ThyssenKrupp Group Bundle

How Well Do You Know ThyssenKrupp?

ThyssenKrupp, a titan of German industry, shapes global markets in steel, engineering, and technology. Its influence spans critical sectors like automotive and construction, making it a key player in worldwide supply chains. Understanding the ThyssenKrupp Group SWOT Analysis is paramount for anyone seeking to navigate the complexities of the industrial landscape.

With a legacy of industrial innovation, the ThyssenKrupp company has consistently adapted to market changes, offering diverse products from steel to elevators. This deep dive into ThyssenKrupp's operations, including its core businesses and revenue streams, will provide a comprehensive understanding of its competitive positioning. Investors and industry observers alike will gain valuable insights into how this major player operates globally and its future growth potential.

What Are the Key Operations Driving ThyssenKrupp Group’s Success?

The ThyssenKrupp Group operates by creating and delivering value through a diverse portfolio of industrial products and services. This primarily serves the automotive, construction, and materials sectors. The ThyssenKrupp company offers high-grade steel products, advanced automotive components, complex industrial plant engineering, and various material services.

One of the key aspects of ThyssenKrupp's business is its deep involvement in the steel industry. For instance, its Steel Europe segment is a leading flat steel manufacturer. It supplies critical materials to industries that require lightweight and high-strength solutions. Moreover, the company designs and constructs large-scale industrial facilities, including chemical plants and cement factories, showcasing its engineering prowess.

The operational processes involve sophisticated manufacturing, global sourcing, continuous technology development, and intricate logistics networks. The production of specialized steel involves advanced metallurgical processes and rigorous quality control. The company leverages a global supply chain to source raw materials efficiently and distribute finished products. Sales channels are diverse, ranging from direct sales to industrial clients to a network of distributors for materials services. To learn more about their strategic direction, consider reading about the Growth Strategy of ThyssenKrupp Group.

ThyssenKrupp provides high-grade steel products, advanced automotive components, and complex industrial plant engineering. They also offer various material services. These offerings are central to their value proposition.

Operations include sophisticated manufacturing, global sourcing, and continuous technology development. Rigorous quality control and advanced metallurgical processes are essential. These processes are crucial for maintaining product quality and efficiency.

Customers benefit from enhanced product performance, increased operational efficiency, and reduced downtime. ThyssenKrupp's focus on customized solutions is a key differentiator. These benefits are achieved through deep engineering expertise and extensive R&D capabilities.

ThyssenKrupp primarily serves the automotive, construction, and materials sectors. The company's products and services are tailored to meet the specific needs of these industries. This focus allows for specialized solutions.

ThyssenKrupp's value proposition centers on providing high-quality products and services. This is achieved through innovation, engineering expertise, and a global presence. The company aims to enhance customer operations and drive efficiency.

- Advanced Materials: Supplying high-grade steel and other materials.

- Engineering Excellence: Designing and constructing complex industrial plants.

- Customized Solutions: Tailoring products and services to meet specific customer needs.

- Global Network: Leveraging a global supply chain and distribution network.

