ThyssenKrupp Group Bundle

How Does ThyssenKrupp Navigate Today's Industrial Battleground?

ThyssenKrupp, a titan forged from the merging of two industrial giants, faces a dynamic and demanding ThyssenKrupp Group SWOT Analysis. Its legacy, dating back to the 19th century, is now tested by the pressures of decarbonization, geopolitical shifts, and relentless competition. Understanding the ThyssenKrupp competitive landscape is crucial to grasping its future.

This analysis delves into the ThyssenKrupp competitors, assessing their strengths and weaknesses within the ThyssenKrupp industry. We'll examine the company's ThyssenKrupp business strategy and its ThyssenKrupp financial performance in relation to its rivals. Furthermore, this exploration provides key insights into the ThyssenKrupp market analysis, including its challenges and opportunities.

Where Does ThyssenKrupp Group’ Stand in the Current Market?

ThyssenKrupp operates across diverse industrial sectors, maintaining a significant presence in the global market. The company's core operations encompass materials services, steel production, and the provision of industrial plants and components. Its value proposition centers on delivering high-quality products and services to key industries such as automotive, construction, and energy, supported by a global network and technological expertise.

In the fiscal year 2022/2023, ThyssenKrupp reported sales of €37.5 billion, demonstrating its substantial scale within the global industrial sector. The company's strategic focus has shifted over time, with a notable divestment of its elevator technology business in 2020 for €17.2 billion, allowing for a greater focus on core industrial and materials segments. This restructuring reflects an evolving Brief History of ThyssenKrupp Group and a strategic realignment towards its core strengths.

ThyssenKrupp's market position varies across its business segments. For example, its Materials Services business is a leading independent materials distributor. ThyssenKrupp Steel Europe is one of Europe’s largest steel producers. The company's geographical presence is strong in Europe, particularly Germany, and extends across North America, South America, and Asia. This broad presence allows ThyssenKrupp to serve a wide range of customer segments, including the automotive industry, construction, energy, and infrastructure.

ThyssenKrupp's market share varies by segment, with Materials Services being a leading distributor. The steel division holds a significant position in Europe. Specific market share figures are not always publicly available.

In fiscal year 2022/2023, sales were €37.5 billion. Adjusted EBIT for the same period was €765 million. The company faces challenges in profitability and is undergoing restructuring.

ThyssenKrupp has a strong presence in Europe, particularly Germany. It also operates in North America, South America, and Asia. This global footprint supports its diverse customer base.

The company divested its elevator technology business in 2020. This move aimed to deleverage and focus on core businesses. Restructuring efforts are ongoing to improve financial performance.

ThyssenKrupp faces challenges related to profitability and the need for significant investments in decarbonization. The competitive landscape includes intense competition in commoditized segments.

- Intense competition in the steel industry.

- Need for investments in sustainable operations.

- Opportunities in specialized steel products.

- Focus on materials distribution and services.

