TUI Bundle

Can TUI Continue Dominating the Global Tourism Market?

TUI Group's journey from an industrial conglomerate to a global tourism leader is a testament to the power of strategic evolution. From its roots as Preussag AG to its current status as the world's largest leisure travel company, TUI has consistently adapted to the ever-changing TUI SWOT Analysis, its business model, and the dynamic demands of the travel industry. With over 66,000 employees serving millions across 100+ countries, understanding TUI's growth strategy and future prospects is crucial for anyone invested in the tourism market.

This analysis delves into TUI's strategic moves, examining its integrated business model and how it leverages its vast portfolio of hotels, cruise lines, and airlines. We'll explore TUI's expansion plans, digital transformation, and sustainability initiatives, providing insights into its competitive advantages and how it navigates challenges within the travel industry. Understanding TUI's approach to sustainable tourism practices and its response to geopolitical events is key to assessing its long-term growth potential and its ability to adapt to changing travel habits.

How Is TUI Expanding Its Reach?

The TUI growth strategy is heavily focused on expansion across various sectors and geographical regions. The company aims to solidify its position in the tourism market through strategic initiatives. These initiatives are designed to enhance its product offerings and reach a broader customer base, thereby improving its TUI future prospects.

TUI company analysis reveals a commitment to adapting to evolving travel industry trends. The company is investing in digital platforms and exploring new markets to maintain its competitive edge. These efforts are crucial for navigating the complexities of the global tourism landscape and ensuring sustainable growth.

The company's strategic moves are a response to changing consumer behaviors and market dynamics. By diversifying its offerings and expanding its geographical footprint, TUI aims to mitigate risks and capitalize on emerging opportunities in the travel sector.

TUI is expanding its core business, particularly hotels and cruises. This expansion includes joint ventures and activities in popular vacation destinations. For example, TUI Cruises is adding new ships to its fleet, such as Mein Schiff Relax, expected in March 2025, which is designed with energy efficiency in mind. Two more ships are planned for launch in the next two years.

TUI is transforming into a global tourism platform company by expanding its digital platforms. This includes developing a tourism marketplace focused on package tours to broaden its product portfolio. The company is also enhancing its app with a focus on native booking flows to increase digital sales made through the app.

TUI plans to expand its presence in Asia, aiming to double its hotel count in the region by 2027. Current resorts are located in Thailand, Sri Lanka, Maldives, Vietnam, Malaysia, and China, with high demand in Vietnam. The company is targeting new high-growth markets in Asia, Latin America, and Southeast Asia to reduce its reliance on its European base.

TUI recently introduced 'Experiences for Locals,' offering over 350 activities in more than 40 cities in the UK and Germany. This initiative aims to diversify revenue streams. The company is also transforming its Markets + Airline business into a 'Global Curated Leisure Marketplace,' expanding its product range and increasing personalized offers. This strategic shift, announced in September 2024, supports growth targets.

TUI's expansion strategy encompasses geographical diversification, digital platform development, and new product offerings. These initiatives are designed to enhance its market position and provide a broader range of services to customers. For more insights, check out the Marketing Strategy of TUI.

- Geographical Expansion: Focusing on Asia, Latin America, and Southeast Asia to reduce dependence on the European market.

- Digital Transformation: Enhancing digital platforms and apps to boost online sales and improve customer experience.

- Product Diversification: Introducing 'Experiences for Locals' and expanding the product range through a curated leisure marketplace.

- Fleet Expansion: Adding new cruise ships to increase capacity and offer more sustainable travel options.

