Time, Inc. Bundle

Decoding Time Inc.'s Audience: Who Are They Now?

Ever wondered who shapes the readership of a media giant like Time Inc.? Understanding customer demographics and target markets is crucial for any company aiming for sustained success, especially in the ever-evolving media landscape. From its inception in 1923, Time Inc. has adapted to significant shifts, culminating in its acquisition by Meredith Corporation and subsequent transformation into Dotdash Meredith. This evolution underscores the importance of knowing its audience.

This exploration delves into the Time, Inc. SWOT Analysis, examining the company's customer profile and how its target market has shifted. We'll analyze the Time Inc. target market, including factors like age range, income levels, geographic audience, and customer interests. This analysis helps uncover the core customer base, informing customer acquisition strategies and advertising effectiveness, ultimately revealing how to reach the target audience effectively.

Who Are Time, Inc.’s Main Customers?

Following the acquisition of Time Inc. by Meredith Corporation in 2018, and subsequent transition to Dotdash Meredith under IAC, the primary customer segments have shifted. The focus is now largely on the home and family marketplace, although a broader audience is still reached through various digital platforms. Understanding the customer demographics and target market is crucial for the media company's success.

Dotdash Meredith serves both consumers (B2C) through its extensive portfolio of digital and print brands and businesses (B2B) through advertising and performance marketing solutions. This dual approach allows the company to maximize revenue streams and engage with a diverse audience. The strategic shift towards direct consumer engagement highlights the importance of knowing the Time Inc. audience.

The company's brands, such as People magazine, provide insights into the Time Inc. customer profile. Understanding the customer demographics is essential for tailoring content and advertising effectively. This focus on direct engagement is a key strategy for long-term growth.

The median age of People magazine readers is 51 years old. Approximately 67% of the readership is female, while 33% is male. A significant portion, 60%, have attended or graduated college, and 59% have a household income of $60,000+.

Around 36% of adult readers have children in the household. This indicates a target audience that is predominantly female, middle-aged or older, educated, and with a comfortable income. These demographics also suggest a focus on family-oriented content.

Dotdash Meredith's digital revenue was up 12% year-over-year to $238.1 million in Q2 2024, and 10% in Q4 2024 to $311 million. This demonstrates the growing importance of digital consumption across its segments and the effectiveness of its strategies.

The company is focusing on direct consumer engagement through its owned sites, email, Apple News+, social media, video, and events. This shift aims to reduce reliance on third-party platforms like Google search, which previously accounted for about 60% of traffic.

The company’s portfolio also includes brands like Allrecipes, Food & Wine, and Travel & Leisure, which cater to specific interests within the broader lifestyle segment. These brands allow Dotdash Meredith to reach a diverse range of consumers. The digital growth and strategic shifts indicate the company's adaptability and focus on its core customer base.

The primary customer segments are diverse, with a significant focus on a female, middle-aged or older demographic with comfortable incomes. Dotdash Meredith is strategically investing in direct consumer engagement across digital platforms. This strategy is designed to build stronger relationships with its audience and drive revenue growth.

- The People magazine readership provides a detailed view of the core audience.

- Digital revenue growth highlights the importance of online platforms.

- Direct engagement strategies aim to strengthen customer relationships.

- The company's focus on diverse content caters to various interests.

