Time, Inc. Bundle

How Did Time Inc. Shape the Media Landscape?

Time Inc., a titan of the media world, once commanded a vast empire of influential publications that defined generations. From its inception in 1922, the Time, Inc. SWOT Analysis reveals how this media company, with iconic titles like Time and People, shaped public discourse. Understanding the evolution of the Time Inc. company is crucial for anyone interested in the dynamics of the publishing industry.

Exploring the Time Inc. business model provides insights into its remarkable journey, from its early success to its eventual acquisition and transformation. The company's history and evolution, including its key executives and leadership, offers a compelling narrative of adaptation and influence. Analyzing how Time Inc. operated its magazine brands and its digital media strategy sheds light on the challenges and opportunities faced by a media giant.

What Are the Key Operations Driving Time, Inc.’s Success?

Before its acquisition, the Time Inc. company was a significant player in the media industry, creating value through its extensive portfolio of over 100 magazine brands and more than 60 websites. These offerings catered to a wide range of audiences, from general news consumers to enthusiasts in sports, lifestyle, finance, and entertainment. The core operations involved content creation, publishing across print and digital platforms, and extensive distribution networks.

A key aspect of Time Inc.'s operations was its in-house production company, Time Inc. Productions, established in 2016 for television shows. The company also engaged in content marketing, targeted advertising programs, branded book publishing, and provided marketing and support services, including subscription sales and retail distribution for its own publications and third-party clients. The company's ability to influence public discourse and its strong brand recognition made its operations unique and effective.

Following the acquisition by Meredith and subsequent merger with Dotdash to form Dotdash Meredith, the operational focus has shifted significantly towards digital media and data-driven advertising. Dotdash Meredith, as of May 2025, is America's largest digital and print publisher, with over 40 iconic brands reaching nearly 200 million people monthly, including 95% of US women. Their current operations emphasize 'intent-driven content, the fastest sites, and the fewest ads' to help consumers make decisions.

Content creation, publishing, and distribution across print and digital platforms were central to Time Inc.'s operations. They also had an in-house production company for television shows. Content marketing, targeted advertising, and branded book publishing were also part of their operations.

The company provided value through its diverse portfolio of magazine brands and websites. It served a wide audience spectrum, from general news consumers to enthusiasts in various fields. Strong brand recognition and influence on public discourse were key aspects of its value.

Dotdash Meredith's focus has shifted towards digital media and data-driven advertising. They are the largest digital and print publisher in the US. Their current operations emphasize 'intent-driven content, the fastest sites, and the fewest ads' to help consumers make decisions.

A critical operational capability is their proprietary cookie-less ad targeting technology, D/Cipher, which leverages AI to enhance ad targeting. This technology has been expanded to non-DDM websites as of February 2025. Partnerships like the one with OpenAI, started in May 2024, differentiate their advertising solutions.

The Time Inc. company's operational focus has evolved significantly. The shift towards digital media and data-driven advertising is a major change. The company now emphasizes 'intent-driven content' and uses AI for enhanced ad targeting.

- Content creation and publishing across various platforms.

- Development of proprietary ad targeting technology.

- Strategic partnerships to enhance advertising solutions.

- Focus on digital media and data-driven advertising.

For more details on the marketing strategy of Time Inc., you can read the article on Marketing Strategy of Time, Inc.

