ThyssenKrupp Group Bundle

Can ThyssenKrupp Forge a New Path to Prosperity?

ThyssenKrupp's recent strategic pivot, including the planned spin-off of its steel division, signals a critical juncture for the industrial giant. This move, reshaping a company with a rich history dating back to the 19th century, demands a close examination of its evolving ThyssenKrupp Group SWOT Analysis and future ambitions. Understanding the

From its origins in steel and machinery, ThyssenKrupp has transformed into a diversified group, navigating a complex industrial landscape. This

How Is ThyssenKrupp Group Expanding Its Reach?

The expansion initiatives of ThyssenKrupp are centered on portfolio optimization and strategic growth, particularly in key areas like steel and multi-tracks segments. The company is actively transforming its steel business, with a focus on decarbonization and securing future competitiveness. This includes exploring the spin-off of its steel division, thyssenkrupp Steel Europe AG, to foster independent growth and allow the remaining businesses to concentrate on their respective strategies.

ThyssenKrupp's growth strategy involves significant investments in new product pipelines and partnerships across various sectors. The Multi-Tracks segment, which includes businesses such as bearings and forged technologies, is leveraging its technological expertise to serve diverse industries. The company aims to diversify its revenue streams and enhance resilience against industry fluctuations through these expansion efforts.

The company's focus on sustainable business practices and ESG initiatives is a crucial element of its long-term strategy. As of May 2024, ThyssenKrupp Steel Europe and HHLA signed a Memorandum of Understanding to collaborate on a new steel mill at the Port of Hamburg, targeting climate-friendly steel production. This collaboration highlights the company's commitment to reducing its carbon footprint and adapting to the evolving demands of the market.

ThyssenKrupp is actively transforming its steel business through strategic initiatives. This includes a focus on decarbonization and the exploration of a spin-off for thyssenkrupp Steel Europe AG. The goal is to create a more agile entity capable of independent growth.

The Multi-Tracks segment, including bearings and forged technologies, is leveraging its expertise. The company is investing in new product pipelines and partnerships to enhance its offerings and market reach. This strategy aims to diversify revenue and improve resilience.

ThyssenKrupp is forming strategic partnerships to drive growth and innovation. The collaboration with HHLA for a new steel mill at the Port of Hamburg is a prime example. These partnerships support the company's sustainability goals.

Sustainability is a key aspect of ThyssenKrupp's expansion strategy. The company is actively pursuing ESG initiatives and investing in climate-friendly steel production. This commitment reflects the company's long-term vision and values.

The company's strategic moves are designed to enhance its market position and capitalize on emerging opportunities. The ongoing transformation and strategic initiatives reflect a forward-looking approach to ensure long-term success and sustainability. For more insights into the company's core values, consider reading the mission, vision, and core values of ThyssenKrupp Group.

ThyssenKrupp's expansion strategy involves several key initiatives focused on growth and sustainability.

- Decarbonization of steel production through partnerships.

- Spin-off of the steel business to foster independent growth.

- Investment in new product pipelines and market expansion in the Multi-Tracks segment.

- Focus on ESG initiatives and sustainable business practices.