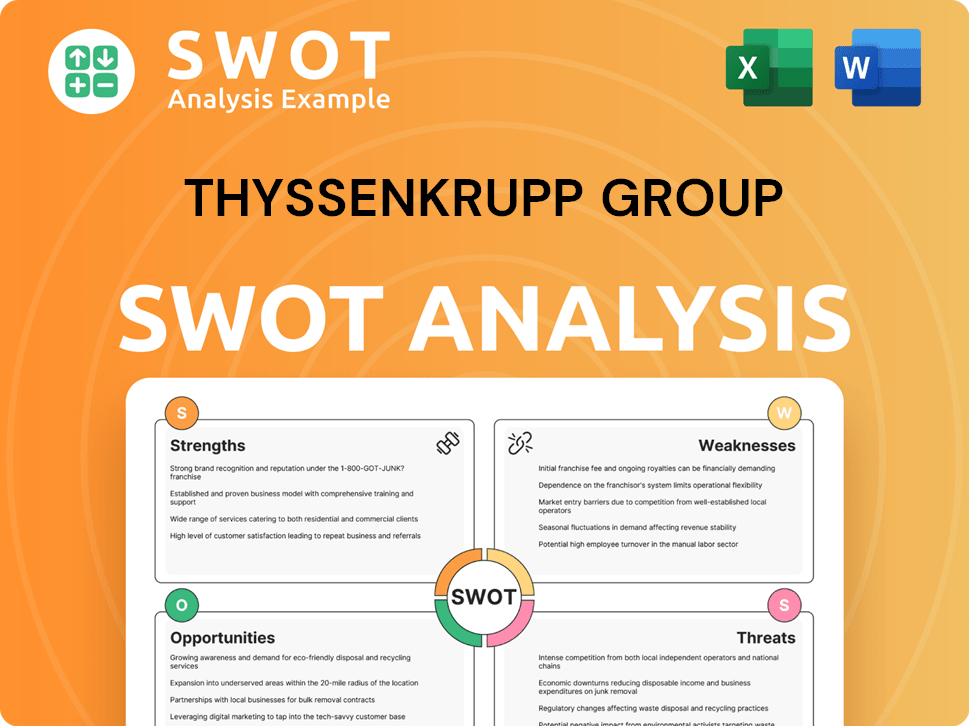

ThyssenKrupp Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ThyssenKrupp Group Make Money?

The ThyssenKrupp Group generates revenue through a diverse range of industrial activities. Key revenue streams include steel products, automotive components, industrial plants, materials services, and engineering solutions. The company's ability to adapt and innovate is crucial for maintaining its financial performance.

For the fiscal year 2022/2023, ThyssenKrupp reported sales of €38 billion, demonstrating the substantial scale of its operations. The company's financial health and strategic direction are closely watched by investors and stakeholders alike. Understanding how ThyssenKrupp operates globally is essential for assessing its long-term viability.

The company employs various monetization strategies to maximize its revenue potential. These strategies include direct sales, long-term supply contracts, and service-based revenue. Furthermore, the company's focus on green transformation and hydrogen technologies is expected to introduce new revenue streams in the future.

The primary revenue streams for ThyssenKrupp come from the sale of steel products, automotive components, and industrial plants. Materials services and engineering solutions also contribute significantly to the company's revenue. These diverse streams support the overall financial health of the ThyssenKrupp business.

Monetization strategies include direct sales for large industrial projects and long-term supply contracts for steel and components. Service-based revenue from maintenance and upgrades of industrial plants is another key strategy. The company also explores bundled services for complex engineering projects.

The Steel Europe segment and Materials Services often contribute significantly to the company's overall revenue. The performance of these segments is crucial for understanding the ThyssenKrupp Group company financial performance. These segments reflect the core of ThyssenKrupp's operations.

The company's strategic focus on green transformation and hydrogen technologies is expected to introduce new revenue streams. Sustainable industrial solutions and related services are key areas for future growth. This focus highlights ThyssenKrupp Group company sustainability initiatives.

The revenue mix can vary significantly by business segment, with Steel Europe and Materials Services often being major contributors. Understanding the dynamics of each segment is vital for investors. This is important for assessing the ThyssenKrupp Group company future outlook.

In the fiscal year 2022/2023, ThyssenKrupp reported sales of €38 billion, showcasing its substantial market presence. This financial performance is a key indicator of the company's overall health. For more insights into the company's ownership structure, consider reading about Owners & Shareholders of ThyssenKrupp Group.

The core of ThyssenKrupp's revenue generation lies in a diversified portfolio. The company leverages various strategies to monetize its products and services effectively.

- Direct Sales: For large-scale industrial projects.

- Long-Term Contracts: Ensuring stable revenue from steel and components.