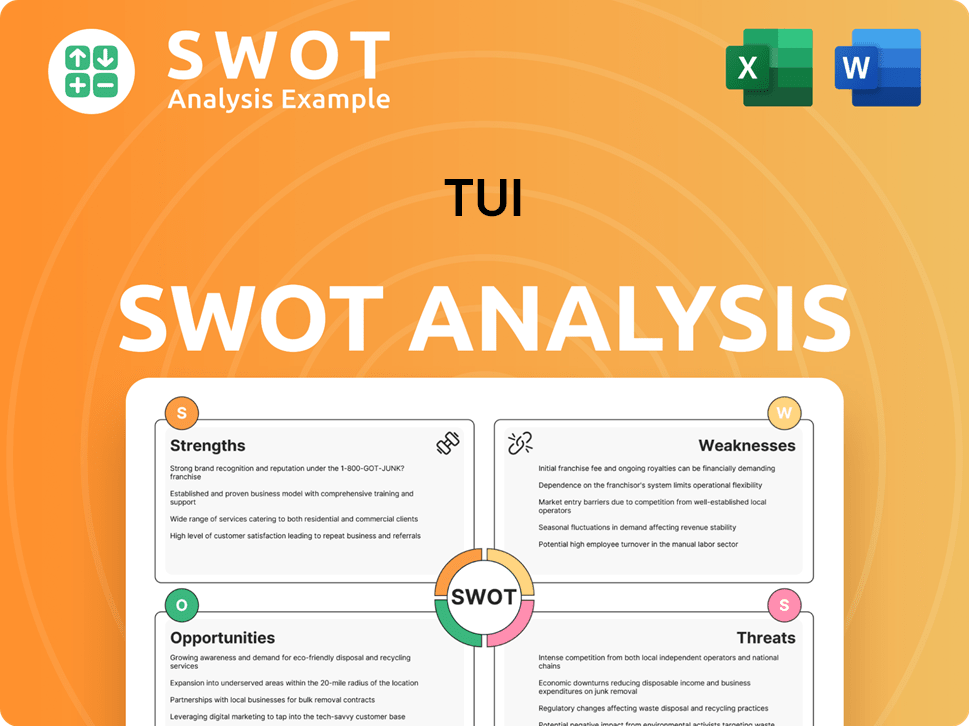

TUI SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does TUI Invest in Innovation?

The TUI Group is heavily invested in innovation and technology to boost its growth and operational efficiency. Their strategy focuses on digital transformation, aiming to expand digital platforms and develop a global tourism platform company. This approach is crucial for adapting to evolving travel industry trends and maintaining a strong position in the tourism market.

A key element of TUI's strategy involves enhancing its mobile application to drive digital sales and providing a wider array of products through a curated leisure marketplace. This includes offering dynamic packages and third-party offerings to meet the diverse needs of modern travelers. The company's focus on technology is integral to its TUI growth strategy.

TUI's commitment to sustainability and cutting-edge technologies is evident in its investments in energy-efficient ships and sustainable aviation fuels. These initiatives are part of TUI's broader effort to reduce its environmental impact and align with the increasing demand for eco-friendly travel options. This is a key part of the company's TUI future prospects.

TUI is expanding its digital platforms to enhance customer experience and drive sales. This includes improvements to its mobile app and the development of a curated leisure marketplace.

The company is investing in energy-efficient ships, such as Mein Schiff Relax, which is set to be delivered in March 2025. They are also exploring the use of sustainable aviation fuels (SAFs) and renewable energy sources for hotels.

TUI is using AI to reduce food waste in its hotels, with initial results showing approximately a 30% reduction in waste. This data-driven approach helps optimize operations and reduce environmental impact.

TUI is committed to the Science Based Targets initiative (SBTi) 2030 targets, aiming to cut emissions by 24% for its airline, 46.2% for Group-operated hotels, and 27.5% for cruises by 2030, compared to 2019 levels. The company aims for net-zero emissions by 2050.

TUI has been recognized on the CDP A List for corporate climate change action for the third time in 2024, highlighting its leadership in environmental responsibility.

TUI plans to have all its hotels in Turkey running on energy supplied by its own solar parks by the end of 2026, demonstrating its commitment to renewable energy.

TUI's innovation strategy focuses on digital platforms, sustainable practices, and data-driven solutions. These initiatives are designed to improve operational efficiency and enhance the customer experience, contributing to the company's long-term growth.

- Digital Platforms: Enhancing mobile apps and developing a curated leisure marketplace.

- Sustainable Technologies: Investing in energy-efficient ships and exploring sustainable aviation fuels.

- Data-Driven Solutions: Using AI to reduce food waste and optimize operations.

- Sustainability Goals: Committing to SBTi targets and aiming for net-zero emissions by 2050.

