T Rowe Price Bundle

How Does T. Rowe Price Thrive in Today's Investment Arena?

The asset management industry is a battlefield of innovation and adaptation, where giants like T. Rowe Price constantly redefine their strategies. With the rise of personalized investment solutions and the ongoing shift towards passive investing, active managers face unprecedented pressure to prove their worth. This analysis dives into the dynamic T Rowe Price SWOT Analysis, exploring how this financial powerhouse navigates the complexities of the competitive landscape.

Established in 1937, T. Rowe Price has evolved from a growth-stock pioneer into a global investment leader. Its impressive $1.54 trillion in assets under management (AUM) as of March 31, 2024, underscores its robust market position and ability to compete within the financial services companies. This exploration will dissect T. Rowe Price's competitive landscape, including its key competitors, competitive advantages, and the industry trends shaping its future, providing a detailed analysis of its market share and financial performance review.

Where Does T Rowe Price’ Stand in the Current Market?

T. Rowe Price holds a significant position within the asset management industry. Its substantial assets under management (AUM) and diverse client base characterize this position. As of March 31, 2024, the firm's AUM reached $1.54 trillion. This places T. Rowe Price among the largest investment managers globally, making it a key player in the financial services companies landscape.

The company's primary offerings include actively managed investment strategies. These span U.S. and international equities, fixed income, and multi-asset solutions. T. Rowe Price serves a broad client base. This includes individual investors, institutional clients, and financial intermediaries. The firm's focus on active management distinguishes it, even as passive investing grows in popularity.

Geographically, T. Rowe Price has a strong presence in North America. It has expanded its global footprint across Europe, Asia, and other regions. This expansion reflects a strategic move to capitalize on growth opportunities in diverse markets. For a deeper dive into the company's growth strategy, consider reading Growth Strategy of T Rowe Price.

T. Rowe Price consistently ranks among the top investment firms globally. Precise market share figures fluctuate, but its substantial AUM reflects a significant position. The company's size and reach make it a major competitor within the asset management industry.

The firm serves a diverse client base, including individual investors and institutions. Its distribution network includes financial intermediaries. This diversified approach helps T. Rowe Price maintain a strong market position. The company's ability to cater to various client needs is a key strength.

T. Rowe Price primarily offers actively managed investment strategies. These strategies cover a wide range of asset classes. The focus on active management is a key differentiator in the market. The company also offers lower-cost share classes to meet client demands.

T. Rowe Price has a strong presence in North America. It has also expanded its global footprint. This expansion includes offices and investment capabilities in Europe and Asia. This global reach supports its competitive position.

T. Rowe Price faces challenges in attracting inflows in certain fixed-income segments where passive strategies are popular. However, its financial health remains robust. It has consistent profitability and a strong balance sheet, generally above industry averages. The company's adaptability and strategic initiatives are crucial for maintaining its competitive edge.

- Adapting to the growth of passive investing.

- Expanding global presence to capture new markets.

- Maintaining strong financial performance.

- Meeting evolving client demands.

