TUI Bundle

How Does TUI Navigate the Turbulent Travel Industry?

The travel and tourism sector is a battlefield of innovation and adaptation, especially after the recent global shifts. TUI Group, a titan in this arena, has consistently reshaped its strategy to stay ahead. From its roots in Germany to its current status as a global tourism powerhouse, TUI's journey is a masterclass in strategic evolution.

Understanding the TUI SWOT Analysis is crucial to grasp the TUI competitive landscape. This analysis will dissect TUI's market analysis, revealing its strategies, and identifying its TUI competitors in the dynamic travel industry competition. We'll explore TUI's market position compared to rivals, examining its competitive advantages of TUI Group and its response to challenges, including TUI's response to low-cost airlines and the impact on the tourism market share.

Where Does TUI’ Stand in the Current Market?

The TUI Group holds a leading position in the global travel and tourism sector, especially within its core European markets. Pinpointing exact market share figures for the entire global tourism industry is difficult, but TUI's significant scale and integrated business model place it among the top players. For example, in the UK, TUI is a major player in the package holiday sector. This makes understanding the TUI competitive landscape crucial.

TUI's main product lines include package holidays, cruises through brands such as TUI Cruises and Marella Cruises, and hotel accommodations under brands like RIU and TUI Blue. The company has a broad geographic presence, with strong operations across Europe, particularly in Germany, the UK, the Nordics, and the Benelux countries, alongside a growing presence in other international markets. TUI serves a diverse customer base, from budget travelers to those seeking premium experiences. A deep dive into the TUI market analysis is essential for understanding its strengths.

Over time, TUI has strategically shifted its positioning, emphasizing its own hotel and cruise brands to gain greater control over the value chain and enhance profitability. This move towards owning more of its product has been a key aspect of its digital transformation and diversification of offerings. For more information on how TUI targets its customers, see this article on the Target Market of TUI.

TUI's core operations revolve around offering integrated travel and tourism services. This includes package holidays, cruises, and hotel accommodations, all designed to provide comprehensive travel experiences. The company's focus on owning and controlling more of its product offerings, like hotels and cruise ships, enhances its ability to manage quality and profitability.

TUI's value proposition lies in offering a one-stop-shop for travel needs, providing convenience and a wide range of options. By integrating various services, TUI aims to create seamless travel experiences for its customers. The company's emphasis on its own brands and digital transformation further enhances its value proposition.

Financially, TUI reported a significant improvement in its fiscal year 2023 results, with underlying EBIT increasing to €977 million, marking a substantial recovery. Revenue for the first quarter of fiscal year 2024 also increased by 15% to €4.3 billion, demonstrating continued growth. Understanding TUI's market position compared to rivals is key to evaluating its success.

- TUI's strong presence in key European markets, particularly the UK and Germany, contributes significantly to its market share.

- The company's integrated business model, including its own hotels and cruise lines, gives it a competitive edge by controlling more of the value chain.

- TUI's focus on digital transformation and expanding its offerings helps it adapt to changing consumer preferences and market trends.

- TUI's financial performance, with improving EBIT and revenue, indicates a robust recovery and strong financial health.