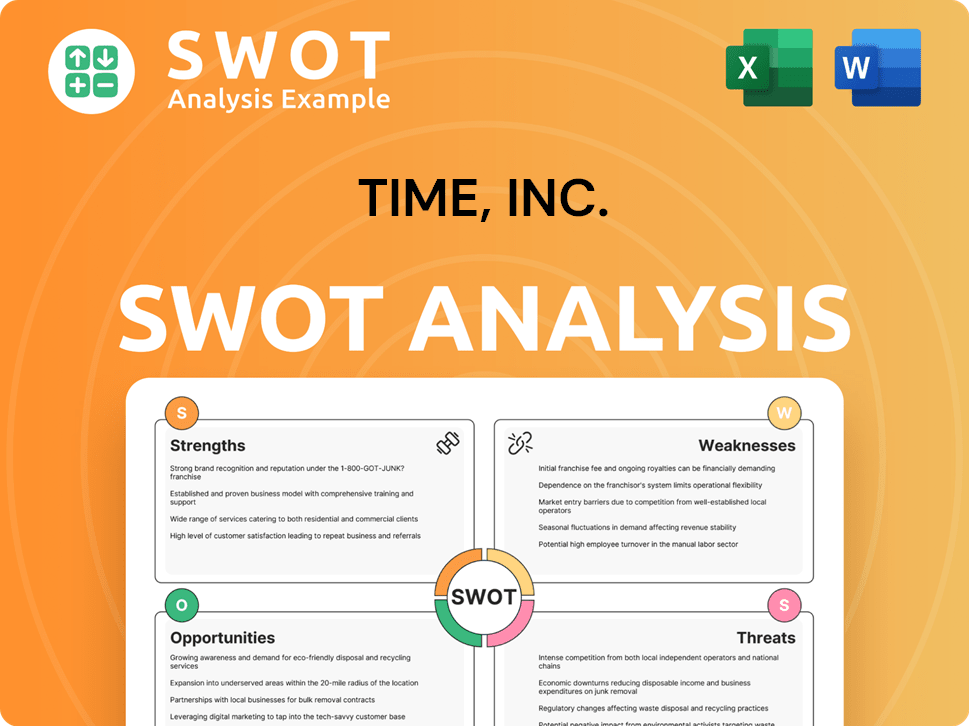

Time, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Time, Inc.’s Customers Want?

Understanding customer needs and preferences is crucial for Dotdash Meredith, influencing content creation, product development, and marketing strategies. Their approach focuses on delivering expert and resourceful content tailored to specific interests, such as health, food, home, and finance. This customer-centric approach is evident in the success of their various online platforms, driving engagement and loyalty.

The company's ability to adapt to evolving consumer behaviors, especially in the digital realm, is key. Dotdash Meredith focuses on providing practical information and solutions, which influences purchasing decisions. Their strategy includes expanding advertising partnerships across key categories like retail, food, and technology, reflecting a deep understanding of their audience's needs.

Customer demographics, the Time Inc. target market, and the Time Inc. audience are central to Dotdash Meredith's business model. They leverage data and AI to personalize experiences, aiming to meet the demand for tailored content and offers. This approach helps them to address customer pain points, such as information overload, by providing trusted, authoritative content.

Dotdash Meredith prioritizes delivering expert content to meet the needs of its audience. This includes in-depth articles, guides, and reviews across various topics, such as health, finance, and home improvement.

Consumers seek practical information and solutions, driving engagement with brands like Allrecipes for culinary needs. This includes providing actionable advice, how-to guides, and product recommendations to help consumers solve problems and make informed decisions.

Content consumption is increasingly digital, with a significant portion occurring on owned sites, email, social media, and video platforms. This shift influences content distribution and advertising strategies.

Loyalty is tied to personalized experiences, with consumers expecting tailored offers and content. Dotdash Meredith leverages AI and customer data to deliver real-time, personalized rewards and seamless omnichannel experiences.

Addressing pain points related to information overload by focusing on authoritative content and a 'no bad ads' policy. This builds trust and ensures a positive user experience.

The company is investing in D/Cipher, an intent advertising tool, to better target advertising without relying on third-party cookies, aligning with evolving privacy preferences. This shows a commitment to innovation and data privacy.

Dotdash Meredith's focus on digital revenue is evident in its financial performance. Digital revenue was up 12% in Q2 2024, demonstrating the importance of digital platforms. The company's strategy also involves adapting to changing consumer preferences, such as the demand for personalized experiences and privacy. For a broader understanding of the competitive landscape, consider exploring the Competitors Landscape of Time, Inc.

- Content quality and relevance are critical for attracting and retaining readers.

- Personalization and data-driven insights enhance user engagement.

- Adapting to digital consumption patterns and privacy concerns is crucial for long-term success.

