ThyssenKrupp Group Bundle

Who Really Calls the Shots at ThyssenKrupp?

Delving into the ThyssenKrupp Group SWOT Analysis reveals the critical importance of understanding its ownership. Knowing the ThyssenKrupp ownership structure unlocks insights into its strategic direction and future potential. This exploration will examine the complex interplay of ThyssenKrupp shareholders and their influence on one of Germany's industrial giants. Uncover the forces that shape this global player.

The ThyssenKrupp parent company and its evolution are deeply intertwined with German industrial history, making it a fascinating case study for investors and strategists alike. Understanding the ThyssenKrupp structure is key to grasping its operations, from its steel production roots to its diversified portfolio today. Examining the roles of various ThyssenKrupp investors provides a comprehensive view of its governance and strategic direction, making it essential for anyone seeking to understand the company's trajectory.

Who Founded ThyssenKrupp Group?

The foundational ownership of what would become the ThyssenKrupp Group is rooted in the histories of two major German industrial entities: Krupp and Thyssen. The initial ownership structures of both companies were characterized by strong family control, reflecting a long-term vision and a concentrated approach to industrial development. Understanding the early ownership dynamics provides crucial context for analyzing the evolution of the company's structure and its current stakeholders.

The Krupp legacy started in 1811 with Friedrich Krupp's cast steel factory in Essen, Germany. Initially, the ownership was entirely within the Krupp family, with Friedrich Krupp as the sole proprietor. Similarly, Thyssen AG's origins trace back to August Thyssen, who founded the company in Mülheim an der Ruhr in 1891. Both companies' early years were marked by family control and a focus on technological innovation and strategic acquisitions.

The early ownership of both Krupp and Thyssen companies was primarily held within the founding families. The Krupp family maintained control through generations, with Alfred Krupp significantly expanding the business. Thyssen followed a similar pattern, with August Thyssen driving the company's growth through acquisitions. The absence of external equity splits or early backers in the modern sense is a key feature of their early ownership structures.

Friedrich Krupp established a cast steel factory in Essen in 1811, marking the beginning of the Krupp dynasty.

August Thyssen founded Thyssen AG in Mülheim an der Ruhr in 1891, focusing on steel production and related industries.

Both Krupp and Thyssen maintained strong family control in their early years, ensuring long-term strategic focus.

Early growth was primarily financed through retained earnings and debt, rather than external equity.

Both companies focused on technological innovation and strategic acquisitions to expand their businesses.

There were no external equity splits or early backers in the modern sense; the company's growth was financed primarily through retained earnings and, at times, debt.

The early ownership of what is now known as ThyssenKrupp, and the details of its evolution, are critical to understanding the company's current structure. The initial ownership of both Krupp and Thyssen was tightly held within the founding families, emphasizing long-term strategic goals and a focus on industrial expansion. This family-centric approach shaped the companies' cultures and their approaches to innovation and market dominance. For further insights into the company's strategic direction, consider reading about the Growth Strategy of ThyssenKrupp Group.

- The Krupp family's control was pivotal in the early years, with Alfred Krupp driving significant expansion.

- August Thyssen's strategic acquisitions were key to the rapid growth of Thyssen AG.

- The absence of external investors in the early stages highlights the family's commitment and control.

- Both companies prioritized technological advancements in steel production.