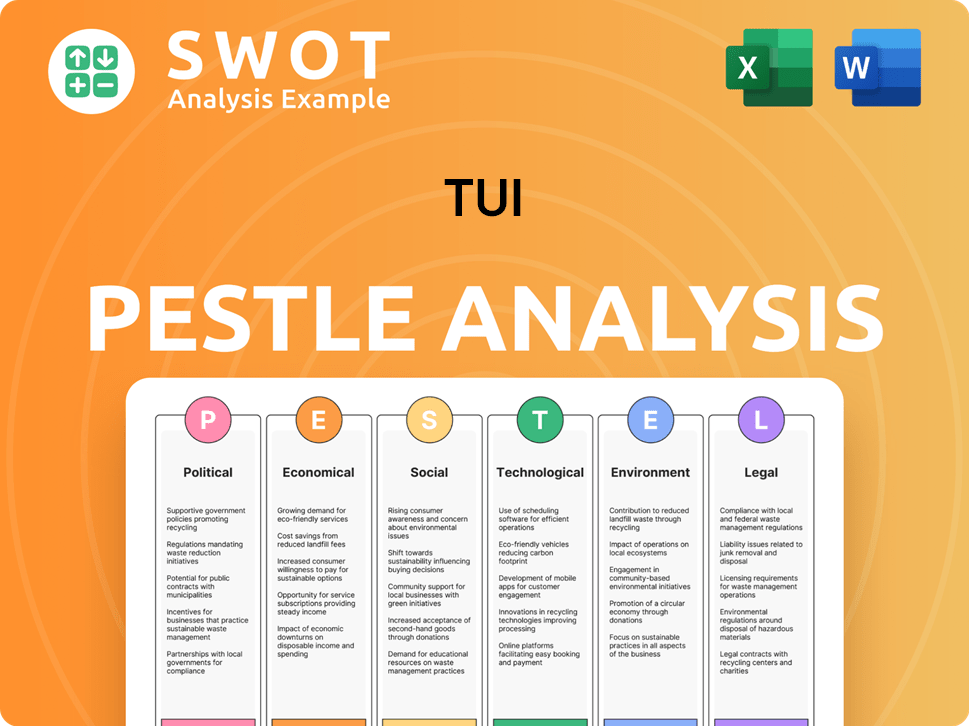

TUI PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is TUI’s Growth Forecast?

The financial outlook for TUI Group is positive, with a clear focus on profitable growth and strengthening its financial position. The company's performance in 2024, and its projections for 2025, indicate a robust recovery and expansion in the travel and tourism sector. This positive trajectory is supported by strong demand and strategic initiatives aimed at enhancing its financial profile.

TUI's strategic focus on the Holiday Experiences segment, including Hotels & Resorts, Cruises, and TUI Musement, has been a key driver of its financial success. The company's ability to adapt to changing travel habits and capitalize on tourism market trends has been crucial. As highlighted in a Competitors Landscape of TUI, understanding the competitive environment is essential for sustained growth.

The company's commitment to sustainable tourism practices and digital transformation is also playing a vital role in its long-term growth potential. These initiatives, combined with effective customer acquisition and retention strategies, are expected to contribute to TUI's continued success in the travel industry.

TUI reported a significant revenue increase of 12% to €23.2 billion for the full financial year 2024. Underlying EBIT improved substantially to €1.3 billion, a 33% increase year-on-year. The Holiday Experiences segment contributed significantly, with underlying EBIT reaching €1.1 billion.

TUI anticipates a year-on-year revenue increase of 5-10% and an increase in underlying EBIT of 7-10% for the financial year 2025. This positive outlook is supported by strong demand for holidays and strategic initiatives.

In 2024, 20.3 million customers traveled with TUI, a 6.8% increase. Bookings for Winter 2024/25 were up 4% with prices 5% higher, and Summer 2025 bookings were up 7% with prices 3% higher as of December 2024.

In its first quarter of fiscal year 2025 (October to December 2024), revenue rose 13% to €4.9 billion and underlying EBIT improved to €50.9 million, marking its tenth consecutive quarter of underlying EBIT growth.

TUI reduced net debt by €0.5 billion to €1.6 billion in 2024, achieving a leverage ratio of 0.8x. The company is on track to meet its medium-term target of strongly below 1.0x.

