Time, Inc. Bundle

Can Dotdash Meredith Revitalize the Legacy of Time Inc.?

The story of Time Inc. is one of reinvention, from its iconic beginnings in 1922 to its current iteration as part of Dotdash Meredith. This media giant, once a cornerstone of American publishing, has navigated a turbulent industry landscape. Understanding the Time, Inc. SWOT Analysis is crucial to grasping its journey and charting its course for the future.

This business analysis explores the growth strategy Dotdash Meredith is employing to ensure Time Inc.'s future prospects in the evolving media market. Examining Time Inc.'s market share analysis, and digital transformation strategy reveals the challenges and opportunities shaping its long-term growth potential. Strategic planning and innovative content strategies are key as this media company seeks to redefine its place in a competitive environment.

How Is Time, Inc. Expanding Its Reach?

Dotdash Meredith's expansion initiatives are strategically focused on driving digital growth, diversifying revenue streams, and strengthening direct consumer relationships. The overarching goal is to become one of the top 10 internet companies in the U.S. by audience size. This ambitious target reflects a commitment to significant growth in the digital space, leveraging the company's existing assets and exploring new opportunities.

A core element of this strategy involves expanding proprietary ad-targeting technology, D/Cipher, beyond its owned properties. This move aims to increase advertising impression supply and provide advertisers with enhanced performance through intent-based targeting. The expansion of D/Cipher is a key component of the company's strategy to compete effectively in the digital advertising market.

The company is also investing heavily in content across its owned sites, email, Apple News+, social media, video, and events. This multi-channel approach is designed to expand consumer touchpoints and foster direct relationships. By focusing on direct consumer engagement, Dotdash Meredith aims to reduce its reliance on third-party platforms for traffic and build more loyal audiences. For a deeper dive into the marketing strategies employed by the company, consider exploring the Marketing Strategy of Time, Inc.

Dotdash Meredith is heavily investing in content across its digital platforms, including websites, email, and social media. This includes the launch of new apps and platforms to expand consumer touchpoints. The goal is to increase direct consumer relationships and reduce reliance on third-party platforms.

The company is expanding its proprietary ad-targeting technology, D/Cipher, to other websites. This initiative aims to increase advertising impression supply and improve ad performance. The expansion began in February 2025, leveraging intent-based targeting.

The launch of new platforms like the People App in April 2025 and MyRecipes in Q4 2024 is aimed at building direct consumer relationships. These platforms are designed to create loyal audiences and drive engagement. These initiatives are crucial for long-term growth.

Despite expected declines in print revenue, the company continues to invest in its print assets. The print business is projected to decline by 13-15% in 2025 and 8-10% in 2026. No print magazines are being closed, indicating a commitment to maintaining a presence in print.

Dotdash Meredith's expansion initiatives are multifaceted, focusing on digital growth, diversified revenue streams, and enhanced consumer relationships. The company aims to reach 175 million U.S. online consumers monthly, including 95% of all U.S. women.

- Expansion of D/Cipher ad-targeting technology to other websites.

- Investment in content across various digital platforms, including the launch of the People App in April 2025.

- Continued investment in print assets despite expected revenue declines of 13-15% in 2025 and 8-10% in 2026.

- Focus on building direct consumer relationships to reduce reliance on third-party platforms.