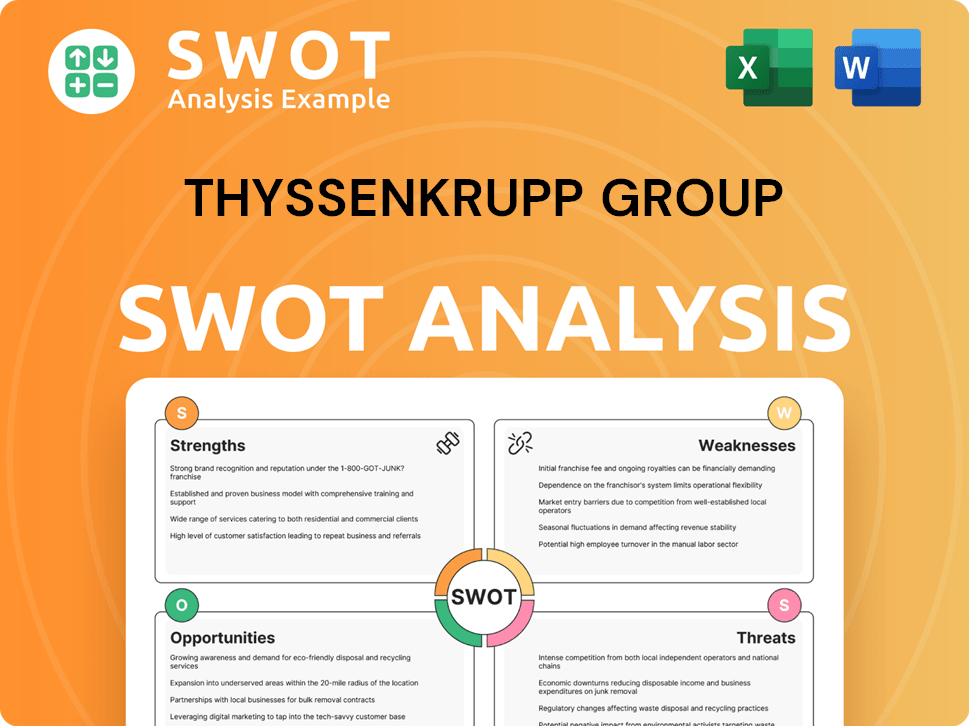

ThyssenKrupp Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ThyssenKrupp Group’s Ownership Changed Over Time?

The evolution of the ThyssenKrupp ownership structure has been marked by significant changes, particularly following the 1999 merger. A key event impacting the company's ownership was the sale of its elevator technology business in 2020. This strategic move reshaped the company's financial landscape and, consequently, its appeal to different investor groups. These shifts reflect a broader trend of industrial conglomerates streamlining operations to focus on core competencies, influencing the composition of ThyssenKrupp shareholders.

The ThyssenKrupp history is intertwined with the influence of major stakeholders. The Alfried Krupp von Bohlen und Halbach Foundation holds a substantial stake, providing significant influence over the company's strategic direction. Alongside the foundation, institutional investors play a crucial role. These include investment funds, asset managers, and pension funds from around the globe. The interplay between the foundation's long-term perspective and the performance-driven interests of institutional investors shapes the company's trajectory.

| Shareholder | Approximate Ownership | Notes |

|---|---|---|

| Alfried Krupp von Bohlen und Halbach Foundation | Around 21% | Largest single shareholder; provides long-term strategic direction. |

| Institutional Investors | Majority of Remaining Shares | Includes investment funds, asset managers, and pension funds. |

| Free Float | Fluctuates | Shares available for public trading on the Frankfurt Stock Exchange. |

The ThyssenKrupp parent company is influenced by a balance between the long-term perspective of the Krupp Foundation and the performance-driven interests of various institutional investors. The company's strategic direction is thus influenced by a balance between the long-term, stability-oriented perspective of the Krupp Foundation and the more performance-driven interests of various institutional investors. Recent actions, such as the sale of the elevator technology business, reflect a broader trend of industrial conglomerates streamlining their operations and focusing on core competencies, influencing who holds stakes in the company. For more insights, you can read about the [ThyssenKrupp Group](0).

The Alfried Krupp von Bohlen und Halbach Foundation remains the largest single shareholder.

- Institutional investors hold a significant portion of the shares.

- The ownership structure influences strategic decisions.

- Changes in ownership reflect the company's evolving business focus.

- The company's stock is actively traded on the Frankfurt Stock Exchange.

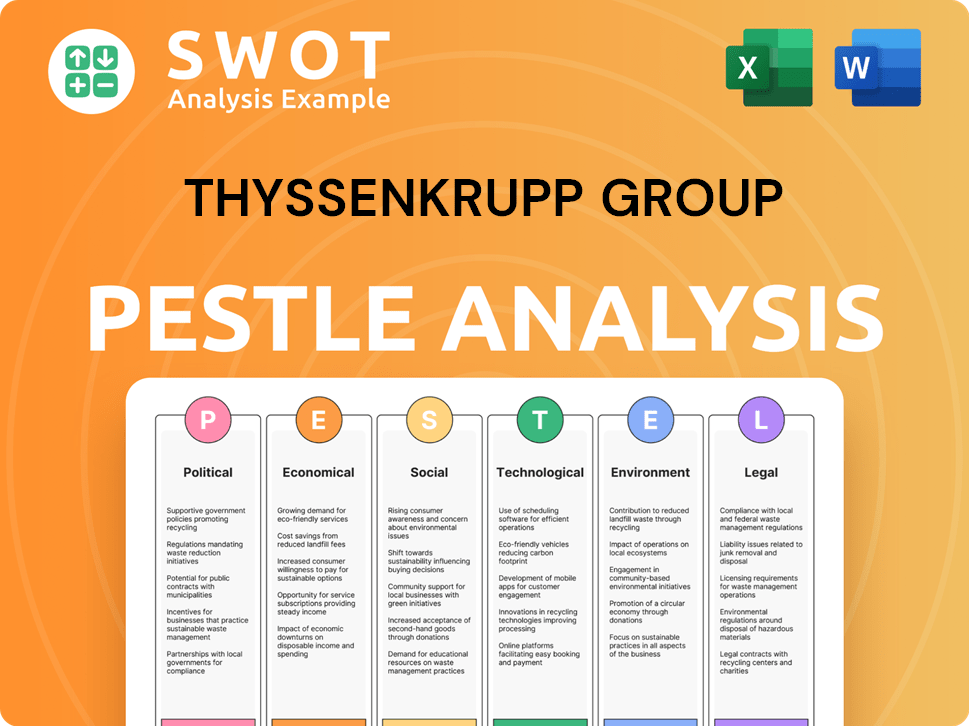

ThyssenKrupp Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ThyssenKrupp Group’s Board?