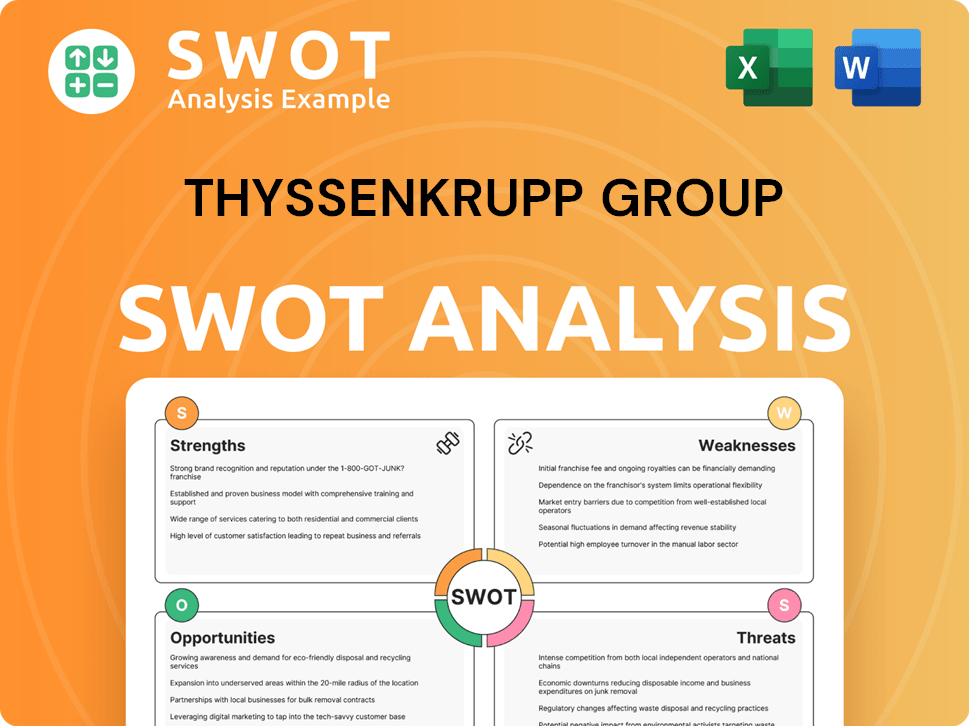

ThyssenKrupp Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging ThyssenKrupp Group?

The ThyssenKrupp competitive landscape is complex, spanning multiple sectors and facing diverse rivals. This analysis examines the key competitors across ThyssenKrupp's main business areas, highlighting the strategic challenges and opportunities the company encounters. Understanding these competitive dynamics is crucial for assessing ThyssenKrupp's business strategy and financial performance.

ThyssenKrupp's diversified industrial portfolio means it competes with a wide range of companies, from global steel giants to specialized engineering firms. The competitive environment is shaped by factors such as technological innovation, market consolidation, and the increasing focus on sustainability. This overview provides insights into the key players and the competitive pressures influencing ThyssenKrupp's operations.

In the steel sector, ThyssenKrupp Steel Europe contends with major international players. ArcelorMittal, the world's leading steel and mining company, presents significant competition due to its broad product range and global presence. Salzgitter AG, based in Germany, and Tata Steel Europe are also strong regional competitors. These companies compete on pricing, product innovation, and production efficiency. The European steel market is highly competitive, influenced by fluctuating raw material costs and environmental regulations. For example, in 2024, the European steel market saw intense competition, with producers vying for market share amidst fluctuating raw material costs and environmental regulations.

ArcelorMittal is a major global competitor in the steel industry. The company's extensive product range and global reach pose a significant challenge to ThyssenKrupp.

Salzgitter AG is a strong regional competitor in Germany. The company's established market position and focus on steel production create direct competition.

Tata Steel Europe is another key regional competitor. The company's presence in the European market adds to the competitive pressure on ThyssenKrupp.

Competition in the steel sector is driven by pricing, product innovation, and production efficiency. Fluctuating raw material costs and environmental regulations also play a significant role.

Producers are constantly vying for market share. Consolidation within the European steel industry is reshaping the competitive landscape.

Companies are focusing on high-strength steels and efficient large-scale production to gain a competitive edge. Decarbonization efforts also create new competitive arenas.

The materials services segment faces competition from a fragmented market of regional and global distributors. Klöckner & Co SE, a leading multi-metal distributor, and other specialized material suppliers are direct competitors. These companies compete on supply chain efficiency, product offerings, and value-added services. The automotive technology segment sees competition from major automotive suppliers like ZF Friedrichshafen AG, Bosch, and Continental AG, which offer a wide range of components and systems. These companies compete on technological innovation, integration capabilities, and global manufacturing footprints. For instance, in 2024, the automotive industry saw increased competition in electric vehicle components, with suppliers focusing on innovation and efficiency to meet growing demand. Further insights into ThyssenKrupp's ownership can be found in this article: Owners & Shareholders of ThyssenKrupp Group.

The materials services segment faces competition from a diverse group of distributors and suppliers.

- Klöckner & Co SE: A leading multi-metal distributor competing on supply chain efficiency.

- Specialized Material Suppliers: These suppliers compete on product offerings and value-added services.

- Competition Factors: Supply chain efficiency, breadth of product offerings, and value-added services are key competitive factors.

