Teradata Bundle

Who Does Teradata Serve in the Data Analytics Realm?

Understanding the Teradata SWOT Analysis is crucial, but even more critical is knowing who benefits from it. Teradata, a leader in enterprise analytics, has a fascinating customer profile. This analysis delves into the specifics of their customer demographics and target market, revealing how Teradata strategically positions itself to meet evolving needs.

This exploration of the

Who Are Teradata’s Main Customers?

The focus of the Teradata company is primarily on business-to-business (B2B) relationships, targeting large enterprises across various industries. These enterprises require advanced data analytics and warehousing capabilities. The company's customer base is diverse, spanning sectors such as financial services, healthcare, retail, and manufacturing, all of which rely on sophisticated database management system (DBMS) solutions.

These large enterprises represent the largest share of the Database Management System market. In 2023, they accounted for a 71% revenue share. This is due to their extensive data management needs, substantial IT budgets, and stringent regulatory compliance requirements. This positions Teradata within a market that values robust data solutions.

While traditional demographic breakdowns like age or income aren't applicable in the B2B context, understanding the Teradata target market involves considering factors such as company size, industry vertical, and technological maturity. The company caters to a wide range of needs, from cloud-only to hybrid and on-premises environments, reflecting diverse customer strategies.

Teradata's customer base is primarily composed of large enterprises. These companies operate in various industries such as finance, healthcare, and retail. Their need for advanced data analytics and warehousing solutions drives their adoption of Teradata's services.

The company focuses on sectors with high data management needs. These include financial services (BFSI), healthcare, retail, and manufacturing. These industries depend on sophisticated database management systems for business intelligence and security.

Teradata addresses a spectrum of analytics needs, from cloud-only to multi-cloud environments. The company's focus includes accelerating AI value, including agentic and generative AI. This approach caters to customers exploring and implementing AI applications.

The cloud business is a key growth area for Teradata. In 2024, cloud revenue reached $609 million. The company aims for at least $1 billion in cloud Annual Recurring Revenue (ARR) by 2025, indicating a shift toward cloud-centric enterprises.

The company's recent emphasis on AI, including agentic and generative AI, shows a shift towards customers who are exploring and implementing AI applications. This requires extensive volumes of high-quality, integrated data. Teradata's cloud business, reaching $609 million in 2024, is a key growth area. The company aims for at least $1 billion in cloud Annual Recurring Revenue (ARR) by 2025, highlighting a clear shift in target segments towards cloud-centric and AI-driven enterprises. This focus supports the Teradata user base by providing advanced solutions.

Teradata's ideal customers are large enterprises with significant data management needs. These companies are often in industries like finance, healthcare, and retail. They are also increasingly focused on leveraging AI and cloud technologies.

- Large enterprises with substantial data volumes

- Industries with high data analytics needs (BFSI, healthcare, retail)