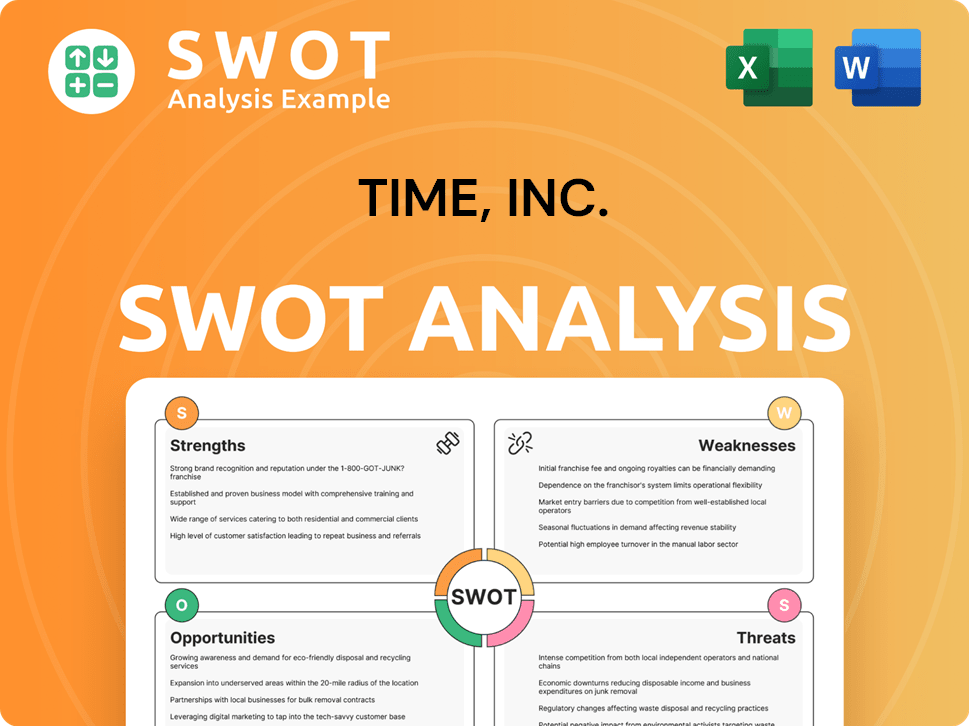

Time, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Time, Inc. Invest in Innovation?

Dotdash Meredith, formerly known as Time Inc., focuses on innovation and technology to drive growth, especially in digital advertising. This strategy involves significant investments in proprietary technologies and strategic partnerships to enhance its offerings and maintain a competitive edge in the media landscape. The company's approach highlights a commitment to adapting to the evolving needs of both advertisers and consumers.

The company's strategy emphasizes leveraging data and AI to improve user experiences and advertising effectiveness. By focusing on these areas, Dotdash Meredith aims to increase revenue and strengthen its position in the media industry. This forward-thinking approach is crucial for navigating the challenges and opportunities in today's dynamic media environment.

A key element of Dotdash Meredith's strategy is its investment in D/Cipher, an in-house ad-targeting technology. This technology uses intent-based targeting instead of traditional cookies, analyzing reader interactions across its 40 online brands. Over half of direct deals now use D/Cipher, leading to increased client spending. This focus on innovative ad-targeting solutions is central to the company's growth strategy.

D/Cipher is an in-house ad-targeting technology that uses intent-based targeting. This approach analyzes billions of reader interactions across Dotdash Meredith's online brands to deliver relevant advertising. The technology has significantly improved advertising effectiveness.

Dotdash Meredith uses artificial intelligence (AI) to enhance its operations and offerings. This includes predicting trends and delivering personalized experiences for consumers. The company is also using AI to improve its contextual targeting platform.

In May 2024, Dotdash Meredith announced a strategic partnership and licensing agreement with OpenAI. This collaboration allows ChatGPT to access Dotdash Meredith's content. The partnership aims to enhance D/Cipher's capabilities with AI-powered insights.

The company leverages data to predict trends and deliver personalized experiences. This data-driven approach is crucial for understanding consumer behavior. It also helps in creating more effective advertising campaigns.

Dotdash Meredith views its AI initiatives as a 'game changer for advertisers.' The use of AI and advanced targeting technologies enables more effective and relevant advertising. This leads to increased client spending and better outcomes.

The company's long-term strategy involves sustained investment in technology and innovation. This includes exploring new partnerships and technologies. The goal is to maintain a competitive edge in the rapidly changing media landscape.

Dotdash Meredith's commitment to innovation is evident in its strategic partnerships and proprietary technologies. These initiatives are designed to enhance advertising effectiveness and improve user experiences, supporting the company's overall growth strategy. For a deeper dive into the company's strategic approach, explore this detailed analysis of the Growth Strategy and Future Prospects of Time Inc.