- Understanding the Time Inc. customer profile and Time Inc. readership helps refine content strategies.

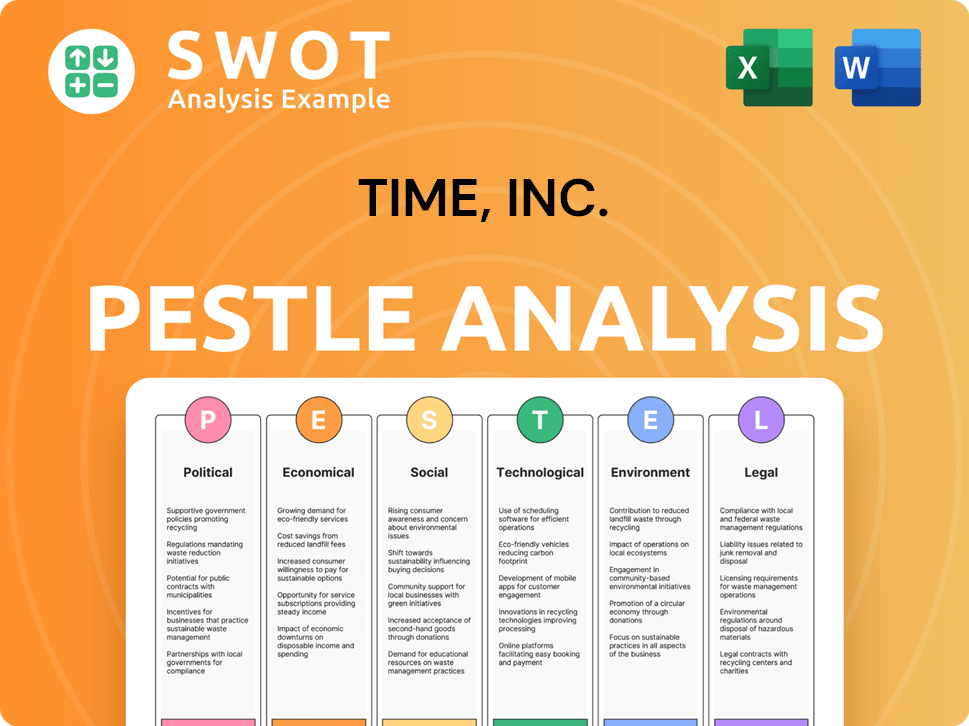

Time, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Time, Inc. operate?

The geographical market presence of the former Time Inc., now operating under Dotdash Meredith, has shifted significantly. Initially, the company had a global footprint, with editions like Time Europe and Time Asia extending its reach beyond the United States. However, post-acquisition, the focus has primarily narrowed to the U.S. market, where it is now positioned as a leading digital publisher.

This strategic shift is evident in the company's revenue streams, with a substantial portion generated within the U.S. In Q2 2024, Dotdash Meredith reported a total revenue of $425.2 million, with digital revenue contributing $238.1 million and print revenue at $191.7 million. This financial data highlights the importance of the U.S. market for the media company audience.

While the core market remains the U.S., the company leverages strategic partnerships to expand its reach. These collaborations allow for broader geographic distribution without direct market entry. This approach is exemplified by the partnership with Are Media in Australia, which enhances advertising capabilities and extends the company's digital footprint.

Dotdash Meredith's primary focus is the U.S. market. The company is described as the largest digital publisher in the U.S. market. The majority of its revenue is generated from the U.S. operations, indicating a strong customer base.

Partnerships extend the company's reach. The partnership with Are Media in Australia is a prime example. This collaboration allows Dotdash Meredith to leverage content and data to achieve broader geographic distribution of sales and growth, rather than direct market entry in all regions.

The strategic partnerships and the core focus on the U.S. market shape the geographical audience of the company. The company's reach is extended through these partnerships, as seen with Are Media in Australia, effectively increasing the audience size.

- The company's primary customer base is in the United States.

- Partnerships allow for international audience expansion without direct market entry.

- The partnership with Are Media in Australia provides access to Dotdash Meredith's behavioral and audience segments.