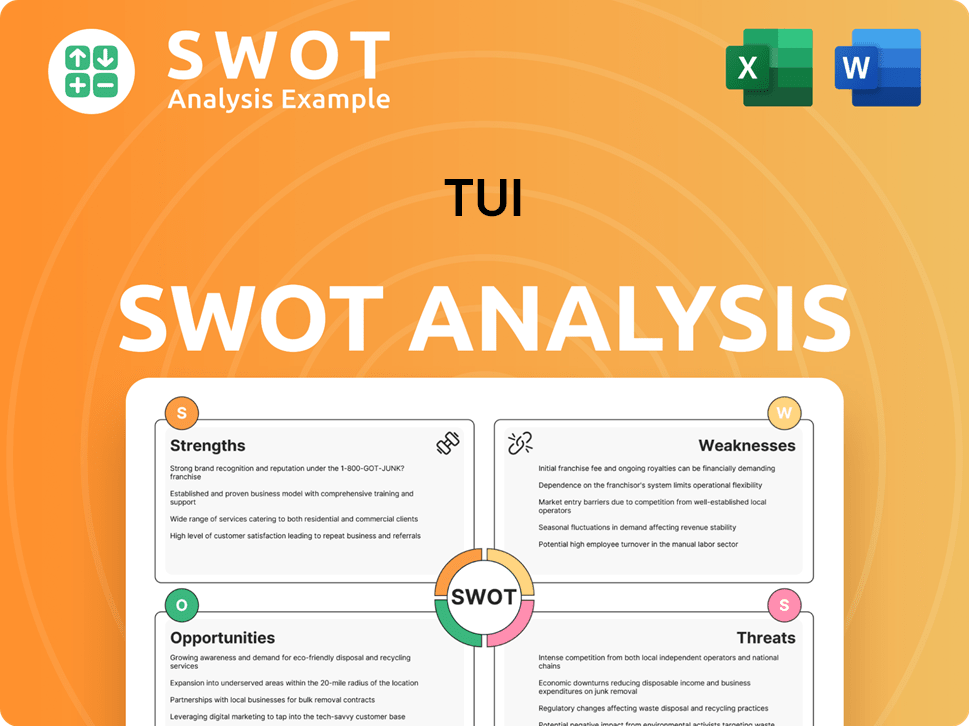

TUI SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging TUI?

The Growth Strategy of TUI involves navigating a complex competitive landscape. The company faces both direct and indirect rivals across its diverse business segments, requiring strategic agility to maintain and grow its market share. Understanding the strengths and weaknesses of these competitors is crucial for TUI's long-term success.

TUI's competitive environment is shaped by factors such as pricing strategies, route networks, customer service, and the increasing influence of online travel agencies. The rise of low-cost carriers and the evolving preferences of travelers demand continuous innovation and adaptation. TUI must continually assess its position relative to its competitors to stay ahead.

In the package holiday sector, TUI competes with major European tour operators. These rivals offer diverse holiday packages and often have strong regional presences. They challenge TUI through competitive pricing and targeted marketing strategies.

TUI Airways faces competition from low-cost carriers and traditional airlines. These competitors primarily focus on price and route networks. The airline industry is highly competitive, with fluctuating fuel costs and changing consumer preferences.

The cruise line segment sees TUI Cruises and Marella Cruises competing with global giants. These companies compete through ship innovation, itinerary variety, and onboard experiences. Market share is fiercely contested in this segment.

The hotel sector presents competition from global hotel chains and independent hotels. Online Travel Agencies (OTAs) also represent significant indirect competition. The hotel industry is subject to changing consumer demands and trends.

Online Travel Agencies (OTAs) like Booking.com and Expedia pose indirect competition. They allow customers to book flights, accommodations, and activities à la carte. Emerging players and technology-driven startups also pose a threat.

Mergers and alliances within the travel industry can alter competitive dynamics. These changes create larger, more powerful entities. Staying informed about industry trends is crucial for TUI's strategic decisions.

Analyzing the TUI competitive landscape reveals a complex interplay of factors. The company must continually adapt to maintain its market position. For instance, in 2024, Ryanair reported a passenger count of over 180 million, highlighting the intense competition from low-cost carriers. Similarly, the cruise industry saw significant growth, with Royal Caribbean Group reporting a revenue increase, demonstrating the ongoing rivalry in this sector. The rise of OTAs continues to impact the industry, with Booking Holdings reporting approximately $21.4 billion in revenue in 2023, underscoring the need for TUI to evolve its digital strategies. TUI's ability to differentiate itself through customer service, sustainability initiatives, and innovative travel experiences will be critical in the face of its TUI competitors.

Several factors influence TUI's market analysis and competitive position.

- Pricing strategies and promotional offers.

- Route network and destination diversity.

- Customer service quality and brand reputation.

- Digital presence and online booking capabilities.

- Sustainability initiatives and environmental impact.

