Time, Inc. Bundle

How Did Time Inc. Navigate the Cutthroat Media Wars?

The media industry is a battlefield, and Time Inc., a publishing giant, once stood at its forefront. From its inception in 1922, Time Inc. shaped how the world consumed news and information, building a vast empire of iconic magazines. But how did this media titan fare against the relentless forces of digital disruption and evolving consumer habits?

This exploration into the Time, Inc. SWOT Analysis will dissect the company's competitive landscape, revealing its key competitors and strategic maneuvers. We'll examine the Time Inc. competitive landscape, analyzing its strengths and weaknesses in a market undergoing constant transformation. Understanding the Time Inc. competitors and the strategies they employed provides crucial insights into the challenges and opportunities faced by legacy media brands. A thorough Time Inc. analysis is essential for anyone seeking to understand the dynamics of the media industry competition and the evolution of the magazine publishing market, and how it influenced the corporate strategy Time Inc..

Where Does Time, Inc.’ Stand in the Current Market?

Prior to its acquisition, the company's core operations centered on content creation and distribution across various media platforms. Time Inc. generated revenue primarily through advertising sales, subscription fees, and the licensing of its content. Its value proposition revolved around delivering high-quality, engaging content to a broad audience, leveraging its established brand recognition and editorial expertise to attract readers and advertisers.

The company's extensive portfolio included over 100 magazine titles, such as People, Time, and Sports Illustrated. These publications catered to a diverse range of interests, from news and current events to lifestyle, entertainment, and sports. Time Inc.'s strategy involved a mix of print and digital offerings, aiming to extend its reach and adapt to the changing media landscape. The company's market position was significantly shaped by its ability to balance its legacy print business with the growing demand for digital content.

The Time Inc. competitive landscape was characterized by intense competition within the media industry. The company faced challenges from traditional magazine publishers, digital media outlets, and emerging content platforms. The magazine publishing market was experiencing a decline in print advertising revenue, prompting Time Inc. to invest in digital initiatives. A key aspect of the Time Inc. analysis involves understanding its strategies to adapt to these shifts and maintain its relevance.

In 2017, Time Inc. reported a net loss of $16 million in Q1, reflecting the financial pressures it faced. The company's revenue declined by 10% during the same period, highlighting the impact of declining print advertising revenue. The company's revenue was significantly impacted by the shift towards digital media consumption.

Time Inc. invested in digital initiatives such as online video, content marketing, and data analytics. These efforts aimed to capture digital ad spend, which was projected to exceed 50% of total media ad spending in 2018. The company's digital transformation was a key strategy to combat the decline in print revenue.

Time Inc. had a strong presence in North America and a notable reach in the UK. The company's geographic focus was primarily on these regions, with its key titles distributed across these markets. This geographic concentration influenced its competitive position and strategic decisions.

The company's product lines included print magazines, digital editions, websites, and video content. These products catered to a wide range of customer segments, from general news readers to enthusiasts in sports, entertainment, and business. The diversity of its offerings was a key element of its market strategy.

Time Inc. faced intense competition from various media outlets, including digital-first companies. The company's corporate strategy Time Inc. involved efforts to diversify its digital presence and adapt to changing consumer behavior. The company's ability to navigate these challenges was crucial for its long-term success.

- Media industry competition: The shift towards digital media and the rise of online platforms.

- Digital transformation: Investments in digital content and online advertising.

- Content distribution strategies: Expanding reach through various digital channels.

- Key performance indicators (KPIs): Tracking revenue, audience engagement, and digital ad performance.

For further insight into the financial aspects and business model, you can explore the Revenue Streams & Business Model of Time, Inc.

