Vietnam Technological & Commercial Joint Stock Bank Bundle

Who Does Techcombank Serve?

In the dynamic landscape of the Vietnam Technological & Commercial Joint Stock Bank SWOT Analysis, understanding the bank's customer demographics and target market is crucial. The evolution of Techcombank, from its inception in 1993, mirrors the shifts in Vietnam's economic and consumer behaviors. This exploration delves into the core of Techcombank's customer base, revealing the strategies that drive its success in the competitive Banking Industry Vietnam.

Techcombank's journey from a generalist approach to a segmented strategy reflects its commitment to meeting diverse financial needs. Analyzing Techcombank customer profile analysis, including age range, income levels, and location, provides valuable insights. This analysis is vital for understanding how Techcombank adapts its offerings, from digital banking solutions to SME loans, to effectively reach its target audience characteristics and maintain customer satisfaction.

Who Are Vietnam Technological & Commercial Joint Stock Bank’s Main Customers?

Understanding the primary customer segments of Vietnam Technological & Commercial Joint Stock Bank, or Techcombank, is crucial for grasping its market position and strategic direction. Techcombank caters to a diverse clientele, encompassing both individual consumers and businesses. This dual approach allows the bank to capture a broad market share within the competitive Banking Industry Vietnam.

The bank's customer base is strategically segmented to maximize its reach and effectiveness. This segmentation allows Techcombank to tailor its products and services to meet the specific needs of each group, ensuring customer satisfaction and loyalty. Analyzing the customer demographics provides insights into the bank's operational focus and future growth strategies.

Techcombank's commitment to understanding its customers is evident in its targeted approach to both individual consumers (B2C) and businesses (B2B). This dual focus highlights the bank's comprehensive strategy to capture a significant share of the Vietnamese financial market. Detailed analysis of these segments reveals key characteristics and preferences that drive the bank's product development and marketing efforts.

The B2C segment primarily includes young professionals and middle-to-high-income individuals. These customers often reside in urban centers like Hanoi and Ho Chi Minh City. They typically have higher education levels and are digitally savvy, preferring technology-driven financial solutions.

Techcombank's B2B segment focuses on small and medium-sized enterprises (SMEs) and larger corporations across various industries. The bank provides a range of corporate banking services, including lending, trade finance, and cash management. This segment is vital for the bank's revenue generation.

Key demographics for Techcombank customers include a significant portion of individuals aged between 25 and 45, representing a large segment of the working population. Income levels vary, with a notable concentration in the middle to high-income brackets. The bank's customer base is predominantly located in urban areas, reflecting the higher concentration of economic activities and digital adoption.

Digital banking is a major focus, with over 80% of customers utilizing online and mobile banking platforms. This trend is driven by the convenience and accessibility of digital services. Techcombank continues to invest in digital infrastructure to enhance customer experience and attract a wider audience. The bank's digital transformation strategy includes expanding its mobile banking features and improving its online security protocols.

Techcombank's strategic focus is on building long-term relationships with its customers, particularly in the B2B segment, and providing comprehensive financial solutions. The bank aims to enhance its digital offerings to cater to the growing demand for online banking services. Market research and customer satisfaction surveys play a crucial role in shaping the bank's product development and customer acquisition strategies.

- Techcombank's customer base includes a significant portion of young professionals and middle-to-high-income individuals.

- The bank is increasingly focused on digital banking, with over 80% of customers using online and mobile platforms.

- Techcombank's B2B segment targets SMEs and larger corporations, offering comprehensive financial solutions.

- The bank's customer acquisition strategy is supported by detailed market research and customer satisfaction surveys.

For more insights into the competitive landscape, it's useful to examine the Competitors Landscape of Vietnam Technological & Commercial Joint Stock Bank. This analysis can provide a broader understanding of how Techcombank positions itself within the banking industry.