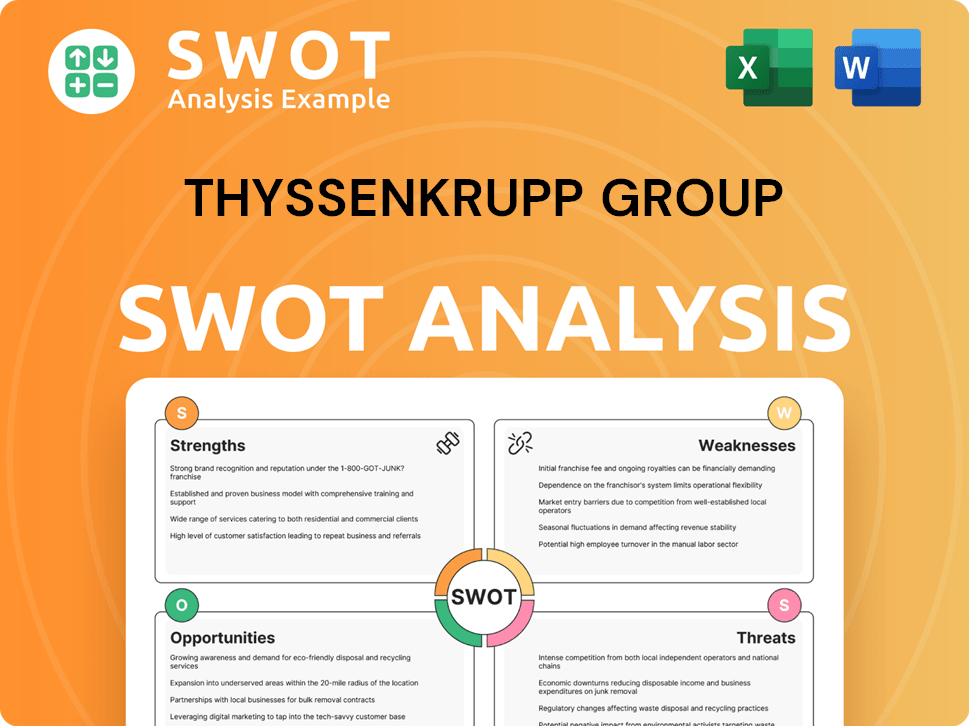

ThyssenKrupp Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ThyssenKrupp Group Invest in Innovation?

The ThyssenKrupp growth strategy is deeply rooted in innovation and technology, particularly in the pursuit of sustainable industrial solutions and digital transformation. This approach is crucial for their future prospects, as they navigate a rapidly changing industrial landscape. The company's commitment to research and development (R&D) is evident in its investments in climate-friendly technologies and processes.

A key element of this strategy involves transforming steel production to hydrogen-based methods, aiming to significantly reduce carbon dioxide (CO2) emissions. This move towards green steel production is a core part of their sustainability efforts. This positions them as a leader in the industry.

ThyssenKrupp company analysis reveals a strong emphasis on leveraging digital transformation across all operations. This includes using advanced analytics, the Internet of Things (IoT), and artificial intelligence (AI) to optimize production, improve maintenance, and develop smart products and services.

A major focus is the shift to hydrogen-based steel production. ThyssenKrupp plans to build a new direct reduction plant with two melters. This plant is expected to produce 2.5 million metric tons of climate-friendly steel annually by 2029.

The company is using advanced analytics, IoT, and AI to improve production processes. This helps in predictive maintenance and the development of smart products and services. Digital strategies aim to boost efficiency and create new revenue streams.

Significant R&D investments are being made, particularly in climate-friendly technologies. These investments are crucial for sustainable industrial solutions. These initiatives are key to the ThyssenKrupp business model.

Sustainability is a core element of ThyssenKrupp's strategy. The move towards green steel and other climate-friendly technologies demonstrates a commitment to environmental responsibility. This approach is vital for the ThyssenKrupp market position.

The company aims to be a leader in technological advancements. Their focus on decarbonization and digital initiatives showcases a forward-thinking approach. This is crucial for the ThyssenKrupp industry outlook.

Innovation at ThyssenKrupp is not just about new products but also about transforming processes. This transformation helps in making existing industrial processes more sustainable and efficient. This contributes directly to their growth objectives.

The company's approach to innovation, coupled with its focus on digital transformation and sustainability, is designed to enhance efficiency, reduce costs, and create new revenue streams. While specific recent patents or industry awards for 2024-2025 were not explicitly detailed in the provided search results, the focus on decarbonization in steel and the ongoing digital initiatives demonstrate a clear commitment to technological leadership. To better understand the competitive landscape, you can explore the Competitors Landscape of ThyssenKrupp Group.

