Valvoline Bundle

How Does Valvoline Stack Up in the Automotive Lubricants Arena?

The automotive industry is a battlefield, and Valvoline Inc. has been a key player since 1866. From its origins as a pioneer in industrial lubricants to its current status as a household name, Valvoline has consistently adapted to market shifts. This exploration delves into the Valvoline SWOT Analysis, its competitive landscape, and its strategies for success.

Understanding the Valvoline competitive landscape is crucial for investors and strategists alike. This analysis will dissect Valvoline competitors across its product lines and service offerings. We'll examine Valvoline market analysis to understand its strategic positioning, including its Valvoline business strategy and how it impacts Valvoline performance in a dynamic market.

Where Does Valvoline’ Stand in the Current Market?

The market position of Valvoline Inc. is primarily defined by its operations in the automotive maintenance and lubricants industry. The company strategically focuses on two main segments: Retail Services and Global Products. Valvoline's business strategy has evolved, with a strong emphasis on the expansion of its Retail Services, particularly through its Valvoline Instant Oil Change (VIOC) service centers.

Valvoline's value proposition centers on providing convenient, high-quality automotive maintenance services and branded lubricants. The Retail Services segment offers quick oil changes and other preventative maintenance, while the Global Products segment supplies a wide range of lubricants. This dual approach allows Valvoline to serve both consumers and automotive professionals, maintaining a significant presence in the automotive aftermarket.

Valvoline's competitive landscape is shaped by its diverse operations. The company's market analysis reveals a strong position in the quick lube market, along with a global presence in lubricant manufacturing and sales. Understanding the dynamics of its competitors is crucial for evaluating Valvoline's performance and future growth prospects, as discussed in the Growth Strategy of Valvoline.

Valvoline operates and franchises VIOC service centers, making it the second-largest quick lube chain in the U.S. The company has over 1,900 locations as of late 2024. This segment provides a direct channel to consumers and generates recurring revenue from routine vehicle maintenance.

Valvoline manufactures and sells lubricants, including engine oils and transmission fluids. The company serves both passenger car and heavy-duty vehicle markets globally. The Global Products business was sold to Aramco in early 2023 for approximately $2.65 billion.

Retail Services are concentrated in the United States and Canada. The Global Products segment had a more expansive international presence prior to its sale. This geographic focus impacts Valvoline's competitive dynamics and market share.

Valvoline's Retail Services segment reports strong same-store sales growth. Total sales for fiscal year 2024 were approximately $1.4 billion. The strategic focus on the quick lube business positions the company well in the growing automotive aftermarket services sector.

Valvoline's competitive advantages include its strong brand recognition and extensive service network. The company faces competition from other quick lube chains, major oil companies, and independent service providers. Its strategic shift to focus on Retail Services aims to capitalize on higher growth and profitability.

- Expansion of VIOC locations, with plans to open 150-200 new stores in fiscal year 2025.

- Focus on customer service and convenience to differentiate from competitors.

- Strategic divestiture of the Global Products business to concentrate on the service model.

- Continuous innovation in products and services to meet evolving customer needs.