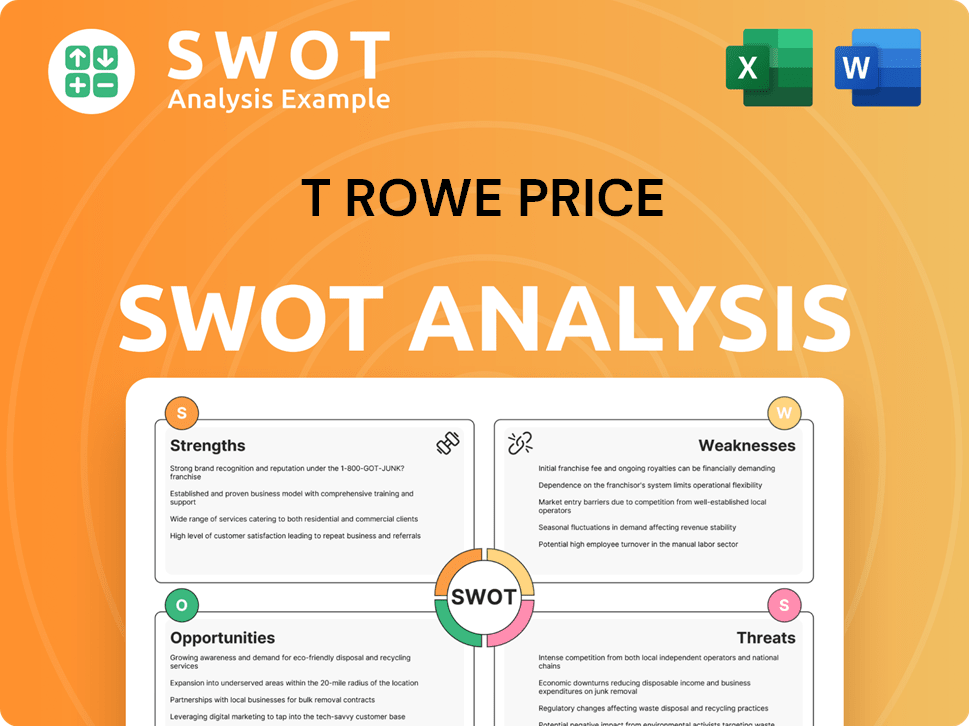

T Rowe Price SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging T Rowe Price?

The investment management landscape is highly competitive, and understanding the Brief History of T Rowe Price is crucial for assessing its current market position. T. Rowe Price faces a complex competitive environment, contending with both direct and indirect rivals for market share. This competition impacts everything from fee structures to product innovation, shaping the strategies of all players involved.

The firm's success hinges on its ability to navigate this competitive arena effectively. Key factors include investment performance, distribution capabilities, and the ability to adapt to evolving investor preferences. The ongoing shift towards passive investing and the rise of fintech further intensify the need for strategic agility.

T. Rowe Price's competitive landscape is dynamic, influenced by market trends, technological advancements, and the strategic moves of its rivals. Understanding these dynamics is essential for evaluating the company's long-term prospects and its ability to maintain a strong position in the asset management industry.

Direct competitors are those that offer similar investment products and services. These firms often compete head-to-head for the same client base. This competition is particularly fierce in the active management space.

Indirect competitors include a broader range of financial service providers, such as robo-advisors and large banks. These firms may offer investment solutions that indirectly compete with T. Rowe Price's offerings, often targeting different segments of the market.

Several factors determine success in the asset management industry, including investment performance, fees, and distribution networks. The ability to attract and retain clients is also crucial. These factors influence the competitive dynamics.

The rise of passive investing and the increasing demand for lower fees are significant market trends. These trends challenge active managers like T. Rowe Price to demonstrate value. Adapting to these shifts is essential for maintaining a competitive edge.

Fintech and the use of AI are transforming the industry, with new players emerging and existing firms adapting. Leveraging technology for personalized advice and automated portfolio management is becoming increasingly important. This drives innovation.

Firms are responding to competitive pressures through various strategies, including product innovation, fee adjustments, and mergers. These strategic moves shape the competitive landscape. The goal is to enhance market position.

The T Rowe Price competitive landscape includes a variety of firms, each with distinct strengths and strategies. Understanding these competitors is vital for assessing T. Rowe Price's market position and future prospects. Key players include:

- Fidelity Investments: Offers a broad range of investment products, including mutual funds, ETFs, and brokerage services, with a strong distribution network. In 2024, Fidelity's assets under management (AUM) totaled over $4.5 trillion.

- Vanguard: A leader in passive investing, Vanguard offers low-cost index funds and ETFs, appealing to cost-conscious investors. Vanguard's AUM exceeded $8 trillion in early 2024.

- BlackRock: The world's largest asset manager, BlackRock competes in both active and passive strategies, with its iShares ETF platform being a significant force. BlackRock's AUM was over $10 trillion in 2024.

- Capital Group: Known for its active management approach, Capital Group manages a diverse portfolio of investments. Capital Group had approximately $2.7 trillion in AUM as of late 2024.

- Franklin Templeton: Offers a wide array of investment solutions, including mutual funds and separately managed accounts. Franklin Templeton's AUM was around $1.5 trillion in 2024.