- Service-Based Revenue: From maintenance and upgrades of industrial plants.

- Innovation: Bundled services for complex engineering projects.

- Strategic Focus: On green transformation and hydrogen technologies.

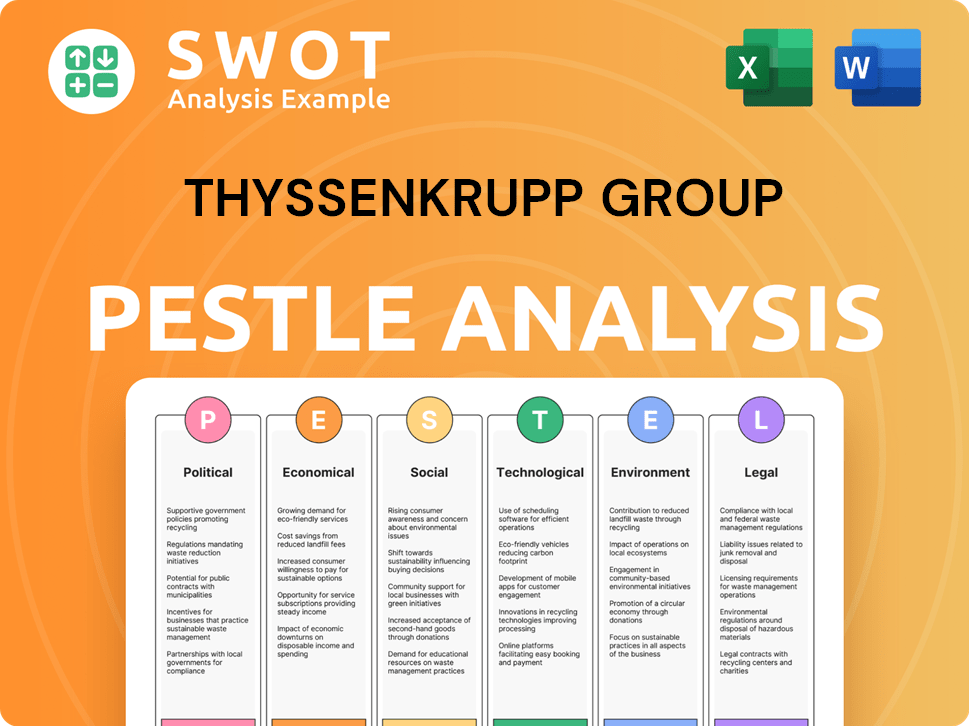

ThyssenKrupp Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped ThyssenKrupp Group’s Business Model?

The ThyssenKrupp Group has navigated significant shifts to maintain its competitive position. Its strategic moves have included divesting non-core assets and bolstering core industrial operations. These actions have been crucial for adapting to market changes and ensuring long-term viability within the global industrial landscape.

A major strategic decision was the sale of its elevator technology business in 2020 for €17.2 billion. This move significantly improved its financial flexibility. The company has also focused on cost-cutting and efficiency programs to counter economic slowdowns and fluctuations in raw material prices. These strategies have been essential for maintaining operational resilience.

ThyssenKrupp's competitive advantages are rooted in its engineering expertise, brand recognition, and global reach. Its leadership in specialized steel production and complex plant engineering provides a strong barrier to entry. The company is adapting to new trends, such as the growing demand for sustainable industrial solutions and the green transformation, by investing in hydrogen technologies and decarbonization efforts.

ThyssenKrupp's history includes mergers and acquisitions that shaped its current structure. The 2020 sale of the elevator business was a pivotal event. This move allowed the company to focus on its core businesses and invest in future technologies.

The company has been undergoing a transformation process, including restructuring and streamlining operations. It has invested in sustainable technologies, such as hydrogen production, to meet the demands of a changing market. These strategic shifts aim to enhance its competitiveness and ensure long-term sustainability.

