T Rowe Price Bundle

Who Does T. Rowe Price Serve?

In the ever-changing world of financial services, understanding the T Rowe Price SWOT Analysis is crucial. Knowing the customer demographics and target market is essential for any investment firm, especially one with a rich history like T. Rowe Price. Founded in 1937, the firm has continuously adapted to meet the evolving needs of its diverse client base.

This exploration into T Rowe Price's customer demographics and T Rowe Price target market will uncover the Investor profile. From individual savers to institutional investors, the firm's ability to understand and cater to its clients is key to its success. We'll examine the T Rowe Price customer base analysis, including age demographics of T Rowe Price investors and income levels of T Rowe Price clients, to see how T. Rowe Price strategically aligns its financial services to meet their needs.

Who Are T Rowe Price’s Main Customers?

Understanding the customer base of T Rowe Price, an established investment firm, involves examining its diverse client segments. The firm, as of December 31, 2024, managed a substantial $1.61 trillion in assets under management (AUM), reflecting its significant presence in the financial services sector. This AUM figure underscores the scale of its operations and the trust placed in it by a broad range of investors.

T Rowe Price's target market encompasses both individual investors and institutional clients. The company operates through several distribution channels to reach its target audience. The firm's approach includes serving both consumers (B2C) and businesses (B2B), offering a wide array of investment solutions tailored to different financial goals and needs. This dual approach allows T Rowe Price to cater to a diverse customer base, from individual retirement savers to large institutional investors.

The firm's focus on retirement-related assets suggests a significant portion of its individual client base consists of those planning for or already in retirement. The company has also expanded into ETFs and the insurance channel, reflecting a response to evolving client preferences and market trends. The expansion into these areas shows how T Rowe Price adapts to the changing needs of its customer demographics and investment landscape.

Individual investors seeking long-term financial goals are a key segment. These investors utilize various investment strategies, including equities, fixed income, and multi-asset solutions. The Private Asset Management (PAM) Group specifically serves high-net-worth individuals, trusts, endowments, and retirement plans.

Institutional clients, including defined contribution retirement plans and financial intermediaries, form another crucial segment. The institutional channel in the Americas saw positive net flows in 2024. This segment benefits from T Rowe Price's expertise in managing large-scale investments and retirement plans.

T Rowe Price operates in both the B2C and B2B markets. For B2C, the focus is on individual investors, while B2B targets institutional clients. This dual approach allows the firm to cater to a wide range of clients. This strategy supports the company's growth and market presence.

A significant portion of the individual client base consists of those planning for or already in retirement. The emphasis on retirement-related assets highlights this focus. The company's target date franchise and retirement income products reflect this focus.

T Rowe Price's customer base is segmented into individual and institutional investors, with a strong emphasis on retirement-related assets. The firm's ability to adapt to changing market trends is evident in its expansion into ETFs and the insurance channel. The company's strategies reflect a deep understanding of its target audience. To learn more about the company's growth, consider reading about the Growth Strategy of T Rowe Price.

- Individual Investors: Focused on long-term financial goals.

- Institutional Clients: Includes retirement plans and financial intermediaries.

- B2C and B2B: Serving both consumers and businesses.

- Retirement Focus: Significant portion of clients are retirement savers.