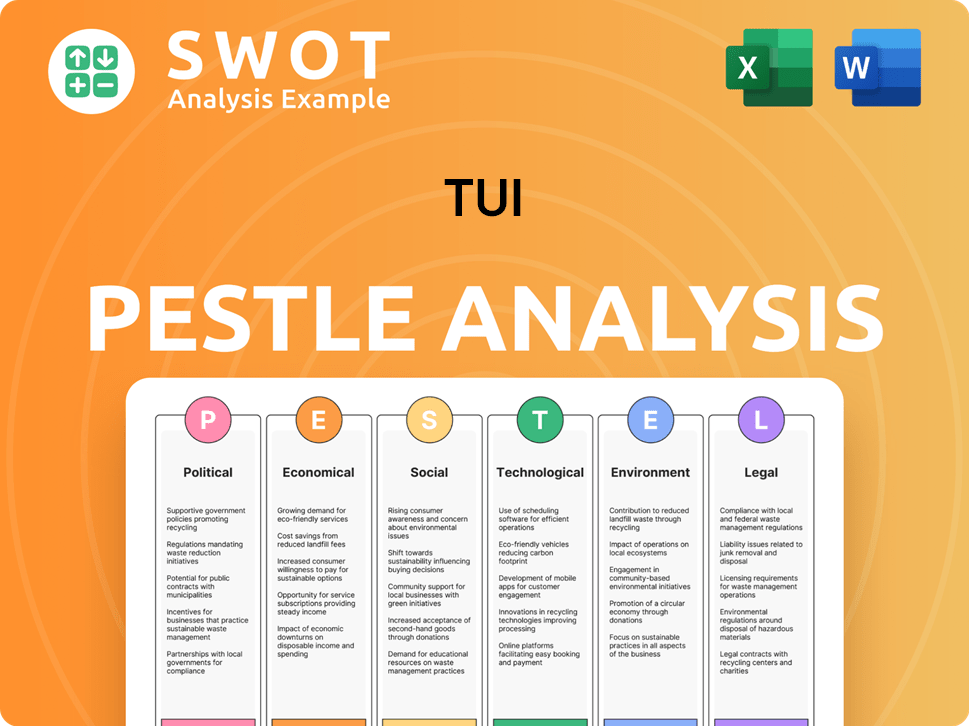

TUI PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives TUI a Competitive Edge Over Its Rivals?

Understanding the TUI competitive landscape involves analyzing its key strengths and how it positions itself against rivals in the travel industry. The company's strategy is built on a foundation of integrated services, brand recognition, and operational efficiency. This approach allows it to offer comprehensive travel packages, manage costs effectively, and maintain a strong presence in the market.

TUI's market analysis reveals a focus on providing a seamless travel experience, from flights and accommodations to activities and excursions. This vertical integration is a significant differentiator, allowing it to control the entire customer journey and offer curated holiday experiences. This integrated model helps in capturing a larger share of customer spending compared to competitors who may specialize in only one aspect of travel.

The company's competitive edge is further enhanced by its strong brand equity, built over decades of operation. This brand recognition reduces customer acquisition costs and fosters loyalty. The scale of operations, including a vast fleet of aircraft, numerous hotels, and cruise ships, provides economies of scale, enabling competitive pricing and improved profitability. The company's commitment to digital transformation and data analytics further enhances its ability to personalize offerings and improve operational efficiency.

TUI's integrated model, encompassing airlines, hotels, and cruise lines, allows for control over the entire customer journey. This integration enables the company to offer unique package holidays that are difficult for competitors to replicate. This approach helps in optimizing costs and capturing a larger share of travel spending.

TUI benefits from strong brand recognition and customer loyalty, particularly in its key European markets. The brand's reputation reduces customer acquisition costs and fosters repeat business. This established trust is a significant advantage in a competitive market.

The scale of TUI's operations, including its extensive fleet and hotel portfolio, provides significant economies of scale. This allows for competitive pricing and greater profitability. Economies of scale are crucial in the travel industry, where cost efficiency is a key driver of success.

TUI's extensive distribution network, both online and through retail travel agencies, provides broad market reach. This network caters to diverse customer preferences, including those who prefer in-person booking assistance. A wide distribution network is essential for reaching a large customer base.

TUI's competitive advantages are primarily driven by its integrated business model, strong brand, and economies of scale. These factors allow it to offer unique travel packages and maintain a strong market position. The company's focus on digital transformation and sustainability further enhances its competitive edge.

- Integrated Model: Controls the entire customer journey, optimizing costs and offering unique packages.

- Strong Brand: Reduces customer acquisition costs and fosters repeat business.

- Economies of Scale: Enables competitive pricing and greater profitability.

- Extensive Distribution Network: Provides broad market reach and caters to diverse customer preferences.

