Walt Disney Bundle

Can Disney Maintain Its Magic in Today's Entertainment Arena?

The Walt Disney Company, a titan of the global entertainment industry, faces a constantly shifting and fiercely competitive environment. Disney's strategic pivot towards direct-to-consumer streaming services, including Disney+, ESPN+, and Hulu, highlights its adaptability in a market increasingly dominated by on-demand content. This shift underscores Disney's commitment to innovation and its ongoing quest for market dominance in the digital age, requiring a keen understanding of the Walt Disney SWOT Analysis.

Understanding the Disney competitive landscape is crucial for investors and strategists alike. This analysis will explore Disney's market position, examining its key competitors and the strategies it employs to maintain its edge. We'll delve into Disney's business strategy, assessing its strengths and weaknesses while providing a comprehensive Disney market analysis to understand its performance relative to its entertainment industry rivals. This examination will also address questions like "How does Disney compete with Netflix?" and "What are Disney's key competitors in the theme park industry?"

Where Does Walt Disney’ Stand in the Current Market?

The Walt Disney Company's market position is robust, spanning various segments within the entertainment industry. Disney holds a significant presence in direct-to-consumer streaming, parks and experiences, studio entertainment, and media networks. Its diversified business model and global reach contribute to its strong competitive standing. This positioning is crucial in understanding the Disney competitive landscape.

Disney's core operations include producing and distributing films, operating theme parks, and managing media networks. Its value proposition centers on providing high-quality entertainment experiences, from animated films to live events and streaming content. This multi-faceted approach allows Disney to capture a broad audience and maintain a strong brand reputation, making it a key player in the entertainment industry rivals.

Disney+ has established itself as a major player in the streaming market. As of the end of fiscal year 2024, Disney+ had 117.6 million subscribers. This segment is critical for Disney's overall revenue and competitive positioning, particularly when comparing Disney's streaming service with its rivals.

The Parks, Experiences and Products segment is a significant revenue generator for Disney. Revenue increased by 13% in the first fiscal quarter of 2024 compared to the prior year. The theme parks' competitive advantages contribute to Disney's strong market position.

Disney's Studio Entertainment segment consistently delivers box office successes. Media Networks, including ESPN and ABC, remain highly influential. These segments contribute to Disney's diversified revenue streams, which is essential for Disney market analysis.

Disney has a strong global presence with theme parks in North America, Europe, and Asia. Its content reaches audiences worldwide. Disney caters to a broad customer base, from families to sports enthusiasts, supporting its global expansion strategies and its impact on competition.

Disney's strategic shift towards digital transformation and direct consumer engagement is a crucial element of its business strategy. This includes a move beyond traditional linear television and theatrical releases. The company's financial health remains robust, with diluted earnings per share from continuing operations of 1.03 for the first fiscal quarter of 2024.

- Disney's financial performance is influenced by its ability to adapt to changing consumer behavior.

- The streaming wars and evolving advertising markets present challenges.

- The company's strong position in family entertainment and theme park operations is a key strength.

- Understanding Marketing Strategy of Walt Disney is crucial for analyzing its competitive position.

Walt Disney SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Walt Disney?

The Walt Disney Company faces a dynamic Disney competitive landscape across its diverse business segments. Understanding the competitive environment is crucial for analyzing Disney market analysis and its strategic positioning in the entertainment industry. This involves assessing both direct and indirect competitors that challenge the company's market share and profitability.

Key rivals vary depending on the specific sector. In streaming, Disney competes with established giants like Netflix and Amazon Prime Video, as well as newer entrants such as Warner Bros. Discovery's Max. The theme park and entertainment divisions face competition from Universal Parks & Resorts and other regional attractions. The theatrical studio business contends with major studios like Warner Bros., Universal Pictures, and Sony Pictures.

Examining Disney's strengths and weaknesses in relation to its competitors is essential for a comprehensive Disney business strategy assessment. This includes evaluating content offerings, pricing models, and the ability to innovate and adapt to changing consumer preferences. The entertainment industry rivals constantly evolve, necessitating continuous strategic adjustments.

Netflix, a global leader in streaming, had over 270 million paid memberships worldwide as of Q1 2024. Amazon Prime Video competes by bundling content with its e-commerce and other services. Max, with its premium content, is a key competitor in the direct-to-consumer market.

Universal Parks & Resorts, owned by Comcast, directly competes with Disney's theme parks. SeaWorld Parks & Entertainment and regional theme parks also vie for visitor spending and leisure time. These competitors often invest in new attractions and experiences to attract visitors.

Warner Bros., Universal Pictures, Sony Pictures, and Paramount Pictures compete in the theatrical market. These studios release films that compete for box office revenue and critical acclaim. The success of a film can significantly impact a studio's financial performance.