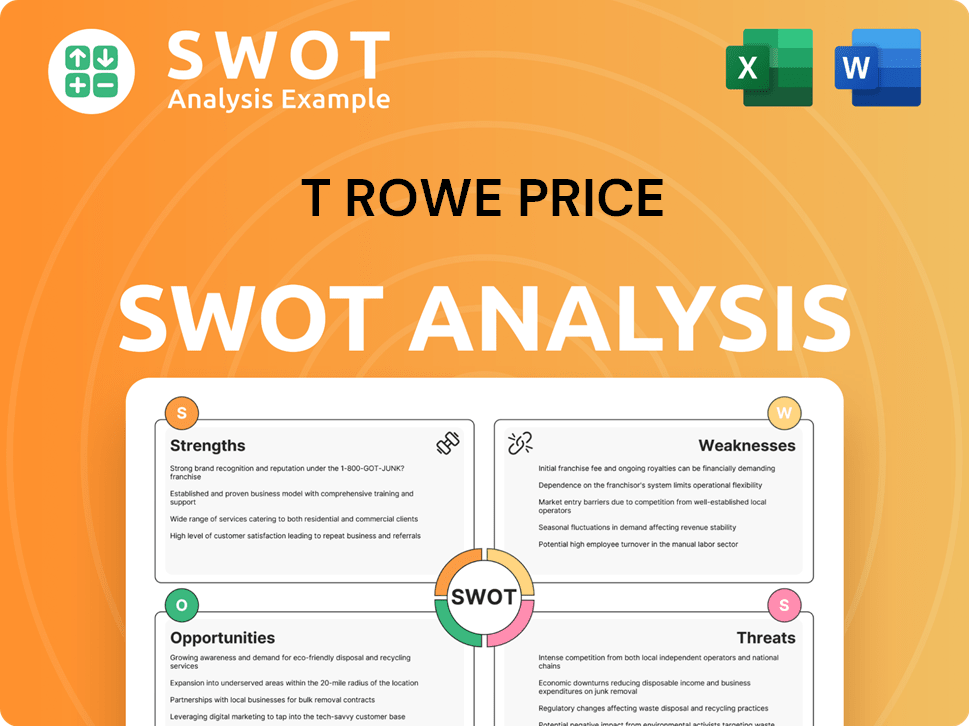

T Rowe Price SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do T Rowe Price’s Customers Want?

Understanding the customer needs and preferences is crucial for any investment firm, and for T Rowe Price, this involves a deep dive into the motivations and financial goals of their diverse client base. Customers of T Rowe Price, including those in or nearing retirement, are primarily driven by the need to achieve long-term financial objectives and navigate the complexities of the market. The company's focus on retirement income solutions reflects a key priority for a significant portion of its clientele.

The firm's approach to meeting customer needs is multifaceted, encompassing active management, research-driven investment processes, and a commitment to innovation in product offerings. This includes expanding its ETF business, growing its presence in the insurance channel, and extending its target date franchise with customization and retirement income products. These efforts are designed to instill investor confidence and provide solutions tailored to various financial goals and risk profiles. Considering the investor profile, this approach is critical.

In 2024, a study highlighted that retirement income and personalization are top priorities for consultants and advisors. This focus is further supported by the firm's development of a five-dimensional (5D) framework to help defined contribution (DC) plan sponsors evaluate retirement income offerings. This framework addresses key objectives such as longevity risk hedge and liquidity of balance, acknowledging the diverse needs in the decumulation phase.

Clients seek active management to navigate market risks and opportunities. This approach is reflected in the firm's active management offerings across equity, fixed income, multi-asset, and alternatives. This is one of the key aspects of the T Rowe Price target market.

The demand for new investment vehicles is influenced by the changing regulatory landscape. The firm is expanding its ETF business and growing its position in the insurance channel. This helps to understand who are T Rowe Price's clients.

Customers, especially those nearing retirement, prioritize retirement income solutions. The firm's 5D framework for DC plan sponsors addresses longevity risk and liquidity. This is a key factor in understanding the age demographics of T Rowe Price investors.

Areas of net flow strength in 2024 included target date strategies (+$16.3 billion), fixed income (+$12.6 billion), and alternatives (+$2.7 billion). This data indicates the company's ability to attract new clients.

There is a growing demand for investment products oriented toward climate change mitigation. This may influence client preferences and investment choices. This can be one of the T Rowe Price investment strategy for different demographics.

The company offers 'blend products' for price-sensitive clients interested in their target date expertise. This helps to cater to a wider range of clients. To learn more about the company, you can read about Owners & Shareholders of T Rowe Price.

The primary needs revolve around achieving long-term financial goals, particularly retirement planning, and navigating market uncertainties. T Rowe Price's customer base analysis reveals a strong preference for active management, research-driven investment processes, and innovative product offerings. Understanding these preferences is crucial for the investment firm.

- Retirement Income Solutions: A significant portion of clients prioritize solutions for generating income during retirement.

- Active Management: Clients seek active management and research-driven investment processes to instill confidence and navigate risks.

- New Investment Vehicles: Demand for new investment vehicles is driven by client needs and the evolving regulatory landscape.

