Teradata Bundle

How Does Teradata Navigate the Ever-Changing Data Analytics Arena?

Since its inception in 1979, Teradata has been a cornerstone of the enterprise analytics sector, evolving from pioneering data warehousing to a connected multi-cloud data platform. With the data landscape constantly shifting, understanding the Teradata SWOT Analysis is crucial for any decision-maker. This exploration delves into Teradata's current standing, examining its key players and strategic positioning in the market.

This analysis provides a comprehensive look at the Teradata competitive landscape, offering insights into its Teradata competitors and their strategies. We'll dissect Teradata's market analysis to uncover its strengths and weaknesses, comparing its offerings against Teradata rivals to understand its competitive advantages and disadvantages. Furthermore, we will explore how Teradata is adapting to the dynamic challenges within the Teradata industry and its future prospects.

Where Does Teradata’ Stand in the Current Market?

Teradata maintains a significant presence in the enterprise analytics and data warehousing sector. Its focus is on providing robust solutions for large enterprises that require advanced analytics capabilities. The company's primary product, Teradata Vantage, is designed to handle complex data environments, offering data integration, analysis, and insights across various cloud platforms.

The company's value proposition centers on delivering enterprise-grade data warehousing and analytics solutions. This includes the ability to manage and analyze large volumes of data, which is crucial for industries like financial services, retail, and telecommunications. Teradata's solutions support critical business operations such as customer intelligence and fraud detection.

Teradata has been adapting to the evolving market, particularly by shifting its focus towards cloud-based solutions to align with industry trends and customer preferences. This strategic move aims to capture growth in the rapidly expanding cloud analytics market. The company reported total revenue of $465 million for the first quarter of 2024, with cloud revenue growing by 10% year-over-year, demonstrating its commitment to cloud-based offerings.

Teradata holds a notable position in the enterprise data warehousing market, though specific market share figures fluctuate. The company is recognized as a leader in enterprise-grade data warehousing and analytics, especially for complex, high-volume data environments. Its focus is on serving large enterprises across various industries.

Teradata primarily targets large enterprises in sectors like financial services, retail, and telecommunications. These customers require powerful analytics for critical operations such as customer intelligence, supply chain optimization, and fraud detection. The company's solutions are tailored to meet the complex data management needs of these segments.

Teradata has strategically shifted its focus to cloud-based solutions to align with industry trends and customer preferences. This move aims to capture growth in the expanding cloud analytics market. This transition is crucial for maintaining competitiveness and meeting the evolving demands of its customer base.

In the first quarter of 2024, Teradata reported total revenue of $465 million. The cloud revenue grew by 10% year-over-year, indicating a successful transition towards cloud-based services. This growth demonstrates the company's ability to adapt to market changes and its focus on cloud solutions.

The Teradata competitive landscape is influenced by the increasing demand for cloud-based data warehousing and analytics solutions. The company's ability to adapt to these changes is crucial for its long-term success. Understanding the Teradata market analysis is essential for investors and stakeholders.

- Cloud Adoption: The shift towards cloud-based solutions is a major trend influencing the Teradata industry.

- Competitive Pressure: The market is competitive, with rivals offering similar services, impacting Teradata's market share compared to its competitors.

- Strategic Focus: Teradata's strategy includes a strong emphasis on cloud solutions to stay competitive.

- Financial Performance: Monitoring Teradata's financial performance and its competitors is key to understanding its position.