- Market Dynamics: The market is fragmented, with companies constantly striving to improve their service offerings.

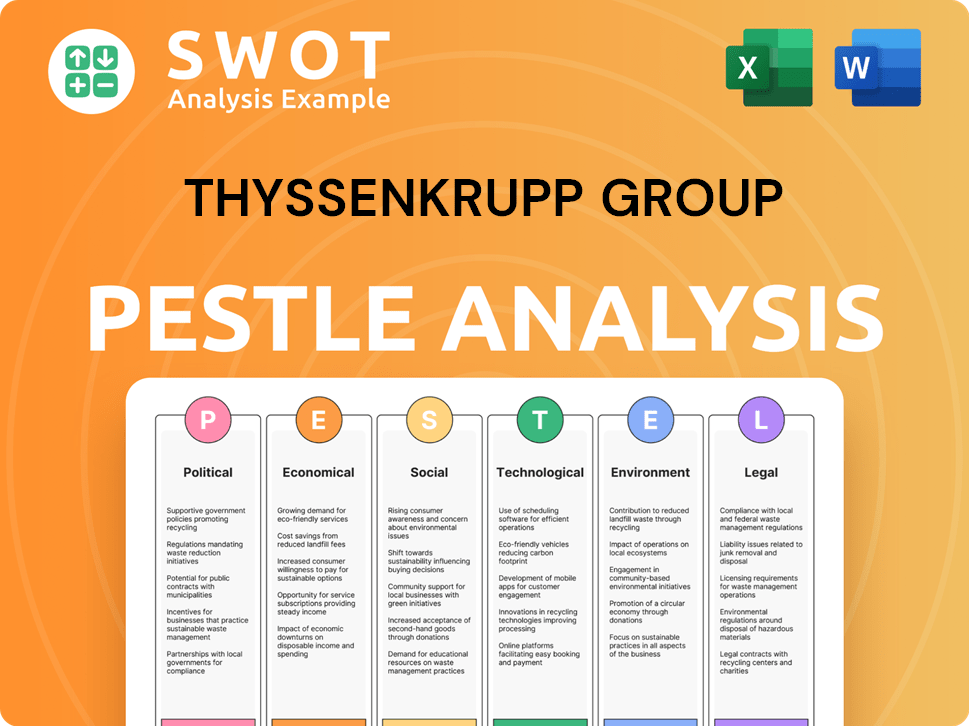

ThyssenKrupp Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives ThyssenKrupp Group a Competitive Edge Over Its Rivals?

Examining the competitive landscape of the group, several key advantages emerge, rooted in its long-standing industrial heritage and technological expertise. The company's strategic moves and financial performance are significantly influenced by its ability to maintain a competitive edge in core sectors like steel production and industrial solutions. For a deeper understanding of the company's target audience, you can explore the Target Market of ThyssenKrupp Group.

One of the most significant aspects of the group's business strategy is its focus on innovation and sustainability, particularly in green steel production and hydrogen technologies. This forward-thinking approach aims to secure its position in a rapidly evolving market. The company’s diversified business model also provides a degree of resilience by spreading risk across various industrial cycles, which is crucial for navigating economic fluctuations and maintaining financial performance.

The company's competitive advantages are multifaceted, encompassing proprietary technologies, extensive global distribution networks, and a strong brand reputation. These elements contribute to customer loyalty and operational efficiency, which are vital in traditional heavy industries. The ability to leverage expertise across different segments, such as automotive technology and materials services, fosters innovation and market access, contributing to its overall competitive positioning.

The company excels in specialized steel production and industrial plant construction, offering high-quality products for demanding applications. Its investments in research and development, especially in green steel production, maintain its technological edge. This focus on innovation is crucial for staying ahead in the ThyssenKrupp competitive landscape.

The company benefits from extensive global distribution networks, particularly in its Materials Services segment, which allows for efficient material delivery. This network provides economies of scale in procurement and logistics, offering a competitive edge in terms of cost and delivery times. This is a key factor in the ThyssenKrupp market analysis.

