TUI Bundle

How Does the TUI Company Navigate the Global Travel Market?

TUI Group, a powerhouse in the travel and tourism sector, recently reported a remarkable 12% revenue surge, reaching €23.2 billion in 2024, underscoring its robust performance. Serving over 20.3 million customers, TUI demonstrates a formidable presence in the leisure industry. With ambitious growth targets for 2025, including a 5-10% revenue increase, understanding TUI's operational dynamics is critical.

This analysis explores the inner workings of the TUI SWOT Analysis, a company that offers a wide array of services from TUI holidays to cruises and hotels. Discover how TUI travel leverages its integrated business model to offer package holidays and manage its airlines, impacting its financial performance. Whether you're curious about TUI destinations, booking, or customer service, this deep dive provides a comprehensive overview of TUI's strategies and future outlook, addressing questions like "How does TUI operate its flights?" and "Is TUI a reliable travel company?".

What Are the Key Operations Driving TUI’s Success?

The TUI company operates through a vertically integrated model, offering a wide array of travel and tourism services. This includes package holidays, cruises, and hotel accommodations, catering to various customer segments. Their operational approach is designed to provide a seamless travel experience from the initial booking to the holiday itself.

This integration allows the TUI group to control service quality and consistency across all touchpoints. They manage their own airlines, operate numerous hotels, and run cruise liners. Partnerships are also key, especially in their hotel and cruise segments, where they engage in joint ventures to expand their offerings. Distribution utilizes both online and offline channels, including their travel agencies and digital platforms.

The company's focus on an 'integrated business model' and 'differentiated content' sets it apart from competitors. They combine their assets (hotels, airlines, cruises) with curated third-party offerings to create unique holiday experiences. Digital transformation is also a priority, aiming to enhance customer experiences through personalized recommendations and streamlined booking. This commitment to customer lifetime value, combined with strong brand recognition and sustainability, translates into benefits such as simplified planning and unique travel options.

The core offerings of TUI travel include package holidays, cruises, and hotel accommodations. They serve a broad customer base, from budget travelers to those seeking premium experiences. The company's diverse portfolio allows them to cater to various preferences and budgets, ensuring a wide market reach.

Operational processes are designed for a seamless travel experience, from booking to the holiday. This includes managing airlines like TUI Airways and operating over 430 hotels across 12 brands in roughly 40 countries. They also run 17 cruise liners under brands such as TUI Cruises.

The supply chain is deeply integrated, with TUI directly sourcing and managing many components. This vertical integration allows control over service quality. Partnerships are crucial, especially in hotels and cruises, expanding their portfolio. Distribution networks leverage both online and offline channels.

The emphasis on an 'integrated business model' and 'differentiated content' sets TUI apart. They combine their assets with curated third-party offerings to create distinct holiday experiences. Digital transformation, focusing on personalized recommendations and streamlined booking, enhances customer experiences.

TUI's integrated approach and focus on digital transformation provide significant customer benefits. This includes simplified planning, consistent quality, and unique travel options, enhancing the overall customer experience. The company's strong brand recognition and commitment to sustainability further differentiate it in the market. For more information on how TUI competes, see Competitors Landscape of TUI.

- Simplified Planning: Streamlined booking processes and comprehensive travel packages.

- Consistent Quality: Control over service delivery through vertical integration.

- Unique Travel Options: Curated experiences combining owned assets and third-party offerings.

- Personalized Recommendations: Enhanced customer experience through digital platforms.

