TUI Bundle

Who Really Owns TUI?

Unraveling the ownership of a global powerhouse like TUI Group is key to understanding its strategic ambitions. Major shifts in a company's shareholder base can signal significant changes ahead, potentially impacting everything from product offerings to market strategies. This deep dive explores the intricate TUI SWOT Analysis, and the evolution of TUI's ownership, from its origins to its current status as a leading force in global tourism.

Understanding the TUI ownership structure is crucial for investors and industry observers alike. This analysis will examine the TUI shareholders, including the TUI major shareholders and the influence of key investors on the company's direction. We'll explore the TUI company ownership breakdown and answer questions like "Who controls TUI?" and "Is TUI a publicly traded company?", providing valuable insights into TUI AG's operations and future prospects in the competitive travel market.

Who Founded TUI?

The story of TUI's origins begins with Preussag AG in 1923, a company initially focused on industrial and mining operations. The evolution of the company into a major player in the tourism sector involved significant strategic changes and numerous acquisitions over many years.

Specific details about the founders, their individual equity stakes, and the initial ownership structure of Preussag AG are not readily available in public records. The company's transformation into a tourism giant involved a shift in focus and ownership, making the early details less relevant to its current structure.

Early ownership would have reflected the industrial nature of the business, likely involving a mix of private and institutional investors common in large German industrial enterprises of the time. The company's journey from its industrial roots to its current status as a leading tourism group is marked by pivotal acquisitions and strategic shifts.

Over time, Preussag transitioned by divesting its industrial assets and acquiring tourism-related businesses. This strategic shift fundamentally reshaped its asset base and ownership profile, attracting investors interested in the growing global tourism industry. Major acquisitions, such as Thomson Travel Group in 2000 and Hapag-Lloyd in 1997, were key in this transformation.

- The early ownership of Preussag AG was typical of German industrial companies of the early 20th century.

- The acquisition of Thomson Travel Group in 2000 was a pivotal moment, significantly altering the company's direction.

- The shift from industrial to tourism focus attracted new investors.

- The evolution of the company's ownership mirrors its strategic pivots.

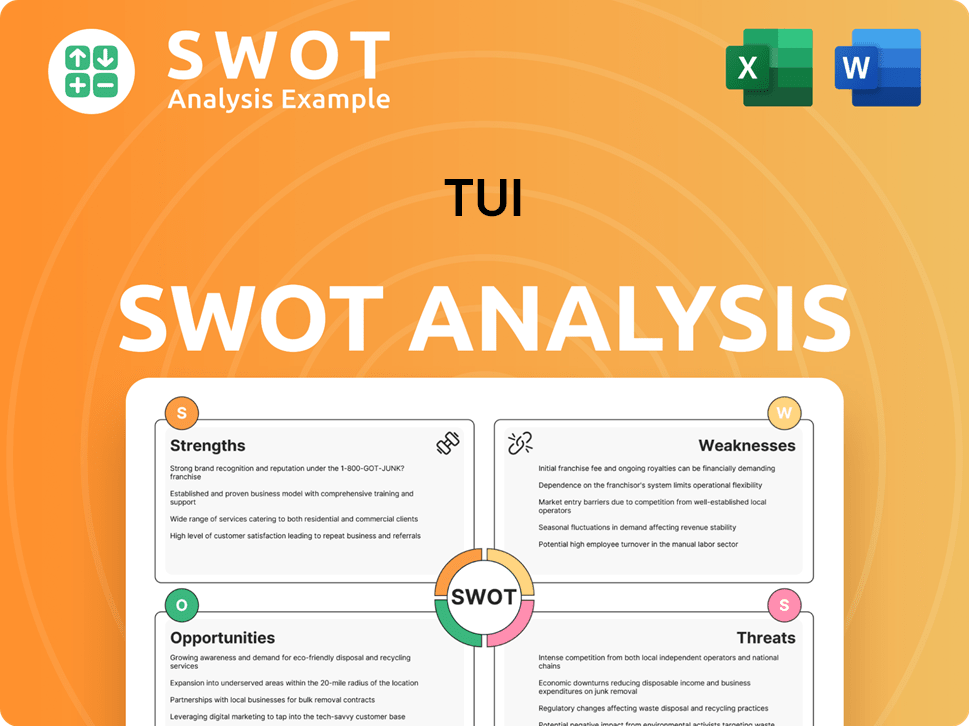

TUI SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has TUI’s Ownership Changed Over Time?