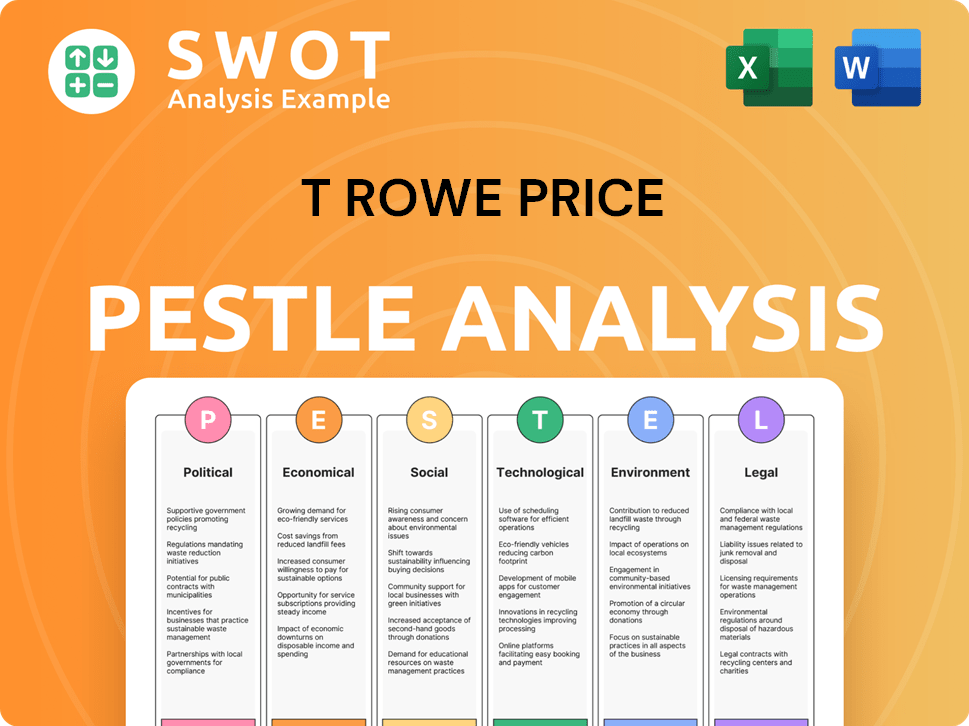

T Rowe Price PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives T Rowe Price a Competitive Edge Over Its Rivals?

In the dynamic T Rowe Price competitive landscape, the firm distinguishes itself through its commitment to active management, proprietary research, and a client-focused approach. These elements have been pivotal in shaping its market position within the asset management industry. The firm's strategic moves, including continuous investments in technology and data analytics, aim to enhance its core strengths and adapt to the evolving demands of the financial services companies sector.

One of the key milestones for the firm has been its consistent focus on delivering long-term investment performance and building a strong brand reputation. This has fostered strong customer loyalty and supported its direct-to-consumer distribution model. Moreover, the firm's adherence to a 'growth-at-a-reasonable-price' (GARP) investment philosophy has provided a consistent framework, influencing its competitive edge in the market.

The firm's competitive advantages are deeply rooted in its robust, in-house global research platform. This platform enables the firm to conduct deep fundamental analysis and identify compelling investment opportunities. This intellectual property is crucial for generating alpha and justifying its active management fees. The firm's ability to innovate its product offerings and enhance its client experience is essential for maintaining its position in the asset management industry.

The firm's primary strength lies in its extensive in-house research capabilities, which allow for deep fundamental analysis and the identification of investment opportunities. The firm has a strong brand equity and reputation for investment excellence and long-term performance. The firm's direct-to-consumer distribution model enhances its client relationships.

The firm faces challenges from the trend toward passive investing and fee compression. It needs to continuously demonstrate the value of active management through superior performance. The firm must innovate its product offerings and enhance its client experience in an increasingly digital world.

The firm is continuously investing in technology to enhance its research capabilities and risk management systems. Ongoing investments in data analytics and artificial intelligence are aimed at augmenting insights derived from its fundamental research. The firm focuses on a 'growth-at-a-reasonable-price' (GARP) philosophy.

The firm's future depends on its ability to sustain the value of active management through superior performance. The firm must continue to innovate its product offerings and enhance its client experience. The firm's ability to adapt to evolving market dynamics will be critical for its long-term success.