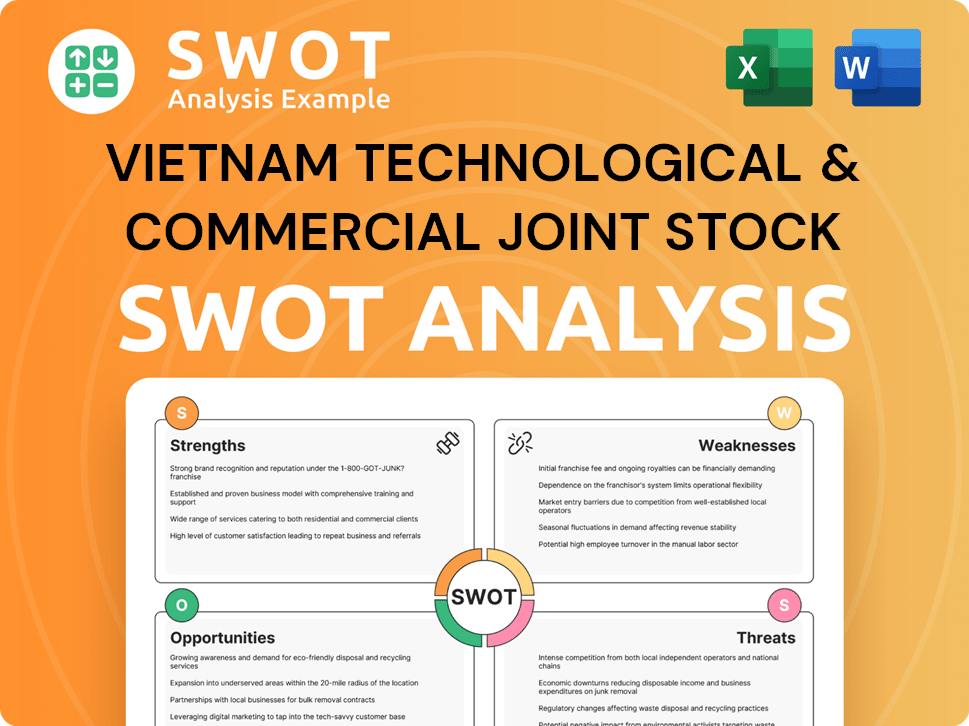

Vietnam Technological & Commercial Joint Stock Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Vietnam Technological & Commercial Joint Stock Bank’s Customers Want?

The key needs and preferences of customers at Vietnam Technological & Commercial Joint Stock Bank (Techcombank) are increasingly centered around convenience, speed, and personalized financial solutions. Both individual and business customers are driving the demand for digital banking services and tailored financial products.

For individual customers, the emphasis is on user-friendly interfaces, seamless digital experiences, and quick processing times for everyday transactions. Business customers, particularly SMEs, prioritize efficient cash flow management, flexible lending options, and integrated digital platforms. These preferences shape Techcombank's product development and customer service strategies.

Techcombank's approach to meeting these needs involves a focus on digital innovation and customer-centric solutions. The bank continuously enhances its digital platforms, offers competitive interest rates, and provides reliable customer support. It also tailors its services to meet the specific needs of different customer segments, such as providing personalized investment advice to affluent clients and specialized credit lines to businesses.

Techcombank customers show a strong preference for digital banking. This includes mobile banking apps and online platforms for various transactions.

Techcombank segments its customers to offer tailored financial products. This includes personalized investment advice for affluent clients and specialized credit lines for businesses.

SMEs prioritize efficient cash flow management and flexible lending options. Techcombank addresses these needs by streamlining digital workflows and leveraging data analytics.

Customer feedback and market trends significantly influence the development of new products and the enhancement of existing services. This helps Techcombank stay competitive.

Reliable customer support is a key decision-making criterion for Techcombank customers. This helps build trust and loyalty.

Competitive interest rates on deposits and loans are important. Techcombank aims to offer attractive rates to attract and retain customers.

Techcombank customers' needs and preferences center around convenience, speed, and personalized financial solutions. The bank focuses on digital banking and tailored products to meet these needs.

- Digital Banking: Mobile banking apps and online platforms for everyday transactions.

- User-Friendly Interfaces: Seamless digital experiences and quick processing times.

- Competitive Rates: Attractive interest rates on deposits and loans.

- Wide Range of Products: Availability of diverse financial products and services.

- Efficient Cash Flow Management: For business customers, especially SMEs.

- Flexible Lending Options: Tailored financial solutions for businesses.

- Integrated Digital Platforms: Streamlined financial operations for businesses.