- D/Cipher: Utilizes intent-based targeting to deliver relevant advertising.

- AI Integration: Enhances operations, predicts trends, and personalizes experiences.

- Partnerships: Collaborations with companies like OpenAI to leverage advanced technologies.

- Data-Driven Approach: Focuses on using data insights to inform strategy and improve outcomes.

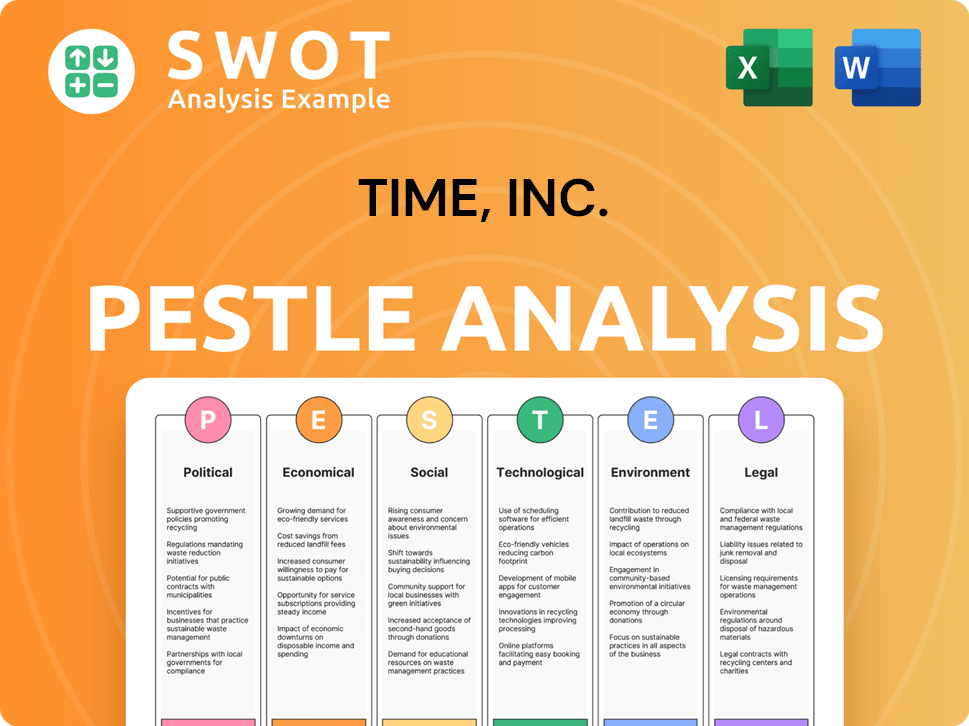

Time, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Time, Inc.’s Growth Forecast?

The financial outlook for Dotdash Meredith, the parent company of Time Inc., is focused on digital revenue growth to offset declines in print revenue. This strategy is crucial for the Growth Strategy and overall Future Prospects of the Media Company. S&P Global Ratings projects that the company's adjusted EBITDA will increase by approximately 5% in both 2025 and 2026.

This projected growth is supported by a forecast of digital revenue growth, expected to be between 5-7% annually over the next two years. The company's Strategic Planning includes leveraging its digital platforms and content to drive revenue. This approach is essential for navigating the evolving media landscape and maintaining a competitive edge.

In the first quarter of 2025, Dotdash Meredith saw a 1% year-over-year increase in revenue, reaching $393.1 million. Digital revenue specifically grew by 7%, and advertising revenue increased by 1%. Licensing and other revenue saw a significant 30% increase, partly due to a partnership with OpenAI, which began in May 2024. For a deeper dive into the Time Inc. and its positioning within the industry, consider exploring the Competitors Landscape of Time, Inc..

S&P Global Ratings anticipates Dotdash Meredith's adjusted EBITDA to reach $360 million in 2025 and $377 million in 2026. This represents a significant increase from $344 million in 2024 and $322 million in 2023.