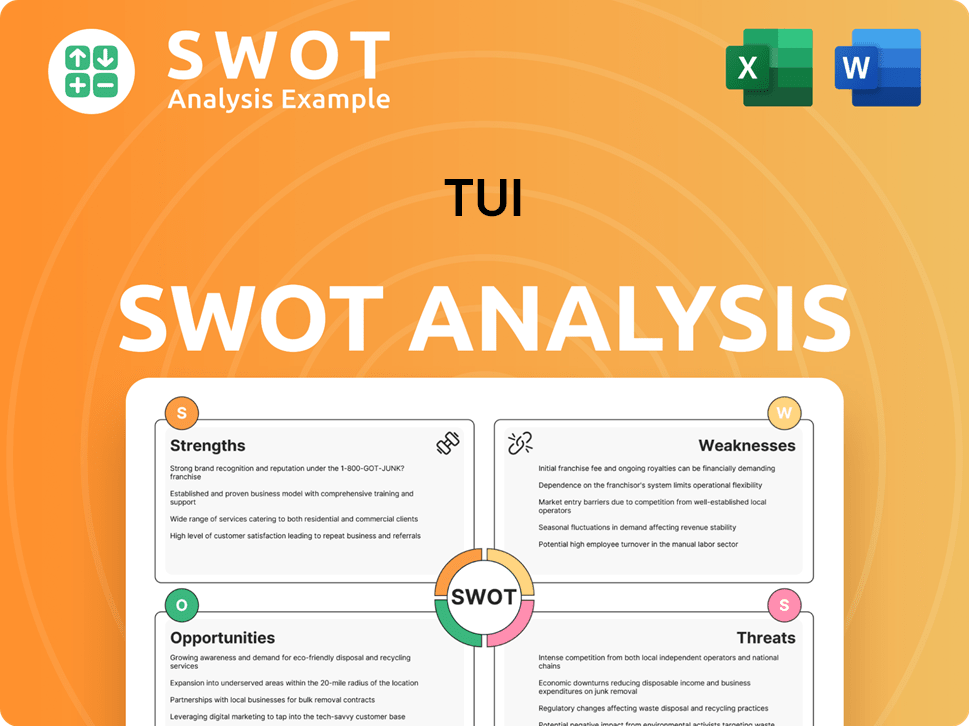

TUI SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TUI Make Money?

The TUI group generates revenue through a diversified model, primarily from package holidays. These holidays combine flights, accommodation, and often include transfers and activities. Other significant revenue streams come from its hotels, cruises, and destination services, showcasing a vertically integrated approach to the travel industry.

In fiscal year 2024, TUI's total revenue reached €23.2 billion, a 12% increase. The 'Holiday Experiences' segment, encompassing Hotels & Resorts, Cruises, and TUI Musement, significantly contributed to this growth. Hotels & Resorts achieved a record result in the first quarter of fiscal year 2025 (October to December 2024), with an underlying EBIT of €150.3 million, a 66% increase year-on-year.

The company employs innovative monetization strategies to enhance its revenue streams. These strategies include dynamically packaged holidays and single components, which offer customers more choices and increase sales of ancillary services. Cross-selling and upselling, leveraging a single customer database, are also key. Additionally, TUI is exploring platform fees, bundled services, and tiered pricing.

Package holidays, which combine flights, accommodation, and other services, are a core revenue generator for TUI travel. These packages offer convenience and often include transfers and activities, appealing to a broad range of customers. The integration of various travel components into a single purchase simplifies the booking process and enhances the customer experience.

The Hotels & Resorts segment is a significant revenue contributor, with a record underlying EBIT of €150.3 million in the first quarter of fiscal year 2025. This segment benefits from strong demand and high occupancy rates, reflecting the popularity of TUI's hotel offerings. The focus on premium products and services supports higher average selling prices.

Cruise operations are another key revenue stream, driven by strong demand and fleet expansion. The cruise sector benefits from higher rates and increased customer interest in cruise holidays. TUI's cruise offerings provide diverse itineraries and experiences, attracting a loyal customer base.

TUI Musement contributes to revenue through destination services and activities. This segment has shown significant improvement in underlying EBIT, indicating growing demand for its offerings. The focus on providing a wide range of experiences enhances the overall holiday package and customer satisfaction.

Ancillary services, such as travel insurance and extra baggage, are additional revenue sources. These services are often bundled with package holidays or offered as add-ons. Cross-selling and upselling strategies, enabled by a single customer database, enhance the sales of these services.