- Companies exploring or implementing AI applications

- Businesses adopting cloud-based solutions

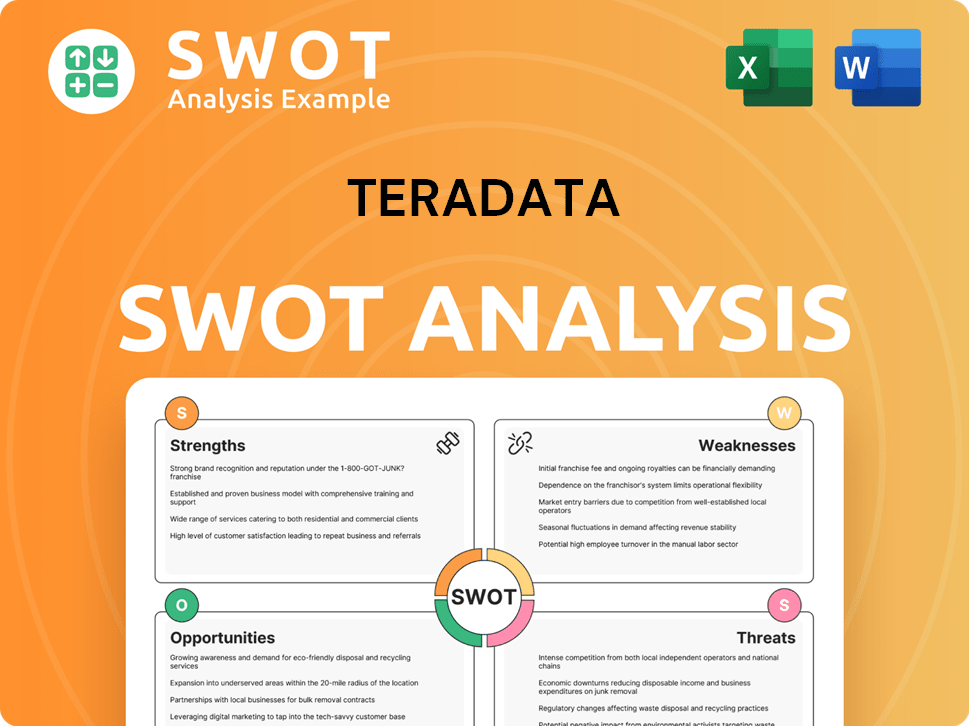

Teradata SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Teradata’s Customers Want?

Understanding the customer needs and preferences of the Teradata company is crucial for grasping its market position. Teradata customers are primarily driven by the need for advanced data analytics and reliable insights. Their choices are influenced by factors such as the ability to manage analytics at scale and the demand for hybrid data environments.

The core psychological driver for choosing Teradata's offerings is the desire for confident decision-making and faster innovation. Practical drivers include the need for scalable solutions capable of processing diverse data types. Teradata addresses common pain points like uncontrolled data growth and the complexity of operating across different data environments.

Teradata tailors its offerings by providing an open and connected platform that supports open table formats, giving customers flexibility in their data architecture. This approach reflects a deep understanding of its Teradata user base and their evolving needs in the data analytics landscape.

Customers require solutions for large-scale data integration to harmonize data across their organizations. This need ensures a single source of truth for all customer data, facilitating more informed decision-making. The demand for efficient data integration is a key driver for Teradata's offerings.

The need for advanced analytics capabilities is paramount, including the ability to manage analytics and models at massive scale. Customers seek solutions that can process semi-structured and unstructured data effectively. This is particularly crucial with the growth of social media, IoT, and big data analytics.

Customers increasingly demand hybrid data analytics environments that blend cloud and on-premises systems. This allows for greater flexibility and control over data management. The ability to operate in both environments is a significant factor in customer purchasing decisions.

There is a growing demand for trusted AI capabilities to enable confident decision-making and faster innovation. Customers are looking for solutions that integrate AI seamlessly into their data analytics workflows. This includes the need for scalable and high-performance solutions to process diverse data types.

Customers require solutions that can handle massive datasets and complex analytics workloads. Scalability is critical to accommodate the increasing volume and variety of data. High performance ensures that insights are delivered quickly and efficiently.

The preference for an open and connected platform that supports open table formats like Apache Iceberg and Linux Foundation Delta Lake. This allows customers flexibility in their data architecture. This approach is essential for integrating with various data sources and tools.

Teradata's focus on customer needs is evident in its product development and strategic partnerships. For example, in 2024, Teradata advanced its trusted AI product capabilities and announced plans to integrate NVIDIA NeMo and NVIDIA NIM microservices. This demonstrates how customer feedback and market trends, particularly the rise of AI and generative AI, directly influence Teradata's product development. Furthermore, Teradata's commitment to enabling highly tailored, meaningful customer experiences is also evident in their focus on providing a holistic 360-degree customer view and proactively identifying and addressing friction in the customer journey. To understand the competitive landscape, consider exploring the Competitors Landscape of Teradata.

Teradata's target market, or Teradata's target market, values solutions that offer:

- Scalability: Ability to handle large volumes of data and growing workloads.

- Performance: Fast processing and delivery of insights.

- Integration: Seamless integration with existing data infrastructure.