- The company's focus is on providing content that resonates with the U.S. market.

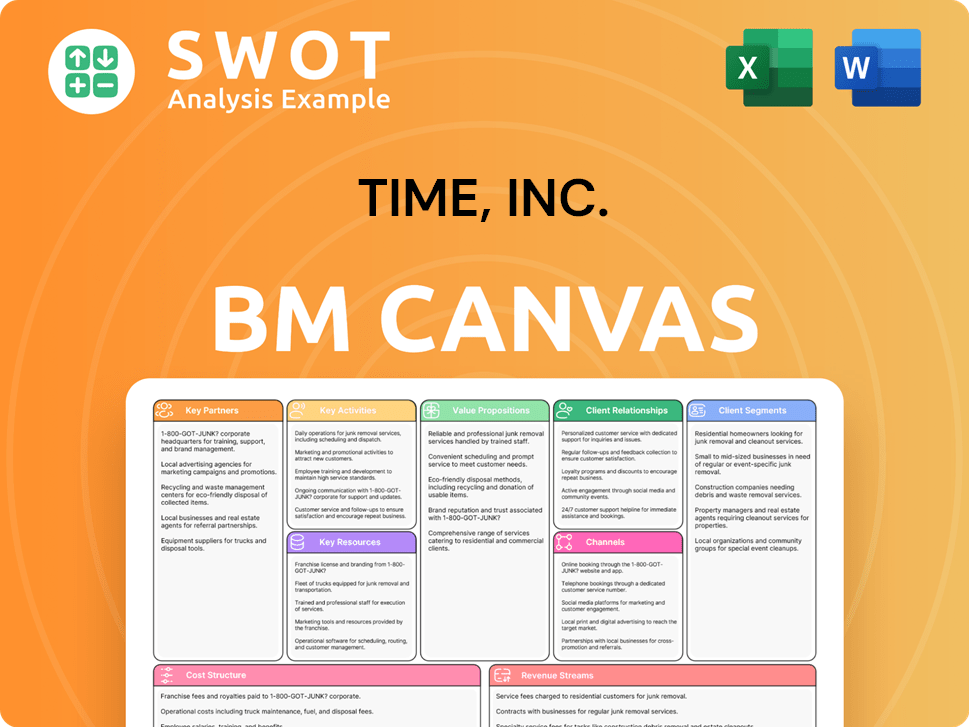

Time, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Time, Inc. Win & Keep Customers?

Dotdash Meredith, the parent company of Time, Inc., employs a multifaceted approach to customer acquisition and retention, adapting to the evolving digital landscape. Their strategies are designed to attract a diverse Time Inc. audience to its extensive portfolio of digital and print brands. This includes leveraging organic search, digital advertising, performance marketing, and content syndication.

Customer acquisition is a key focus, with digital advertising revenue increasing by 16% year-over-year in Q3 2024. They also utilize content syndication partners and licensing agreements to expand their reach. Retention strategies center on personalization and direct engagement, aiming to foster long-term relationships with their Time Inc. readership.

The company is actively working to reduce reliance on third-party platforms and encourage direct visits to its sites. This shift is supported by investments in owned sites, email marketing, social media, video content, and events. Furthermore, they focus on providing high-quality content and minimizing disruptive advertising, enhancing the user experience.

Brands like Allrecipes.com often appear in top search positions, driving organic traffic. This strategy capitalizes on user search queries to attract potential customers. Effective SEO is a crucial element in reaching the Time Inc. target market.

Digital advertising revenue is a significant acquisition channel, growing by 16% year-over-year in Q3 2024. This includes direct sales and programmatic exchanges, helping to reach a broader audience. Effective advertising is crucial for customer acquisition strategies.

Partnerships with Apple News+ and licensing agreements, like the one with OpenAI in May 2024, boost revenue. Licensing and other revenue increased by 19% in Q2 2024. This helps expand the reach of content to new audiences.

Focusing on direct visits to their sites and reducing reliance on third-party platforms. Investments in owned sites, email marketing, and social media are key. This approach enhances user experience and fosters loyalty.