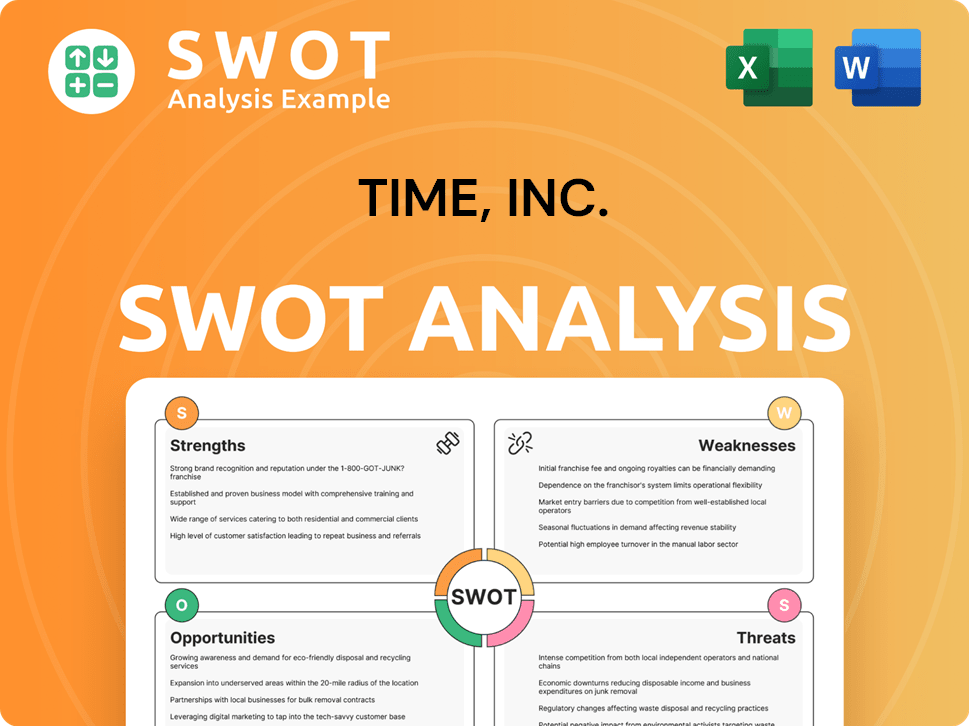

Time, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Time, Inc. Make Money?

Historically, the Time Inc. company generated revenue through magazine subscriptions, newsstand sales, and advertising across its print and digital platforms. They also capitalized on content marketing, branded book publishing, and live events.

As Dotdash Meredith, the Time Inc. business model now focuses on digital advertising, performance marketing, and licensing. This shift reflects an adaptation to the evolving media landscape and a strategic move to diversify revenue streams.

The Time Inc. company has diversified its revenue streams through innovative monetization strategies.

Digital advertising revenue grew by 3% in Q4 2024, driven by higher premium ad sales, particularly in the tech and health/pharmaceuticals sectors. This indicates a successful focus on high-value advertising opportunities.

Performance marketing revenue saw a significant surge of 22% in Q4 2024, fueled by a 39% increase in affiliate commerce. This highlights the effectiveness of their e-commerce initiatives.

Licensing and other revenue experienced a substantial 30% year-over-year increase in Q1 2025. This growth was largely due to the partnership with OpenAI, which began in May 2024, and improved performance from content syndication partners and Apple News+.

Dotdash Meredith is expanding its D/Cipher contextual advertising platform to non-DDM websites. This move aims to enhance ad targeting beyond its owned inventory and increase revenue potential.

The company is launching new direct-to-consumer products, such as the People App in April 2025 and MyRecipes in Q4 2024, to build direct audience relationships and reduce reliance on traditional search discovery.

For the full year 2025, Dotdash Meredith projects healthy digital revenue growth of between 7-10%. This indicates a positive outlook for the company's financial performance.

The Time Inc. company has undergone significant changes in its revenue streams. The shift from print-focused models to digital-first strategies, including digital advertising, performance marketing, and licensing, is evident. For more insights into the Time Inc.'s target market, see Target Market of Time, Inc.

- Digital advertising growth, particularly in key sectors, is a primary revenue driver.

- Performance marketing, especially affiliate commerce, contributes significantly to revenue.

- Licensing and partnerships are expanding revenue sources.

- Direct-to-consumer products are being developed to build audience relationships.