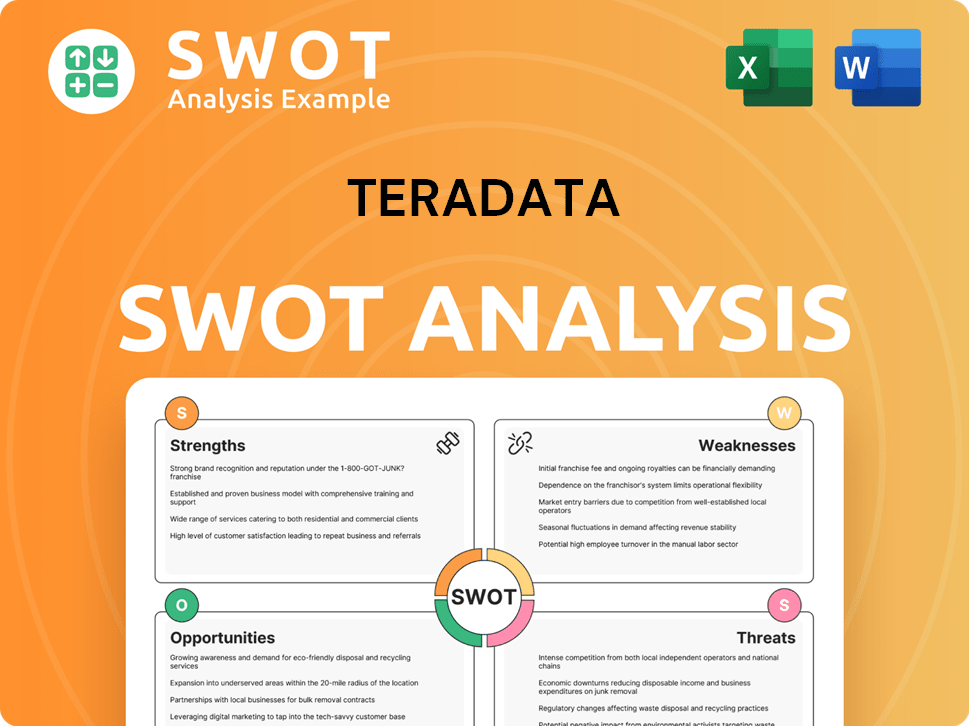

Teradata SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Teradata?

The Teradata competitive landscape is dynamic, shaped by a mix of established players and emerging challengers. This analysis of the Teradata competitors highlights the key rivals and the strategies they employ. Understanding the competitive environment is crucial for assessing Teradata's market analysis and its future prospects.

Teradata faces competition across various segments, including data warehousing, analytics, and cloud services. The intensity of competition varies based on the specific offerings and target markets. The company's ability to innovate and adapt to market changes is critical for maintaining its position.

The competitive environment is influenced by factors such as cloud adoption, pricing models, and the ability to support advanced analytics workloads, including AI and machine learning. For a deeper dive into the company's strategic approach, you can explore the Marketing Strategy of Teradata.

Direct competitors in the enterprise data warehousing and analytics space include Snowflake, Databricks, and the cloud offerings from major hyperscalers.

Snowflake is a cloud-native data warehousing platform known for its scalability and pay-as-you-go model. It has gained significant market share, attracting a broad range of enterprises. In 2024, Snowflake reported over $2.8 billion in product revenue, showcasing its strong market presence.

Databricks focuses on data lakehouses and AI/ML capabilities, competing for advanced analytics workloads. Databricks' valuation reached $43 billion in 2023, reflecting its strong position in the market.

Major cloud providers like AWS (Amazon Redshift), Microsoft Azure (Azure Synapse Analytics), and Google Cloud (BigQuery) are formidable competitors. These providers offer comprehensive data analytics suites integrated within their broader cloud ecosystems.

Indirect competition comes from data integration, business intelligence, and specialized analytics vendors. This includes companies offering solutions for specific use cases or open-source alternatives that provide cost-effective options.

The competitive landscape is influenced by cloud adoption, ease of use, performance at scale, and the ability to support diverse analytical workloads, including AI and machine learning. The ongoing 'battles' often revolve around these key factors.

Several factors drive competition in the data analytics market, influencing Teradata's strategy and its ability to maintain its position. These factors include:

- Cloud Adoption: The shift towards cloud-based solutions is a major trend, with companies like Snowflake and the cloud offerings from AWS, Microsoft Azure, and Google Cloud gaining traction.

- Ease of Use: User-friendly interfaces and simplified deployment processes are critical for attracting customers.

- Performance at Scale: The ability to handle large datasets and complex queries efficiently is crucial, especially with the growth of big data.

- AI and Machine Learning Capabilities: The integration of AI and ML functionalities is becoming increasingly important, with Databricks leading in this area.