- AI Capabilities: Advanced AI and machine learning functionalities.

- Hybrid Cloud Support: Flexibility to operate in both cloud and on-premises environments.

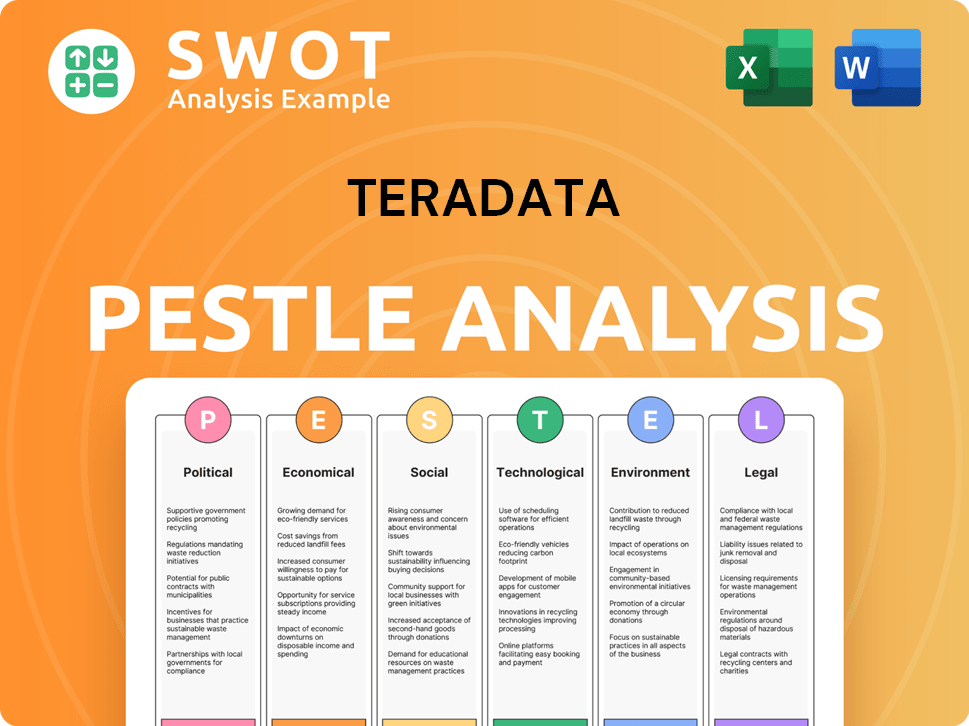

Teradata PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Teradata operate?

The geographical market presence of the company is substantial, serving a diverse customer base across various regions. Historically, the company has organized its business operations into three primary geographic regions: Americas, EMEA, and APJ. This strategic segmentation allows for focused market penetration and tailored service delivery, ensuring that the company can effectively address the unique needs of its global customer base.

North America has traditionally been a leading market for database management systems. In 2023, North America held a 41% revenue share, driven by the concentration of technology firms, high cloud adoption rates, and significant investments in data-centric technologies. The company's success in this region underscores its ability to meet the sophisticated demands of a technologically advanced market. The company's global strategy is designed to leverage these strengths and capitalize on emerging opportunities in other key markets.

The Asia Pacific region is experiencing rapid growth, with an expected Compound Annual Growth Rate (CAGR) of 13.15% from 2024 to 2032. This growth is fueled by increasing digitalization and the expansion of IT infrastructure in the region. This expansion is a key focus area for the company, as it seeks to capitalize on the region's burgeoning market for data analytics solutions. The company's strategic investments in the APJ region are designed to capture this growth potential.

The company focuses on localizing its offerings and establishing partnerships to succeed in diverse markets. This approach ensures that the company can adapt its solutions to meet the specific needs and preferences of customers in different regions. This strategy is key to the company's global expansion and market penetration efforts.

The company's multi-cloud approach, with solutions like VantageCloud Lake available on platforms such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, is designed to cater to regional preferences and cloud adoption rates. Further integrations are planned for the first half of 2025. This multi-cloud strategy enhances the company's flexibility and reach.