Built over centuries, the group's strong brand equity fosters customer loyalty and trust, especially in heavy industries where reliability is paramount. This reputation helps in maintaining customer relationships and securing contracts. This is a critical element in the ThyssenKrupp industry.

The diversified portfolio provides resilience by spreading risk across different industrial cycles. Leveraging expertise across segments like automotive technology and materials services leads to synergistic benefits. This strategic approach supports its business strategy.

The company's competitive advantages are rooted in its technological expertise and diversified business model. Recent financial results show the company is focusing on sustainable practices to maintain its market position. Its strategic transformation includes a strong emphasis on decarbonization and hydrogen technologies, positioning it favorably for the future.

- Proprietary technologies and deep engineering know-how, especially in steel production.

- Extensive global distribution networks and supply chain strengths.

- Strong brand equity and customer trust built over many years.

- Diversified portfolio providing resilience across various industrial cycles.

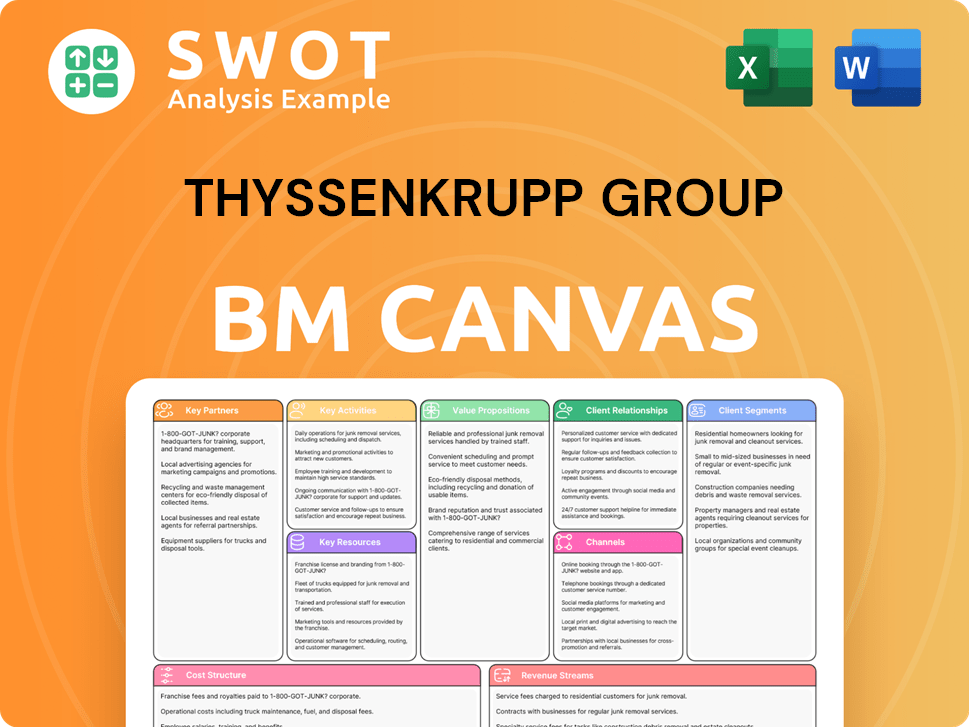

ThyssenKrupp Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping ThyssenKrupp Group’s Competitive Landscape?

The competitive landscape for the ThyssenKrupp Group is shaped by industry trends, including decarbonization and technological advancements. The company faces challenges and opportunities in a dynamic market. Its ability to adapt to these changes will determine its future success. For a detailed look at the company’s growth strategy, see the Growth Strategy of ThyssenKrupp Group.

ThyssenKrupp's position in the ThyssenKrupp industry is influenced by its financial performance and strategic decisions. The company's ability to innovate and adapt to market changes is crucial for maintaining its competitive edge. Analyzing the ThyssenKrupp market analysis helps understand its current standing and future prospects. Understanding the ThyssenKrupp competitive landscape is essential for investors and stakeholders.

Decarbonization and sustainability are major trends, particularly affecting the steel division. This requires significant investment in green technologies. Regulatory changes, such as the EU's Carbon Border Adjustment Mechanism (CBAM), will influence costs and competitiveness. The company aims to produce 3 million tons of climate-friendly steel by 2030.