- Pricing and Cost-Effectiveness: Competitive pricing models, including pay-as-you-go options, are essential for attracting and retaining customers.

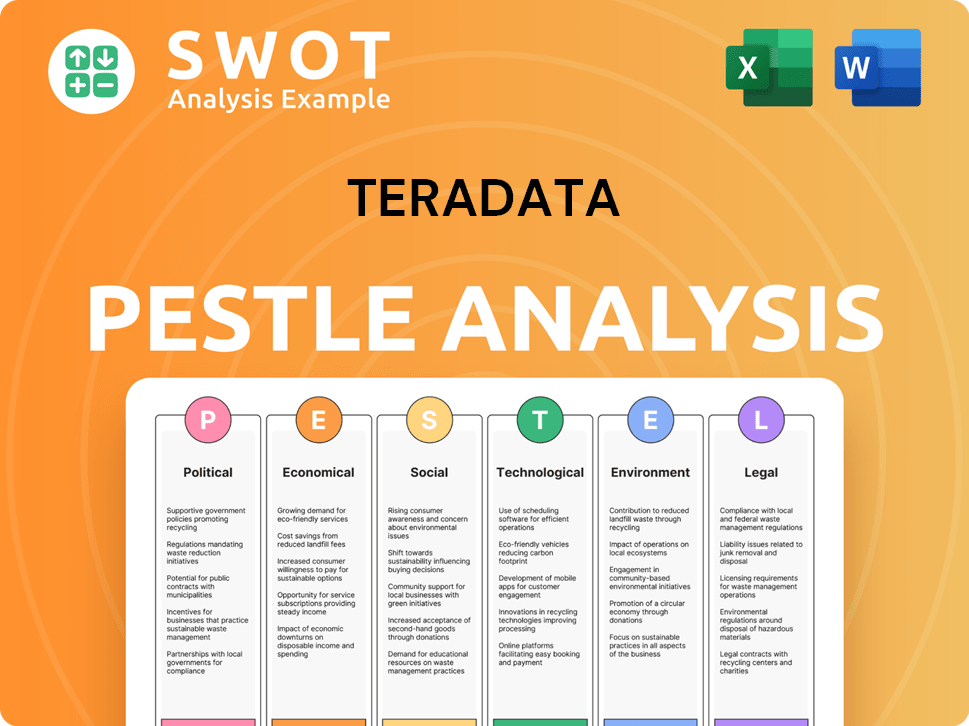

Teradata PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Teradata a Competitive Edge Over Its Rivals?

Understanding the Owners & Shareholders of Teradata is crucial for assessing its competitive landscape. Teradata's competitive advantages are rooted in its long-standing expertise in data management and analytics. This expertise is coupled with a robust platform and a well-established enterprise customer base. The company's ability to provide powerful analytics capabilities, especially in hybrid and multi-cloud environments, is a key differentiator.

Teradata's proprietary technology, particularly its Massively Parallel Processing (MPP) architecture, has historically provided superior performance for large-scale, complex queries. While cloud platforms have democratized some of these capabilities, Teradata's Vantage platform continues to offer powerful analytics capabilities. This positions Teradata well in the big data analytics market.

The company's focus on a connected multi-cloud data platform allows it to provide flexibility and avoid vendor lock-in for its customers, enabling them to leverage data across various cloud providers. Furthermore, Teradata's continuous innovation in areas like AI/ML integration and data governance within its platform helps it stay relevant. This is crucial for navigating the current competitive threats to Teradata.

Teradata has been a key player in the data warehousing space for decades. It has consistently adapted its offerings to meet evolving market demands. Recent strategic moves include enhancing its cloud capabilities and expanding its AI/ML integrations within the Vantage platform to stay competitive in the Teradata competitive landscape.

Teradata's strategy involves focusing on hybrid and multi-cloud solutions to provide flexibility to its customers. The company is investing in AI and machine learning capabilities to enhance its platform. These moves are designed to maintain its market share and address the challenges posed by its competitors in the Teradata industry.

Teradata's competitive edge comes from its deep technical expertise and established enterprise-grade features. Its strong brand equity and long-standing relationships with large enterprise customers are also significant advantages. This customer loyalty is reinforced by Teradata's professional services and support, which are crucial for complex enterprise deployments.