The company uses various monetization strategies, including dynamically packaged holidays and single components. They also focus on customer lifetime value optimization through loyalty programs and a wider range of services. The average selling prices for winter 2024/25 increased by 5%, and summer 2025 bookings show a 3% increase, reflecting a focus on premium products.

A key strategy is customer lifetime value optimization, aiming to retain customers within the TUI ecosystem. This is achieved through loyalty initiatives and offering a comprehensive range of services throughout the year, from summer holidays to city breaks. The company's focus on premium products and services, along with increased average selling prices, supports this customer-centric approach.

- Loyalty Programs: Encourage repeat bookings and customer retention.

- Wider Service Range: Provide services throughout the year, including city breaks.

- Premium Products: Focus on higher-value offerings to increase revenue.

- Increased Average Selling Prices: Reflect the focus on premium products and services.

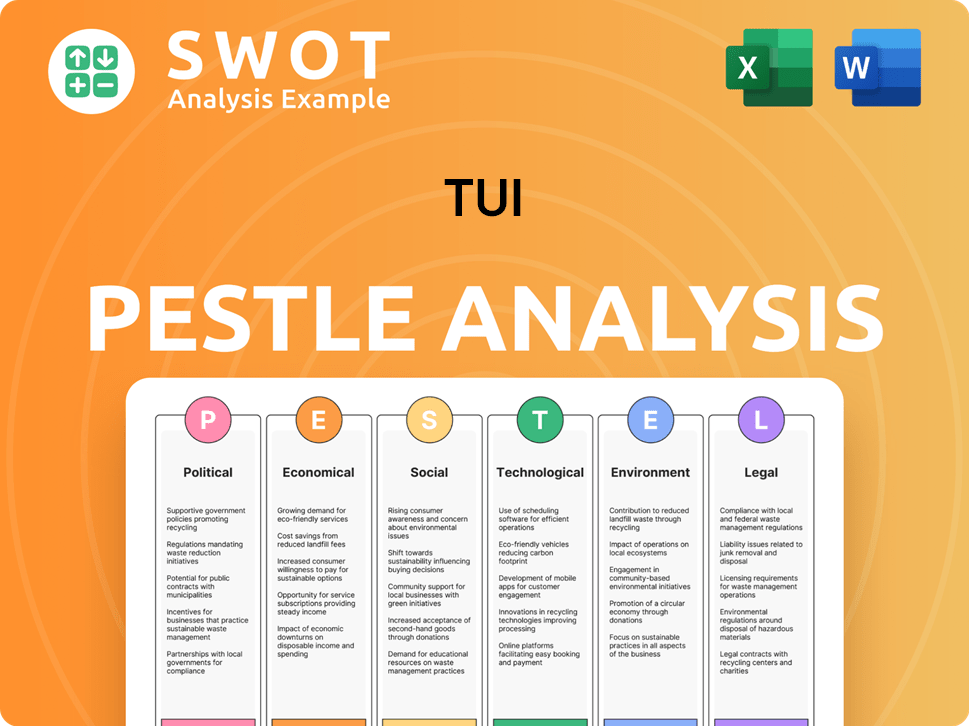

TUI PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped TUI’s Business Model?

The Brief History of TUI reveals a company that has strategically evolved. Key milestones include a shift towards an 'asset-right strategy' within its Holiday Experiences segment and a dynamic repositioning of its tour operator business. This involves expanding its product offerings and customer base to increase market share and improve earnings, demonstrating the

A significant strategic move for

Operational challenges like industry volatility, fluctuating fuel prices, and geopolitical tensions have been addressed by

The focus on an 'asset-right strategy' and repositioning of the tour operator business are crucial. Expanding into new products and customer segments is a key strategy. The goal is to increase market share and boost earnings.

Transitioning into a global tourism platform company is a key move. Expanding the core business with hotels and cruises is a priority. Digital platforms are increasingly important for growth.