The evolution of TUI Group's ownership reflects its strategic shift from an industrial conglomerate to a tourism-focused entity. Around the year 2000, Preussag AG rebranded as TUI AG, marking a pivotal moment in the company's history. This transformation signaled a dedicated commitment to the tourism sector, setting the stage for subsequent changes in its ownership structure. The company operates as a publicly traded entity, listed on the London Stock Exchange (LSE) and the Hanover and Frankfurt Stock Exchanges. This transition has significantly impacted the company's strategic direction and operational focus.

A key event affecting the TUI ownership structure was the departure of Alexey Mordashov, a major Russian shareholder. His divestment in 2022, due to sanctions, led to a notable shift in the ownership landscape. This event increased the free float and the proportion of shares held by institutional investors and the general public. The company's journey from an industrial conglomerate to a tourism giant has been marked by several ownership adjustments. These changes have reshaped the company's focus and its relationship with its shareholders.

| Year | Event | Impact on Ownership |

|---|---|---|

| ~2000 | Preussag AG Rebrands as TUI AG | Signaled a shift to tourism focus |

| 2022 | Alexey Mordashov Divests | Increased free float; changed shareholder composition |

| Early 2025 | Stabilization of Free Float | Reflects a more dispersed ownership among institutional investors and the public |

As of early 2025, TUI's major shareholders include a variety of institutional investors, such as mutual funds and asset managers. The ownership is now characterized by a distributed structure, with no single entity holding a dominant controlling stake. This distribution among institutional and individual public shareholders is typical of large, established public companies. For detailed information on institutional ownership, one can refer to the company's annual reports and SEC filings (for its ADRs). This dispersed ownership structure often leads to a greater emphasis on overall shareholder value, along with enhanced accountability to a wider investor base. Read more about the Growth Strategy of TUI.

TUI ownership has evolved significantly, especially after 2000. The exit of a major shareholder increased the free float. Institutional investors now hold a significant portion of shares.

- TUI Group is a publicly traded company.

- Ownership is now more dispersed.

- Institutional investors play a key role.

- The company's strategy is influenced by its ownership structure.

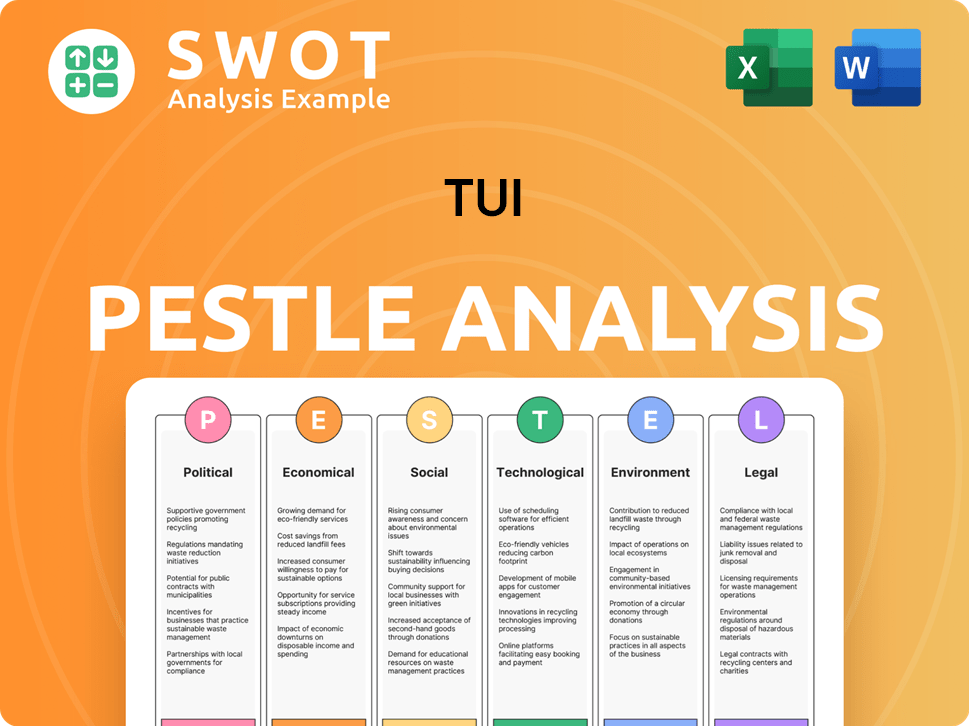

TUI PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on TUI’s Board?

The current board of directors for the TUI Group, as of early 2025, is structured to balance executive management, independent members, and representatives from major shareholders. The company's investor relations section provides public access to the board's composition. Historically, major shareholders have had representation on the board, but the current trend indicates an increasing number of independent directors, which is a shift in the TUI ownership structure.