The market analysis reveals that Teradata faces competition from cloud-native data warehouse providers. The company's ability to innovate and adapt to changing market dynamics is crucial. Teradata's market share compared to its competitors is a key indicator of its success in the Teradata rivals.

Teradata's strengths include its established enterprise customer base, robust platform, and deep expertise in data warehousing. Its weaknesses include the need to adapt to the rapid growth of cloud-native competitors and the potential for vendor lock-in with its platform. The company must continue to innovate to maintain its position.

- Strengths: Strong brand, enterprise-grade features, and deep technical expertise.

- Weaknesses: Dependence on legacy systems and the need to compete with cloud-native solutions.

- Opportunities: Expanding cloud offerings and integrating AI/ML capabilities.

- Threats: Competition from cloud providers and the potential for disruption from new technologies.

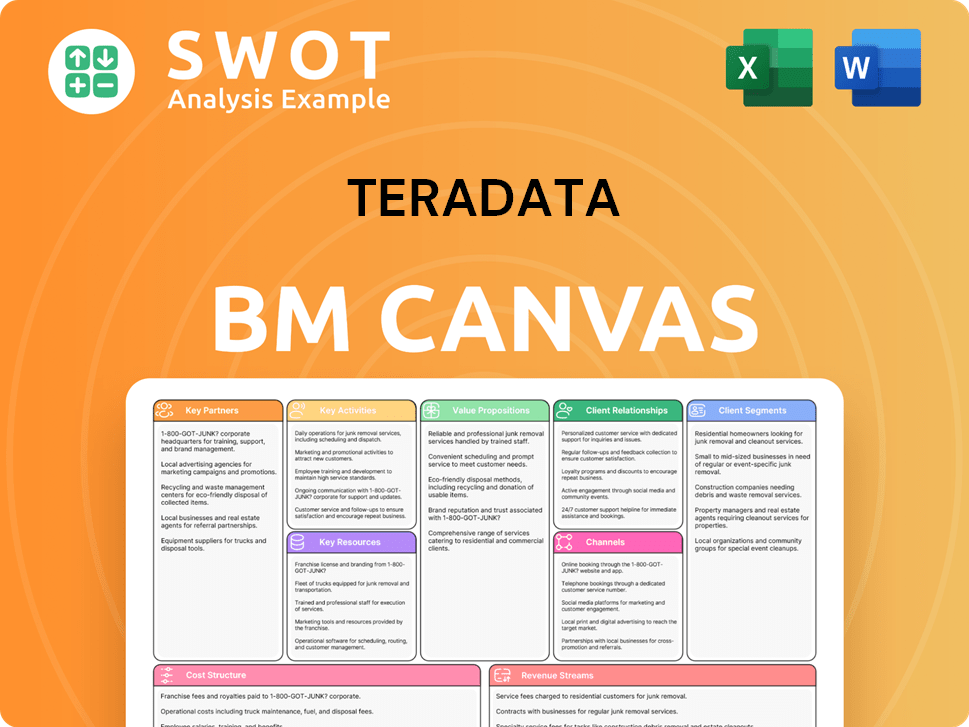

Teradata Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Teradata’s Competitive Landscape?

The Teradata competitive landscape is significantly influenced by the evolving data analytics market and the rapid adoption of cloud technologies. Understanding the Teradata industry dynamics, including the strategies of its rivals, is crucial for investors and business strategists. This analysis focuses on current trends, future challenges, and potential opportunities for Teradata, providing a comprehensive Teradata market analysis.

The company faces risks from intense competition and the need to adapt to changing market demands. However, there are also substantial opportunities for growth, especially in areas like AI-driven insights and hybrid cloud management. The future of Teradata in the competitive landscape depends on its ability to innovate and capitalize on these opportunities. For a deeper understanding of the company’s strategic direction, consider the Growth Strategy of Teradata.

Key industry trends include the increasing adoption of cloud computing, the rise of AI and machine learning, and the growing demand for real-time analytics. The shift towards cloud-native data platforms is reshaping the competitive environment. Regulatory changes around data privacy, such as GDPR and CCPA, also influence the market.