- Reliable Customer Support: Ensuring customer satisfaction and loyalty.

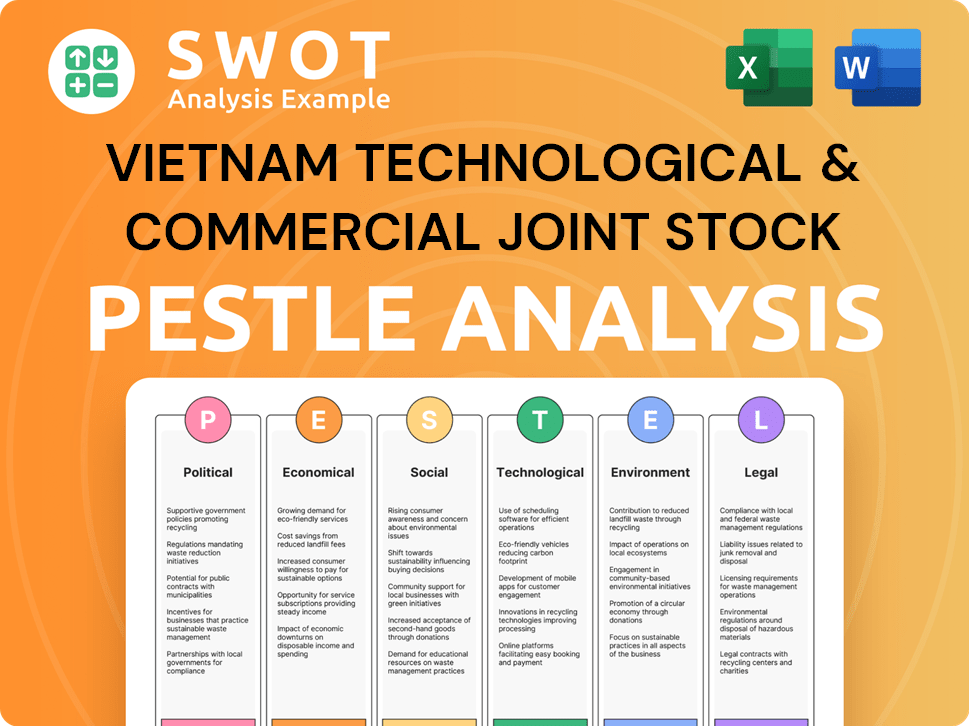

Vietnam Technological & Commercial Joint Stock Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Vietnam Technological & Commercial Joint Stock Bank operate?

Techcombank, officially known as Vietnam Technological & Commercial Joint Stock Bank, strategically focuses its geographical market presence within Vietnam. Its primary markets are concentrated in key economic hubs and urban centers across the country. This strategic focus allows the bank to leverage higher population densities, economic activity, and a larger concentration of both individual and business customers.

The bank's significant market share and brand recognition are particularly strong in major cities such as Hanoi, Ho Chi Minh City, and Da Nang. These regions are characterized by higher purchasing power and a greater demand for sophisticated financial services. Techcombank's expansion strategy is data-driven, emphasizing areas with high growth potential and adapting its market entry strategies to reflect the specific economic and social characteristics of each locale.

Techcombank's geographical strategy is a key component of its overall approach, as detailed in the Growth Strategy of Vietnam Technological & Commercial Joint Stock Bank. The bank continuously expands its network, focusing on areas with high growth potential.

Techcombank's main focus is on Vietnam's major cities, including Hanoi, Ho Chi Minh City, and Da Nang. These cities have higher economic activity and a larger customer base. This concentration helps the bank optimize its resources and tailor services to specific regional needs.

Customer demographics and preferences vary across regions. Urban customers are more digitally savvy and seek advanced digital banking solutions. Rural customers may prefer traditional branch services. Techcombank customizes its offerings and marketing to meet these regional differences.

Techcombank strategically places branches and ATMs to serve its target market. The bank continuously expands its network, focusing on areas with high growth potential. This expansion is based on detailed market analysis and customer demand.

The bank adapts its market entry strategies to the specific economic and social characteristics of each locale. This includes targeted promotional campaigns and localized services. This approach ensures that Techcombank remains relevant and competitive in diverse markets.