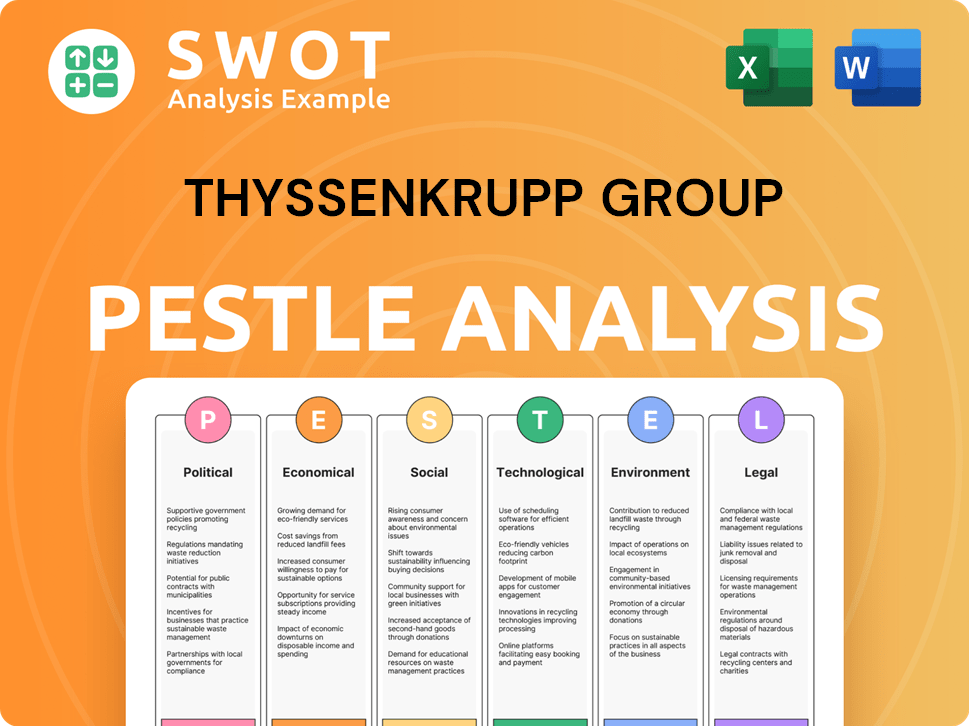

ThyssenKrupp Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ThyssenKrupp Group’s Growth Forecast?

The financial outlook for ThyssenKrupp is shaped by strategic portfolio adjustments and a commitment to achieving sustainable profitability. The company's Brief History of ThyssenKrupp Group reveals a long-term focus on adapting to market changes and optimizing its business structure.

For the first half of the fiscal year 2023/2024, ending March 31, 2024, ThyssenKrupp reported a decrease in sales to €19.0 billion from €20.7 billion in the same period of the previous year. Adjusted EBIT also declined, reaching €190 million compared to €750 million. Net income for H1 2023/2024 showed a loss of €279 million, a shift from a profit of €98 million in H1 2022/2023.

Despite these figures, ThyssenKrupp maintains its full-year guidance for fiscal year 2023/2024. This includes projecting adjusted EBIT in the mid-three-digit million euro range and a net income in the low-to-mid three-digit million euro range. The company anticipates a free cash flow before M&A in the low three-digit million euro range. These forecasts are supported by anticipated improvements in the Materials Services and Industrial Components segments, along with contributions from Marine Systems.

In H1 2023/2024, sales were €19.0 billion, a decrease from €20.7 billion in the same period of the previous year. This reflects the impact of market dynamics and strategic business adjustments. The company's performance is influenced by its diverse business segments and global economic conditions.

Adjusted EBIT decreased to €190 million in H1 2023/2024, down from €750 million. The net income for the same period showed a loss of €279 million, contrasting with a profit of €98 million in H1 2022/2023. These figures highlight the challenges and strategic focus areas.

ThyssenKrupp projects adjusted EBIT in the mid-three-digit million euro range and net income in the low-to-mid three-digit million euro range for the fiscal year 2023/2024. The company also anticipates a free cash flow before M&A in the low three-digit million euro range.

Improvements are expected in Materials Services and Industrial Components segments. Marine Systems is also expected to contribute. The potential spin-off of the steel business is a key component of the long-term financial strategy, aimed at unlocking value.

The company's growth strategy focuses on portfolio optimization and sustainable profitability. This involves strategic adjustments and a commitment to strengthening its balance sheet. The goal is to improve profitability across its diverse segments.

Future prospects include potential improvements in key segments and strategic moves like the possible spin-off of the steel business. These initiatives aim to unlock value and allow the remaining businesses to focus on their growth paths. This will potentially improve capital allocation.

The financial performance analysis reveals a decrease in sales and adjusted EBIT in H1 2023/2024. However, the company maintains its full-year guidance, indicating confidence in its strategic direction. The focus is on long-term value creation.

Global economic trends significantly impact ThyssenKrupp's performance, influencing sales and profitability. The company's ability to adapt to these trends is crucial for its financial outlook. Market dynamics play a key role in the company's strategic decisions.