The Board of Directors at ThyssenKrupp is crucial for the company's governance, especially given its complex ownership. The supervisory board includes representatives from both shareholders and employees, adhering to German co-determination laws. Members represent major shareholders, such as the Alfried Krupp von Bohlen und Halbach Foundation. The chairman often has strong ties to the foundation or is an independent professional with extensive industry experience. Understanding the ThyssenKrupp ownership structure is key to grasping how decisions are made.

The current composition of the board reflects the company's strategic direction and the influence of its major stakeholders. The board's structure aims to balance the interests of various parties, ensuring that the company's long-term goals are met. The focus is on maintaining a balance between shareholder interests and the company's operational needs. This structure is designed to support the company's transformation and ensure its success in a competitive market. The board's decisions are influenced by the company's ThyssenKrupp shareholders and the broader economic environment.

| Board Role | Name | Notes |

|---|---|---|

| Chairman of the Supervisory Board | Reinhold Achatz | Appointed in 2023 |

| CEO | Miguel Ángel López Borrego | Appointed in 2023 |

| Member of the Supervisory Board | Sigrid Evelyn Nikutta | Represents employee interests |

ThyssenKrupp operates on a 'one-share-one-vote' principle, with each share generally carrying one voting right. However, the Alfried Krupp von Bohlen und Halbach Foundation, holding approximately 21% of the shares, exerts significant influence over key decisions, including board appointments and strategic initiatives. While there are no special voting rights or golden shares explicitly granting outsized control, the foundation's substantial stake makes it a dominant force. For more insights, check out the Brief History of ThyssenKrupp Group.

The Board of Directors includes representatives from shareholders and employees.

- The Alfried Krupp von Bohlen und Halbach Foundation holds a significant stake.

- The 'one-share-one-vote' principle is in effect.

- The board's structure aims to balance stakeholder interests.

- The company faces scrutiny from investors regarding its performance.

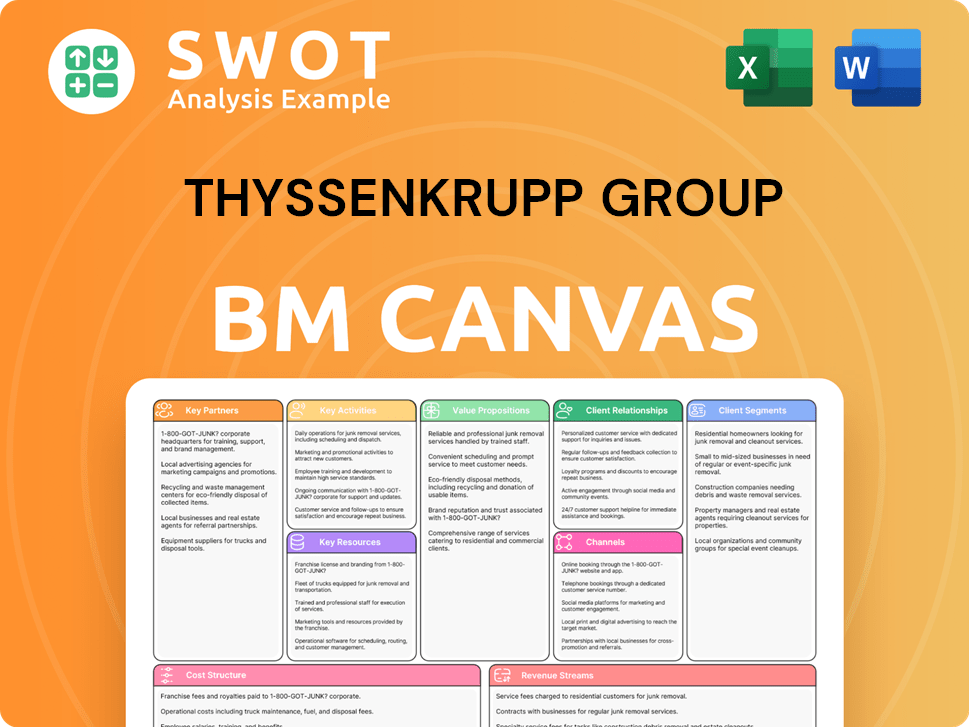

ThyssenKrupp Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ThyssenKrupp Group’s Ownership Landscape?