Techcombank's geographical strategy is centered on key urban areas in Vietnam. These areas offer significant opportunities for growth and customer acquisition.

- Hanoi: The capital city, with a large and growing population, offers a substantial market for both retail and corporate banking services.

- Ho Chi Minh City: As the economic hub of Vietnam, this city is a critical market for Techcombank, with high demand for financial products and services.

- Da Nang: This central city is experiencing rapid economic growth and is a focus for Techcombank's expansion, particularly in the tourism and services sectors.

- Other Tier 1 and Tier 2 Cities: Techcombank also targets other major cities across Vietnam to broaden its market reach and customer base.

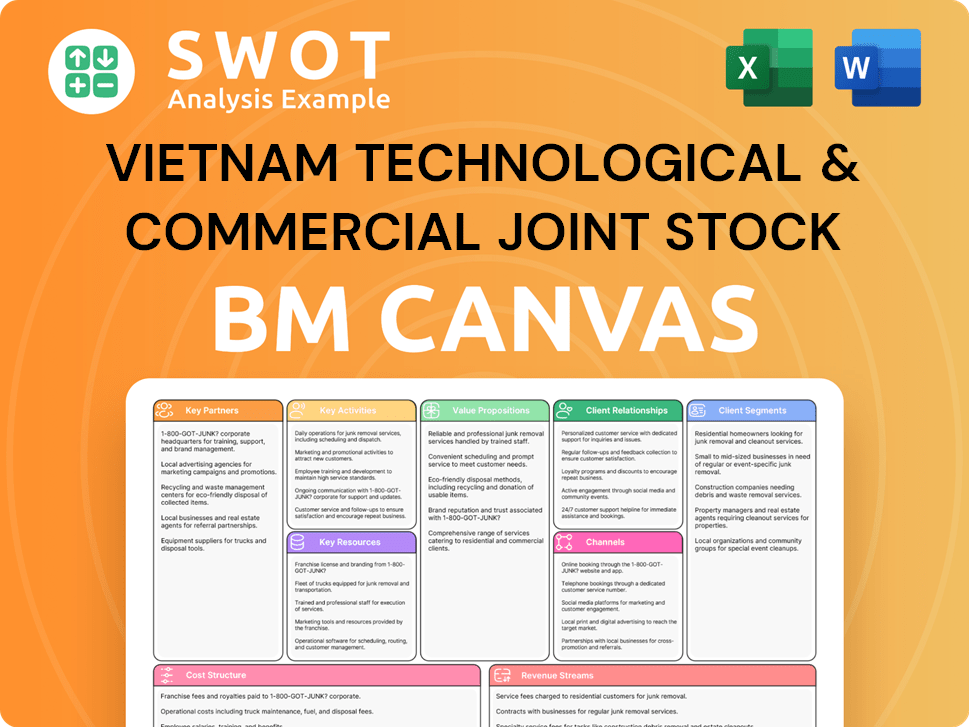

Vietnam Technological & Commercial Joint Stock Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Vietnam Technological & Commercial Joint Stock Bank Win & Keep Customers?

To acquire and retain customers, Vietnam Technological & Commercial Joint Stock Bank (Techcombank) employs a multifaceted strategy. This approach combines digital and traditional marketing channels to reach a broad customer base. The bank focuses on understanding its customer demographics and tailoring its services to meet their specific needs, thereby fostering loyalty and driving growth within the competitive banking industry in Vietnam.

Digital channels, including social media marketing, search engine optimization, and targeted online advertising, are crucial for reaching the bank's digitally-savvy customer base. Traditional advertising through television, radio, and print media is also utilized to reach a broader demographic. Sales tactics include direct sales teams for corporate clients and in-branch promotions for retail customers. These combined efforts aim to enhance the customer experience and drive customer acquisition.

Techcombank's customer acquisition and retention strategies are continuously refined based on customer feedback and market analysis. The bank focuses on increasing customer lifetime value and reducing churn rate through personalized banking experiences and exceptional customer support. This data-driven approach allows Techcombank to adapt quickly to changing market dynamics and customer preferences, ensuring long-term success in the banking industry.