The board's role is crucial in overseeing the strategic direction of the globally operating tourism company. The board's decisions are closely scrutinized by a diverse institutional investor base, particularly concerning capital increases, debt management, and strategic investments, especially in the post-pandemic recovery phase. The departure of major shareholders, such as Alexey Mordashov, has also influenced the composition and dynamics of the board, leading to a more independent governance structure, which affects TUI shareholders.

| Board Member | Role | Notes |

|---|---|---|

| Sebastian Ebel | Chief Executive Officer | Oversees the strategic direction and day-to-day operations. |

| Mathias Kiep | Chief Financial Officer | Responsible for financial strategy and performance. |

| David Burling | Executive Director | Focuses on strategy and business development. |

The voting structure of TUI AG is generally based on a one-share-one-vote principle, which is common for German stock corporations. There are no indications of dual-class shares, special voting rights, or golden shares that would grant outsized control to specific individuals or entities. This promotes a more equitable distribution of voting power among shareholders. The recent changes in the shareholder base have led to a stronger focus on governance, as highlighted in the Brief History of TUI.

The voting structure at TUI is based on a one-share-one-vote system, ensuring fair distribution of power. The board's decisions are closely monitored by shareholders, especially regarding financial strategies. The company's governance has been strengthened in recent years.

- One-share-one-vote system.

- Focus on capital increases and debt management.

- Increased independent directors.

- Shareholder scrutiny of board decisions.

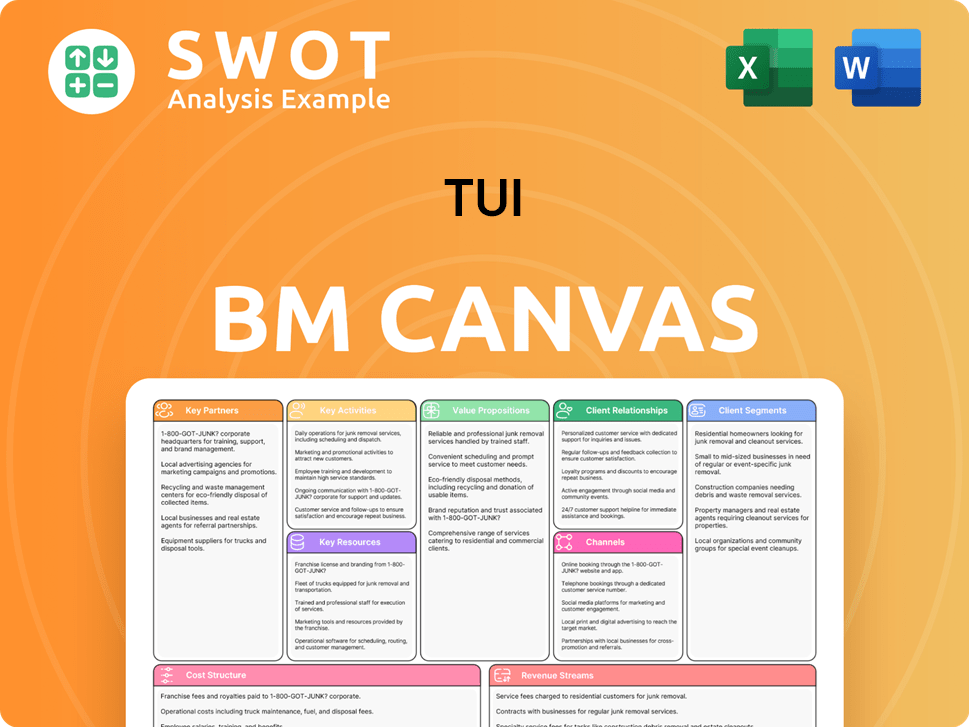

TUI Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped TUI’s Ownership Landscape?

Over the past few years, the ownership structure of the TUI Group has undergone significant shifts, largely influenced by the economic fallout from the COVID-19 pandemic. To navigate the crisis, TUI implemented substantial capital increases in 2021 and 2022, raising billions of euros. These actions, while crucial for financial stability, led to a dilution of existing TUI shareholders and the introduction of new investors. This period was marked by a need to repay state aid and strengthen the company's financial position amid unprecedented challenges in the travel industry.

