape, presenting both challenges and opportunities for institutions like Techcombank. Understanding these dynamics is crucial for evaluating the bank's strategic positioning and future prospects. This analysis focuses on the industry trends, future challenges, and opportunities shaping the trajectory of Techcombank within the Vietnamese banking sector.

Techcombank's competitive position is influenced by its ability to adapt to digital transformation, manage risks effectively, and capitalize on economic growth. The bank faces challenges from fintech companies and evolving customer expectations, but also benefits from Vietnam's expanding economy and increasing demand for financial services. The future outlook for Techcombank depends on its strategic initiatives, financial performance, and ability to navigate the changing landscape.

The Vietnamese banking sector is experiencing a surge in digital transformation, with a focus on mobile banking, AI-driven customer service, and blockchain applications. Regulatory changes, including stricter compliance and data privacy laws, are reshaping operational frameworks. Consumer preferences are shifting towards digital-first interactions, demanding seamless and personalized financial services. These trends are reshaping the Marketing Strategy of Vietnam Technological & Commercial Joint Stock Bank.

Key challenges include continuous investment in technology to remain competitive, managing cybersecurity risks, and adapting to complex regulatory environments. The rise of fintech companies and non-bank financial institutions poses a significant competitive threat. Maintaining customer loyalty in a digital space where switching costs are low is also a major challenge. The need to balance innovation with risk management is critical.

Opportunities include capitalizing on the growing demand for digital banking services, expanding into underserved segments, and innovating new product offerings. Leveraging data analytics for targeted marketing and improved risk assessment can enhance customer satisfaction. Strategic partnerships with fintech companies can drive innovation and open new revenue streams. Vietnam's robust economic growth and rising middle class offer significant potential for increased demand for financial products and services.

Techcombank is focusing on digital transformation, enhancing its technology infrastructure, and expanding its digital banking services. The bank is investing in data analytics to personalize customer experiences and improve risk management. Strategic partnerships and collaborations with fintech companies are part of their strategy. Techcombank's strong financial health and proactive approach position it well to navigate challenges and capitalize on opportunities.

The Vietnamese banking sector's digital banking transactions are growing significantly, with mobile banking adoption rates increasing year over year. Fintech investments in Vietnam are on the rise, indicating heightened competition. Regulatory changes, such as those related to Basel III implementation, are impacting capital requirements and risk management practices. Economic growth in Vietnam, projected at around 6% in 2024, is driving increased demand for financial products.

- Digital banking transactions in Vietnam increased by 40% in 2023.

- Fintech investments in Vietnam reached over $100 million in 2024.

- Techcombank's net profit grew by 20% in 2024, reflecting strong performance.

- The Vietnamese middle class is expanding, creating a larger customer base for financial services.

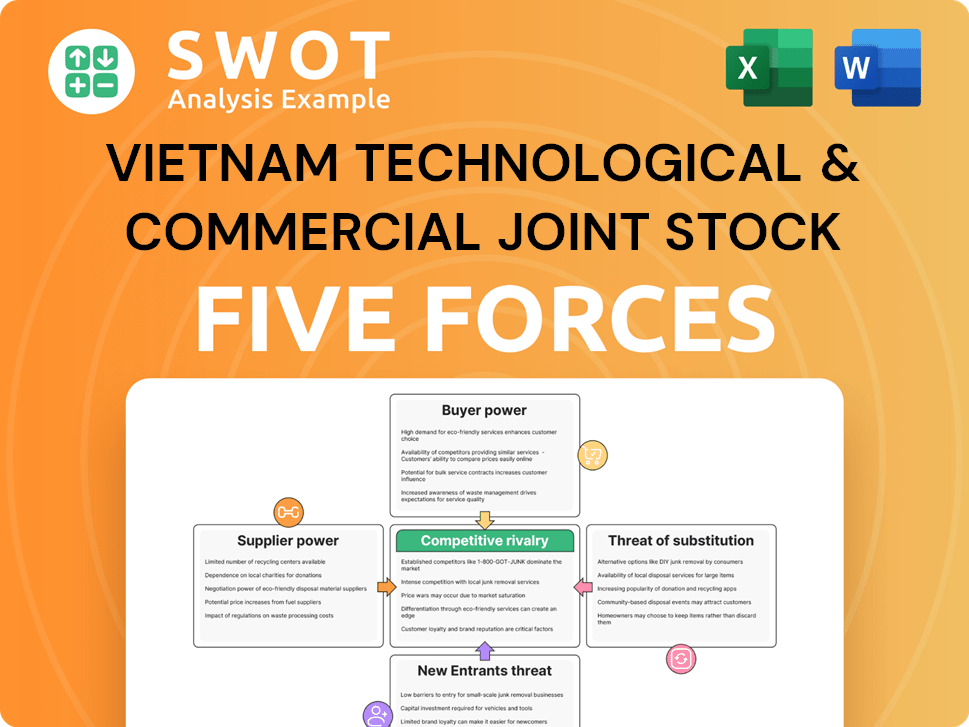

Vietnam Technological & Commercial Joint Stock Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vietnam Technological & Commercial Joint Stock Bank Company?

- What is Growth Strategy and Future Prospects of Vietnam Technological & Commercial Joint Stock Bank Company?

- How Does Vietnam Technological & Commercial Joint Stock Bank Company Work?

- What is Sales and Marketing Strategy of Vietnam Technological & Commercial Joint Stock Bank Company?

- What is Brief History of Vietnam Technological & Commercial Joint Stock Bank Company?

- Who Owns Vietnam Technological & Commercial Joint Stock Bank Company?

- What is Customer Demographics and Target Market of Vietnam Technological & Commercial Joint Stock Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.