Techcombank leverages digital channels like social media, SEO, and online advertising to engage with its target market. These efforts are designed to attract new customers and build brand awareness. The bank's digital marketing strategies are data-driven, focusing on reaching a tech-savvy customer base.

Traditional advertising methods, such as television, radio, and print media, are used to reach a wider audience. This approach ensures that Techcombank's message is accessible to a diverse range of potential customers. Traditional advertising complements digital efforts, creating a comprehensive marketing strategy.

Direct sales teams target corporate clients, while in-branch promotions attract retail customers. Attractive introductory offers for new accounts and credit cards are common. These sales tactics are designed to drive immediate customer acquisition and increase market share.

Techcombank invests in loyalty programs to reward and retain existing customers. These programs offer benefits and incentives to encourage continued engagement with the bank. Loyalty programs help to increase customer lifetime value and reduce churn.

Techcombank uses customer data and CRM systems to personalize banking experiences. This includes tailored marketing campaigns and product offerings based on customer preferences and financial history. Personalized services enhance customer satisfaction and foster loyalty.

- Personalized loan offers based on financial history.

- Investment advice tailored to individual customer profiles.

- Enhanced digital banking experiences for greater convenience.

- Exceptional customer support to address inquiries and resolve issues.

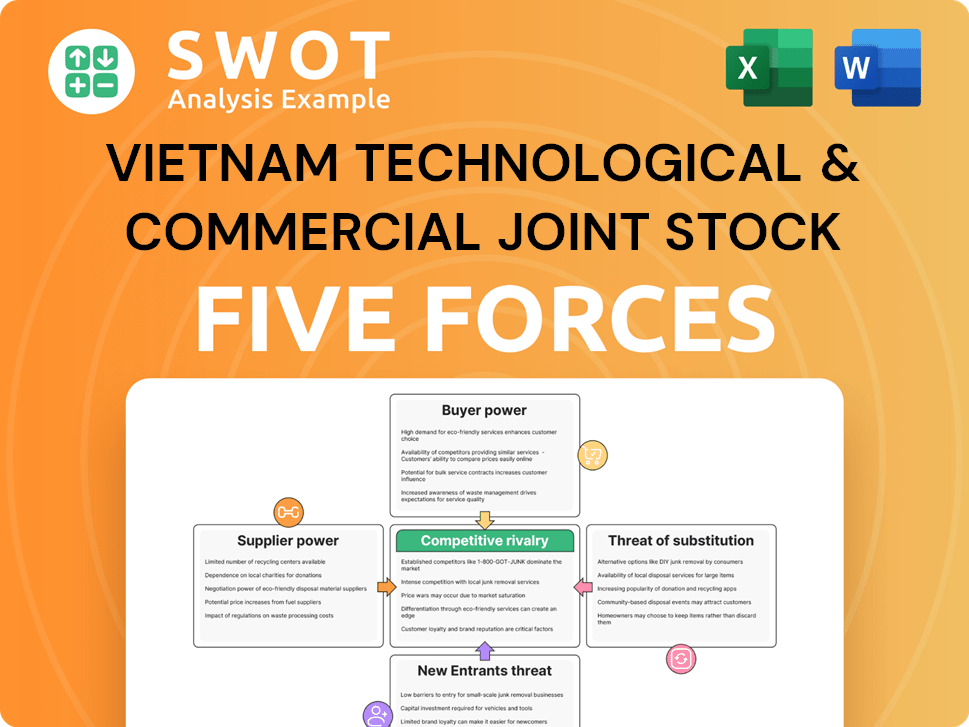

Vietnam Technological & Commercial Joint Stock Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vietnam Technological & Commercial Joint Stock Bank Company?

- What is Competitive Landscape of Vietnam Technological & Commercial Joint Stock Bank Company?

- What is Growth Strategy and Future Prospects of Vietnam Technological & Commercial Joint Stock Bank Company?

- How Does Vietnam Technological & Commercial Joint Stock Bank Company Work?

- What is Sales and Marketing Strategy of Vietnam Technological & Commercial Joint Stock Bank Company?

- What is Brief History of Vietnam Technological & Commercial Joint Stock Bank Company?

- Who Owns Vietnam Technological & Commercial Joint Stock Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.