Traditional broadcasters and cable networks, such as Paramount Global and Comcast's NBCUniversal, compete for advertising revenue and viewership. These networks offer a wide range of content, including news, sports, and entertainment programming.

Independent content creators and niche streaming services also impact the competitive landscape. These players cater to specific audiences, potentially disrupting traditional media consumption habits. They often leverage digital platforms to reach their target demographics.

Proposed joint ventures, such as the sports streaming venture between Disney, Fox, and Warner Bros. Discovery, can reshape competition. These alliances can consolidate market power and content offerings, influencing the overall competitive dynamics.

Several factors influence the competitive landscape. These include content quality and quantity, pricing strategies, technological innovation, and brand recognition. Disney's strategies for innovation in the entertainment industry are crucial.

- Content Libraries: The breadth and appeal of content libraries are critical. Disney's vast library of intellectual property is a key advantage.

- Pricing and Bundling: Competitive pricing and bundling strategies, such as offering combined streaming packages, impact subscriber acquisition and retention.

- Technological Advancements: Adoption of new technologies, like enhanced streaming features and immersive theme park experiences, is essential for staying competitive.

- Global Expansion: Disney's global expansion strategies and its impact on competition involve adapting content and offerings to local markets.

- Brand Strength: Disney's strong brand recognition and reputation for quality entertainment are significant competitive advantages. You can read more about the company's history in Brief History of Walt Disney.

Walt Disney PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Walt Disney a Competitive Edge Over Its Rivals?

The Walt Disney Company's competitive advantages stem from its powerful brand, diverse business model, and extensive global reach. The company's iconic characters and stories create a strong emotional connection with consumers, fostering immense customer loyalty. This brand equity provides a significant barrier to entry for competitors. A 2024 report indicated that the company's brand value is estimated to be over $60 billion, highlighting its strength in the entertainment industry.

Disney's diversified business model, which includes media networks, theme parks, studio entertainment, and direct-to-consumer services, allows for cross-promotion and revenue generation across multiple touchpoints. This synergistic ecosystem creates a virtuous cycle, where successful films drive merchandise sales, theme park attendance, and streaming subscriptions. In 2024, the company's revenue was approximately $88.89 billion, demonstrating its financial strength.

The company's global distribution networks, including theatrical release infrastructure, broadcast channels, and streaming platforms, ensure widespread reach for its content. While brand equity has been built over decades, its direct-to-consumer streaming capabilities have evolved more recently in response to industry shifts. The company leverages these advantages in its marketing campaigns, product development, and strategic partnerships, consistently reinforcing its position as a premier entertainment provider.

Disney's vast library of proprietary content, featuring iconic characters and franchises like Mickey Mouse, Star Wars, Marvel, and Pixar, creates a powerful emotional connection with consumers. This extensive IP portfolio serves as a significant barrier to entry for competitors. The enduring popularity of the Marvel Cinematic Universe continues to drive engagement across Disney's various platforms, contributing to its strong market position.

Disney's diversified business model, encompassing media networks, theme parks, studio entertainment, and direct-to-consumer services, enables cross-promotion and revenue generation across multiple touchpoints. Successful films drive merchandise sales, theme park attendance, and streaming subscriptions, creating a virtuous cycle. This integrated approach enhances overall profitability and resilience in the competitive landscape.

Disney's extensive global distribution networks, including theatrical release infrastructure, broadcast channels, and streaming platforms, ensure widespread reach for its content. This broad distribution network allows Disney to reach audiences worldwide, maximizing its revenue potential. The company continues to expand its international presence, further solidifying its global market share.

Disney leverages its competitive advantages in marketing campaigns, product development, and strategic partnerships. Continuous innovation in streaming technology and content production is essential to maintain its edge. The company's ability to adapt to changing consumer behavior and technological advancements is crucial for its long-term success.

The Disney competitive landscape is shaped by its core strengths. Its brand equity, built over decades, is a significant asset. The company's diversified business model allows for revenue generation across multiple segments. For more insights into the company's strategies and market position, consider reading an article analyzing the Disney market analysis.

- Brand Recognition: Disney's iconic characters and stories create strong customer loyalty.

- Content Portfolio: A vast library of proprietary content provides a continuous pipeline for new films and series.

- Diversified Revenue Streams: The company generates revenue from media networks, theme parks, studio entertainment, and streaming services.

- Global Presence: Extensive distribution networks ensure widespread reach for its content.

Walt Disney Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Walt Disney’s Competitive Landscape?

The Disney competitive landscape is currently shaped by rapid technological advancements and shifting consumer preferences. The entertainment industry is experiencing significant changes, particularly in how content is consumed and experienced. The company must navigate these trends to maintain its market position and drive future growth. For a comprehensive understanding of how Disney has adapted, consider reading about the Growth Strategy of Walt Disney.