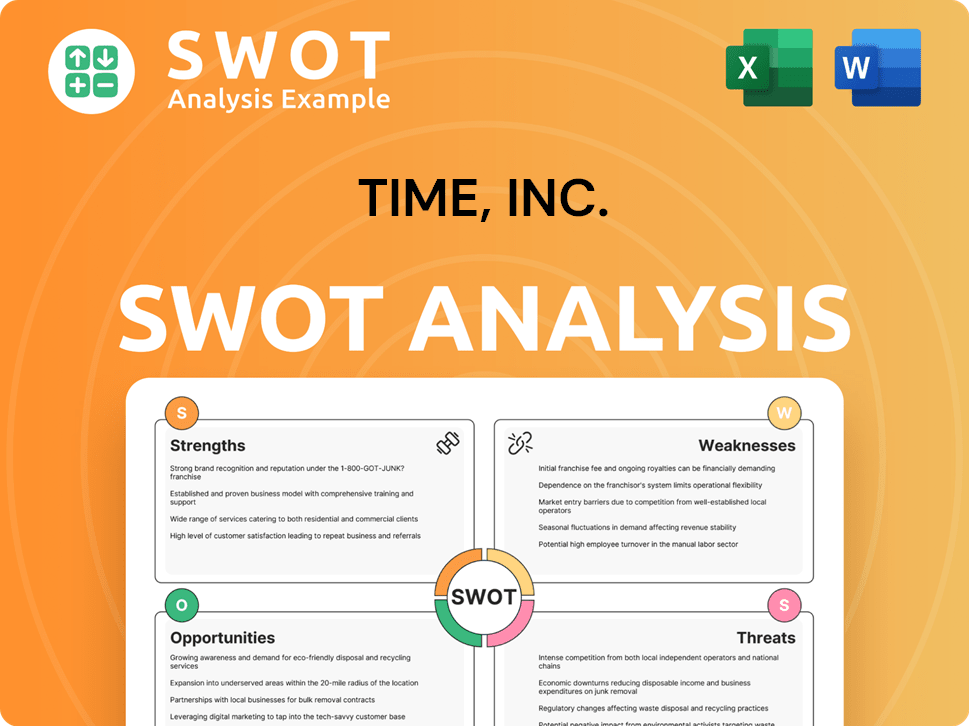

Time, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Time, Inc.?

The Marketing Strategy of Time, Inc. was significantly shaped by the competitive landscape it operated within. Before its acquisition, the company faced a complex array of rivals, both direct and indirect, across the evolving media industry. Understanding these competitors is crucial for analyzing the company's strategic positioning and challenges.

The competitive analysis of Time Inc. requires a deep dive into the media industry competition. This involves examining traditional magazine publishers, digital-first media companies, and major technology platforms. The company's ability to maintain market share and financial performance depended heavily on its response to these competitive pressures.

The magazine publishing market was a key battleground for Time Inc. Here, it faced direct competition from established players. These competitors challenged Time Inc. through their brand equity, strong advertiser relationships, and digital content strategies.

Hearst Communications was a major direct competitor. With titles like 'Good Housekeeping' and 'Elle', Hearst competed for advertising revenue and readership. In 2023, Hearst's total revenue was approximately $11.9 billion, demonstrating its strong position in the market.

Condé Nast, publisher of titles such as 'Vogue' and 'The New Yorker', was another key rival. Condé Nast focused on premium content and brand experiences to attract high-end advertising. In 2024, Condé Nast's digital advertising revenue saw a slight increase, reflecting its efforts in digital transformation.

BuzzFeed, Vox Media, and Vice Media represented significant indirect competition. These companies leveraged social media and viral content to attract younger audiences and digital ad dollars. In 2023, BuzzFeed's revenue was approximately $300 million, highlighting their impact on the digital advertising landscape.

Google and Facebook were formidable competitors for advertising revenue. Their vast reach and sophisticated targeting capabilities attracted significant marketing budgets. In 2024, Google and Facebook continued to dominate the digital advertising market, capturing a significant share of overall ad spending.

Streaming services such as Netflix and Hulu competed for consumer time and subscription revenue. This further fragmented the media consumption landscape. In 2024, Netflix reported over 260 million paid memberships worldwide, indicating the growing influence of streaming services.

Consolidation within the media industry further complicated the competitive landscape. Mergers and acquisitions frequently reshaped the competitive playing field. In 2024, several media companies announced strategic partnerships and acquisitions to adapt to the changing market dynamics.

Time Inc.'s challenges in the media market included adapting to digital transformation, maintaining content distribution strategies, and competing for advertising revenue. The company's key performance indicators (KPIs) were heavily influenced by these competitive pressures.

- The rise of digital-first media platforms and tech giants.

- The shift in advertising budgets towards digital channels.

- The increasing fragmentation of media consumption.

- The need for strategic initiatives to combat competition.