For a deeper dive into TUI's strategic initiatives, consider exploring the Growth Strategy of TUI. This article provides valuable insights into the company's plans for future growth and its response to the dynamic challenges in the travel market. The company's ability to adapt and innovate will be crucial for maintaining its competitive position.

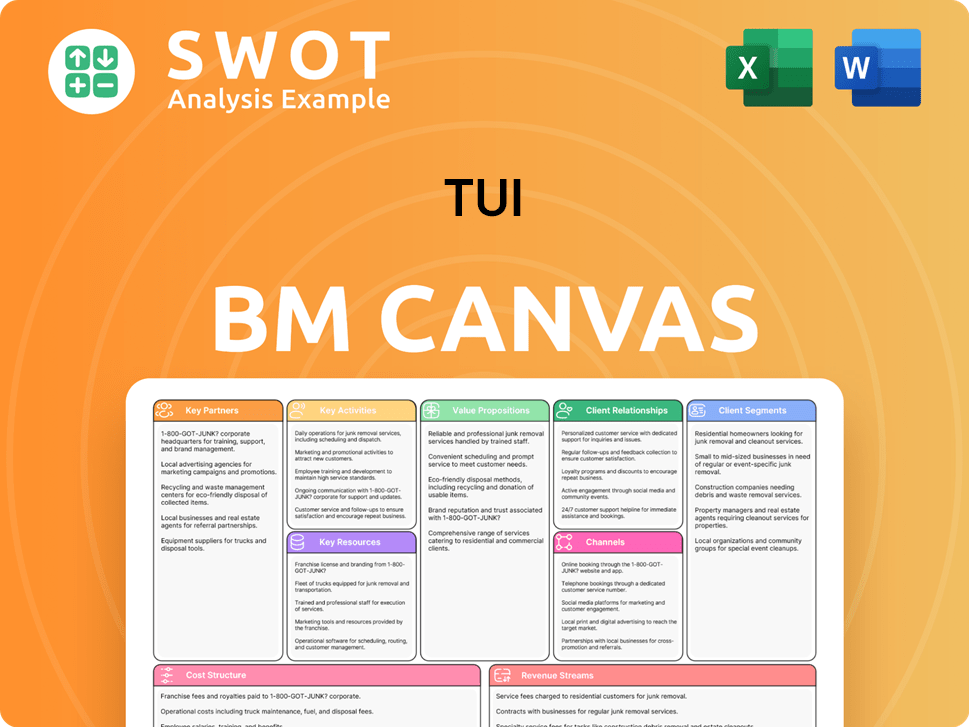

TUI Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping TUI’s Competitive Landscape?

The travel and tourism industry is undergoing a significant transformation, significantly impacting the TUI competitive landscape. Technological advancements, sustainability concerns, and changing consumer preferences are reshaping the sector. This dynamic environment presents both challenges and opportunities for companies like TUI, demanding strategic adaptation to maintain and enhance their market position. Understanding TUI's market analysis and its rivals is crucial for investors and industry observers.

TUI faces a complex web of competitors, ranging from traditional tour operators to online travel agencies and low-cost airlines. External factors like geopolitical instability and economic downturns also pose risks. However, opportunities exist in emerging markets and through product innovation. Analyzing the competitive landscape is essential to assess TUI's future prospects and strategic direction. To understand who are the owners and shareholders of TUI, you can check out this article: Owners & Shareholders of TUI.

Key trends include the growing influence of technology, with AI and data analytics personalizing travel experiences. Sustainability is a major factor, with consumers increasingly preferring eco-friendly options. Regulatory changes, particularly regarding environmental standards and consumer protection, are also significantly impacting the travel industry.

Anticipated challenges include the rise of hyper-personalized travel planning, further industry consolidation, and the emergence of new competitors. Economic downturns, increased regulations, and geopolitical instability pose significant threats. Aggressive competition from online travel agencies and low-cost airlines continues to pressure profit margins.

Growth opportunities exist in emerging markets, especially in Asia and Africa, where disposable incomes are rising. Product innovations, such as new hotel concepts and personalized package holidays, offer avenues for differentiation. Strategic partnerships with technology providers and local businesses can unlock new markets and enhance service offerings.