S&P Global Ratings raised TUI's long-term ratings to 'BB-' from 'B+' in March 2025. Fitch upgraded TUI to 'BB' with a stable outlook, restoring its pre-pandemic rating levels.

TUI anticipates continued positive FOCF generation, expecting modestly above €200 million per year, which will further strengthen its liquidity. This will support its future investments.

TUI plans to define a shareholder return strategy by the end of 2025. This indicates a focus on rewarding investors and enhancing shareholder value.

TUI's investment in new travel technologies and its expansion plans in Europe are key components of its growth strategy. These investments are designed to enhance customer experience and operational efficiency.

TUI is actively adapting to changing travel habits through its digital transformation strategy. This includes investments in technology to improve customer acquisition and retention.

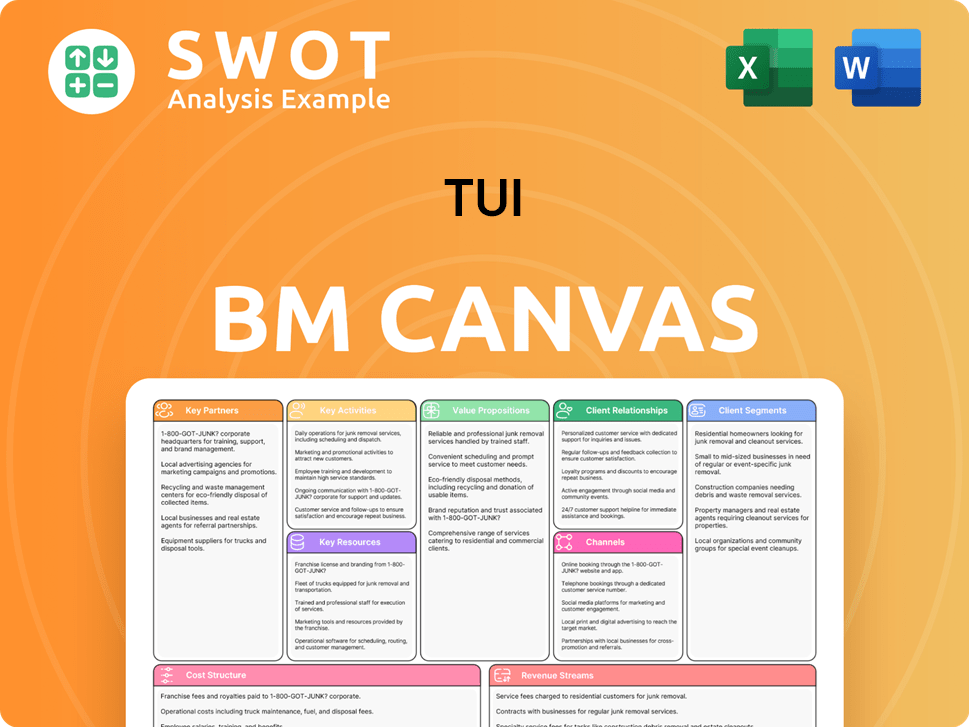

TUI Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow TUI’s Growth?

The success of TUI Group's growth strategy hinges on navigating several risks inherent in the travel and tourism sector. These challenges include market competition, regulatory changes, and geopolitical uncertainties. Understanding these potential obstacles is crucial for assessing TUI's future prospects and its ability to maintain a competitive edge in the tourism market.

Supply chain vulnerabilities, particularly concerning fuel and input costs, pose a significant risk. Furthermore, technological disruption and internal resource constraints can impact growth. TUI addresses these risks through strategic hedging, digital transformation initiatives, and a focus on operational excellence.

TUI's integrated business model is designed to respond to competitive threats and external factors. The company has demonstrated its ability to recover from significant challenges, such as the pandemic, and is focused on strengthening its balance sheet and driving profitable growth. For a deeper understanding of TUI's core values, consider reading about the Mission, Vision & Core Values of TUI.

The travel industry is highly competitive, with potential for over-capacity and price reductions. TUI mitigates this through a hybrid approach of owned and third-party operated flights. Focusing on differentiated content and direct distribution channels also helps to navigate the competitive landscape.