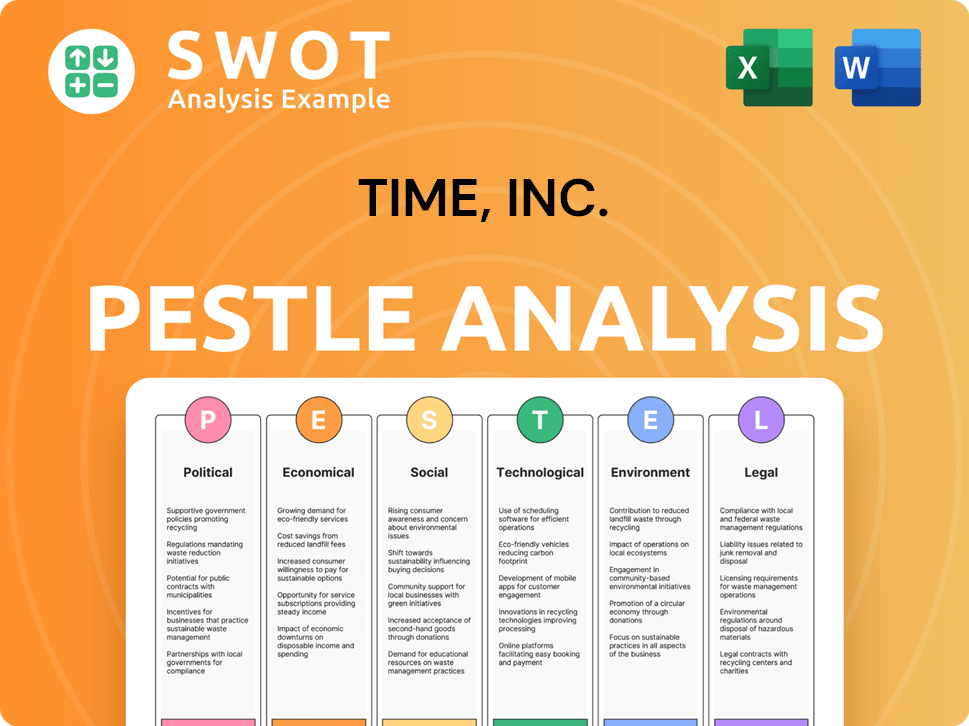

Time, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Time, Inc. a Competitive Edge Over Its Rivals?

Before its acquisition, the company, Time Inc., held several key competitive advantages, though these were increasingly challenged by shifts in the media industry. A primary strength was its strong brand equity, with iconic titles like Time, People, Sports Illustrated, and Fortune. These brands had decades of recognition, trust, and established readership, providing a significant barrier to entry for new competitors. This brand recognition also attracted advertisers who sought association with these respected publications. This is crucial when analyzing the Time Inc. competitive landscape.

The company also benefited from economies of scale in content creation and distribution. As a large publisher, it could leverage shared resources for editorial teams, printing, and distribution networks, potentially reducing per-unit costs compared to smaller outlets. Its extensive distribution channels, including newsstands, subscriptions, and retail partnerships, ensured broad availability of its print products. Furthermore, the company had a deep pool of experienced journalistic talent, which was crucial for producing high-quality, authoritative content—a key differentiator in an increasingly crowded and often less credible digital content landscape. Understanding these aspects is essential for a thorough Time Inc. analysis.

The company also possessed valuable intellectual property in the form of its vast archives of content and photography, which could be monetized through licensing and syndication. However, the sustainability of these advantages faced threats. Brand loyalty in print was eroding with the shift to digital, and while Time Inc. attempted to leverage its brands online, it faced intense competition from digitally native media companies. Economies of scale in print became less relevant as digital distribution costs were significantly lower for online-only competitors. The challenge for Time Inc. was to effectively translate its traditional strengths into the digital realm and demonstrate that its advantages were sustainable in a rapidly evolving media ecosystem. It is important to consider Time Inc. competitors in this context.

Iconic brands like Time, People, and Sports Illustrated enjoyed strong brand recognition and customer loyalty, providing a significant competitive advantage. This recognition helped attract both readers and advertisers. However, this advantage was challenged by the shift to digital media and the rise of new competitors. This is an important factor in the media industry competition.

Time Inc. benefited from economies of scale in content creation, printing, and distribution. As a large publisher, it could leverage shared resources to reduce per-unit costs. However, this advantage was diminished by the lower distribution costs of digital media. This is a key aspect of the magazine publishing market.