Challenges include managing declining sales and adjusted EBIT. Opportunities lie in strategic initiatives such as the spin-off of the steel business and improvements in key segments. The company aims to leverage these opportunities for growth.

Long-term growth projections are supported by strategic portfolio adjustments and the focus on sustainable profitability. The company aims to strengthen its balance sheet and improve profitability across its segments. This will drive long-term value creation.

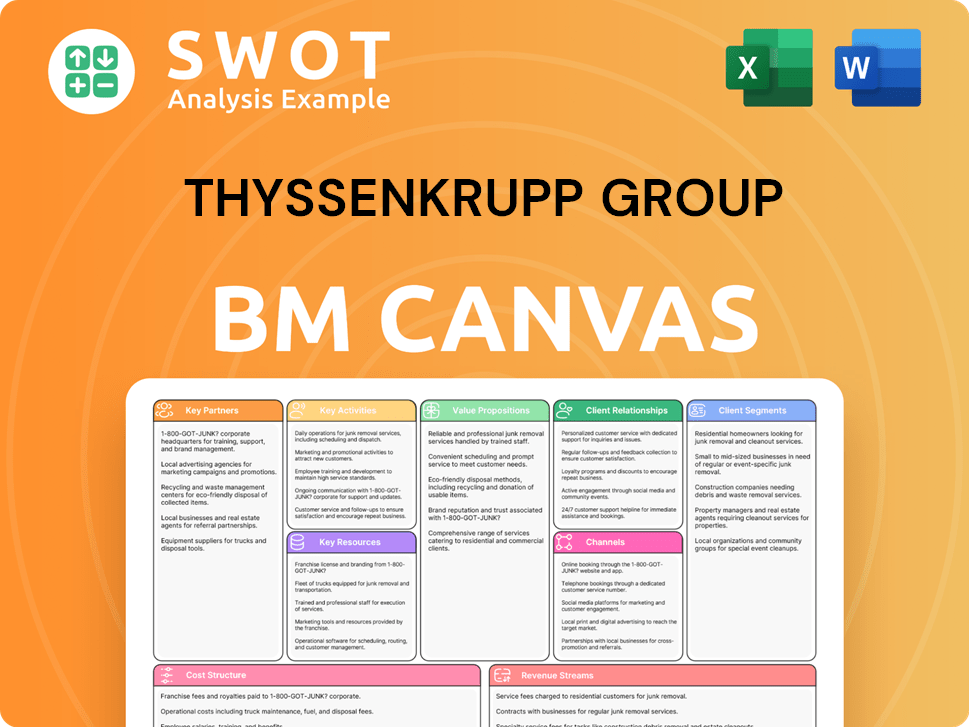

ThyssenKrupp Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ThyssenKrupp Group’s Growth?

The Marketing Strategy of ThyssenKrupp Group faces several potential risks and obstacles that could impact its future. These challenges span both strategic and operational areas, requiring careful management to ensure sustainable growth. The cyclical nature of the steel and materials industries subjects the company to fluctuations in demand, raw material costs, and broader economic conditions.

Market competition, especially from Asian producers, poses a constant threat to pricing and market share. Regulatory changes, particularly those related to environmental protection and decarbonization, present both opportunities and financial burdens. Supply chain vulnerabilities, exacerbated by geopolitical tensions, can disrupt production and increase costs.

Internally, managing a diversified portfolio of businesses, including the potential spin-off of the steel division, demands precise strategic execution. ThyssenKrupp's ability to navigate these challenges will determine its success in achieving its growth ambitions and solidifying its position in the industry.

The steel and materials industries are highly cyclical. This means that the company's performance is heavily influenced by economic cycles, affecting demand and pricing. For instance, in the first half of fiscal year 2023/2024, lower material prices and reduced demand impacted the company's financial results.

Intense competition, especially from Asian steel producers, puts pressure on pricing and market share. This requires the company to continuously innovate and improve efficiency to remain competitive. The competitive landscape demands constant adaptation and strategic agility.

Regulatory changes, particularly those related to environmental protection and decarbonization, pose significant challenges. While the company is investing in green steel production, the associated capital expenditure and technological hurdles present risks. These investments are critical for the future.