Regulatory changes and geopolitical events significantly impact the travel industry. The COVID-19 pandemic and the war in Ukraine demonstrated the effects on customer spending and travel desires. TUI counters this by diversifying offerings and focusing on operational excellence to maintain margins.

Fluctuations in fuel and other input costs pose a supply chain risk. TUI has strategically hedged over 90% of its euro, dollar, and fuel requirements until Summer 2025. However, input cost volatility remains a key concern for the company.

Rapid digital evolution requires continuous adaptation to stay competitive and secure customer data. TUI is investing in digital transformation and new technologies. The company acknowledges privacy risks associated with customer data handling and third-party usage.

Attracting and retaining talent can impact growth, especially after cost-saving measures. TUI's focus on operational excellence and transformation initiatives aims to make the business more agile and cost-efficient, which can help address internal challenges.

TUI employs risk management frameworks, including ongoing assessment and preparation. This involves diversification, scenario planning, and maintaining a robust financial position. The integrated business model is a strength in responding to competitive threats and external factors.

To mitigate fuel price volatility, TUI has hedged over 90% of its fuel requirements through Summer 2025. This proactive measure provides stability and helps manage operational costs. The strategy is a key element of TUI's financial risk management.

TUI continues to invest in digital transformation, which is essential for adapting to changing travel habits and market trends. This includes investments in new technologies to enhance customer experience and improve operational efficiency. These investments are critical for long-term growth.

Geopolitical events can significantly affect the travel industry, as seen with the war in Ukraine. These events can impact customer spending and travel preferences. TUI's diversified offerings and operational excellence help mitigate these impacts.

Sustainability is a growing concern in the tourism market, and TUI is addressing this through various initiatives. These include efforts to reduce carbon emissions and promote sustainable tourism practices. Sustainable practices are becoming increasingly important for long-term success.

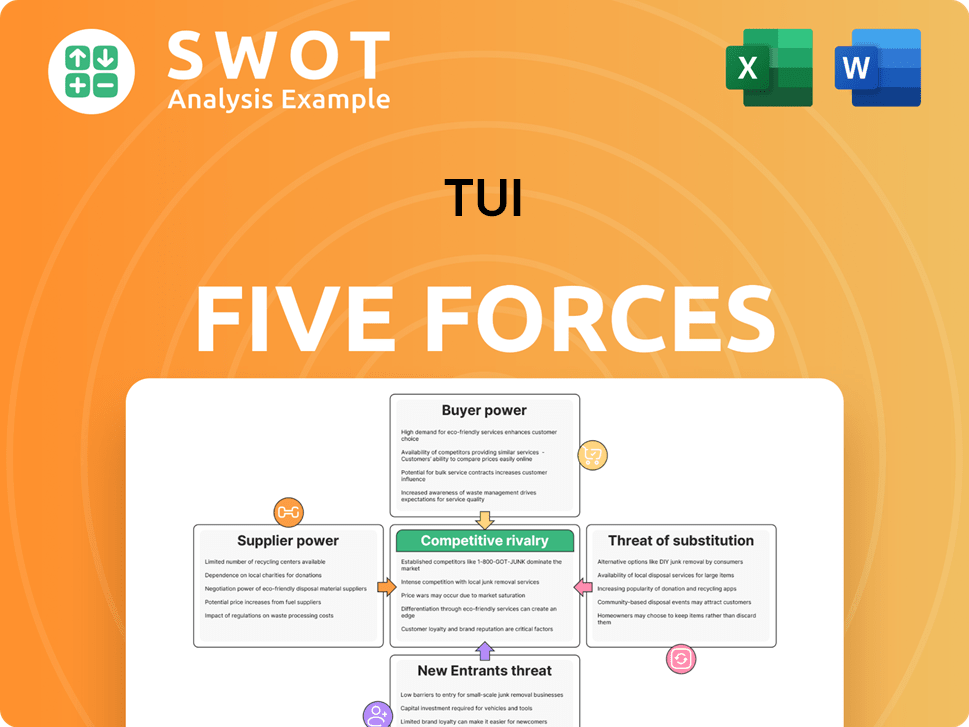

TUI Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.