Strong brand recognition and global presence are significant advantages. The integrated business model provides consistent service. Focus on digitalization and sustainability enhances customer experiences.

In early 2025, S&P and Moody's upgraded their outlook to B+ and B1, respectively. The company has reduced net debt and improved its financial profile. These improvements reflect the company's financial stability.

- Strong brand recognition and global presence.

- Integrated business model encompassing flights, accommodations, cruises, and tours.

- Differentiated product portfolio.

- Focus on digitalization and technology.

- Commitment to sustainability, including eco-friendly resorts and reduced carbon footprint.

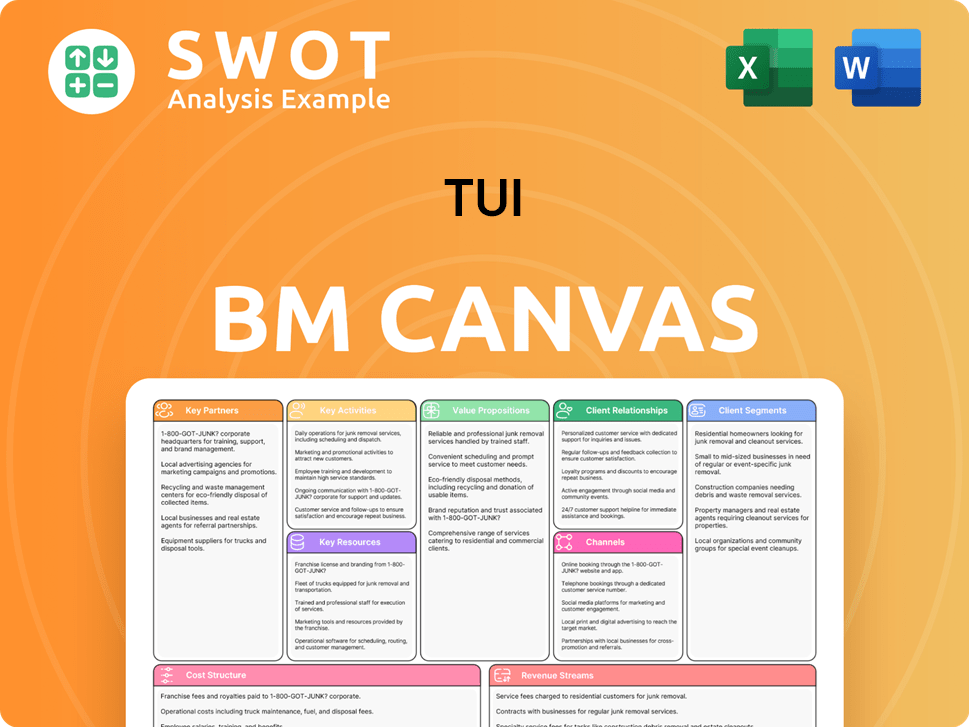

TUI Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is TUI Positioning Itself for Continued Success?

The TUI group holds a leading position in the global tourism industry, distinguished by its extensive global reach and diverse product offerings. In the financial year 2024, the company served 20.3 million customers, which underscores its substantial market share and customer base. The integrated business model of TUI travel fosters robust customer loyalty and encourages repeat bookings.

However, the TUI company encounters several significant risks. These include dependence on external factors like economic conditions and geopolitical events, susceptibility to fluctuations in exchange rates and fuel prices, and substantial fixed costs associated with maintaining its vast infrastructure. The travel industry is also vulnerable to technological disruptions and evolving consumer preferences.

The TUI group is a major player in the global tourism market. Its integrated model, including airlines, hotels, and cruises, provides a comprehensive travel experience. The company's broad reach allows it to cater to a wide variety of travelers and destinations.

The travel industry is inherently volatile. Economic downturns, geopolitical instability, and unforeseen events like pandemics can significantly impact business. Fluctuations in currency exchange rates and fuel prices also pose financial risks. These factors can affect TUI holidays prices and profitability.