- Climate Change Mitigation: Growing interest in investment products oriented toward climate change mitigation.

- Customization and Personalization: Increased focus on personalized financial solutions.

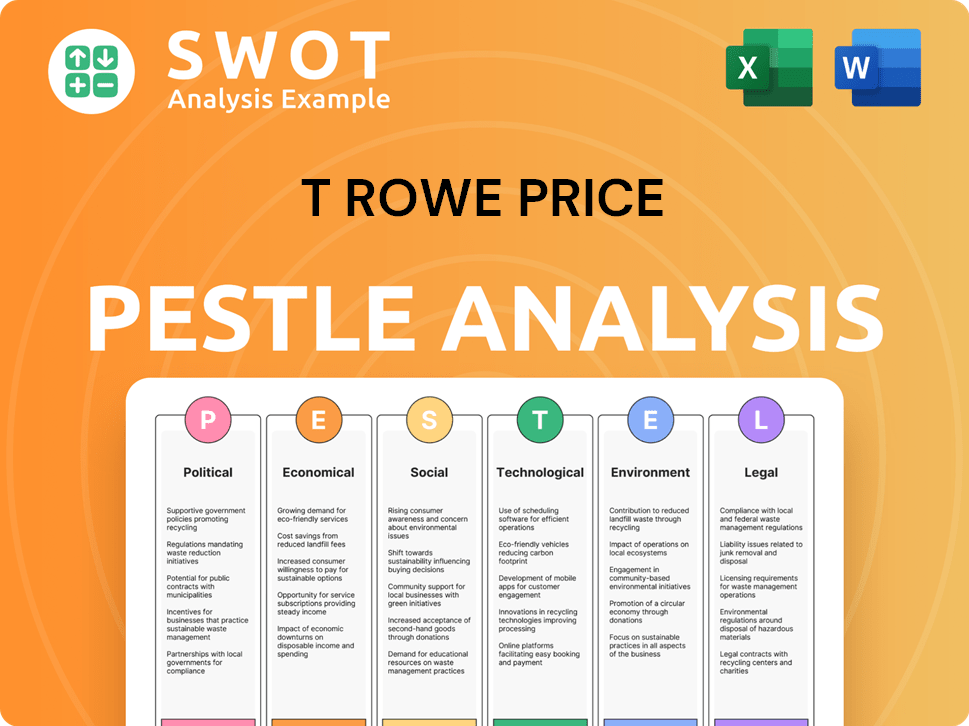

T Rowe Price PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does T Rowe Price operate?

The investment firm, T. Rowe Price, maintains a global presence, serving clients across 54 countries. This extensive reach is a key aspect of their customer demographics and target market strategy. The firm divides its geographical markets into the Americas, Europe, the Middle East, and Africa (EMEA), and Asia Pacific (APAC), demonstrating a commitment to serving a diverse international client base.

Investors located outside the U.S. represented approximately 9% of the total assets under management at the close of 2024. This figure highlights the significance of their international customer base within the overall financial services business. T. Rowe Price's global strategy underscores its commitment to providing investment solutions worldwide, adapting to the needs of various investor profiles.

T. Rowe Price's geographical market presence is further supported by its localized marketing efforts and product offerings. The firm's approach to customer segmentation includes tailoring its services to meet the specific needs of clients in different regions. For a deeper understanding of their business model, you can explore the Revenue Streams & Business Model of T Rowe Price.

In 2024, the Americas, particularly the institutional channel, experienced positive flows. This indicates strong performance and client acquisition in the region. Understanding the geographic distribution of T. Rowe Price customers is crucial for assessing its market position.

The EMEA and APAC regions also saw positive flows, highlighting the firm's success in these key markets. This growth demonstrates the effectiveness of T. Rowe Price's investment strategy in attracting and retaining clients across different investor profiles in various geographic locations.

T. Rowe Price has extended its target date franchise into Canada, demonstrating its commitment to expanding its services. This expansion shows the firm's strategic focus on new markets and its ability to adapt its offerings to meet the needs of different demographics.

The launch of 'The Power of Curiosity' global branding program in February 2024, starting in the United States, reflects a strategic approach to brand building. This initiative underscores the firm's efforts to enhance brand recognition and attract new clients across various markets.