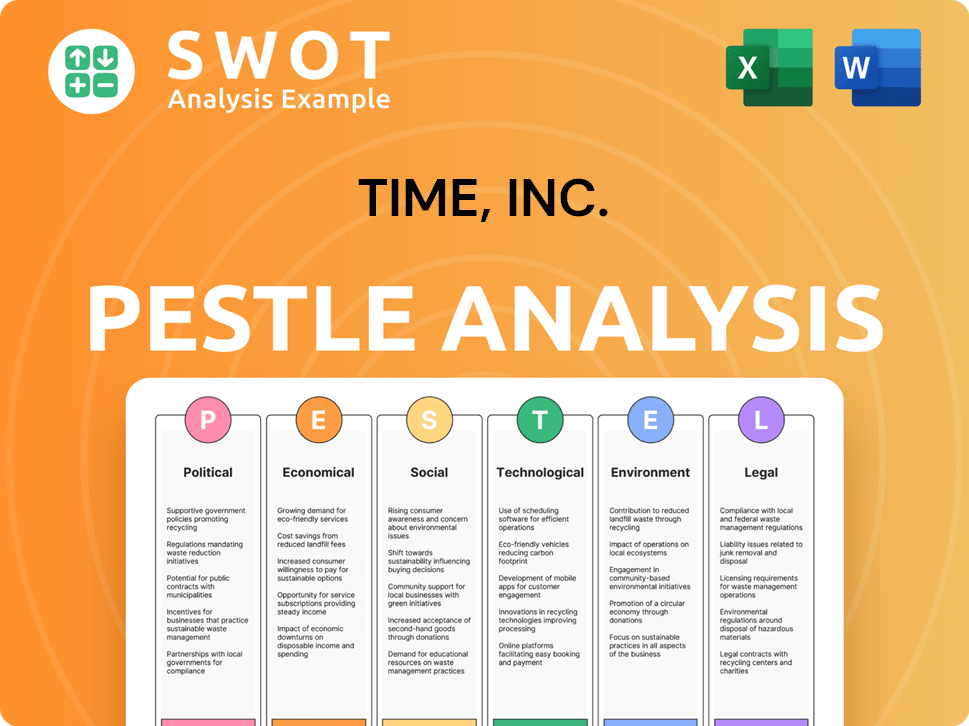

Time, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Time, Inc.’s Business Model?

The evolution of the Time Inc. company is marked by significant milestones, strategic shifts, and a constant adaptation to the changing media landscape. Founded in 1922, the company quickly established itself as a major player in the publishing world. This journey includes major acquisitions, spin-offs, and mergers, reflecting its efforts to stay relevant in the face of digital disruption.

A pivotal moment was the 1990 merger with Warner Communications, creating Time Warner, a massive media conglomerate. However, the company was later spun off in 2014. The acquisition by Meredith Corporation in 2018 and the subsequent merger with IAC's Dotdash in 2021 to form Dotdash Meredith further reshaped the company's direction. These moves highlight a strategic focus on digital growth and audience engagement.

Today, Dotdash Meredith operates with a focus on digital content, leveraging its extensive reach and intent-driven content strategy. The company's competitive edge is rooted in its ability to attract a large audience, its emphasis on high-quality content, and the use of advanced technology to enhance its advertising business.

Founded in 1922, launching iconic publications like Fortune and Life. The 1990 merger with Warner Communications created Time Warner. Spun off from Time Warner in 2014. Acquisition by Meredith Corporation in 2018 and the merger with IAC's Dotdash in 2021 to form Dotdash Meredith.

The company has shifted its focus to digital media and direct-to-consumer products. Divestiture of brands like Time, Fortune, and Money post-acquisition. Emphasis on intent-driven content and AI-powered advertising through D/Cipher. Recent debt refinancing to strengthen its financial position.

Dotdash Meredith has a massive audience reach, with nearly 200 million monthly users. Strong brand recognition of retained titles like People and Better Homes & Gardens. Leveraging AI-powered technology, such as D/Cipher, to enhance advertising effectiveness. A robust product licensing program contributes to revenue.

Decline in print readership and advertising revenue. The broader industry shift toward digital platforms. Impact of AI Overviews on search traffic. Addressing these challenges involves building direct audience relationships and expanding contextual advertising.

Dotdash Meredith is focused on digital growth and direct audience engagement. The company is actively building direct audience relationships through new direct-to-consumer products like the People App. The company recently completed a significant debt refinancing initiative in early 2025, restructuring $1.18 billion of existing debt to extend maturities to 2032.