ThyssenKrupp leverages its extensive engineering expertise and strong brand recognition. Its global footprint allows it to serve diverse markets effectively. The company's focus on innovation and sustainability strengthens its position in the industry.

The financial performance of ThyssenKrupp reflects its strategic adjustments and market conditions. The company's revenue and profitability are influenced by factors such as raw material prices, global economic trends, and its ability to execute its transformation strategy. The divestiture of the elevator business significantly impacted its financial structure.

ThyssenKrupp's core businesses include materials services, industrial components, and plant technology. The company's operations are global, with a significant presence in Europe, the Americas, and Asia. These diverse operations contribute to the company's overall revenue and market reach.

- Materials Services: Distribution and processing of steel and other materials.

- Industrial Components: Production of components for various industries, including automotive and construction.

- Plant Technology: Engineering, construction, and maintenance of industrial plants.

- Hydrogen Technologies: Developing and implementing hydrogen production solutions.

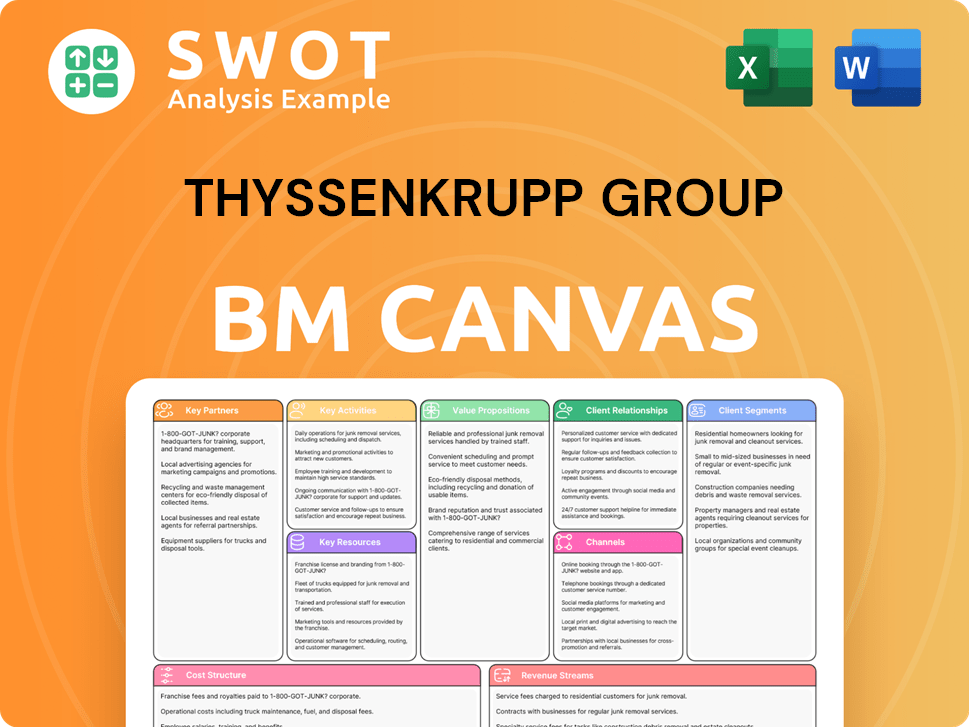

ThyssenKrupp Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is ThyssenKrupp Group Positioning Itself for Continued Success?

The ThyssenKrupp Group maintains a significant position in the global industrial landscape, particularly in steel production and industrial engineering. Its market share in specialized steel products and certain industrial plant segments remains notable. The company's global reach, with operations and sales across numerous countries, further solidifies its market standing. Understanding how ThyssenKrupp operates globally is crucial for assessing its strategic positioning.

However, ThyssenKrupp faces several key risks, including volatility in raw material prices and intense competition. The ongoing energy transition and the need for decarbonization present both challenges and opportunities. The need for substantial investments in new technologies and processes is critical. For insights into the company's strategic direction, consider the Growth Strategy of ThyssenKrupp Group.