The firm's competitive advantages include its in-house research platform, strong brand reputation, and direct-to-consumer distribution model. These advantages have allowed the firm to maintain a strong market position. The firm’s commitment to active management and its GARP investment philosophy further contribute to its competitive edge. For a deeper dive into the firm's business model, consider reading about Revenue Streams & Business Model of T Rowe Price.

- In-House Research: A significant team of analysts and portfolio managers conduct deep fundamental analysis.

- Brand Reputation: Strong brand equity built on decades of disciplined investment processes and consistent performance.

- Client-Centric Approach: Direct-to-consumer distribution model that fosters strong relationships with individual investors.

- Technology Investments: Ongoing investments in data analytics and AI to enhance research capabilities.

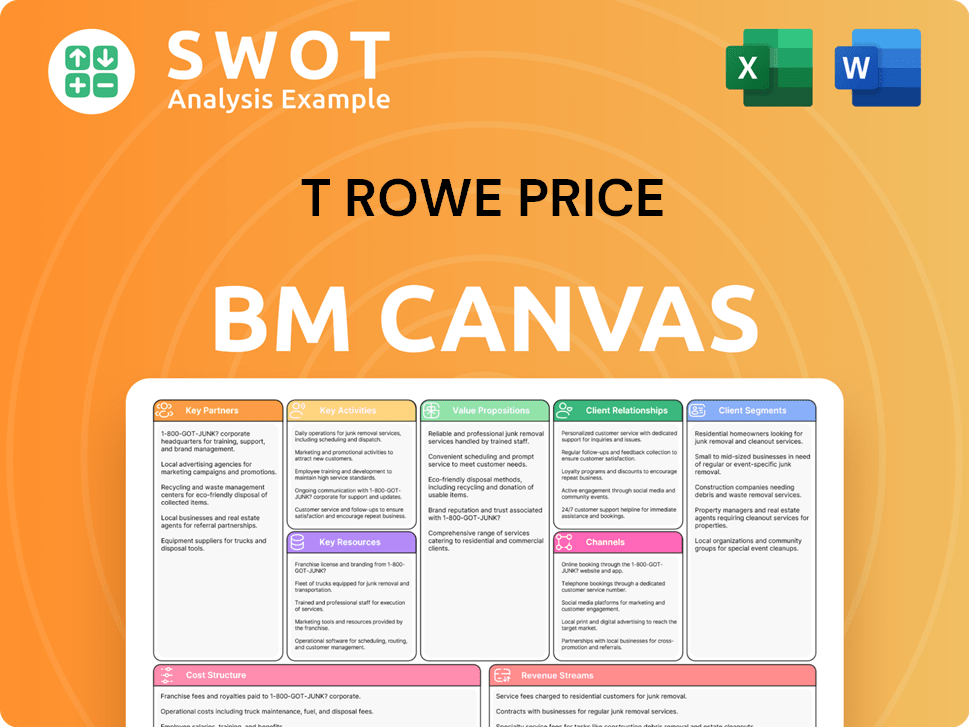

T Rowe Price Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping T Rowe Price’s Competitive Landscape?

The investment management industry is undergoing significant shifts, shaping the competitive landscape for firms like T. Rowe Price. Technological advancements, evolving investor preferences, and regulatory changes are key factors influencing the market position of investment firms. Understanding these trends is crucial for assessing the future outlook of T. Rowe Price and its ability to maintain a competitive edge. The Growth Strategy of T Rowe Price offers additional insights into the company's strategic initiatives within this dynamic environment.

T. Rowe Price faces both opportunities and challenges in this evolving landscape. The rise of passive investment strategies, fee compression, and the need for enhanced digital experiences are reshaping the industry. Furthermore, adapting to regulatory changes and meeting the demands of ESG investing are essential for maintaining a strong market position. This article explores the current trends, future challenges, and opportunities that define the competitive environment for T. Rowe Price.

The asset management industry is significantly influenced by technology, including AI and machine learning, which are changing investment research and client interactions. The shift towards passive investment strategies and fee compression continues to pressure active managers. Regulatory changes, such as increased scrutiny on fees and transparency, add further complexity. These trends impact the competitive landscape for T. Rowe Price and other financial services companies.