Facing challenges like the 'streaming wars' and the need to maintain profitability in direct-to-consumer segments, Disney must also capitalize on opportunities in emerging markets and product innovations. Strategic partnerships and new technologies offer avenues for growth and engagement. The company's ability to differentiate its content, innovate technologically, and form strategic alliances will be critical for its future success in the media and entertainment sector.

The entertainment industry is witnessing a surge in streaming services, with companies like Netflix, Amazon, and others competing fiercely. Consumer preferences are shifting towards on-demand content and personalized experiences. The adoption of virtual reality and augmented reality is also growing, offering new avenues for immersive entertainment.

Maintaining profitability in the direct-to-consumer segment is a significant hurdle, as Disney aims for DTC profitability in fiscal year 2025. The company faces increasing content costs and subscriber churn in the streaming market. Additionally, managing a vast portfolio of assets and ensuring consistent quality across all its segments presents ongoing challenges.

Emerging markets, particularly in Asia and Latin America, provide substantial growth potential for Disney+. Product innovations, such as AI-driven content creation, can enhance offerings. Strategic partnerships, like the joint venture for a new sports streaming service, can unlock new revenue streams. The company is also exploring immersive storytelling and interactive entertainment.

Disney's competitive position is evolving towards a more digitally integrated and globally focused entertainment powerhouse. Strategies centered on content differentiation, technological innovation, and strategic alliances are key. The company's ability to adapt to changing consumer behavior and leverage its brand effectively will determine its success.

In 2024, Disney's revenue reached approximately $88.9 billion. Disney+ had approximately 150 million subscribers worldwide as of Q1 2024. The Parks, Experiences, and Products segment generated over $30 billion in revenue in 2024. The company's market capitalization is around $200 billion.

- Disney's streaming services are competing with Netflix, which reported over 260 million subscribers globally in Q1 2024.

- The company is investing heavily in content, with content spending expected to be around $30 billion in 2024.

- Disney's strategic partnerships, such as the joint venture for a new sports streaming service, are expected to generate significant revenue.

- The company is focusing on innovation in theme parks, with new attractions and experiences planned to attract visitors.

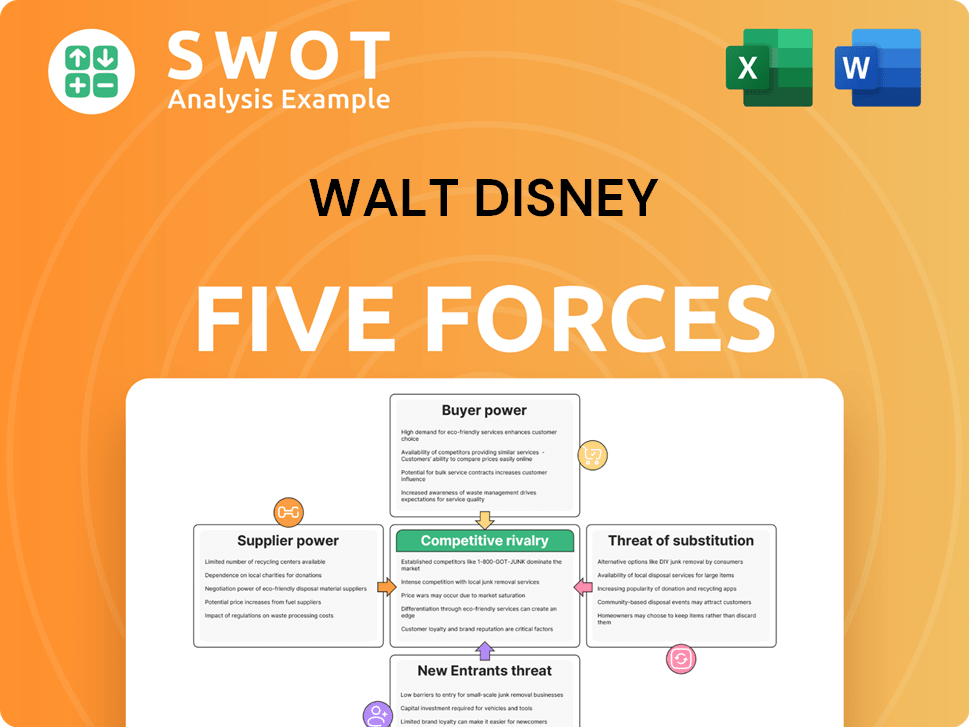

Walt Disney Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Walt Disney Company?

- What is Growth Strategy and Future Prospects of Walt Disney Company?

- How Does Walt Disney Company Work?

- What is Sales and Marketing Strategy of Walt Disney Company?

- What is Brief History of Walt Disney Company?

- Who Owns Walt Disney Company?

- What is Customer Demographics and Target Market of Walt Disney Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.