The company had a deep pool of experienced journalistic talent, which produced high-quality, authoritative content. This was a key differentiator in an increasingly crowded digital content landscape. Maintaining this talent and adapting to digital formats was crucial for survival. This is part of the overall corporate strategy Time Inc.

Time Inc. possessed valuable intellectual property in the form of its vast archives of content and photography, which could be monetized through licensing and syndication. However, the company needed to find new ways to monetize this IP in the digital age. This is a critical factor in assessing Time Inc.'s business model compared to rivals.

The main challenges for Time Inc. included the erosion of print readership, competition from digital media companies, and the need to adapt its business model to the digital age. The company had to translate its traditional strengths into the digital realm to remain competitive. One must consider the Time Inc. challenges in the media market.

- Declining Print Revenue: The shift to digital media significantly impacted print revenue streams, requiring a shift in focus.

- Digital Competition: The rise of digitally native media companies posed a significant threat to Time Inc.'s market share.

- Monetization Strategies: Time Inc. needed to find effective ways to monetize its content and brand in the digital landscape.

- Adaptation: The company needed to adapt its editorial and business strategies to remain relevant in a rapidly evolving media ecosystem.

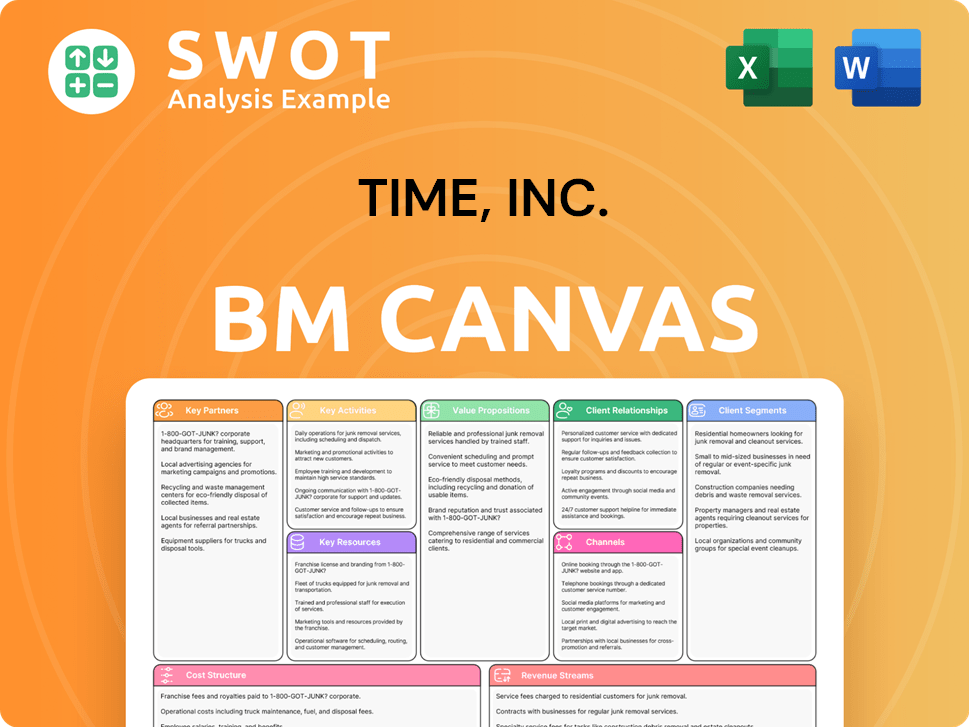

Time, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Time, Inc.’s Competitive Landscape?

The media industry is currently experiencing a significant transformation, driven by digital disruption, technological advancements, and evolving consumer behaviors. This dynamic environment presents both challenges and opportunities for companies like the former Time Inc., now part of Dotdash Meredith. Understanding the Time Inc. competitive landscape requires a deep dive into these industry trends, potential risks, and future outlook.

The shift towards digital consumption, the rise of artificial intelligence, and regulatory changes are key factors shaping the media landscape. These trends influence content creation, distribution, and monetization strategies. For Time Inc. competitors, adapting to these changes is crucial to maintain market share and achieve sustainable growth. The company's strategic initiatives will be critical in navigating this complex environment.

Digital advertising spending is projected to reach approximately $900 billion by 2025, highlighting the importance of digital content. AI is transforming content delivery, creation, and data analytics. Regulatory changes, particularly concerning data privacy, also impact business models.