A 2024 marketer sentiment outlook revealed that the majority of participants expected to increase marketing activities in Europe (75%), the UK (60%), and Asia (60%). This data indicates a strategic focus on these regions for expansion and brand recognition. This focus helps define who are T Rowe Price's clients and their geographic distribution.

- This strategic focus helps in attracting new clients.

- The expansion highlights the firm's commitment to meeting the needs of its target market.

- The investment firm is adapting its offerings to different demographics.

- This approach supports T. Rowe Price's investment strategy.

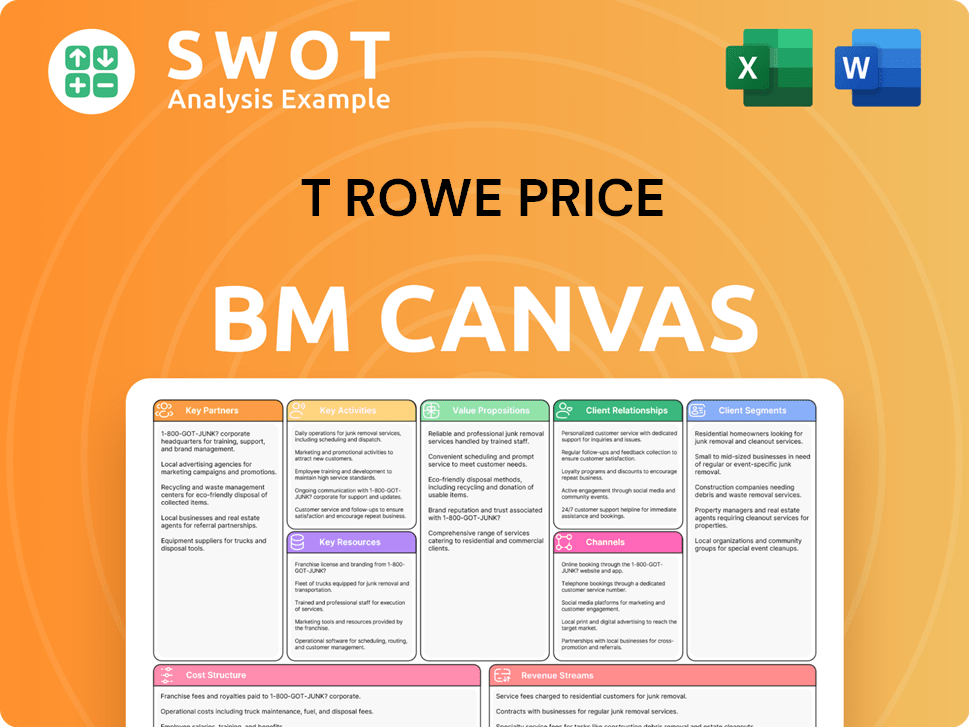

T Rowe Price Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does T Rowe Price Win & Keep Customers?

The focus of T. Rowe Price on customer acquisition and retention is a key element of its business strategy. The firm employs a multifaceted approach to attract and retain customers, utilizing a blend of marketing channels, sales tactics, and personalized experiences. Their commitment to active management, independent proprietary research, and leadership in the retirement sector are key differentiators in their acquisition efforts. Understanding the nuances of T Rowe Price's target market and customer demographics is crucial for assessing their success.

T. Rowe Price's strategies are designed to resonate with a diverse investor profile, from individual investors to institutional clients. The firm's approach to client relationships is built on a foundation of trust, expertise, and a deep understanding of evolving financial needs. They aim to provide strong investment management expertise and service, continually investing in key capabilities to meet the demands of their customer base. A detailed Growth Strategy of T Rowe Price provides further context.

In February 2024, the firm launched a new global branding program called 'The Power of Curiosity,' which leverages a mix of national and local television commercials, streaming services, digital and online video advertisements, social media, print media, and partnership channels. This campaign aims to elevate awareness and consideration of their active investment management approach. The firm's commitment to innovation is evident in the expansion of its ETF business, the insurance channel, and the extension of its target date franchise with customization and retirement income products.