The company expects digital revenue to grow by 7-10% for the full year 2025. This growth is a key driver of the overall financial performance and strategic direction.

The company anticipates adjusted EBITDA for the full year 2025 to be between $330 million and $350 million. This is a notable increase from the $295.2 million reported in 2024.

Free operating cash flow is projected to be around $106 million in 2025 and $175 million in 2026. The net leverage ratio is expected to decrease to 4x by the end of 2025 and 3.5x by the end of 2026.

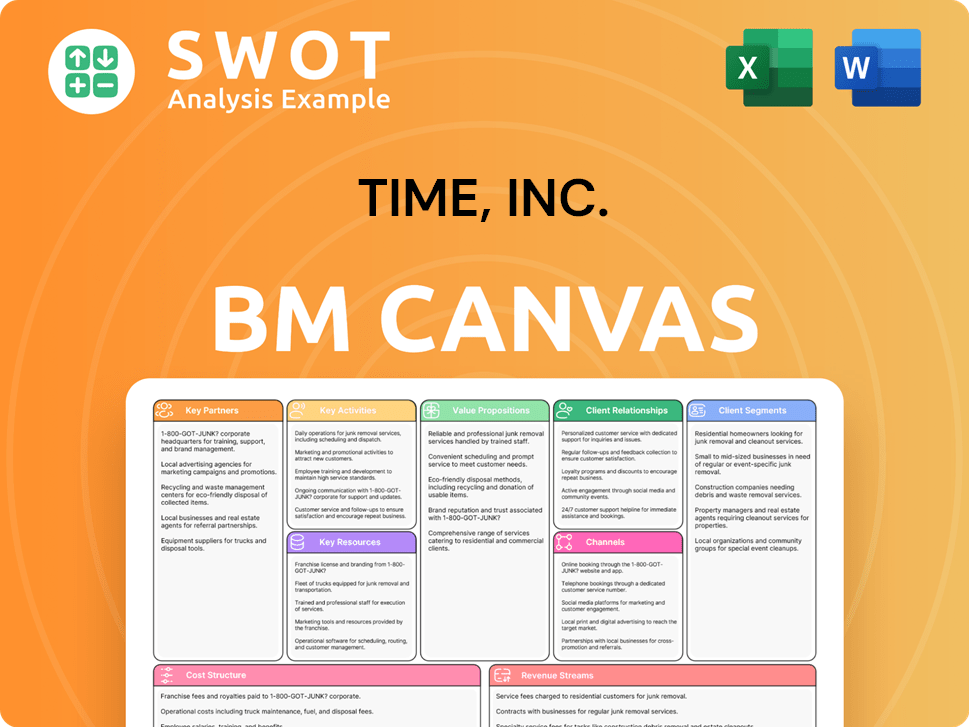

Time, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Time, Inc.’s Growth?

The Time Inc. faces several potential risks and obstacles that could influence its Growth Strategy and Future Prospects. The media landscape is constantly evolving, and several factors could impact the company's performance. Understanding these challenges is crucial for a comprehensive Business Analysis and effective Strategic Planning.

A significant hurdle for Time Inc. is the decline in the print business. The shift towards digital media consumption poses a direct threat to print revenues. Additionally, the rise of generative AI presents a new challenge to the company's digital traffic and revenue models, requiring proactive adaptation.

Economic cyclicality also poses a risk. The company's pay-for-performance revenue streams are somewhat dependent on consumer spending and advertising budgets. Fluctuations in these areas could affect financial performance. Despite these challenges, Time Inc. is implementing strategies to mitigate these risks and foster sustainable growth.

Time Inc. anticipates a decline in print revenue. Projections indicate a 13-15% decrease in 2025 and an 8-10% decline in 2026. This decline necessitates strategic adjustments to offset the impact of lower print revenue.

The rise of generative AI poses a risk to digital traffic. In Q1 2025, the company experienced a 3% year-over-year decline in core user sessions. AI-generated answers are beginning to affect publisher traffic, appearing in approximately 15% of searches in key categories.