A notable change occurred in 2022 with the divestiture of shares by Alexey Mordashov, previously the largest private shareholder. Due to sanctions, Mordashov's stake was significantly reduced and subsequently sold off. This event dramatically increased TUI AG's free float, moving the company towards a more widely held public structure. This shift reflects a broader trend in the industry where concentrated private ownership sometimes gives way to a more dispersed shareholder base, potentially enhancing liquidity and market access for companies like TUI.

| Ownership Change | Details | Impact |

|---|---|---|

| Capital Increases (2021-2022) | Billions of euros raised through new share issuances. | Dilution of existing shareholders; strengthened balance sheet. |

| Mordashov Share Divestiture (2022) | Sale of a significant portion of shares due to sanctions. | Increased free float; shift towards a more widely held public company. |

| Focus on Deleveraging | Company's intention to reduce debt and potentially seek growth opportunities. | May influence future capital market activities or strategic partnerships. |

Looking forward to early 2025, TUI is focused on deleveraging and returning to profitability. The company's strategic direction includes reducing debt and exploring growth opportunities, which might involve further capital market activities or strategic partnerships. The emphasis on sustainable tourism and digital transformation could also attract new investors focused on ESG criteria or technology-driven growth. Further consolidation in the travel industry could also impact TUI's ownership through mergers or acquisitions, although no concrete plans have been announced.

TUI raised billions through capital increases to manage debt and strengthen its financial position. This involved issuing new shares, which diluted existing shareholders. The company aimed to repay state aid and improve its balance sheet during the challenging pandemic period.

The divestiture of shares by Alexey Mordashov significantly altered the ownership structure. This led to a larger free float, making the company more publicly held. This change reflects broader industry trends towards dispersed ownership.

TUI is focused on reducing debt and exploring growth opportunities. This could involve further capital market activities or strategic partnerships. Sustainable tourism and digital transformation are also key strategic areas.

Consolidation in the travel industry might impact TUI's ownership through mergers or acquisitions. The company's actions reflect broader trends in the travel sector. The shift towards dispersed ownership can enhance market access.

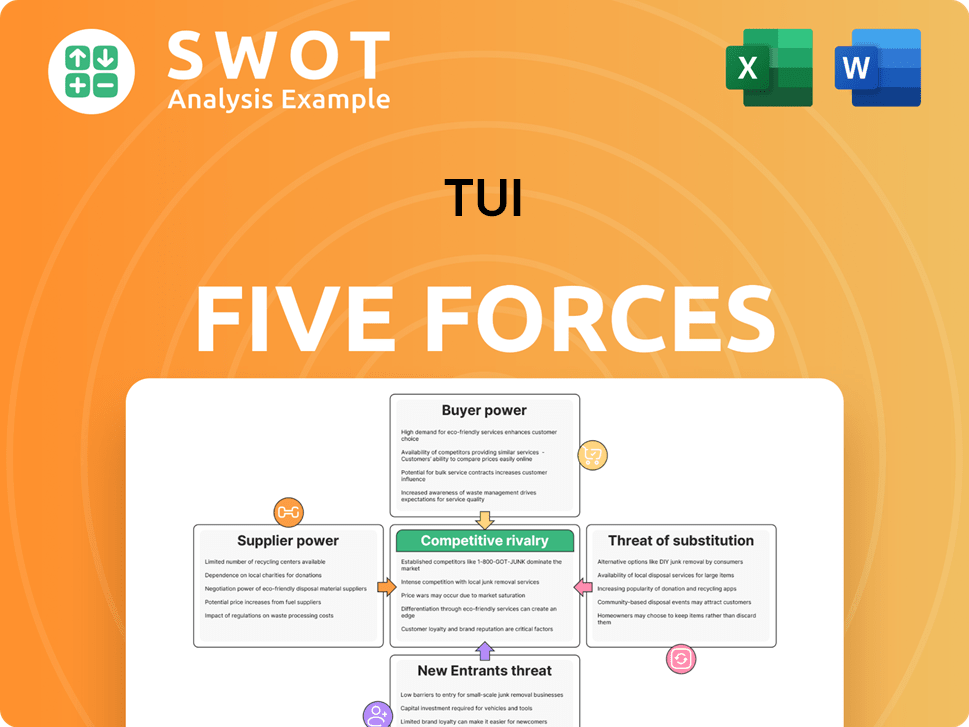

TUI Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TUI Company?

- What is Competitive Landscape of TUI Company?

- What is Growth Strategy and Future Prospects of TUI Company?

- How Does TUI Company Work?

- What is Sales and Marketing Strategy of TUI Company?

- What is Brief History of TUI Company?

- What is Customer Demographics and Target Market of TUI Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.