TUI is focusing on strengthening its balance sheet, expanding its hotel and cruise portfolio, and accelerating digital transformation. The company aims to increase the hotel and cruise segment's share of earnings to 40-50% in the medium term. This strategic shift emphasizes higher-margin businesses and greater control over its product offerings.

The travel industry is intensely competitive, with TUI facing rivals across various segments. Understanding TUI's market position compared to rivals is crucial for assessing its future prospects. TUI's response to low-cost airlines and its digital transformation strategies are key factors in its competitive strategy. The company's brand reputation compared to competitors also plays a significant role in its market performance.

- Market Share and Position: TUI holds a significant market share in the European tourism market. The company's market share in the UK, for example, is substantial, though precise figures fluctuate. Analyzing TUI's market position compared to rivals like easyJet Holidays, Jet2holidays, and smaller regional players is crucial.

- Competitive Advantages: TUI's competitive advantages include its vertically integrated business model, which encompasses airlines, hotels, cruises, and tour operations. Its extensive distribution network and strong brand recognition contribute to its market strength.

- Digital Transformation: TUI is investing heavily in digital transformation to enhance customer experience and operational efficiency. This includes the development of personalized travel planning tools and online booking platforms.

- Sustainability Initiatives: TUI is implementing sustainability initiatives to meet growing consumer demand for eco-friendly travel options. These include reducing carbon emissions from its airline operations and promoting sustainable tourism practices in its hotels and resorts.

- Financial Performance: TUI's financial performance is closely tied to the overall health of the travel industry and external factors such as economic conditions and geopolitical events. The company's revenue and profitability are affected by fluctuations in travel demand and currency exchange rates. In 2024, TUI reported positive earnings, reflecting a recovery in travel demand.

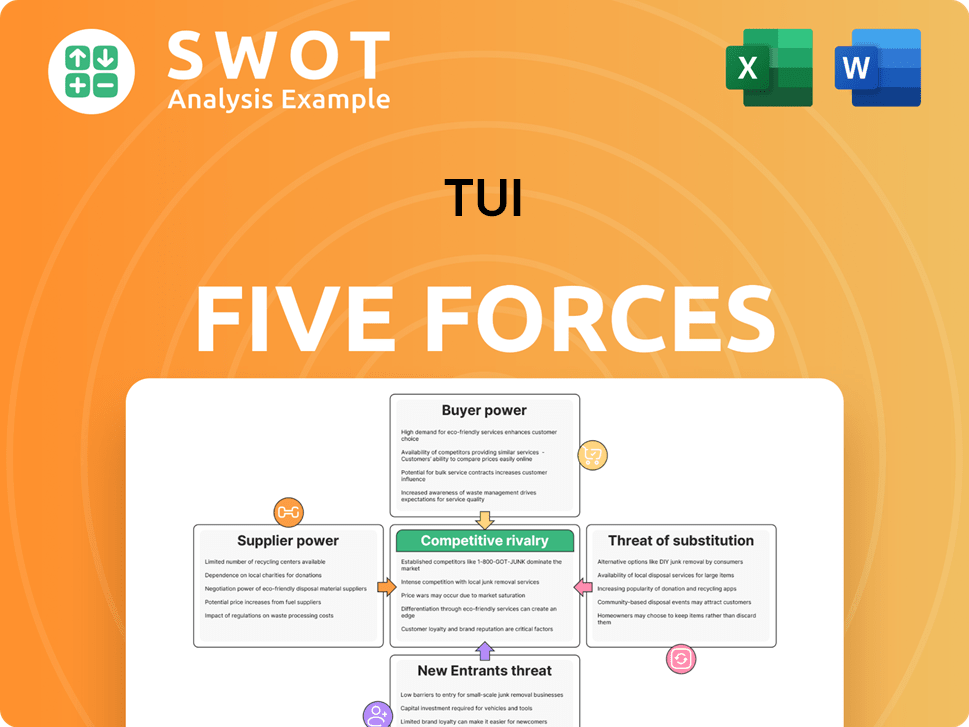

TUI Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TUI Company?

- What is Growth Strategy and Future Prospects of TUI Company?

- How Does TUI Company Work?

- What is Sales and Marketing Strategy of TUI Company?

- What is Brief History of TUI Company?

- Who Owns TUI Company?

- What is Customer Demographics and Target Market of TUI Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.