Pay-for-performance revenue is sensitive to economic cycles. Consumer discretionary spending and advertising budgets influence revenue. Economic downturns or shifts in advertising spending can negatively impact financial results.

Reliance on search platforms and third-party cookies presents a challenge. Weakening referral traffic from search platforms impacts digital traffic. The phasing out of third-party cookies also affects advertising revenue.

Time Inc. operates in a competitive media landscape. Competition from digital-first media companies and established media giants impacts market share. Adapting to changing consumer preferences is crucial.

The advertising market is subject to volatility. The withdrawal of major advertisers could impact pricing. The company's ability to maintain ad revenue depends on its relationships with advertisers and the effectiveness of its ad tech.

Time Inc. is focusing on diversifying content and platforms to reduce reliance on print. The company is also concentrating on direct consumer relationships to build loyalty. Leveraging in-house ad-tech provides a more sustainable advertising ecosystem.

The company is investing in its own technology, like D/Cipher, to reduce dependency on Google and third-party cookies. Licensing deals with OpenAI are also part of the strategy. These investments aim to create a more resilient digital infrastructure.

For more details, you can read this article about Revenue Streams & Business Model of Time, Inc. to better understand its financial structure and strategic direction.

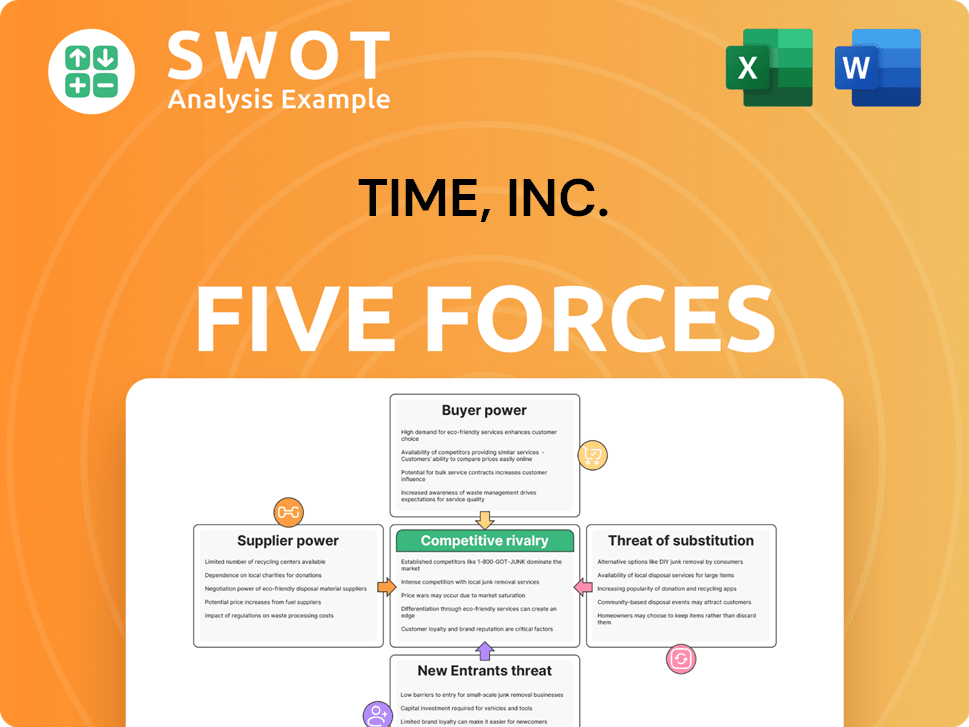

Time, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Time, Inc. Company?

- What is Competitive Landscape of Time, Inc. Company?

- How Does Time, Inc. Company Work?

- What is Sales and Marketing Strategy of Time, Inc. Company?

- What is Brief History of Time, Inc. Company?

- Who Owns Time, Inc. Company?

- What is Customer Demographics and Target Market of Time, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.