Sustained outflows from active equity funds, aggressive pricing strategies from competitors, and the emergence of disruptive market entrants pose significant challenges. Adapting to evolving consumer preferences, especially among younger generations, is crucial. Maintaining competitive fund performance and justifying fees in a cost-conscious market are also ongoing hurdles. These challenges require continuous strategic adjustments for T. Rowe Price.

Expanding multi-asset solutions and increasing global presence, particularly in Asia and emerging markets, offer growth opportunities. Strategic partnerships with fintech firms and enhancing digital platforms can unlock new distribution channels. Catering to the growing demand for ESG investing and personalized investment solutions is also a key opportunity. These opportunities can strengthen T. Rowe Price's market position.

T. Rowe Price's competitive landscape includes both established firms and emerging players. Key competitors include Vanguard, BlackRock, Fidelity, and others. The competitive advantages of T. Rowe Price include its strong brand reputation, investment performance, and client service. A detailed analysis of T. Rowe Price's competitive environment shows that its ability to adapt to industry changes is critical for maintaining its market share.

To remain competitive, T. Rowe Price must focus on demonstrating the value of active management, leveraging technology, and expanding its global footprint. The firm's strengths include its long-term investment approach and strong client relationships. However, weaknesses include potential outflows from active funds and the need to adapt to evolving investor preferences.

- Digital Transformation: Enhance digital platforms and client experiences.

- ESG Integration: Expand ESG offerings to meet investor demand.

- Global Expansion: Increase presence in international markets.

- Strategic Partnerships: Collaborate with fintech firms.

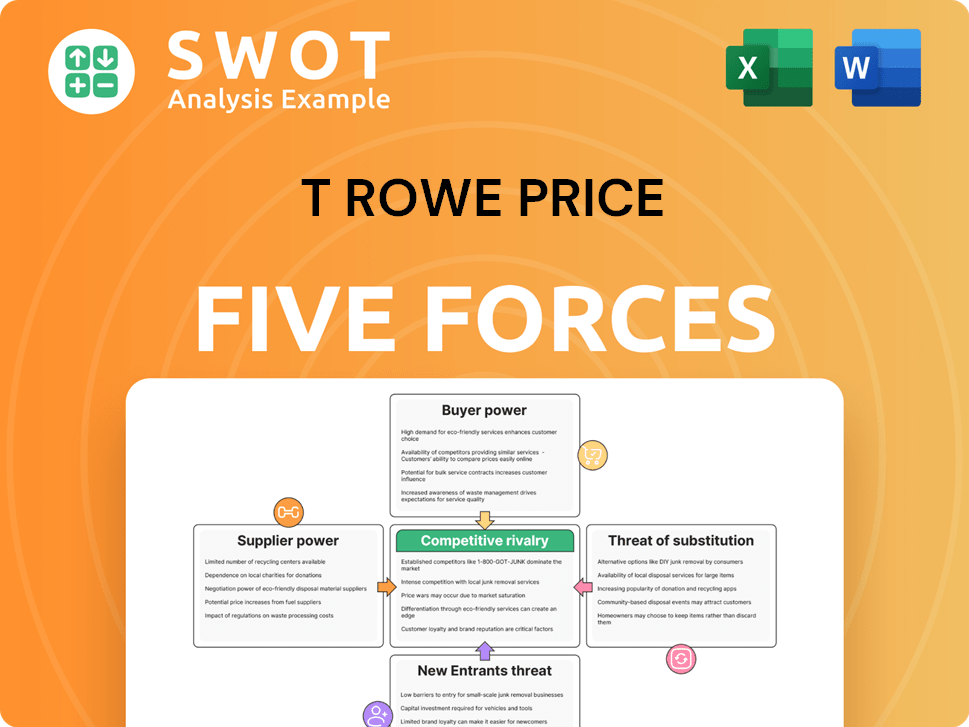

T Rowe Price Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of T Rowe Price Company?

- What is Growth Strategy and Future Prospects of T Rowe Price Company?

- How Does T Rowe Price Company Work?

- What is Sales and Marketing Strategy of T Rowe Price Company?

- What is Brief History of T Rowe Price Company?

- Who Owns T Rowe Price Company?

- What is Customer Demographics and Target Market of T Rowe Price Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.