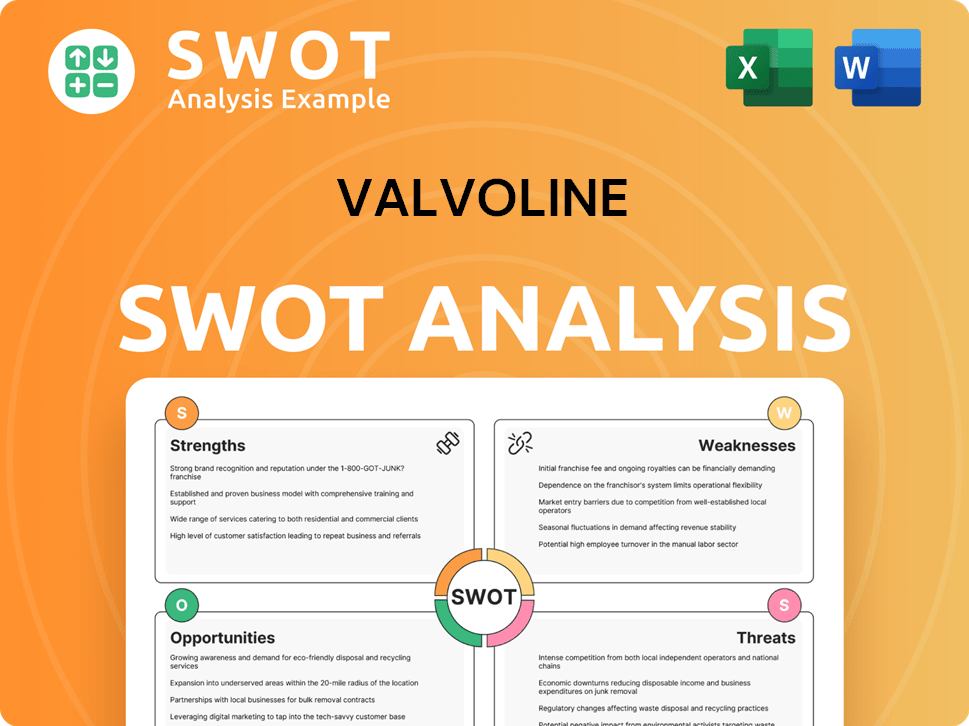

Valvoline SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Valvoline?

Understanding the Valvoline competitive landscape requires a deep dive into its two main business segments: Retail Services (Valvoline Instant Oil Change) and Global Products (post-divestiture). The company faces a diverse set of rivals, each vying for market share in the automotive services and lubricants sectors. This competitive environment is shaped by factors such as brand recognition, service offerings, pricing strategies, and the evolving demands of the automotive industry. For a deeper understanding of the company's origins, consider reading Brief History of Valvoline.

The competitive dynamics also shift with industry trends, including the rising adoption of electric vehicles (EVs) and strategic moves like mergers and acquisitions. These elements require Valvoline to adapt its business strategy to maintain and enhance its market position. A thorough Valvoline market analysis is crucial for investors and stakeholders to gauge the company's potential for future growth and performance.

In the quick lube service market, Valvoline's main competitors include Jiffy Lube, Meineke Car Care Centers, and Grease Monkey. These rivals compete through extensive franchising, competitive pricing, and expanding service menus. The broader automotive aftermarket also presents competition from independent repair shops and dealership service centers, offering comprehensive maintenance and repair services. The rise of mobile oil change services and DIY trends also present indirect competition.

Jiffy Lube, a subsidiary of Shell, is a major competitor with over 2,000 franchised service centers in North America, offering convenience and brand recognition. Meineke and Grease Monkey also compete in this space, focusing on routine maintenance services.

Independent repair shops and dealership service centers offer a full spectrum of services, representing an alternative for consumers. Mobile oil change services and DIY trends present indirect competition.

Major global oil companies such as ExxonMobil (Mobil 1), Shell (Pennzoil, Quaker State), BP (Castrol), and Chevron (Havoline) dominate the automotive lubricants market. These companies benefit from vast refining capabilities and extensive global distribution networks.

Competitors focus on product innovation (e.g., synthetic oils), brand loyalty, and aggressive marketing. Smaller specialized lubricant manufacturers also compete in niche segments.

The increasing adoption of EVs presents a new dimension, potentially impacting demand for traditional engine oils. Mergers and alliances, such as the Aramco acquisition of Valvoline's Global Products, reshape market dynamics.

Key competitive factors include technological advancements in lubricant formulations, strategic partnerships with OEMs, and pricing strategies in various global markets. The ability to adapt to changing consumer preferences and technological advancements is crucial.

Valvoline's competitive advantages and disadvantages are shaped by its service offerings, brand recognition, and market presence. Jiffy Lube benefits from Shell's global presence, while Meineke and Grease Monkey compete on convenience. The Global Products segment faces intense competition from established oil companies. Key players in the Valvoline market include:

- Jiffy Lube: Extensive network and brand recognition.

- Meineke: Focus on routine maintenance and service offerings.

- Grease Monkey: Convenience and service offerings.

- ExxonMobil (Mobil 1): Product innovation and global distribution.

- Shell (Pennzoil, Quaker State): Brand loyalty and marketing.