The decline in print advertising revenue necessitates a shift to digital-first revenue streams. Intense competition for digital advertising dollars from tech giants poses a significant hurdle. Maintaining audience engagement amidst content saturation and short-form video platforms is also challenging.

The demand for high-quality, trustworthy content presents an opportunity for established brands to reinforce their authority. Diversification into new revenue streams, such as e-commerce and premium subscriptions, offers growth avenues. Strategic use of AI can enhance content creation and user experiences.

Leveraging strong brand equity and content expertise to adapt to trends is crucial. Embracing new technologies and diversifying revenue streams are key. Expanding into emerging markets with growing internet penetration offers substantial growth potential.

The Time Inc. analysis reveals that the company must leverage its brand equity and content expertise to adapt to these trends. The media industry is highly competitive, and companies must innovate and diversify to stay ahead. For example, the magazine publishing market is experiencing a shift toward digital platforms. Understanding the competitive advantages of Time Inc. and its ability to execute Time Inc. strategies for digital transformation will determine its future success. To gain a better understanding of the company's background, you can read a Brief History of Time, Inc.

The media landscape is rapidly evolving due to digital transformation, AI, and regulatory changes. Companies must adapt to these trends to remain competitive. The former Time Inc. brands have opportunities to leverage their brand equity and content expertise.

- Digital advertising spending is a primary revenue source, projected to reach $900 billion by 2025.

- AI offers opportunities for personalized content and enhanced data analytics.

- Diversification into e-commerce and premium subscriptions is key for revenue growth.

- Expanding into emerging markets represents substantial growth potential.

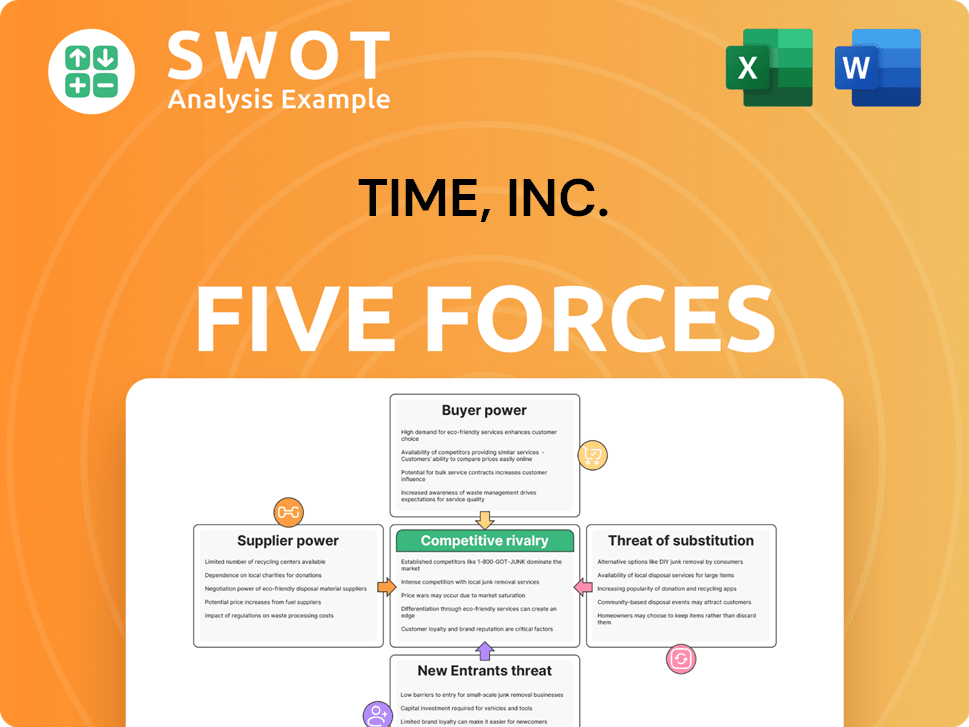

Time, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Time, Inc. Company?

- What is Growth Strategy and Future Prospects of Time, Inc. Company?

- How Does Time, Inc. Company Work?

- What is Sales and Marketing Strategy of Time, Inc. Company?

- What is Brief History of Time, Inc. Company?

- Who Owns Time, Inc. Company?

- What is Customer Demographics and Target Market of Time, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.