ThyssenKrupp is a major player in steel production and industrial engineering. Its market share in specialized steel products is significant. The company's global presence supports its market position.

Key risks include raw material price volatility and intense competition. Geopolitical uncertainties and regulatory changes also pose challenges. The energy transition requires substantial investments.

ThyssenKrupp is focused on 'green transformation' and sustainable solutions. Investments in hydrogen technologies and climate-friendly steel production are planned. The company aims for sustainable growth and digital transformation.

Focus on sustainable growth and digital transformation. Commitment to strengthening core businesses. Adaptation to evolving market demands is a priority.

ThyssenKrupp must navigate raw material price fluctuations and intense competition. The company is investing in sustainable technologies to meet future demands. Understanding ThyssenKrupp's structure is important for investors.

- Geopolitical risks and regulatory changes impact operations.

- The energy transition presents both challenges and opportunities.

- Investments in hydrogen and climate-friendly steel are crucial.

- Digital transformation and sustainable growth are key strategies.

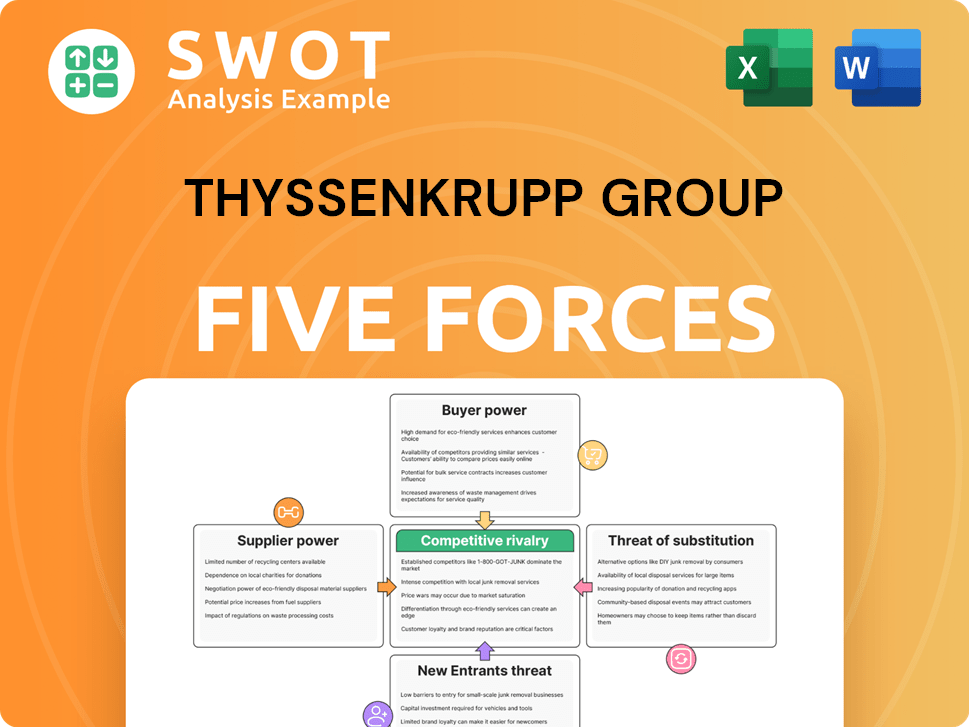

ThyssenKrupp Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ThyssenKrupp Group Company?

- What is Competitive Landscape of ThyssenKrupp Group Company?

- What is Growth Strategy and Future Prospects of ThyssenKrupp Group Company?

- What is Sales and Marketing Strategy of ThyssenKrupp Group Company?

- What is Brief History of ThyssenKrupp Group Company?

- Who Owns ThyssenKrupp Group Company?

- What is Customer Demographics and Target Market of ThyssenKrupp Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.