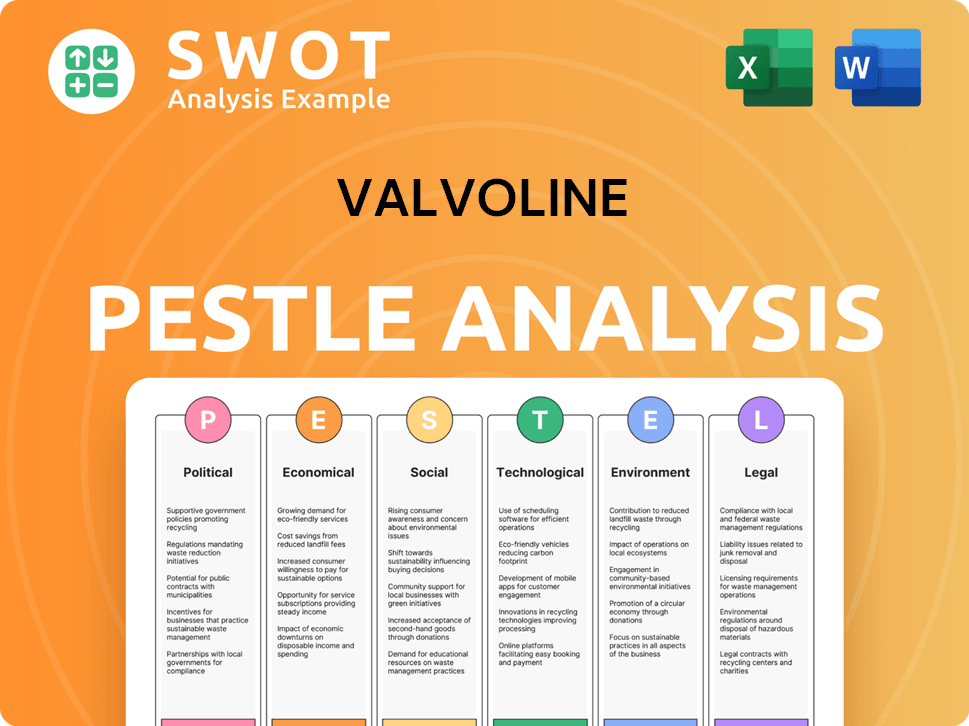

Valvoline PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Valvoline a Competitive Edge Over Its Rivals?

The competitive landscape for Valvoline Inc. is shaped by its strategic focus on the Retail Services segment, particularly its network of quick lube service centers. This shift has allowed the company to leverage its strong brand recognition and operational efficiencies to compete effectively in the automotive maintenance industry. The company's ability to adapt to evolving market trends, such as the increasing adoption of electric vehicles, will be crucial for maintaining its competitive edge.

Valvoline's business strategy centers on providing convenient, high-quality automotive services. This is achieved through a combination of a well-established brand, an extensive service network, and a customer-centric approach. The company's performance is closely tied to its ability to maintain and expand its service center footprint while adapting to changing consumer preferences and technological advancements in the automotive sector.

A key aspect of Valvoline's competitive positioning involves its ability to differentiate itself from competitors through superior customer service and operational excellence. The company's focus on data-driven decision-making and continuous improvement allows it to optimize its service offerings and enhance customer satisfaction. This approach is critical in a market where customer loyalty and convenience are paramount.

Valvoline benefits from a strong brand reputation built over nearly 160 years, fostering significant customer loyalty. The distinct yellow and blue branding is widely recognized, creating a sense of familiarity and trust. This established brand equity is a key differentiator in the competitive automotive maintenance market, as discussed in Growth Strategy of Valvoline.

Valvoline operates the second-largest quick lube chain in the U.S., providing unparalleled convenience through its widespread geographic presence. This extensive network ensures consistent service quality and efficiency across locations. The 'stay-in-your-car' oil change model enhances customer convenience, a key differentiator in a time-sensitive market.

The company utilizes sophisticated analytics to optimize store performance, manage inventory, and enhance customer service. This data intelligence allows for targeted marketing and efficient resource allocation, improving profitability. Ongoing training for service center technicians ensures a high level of service quality and diagnostic capability.

Valvoline's franchising model enables rapid expansion with less capital expenditure, leveraging local entrepreneurship while maintaining brand standards. This approach facilitates geographic growth and market penetration. In fiscal year 2024, the company's retail services segment saw continued growth, reflecting the success of this strategy.