- D/Cipher ad-targeting tool is utilized in roughly 50% of all direct sales campaigns.

- The company benefits from strong brand recognition of its retained titles like People and Better Homes & Gardens.

- Dotdash Meredith has a massive audience reach, with nearly 200 million monthly users.

- The company is expanding its contextual advertising platform.

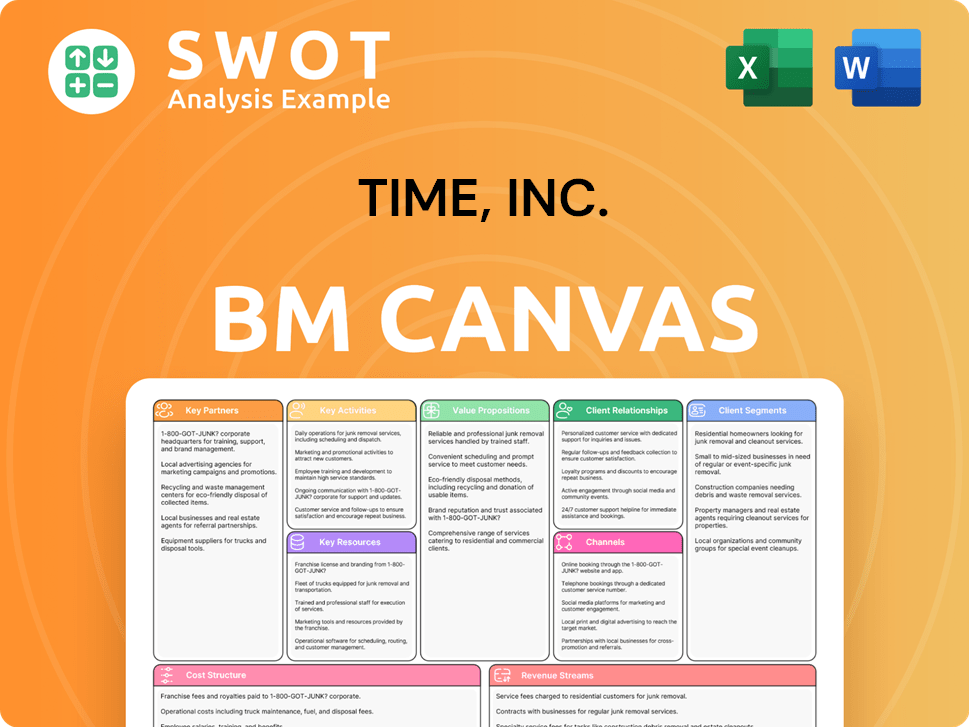

Time, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Time, Inc. Positioning Itself for Continued Success?

Dotdash Meredith, the parent company of Time Inc., holds a prominent position in the media industry as the largest digital and print publisher in the United States. Its extensive portfolio includes over 40 brands, reaching nearly 200 million people monthly, with a significant presence among US women, accounting for 95% of the demographic. The company's strategic partnerships, such as the one with Are Media in Australia, boost its global reach, effectively doubling Are Media's digital footprint and expanding its online audience to 10.4 million monthly.

However, Dotdash Meredith faces significant challenges and risks. The media industry is undergoing rapid technological shifts and changing consumer preferences, which include a decline in print media. The company's print business is projected to decline by 13%-15% in 2025 and 8%-10% in 2026 due to these pressures. Regulatory changes, new competition, and economic cycles, which can impact advertising budgets and consumer spending, also pose risks. For example, programmatic ad revenue, which accounts for a third of total advertising, is susceptible to market uncertainty, and changes in ad spending from major advertisers.

Dotdash Meredith is the largest digital and print publisher in America, reaching nearly 200 million people monthly. Brands like People significantly contribute to revenue and profit. Strategic partnerships extend global reach, such as the one with Are Media in Australia.

The media company faces risks from technological disruption and changing consumer preferences. The print business is expected to decline. Programmatic ad revenue is also vulnerable to market uncertainties. The impact of Google AI Overviews on traffic has been noted in Q1 2025.