The company is actively expanding its go-to-market reach by onboarding new customers and making vertical investments. While specific sales distribution figures by region for 2024-2025 are not readily available, the company's continuous innovation and partnerships are designed to strengthen its market position globally. This expansion includes strategic investments in key growth areas.

The company's focus on data analytics solutions and services caters to a broad data analytics audience. This includes businesses across various industries seeking to leverage data for insights and decision-making. The company's commitment to innovation and customer success supports its position in the market.

The company's customer base spans various industries, including finance, healthcare, retail, and manufacturing. Understanding the customer demographics by industry is crucial for tailoring solutions and marketing efforts. The company's solutions are designed to meet the specific needs of each industry.

The company's market positioning emphasizes its ability to provide comprehensive data analytics solutions. The company's strategic approach includes continuous innovation and partnerships to strengthen its market position globally. Learn more about the company's Marketing Strategy of Teradata.

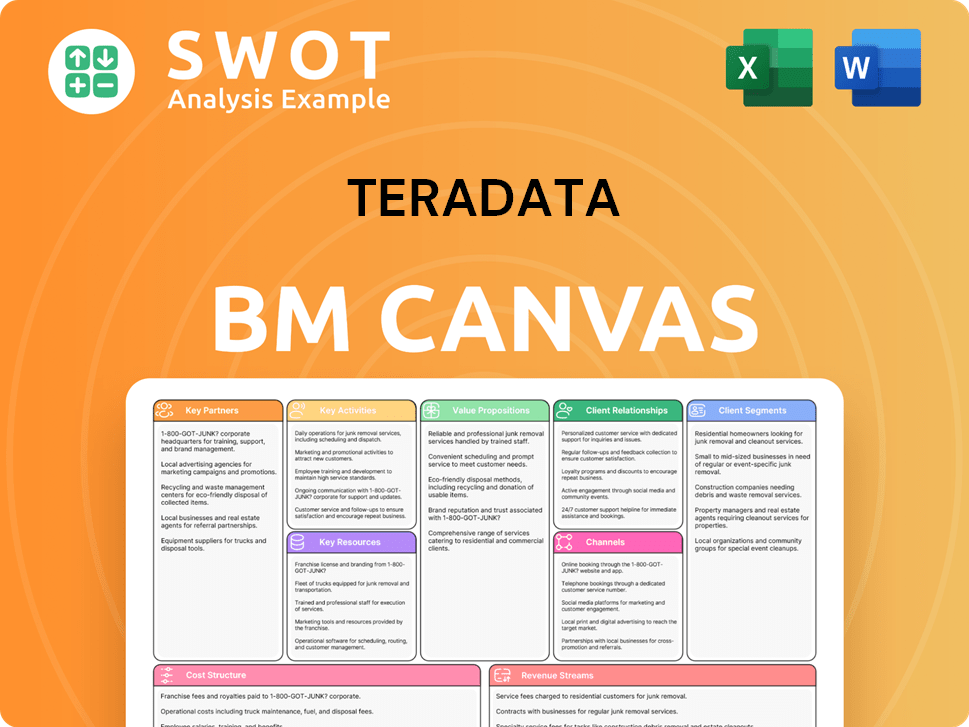

Teradata Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Teradata Win & Keep Customers?

The [Company Name] employs a strategic approach to customer acquisition and retention, focusing on its hybrid cloud analytics and data platform. This strategy is designed to attract and retain customers in the competitive data analytics market. A key aspect of their strategy involves continuous innovation and enhancing customer success programs.

Their efforts in customer acquisition include strengthening their brand and expanding alliances with market leaders. They aim to leverage their strong capabilities in integrating and harmonizing data, especially for those exploring AI applications. The company is also focused on expanding its international presence through strategic partnerships.

For retention, the company prioritizes delivering continuous innovation and enhancing customer success programs. The transition to a subscription-based model also supports retention, providing more predictable financial performance. This is supported by the cloud net expansion rate of 117% in Q4 2024, demonstrating strong growth from existing cloud customers.