Valvoline's competitive advantages include its strong brand, extensive service network, and operational efficiencies. These factors contribute to high customer retention rates and a sustainable business model. The company's ability to adapt to changing consumer preferences and technological advancements is crucial for long-term success.

- Brand Equity: A long-standing reputation for quality and performance.

- Service Network: A widespread network of quick lube service centers providing convenience.

- Operational Efficiency: Data-driven approach to optimize store performance and customer service.

- Franchising: Rapid expansion and market penetration through franchising.

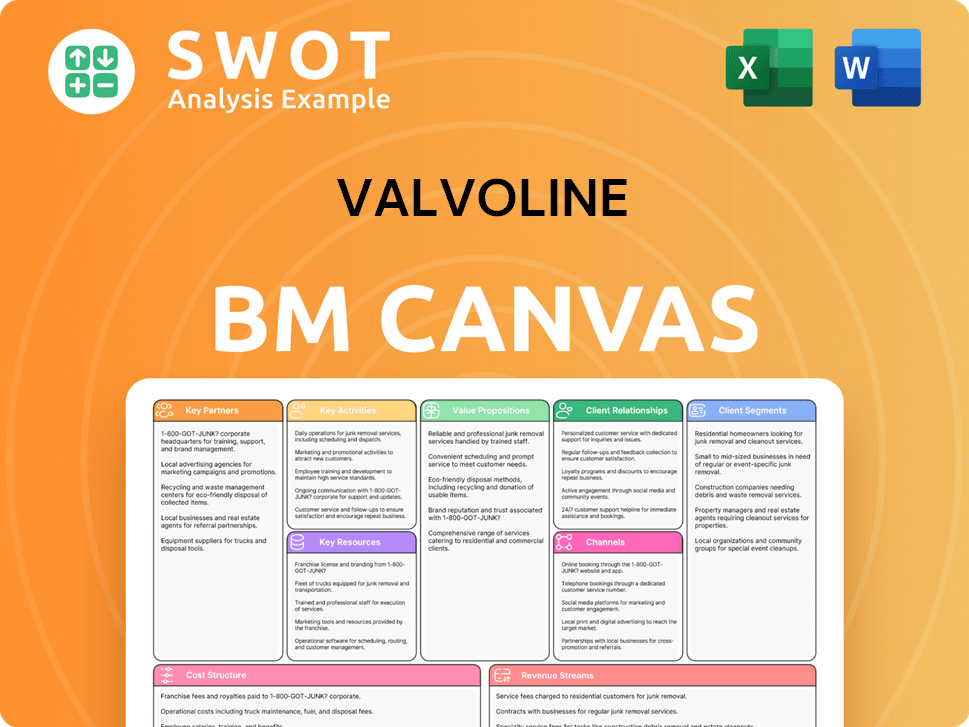

Valvoline Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Valvoline’s Competitive Landscape?

The automotive maintenance and lubricants industry is currently undergoing significant transformations, presenting both challenges and opportunities for companies like Valvoline. Key trends include the rise of electric vehicles (EVs), increasing vehicle technology complexity, and evolving consumer preferences. These factors necessitate strategic adaptation and innovation to maintain a competitive edge. Analyzing the Valvoline competitive landscape requires understanding these dynamics and how the company is positioned to respond.

The shift towards EVs presents a notable challenge, as traditional oil changes become less relevant. However, this also opens doors for diversification into new service areas, such as EV-specific maintenance and charging solutions. Simultaneously, the industry faces stricter emissions standards and the need for advanced diagnostic capabilities, influencing product development and service offerings. A comprehensive Valvoline market analysis must consider these multifaceted changes to assess future performance.

The automotive industry is experiencing a significant shift towards electric vehicles (EVs), reducing the demand for traditional engine oil. Vehicle technology is becoming increasingly complex, necessitating advanced diagnostic equipment and technician training. Consumer preferences are evolving, with a growing demand for convenience and digital integration in vehicle maintenance.

Adapting the Valvoline Instant Oil Change (VIOC) model to an EV-dominated future is a primary challenge. This involves expanding service offerings beyond oil changes to include EV-specific maintenance. Maintaining a competitive edge requires continuous investment in training and technology to meet evolving vehicle maintenance needs. The need to navigate fluctuating commodity prices and supply chain disruptions also poses a challenge.