Geopolitical tensions and global events can disrupt supply chains, increasing costs and affecting production. Securing reliable and affordable access to raw materials and energy is crucial for maintaining operations. These vulnerabilities necessitate robust risk management strategies.

Managing a diverse portfolio of businesses, including potential spin-offs, requires careful strategic execution. Ensuring all segments can thrive independently or as part of a more focused group is essential. Effective management is key to unlocking value.

The transition to green steel production involves substantial capital expenditure and technological challenges. Addressing these hurdles requires significant investment and innovation. Overcoming these challenges is vital for long-term sustainability and success.

The inherent volatility of the steel and materials markets poses a significant risk. Fluctuations in raw material prices, such as iron ore and coal, directly impact production costs. Economic downturns can decrease demand, affecting sales volumes and profitability. ThyssenKrupp's financial performance is closely tied to these market dynamics.

Geopolitical tensions and global economic instability can disrupt supply chains and increase operational costs. Trade wars, sanctions, and currency fluctuations can further complicate business operations. These factors necessitate robust risk management and diversification strategies. The company must navigate an uncertain global landscape.

Intense competition from both established and emerging players in the steel industry puts pressure on pricing and market share. Companies must continuously innovate to stay ahead. The competitive environment requires strategic agility and operational efficiency. This includes competitors from Asia.

Rapid technological advancements and the need for innovation in areas like green steel production require substantial investment. The risk of technological obsolescence or failure to adopt new technologies quickly can impact competitiveness. Continuous investment in research and development is crucial. This is key for future growth.

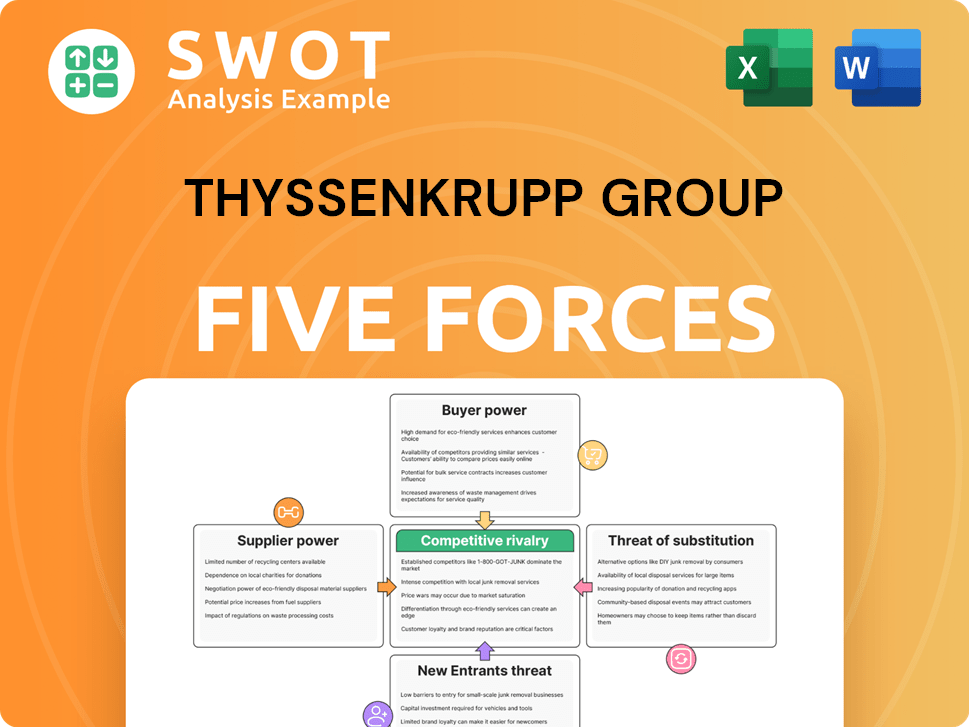

ThyssenKrupp Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ThyssenKrupp Group Company?

- What is Competitive Landscape of ThyssenKrupp Group Company?

- How Does ThyssenKrupp Group Company Work?

- What is Sales and Marketing Strategy of ThyssenKrupp Group Company?

- What is Brief History of ThyssenKrupp Group Company?

- Who Owns ThyssenKrupp Group Company?

- What is Customer Demographics and Target Market of ThyssenKrupp Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.