The company focuses on strengthening its brand within the rapidly evolving AI market. This includes showcasing its capabilities and solutions to attract new customers. By positioning itself as a leader in data analytics, it draws in potential clients seeking advanced solutions.

Expanding alliances with other market leaders is a core acquisition strategy. These partnerships extend the company's reach and provide access to new customer segments. Collaborations help to broaden the market presence and offer integrated solutions.

The company specifically targets customers exploring AI applications. By highlighting its capabilities in data integration and analytics, it attracts businesses looking to implement AI solutions. This targeted approach helps to acquire clients in the growing AI sector.

Enhancing customer success programs is a key retention strategy. These programs ensure customers receive the support and resources they need to maximize the value of the company's solutions. Strong customer support drives loyalty and reduces churn.

The company’s retention strategies are designed to build customer loyalty and drive value. They focus on providing a single source of customer data and best-in-class analytics to deliver personalized experiences. The company's commitment to customer experience (CX) is a vital retention strategy.

- Continuous Innovation: Regularly updating and improving its platform to meet evolving customer needs.

- Subscription Model: The transition to a subscription-based model provides more predictable and stable financial performance.

- Customer Experience (CX): Building customer loyalty and driving value by providing a single source of all customer data and best-in-class analytics capabilities to deliver personalized experiences.

- Positive Feedback: Recognition as a '2024 Customers' Choice' in Gartner Peer Insights' 'Voice of the Customer' report.

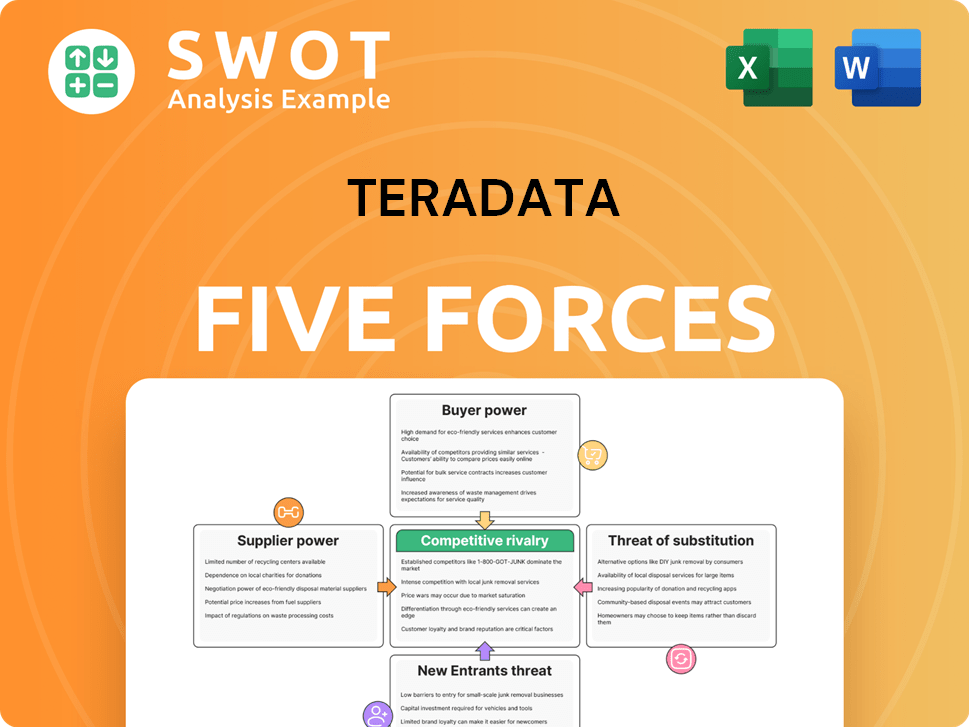

Teradata Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Teradata Company?

- What is Competitive Landscape of Teradata Company?

- What is Growth Strategy and Future Prospects of Teradata Company?

- How Does Teradata Company Work?

- What is Sales and Marketing Strategy of Teradata Company?

- What is Brief History of Teradata Company?

- Who Owns Teradata Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.