Current trends in 2025 emphasize personalization, gamification, and experience-based rewards. Dotdash Meredith's ad targeting approach, D/Cipher, uses reader behavior to deliver more relevant content. This aligns with the industry's shift towards more personalized advertising, which can contribute to both acquisition and retention. For a deeper dive into the overall approach, consider reading about the Marketing Strategy of Time, Inc.

Shifting traffic from third-party platforms to owned sites is a key strategy. This allows for greater control over the customer experience and data. This directly impacts the Time Inc. customer profile.

Utilizing email marketing and social media to expand consumer touchpoints. These channels enable direct communication and engagement with the audience. This is crucial for understanding the customer demographics.

Creating video content and hosting events to expand consumer touchpoints. These initiatives enhance brand engagement and provide diverse content formats. This broadens the appeal to the media company audience.

Implementing a 'no bad ads' policy to improve the user experience. This helps minimize disruptive advertising and fosters a positive brand image. A positive experience enhances retention.

Using D/Cipher, an ad targeting approach, to deliver more relevant content. This personalized approach enhances the user experience. This is crucial for Time Inc. customer interests and hobbies.

Optimizing the print business by focusing on valuable customers. This includes 'firing bad subscribers' to improve profitability. This strategy focuses on the Time Inc. core customer base.

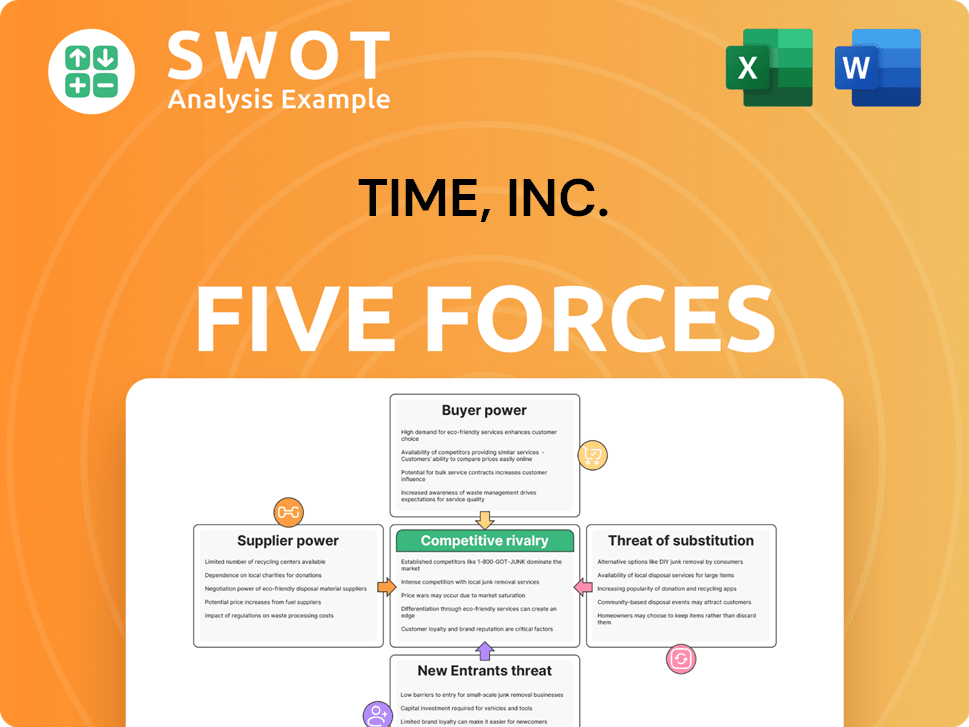

Time, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Time, Inc. Company?

- What is Competitive Landscape of Time, Inc. Company?

- What is Growth Strategy and Future Prospects of Time, Inc. Company?

- How Does Time, Inc. Company Work?

- What is Sales and Marketing Strategy of Time, Inc. Company?

- What is Brief History of Time, Inc. Company?

- Who Owns Time, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.