Teradata competitors include born-in-the-cloud providers, which may have cost or agility advantages. Aggressive pricing strategies from hyperscale cloud providers and the maturity of open-source alternatives pose challenges. Differentiating in a crowded market where many vendors offer similar core functionalities is also a significant hurdle.

The exponential growth of data across all industries fuels the demand for advanced analytics, which is a core strength for Teradata. The increasing complexity of data environments creates a need for platforms that seamlessly connect and analyze distributed data. Expanding into emerging markets and strengthening cloud ecosystem partnerships present further opportunities.

Teradata's strategy focuses on driving cloud ARR growth and innovation in areas such as AI-driven insights and data governance. The company aims to capture new revenue streams and solidify its position as a critical provider of enterprise analytics solutions. Cloud ARR increased by 10% in Q1 2024 to $201 million.

Understanding Teradata's competitive advantages and disadvantages is vital for evaluating its market position. Key features of Teradata's competitors' products and Teradata's strengths and weaknesses analysis reveal insights into the competitive dynamics.

- Cloud Adoption: The ability to offer robust cloud solutions is critical. Teradata vs Amazon Redshift comparison, and other cloud-native providers are significant.

- AI and Machine Learning: Integrating AI-driven insights into its offerings is essential.

- Data Governance: Providing strong data governance and compliance features is crucial to meet regulatory requirements.

- Hybrid Cloud Management: Seamlessly connecting and analyzing data across various environments is a key differentiator.

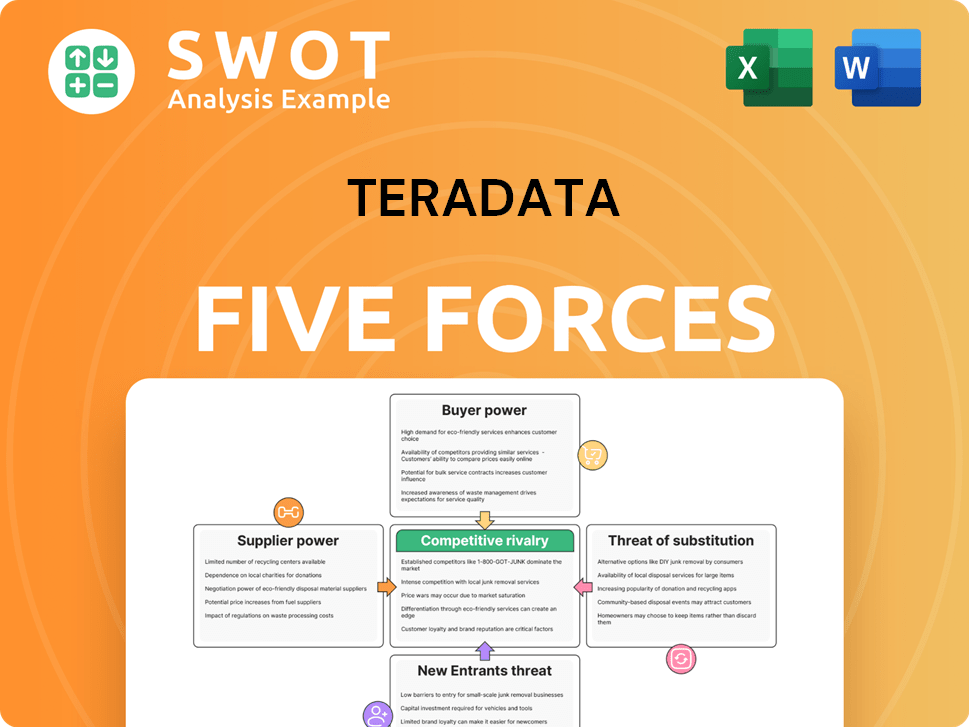

Teradata Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Teradata Company?

- What is Growth Strategy and Future Prospects of Teradata Company?

- How Does Teradata Company Work?

- What is Sales and Marketing Strategy of Teradata Company?

- What is Brief History of Teradata Company?

- Who Owns Teradata Company?

- What is Customer Demographics and Target Market of Teradata Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.