The company is focused on strategic initiatives to ensure future growth. The TUI booking platform is expanding its digital offerings and leveraging synergies between its divisions. Sustainability is also a key focus, with ambitious emission reduction targets.

The company is transforming into a global tourism platform. This involves expanding digital platforms and broadening product offerings. The company aims for revenue growth of 5% to 10% and underlying EBIT growth of 7% to 10% for the financial year 2025.

To sustain its market position, TUI destinations is concentrating on several key areas. These include enhancing its digital platforms, expanding its product range to include more third-party options, and delivering more personalized customer experiences.

- Expanding digital platforms for a better customer experience and increased booking efficiency.

- Broadening product offerings to include more third-party options, providing greater choice for customers.

- Focusing on delivering personalized experiences to increase customer satisfaction and loyalty.

- Strengthening synergies between its 'Holiday Experiences' and 'Markets + Airline' divisions to improve operational efficiency.

The company is also committed to sustainability, with climate targets validated by the Science Based Targets initiative (SBTi), aiming to reduce emissions from its airline, hotels, and cruise businesses by 2030. TUI’s leadership emphasizes strengthening synergies, offering more products, and increasing customer contacts throughout the year, with a focus on becoming more efficient, profitable, and economically stronger. More insights can be found in the Growth Strategy of TUI.

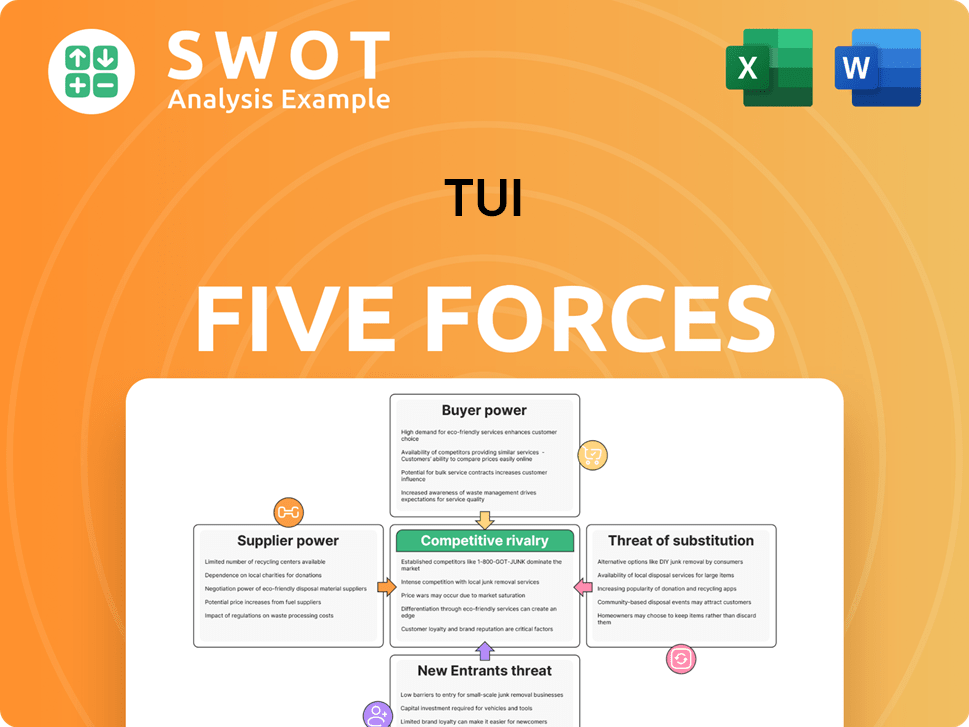

TUI Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of TUI Company?

- What is Competitive Landscape of TUI Company?

- What is Growth Strategy and Future Prospects of TUI Company?

- What is Sales and Marketing Strategy of TUI Company?

- What is Brief History of TUI Company?

- Who Owns TUI Company?

- What is Customer Demographics and Target Market of TUI Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.