Dotdash Meredith is investing in direct audience and advertiser connections. This includes expanding its D/Cipher advertising platform and launching direct-to-consumer products like the People App. The company is leveraging its partnership with OpenAI. S&P Global Ratings expects adjusted EBITDA growth of about 5% in both 2025 and 2026.

Expansion of the D/Cipher contextual advertising platform. Launching direct-to-consumer products. Leveraging the partnership with OpenAI to develop modeling technology. Debt refinancing in early 2025 extended debt maturities to 2032.

Dotdash Meredith is strategically focusing on initiatives to sustain and expand its revenue streams, including direct connections with audiences and advertisers. This involves expanding its D/Cipher contextual advertising platform to non-DDM websites and launching direct-to-consumer products. The company is also leveraging its partnership with OpenAI, which began in May 2024, to develop modeling technology for D/Cipher and drive licensing revenue growth.

- S&P Global Ratings projects Dotdash Meredith's adjusted EBITDA to grow by approximately 5% in both 2025 and 2026.

- Digital revenue is expected to grow by 5%-7% each year, contributing to overall financial performance.

- The recent debt refinancing in early 2025, which extended debt maturities to 2032, provides greater financial flexibility.

- For more insights, explore the Competitors Landscape of Time, Inc. to understand the competitive dynamics.

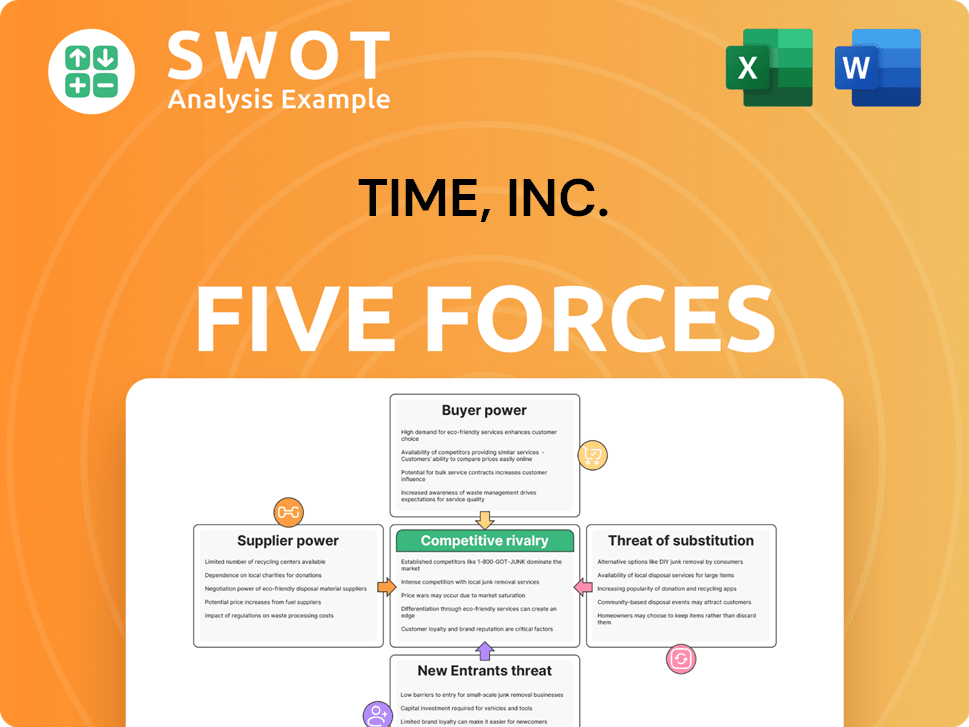

Time, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Time, Inc. Company?

- What is Competitive Landscape of Time, Inc. Company?

- What is Growth Strategy and Future Prospects of Time, Inc. Company?

- What is Sales and Marketing Strategy of Time, Inc. Company?

- What is Brief History of Time, Inc. Company?

- Who Owns Time, Inc. Company?

- What is Customer Demographics and Target Market of Time, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.