In the past three to five years, the ThyssenKrupp ownership structure has seen significant shifts driven by strategic decisions. A pivotal move was the sale of its Elevator Technology business in 2020, which generated an enterprise value of €17.2 billion. This divestiture was a key step in the company's transformation, aimed at reducing debt and enabling investments in its remaining core businesses. This restructuring has likely altered the ThyssenKrupp shareholders base, potentially attracting investors interested in the evolving focus on materials and industrial components.

More recently, ThyssenKrupp has continued to evaluate strategic options for its various segments, including the steel division. Discussions about potential partnerships or spin-offs are ongoing, which could further reshape the ThyssenKrupp structure. The company's focus on green transformation and decarbonization initiatives in its steel production also attracts investors with an ESG (Environmental, Social, and Governance) focus. These developments are critical as the company navigates market dynamics and seeks to enhance shareholder value.

Industry trends, such as increased institutional ownership and the rise of activist investors, also influence ThyssenKrupp investors. While the Krupp Foundation remains a stable anchor investor, the company is subject to broader market forces. Ongoing restructuring efforts and a clear strategic path are essential to attract and retain investors. For a deeper understanding of the company's marketing strategies and how they align with its ownership changes, consider reading the Marketing Strategy of ThyssenKrupp Group.

The sale of the Elevator Technology business in 2020 for €17.2 billion was a major change. This led to a shift in the investor base, attracting those interested in materials and industrial components.

Ongoing discussions about the steel division, including potential partnerships or spin-offs, are reshaping the company. The focus on green transformation attracts ESG-focused investors.

Increased institutional ownership and activist investors are influencing ThyssenKrupp. The Krupp Foundation remains a key investor, but market forces play a significant role.

Continued restructuring and a clear strategic path are crucial for attracting and retaining investors. Operational efficiency and profitability will shape the future ownership.

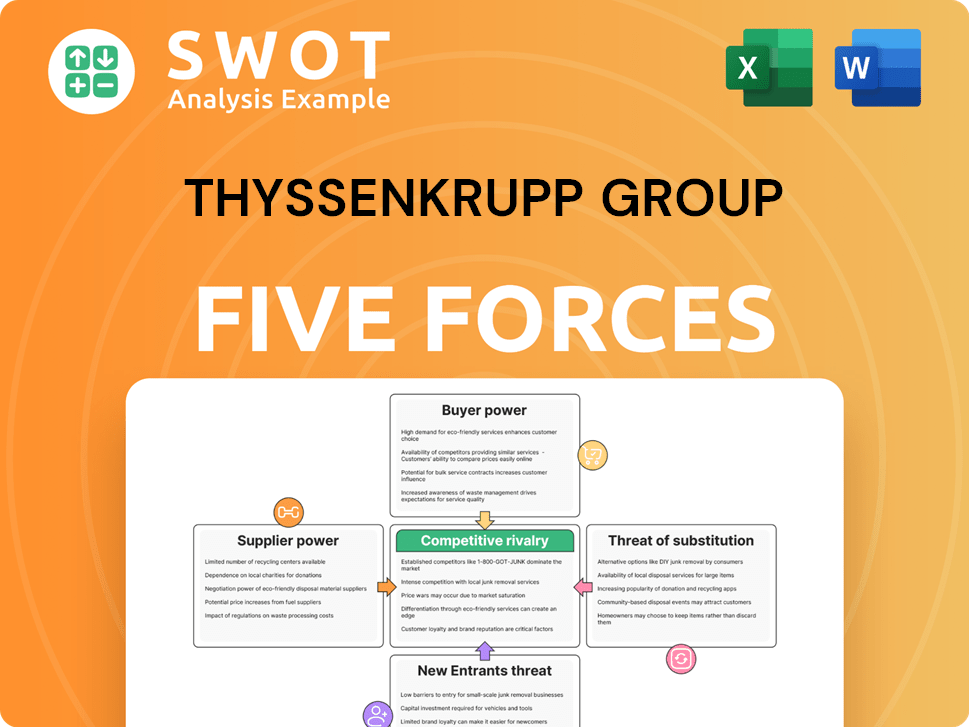

ThyssenKrupp Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ThyssenKrupp Group Company?

- What is Competitive Landscape of ThyssenKrupp Group Company?

- What is Growth Strategy and Future Prospects of ThyssenKrupp Group Company?

- How Does ThyssenKrupp Group Company Work?

- What is Sales and Marketing Strategy of ThyssenKrupp Group Company?

- What is Brief History of ThyssenKrupp Group Company?

- What is Customer Demographics and Target Market of ThyssenKrupp Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.