Diversifying service portfolios to include tire services, battery checks, and EV-related maintenance presents significant growth opportunities. Geographic expansion, especially in underserved markets, and strategic partnerships can open new avenues for service delivery. The increasing average age of vehicles on the road provides ongoing opportunities for aftermarket services. The focus on a service-oriented business model offers resilience against commodity price fluctuations.

Valvoline is expanding its service offerings to include a broader range of automotive maintenance services. The company is investing in technician training and advanced diagnostic equipment. Strategic partnerships with automotive manufacturers or technology providers are being explored. Focusing on customer loyalty programs and digital integration enhances the customer experience.

To maintain and enhance its market position, Valvoline is focusing on diversification, geographic expansion, and strategic partnerships. The company's ability to adapt to the changing automotive landscape, particularly the rise of EVs, will be crucial. Understanding its Valvoline competitors and their strategies is essential for effective market positioning. The latest data shows that the quick lube market, where Valvoline operates, is highly competitive, with several national and regional players vying for market share. According to recent reports, the quick lube industry is projected to continue growing, albeit at a slower pace than in previous years, reflecting the impact of EVs.

- Valvoline is adapting its service model to include services relevant to both ICE and EV vehicles.

- Geographic expansion, especially in underserved markets, is a key strategy.

- Strategic partnerships are being explored to enhance service delivery and product development.

- Investment in training and technology is crucial to meet evolving vehicle maintenance needs.

- Focus on customer loyalty programs and digital integration to enhance customer experience.

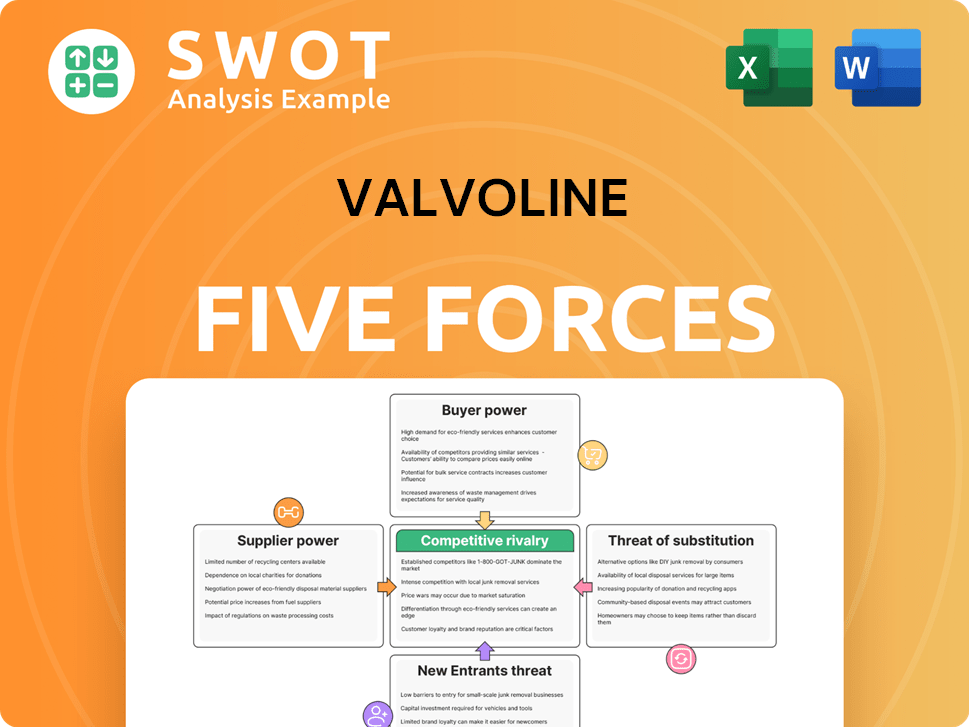

Valvoline Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Valvoline Company?

- What is Growth Strategy and Future Prospects of Valvoline Company?

- How Does Valvoline Company Work?

- What is Sales and Marketing Strategy of Valvoline Company?

- What is Brief History of Valvoline Company?

- Who Owns Valvoline Company?

- What is Customer Demographics and Target Market of Valvoline Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.