Digitalization and automation are transforming manufacturing and supply chains. Investment in Industry 4.0 solutions is crucial for efficiency. Demand for lightweight materials in sectors like automotive also impacts traditional steel producers. Geopolitical shifts and supply chain disruptions pose ongoing challenges.

Navigating the substantial capital requirements for decarbonization while maintaining profitability is key. Competition from companies with lower carbon footprints will increase. Adapting to rapid technological changes and supply chain disruptions requires strategic agility. The company must balance investments and manage risks.

The transition to a green economy drives demand for sustainable solutions. Expertise in plant engineering can capitalize on infrastructure development. Emerging markets offer growth opportunities for materials services. Strategic partnerships are crucial for expanding market reach. The company's focus on sustainable solutions can position it as a leader.

ThyssenKrupp's ThyssenKrupp business strategy involves focusing on sustainable solutions and technological innovation. The company is investing in green steel production and hydrogen technologies. Strategic alliances are essential for sharing the burden of investments and expanding market reach.

- Prioritize investments in green technologies.

- Develop strategic partnerships to share costs and expand market reach.

- Focus on innovation in materials and manufacturing processes.

- Adapt to changing geopolitical and economic conditions.

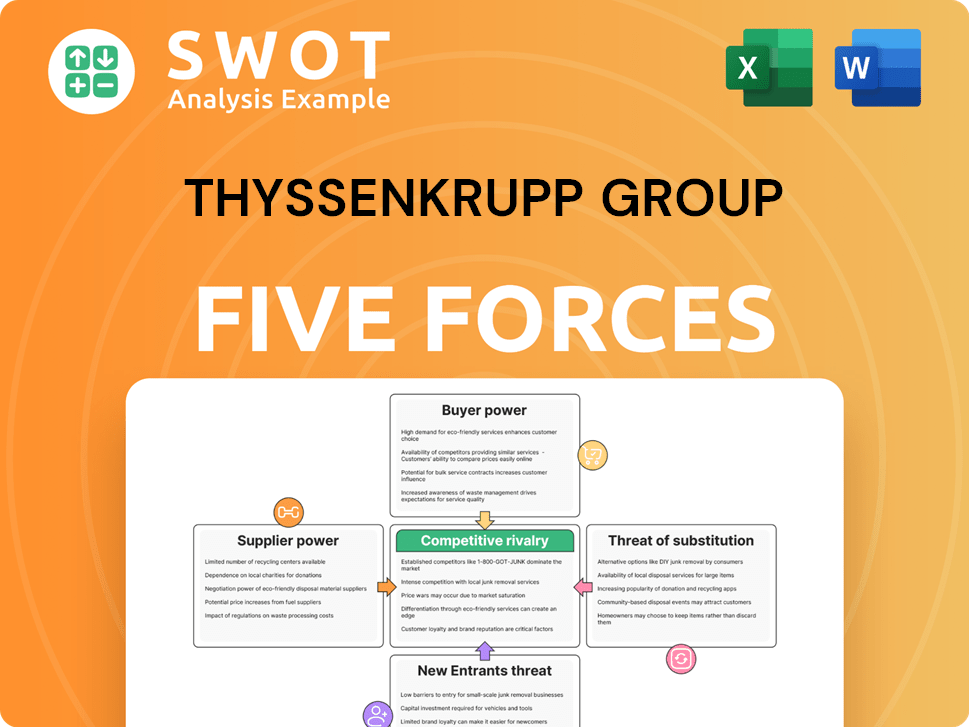

ThyssenKrupp Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ThyssenKrupp Group Company?

- What is Growth Strategy and Future Prospects of ThyssenKrupp Group Company?

- How Does ThyssenKrupp Group Company Work?

- What is Sales and Marketing Strategy of ThyssenKrupp Group Company?

- What is Brief History of ThyssenKrupp Group Company?

- Who Owns ThyssenKrupp Group Company?

- What is Customer Demographics and Target Market of ThyssenKrupp Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.