T. Rowe Price utilizes a diverse range of marketing channels, including television, streaming services, digital advertising, social media, and print media. The 'Power of Curiosity' campaign, launched in February 2024, is a key component of their marketing strategy.

The firm focuses on building strong relationships with financial professionals and consultants. Participation in events like the 2024 NAPA 401(k) Summit allows them to engage with advisors and discuss industry trends.

The introduction of Personalized Retirement Manager (PRM) and a Managed Lifetime Income product highlights their commitment to tailored solutions. These services are designed to meet the specific needs of retirees.

Retention efforts center around providing strong investment management expertise and service. The firm continually invests in its capabilities, including investment and distribution professionals, and develops new product offerings.

T. Rowe Price focuses on several key strategies to acquire and retain customers. These strategies are designed to provide value and build long-term relationships with their clients. Understanding T Rowe Price's customer base analysis reveals the importance of these approaches.

- Active Investment Management: Emphasizing their commitment to active management and independent research to differentiate their services.

- Marketing Campaigns: Launching comprehensive marketing campaigns, such as 'The Power of Curiosity,' across multiple channels to elevate brand awareness.

- Product Innovation: Expanding product offerings, including ETFs, insurance channel products, and customized retirement solutions, to meet evolving client needs.

- Client Engagement: Actively engaging with financial professionals and consultants to understand and address their needs, as seen in events like the NAPA 401(k) Summit.

- Personalized Services: Introducing services like Personalized Retirement Manager (PRM) to provide tailored asset allocations and retirement income solutions.

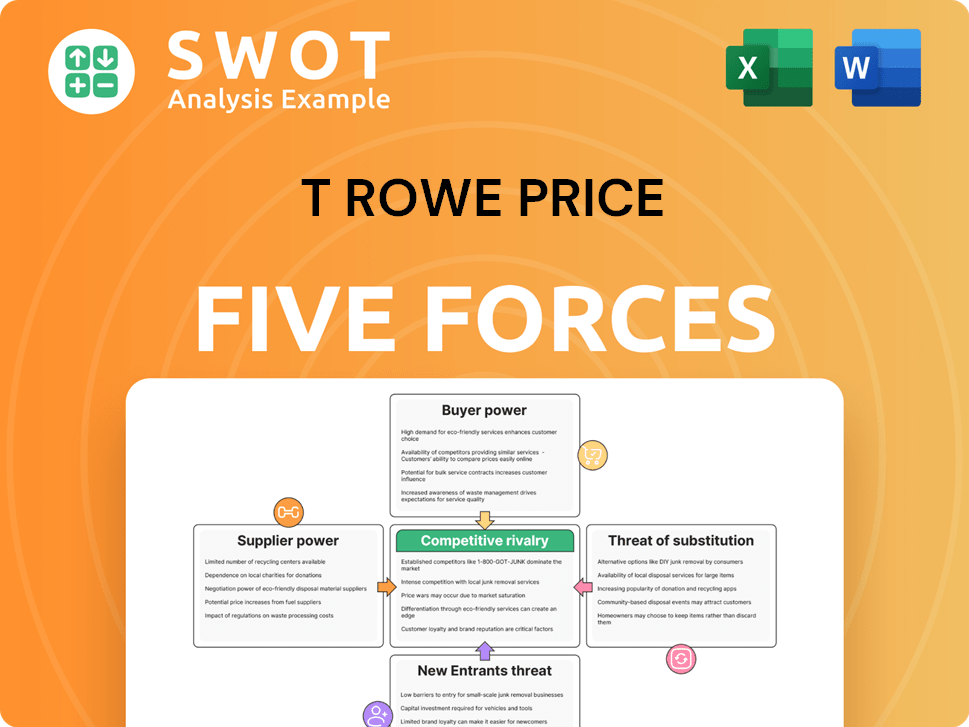

T Rowe Price Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of T Rowe Price Company?

- What is Competitive Landscape of T Rowe Price Company?

- What is Growth Strategy and Future Prospects of T Rowe Price Company?

- How Does T Rowe Price Company Work?

- What is Sales and Marketing Strategy of T Rowe Price Company?

- What is Brief History of T Rowe Price Company?

- Who Owns T Rowe Price Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.